Market Overview

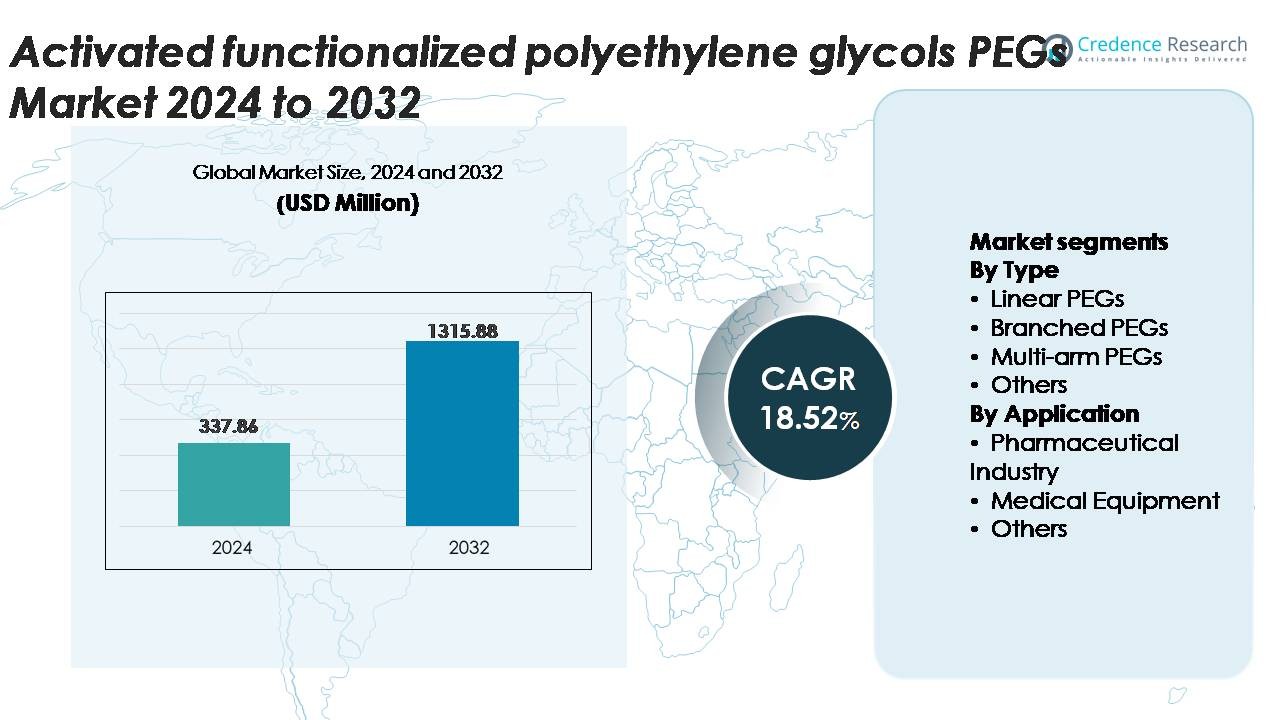

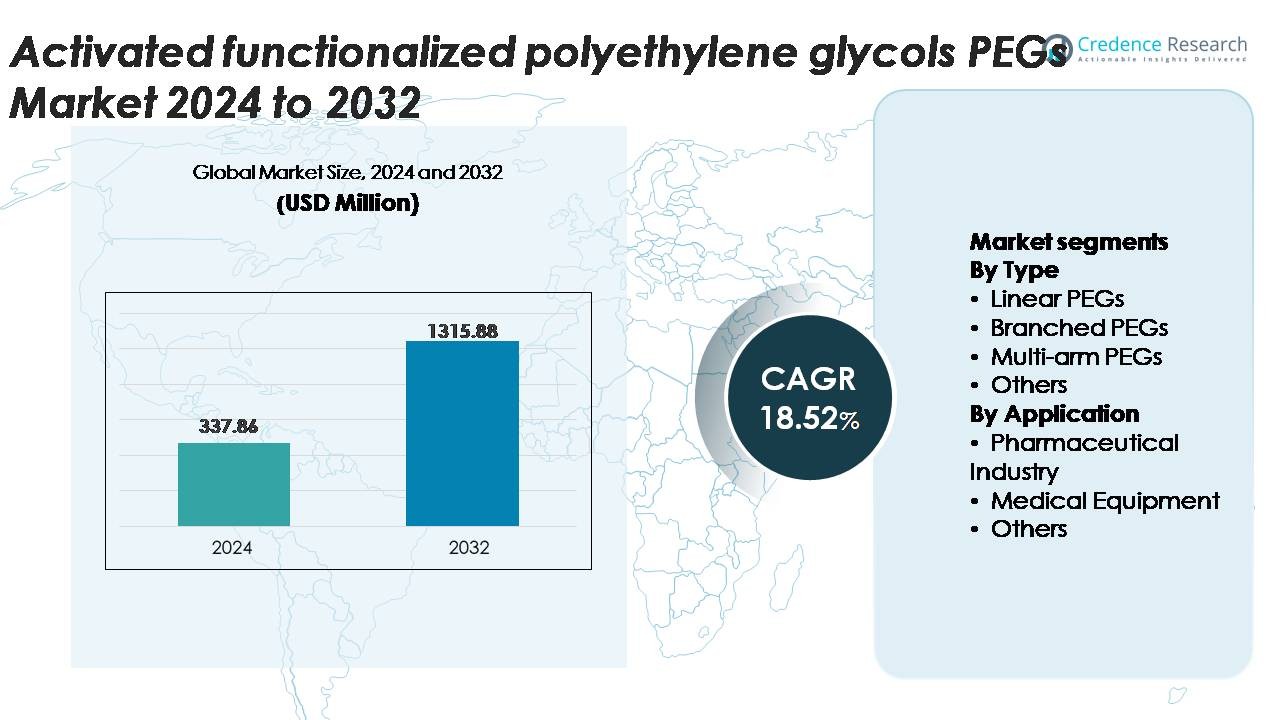

The Activated functionalized polyethylene glycols (PEGs) market was valued at USD 337.86 million in 2024 and is projected to reach USD 1,315.88 million by 2032, registering a CAGR of 18.52% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Activated Functionalized Polyethylene Glycols (PEGs) Market Size 2024 |

USD 337.86 Million |

| Activated Functionalized Polyethylene Glycols (PEGs) Market, CAGR |

18.52% |

| Activated Functionalized Polyethylene Glycols (PEGs) Market Size 2032 |

USD 1,315.88 Million |

The activated functionalized polyethylene glycols (PEGs) market is shaped by a strong cohort of specialized manufacturers and global chemical leaders, including Nektar Therapeutics, Laysan Bio, SINOPEG, Chemgen Pharma, Creative PEGWorks, BASF, NOF, SunBio, Merck, and JenKem Technology. These companies compete through high-purity PEG production, diversified functionalization chemistries, and GMP-compliant manufacturing tailored for biologics, mRNA delivery, and medical device applications. North America remains the leading region, holding around 38% of the global market due to its advanced biopharmaceutical ecosystem and strong innovation capacity. Europe follows with approximately 27%, driven by robust biologics research and regulated excipient standards, while Asia-Pacific grows rapidly as a competitive manufacturing hub.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The activated functionalized polyethylene glycols (PEGs) market was valued at USD 337.86 million in 2024 and is expected to reach USD 1,315.88 million by 2032, registering a CAGR of 18.52% during the forecast period.

- Market growth is driven by rising PEGylation adoption in biologics, expanding mRNA therapeutics, and increasing demand for high-purity PEG derivatives in drug delivery, medical coatings, and diagnostic technologies.

- Key trends include the shift toward customized PEG architectures, growing use in regenerative medicine and nanomedicine, and expanding applications in high-performance biomaterials and advanced therapeutic platforms.

- Competitive dynamics remain strong, with leading players focusing on GMP manufacturing, narrow-dispersity PEGs, and diversified functional chemistries, while restraints include high production costs and stringent purity regulations.

- North America leads with 38% regional share, followed by Europe at 27% and Asia-Pacific at 24%, while Linear PEGs dominate the type segment with the highest adoption in pharmaceutical applications.

Market Segmentation Analysis:

By Type

Linear PEGs command the largest market share among all type categories due to their high structural uniformity, predictable reactivity, and broad compatibility with activated functional groups used in drug delivery, biomaterials, and surface modification. Their dominance is further supported by strong adoption in PEGylated APIs and protein-stabilization processes. Branched and multi-arm PEGs are gaining traction in advanced conjugation and nanoparticle engineering, though they remain niche compared to linear grades. Specialty and other PEG formats continue to expand usage in targeted delivery and rheology-modification applications, driven by increasing formulation complexity and biologics development.

- For instance, NOF Corporation’s SUNBRIGHT® ME-050HS linear mPEG-NHS provides an activated ester with a molecular weight of 5,000 Da and a hydrolysis half-life of approximately 40 minutes at 25 °C, enabling efficient protein conjugation workflows.

By Application

The pharmaceutical industry represents the dominant application segment, supported by extensive use of activated functionalized PEGs in drug conjugation, antibody modification, controlled-release formulations, and solubility enhancement. This segment maintains the largest share due to rising biologics production and continuous adoption of PEGylation strategies to improve pharmacokinetics. Medical equipment applications also exhibit steady growth, particularly in surface-coating, biocompatibility enhancement, and hydrophilic modification of implants and diagnostic devices. Other applications, including specialty chemicals and materials engineering, benefit from expanding research on PEG-linked polymers and biofunctional interfaces for next-generation therapeutic and analytical products.

- For instance, Nektar Therapeutics’ clinically validated PEGylation platform has produced PEG-drug conjugates using 20,000 Da and 40,000 Da multi-arm and linear activated PEGs to achieve extended circulation half-lives in protein therapeutics.

Key Growth Drivers

Rising Adoption of PEGylation in Biologics and Advanced Drug Delivery

The expanding pipeline of biologics, peptides, and antibody-based therapeutics continues to drive strong demand for activated functionalized PEGs due to their ability to enhance solubility, stability, and half-life of therapeutic molecules. PEGylation improves pharmacokinetic performance, reduces dosing frequency, and minimizes immunogenicity, making it indispensable for next-generation formulations. Pharmaceutical companies increasingly rely on NHS-activated, maleimide-terminated, and azide-functional PEGs to support precise conjugation and controlled molecular orientation. With more than 2,000 biologics under development globally, manufacturers require consistent, high-purity PEGs that meet stringent regulatory expectations. This trend accelerates long-term consumption, especially as biosimilars, long-acting injectables, and highly targeted therapies gain broader commercial presence.

- For instance, a 40,000 Da (40 kDa) branched PEG chain was used in the development of the approved product Peginterferon alfa-2a (developed by a licensee, Roche, and marketed as Pegasys), which extended the drug’s half-life, allowing for once-weekly dosing for Hepatitis C treatment, a significant improvement over daily dosing of the non-PEGylated version.

Growing Integration of Functionalized PEGs in Biomaterials and Medical Device Coatings

Activated functional PEGs play a crucial role in improving hydrophilicity, reducing protein fouling, and enhancing biocompatibility in medical devices, implants, and diagnostic surfaces. Their ability to create non-reactive, stable, and uniform polymer brushes on metals, ceramics, and polymeric substrates drives adoption in catheters, biosensors, microfluidic components, and controlled-release systems. As minimally invasive procedures rise and device design becomes more sophisticated, manufacturers require surface-engineered materials that resist biofilm formation and enable reliable biological interactions. Functional PEG derivatives such as epoxy-, aldehyde-, and thiol-activated types support precise molecular grafting, expanding usage across advanced wound care, orthopedic implants, and regenerative medicine scaffolds.

- For instance, NOF Corporation’s SUNBRIGHT® 4-arm PEG-NHS series, supplied in 10,000 Da and 20,000 Da molecular weights, enables uniform hydrogel network formation and reduces protein adsorption below 5 ng/cm² on coated surfaces, significantly enhancing device biocompatibility.

Expansion of High-Purity PEGs in mRNA Platforms, Immunotherapies, and Diagnostic Technologies

The rapid scaling of mRNA vaccines, lipid nanoparticle (LNP) formulations, and precision immunotherapies has significantly increased demand for ultra-high-purity activated PEGs. These PEGs function as critical excipients in nanoparticle delivery systems, ensuring stability, optimized circulation time, and efficient encapsulation. Emerging diagnostic technologies such as microarray chips, affinity sensors, and high-throughput analytical tools also depend on functional PEG linkers for molecular immobilization and noise reduction. Regulatory emphasis on excipient traceability and batch consistency pushes manufacturers to produce PEGs with low endotoxin levels, narrow polydispersity, and high activation efficiency. As global R&D investments in gene therapies, mRNA platforms, and personalized medicine accelerate, demand for specialty PEG derivatives continues to strengthen.

Key Trends & Opportunities

Increasing Shift Toward Customizable PEG Architectures for Precision Conjugation

A key trend shaping the market is the rising preference for customized PEG structures tailored to specific molecular targets, conjugation chemistries, and therapeutic delivery needs. Pharmaceutical companies increasingly require PEGs with defined molecular weights, narrow dispersity profiles, and specific end-group functionalities to support site-specific conjugation. Multi-arm, heterobifunctional, and orthogonally reactive PEGs are gaining traction as drug developers pursue higher payload delivery efficiency and reduced off-target effects. This customization trend opens strong opportunities for PEG manufacturers offering modular synthesis platforms, GMP-compliant production, and rapid-development services to support emerging biopharma pipelines.

- For instance, JenKem Technology supplies heterobifunctional PEGs such as NHS-PEG-Maleimide in molecular weights ranging from 2,000 Da to 40,000 Da, with polydispersity indices typically below 1.05, enabling highly controlled protein and peptide conjugation.

Growing Opportunities in Nanomedicine, Regenerative Medicine, and Smart Biomaterials

Advancements in nanomedicine and regenerative therapies are expanding opportunities for activated PEGs as functional linkers, coating materials, and stabilizers. PEG-based hydrogels, PEG-crosslinked scaffolds, and PEG-modified nanoparticles enable controlled drug release, improved cellular interaction, and enhanced implant integration. The rise of 3D bioprinting, tissue engineering, and AI-enabled biomaterial design further increases PEG usage in customized therapeutic matrices. In diagnostics, PEG-functional interfaces improve sensitivity in biosensors, microarrays, and molecular detection platforms. These emerging domains provide long-term growth potential as healthcare systems increasingly adopt precision materials and miniaturized therapeutic devices.

- For instance, Creative PEGWorks supplies 4-arm PEG-Vinyl Sulfone hydrogels in 10,000 Da and 20,000 Da variants, capable of forming crosslinked networks with gelation times under 60 seconds, supporting rapid scaffold formation for nanomedicine and regenerative applications.

Key Challenges

Regulatory Complexity and Stringent Purity Requirements

Activated PEGs used in pharmaceuticals and medical devices must meet exceptionally strict purity, traceability, and consistency standards. Regulatory agencies enforce tight controls on endotoxin levels, residual solvents, activation efficiency, and product characterization. Meeting these requirements demands advanced manufacturing, rigorous quality assurance, and validated analytical methodologies, which increase production costs and extend development cycles. Variability in global regulatory frameworks further complicates compliance for companies operating across multiple regions. These challenges create entry barriers for smaller manufacturers and require continuous investments in analytical technology, documentation, and GMP-certified infrastructure.

High Production Costs and Raw Material Dependency

Manufacturing activated functionalized PEGs involves multistep synthesis, specialized catalysts, controlled polymerization environments, and high-purity purification systems. Fluctuations in prices of ethylene oxide and related precursors directly impact production economics, while stringent handling requirements add further operational complexity. The need for ultra-high-purity grades for biologics and mRNA delivery significantly increases manufacturing overhead. Smaller firms may struggle to achieve cost competitiveness or secure reliable raw material supply chains. These cost pressures can limit scalability, delay commercialization timelines, and reduce adoption in cost-sensitive markets such as basic medical devices or low-margin therapeutic formulations.

Regional Analysis

North America

North America holds the largest share of the activated functionalized PEGs market, accounting for around 38%, driven by strong biopharmaceutical manufacturing, mature biologics pipelines, and high adoption of PEGylation technologies. The region benefits from extensive R&D investment, robust regulatory frameworks, and the presence of leading biotech companies specializing in monoclonal antibodies, mRNA delivery, and targeted therapies. Growing demand for high-purity PEGs in medical devices and diagnostic platforms further strengthens regional consumption. Additionally, the U.S. leads in GMP-certified PEG production capabilities, ensuring consistent supply for advanced drug development programs.

Europe

Europe represents approximately 27% of the market, supported by its advanced pharmaceutical infrastructure, strong biologics research ecosystem, and increasing emphasis on high-quality excipients for precision therapeutics. Countries such as Germany, the U.K., and Switzerland remain central hubs for PEGylated drug development and medical device innovation. Growing adoption of PEG-based biomaterials in regenerative medicine, surgical coatings, and controlled-release formulations further elevates demand. Regulatory harmonization under EMA guidelines also accelerates the commercialization of PEG-modified therapeutics. The region’s push for clinical innovation and biocompatible materials continues to sustain steady market expansion.

Asia-Pacific

Asia-Pacific commands around 24% of the global market and exhibits the fastest growth due to expanding biologics manufacturing, rising government investment in pharmaceutical R&D, and rapid scaling of mRNA and nanoparticle-based therapeutic platforms. China, India, Japan, and South Korea are strengthening PEG production capabilities to support domestic drug development and export-oriented APIs. Rising demand for functionalized PEGs in medical equipment, coatings, and diagnostic consumables further drives regional consumption. The region’s growing contract manufacturing sector, coupled with competitive production costs, enhances its positioning as a key supplier of activated PEG derivatives.

Latin America

Latin America accounts for about 6% of the market, driven primarily by increasing pharmaceutical production in Brazil, Mexico, and Argentina. Demand is rising for activated PEGs used in solubility enhancement, formulation stability, and surface modification of medical devices. Government support for local API manufacturing and improving regulatory frameworks contribute to greater adoption of PEG-based excipients. While the region still relies heavily on imports for high-purity PEGs, expanding biologics and biosimilar investments are creating new opportunities. Growth remains gradual but steady as healthcare systems modernize and local manufacturers upgrade production capabilities.

Middle East & Africa

The Middle East & Africa region holds approximately 5% of the market, supported by growing healthcare modernization, increased adoption of biologics, and expanding demand for PEG-coated medical equipment. Countries such as the UAE, Saudi Arabia, and South Africa are investing in pharmaceutical infrastructure and diagnostic technologies, driving incremental use of activated PEGs in therapeutic formulations and device coatings. While limited domestic manufacturing constrains overall market development, increasing partnerships with global suppliers and expanding clinical research activity are strengthening the region’s long-term demand profile.

Market Segmentations:

By Type

- Linear PEGs

- Branched PEGs

- Multi-arm PEGs

- Others

By Application

- Pharmaceutical Industry

- Medical Equipment

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape:

The competitive landscape of the activated functionalized polyethylene glycols (PEGs) market is characterized by a mix of established global chemical producers, specialized PEG manufacturers, and biotechnology-focused suppliers competing on product purity, functional diversity, and regulatory compliance. Leading companies prioritize GMP-certified production, narrow polydispersity control, and high-activation efficiency to meet stringent pharmaceutical and medical device standards. Strategic focus areas include expanding heterobifunctional and multi-arm PEG portfolios, enhancing analytical characterization capabilities, and strengthening supply reliability for biologics, mRNA vaccines, and advanced drug delivery systems. Partnerships with biopharmaceutical firms, investments in custom synthesis platforms, and geographic expansion into Asia-Pacific manufacturing hubs are becoming central competitive strategies. Market players also differentiate through technical support services, rapid development timelines, and the ability to deliver tailor-made PEG architectures optimized for conjugation chemistry. As R&D pipelines shift toward targeted therapies and precision materials, competition intensifies around innovation, scalability, and regulatory readiness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In June 2024, SunBio published a milestone article on a dough-type hydrogel product that when crosslinked increased its storage modulus from 3.7 kPa to 32 kPa, leveraging PEG-derived functional scaffolds for irregular bone-defect repair.

- In March 2024, BASF Pharma Solutions launched its “Kolliphor® P188 Cell Culture” shear-protectant product and invested in a new GMP solution centre in North America, reinforcing its positioning in high-performance excipients including polymer-PEG systems.

- In 2024, The company Laysan Bio continues to list a broad portfolio of cGMP-grade activated PEG products (monofunctional, bifunctional, multi-arm, heterobifunctional) as part of its offering.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for activated functionalized PEGs will continue rising as biologics, peptides, and antibody–drug conjugates expand globally.

- PEG derivatives will gain deeper integration into lipid nanoparticle systems supporting next-generation mRNA and gene-delivery platforms.

- Customizable PEG architectures, including heterobifunctional and multi-arm formats, will see wider adoption for precision conjugation.

- Regulatory emphasis on excipient traceability and GMP compliance will push manufacturers toward higher purity and advanced analytical capabilities.

- PEG-based biomaterials will experience growing use in regenerative medicine, tissue engineering, and implant surface modification.

- Partnerships between PEG producers and biopharma companies will strengthen to accelerate drug formulation and scale-up.

- Asia-Pacific will emerge as a leading manufacturing hub for functionalized PEGs due to expanding biopharma infrastructure.

- Medical devices will increasingly incorporate PEG coatings to improve hydrophilicity, biocompatibility, and patient safety.

- Innovations in PEGylation chemistry will enhance therapeutic stability, targeted delivery, and dosing efficiency.

- Market competition will intensify as new suppliers enter with specialized PEG derivatives and cost-efficient production technologies.