Market Overview

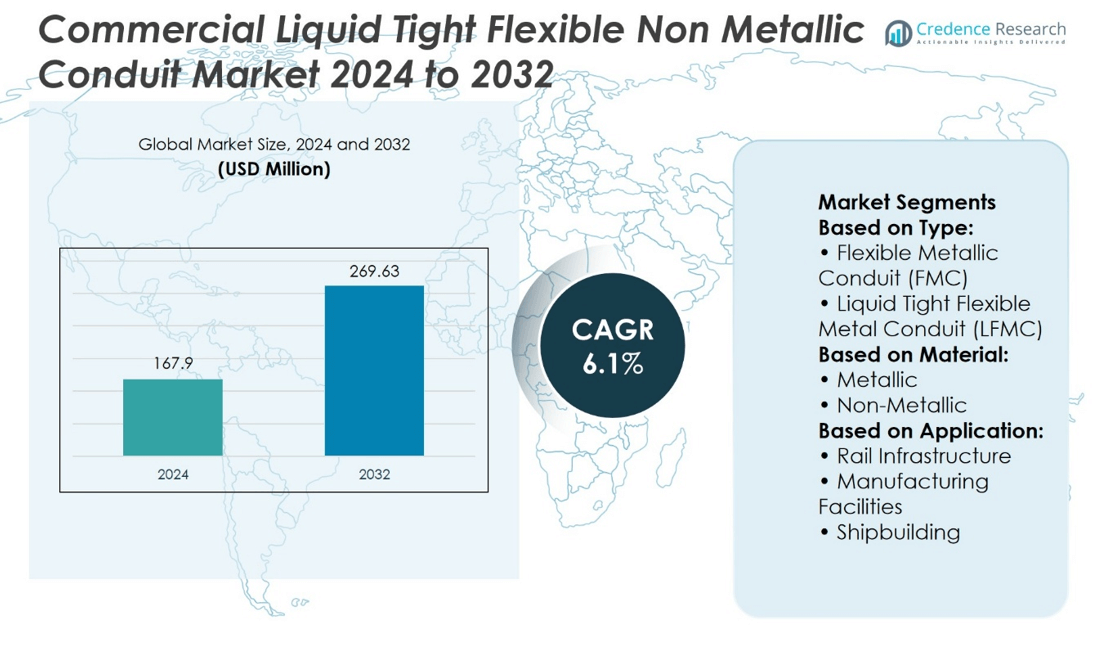

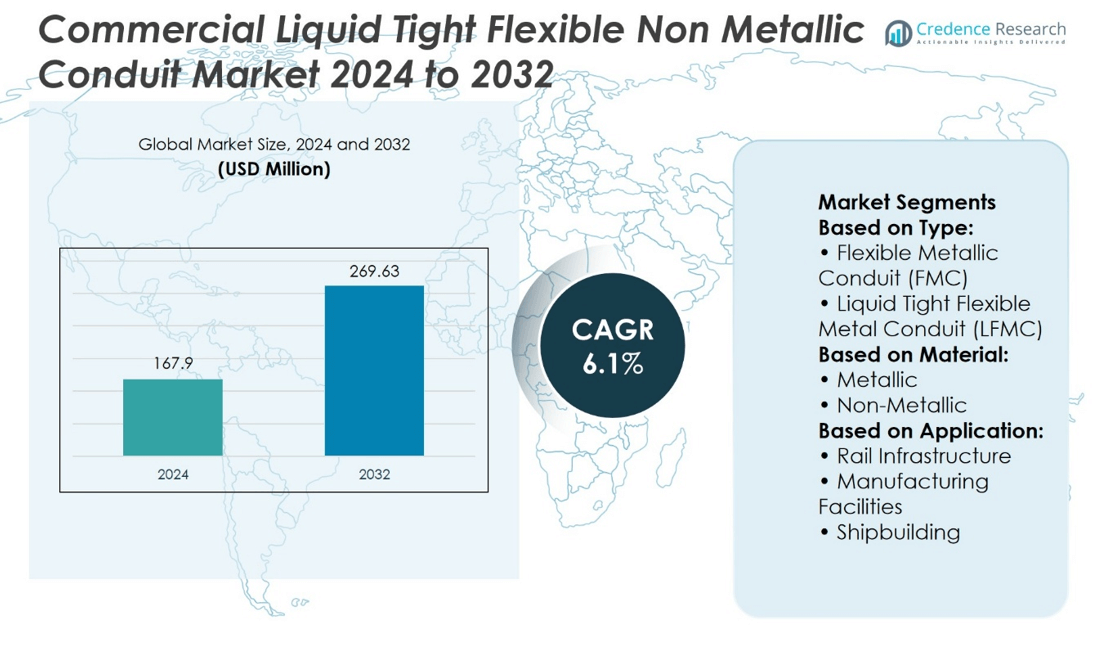

Commercial Liquid Tight Flexible Non-Metallic Conduit Market size was valued at USD 167.9 million in 2024 and is anticipated to reach USD 269.63 million by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Liquid Tight Flexible Non-Metallic Conduit Market Size 2024 |

USD 167.9 million |

| Commercial Liquid Tight Flexible Non-Metallic Conduit Market , CAGR |

6.1% |

| Commercial Liquid Tight Flexible Non-Metallic Conduit Market Size 2032 |

USD 269.63 million |

The Commercial Liquid Tight Flexible Non-Metallic Conduit Market experiences strong growth driven by escalating commercial construction and infrastructure projects worldwide. Increasing safety and fire-resistance regulations push demand for reliable, certified conduit systems. The trend toward smart buildings and industrial automation fuels the need for flexible, durable wiring solutions. Manufacturers respond by innovating with eco-friendly materials and enhanced product performance. Rising adoption in emerging markets further supports expansion, while the focus on sustainability aligns with global green building initiatives. These factors collectively accelerate market development, encouraging continuous technological advancement and broader application across diverse commercial and industrial sectors.

The Commercial Liquid Tight Flexible Non-Metallic Conduit Market demonstrates notable regional variations, with North America holding a dominant share due to well-established construction sectors and rigorous safety standards. Europe follows closely, driven by strong regulatory frameworks and sustainable building initiatives. Asia-Pacific represents the fastest-growing market, propelled by rapid urbanization, industrial growth, and infrastructure investments. Key players, including ABB, Atkore, Hubbell, Eaton, Legrand, and Electri-Flex, maintain competitive advantages through localized manufacturing, strategic partnerships, and tailored product offerings that comply with regional standards. These companies continuously invest in innovation and distribution expansion to capitalize on emerging opportunities across diverse geographic markets.

Market Insights

- The Commercial Liquid Tight Flexible Non-Metallic Conduit Market was valued at USD 167.9 million in 2024 and is expected to reach USD 269.63 million by 2032, growing at a CAGR of 6.1%.

- Increasing commercial construction and infrastructure projects worldwide drive strong market growth.

- Strict safety and fire-resistance regulations boost demand for certified, reliable conduit systems.

- The rise of smart buildings and industrial automation increases the need for flexible, durable wiring solutions.

- Manufacturers focus on eco-friendly materials and improved product performance to meet sustainability goals.

- North America leads the market with established construction sectors and rigorous safety standards, while Asia-Pacific grows rapidly due to urbanization and industrialization.

- Intense competition among key players like ABB, Atkore, and Hubbell encourages innovation and expansion across diverse regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Surging Demand for Lightweight, Corrosion-Resistant Alternatives to Metallic Conduits

The Commercial Liquid Tight Flexible Non-Metallic Conduit Market benefits from growing preference for non-metallic solutions in environments prone to corrosion or chemical exposure. Contractors and engineers increasingly specify non-metallic conduits in projects where metal conduits may deteriorate or add unnecessary weight. These conduits offer superior resistance to rust, moisture, and harsh chemicals, making them ideal for use in food processing, pharmaceuticals, and coastal installations. Their lighter weight also reduces labor and equipment costs during installation. It supports both underground and surface installations without compromising on durability or flexibility. End-users adopt them to meet long-term performance expectations while minimizing maintenance and replacement needs.

- For instance, Electri‑Flex’s LNMP 13 conduit weighs 42 lb per 100 ft, enabling streamlined installation in robotic assembly lines and automated facilities.

Increasing Adoption in Commercial Buildings and Smart Infrastructure Projects

Smart buildings and modern commercial facilities require wiring systems that integrate easily with automation and energy management technologies. The Commercial Liquid Tight Flexible Non-Metallic Conduit Market is well positioned to support these needs through products that offer flexibility, safety, and ease of integration. Conduits enable clean routing of power and data cables in tight spaces or dynamic building layouts. Architects and electrical planners choose non-metallic options for their adaptability and clean aesthetic. It continues to gain ground in offices, retail spaces, and healthcare facilities. Adoption grows in tandem with expansion of intelligent infrastructure and commercial renovation projects.

- For instance, ABB expanded its Harnessflex® conduit distribution through a partnership covering over 10 million feet of cable handling systems across North America, enhancing availability and support in automated infrastructure projects.

Strict Regulatory Requirements and Safety Standards Boost Material Innovation

Electrical codes and safety standards continue to tighten across global markets, driving the demand for conduit systems that meet high-performance benchmarks. Manufacturers in the Commercial Liquid Tight Flexible Non-Metallic Conduit Market invest in advanced polymers and design improvements to comply with evolving fire-resistance and mechanical protection standards. It must meet certifications such as UL 1660 and IEC 61386 to qualify for critical applications. These standards influence buyer decisions in sectors such as education, transportation, and government buildings. Regulatory agencies support the use of non-metallic systems in low-voltage and moisture-prone environments. Compliance reinforces the market’s credibility and encourages broader adoption.

Growing Cost Sensitivity and Labor Efficiency in Electrical Installations

Construction and electrical contractors face constant pressure to reduce project timelines and labor expenses. The Commercial Liquid Tight Flexible Non-Metallic Conduit Market addresses these concerns by offering solutions that are easier to handle and install compared to metal alternatives. It eliminates the need for heavy tools and multiple fittings, speeding up work without compromising safety. Installers benefit from lower fatigue and faster throughput, especially in retrofitting or confined environments. This advantage supports adoption in residential complexes and commercial fit-outs. Cost savings in both materials and labor remain a key incentive for decision-makers choosing non-metallic conduit systems.

Market Trends

Increased Integration with Smart Wiring and Energy-Efficient Systems

The Commercial Liquid Tight Flexible Non-Metallic Conduit Market is evolving to support the growing need for smart and energy-efficient building systems. Smart lighting, automated HVAC, and connected security solutions require conduit systems that are both flexible and compatible with low-voltage and power-distribution wiring. Non-metallic conduits offer the adaptability and protection needed to route these systems through tight or complex spaces. It plays a vital role in enabling reliable signal transmission while protecting wiring from moisture and abrasion. This alignment with intelligent infrastructure trends is pushing manufacturers to design conduits tailored for smart building compatibility. Product innovations reflect the growing intersection of electrical and data technologies.

- For instance, ABB expanded its Harnessflex® conduit line to support over 10 million meters of industrial and automated wiring applications across transportation and manufacturing sectors.

Sustained Shift Toward Halogen-Free and Low-Smoke Conduit Materials

Fire safety and environmental standards influence material selection in modern construction. The Commercial Liquid Tight Flexible Non-Metallic Conduit Market is seeing a growing preference for halogen-free, low-smoke conduit materials that reduce toxic emissions during fire incidents. It supports safe evacuations and meets regulations in schools, hospitals, transport terminals, and public buildings. Manufacturers are investing in compounds that provide both flexibility and fire safety compliance without compromising mechanical strength. These materials improve occupant safety and help buildings qualify for green certifications. The trend supports long-term durability while aligning with eco-conscious construction practices.

- For instance, Electri‑Flex specified its liquatite Zero‑Halogen conduit across rail, transit, and tunnel projects covering over 2 million feet, significantly enhancing occupant safety in confined public-access environments by minimizing smoke and toxic gas release.

Preference for Modular and Pre-Fabricated Electrical Installations

The market is responding to the industry’s movement toward modular construction and prefabricated electrical assemblies. The Commercial Liquid Tight Flexible Non-Metallic Conduit Market supports these trends by providing solutions that are easy to cut, bend, and integrate into prefabricated wall or ceiling panels. It simplifies factory-assembled modules where speed and precision are essential. Contractors gain from reduced installation time on-site and improved quality control in off-site production environments. The adaptability of non-metallic conduits enhances their suitability for fast-track construction projects. This trend reinforces their relevance in commercial and institutional building sectors.

Growing Product Customization for Industry-Specific Requirements

Different sectors demand specialized performance from conduit systems depending on environmental, operational, and regulatory needs. The Commercial Liquid Tight Flexible Non-Metallic Conduit Market is responding with a growing range of customized conduit solutions for industries like healthcare, marine, agriculture, and data centers. It includes products with antimicrobial coatings, UV-resistant jackets, and high-flex formulations. These features support compliance, operational efficiency, and longevity under unique field conditions. Manufacturers are expanding their portfolios to serve more niche applications with tailored specifications. Customization strengthens market penetration across diversified commercial infrastructure projects.

Market Challenges Analysis

Inconsistent Performance Across Harsh Environments Limits Broader Adoption

The Commercial Liquid Tight Flexible Non-Metallic Conduit Market faces challenges in meeting the full spectrum of environmental and mechanical demands found in heavy-duty applications. While non-metallic conduits perform well in many settings, they can fall short in extreme heat, high-impact, or chemical-intensive environments. It must compete with metal-based alternatives that offer superior strength and temperature resistance in sectors such as oil and gas, heavy manufacturing, and mining. This performance gap limits its adoption in projects that require long-term durability under extreme operating conditions. Engineers and contractors often default to metal options where material failure could compromise safety or uptime. Product limitations in these high-stress segments continue to restrain market expansion.

Fluctuations in Raw Material Supply and Regulatory Complexity

Raw materials used in non-metallic conduit manufacturing, such as polyvinyl chloride (PVC) and other polymers, are subject to supply chain disruptions and price volatility. The Commercial Liquid Tight Flexible Non-Metallic Conduit Market relies on stable access to high-grade compounds to ensure consistent product quality. It also must navigate a complex web of regional building codes, safety certifications, and environmental regulations. These vary across jurisdictions and project types, increasing the compliance burden for manufacturers. Delays in certification or revisions to fire safety and emissions standards can slow product approvals and market entry. Regulatory uncertainty and material sourcing constraints create operational challenges that manufacturers must address to maintain competitiveness.

Market Opportunities

Expanding Demand from Renewable Energy and Sustainable Infrastructure Projects

The transition toward renewable energy and sustainable infrastructure opens significant growth avenues for the Commercial Liquid Tight Flexible Non-Metallic Conduit Market. Solar farms, wind power installations, and energy-efficient buildings require safe, lightweight, and corrosion-resistant conduit systems. It offers advantages in these environments by providing flexible protection for wiring exposed to UV, moisture, and fluctuating temperatures. Engineers prefer non-metallic options in solar and battery storage systems where electromagnetic interference must be minimized. This aligns well with the industry’s push for decarbonization and energy resilience. Rising investment in green infrastructure worldwide will continue to create new application areas for these conduit solutions.

Digital Transformation and Data Center Expansion Create Specialized Needs

The accelerating digital transformation and global data center construction boom offer strategic opportunities for product innovation. The Commercial Liquid Tight Flexible Non-Metallic Conduit Market supports the critical infrastructure of hyperscale and edge data centers by ensuring secure cable management in confined and high-density environments. It enables easy routing of power and fiber-optic cables without interference or degradation. Data centers often require materials with fire-retardant, halogen-free, and anti-static properties, pushing manufacturers to develop specialized conduit products. These technical demands promote higher-value applications beyond standard commercial settings. Expanding connectivity, cloud services, and AI-driven computing will continue to drive conduit demand in this fast-evolving sector.

Market Segmentation Analysis:

By Type

The Commercial Liquid Tight Flexible Non-Metallic Conduit Market includes two key conduit types: Flexible Metallic Conduit (FMC) and Liquid Tight Flexible Metal Conduit (LFMC). LFMC finds stronger adoption in applications requiring moisture and corrosion protection, such as washdown areas, outdoor systems, and industrial machinery. Its design features a flexible metallic core with an outer non-metallic jacket, offering enhanced protection in wet or corrosive environments. FMC, though commonly used in interior commercial installations, lacks the same level of environmental sealing, limiting its role in high-risk areas. The increasing demand for safer, liquid-resistant electrical pathways supports the wider use of LFMC across industries focused on performance and code compliance.

- For instance, Atkore International supplied more than 3 million feet of Liquid Tight Flexible Metal Conduit for industrial and commercial projects focusing on moisture resistance and durability.

By Material Type (Metallic, Non-Metallic)

By material type, the market divides into metallic and non-metallic conduits. The Commercial Liquid Tight Flexible Non-Metallic Conduit Market emphasizes the advantages of non-metallic options such as polyvinyl chloride (PVC) and thermoplastic polyurethane. These conduits are lightweight, corrosion-resistant, and easier to install than their metallic counterparts. They offer electrical insulation, chemical resistance, and flexibility without the need for grounding. While metallic conduits remain preferred in high-temperature or mechanically demanding environments, non-metallic types continue to expand in use where safety, speed of installation, and material handling efficiency matter most.

- For instance, Hubbell Incorporated supplied more than 4 million feet of PVC-based liquid-tight flexible conduit for commercial and industrial electrical installations, demonstrating strong demand for corrosion-resistant materials.

By Application

The market serves a wide range of applications, including rail infrastructure, manufacturing facilities, and shipbuilding. Manufacturing facilities lead in conduit consumption due to the complexity and density of electrical systems in automated production environments. Non-metallic conduits are used extensively for routing power and control wiring across machinery and equipment. In rail infrastructure, lightweight, flexible conduits support installation in stations and onboard electrical systems where vibration resistance and compact routing are critical. Shipbuilding also uses non-metallic conduits in non-critical areas exposed to salt air or moisture. The market adapts across these sectors by offering targeted solutions that meet environmental, operational, and regulatory requirements.

Segments:

Based on Type:

- Flexible Metallic Conduit (FMC)

- Liquid Tight Flexible Metal Conduit (LFMC)

Based on Material:

Based on Application:

- Rail Infrastructure

- Manufacturing Facilities

- Shipbuilding

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for approximately 40% of the global market, leading due to advanced infrastructure, stringent safety regulations, and high adoption of non‑metallic conduit systems in commercial building projects. The region’s emphasis on durable, lightweight, and fire-resistant materials—aligned with eco‑friendly construction practices and smart-building deployment—boosts adoption. It benefits from significant federal and state infrastructure investments and regulatory frameworks like the National Electrical Code (NEC) that promote safety and sustainability in electrical installations. North American contractors prefer non‑metallic conduit products for ease of installation, reduced labor costs, and compatibility with modern wiring systems. The presence of established manufacturers and strong distribution networks ensures reliable product supply and technical support. These factors collectively reinforce North America’s dominant market position.

Europe

Europe holds around 28% of the market, propelled by robust demand for corrosion-resistant, energy-efficient, and regulatory-compliant conduit systems. European Union directives and national fire safety standards encourage the use of halogen-free, low-smoke, and recyclable materials in public and commercial facilities. It drives innovation in material composition and design to uphold safety while mitigating environmental impact. Demand stems from infrastructure modernization, green building initiatives, and strong maritime and industrial sectors. Contractors opt for non-metallic conduits that deliver chemical resistance and mechanical flexibility without compromising fire safety standards. The region’s focus on sustainable construction and infrastructure upgrading supports steady demand for these advanced conduit systems.

Asia Pacific

Asia Pacific commands about 21% of the market, fueled by rapid urban growth, industrialization, and demand for affordable, modern electrical infrastructure. Governments in China, India, and Southeast Asia invest heavily in smart cities, commercial complexes, and renewable energy facilities that require efficient wiring solutions. The market responds with cost-effective, corrosion-resistant non‑metallic conduits that suit large-scale deployment. Adoption is strong in institutional, retail, data center, and infrastructure projects that prioritize speed and scalability. Manufacturers localize production to meet demand and reduce costs. Expanding investment in sustainability and safety across the region strengthens the case for non-metallic conduit systems.

Latin America

Latin America contributes around 5% of the global share, with growth supported by evolving infrastructure and commercial development. Urbanization and expanding commercial construction in countries like Brazil and Mexico fuel demand for flexible, moisture-resistant conduits. It faces slower adoption due to economic and regulatory challenges. Nonetheless, non‑metallic conduit systems gain traction in electrification and retrofit projects seeking safer, lower-maintenance solutions. Collaboration with local building agencies and utility providers helps expand deployment. The region presents potential for expansion as regulatory frameworks evolve and investment increases.

Middle East & Africa

Middle East & Africa make up approximately 6% of the market, driven by infrastructure projects, energy sector demand, and corrosive environmental conditions. Non‑metallic conduits offer attractive solutions for installations in humid, saline, or petrochemical-heavy environments. It supports oil and gas facilities, commercial complexes, and maritime infrastructure where durability and chemical resistance are essential. Regulatory progress, though uneven, gradually supports adoption. Manufacturers increasingly tailor offerings—like halogen-free or UV-resistant conduits—to regional requirements. Strategic collaborations and awareness-building spur demand in both established and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Commercial Liquid-Tight Flexible Non-Metallic Conduit Market is characterized by a competitive landscape dominated by ABB, Atkore, Electri-Flex Company, Eaton, Southwire Company, Techno Flex, Thomas & Betts, Zhejiang Flexible Technology. The Commercial Liquid-Tight Flexible Non-Metallic Conduit market exhibits intense competition driven by innovation, regulatory compliance, and expanding infrastructure needs. Market leaders leverage advanced materials and designs to enhance durability, flexibility, and safety, addressing the increasing demand in commercial construction and industrial applications. Companies focus on expanding their distribution networks and improving product availability to capture broader market shares. Additionally, rising emphasis on fire safety, environmental standards, and integration with smart building technologies propels continuous product development. Firms that effectively align their strategies with evolving industry regulations and customer requirements strengthen their market positions. Competitive differentiation increasingly hinges on product performance, certification compliance, and tailored solutions for specific end-use environments, such as hazardous or high-moisture locations.

Recent Developments

- In August 2025, Atkore’s Liquid-Tuff LFNC-B conduit is highlighted for lightweight construction, flexibility, and resistance to water and chemicals.

- In August 2025, a company highlighted its Liquid-Tuff LFNC-B conduit. This conduit is designed for lightweight construction, offering flexibility and resistance to water and chemicals. It is UL-listed for outdoor and direct burial applications.

- In July, 2025 Ongoing expansion of LFNC product range focusing on durability and high flexibility for commercial builds and retrofits.

- In 2023, there was a notable increase in the emphasis on sustainability and the utilization of recycled materials in manufacturing processes across various industries. This shift is driven by growing environmental awareness, stricter regulations, and a desire to reduce the environmental impact of production.

Market Concentration & Characteristics

The Commercial Liquid Tight Flexible Non-Metallic Conduit Market demonstrates a moderately concentrated structure, dominated by a limited number of key players who command significant market shares through strong brand presence and extensive distribution networks. It exhibits characteristics of a mature industry with steady demand driven primarily by commercial construction, industrial automation, and infrastructure development. Market participants compete by focusing on product innovation, compliance with evolving safety and environmental regulations, and customization to meet specific application needs. The presence of stringent regulatory standards, such as fire resistance and liquid-tight certification, elevates barriers to entry, limiting competition from smaller or new entrants. Regional demand variations influence product offerings and pricing strategies, with developed markets emphasizing advanced technology and compliance, while emerging markets prioritize cost efficiency and scalability. It operates within a supply chain that relies heavily on raw material availability, manufacturing capabilities, and logistical efficiency. Companies invest in improving manufacturing processes and expanding their product portfolios to address the growing complexity of commercial electrical installations. The market also reflects increasing adoption of sustainable materials and solutions that align with green building initiatives. Competitive rivalry remains intense, driving continuous enhancements in durability, flexibility, and installation ease. Overall, the market balances stable demand with dynamic technological advancement, positioning it for sustained growth amid evolving industry standards and expanding infrastructure needs worldwide.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand due to increased commercial construction activities globally.

- Rising safety regulations will drive demand for certified liquid-tight conduit solutions.

- Adoption of smart building technologies will encourage integration of advanced conduit systems.

- Manufacturers will focus on developing eco-friendly and sustainable materials.

- Growing industrial automation will create new opportunities for flexible conduit applications.

- Emerging economies will show higher growth rates due to infrastructure development.

- Companies will invest in research to enhance product durability and flexibility.

- Expansion of distribution networks will improve product availability in remote regions.

- Increasing emphasis on fire resistance and chemical protection will shape product design.

- Strategic partnerships and mergers will strengthen market positions and innovation capabilities.