| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

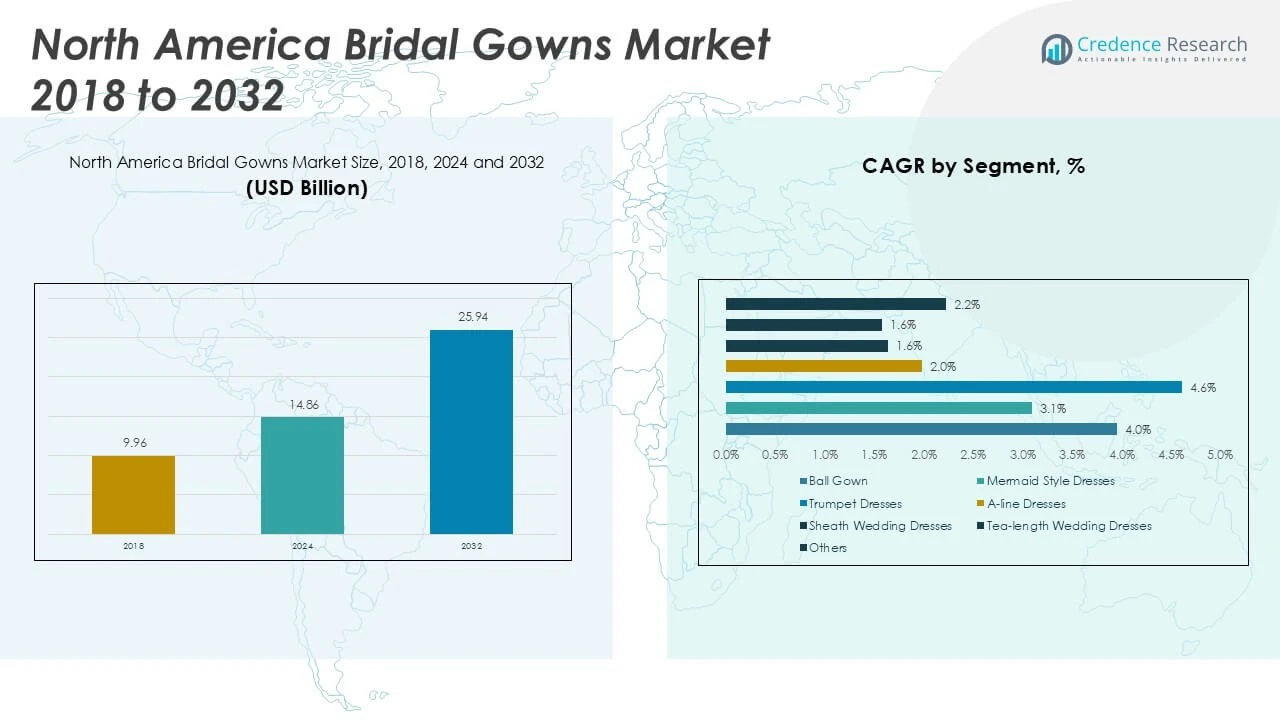

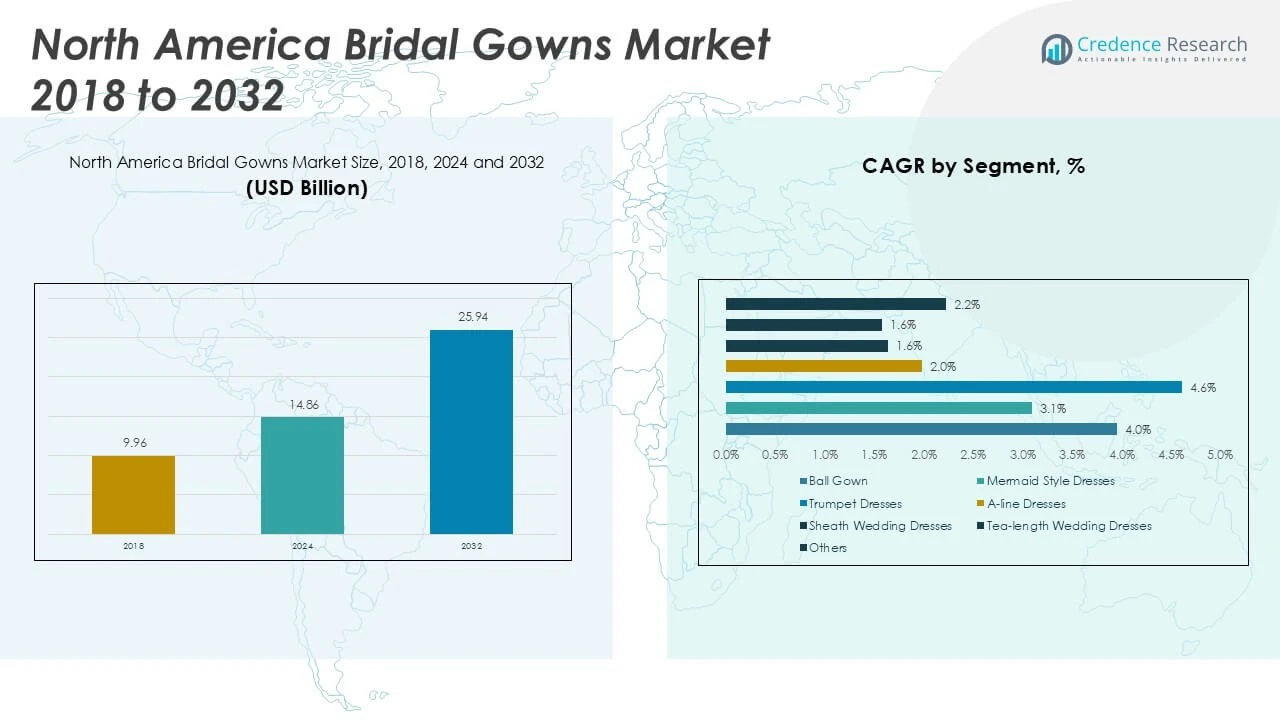

| North America Bridal Gowns MarketSize 2024 |

USD14.86 million |

| North America Bridal Gowns Market, CAGR |

6.72% |

| North America Bridal Gowns Market Size 2032 |

USD25.94 million |

Market Overview

The North America Bridal Gowns Market is projected to grow from USD14.86 million in 2024 to an estimated USD25.94 million based on 2032, with a compound annual growth rate (CAGR) of 6.72% from 2025 to 2032.

Key drivers fueling this growth include a resurgence in destination weddings, a strong emphasis on individualistic wedding themes, and the influence of social media platforms showcasing celebrity bridal looks and designer trends. The market is also witnessing rising demand for sustainable and ethically made bridal gowns, pushing designers and manufacturers toward eco-conscious fabric sourcing and production methods. Innovations such as customizable gowns, virtual fittings, and omni-channel retail experiences are further enhancing consumer engagement.

Geographically, the United States holds a dominant share of the North America bridal gowns market, supported by a robust bridal fashion industry and high per capita wedding expenditure. Canada is also contributing to market growth, driven by increasing consumer preference for designer labels and bespoke wedding services. Key players operating in the region include David’s Bridal, Vera Wang, Amsale Aberra, BHLDN (Anthropologie), and Kleinfeld Bridal. These brands continue to strengthen their market position through design collaborations, expanded e-commerce presence, and adaptive marketing strategies targeting digitally savvy brides.

Market Drivers

Rising Demand for Customization and Personal Expression in Bridal Wear

The North America Bridal Gowns Market benefits from a growing preference for personalized bridal attire. Brides today seek unique designs that reflect their individual style and cultural values. Designers and retailers are responding by offering made-to-order and customizable options. This shift away from traditional, off-the-rack gowns is reshaping design and production processes. It enables brands to cater to diverse preferences, including non-traditional color palettes, cultural motifs, and body-inclusive silhouettes. The trend supports premium pricing strategies and enhances brand loyalty.

- For instance, a major U.S. bridal retailer expanded its customization options in 2023, launching a collection with over 300 unique fabric and design variations to meet evolving consumer preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Influence of Social Media and Celebrity Trends on Purchase Decisions

Social media platforms are shaping consumer expectations in the North America Bridal Gowns Market. Brides often look to celebrity weddings, influencers, and bridal fashion blogs for inspiration. Viral trends and high-profile events directly influence fabric choices, silhouettes, and design elements. Brands maintain visibility by showcasing collections through Instagram, TikTok, and Pinterest. It enhances engagement and creates aspirational appeal among digital-native customers. Real-time exposure to global bridal trends accelerates demand for trend-aligned offerings.

- For instance, the search volume for “celebrity wedding dresses” peaked at 2.8 million monthly searches in 2024, signaling the strong influence of social media and pop culture on bridal trends.

Increased Spending on Weddings and Bridal Fashion Post-Pandemic

Wedding budgets have expanded in North America, with a greater share now allocated to attire and accessories. Consumers prioritize quality, exclusivity, and emotional value over price sensitivity. The North America Bridal Gowns Market benefits from this shift, with growing sales in luxury and designer segments. It reflects broader lifestyle trends focused on meaningful and memorable events. Retailers are aligning inventory and marketing to target couples willing to spend more on their special day. The bridal gown becomes a central investment in the overall wedding experience.

Sustainability and Ethical Practices Gain Momentum in Bridal Fashion

The North America Bridal Gowns Market is responding to rising consumer awareness about environmental and ethical issues. Many brides now prefer gowns made from sustainable fabrics and produced through fair labor practices. It drives innovation in material sourcing, supply chain transparency, and circular fashion models. Eco-conscious collections are gaining traction across both premium and mid-range segments. Brands promoting ethical values often build stronger customer trust and long-term loyalty. Sustainability is no longer a niche offering but a competitive differentiator.

Market Trends

Growing Popularity of Sustainable and Eco-Friendly Bridal Gowns

The North America Bridal Gowns Market is experiencing a shift toward sustainable fashion choices. Brides are increasingly prioritizing environmentally responsible options, prompting designers to incorporate organic fabrics, recycled materials, and low-impact production processes. Brands are highlighting transparency in their sourcing and manufacturing, which resonates with conscious consumers. It supports a narrative of mindful luxury that blends ethics with aesthetics. Retailers are expanding collections that meet sustainability criteria without compromising design. This trend reinforces long-term value and aligns with broader fashion industry movements.

- For instance, over 6,000 bridal brands in North America are now offering sustainable gown options, with at least 450 manufacturers integrating recycled materials into their designs.

Emergence of Online Platforms and Virtual Bridal Shopping

The digital transformation in retail is shaping how brides approach gown selection. The North America Bridal Gowns Market is seeing rising traction for virtual consultations, online fittings, and AR-based try-on experiences. E-commerce platforms are offering detailed visuals, fabric swatches, and customization tools to recreate the boutique experience remotely. It reduces geographic limitations and appeals to tech-savvy customers. Brands are investing in user-friendly interfaces and customer support to build confidence in online purchases. Virtual channels are becoming essential to remain competitive and relevant.

- For instance, more than 3,500 bridal retailers across North America now offer virtual consultations, and leading e-commerce platforms have recorded an increase of over 1.2 million bridal gown searches per month.

Influence of Minimalist and Non-Traditional Design Aesthetics

Modern brides are embracing minimalist styles and unconventional silhouettes. The North America Bridal Gowns Market is evolving to accommodate changing design sensibilities, shifting away from overly ornate gowns to sleeker, contemporary looks. It reflects broader fashion preferences favoring clean lines, subtle embellishments, and functional elegance. Designers are offering options like jumpsuits, two-piece sets, and short dresses for casual or second ceremonies. This trend caters to diverse wedding formats, from courthouse weddings to destination celebrations. Retailers are curating collections that reflect these varied preferences.

Increased Focus on Inclusivity and Size Diversity in Bridal Fashion

The demand for inclusive sizing and body-positive representation continues to grow. The North America Bridal Gowns Market is addressing this by expanding size ranges and showcasing diverse models in marketing campaigns. It reflects the industry’s efforts to serve all body types with equal attention to fit and style. Retailers are training staff to provide supportive consultations across demographics. It enhances accessibility and fosters emotional connections with customers. Inclusivity is becoming central to the market’s evolution and brand identity.

Market Challenges

Rising Costs and Supply Chain Disruptions Impact Profit Margins

The North America Bridal Gowns Market faces ongoing pressure from rising material and labor costs. Global supply chain disruptions have led to delays in fabric sourcing and production schedules. It affects timely delivery and increases operational expenses for both manufacturers and retailers. Smaller boutiques struggle to absorb these fluctuations without passing costs to consumers. This scenario creates pricing challenges in a market already sensitive to budget variations. Maintaining quality while managing costs remains a key concern for brands operating in the region.

- For instance, North America’s bridal gown industry saw over 1,200 boutique closures in the past five years due to rising material and labor costs

Changing Consumer Behavior and Decline in Traditional Weddings

Shifting wedding trends present structural challenges for the North America Bridal Gowns Market. Many couples are choosing smaller, informal ceremonies that reduce demand for traditional gowns. It impacts sales volume and alters product demand toward casual or multifunctional attire. The market must adapt to meet preferences for versatile, affordable options without diluting brand prestige. Consumer expectations are evolving, with greater emphasis on convenience, experience, and personalization. Brands must innovate continuously to stay relevant amid changing wedding formats and cultural attitudes.

Market Opportunities

Expansion of Direct-to-Consumer Channels and Digital Retail Strategies

The rise of direct-to-consumer (DTC) models offers strong growth potential for the North America Bridal Gowns Market. Brands can control pricing, customer experience, and inventory more effectively through their own platforms. It allows designers to engage directly with brides, personalize services, and gather valuable feedback. Online showrooms and virtual fittings help reduce the need for physical space while maintaining customer satisfaction. This model also supports faster delivery cycles and better response to trends. DTC strategies strengthen brand identity and increase customer retention.

Growing Demand for Culturally Inclusive and Niche Bridal Collections

Designers have an opportunity to serve a diverse population with culturally inclusive bridal wear. The North America Bridal Gowns Market can benefit by introducing collections that reflect cultural traditions, religious preferences, and regional aesthetics. It helps brands build loyalty among underrepresented communities. Offering niche collections for fusion weddings, modest fashion, or heritage-inspired designs can open new revenue streams. It also enables differentiation in a competitive market. Meeting these needs signals respect and responsiveness, which enhances long-term brand value.

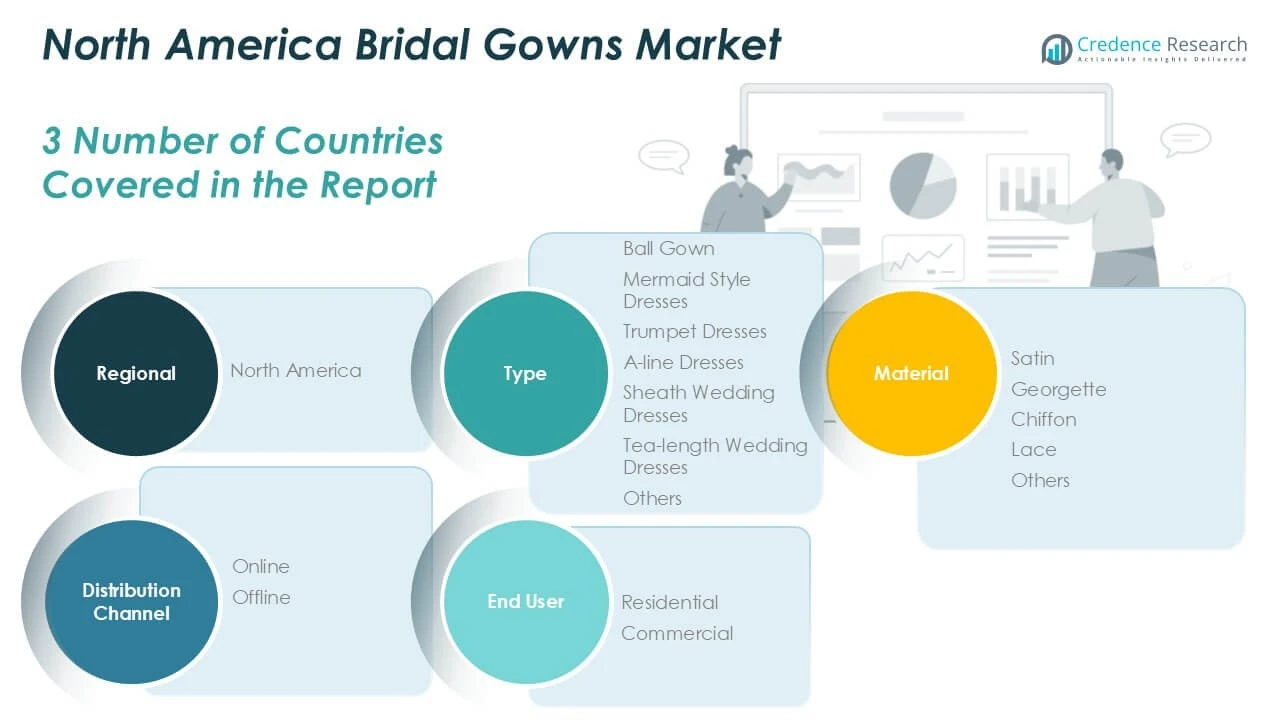

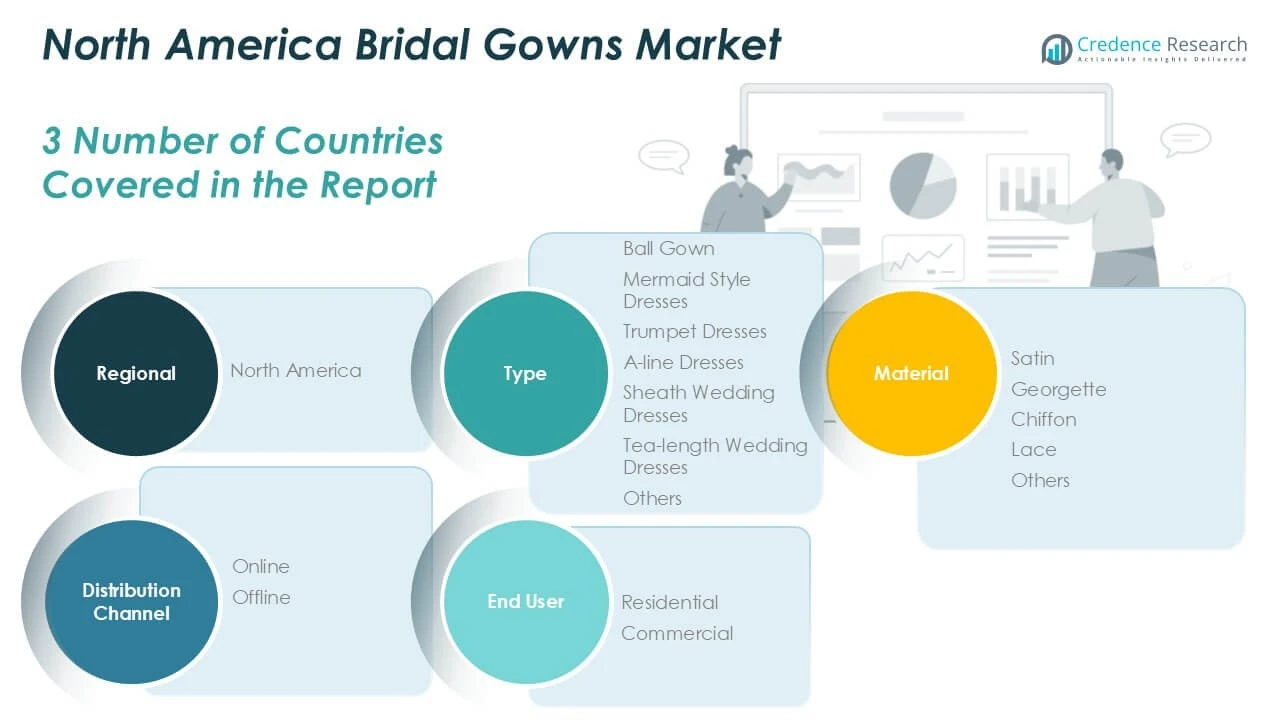

Market Segmentation Analysis

By Type

The North America Bridal Gowns Market features a diverse range of gown types, catering to various body types, personal styles, and wedding themes. A-line dresses lead the segment due to their flattering silhouette and versatility across formal and informal weddings. Ball gowns maintain strong demand among brides favoring traditional and opulent styles, especially for church or ballroom settings. Mermaid and trumpet styles attract fashion-forward consumers seeking a modern, body-contouring look. Sheath and tea-length dresses serve brides preferring minimalist or destination wedding attire. It also includes niche designs under the “Others” category, which reflects evolving fashion trends and experimental styles.

By Material

Material selection plays a critical role in gown aesthetics, comfort, and pricing. Satin leads the material segment due to its luxurious finish and structured appeal, often chosen for formal ceremonies. Lace remains highly popular for its romantic and intricate detailing, especially in vintage or bohemian styles. Chiffon and georgette provide lightweight, breathable options ideal for outdoor or summer weddings. The market continues to innovate in fabric blends and sustainable materials, expanding the “Others” category with eco-friendly alternatives. It shows growing responsiveness to both functionality and fashion sensibilities.

By Distribution Channel

The market operates through online and offline distribution channels, each playing a strategic role in reaching target consumers. Offline channels, including specialty boutiques and department stores, hold the largest share by offering personalized fittings and in-store experiences. Online platforms are growing rapidly, supported by enhanced digital tools and flexible return policies. It enables brands to reach a broader demographic and adapt to evolving shopping behaviors. The online segment shows strong growth potential due to rising e-commerce trust among younger consumers.

By End User

The North America Bridal Gowns Market segments end users into residential and commercial categories. Residential users represent individual brides purchasing gowns for personal use, driving the majority of sales. Commercial end users, including rental services and bridal salons, contribute to recurring demand and inventory turnover. It supports long-term sales stability and enables product accessibility across budget segments. The growth in rental services highlights shifting consumer priorities toward cost-efficiency and sustainability.

Segments

Based on Type

- Ball Gown

- Mermaid Style Dresses

- Trumpet Dresses

- A-line Dresses

- Sheath Wedding Dresses

- Tea-length Wedding Dresses

- Others

Based on Material

- Satin

- Georgette

- Chiffon

- Lace

- Others

Based on Distribution Channel

Based on End User

Based on Region

Regional Analysis

U.S. Bridal Gowns Market

The U.S. dominates the North America Bridal Gowns Market, accounting for nearly 78% of the regional revenue share in 2024. A strong culture of wedding celebration, high disposable income, and a mature bridal fashion industry support market leadership. The U.S. market benefits from diverse consumer preferences, ranging from luxury designer gowns to budget-conscious options. It has a robust distribution network that includes flagship bridal boutiques, department stores, and emerging direct-to-consumer channels. Trends such as sustainability, cultural inclusivity, and customization are widely adopted. The market remains dynamic, with frequent product launches and strong brand visibility across digital and physical platforms.

Canada Bridal Gowns Market

Canada holds around 18% of the North America Bridal Gowns Market and continues to grow with rising demand for designer bridal wear. Urban centers such as Toronto, Vancouver, and Montreal are major contributors due to their cosmopolitan demographics and high wedding expenditures. Canadian consumers are increasingly interested in ethical fashion and locally crafted bridal gowns. It reflects evolving preferences for quality, craftsmanship, and sustainable sourcing. Retailers are expanding online and showroom services to offer convenience and broader selection. The Canadian market presents strong opportunities for niche and bespoke designers.

Mexico Bridal Gowns Market

Mexico accounts for an estimated 4% share of the North America Bridal Gowns Market. The market is growing gradually, driven by increasing western influence on wedding fashion and rising middle-class income. Traditional preferences remain prevalent, but modern styles are gaining popularity among younger brides. It creates a hybrid demand for both culturally rooted and contemporary gowns. Urban expansion and e-commerce adoption support access to premium bridal brands. Mexico’s bridal retail space is diversifying with both global and regional players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Monique Lhuillier

- Claire Pettibone

- Rita Vinieris

- Sareh Nouri

- HONOR NYC

- Kelly Faetanini

- Wedding Angels Bridal Boutique

- Hayley Paige

- Lazaro

Competitive Analysis

The North America Bridal Gowns Market is highly competitive, marked by the presence of both established designers and boutique labels. Leading players such as Monique Lhuillier, Claire Pettibone, and Hayley Paige focus on high-end, couture-inspired collections that cater to luxury buyers. Boutique brands like Sareh Nouri and Kelly Faetanini offer handcrafted, niche collections appealing to brides seeking exclusivity and personal expression. The market also features bridal boutiques like Wedding Angels Bridal Boutique, which emphasize personalized service and curated selections. It fosters competition across price points, design aesthetics, and customer experience. Most players invest in digital platforms, influencer partnerships, and sustainable practices to maintain market relevance and customer loyalty. Brand identity, innovation in design, and supply chain agility define competitive success in this evolving landscape.

Recent Developments

- In April 2024, Monique Lhuillier unveiled her Spring 2025 bridal collection, drawing inspiration from Victorian influences. The collection features rich floral laces, sculptural taffetas, diverse hemlines, and intricate embroidery, embodying timeless elegance and poise.

- In April 2024, Claire Pettibone launched her Spring 2025 collection titled “The Secret Garden,” featuring whimsical, ethereal bridal gowns inspired by nature. The collection highlights delicate florals, intricate lace, and soft, flowing silhouettes suitable for various wedding styles.

- In May 2024, Rita Vinieris presented the Rivini Spring 2025 collection, inspired by “amour” and the spectacular moments in life. The collection features sublime pieces with meticulous details and generous lush volumes, evoking a playground for self-expression and an ode to couture.

- In March 2024, Kelly Faetanini introduced “The Icons Collection” for 2025, featuring modern spins on classic designs. The collection emphasizes femininity, romance, and the essence of a classic soul with a modern twist, crafted with attention to detail and movement

Market Concentration and Characteristics

The North America Bridal Gowns Market demonstrates a moderately fragmented structure, with a mix of established luxury designers and niche boutique brands shaping competitive dynamics. It reflects a high degree of product differentiation driven by style, material, fit, and customization. Market players focus on exclusivity, design innovation, and personalized service to attract and retain customers. The industry operates across diverse price tiers, from mass-market to premium segments, accommodating a wide consumer base. Seasonal demand peaks and evolving fashion trends influence inventory strategies and production planning. It remains sensitive to cultural shifts, digital adoption, and sustainability expectations, which continue to redefine market characteristics.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Distribution Channel, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The gift packaging market will continue to grow due to rising demand for premium presentation in personal and corporate gifting. Brands are investing in aesthetically rich and custom-designed packaging to elevate unboxing experiences.

- Sustainable packaging solutions will gain prominence as consumers prioritize eco-friendly materials. Companies will increasingly adopt recyclable, biodegradable, and reusable options to align with environmental regulations and consumer preferences.

- E-commerce expansion will boost demand for protective yet attractive gift packaging formats. Retailers will focus on packaging that preserves product quality while enhancing visual appeal during delivery.

- Personalization will drive future growth, with consumers seeking unique, tailor-made designs for various occasions. Advances in digital printing and on-demand production will support this trend.

- Seasonal demand spikes during holidays and festivals will remain key revenue generators. Manufacturers will plan agile production cycles to cater to changing design and volume needs during peak periods.

- Luxury packaging will attract higher margins as premium brands differentiate through elegant, high-end wrapping solutions. Innovations in materials, texture, and finishes will support brand storytelling and consumer engagement.

- Innovations in smart packaging, such as QR codes and NFC-enabled tags, will enhance interactivity and product traceability. These features will be used to offer personalized messages or authentication in high-value gift segments.

- The corporate gifting segment will expand, encouraging bulk procurement of branded and customizable gift boxes. It will create opportunities for packaging companies to develop exclusive B2B offerings.

- Asia Pacific will remain a growth hotspot due to rising disposable incomes, cultural gifting practices, and increasing retail activity. Local players will scale production to meet growing domestic and export demand.

- Strategic partnerships between packaging companies and gifting brands will increase. These collaborations will aim to co-create innovative designs, manage cost-efficiency, and enhance market reach through shared expertise.