Market Overview:

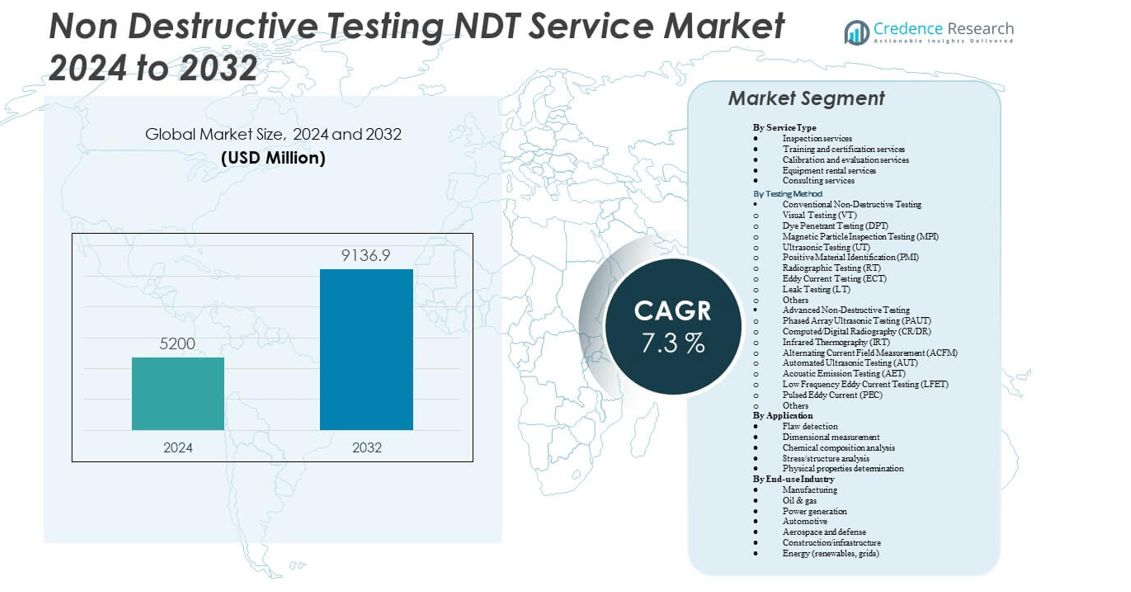

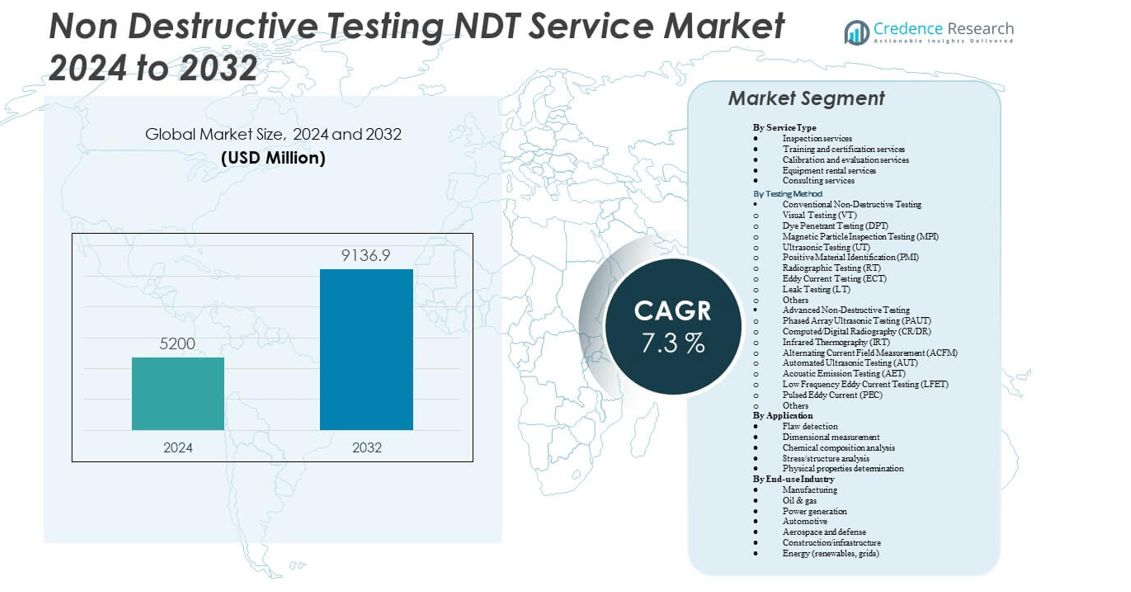

The Non-Destructive Testing (NDT) Service Market is projected to grow from USD 5200 million in 2024 to an estimated USD 9136.9 million by 2032, with a compound annual growth rate (CAGR) of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non Destructive Testing (NDT) Service Market Size 2024 |

USD 5200 million |

| Non Destructive Testing (NDT) Service Market, CAGR |

7.3% |

| Non Destructive Testing (NDT) Service Market Size 2032 |

USD 9136.9 million |

Market growth is driven by strict safety regulations, rising industrial standards, and the demand for advanced testing technologies. Industries such as oil and gas, aerospace, automotive, and power generation rely heavily on NDT services to ensure asset reliability and reduce downtime. Increasing infrastructure development, aging equipment, and growing awareness about preventive maintenance practices also fuel demand. Continuous advancements in techniques like ultrasonic, radiographic, and magnetic particle testing further strengthen adoption, while automation and digitalization are enhancing accuracy and efficiency in inspection processes.

Regionally, North America leads the Non Destructive Testing Service Market due to its strong presence of advanced industries, high regulatory compliance, and adoption of innovative testing technologies. Europe follows with significant demand from aerospace and automotive sectors, emphasizing strict quality standards. Asia Pacific is emerging as the fastest-growing region, supported by rapid industrialization, expanding infrastructure projects, and increasing investments in energy and manufacturing. Countries like China, India, and South Korea are strengthening their position through large-scale construction and power generation activities. Meanwhile, the Middle East is witnessing growing adoption in oil and gas operations, while Latin America is expanding gradually with industrial modernization efforts.

Market Insights:

- The Non Destructive Testing NDT Service Market is projected to grow from USD 5200 million in 2024 to USD 9136.9 million by 2032, at a CAGR of 7.3%.

- Strict safety regulations and industry compliance requirements are key drivers fueling demand for advanced testing services.

- Expanding infrastructure projects and modernization of industrial facilities increase the reliance on inspection and evaluation services.

- High costs of advanced testing equipment and shortage of certified professionals act as major restraints for smaller firms.

- North America holds the largest market share at 34%, supported by advanced industries and regulatory enforcement.

- Europe captures 28% of the market, led by aerospace, automotive, and renewable energy inspection needs.

- Asia Pacific represents 25% share, emerging as the fastest-growing region due to large-scale industrialization and infrastructure growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Safety-Critical Industries

The Non Destructive Testing NDT Service Market is gaining momentum due to the rising need for safety in critical industries. Sectors such as oil and gas, aerospace, automotive, and power generation rely heavily on inspection services. It ensures that equipment, components, and infrastructure meet high standards without compromising operational integrity. Regulators are enforcing stricter compliance measures, which are pushing organizations to adopt NDT more widely. Growing investment in preventive maintenance further enhances demand for reliable inspection services. Operators see NDT as essential to reduce risks of failure. It becomes a critical tool in maintaining safety and extending equipment life. Continuous demand from these industries forms a strong base for steady market growth.

- For example, Baker Hughes’ Panametrics multipath ultrasonic flow meters deliver custody transfer–grade accuracy for oil and gas pipelines. Their eight-path technology maintains precision under varying flow conditions, with performance validated through industry calibration standards.

Increasing Infrastructure Development and Modernization

Growing infrastructure development and modernization projects are expanding the application scope of NDT services. Governments and private investors are funding large-scale construction, power plants, and transport networks. It drives the need for inspection to verify structural integrity at every stage. Emerging economies are accelerating adoption to support safe and efficient projects. Rapid urbanization across Asia Pacific and the Middle East strengthens demand for specialized services. The push for smart cities also creates new testing opportunities. Companies providing advanced inspection solutions benefit from recurring projects. The increasing infrastructure base ensures NDT remains a vital requirement across diverse applications.

- For instance, Applus+ RTD’s “Rayscan Oyster” real-time digital radiographic inspection system enables onshore pipeline weld inspections for diameters up to 36 inches using a shielded mobile setup. The system maintains radiation dose rates below 7.5 µSv/hr at approximately a three-meter distance, enabling safer operations near welding crews.

Growing Adoption of Advanced Testing Technologies

Technology advancements are reshaping the Non Destructive Testing NDT Service Market. Automation, artificial intelligence, and digital tools are improving accuracy and speed in inspection processes. It allows organizations to detect flaws at earlier stages and avoid costly breakdowns. Adoption of ultrasonic, radiographic, and magnetic particle testing techniques has widened. Digital records and remote monitoring improve accessibility for global teams. Industries value solutions that enhance efficiency without disrupting operations. Rising focus on predictive maintenance aligns strongly with advanced testing methods. Demand for high-performance inspection continues to grow in line with these technological improvements.

Rising Emphasis on Asset Life Extension and Cost Efficiency

Companies are focusing on extending asset life while reducing overall costs. It makes NDT services highly valuable, especially for aging infrastructure and machinery. Industrial operators view inspection as a long-term investment for safety and operational reliability. Aging energy plants, pipelines, and aerospace fleets create a pressing demand for inspections. Organizations seek to minimize downtime and optimize maintenance cycles with accurate results. Regulatory requirements amplify the need for frequent testing and documentation. NDT becomes a cost-effective alternative to replacements or repairs. Sustained emphasis on efficiency and asset longevity drives wider adoption of inspection services.

Market Trends:

Growing Integration of Digital Twin and Simulation Technologies

The Non Destructive Testing NDT Service Market is witnessing a trend toward integration with digital twin technologies. Industries are leveraging simulation models to replicate real-time equipment performance. It allows predictive analytics and faster decision-making based on inspection outcomes. Virtual testing enhances efficiency by reducing the need for physical trials. Organizations can monitor structural health continuously with data-driven approaches. The ability to visualize defects digitally strengthens preventive maintenance efforts. Digital twins ensure precise evaluation of performance under different stress conditions. This trend is transforming inspection into a more dynamic and intelligence-driven process.

Rising Use of Robotics and Automated Inspection Systems

Robotics is transforming the landscape of NDT services with increasing adoption across industries. Automated systems perform inspections in hazardous or hard-to-reach environments with higher accuracy. It reduces risks for human operators while improving operational efficiency. Drones and robotic crawlers are being deployed in oil rigs, pipelines, and aerospace facilities. Automation enables faster coverage of large-scale infrastructure. Companies see it as a way to save costs and ensure compliance. Robotics-based inspection aligns with the broader movement toward Industry 4.0. It strengthens the market by making inspections safer, more reliable, and scalable.

- For instance, Eddyfi Technologies deployed its VersaTrax and Magg robotic magnetic crawlers for pipeline and tank inspections, enabling remote visual and ultrasonic testing over distances up to 100 meters in air and 60 meters underwater. These systems reduce the need for human entry into hazardous areas while enhancing defect detection accuracy in high-risk infrastructure.

Expanding Application of NDT in Renewable Energy Projects

The Non Destructive Testing NDT Service Market is expanding into renewable energy industries. Wind turbines, solar plants, and hydroelectric facilities require advanced inspections to maintain performance. It supports reliable operations in sectors that are scaling at a rapid pace. Manufacturers of renewable systems view NDT as crucial for lifecycle monitoring. Frequent inspections ensure uninterrupted energy generation and reduced maintenance costs. The trend aligns with global decarbonization goals. Expanding clean energy infrastructure creates consistent opportunities for NDT providers. The market adapts to new energy ecosystems by offering specialized services.

- For instance, ultrasonic phased array NDT has been applied in wind turbine blade inspections to detect internal defects such as wrinkles, delamination, and disbonds, with a detection resolution of around 1.5 mm. This technology improves quality control during manufacturing and enhances overall blade reliability in large-scale renewable energy projects.

Increasing Role of Artificial Intelligence in Defect Detection

Artificial intelligence is playing a major role in advancing defect detection capabilities. Algorithms analyze vast inspection datasets with greater precision than manual reviews. It identifies patterns and anomalies that could indicate early-stage failures. Machine learning enhances predictive maintenance by improving detection accuracy. Industries value AI-powered insights for reducing human error in inspections. AI tools help shorten inspection timelines while improving consistency. Integration with existing systems supports seamless adoption across industries. The growing role of AI strengthens trust in data-driven inspection services.

Market Challenges Analysis:

High Costs and Skill Shortages Affecting Adoption

The Non Destructive Testing NDT Service Market faces challenges from high costs of advanced equipment and skilled workforce shortages. Investing in modern inspection tools, robotics, and AI systems requires significant capital. Smaller enterprises often struggle to allocate budgets for such solutions. It restricts widespread adoption across all market levels. A shortage of certified inspectors adds further complexity, leading to longer project timelines. Training requirements increase costs for service providers and clients. Companies face difficulty balancing operational budgets with growing compliance demands. These challenges restrain growth despite strong industry potential.

Regulatory Complexity and Lack of Standardization

Global industries encounter hurdles due to varying regulations and lack of standardized inspection protocols. The Non Destructive Testing NDT Service Market must adapt services to meet diverse compliance requirements across regions. It creates operational inefficiencies for companies operating in multiple countries. Clients demand consistency in testing outcomes, yet standards differ across industries. Unclear regulations in developing economies create uncertainty for service providers. Maintaining certifications across regions adds administrative burdens. Companies often face delays in projects due to changing regulatory frameworks. The lack of harmonization slows down global adoption despite technological progress.

Market Opportunities:

Rising Demand in Emerging Economies with Industrial Expansion

Emerging economies present significant opportunities for the Non Destructive Testing NDT Service Market. Industrialization in Asia Pacific, Middle East, and Latin America is creating demand for inspection services. It supports growth in construction, energy, and manufacturing sectors. Governments are investing in infrastructure and energy diversification, driving inspection requirements. Expanding oil and gas operations in the Middle East boost demand for advanced testing. Rapidly growing power generation in Asia Pacific requires frequent inspections to ensure reliability. Service providers offering affordable and scalable solutions can capture large untapped markets. The potential in these regions supports a robust growth outlook.

Growing Potential in Digital and Automated Testing Solutions

Technology-driven inspection offers immense opportunities to service providers. The Non Destructive Testing NDT Service Market benefits from increasing reliance on digital platforms, robotics, and AI. It enables faster, more accurate, and cost-efficient inspections. Clients are demanding solutions that minimize downtime while maximizing efficiency. Providers who invest in innovation can strengthen their market presence. The adoption of digital records, simulation, and predictive analytics enhances service value. Companies embracing automation gain a competitive edge in complex industries. These opportunities allow market players to align with the future of industrial operations.

Market Segmentation Analysis:

The Non Destructive Testing NDT Service Market demonstrates diverse growth across service types, testing methods, applications, and end-use industries.

By service types, inspection services hold the largest share, driven by their critical role in ensuring compliance and operational safety. Training and certification services are expanding steadily, supported by growing demand for skilled professionals and international standards. Calibration and evaluation services remain essential for maintaining testing accuracy, while equipment rental services attract cost-conscious industries. Consulting services are strengthening their position, offering customized solutions and supporting regulatory adherence across complex sectors.

- For instance, the British Institute of Non-Destructive Testing (BINDT) administers PCN certification in compliance with ISO 9712:2012 standards, auditing over 80 training organizations annually and certifying thousands of NDT professionals worldwide to meet stringent international competency benchmarks.

By testing method, conventional approaches such as ultrasonic testing, radiographic testing, and magnetic particle inspection dominate usage due to proven reliability and cost-effectiveness. It continues to see strong adoption in legacy systems and infrastructure. Advanced methods, including phased array ultrasonic testing, digital radiography, and infrared thermography, are gaining prominence for their precision and compatibility with automation. These technologies cater to industries requiring high accuracy in defect detection and real-time monitoring.

- For instance, RVS Quality Certifications Pvt. Ltd. offers advanced phased array ultrasonic testing (PAUT) services for process plants. The technology enables high-accuracy volumetric inspections, detecting fine internal defects through real-time imaging ideal for industries such as aerospace, oil & gas, and manufacturing.

By applications such as flaw detection and stress analysis account for the highest demand, reflecting the priority of safety-critical assessments. Dimensional measurement and chemical composition analysis are increasingly applied in manufacturing and aerospace, while physical property determination supports advanced material testing. Each application strengthens industry reliance on accurate and repeatable results.

By end-use industries further shape demand, with oil and gas, power generation, and aerospace remaining dominant users due to strict safety regulations. Manufacturing and automotive sectors contribute significantly with ongoing modernization and quality control needs. Construction and infrastructure projects expand adoption for structural evaluations, while renewable energy grids represent a growing area of opportunity for advanced NDT services.

Segmentation:

By Service Type

- Inspection services

- Training and certification services

- Calibration and evaluation services

- Equipment rental services

- Consulting services

By Testing Method

- Conventional Non-Destructive Testing

- Visual Testing (VT)

- Dye Penetrant Testing (DPT)

- Magnetic Particle Inspection Testing (MPI)

- Ultrasonic Testing (UT)

- Positive Material Identification (PMI)

- Radiographic Testing (RT)

- Eddy Current Testing (ECT)

- Leak Testing (LT)

- Others

- Advanced Non-Destructive Testing

- Phased Array Ultrasonic Testing (PAUT)

- Computed/Digital Radiography (CR/DR)

- Infrared Thermography (IRT)

- Alternating Current Field Measurement (ACFM)

- Automated Ultrasonic Testing (AUT)

- Acoustic Emission Testing (AET)

- Low Frequency Eddy Current Testing (LFET)

- Pulsed Eddy Current (PEC)

- Others

By Application

- Flaw detection

- Dimensional measurement

- Chemical composition analysis

- Stress/structure analysis

- Physical properties determination

By End-use Industry

- Manufacturing

- Oil & gas

- Power generation

- Automotive

- Aerospace and defense

- Construction/infrastructure

- Energy (renewables, grids)

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America holds the largest share of the Non Destructive Testing NDT Service Market with 34%. Strong regulatory enforcement, advanced industrial infrastructure, and early adoption of cutting-edge testing methods drive regional leadership. Aerospace, oil and gas, and power generation sectors remain major contributors. It benefits from a mature service provider base offering both conventional and advanced solutions. Increasing focus on predictive maintenance further strengthens adoption. The region continues to dominate by combining technological innovation with strict compliance requirements.

Europe accounts for 28% of the global market, supported by strong manufacturing, automotive, and aerospace industries. The region emphasizes quality assurance and environmental safety, fueling the need for comprehensive testing services. Adoption of advanced techniques such as phased array ultrasonic testing and digital radiography is accelerating. It is reinforced by strict EU regulations that mandate testing across energy and construction projects. High investments in renewable energy grids create new opportunities. Europe maintains strong growth momentum through integration of advanced inspection technologies.

Asia Pacific follows with a 25% market share, emerging as the fastest-growing region due to industrial expansion and infrastructure development. Countries like China, India, and South Korea are driving adoption through large-scale manufacturing and power projects. Demand for advanced inspection is rising across automotive, construction, and energy sectors. It gains further traction from rising investments in oil and gas exploration and renewable energy capacity. Service providers are expanding their footprint to meet growing needs. Middle East and Africa together account for 13%, driven by oil and gas projects, construction growth, and diversification into renewable energy. These regions are gradually increasing adoption of advanced testing solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SGS Société Générale de Surveillance SA (Switzerland)

- Bureau Veritas (France)

- Baker Hughes Company (US) / Waygate Technologies

- Applus Services, S.A. (Spain)

- Intertek Group plc (UK)

- MISTRAS Group (US)

- Acuren Group Inc (US/Canada)

- Eddyfi Technologies (Canada)

- Ashtead Technology (UK)

- Olympus Corporation / Evident (Japan)

- TÜV Rheinland (Germany)

- Team Inc (US)

- Element Materials Technology (UK)

- Hexagon AB (Sweden)

- LynX Inspection (Canada)

- Sonatest Ltd (UK)

- YXLON International (Germany)

- TD Williamson, Inc (US)

Competitive Analysis:

The Non Destructive Testing NDT Service Market is highly competitive with global and regional players offering specialized solutions. Leading companies such as SGS SA, Bureau Veritas, Intertek Group, Applus+, and TÜV Rheinland dominate through wide service portfolios and global presence. It benefits from their expertise in both conventional and advanced inspection technologies. Smaller regional firms compete by offering cost-effective services and local compliance knowledge. Companies focus on strategic partnerships, digitalization, and automation to expand capabilities. Growing emphasis on training, certification, and predictive maintenance solutions adds competitive intensity. The market remains fragmented, with innovation and compliance readiness serving as key differentiators.

Recent Developments:

- In July 2025, NDT Global acquired Entegra, a specialist in ultra-high‑resolution magnetic flux leakage (UHR MFL) in‑line inspection services. This move significantly expanded NDT Global’s capabilities in the gas pipeline sector and enhanced its integrated pipeline integrity solutions

- In Dec 2024, Apave Group acquired IRISNDT, a North American non‑destructive testing and inspection firm. The acquisition strengthened Apave’s presence in the USA, Canada, Australia, and the UK, and added advanced inspection and asset integrity engineering services to its portfolio.

- In June 2025, Metalogic announced the acquisition of NDT‑PRO Services, a Houston‑based inspection provider. The move expanded Metalogic’s Gulf Coast footprint and reinforced its service capabilities in the oil and gas sector.

- In May 2023, Nordic Inspekt Group AB, part of Inin Group, announced a preliminary agreement to acquire AlfaTest AB, a Swedish NDT company. This move enables Nordic Inspekt Group to expand into the global maritime NDT services market and bolsters its position within Sweden’s NDT sector by integrating AlfaTest’s operational expertise and service footprint.

Report Coverage:

The research report offers an in-depth analysis based on Service Type, Testing Method, Application, and End-use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing industrialization across emerging economies will drive wider adoption of inspection services to ensure operational safety and regulatory compliance.

- Expansion of renewable energy infrastructure will create strong demand for advanced testing in wind, solar, and grid systems.

- Adoption of robotics and drones will accelerate, allowing faster and safer inspections in hazardous and remote environments.

- Integration of artificial intelligence will enhance defect detection accuracy and support predictive maintenance strategies.

- Rising complexity in aerospace and defense components will boost reliance on sophisticated testing methods for reliability assurance.

- Increasing digitalization will enable real-time data sharing, remote inspections, and enhanced collaboration across global teams.

- The market will benefit from stronger regulatory frameworks that mandate frequent inspection and certification in critical industries.

- Investments in training and certification will expand the skilled workforce, addressing shortages and ensuring standardized practices.

- Oil and gas operations will continue to rely heavily on non-destructive testing to manage asset integrity and minimize downtime.

- Continuous innovation in advanced technologies such as phased array, infrared thermography, and computed radiography will define long-term growth trajectories.