Market Overview:

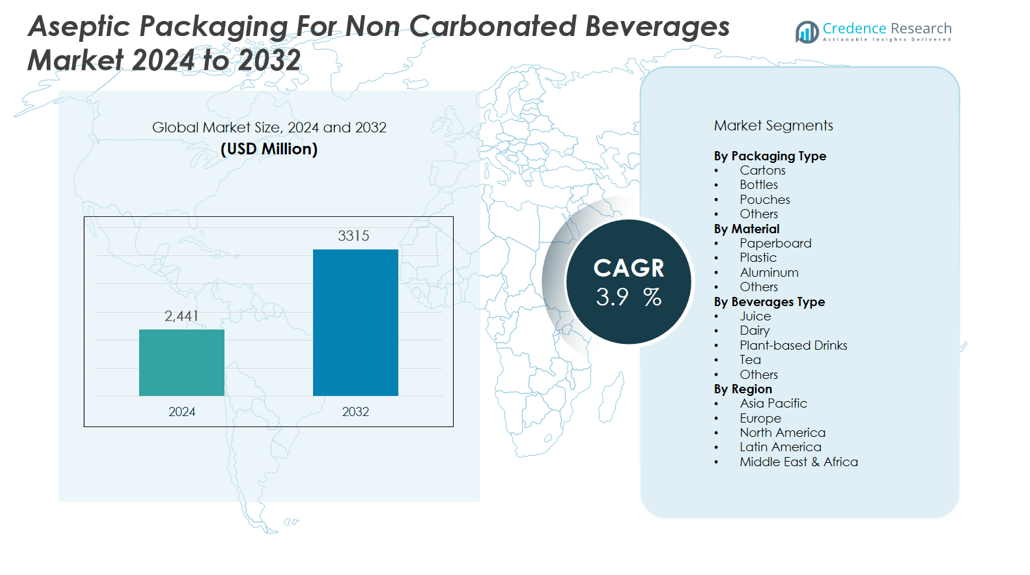

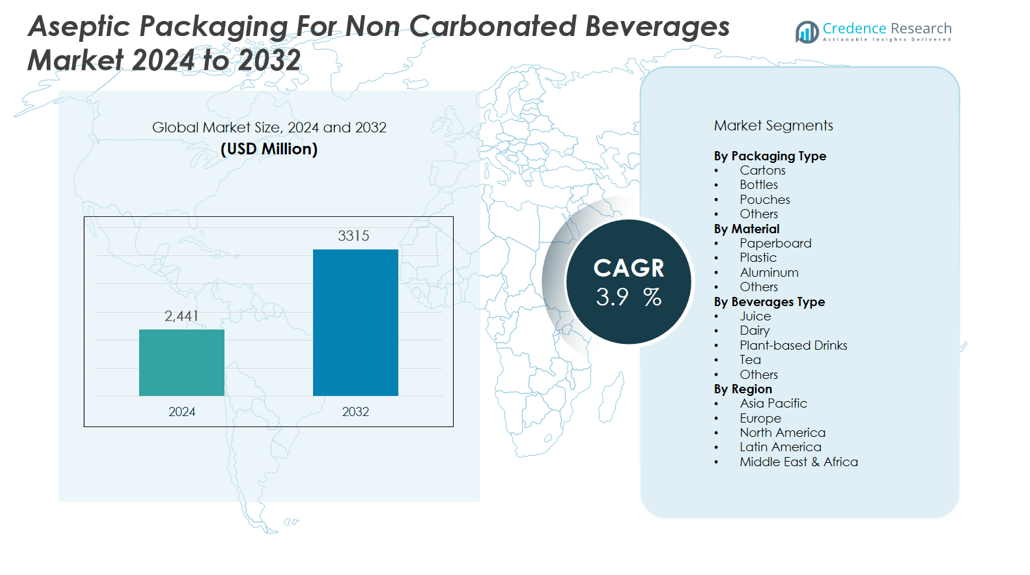

The aseptic packaging for non carbonated beverages market size was valued at USD 2,441 million in 2024 and is anticipated to reach USD 3315 million by 2032, at a CAGR of 3.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aseptic Packaging for Non-Carbonated Beverages Market Size 2024 |

USD 2,441 million |

| Aseptic Packaging for Non-Carbonated Beverages Market, CAGR |

3.9% |

| Aseptic Packaging for Non-Carbonated Beverages Market Size 2032 |

USD 3315 million |

Key market drivers include heightened consumer awareness regarding food safety, a strong preference for preservative-free and minimally processed beverages, and shifting lifestyles favoring on-the-go consumption. Aseptic packaging technologies offer significant advantages by maintaining product freshness, extending shelf life without refrigeration, and reducing the need for chemical additives. These features align with both consumer health trends and sustainability goals, as aseptic cartons and bottles are often lightweight, recyclable, and reduce food waste. Manufacturers are actively investing in advanced aseptic filling systems and barrier materials to improve packaging integrity, product safety, and operational efficiency. In addition, regulatory standards mandating enhanced hygiene and shelf stability further accelerate adoption within the beverage industry.

Regionally, Asia Pacific dominates the aseptic packaging for non-carbonated beverages market, driven by a large consumer base, rapid urbanization, and major investments in processing infrastructure—especially in China and India. Leading players such as Tetra Pak, Scholle IPN, UFlex, DS Smith, and Sealed Air have a strong presence in this region. Europe follows with strong demand for premium, organic beverages and strict food safety regulations. North America sees steady growth as consumers shift to natural drinks and sustainable packaging, while Latin America and the Middle East & Africa offer new opportunities through rising incomes and expanding retail channels.

Market Insights:

- The aseptic packaging for non carbonated beverages market reached USD 2,441 million in 2024 and will reach USD 3,315 million by 2032.

- Consumer preference for safe, preservative-free, and ready-to-drink beverages fuels steady market growth.

- Aseptic packaging ensures product freshness, extends shelf life, and reduces food waste without the need for refrigeration.

- Sustainability trends push brands toward recyclable, lightweight cartons and investment in advanced, eco-friendly materials.

- High initial capital and technical complexity in aseptic systems create barriers for new entrants and smaller manufacturers.

- Asia Pacific holds 41% share, driven by urbanization and major investment in beverage processing, with China and India leading demand.

- Europe accounts for 29% share and North America 18%, with both regions emphasizing premium, organic, and functional beverage innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Demand for Safe and Convenient Beverage Options:

The aseptic packaging for non carbonated beverages market benefits from a growing preference for ready-to-drink, on-the-go beverage solutions among consumers. This trend stems from busier lifestyles, urban migration, and a heightened awareness of food safety. Shoppers seek packaging that maintains the integrity and freshness of juice, dairy, tea, and plant-based drinks without added preservatives. Aseptic packaging answers these needs by enabling longer shelf life and minimizing risk of contamination. It supports the increasing shift toward healthier, minimally processed beverage products. Manufacturers recognize this demand and continue to expand their aseptic packaging lines to capture a broader consumer base.

- For instance, Tetra Pak’s Tetra Evero Aseptic carton bottle enables ultra-high-temperature (UHT) processing, resulting in milk and non-carbonated beverages with a shelf life of up to 12 months without refrigeration, while launching over 500 such commercial lines globally by 2017.

Stringent Regulatory Requirements for Food Safety and Hygiene:

Regulatory authorities across regions enforce strict standards for food and beverage safety. The aseptic packaging for non carbonated beverages market must comply with regulations that prioritize hygiene, product traceability, and the elimination of microbial risks. These mandates encourage beverage producers to invest in advanced aseptic processing and packaging technologies. It also fosters the adoption of cleanroom environments, sterile barrier materials, and automated filling systems. Companies that prioritize compliance achieve a competitive advantage and reduce the likelihood of costly recalls or reputational damage.

- For instance, SIG Combibloc’s SIG NEO machine is the world’s fastest family-size aseptic carton pack filling system, running up to 18,000 packs per hour, and delivers a 25% lower carbon footprint per filled pack compared to earlier machines.

Sustainability and Reduced Environmental Impact Drive Packaging Choices:

Sustainability considerations strongly influence purchasing decisions in the beverage industry. The aseptic packaging for non carbonated beverages market gains traction from the lightweight, recyclable nature of cartons and pouches. It enables beverage brands to reduce transportation costs and lower greenhouse gas emissions, while supporting consumer demand for eco-friendly products. Companies invest in renewable materials and improved recycling infrastructure to further enhance their green credentials. This commitment to sustainability resonates with environmentally conscious consumers and helps brands differentiate in a competitive market.

Continuous Technological Advancements in Aseptic Packaging Solutions:

Ongoing technological innovation propels the aseptic packaging for non carbonated beverages market forward. Advances in barrier materials, automated filling lines, and digital monitoring systems have improved both the safety and quality of packaged beverages. It allows producers to extend shelf life without refrigeration, maintain product taste, and reduce waste. Investments in new technologies also streamline production, increase output, and lower operational costs. Companies that adopt cutting-edge solutions position themselves for sustained growth and market leadership.

Market Trends:

Adoption of Eco-Friendly Materials and Circular Packaging Solutions:

Sustainability shapes the future of the aseptic packaging for non carbonated beverages market, with beverage brands rapidly shifting toward renewable, recyclable, and compostable materials. Companies incorporate plant-based polymers and responsibly sourced paperboard to reduce plastic use and support circular economy initiatives. It enables brands to meet growing consumer expectations for low-impact packaging while addressing evolving regulatory demands for environmental stewardship. Industry leaders invest in closed-loop recycling systems and partner with supply chain stakeholders to enhance material recovery. The focus on reducing waste, minimizing carbon footprint, and creating fully recyclable aseptic cartons or pouches drives innovation across the market.

- For instance, Elopak reduced the carbon footprint of an average carton with a closure from 32gCO2e to 25gCO2e—a 14% decrease—through continuous design optimizations.

Expansion of Value-Added and Functional Beverage Categories:

The aseptic packaging for non carbonated beverages market witnesses strong momentum from the proliferation of value-added and functional drinks. Demand rises for beverages enriched with vitamins, minerals, probiotics, and plant-based proteins, which require superior packaging to preserve active ingredients and extend shelf life. It drives companies to develop advanced aseptic packaging solutions capable of protecting sensitive formulations and supporting clean-label claims. Brands launch premium juice blends, dairy alternatives, and wellness beverages in single-serve aseptic formats to capture health-conscious consumers. The shift toward diverse, functional products prompts manufacturers to enhance packaging versatility, design, and convenience features to strengthen market appeal.

- For instance, SIG’s aseptic fillers can process up to 24,000 small carton packs or 15,000 multi-serve cartons per hour, providing brands with scale and versatility in meeting growing demand for functional beverage packaging.

Market Challenges Analysis:

High Capital Investment and Complex Technological Requirements:

The aseptic packaging for non carbonated beverages market faces significant barriers due to the high initial investment required for advanced packaging machinery and sterile environments. Companies must allocate substantial resources to install, operate, and maintain aseptic filling lines and cleanroom facilities. It demands technical expertise and specialized workforce training, which can limit market entry for smaller players. Frequent upgrades in equipment and compliance with evolving safety standards further increase operational costs. These factors put pressure on manufacturers to justify investments with high production volumes and strong market demand.

Recycling Infrastructure Limitations and Consumer Awareness Gaps:

Recycling challenges present another hurdle for the aseptic packaging for non carbonated beverages market, particularly in regions with underdeveloped waste management systems. It remains difficult to efficiently recycle multilayer packaging materials, which can hinder progress toward sustainability goals. Brands must address consumer confusion about proper disposal and actively promote recycling education. Variability in municipal recycling capabilities often leads to inconsistent recovery rates. Market players need to invest in collaboration with local authorities and material suppliers to improve recyclability and ensure a closed-loop packaging life cycle.

Market Opportunities:

Emergence of Premium and Functional Beverages Across New Segments

The aseptic packaging for non carbonated beverages market holds strong potential for growth with the launch of premium and functional beverage products. Brands expand their offerings with organic juices, plant-based drinks, and wellness formulations that demand extended shelf life and high product integrity. It enables companies to address evolving consumer preferences for health-focused and convenient solutions. The demand for single-serve, on-the-go packaging formats continues to rise, creating space for innovation in design and materials. Manufacturers who invest in value-added features and advanced aseptic technology position themselves to capture new market segments.

Expansion Into Untapped and Developing Regional Markets

Opportunities for market expansion are significant in emerging economies, where rising disposable incomes and urbanization drive demand for safe, shelf-stable beverages. The aseptic packaging for non carbonated beverages market stands to benefit from government initiatives supporting food safety, infrastructure upgrades, and modern retail growth in these regions. It allows global and regional players to establish strong distribution networks and address gaps in cold chain logistics. Strategic partnerships with local beverage producers further enhance market reach and competitiveness. These conditions set the stage for sustained growth and diversification in the global beverage landscape.

Market Segmentation Analysis:

By Material:

The aseptic packaging for non carbonated beverages market segments by material into paperboard, plastic, aluminum, and others. Paperboard dominates the segment due to its lightweight, renewable qualities, and strong barrier properties. Plastic materials, such as polyethylene and polypropylene, follow closely and provide flexibility, strength, and compatibility with various packaging formats. Aluminum holds a niche share, offering superior protection from light and oxygen for sensitive beverages. Market participants continue to innovate with bio-based and recyclable materials to address environmental concerns and regulatory requirements.

- For instance, Sealed Air developed lightweight polypropylene (PP) trays that are typically 10–30 percent lighter than APET alternatives while maintaining the same strength and rigidity, resulting in 24% lower carbon footprint for packaging.

By Packaging Type:

The market divides by packaging type into cartons, bottles, pouches, and others. Cartons lead the segment, favored for their cost efficiency, ease of handling, and sustainability profile. Bottles, often used for premium and dairy-based beverages, deliver enhanced convenience and shelf appeal. Pouches see growing adoption in emerging markets due to their affordability and portability. It allows beverage brands to tailor packaging choices to evolving consumer preferences and diverse distribution channels.

- For instance, Accredo Packaging 100% sugarcane-derived polyethylene pouch, launched in 2024, removes approximately 43g of CO₂ per pouch produced, offering a negative carbon footprint and store drop-off recyclability throughout the US.

By Beverages Type:

The aseptic packaging for non carbonated beverages market classifies by beverage type into juice, dairy, plant-based drinks, tea, and others. Juice remains the dominant application, supported by high global consumption and demand for long shelf life. Dairy and plant-based beverages register strong growth, driven by health trends and new product launches. Ready-to-drink tea and other wellness drinks also expand rapidly, creating new opportunities for aseptic packaging providers.

Segmentations:

By Material:

- Paperboard

- Plastic

- Aluminum

- Others

By Packaging Type:

- Cartons

- Bottles

- Pouches

- Others

By Beverages Type:

- Juice

- Dairy

- Plant-based Drinks

- Tea

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific :

Asia Pacific holds 41% share of the aseptic packaging for non carbonated beverages market, leading all regions. The region’s growth is fueled by a large population base, expanding urban centers, and rising demand for convenient beverage options. Strong investments in food and beverage processing infrastructure support rapid adoption of aseptic technology, especially in China, India, and Southeast Asia. Local producers and multinational brands both target the region to capture opportunities in juice, dairy, and plant-based beverages. Regulatory support for food safety, combined with growing environmental awareness, encourages innovation in packaging solutions. Asia Pacific continues to attract significant capital and technology inflows, reinforcing its dominant market position.

Europe :

Europe accounts for 29% share of the global aseptic packaging for non carbonated beverages market, underpinned by strong demand for organic and premium drinks. The region’s strict food safety regulations and consumer commitment to sustainability drive early adoption of aseptic and recyclable packaging. Western European countries, particularly Germany, France, and the United Kingdom, set the pace with investments in advanced filling lines and eco-friendly materials. Brands in Europe focus on packaging differentiation, shelf appeal, and minimal environmental impact to address sophisticated consumer preferences. Retailers and beverage companies pursue partnerships that encourage recycling and closed-loop supply chains. Europe remains at the forefront of packaging innovation and premium beverage trends.

North America:

North America holds 18% share of the aseptic packaging for non carbonated beverages market, benefiting from rising interest in clean-label, natural, and functional beverages. The region’s consumers seek out single-serve packaging and new product formats that align with fast-paced lifestyles. Leading brands leverage aseptic technology to extend shelf life and deliver fresh, preservative-free options. Investments in automation and advanced quality control continue to strengthen market competitiveness. North America sees growing interest in plant-based, protein-enriched, and wellness beverages, prompting companies to diversify their portfolios. The region’s mature retail infrastructure and evolving health preferences drive stable demand for aseptic packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Tetra Pak

- Scholle IPN,

- DS Smith

- Sealed Air

- SIG Combibloc

- Elopak, Amcor

- Greatview Aseptic Packaging

- Ecolean

Competitive Analysis:

The aseptic packaging for non carbonated beverages market features strong competition among established global and regional players. Leading companies such as Tetra Pak, Scholle IPN, UFlex, DS Smith, and Sealed Air leverage advanced filling technologies, global distribution networks, and innovation in sustainable materials to strengthen market positions. It demands continuous investment in research and development to address evolving consumer preferences for safety, sustainability, and convenience. Strategic partnerships and acquisitions remain common as companies aim to expand product portfolios and geographic reach. Product differentiation focuses on unique packaging formats, enhanced shelf appeal, and value-added features. Market leaders maintain competitive advantages through operational efficiency, regulatory compliance, and robust supply chain capabilities. This dynamic landscape requires constant innovation and agility to capture emerging opportunities and respond to shifting market demands.

Recent Developments:

- In June 2025, UFlex Ltd launched an FSSAI-compliant single-pellet solution for recycled PET (rPET) in food and beverage packaging, enabling easier compliance with new regulations and driving packaging sustainability.

- In May 2025, Sealed Air unveiled new recycle-ready packaging solutions at IFFA 2025, focused on operational efficiency and sustainability for high-demand protein and liquid applications, featuring advanced CRYOVAC Darfresh products and automation systems.

- In July 2025, Amcor and Mediacor jointly launched a refill pouch for Nana laundry and cleaning products, reflecting Amcor’s commitment to advancing sustainable packaging solutions.

Market Concentration & Characteristics:

The aseptic packaging for non carbonated beverages market features moderate concentration, with a mix of global leaders and regional players shaping competitive dynamics. Leading companies leverage advanced technology, robust supply chains, and strong brand partnerships to secure significant market presence. It displays high entry barriers due to capital-intensive equipment, stringent hygiene requirements, and complex regulatory standards. Product differentiation focuses on sustainable materials, innovative packaging formats, and improved shelf appeal. Companies prioritize continuous investment in R&D and automation to enhance operational efficiency. The market remains responsive to shifting consumer trends, evolving health preferences, and the growing emphasis on environmental responsibility.

Report Coverage:

The research report offers an in-depth analysis based on Material, Packaging Type, Beverages Type, and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Regulatory evolution will push the aseptic packaging for non carbonated beverages market to adopt higher hygiene standards and advanced traceability systems.

- Investment in renewable materials will increase, driving innovation in plant-based polymers and paperboard composites.

- Beverage brands will continue launching functional and premium products that demand aseptic protection for vitamins, probiotics, and natural ingredients.

- Single-serve formats will expand further, as consumers seek convenience and on-the-go beverage solutions.

- Manufacturers will deploy automation and digital monitoring to improve efficiency and reduce packaging defects.

- Collaboration across the value chain will strengthen closed-loop recycling systems in key regions.

- Emerging markets in Asia, Latin America, and Africa will attract new investments in packaging infrastructure and beverage production.

- Sustainability certifications and eco-labels will gain importance, influencing consumer decisions and corporate strategy.

- Lifecycle analysis tools will inform material choices and packaging design to lower carbon footprint and waste.

- Industry partnerships will foster innovation in lightweight barrier coatings and aseptic filling technologies.