Market Overview

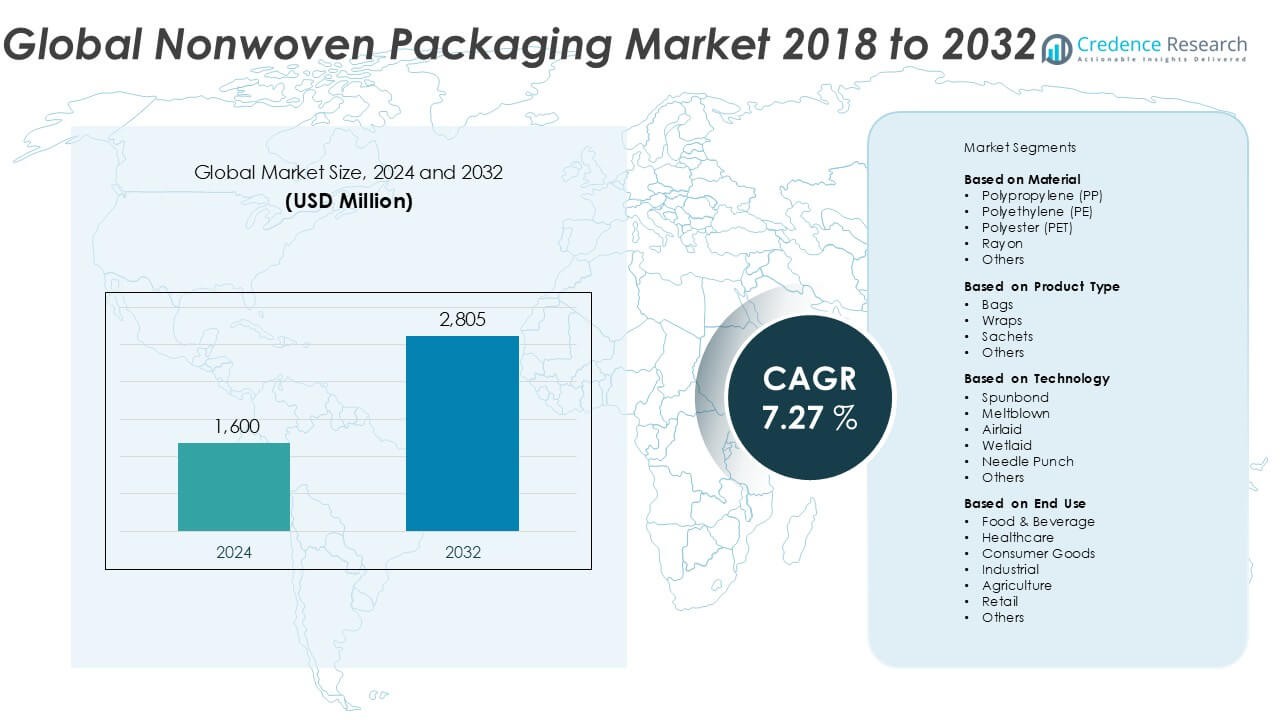

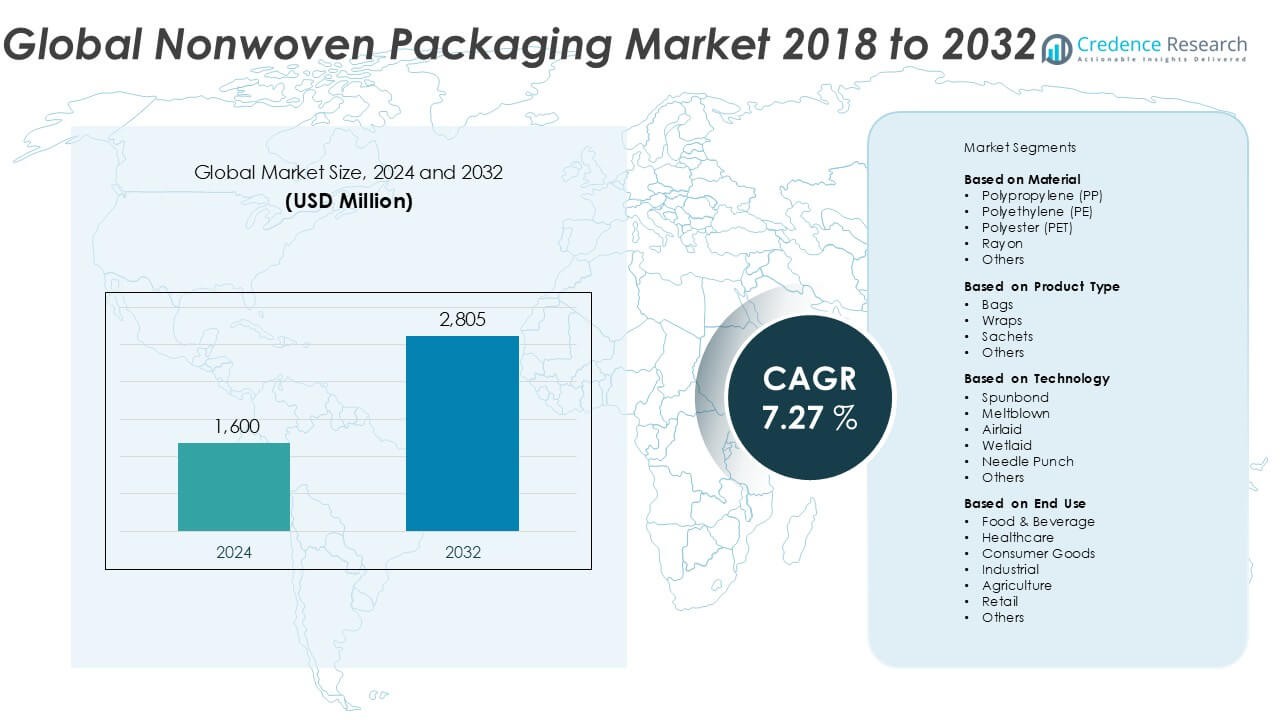

The Nonwoven Packaging market size was valued at USD 1,600 million in 2024 and is anticipated to reach USD 2,805 million by 2032, at a CAGR of 7.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nonwoven Packaging Market Size 2024 |

USD 1,600 Million |

| Nonwoven Packaging Market, CAGR |

7.27% |

| Nonwoven Packaging Market Size 2032 |

USD 2,805 Million |

The Nonwoven Packaging market is shaped by key players such as Ahlstrom, Dupont de Nemours, Inc., Glatfelter Corporation, ANDRITZ, Novipax Buyer, LLC, EAM Corporation (Domtar Corporation), BENZ Packaging, Jayashree Spun Bond, Felix Nonwovens, Aster srl, and CK Fabrics. These companies drive innovation through advanced technologies, sustainable materials, and global distribution networks. Asia-Pacific leads the market with a 32% share in 2024, driven by high production capacities in China and rising demand in India and Japan. North America and Europe follow with 28% and 25% shares, respectively, supported by strong retail and food packaging industries alongside regulatory backing for eco-friendly solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Nonwoven Packaging market was valued at USD 1,600 million in 2024 and is projected to reach USD 2,805 million by 2032, growing at a CAGR of 7.27% during the forecast period.

- The market is driven by rising demand for sustainable and reusable packaging solutions, particularly in retail, food & beverage, and personal care sectors, replacing single-use plastic.

- Trends include the growing popularity of spunbond technology and customizable, lightweight nonwoven bags, with the bags segment accounting for over 45% of the market share in 2024.

- Competition is shaped by global players like Ahlstrom, Glatfelter, and Dupont, along with regional firms such as Jayashree Spun Bond and Felix Nonwovens; ongoing innovation and expansion remain central to market strategies.

- Asia-Pacific leads with 32% of the market share, followed by North America (28%) and Europe (25%); Latin America and MEA together account for the remaining 15%, reflecting gradual growth.

Market Segmentation Analysis:

By Material:

The polypropylene (PP) segment held the dominant market share in the nonwoven packaging market in 2024, accounting for over 40% of the total revenue. PP’s lightweight nature, durability, and resistance to moisture make it a preferred choice in food and industrial packaging. Additionally, its recyclability and cost-effectiveness contribute to widespread adoption. The polyethylene (PE) and polyester (PET) segments also show steady growth, driven by applications requiring high tensile strength and chemical resistance. Rayon and other materials are gaining moderate traction due to their biodegradable nature, aligning with growing sustainability trends.

- For instance, Berry Global processes approximately 2 billion pounds of PP resin annually, with a significant share used in the production of nonwoven materials for packaging and hygiene applications, highlighting the scalability and industry preference for PP.

By Product Type:

Among product types, the bags segment emerged as the dominant category in 2024, capturing the largest market share of over 45%. Nonwoven bags are extensively used across retail, food packaging, and industrial sectors due to their reusability, strength, and eco-friendliness. The growing bans on single-use plastic bags in several regions further boost the demand for nonwoven alternatives. Wraps and sachets follow closely, driven by applications in personal care, pharmaceuticals, and convenience food sectors. The others segment includes specialty pouches and covers, which are seeing gradual adoption in niche applications.

- For instance, Zedpack, a major Indian nonwoven bag manufacturer, has a production capacity exceeding 300,000 nonwoven bags per day, supporting major retailers and FMCG clients with eco-alternatives to plastic carry bags.

By Technology:

Spunbond technology led the market in 2024, contributing to more than 50% of the total revenue share in the nonwoven packaging sector. The segment’s dominance is attributed to its high production speed, cost-efficiency, and versatility in manufacturing lightweight yet durable packaging materials. It is widely used for making nonwoven bags and wraps. Meltblown and airlaid technologies are expanding in niche areas, such as filtration and absorbent packaging. Wetlaid and needle punch technologies, though less prevalent, cater to specialized applications requiring enhanced strength, absorbency, or softness. The others segment comprises emerging and hybrid techniques gaining attention in R&D.

Key Growth Drivers

Rising Demand for Sustainable and Eco-Friendly Packaging

The growing environmental concerns and strict regulatory frameworks are pushing industries to adopt sustainable packaging solutions. Nonwoven packaging, particularly made from recyclable and biodegradable materials such as polypropylene and rayon, is gaining significant traction. As global restrictions on single-use plastics intensify, manufacturers are shifting toward eco-friendly alternatives. This transition is strongly supported by consumer preferences for green products, driving increased demand across retail, food & beverage, and personal care sectors. The market continues to benefit from these sustainability-driven changes in purchasing and manufacturing behaviors.

- For instance, Ahlstrom has developed nonwoven biodegradable packaging solutions using renewable fibers, producing over 200,000 metric tons of sustainable nonwovens annually across its global manufacturing sites.

Growth in E-commerce and Retail Sectors

The rapid expansion of the e-commerce and organized retail industries has significantly accelerated the demand for durable, lightweight, and cost-effective packaging solutions. Nonwoven packaging offers excellent strength, flexibility, and aesthetic appeal, making it ideal for product protection and branding during transit. Online retail platforms require packaging that supports quick handling, easy customization, and lower shipping costs—criteria well met by nonwoven products. As online shopping becomes increasingly mainstream globally, the use of such advanced packaging formats continues to grow steadily.

- For instance, DuPont supports the e-commerce sector with its Tyvek® nonwoven material, shipping over 190 million square meters annually to meet packaging and protective needs across logistics and retail channels.

Advancements in Nonwoven Fabric Technologies

Innovations in nonwoven technologies, including improvements in spunbond, meltblown, and composite manufacturing processes, are enhancing product performance and expanding application scope. These advancements enable better customization, increased tensile strength, moisture resistance, and cost efficiency. Furthermore, automated production and high-speed fabric bonding techniques are driving down manufacturing costs, making nonwoven packaging more accessible to small and medium enterprises. Such continuous technological development contributes to the overall scalability and versatility of nonwoven solutions, thereby fueling market expansion.

Key Trends & Opportunities

Surge in Demand for Reusable and Customizable Packaging

With sustainability taking center stage, businesses and consumers alike are shifting to reusable and aesthetically appealing packaging. Nonwoven bags, wraps, and pouches are increasingly used as substitutes for single-use plastics in retail and promotional applications. Additionally, brand owners are leveraging the customizable nature of nonwoven materials to enhance product visibility and consumer engagement. This trend not only improves environmental outcomes but also supports marketing objectives, making it a dual-purpose opportunity for manufacturers and retailers alike.

- For instance, Glatfelter Corporation operates over 14 manufacturing facilities globally, producing custom nonwoven packaging substrates tailored for brand differentiation in personal care, food, and industrial packaging markets.

Increased Adoption in Food and Beverage Industry

The food and beverage sector is embracing nonwoven packaging for its hygiene benefits, moisture resistance, and breathability. These properties make nonwovens ideal for wrapping perishables, bakery items, and ready-to-eat meals. With rising demand for convenient and safe packaging solutions, especially in fast-food and take-away services, manufacturers are exploring nonwoven formats as a viable alternative to traditional films and containers. This trend opens new growth avenues in food safety–driven and regulation-sensitive markets worldwide.

- For instance, Novipax produces over 4 billion absorbent food pads annually, many of which incorporate nonwoven layers to enhance freshness and food safety in meat, poultry, and seafood packaging.

Expansion into Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa present untapped potential due to increasing urbanization, growing middle-class populations, and changing consumer preferences. Local governments are also promoting sustainable packaging practices to manage mounting plastic waste. These regions offer favorable conditions for manufacturers to expand production capacities, form joint ventures, and cater to new demographics. Strategic investments and localization efforts are creating significant market opportunities in these fast-growing regions.

Key Challenges

Price Volatility of Raw Materials

The cost of key raw materials such as polypropylene and polyester is subject to fluctuations driven by crude oil prices and global supply-demand dynamics. These price swings create uncertainty for manufacturers and can significantly impact profit margins. While demand remains strong, the inability to consistently procure raw materials at stable costs may deter smaller players or lead to price-sensitive shifts among end-users. This challenge requires effective supply chain management and diversified sourcing strategies.

Limited Consumer Awareness in Developing Regions

In many developing economies, the benefits of nonwoven packaging—such as reusability, biodegradability, and strength—remain underappreciated due to lack of consumer education and availability. Traditional plastic packaging still dominates due to lower upfront costs and familiarity. Overcoming this gap demands extensive marketing, awareness campaigns, and government-led initiatives promoting sustainable alternatives. Until widespread consumer acceptance is achieved, penetration into these markets will remain slower than expected.

Recycling and Disposal Concerns

Although nonwoven packaging offers eco-friendly advantages, its end-of-life recyclability varies depending on the blend of materials used. Multilayered or composite nonwovens, while improving functionality, pose challenges for conventional recycling systems. Improper disposal may undermine the environmental benefits and raise concerns among regulators and environmentally conscious consumers. Ensuring closed-loop systems and improving recyclability standards are critical to overcoming this long-term sustainability concern.

Regional Analysis

North America

North America accounted for approximately 28% of the global nonwoven packaging market share in 2024, driven by strong demand from the retail, food & beverage, and healthcare sectors. The region’s advanced infrastructure and regulatory push for sustainable packaging support high adoption of nonwoven materials, particularly polypropylene-based products. The United States leads in consumption, benefiting from robust e-commerce growth and consumer preference for reusable bags and pouches. Innovations in meltblown and spunbond technologies are further stimulating regional growth. Additionally, supportive government policies toward plastic alternatives contribute to increasing investments in eco-friendly nonwoven packaging solutions.

Europe

Europe held around 25% of the global market share in 2024, supported by stringent environmental regulations and high awareness about sustainable packaging. Countries like Germany, France, and the UK are leading adopters due to government-imposed bans on single-use plastics and proactive circular economy policies. The region has witnessed significant investment in bio-based and recyclable nonwoven materials, especially in the retail and personal care sectors. Demand for reusable nonwoven bags and customizable wraps is increasing, aided by consumer consciousness and retail compliance with EU sustainability directives. Innovation and regulatory compliance continue to shape the region’s market growth trajectory.

Asia-Pacific

Asia-Pacific dominated the nonwoven packaging market in 2024 with a 32% global market share, led by China, India, and Japan. Rapid urbanization, growing retail sectors, and expanding middle-class populations are key growth drivers. China leads in production and export of nonwoven packaging materials due to large-scale manufacturing facilities and government policies supporting environmental protection. India is witnessing rising demand in food packaging and personal care, while Japan focuses on quality and hygiene in nonwoven formats. Increasing awareness of environmental issues and local bans on plastic are encouraging adoption of sustainable nonwoven alternatives across several APAC economies.

Latin America

Latin America contributed approximately 7% of the global nonwoven packaging market in 2024, with Brazil and Mexico representing the largest shares. The market is gradually expanding due to the region’s increasing retail activities, growth in food processing, and rising consumer interest in eco-friendly packaging. Public and private sector initiatives promoting sustainable practices are fostering demand for reusable and biodegradable packaging solutions. Although plastic packaging still dominates, the shift toward nonwoven formats is evident in urban centers. The region also benefits from trade relations with North American and European partners demanding sustainable packaging compliance.

Middle East & Africa (MEA)

The Middle East & Africa held around 8% of the global nonwoven packaging market share in 2024. Market growth in this region is supported by increasing investments in retail, healthcare, and food industries, particularly in the UAE, Saudi Arabia, and South Africa. While nonwoven adoption is still in its early stages compared to developed markets, rising awareness of sustainability and governmental restrictions on plastics are pushing demand upward. Industrial growth, urbanization, and tourism are indirectly contributing to packaging modernization. However, limited local manufacturing and high dependence on imports remain key challenges in accelerating market penetration.

Market Segmentations:

By Material

- Polypropylene (PP)

- Polyethylene (PE)

- Polyester (PET)

- Rayon

- Others

By Product Type

- Bags

- Wraps

- Sachets

- Others

By Technology

- Spunbond

- Meltblown

- Airlaid

- Wetlaid

- Needle Punch

- Others

By End Use

- Food & Beverage

- Healthcare

- Consumer Goods

- Industrial

- Agriculture

- Retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the nonwoven packaging market is characterized by the presence of both global conglomerates and regional players actively investing in innovation, sustainability, and expansion. Key companies such as Ahlstrom, Dupont de Nemours, Inc., Glatfelter Corporation, and ANDRITZ are leveraging advanced nonwoven technologies like spunbond and meltblown to meet the growing demand for lightweight, durable, and eco-friendly packaging solutions. These firms focus on enhancing production efficiency, expanding product portfolios, and aligning with environmental regulations to maintain market leadership. Meanwhile, emerging players like Jayashree Spun Bond, Felix Nonwovens, and Aster srl are gaining traction through cost-effective and customizable solutions tailored to local needs. Strategic mergers, acquisitions, and partnerships are becoming increasingly common, enabling companies to strengthen distribution networks and broaden market reach. Additionally, innovations in biodegradable and recyclable nonwoven materials are creating new opportunities, prompting continuous investment in R&D across the industry. Overall, the market remains moderately consolidated, with innovation as a key differentiator.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jayashree Spun Bond

- Glatfelter Corporation

- BENZ Packaging

- Dupont de Nemours, Inc.

- CK Fabrics

- EAM Corporation (Domtar Corporation)

- Ahlstrom

- Aster srl

- Novipax Buyer, LLC

- ANDRITZ

- Felix Nonwovens

Recent Developments

- In February 2025, Novolex and Pactiv Evergreen announced a merger to strengthen food-service packaging with a focus on recyclable and compostable non-woven wraps.

- In January 2025, Kimberly-Clark confirmed a USD 2 billion five-year domestic expansion covering a new Warren, Ohio non-woven facility and an extended Beech Island, South Carolina site, adding 900 skilled automation positions.

- In November 2024, Valmet announced the integration of the IQ quality control system for the sustainable packaging and nonwoven packaging industry. This IQ system has the capability to measure component, color, and ash content with precision. It can also optimize the amount of raw material used and offer greater efficiency along with a lower carbon footprint.

- In September 2024, Asahi Kasei officially launched a new grade of flame retardant nonwoven fabric. This solution provides thermal runaway protection that can be applied in top covers and other usage in the EV battery pack.

- In August 2024, Manjushree Spntek designed a premium range of hybrid nonwovens for chemotherapy gowns. Hightex monolithic hybrid nonwovens are created by combining a special polymer-based continuous fiber web with reinforced thermoplastics, which offer a superior barrier for chemicals and hazardous drugs and offer comfort during the procedures.

- In January 2024, Mitsui Chemicals Asahi Life Materials Co. Ltd unveiled the Ecorise PLA spunbond nonwoven material in Tokyo. This material has been adopted as packaging material for tennis racquets sold by sports goods giant, Yonex.

Market Concentration & Characteristics

The Nonwoven Packaging Market demonstrates a moderately concentrated structure with a mix of global leaders and regional manufacturers competing on product innovation, cost efficiency, and sustainability. It features a dynamic landscape where large companies such as Dupont de Nemours, Ahlstrom, and Glatfelter dominate through scale, technological advancement, and extensive distribution networks. Regional players like Jayashree Spun Bond and Felix Nonwovens address localized demand with customizable and affordable solutions. It remains highly responsive to regulatory changes, particularly in environmental policy, which influences material selection and design preferences. Companies actively invest in recyclable and biodegradable alternatives to strengthen their market position and comply with evolving packaging standards. Demand for reusable, lightweight, and durable formats continues to rise across sectors such as retail, food, and healthcare. The market exhibits innovation-driven growth, supported by ongoing R&D in spunbond, meltblown, and composite technologies. Competitive differentiation relies on sustainability credentials, production speed, and product versatility. Pricing pressure from raw material volatility affects small and mid-sized firms more significantly, reinforcing the advantage of vertically integrated players.

Report Coverage

The research report offers an in-depth analysis based on Material, Product Type, Technology, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The nonwoven packaging market is expected to witness steady growth due to increasing demand for sustainable and reusable packaging materials.

- Advancements in nonwoven technologies like spunbond and meltblown will enhance product performance and production efficiency.

- Regulatory pressure against single-use plastics will accelerate the shift toward eco-friendly nonwoven alternatives across industries.

- Growing e-commerce and retail sectors will boost demand for lightweight and durable nonwoven packaging formats.

- Customizable and printed nonwoven packaging will gain popularity as brands seek differentiated shelf presence.

- Asia-Pacific will remain the leading regional market due to expanding manufacturing capabilities and rising consumer demand.

- Investment in biodegradable and recyclable nonwoven materials will drive product innovation and market penetration.

- Strategic collaborations and mergers will help companies expand regional reach and diversify product portfolios.

- Increasing application in food, healthcare, and personal care sectors will support diversified market expansion.

- Rising consumer awareness of environmental issues will continue to influence purchasing behavior toward nonwoven packaging.