Market Overview

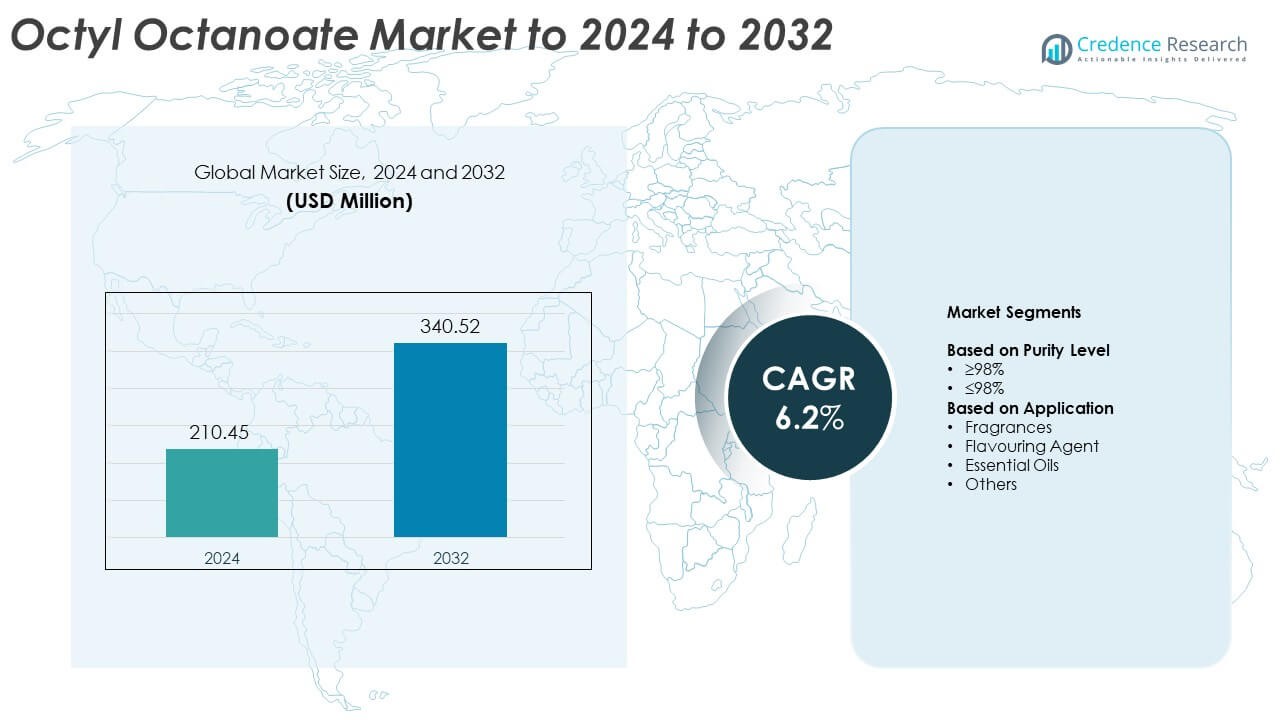

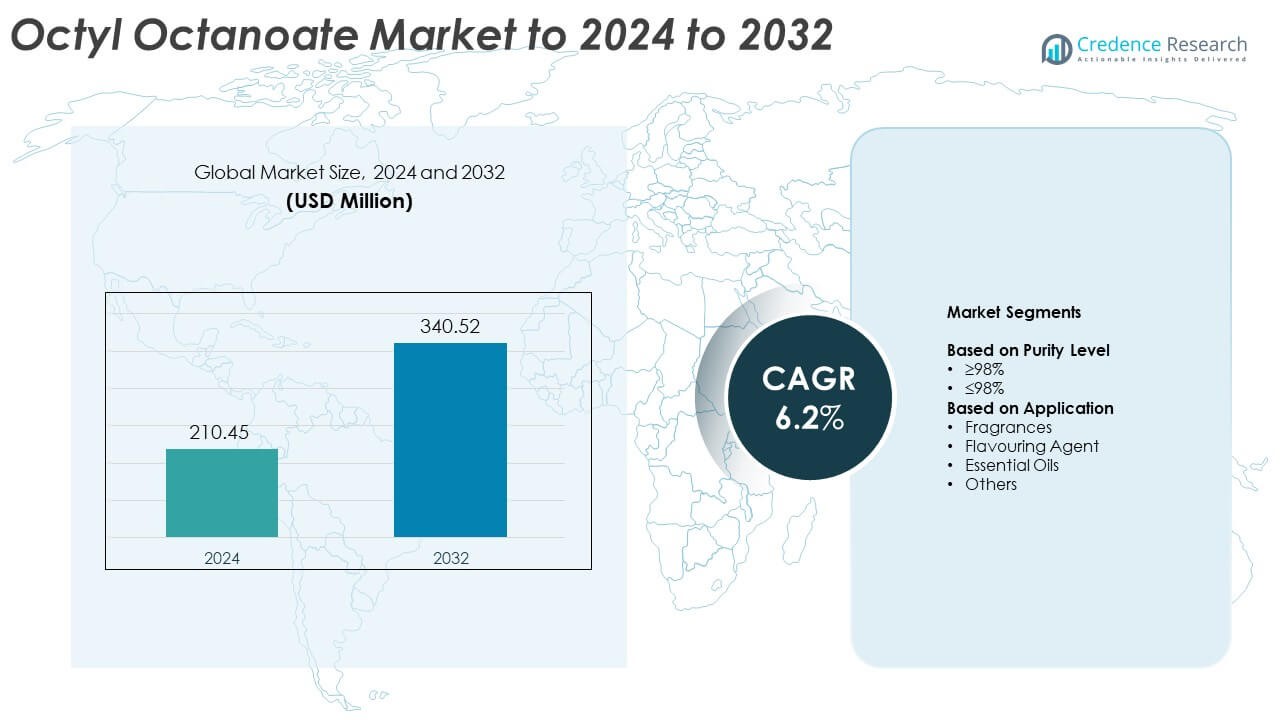

Octyl Octanoate Market size was valued at USD 210.45 Million in 2024 and is anticipated to reach USD 340.52 Million by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Octyl Octanoate Market Size 2024 |

USD 210.45 Million |

| Octyl Octanoate Market, CAGR |

6.2% |

| Octyl Octanoate Market Size 2032 |

USD 340.52 Million |

The Octyl Octanoate Market is shaped by leading players such as Zschimmer & Schwarz, Stepan Company, Emery Oleochemicals, BASF, Berg + Schmidt GmbH & Co. KG, Croda International Plc, Vantage Specialty Ingredients, and IOI Oleochemical Industries Berhad, all of which compete through high-purity ester production and strong supply capabilities. These companies support key applications in fragrances, flavouring systems, and essential oil blends. North America leads the global market with about 34% share due to advanced formulation industries, while Europe follows with nearly 29% share driven by its mature fragrance and cosmetics ecosystem. Asia Pacific holds close to 25%, supported by expanding personal care manufacturing and rising consumer demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Octyl Octanoate Market reached USD 210.45 Million in 2024 and is projected to hit USD 340.52 Million by 2032, growing at a CAGR of 6.2%.

• Market growth is driven by strong demand from fragrances, which held about 58% share in 2024 due to rising use in premium perfumes and personal care aromas.

• High-purity grades show a clear trend shift, with ≥98% purity capturing nearly 63% share as brands prioritize cleaner scent profiles and stable formulation performance.

• Competition remains moderate, with companies expanding production efficiency, focusing on high-purity ester development, and strengthening distribution networks to meet increasing global fragrance and flavour demand.

• North America leads with nearly 34% share, followed by Europe at around 29%, while Asia Pacific accounts for close to 25% and grows fastest due to rising personal care manufacturing and expanding consumer spending.

Market Segmentation Analysis:

By Purity Level

The ≥98% purity segment leads the Octyl Octanoate Market with about 63% share in 2024 due to its strong suitability for high-grade fragrance and flavor formulations. Manufacturers prefer this segment because high-purity material offers better stability, cleaner aromatic notes, and consistent performance in premium products. The ≤98% category serves cost-focused applications but grows at a slower pace. Rising demand for luxury perfumes and fine aromatic blends continues to push buyers toward ≥98% purity, strengthening its dominance across global production and formulation activities.

- For instance, Givaudan utilizes a sophisticated supply chain involving nearly 3,000 raw material suppliers to manage over 12,400 raw materials for production.

By Application

Fragrances dominate the application segment with nearly 58% share in 2024, driven by strong demand from fine perfumes, body mists, and personal care products. Octyl octanoate supports long-lasting scent profiles and enhances aromatic depth, making it a preferred material for fragrance houses. The flavouring agent and essential oils segments grow steadily as companies expand natural-inspired formulations. Other applications remain smaller but contribute to niche blends. Expanding personal grooming trends and rising consumption of premium fragrance products secure the leadership of the fragrance segment.

- For instance, Symrise manufactures about 35,000 products from around 10,000 raw materials and operates a global network of 36 production sites.

Key Growth Drivers

Rising Demand in Premium Fragrances

Growing consumption of high-end perfumes and personal care aromas drives strong demand for octyl octanoate because the compound enhances scent longevity and provides smooth, floral notes. Global fragrance makers prefer this ester due to its stable performance in both alcohol-based and oil-based formulations. Expanding personal grooming trends, especially in emerging economies, strengthens downstream consumption. Premiumization across beauty and wellness brands further supports steady adoption, making this segment a major driver of market expansion.

- For instance, dsm-firmenich, a leader in nutrition, health, and beauty, invested over €700 million in science and research in 2023 and operates 15 research & development centers globally.

Expansion of the Flavour and Aroma Chemicals Industry

The rapid growth of flavour and aroma chemicals boosts the need for octyl octanoate as companies develop more natural, mild, and consumer-friendly profiles. Food and beverage producers adopt this ester to improve aroma stability and deliver cleaner sensory experiences. Rising demand for processed foods, ready-to-drink beverages, and confectionery products enhances usage across blended flavour systems. Increasing regulatory acceptance of specific esters in controlled concentrations also helps expand commercial opportunities, making this another core driver of market growth.

- For instance, IFF operates a vast global network with approximately 150 manufacturing facilities, creative centers, and application laboratories across around 40 countries.

Increasing Use in Essential Oils and Aromatherapy Products

The wellness industry expands steadily, raising demand for essential oil blends used in diffusers, massage oils, and therapeutic products. Octyl octanoate supports smooth aromatic transitions and enhances overall formulation stability, making it a valued ingredient. Growing consumer preference for mood-enhancing products and natural lifestyle solutions strengthens product formulation pipelines. The rise of spa therapy chains and home aromatherapy adoption contributes to sustained demand, cementing this category as a key growth driver.

Key Trends and Opportunities

Shift Toward High-Purity Ester Grades

Producers increasingly focus on ≥98% purity because premium aroma and flavour applications require consistent performance and clean olfactory profiles. High-purity grades support better compatibility with complex formulations and align with rising quality standards across cosmetics and food sectors. Companies investing in advanced purification technology gain stronger positions in supply chains. This shift creates opportunities for manufacturers to introduce improved product lines and strengthen relationships with global fragrance houses.

- For instance, BASF operates a global production network for its aroma ingredients business, including a world-scale integrated site in Kuantan, Malaysia. The company has a total global annual production capacity for citral of approximately 118,000 metric tons (following the completion of new plants after 2026).

Growth of Natural and Clean-Label Formulations

The clean-label movement influences product development as brands reduce harsh solvents and synthetic additives. Octyl octanoate benefits from its mild, nature-aligned profile, offering an attractive option for formulators in cosmetics, flavours, and essential oils. Consumer interest in plant-based and minimally processed products accelerates innovation in aroma blends. This trend creates space for suppliers to expand portfolios targeting sustainable and eco-friendly formulations, generating new commercial pathways.

- For instance, the Takasago Group operates a global network of offices, production sites, and R&D centers in 28 countries and regions. As of December 2024, the scope of their environmental certification was expanded to include 21 domestic and overseas production sites and the Corporate R&D Division in Japan.

Rising Adoption in Niche Personal Care Segments

Smaller personal care categories like artisanal fragrances, aromatherapy candles, and botanical skin-care blends increasingly incorporate octyl octanoate for its smoothing aromatic character. These niche markets grow rapidly through online channels and premium boutique brands. The shift toward handcrafted and small-batch products boosts demand for versatile, high-quality esters. Manufacturers that supply flexible product grades and small-volume solutions gain strong entry points into these emerging opportunities.

Key Challenges

Fluctuating Raw Material Availability

Unstable availability of feedstock chemicals used in ester production creates periodic supply tightness. Variability in petrochemical and natural alcohol supply affects production consistency and drives cost pressures for formulators. Manufacturers face challenges in maintaining stable pricing for end users during volatility. This issue also influences long-term planning for fragrance and flavour producers who depend on predictable input quality.

Regulatory Compliance Across Multiple End-Use Sectors

Aroma and flavour ingredients face stringent regional regulations covering safety limits, purity standards, and acceptable usage categories. Meeting these diverse guidelines increases compliance costs for producers and slows product approvals. Differences between cosmetic, food, and aromatherapy regulations require detailed documentation and testing. These constraints pose challenges for companies aiming to expand into new markets while maintaining consistent formulation standards.

Regional Analysis

North America

North America holds around 34% share of the Octyl Octanoate Market in 2024, driven by strong demand from premium fragrance brands, personal care manufacturers, and established flavouring companies. The region benefits from advanced production capabilities and high adoption of high-purity aroma chemicals. Growth remains steady due to rising consumer spending on luxury perfumes and wellness products. Expanding aromatherapy use and clean-label formulation trends also support wider adoption. The presence of major formulators and well-structured distribution networks keeps North America a leading contributor to overall market growth.

Europe

Europe accounts for nearly 29% share of the Octyl Octanoate Market in 2024, supported by its mature fragrance and flavouring industries. The region hosts several global perfume houses and food ingredient manufacturers, which drives sustained consumption of high-purity octyl octanoate. Increasing regulatory focus on quality and safety encourages producers to use stable and compliant aroma esters. Demand also rises due to growth in natural cosmetic formulations and essential oil blends. Ongoing investments in R&D, sustainability programs, and premium product innovation help maintain Europe’s strong market position.

Asia Pacific

Asia Pacific holds about 25% share of the Octyl Octanoate Market in 2024 and remains the fastest-growing region due to its expanding personal care, fragrance, and food processing sectors. Countries such as China, India, Japan, and South Korea experience rising demand for fine fragrances, aromatherapy products, and flavored beverages. Increasing urbanization and rising disposable income strengthen consumption across mass and premium categories. Regional manufacturers also scale production of aroma chemicals, improving supply availability. Growing investments in cosmetic ingredient manufacturing support continued growth in the octyl octanoate segment.

Latin America

Latin America represents around 7% share of the Octyl Octanoate Market in 2024, with demand largely driven by expanding personal care and fragrance industries in Brazil, Mexico, and Colombia. The region shows growing interest in aromatherapy products and natural-styled cosmetic formulations. Local brands increasingly adopt octyl octanoate to enhance fragrance stability and improve product sensory appeal. Market growth is supported by rising middle-class spending on grooming and wellness. However, slower industrial development compared to major regions moderates long-term expansion, keeping Latin America a mid-tier contributor.

Middle East and Africa

Middle East and Africa hold close to 5% share of the Octyl Octanoate Market in 2024, supported by rising demand for fine fragrances, particularly in Gulf countries with strong perfume cultures. Growth is also influenced by expanding cosmetic manufacturing and increasing acceptance of aromatherapy products across urban areas. Regional import dependence remains high, but new investments in personal care and wellness sectors create opportunities for higher consumption. Market expansion continues at a moderate pace due to limited local production capacity and varying regulatory frameworks across countries.

Market Segmentations:

By Purity Level

By Application

- Fragrances

- Flavouring Agent

- Essential Oils

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Octyl Octanoate Market includes Zschimmer & Schwarz, Stepan Company, Emery Oleochemicals, BASF, Berg + Schmidt GmbH & Co. KG, Croda International Plc, Vantage Specialty Ingredients, and IOI Oleochemical Industries Berhad. The market features a mix of global oleochemical producers and specialized aroma-chemical suppliers that focus on consistent purity levels, reliable raw material sourcing, and scalable production capabilities. Competitors enhance their positions by investing in efficient esterification processes, strengthening distribution partnerships, and expanding portfolios aligned with fragrance, flavour, and essential oil applications. Many companies emphasize high-purity grades to meet the rising demand for premium formulations across cosmetics and personal care products. Strategic activities include upgrading manufacturing technologies, improving sustainability practices, and intensifying research efforts to support clean-label and natural product development. Growing regional demand, especially in Asia Pacific, encourages players to expand supply chains and increase capacity to secure long-term competitiveness in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Emery Oleochemicals announced a technical presentation and exhibition at the STLE 2025 Annual Meeting, focusing on sustainable innovations in ester base stocks and additives.

- In 2025, Vantage announced the launch of four new personal care ingredients at the in-cosmetics global tradeshow, illustrating their ongoing innovation in personal care chemicals, likely including Octyl Octanoate-related formulations or derivatives as part of their specialty ingredients portfolio.

- In 2023, BASF introduced a proprietary process for producing 2-octyl acrylate (2-OA), a related C8-based monomer, as part of its expansion of bio-based monomers portfolio.

Report Coverage

The research report offers an in-depth analysis based on Purity Level, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as fragrance and personal care demand increases.

- High-purity grades will gain wider adoption across premium formulations.

- Flavouring applications will expand with rising processed food consumption.

- Aromatherapy and essential oil blends will drive stronger usage in wellness products.

- Manufacturers will invest in advanced purification technology to improve consistency.

- Clean-label and natural formulation trends will open new commercial opportunities.

- Asia Pacific will continue to grow fastest due to expanding cosmetic industries.

- Regulatory clarity will improve product approvals and streamline global trade.

- Supply chain optimization will reduce volatility in raw material availability.

- Niche personal care brands will boost demand through small-batch and artisanal products.