Market Overview

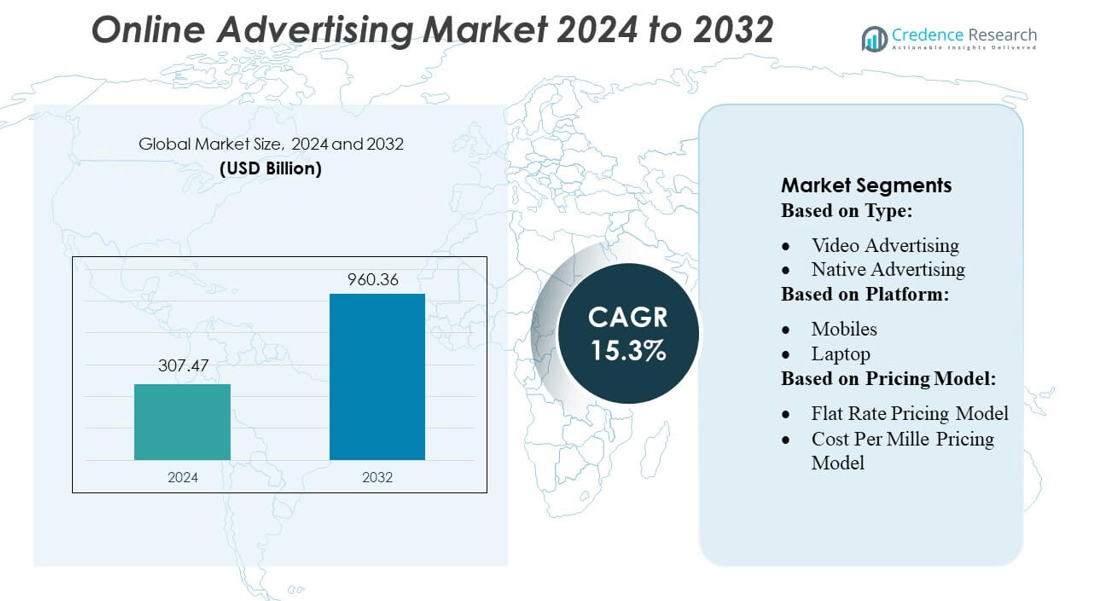

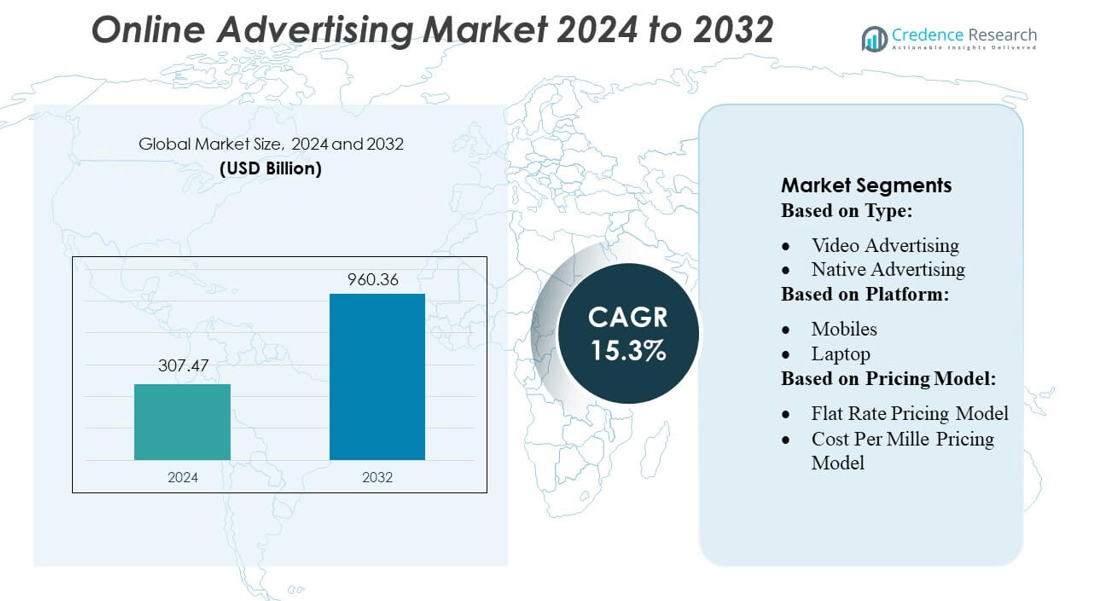

Online Advertising Market size was valued USD 307.47 billion in 2024 and is anticipated to reach USD 960.36 billion by 2032, at a CAGR of 15.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Online Advertising Market Size 2024 |

USD 307.47 billion |

| Online Advertising Market, CAGR |

15.3% |

| Online Advertising Market Size 2032 |

USD 960.36 billion |

The Online Advertising Market’s competitive landscape is shaped by intense rivalry, technological innovation, and strategic differentiation. Leading firms vigorously invest in AI-driven programmatic platforms, real-time bidding, and first-party data capabilities to boost targeting precision and campaign efficiency. Major players leverage massive consumer reach on social, video, and retail platforms, while also emphasizing privacy-safe solutions and cross-channel attribution models. As firms scale globally, regional strategies matter: North America leads the market with about 34% share, driven by high internet penetration, mature ad tech infrastructure, and strong digital ad spend across search, display, and video formats.

Market Insights

- The Online Advertising Market was valued at USD 307.47 billion in 2024 and is projected to reach USD 960.36 billion by 2032 at a 3% CAGR, supported by rising digital spending, expanding online audiences, and increasing adoption of AI-enabled advertising solutions.

- Strong market drivers include rapid mobile and video consumption, accelerated e-commerce growth, and wider use of programmatic platforms that enhance precision targeting and campaign scalability.

- Key trends focus on privacy-centric advertising, growth of retail media networks, and rising demand for immersive formats such as AR and interactive ads, reshaping advertiser engagement strategies.

- Competitive intensity increases as global platforms invest in AI, first-party data, real-time bidding, and analytics, while firms emphasize transparency, brand safety, and cross-channel measurement to differentiate.

- Regionally, North America leads with about 34% share, while by type, video advertising holds the dominant segment share, driven by stronger engagement and higher ROI across mobile and social platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Video advertising dominates the online advertising market, accounting for the largest share—often estimated at over one-third of total digital ad spending—driven by rising user engagement on streaming platforms, short-form video apps, and connected TV environments. Brands prefer video formats due to higher click-through rates, improved storytelling capability, and better ROI compared to static formats. Growth is further fueled by advancements in programmatic video delivery, AI-based content personalization, and improved mobile network speeds, which enhance loading performance and expand reach across demographics.

- For instance, Snap reported that AR Lenses in its camera were used 8 billion times per day, and over 400,000 developers have created more than 4 million Lenses using its Lens Studio platform.

By Platform

Mobile platforms hold the dominant market position, capturing well above half of total online ad spending as consumers increasingly rely on smartphones for browsing, shopping, and media consumption. The segment’s growth is supported by expanding 4G/5G penetration, high in-app engagement rates, and superior ad-targeting precision through device-level data. Marketers prefer mobile ads for their location-based targeting, dynamic personalization, and strong conversion metrics. Additionally, app-based ecosystems allow seamless integration of video, native, and interactive formats, further accelerating mobile’s lead over desktops, laptops, and tablets.

- For instance, Microsoft has enhanced its Azure App Service platform to provide native support for Progressive Web Apps (PWAs) and seamless integration with serverless technologies like Azure Functions. The service is deployed across more than 70 Azure regions worldwide, enabling developers to build and deploy highly responsive and scalable web apps.

By Pricing Model

The Cost Per Click (CPC) pricing model leads the segment, representing the largest share due to its performance-driven structure and direct link to measurable user actions. Advertisers favor CPC because it optimizes budget utilization, reduces wastage, and supports real-time campaign adjustments based on click-through behavior. This model gains traction across search engines, e-commerce platforms, and social media networks where intent-driven traffic is strong. Its dominance is reinforced by advancements in analytics, automated bidding, and AI-enhanced audience segmentation that increase accuracy in predicting high-value user interactions.

Key Growth Drivers

Expansion of Programmatic Advertising

Programmatic advertising drives substantial growth as brands increasingly adopt automated, data-driven platforms to optimize campaign performance. Real-time bidding capabilities enable precise audience targeting, higher inventory efficiency, and improved ROI. As advertisers shift budgets toward algorithmic ad buying, demand grows for AI-driven personalization, dynamic creative optimization, and cross-device audience mapping. The integration of machine learning enhances predictive insights, enabling faster decision-making and reducing acquisition costs. This automation trend accelerates adoption across sectors such as retail, BFSI, entertainment, and e-commerce, strengthening programmatic’s position as a major growth catalyst.

- For instance, Multi-Task Multi-Domain (MTMD) lightweight model that replaced nine production ranking systems, reducing cost-per-click by 2% in live traffic while maintaining latency.

Rapid Growth of Mobile and Video Consumption

The surge in mobile internet usage and short-form video content consumption significantly propels online advertising growth. High smartphone penetration, faster 4G/5G networks, and increasing time spent on video-centric platforms strengthen the appeal of mobile-first campaigns. Advertisers benefit from immersive video formats that deliver stronger engagement and higher click-through rates than static content. The popularity of connected TV, OTT platforms, and social video apps further fuels demand for targeted video ads. As consumer behavior shifts toward on-the-go visual content, brands intensify investments in mobile and video advertising channels.

- For instance, Waystar’s Claim Manager maintains a 98.5% first-pass clean claim rate, powered by more than 2.5 million built-in claim edits updated in real time. This level of automation reduces resubmission delays and supports faster reimbursement across 5,000 payer connections.

Rising Adoption of AI and Data Analytics

AI and advanced analytics are major growth drivers, empowering advertisers with granular insights and predictive capabilities to enhance campaign effectiveness. Machine learning algorithms improve audience segmentation, automate bidding strategies, and optimize creative elements based on real-time performance signals. The growing use of customer data platforms and attribution tools helps brands understand user journeys and allocate budgets more efficiently. Additionally, AI-powered personalization boosts conversion rates by delivering contextually relevant ads. As digital ecosystems generate larger datasets, analytics-driven decision-making becomes indispensable for maximizing ad spend efficiency.

Key Trends & Opportunities

Growth of Privacy-Focused Advertising Solutions

Privacy-centric advertising is emerging as a key trend as regulators enforce stricter data protection rules and browsers phase out third-party cookies. This shift creates new opportunities for contextual advertising, first-party data strategies, and privacy-preserving identity solutions. Brands are investing in consent-driven data collection, clean rooms, and encrypted targeting frameworks to maintain relevance while ensuring compliance. The industry’s transition toward transparent, user-centric models opens avenues for innovative targeting methodologies that balance personalization with privacy, reshaping how advertisers track, attribute, and optimize customer interactions.

- For instance, Amazon Ads also highlighted a mobile campaign on MX Player, where a smartphone brand achieved 61 million + impressions and a 94% video completion rate, while driving 70% higher attention than online video benchmarks.

Expansion of Retail Media Networks

Retail Media Networks (RMNs) present a fast-growing opportunity as major e-commerce platforms monetize their first-party shopper data. Brands increasingly leverage RMNs to reach high-intent consumers through sponsored listings, display ads, and personalized product recommendations. These networks offer precise attribution, closed-loop reporting, and strong conversion rates, making them attractive for performance marketers. As retailers scale omnichannel ecosystems—spanning apps, marketplaces, and in-store digital screens—the advertising inventory expands. This trend enables advertisers to access premium retail audiences while helping retailers establish a high-margin revenue stream.

- For instance, NextGen Ambient Assist, introduced nearly two years ago, now handles 1.5 million patient encounters annually. It saves providers up to two hours per day in documentation by transcribing encounters in real time and generating summaries via AI.

Rise of Immersive and Interactive Ad Formats

Immersive formats such as AR/VR ads, 3D product visualizations, and gamified experiences are gaining traction, creating new engagement opportunities for brands. Advancements in augmented reality, AI-driven creative tools, and in-app interactive environments support deeper consumer interaction. Sectors like fashion, automotive, and beauty increasingly use AR try-ons and virtual showrooms to enhance customer experience. As metaverse environments and spatial computing platforms evolve, advertisers explore new digital spaces to deliver measurable and interactive campaigns. This shift opens avenues for richer storytelling and higher engagement levels.

Key Challenges

Increasing Ad Fraud and Brand Safety Concerns

Ad fraud—including bot traffic, click fraud, and impression manipulation—remains a major challenge that erodes advertiser trust and inflates campaign costs. Brands struggle to maintain transparency as fraudulent actors exploit programmatic systems and cross-channel networks. Additionally, brand safety risks increase as ads occasionally appear next to inappropriate or harmful content, damaging reputation. Despite advancements in verification tools and fraud detection algorithms, ensuring clean inventory and safe placements requires continuous monitoring, higher security investments, and collaboration across publishers, agencies, and technology providers.

Fragmented Ecosystem and Measurement Complexity

The online advertising landscape is highly fragmented across platforms, devices, and ad formats, complicating unified measurement and attribution. Brands face difficulty in tracking user journeys consistently due to walled gardens, privacy restrictions, and varied data standards. Cross-device identification challenges further limit accurate ROI assessment. As platforms prioritize first-party data, advertisers often navigate inconsistent metrics and limited interoperability. This complexity increases operational overhead and hinders budget optimization. Developing unified measurement frameworks and interoperable identity solutions becomes essential for achieving accurate, cross-channel performance insights.

Regional Analysis

North America

North America holds the largest share of the online advertising market, accounting for around 40% of global revenue. The region benefits from strong digital adoption, high internet penetration, and significant spending by major advertisers across retail, technology, and financial services. Companies such as Google, Meta, and Amazon dominate digital ad ecosystems, strengthening market maturity. Programmatic buying, video advertising, and performance-based campaigns are widely adopted due to advanced analytics and data-driven targeting. Although growth is steady rather than rapid, North America maintains leadership due to its developed infrastructure and strong advertiser demand.

Asia–Pacific

Asia–Pacific accounts for approximately 30–35% of the global online advertising market and represents the fastest-growing region. Rapid smartphone penetration, expanding 4G/5G networks, and rising digital spending in China, India, and Southeast Asia fuel strong growth. Consumers in this region are highly mobile-first, driving demand for video, in-app, and social media advertising. E-commerce platforms significantly increase digital ad investments through retail media networks. With a young digital population and fast-evolving mobile ecosystems, Asia–Pacific is expected to continue gaining market share and remain a major driver of global online advertising growth.

Europe

Europe holds about 15–20% of the online advertising market, supported by high digital literacy and strong adoption of data-driven advertising. Markets such as the UK, Germany, and France lead investment in programmatic and performance-based campaigns. However, stricter data privacy regulations encourage growth in contextual and privacy-compliant advertising strategies. Despite slower expansion compared to Asia–Pacific, Europe maintains steady growth due to consistent digital transformation among enterprises and high-quality ad inventory. The region’s focus on transparency, brand safety, and standardized measurement ensures stable advertiser confidence and sustained demand.

Latin America

Latin America captures roughly 6–8% of global online advertising spending, supported by rising internet access and expanding mobile usage across Brazil, Mexico, and Argentina. Social media platforms play a significant role in advertising budgets due to high user engagement. The growth of regional e-commerce platforms is increasing demand for digital ads, particularly mobile and video formats. Although economic volatility and uneven digital infrastructure slow overall expansion, investment in mobile-first campaigns and digital transformation among local businesses contributes to steady market development and improved regional competitiveness.

Middle East & Africa (MEA)

The Middle East & Africa region holds around 5–7% of the global online advertising market, with growth driven by increasing smartphone adoption and expanding internet connectivity. GCC countries, particularly the UAE and Saudi Arabia, lead digital ad spending due to strong economic conditions and rapid digitalization. Social media and mobile video advertising are major growth areas, supported by a young, highly engaged population. Despite challenges such as inconsistent digital infrastructure in some countries, improving connectivity and rising interest in programmatic advertising support gradual market expansion.

Market Segmentations:

By Type:

- Video Advertising

- Native Advertising

By Platform:

By Pricing Model:

- Flat Rate Pricing Model

- Cost Per Mille Pricing Model

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Online Advertising Market features major global players ByteDance Ltd., Snap Inc., Microsoft Corporation, Pinterest, Tencent, Amazon.com, Inc., Google LLC, Twitter, Inc., Adobe Systems, Inc., and Facebook, Inc. The Online Advertising Market is highly dynamic, shaped by rapid technological advancements, shifting consumer behavior, and intensifying platform-level innovation. Companies compete by enhancing targeting accuracy, expanding programmatic capabilities, and integrating AI-driven personalization to optimize ad performance. The growing emphasis on privacy compliance, including the shift toward first-party data strategies and contextual advertising, is redefining competitive priorities. Meanwhile, demand for immersive formats such as video, AR, and interactive ads continues to rise, pushing platforms to differentiate through user engagement and advanced analytics. As digital ecosystems evolve, competition increasingly centers on automation, measurement transparency, and cross-channel ad delivery efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, The Trade Desk. announced the launch of OpenSincera, a new application designed to provide greater visibility into advertising performance and the health of the digital advertising supply chain. OpenSincera, which is free and open to all participants in the advertising industry, leverages Sincera’s rich advertising metadata to deliver deeper insights into advertising quality.

- In May 2025, Meta Platforms, Inc. announced a series of ad updates for its platforms Facebook, Instagram, and Threads at NewFronts 2025. These updates include enhanced tools for creator collaborations, a new method for advertising within trending Reels, updated Partnership Ads, and the introduction of video ads on Threads.

- In March 2025, Adobe announced a strategic collaboration with Amazon Web Services (AWS) and Amazon Ads. The collaboration enhances the Adobe Experience Platform (AEP) with AWS’s generative AI services, Amazon Connect, and Amazon Ads to support the creation of high-impact, data-driven advertising and customer engagement.

- In May 2023, Google, Inc. expanded its collaboration with SAP SE to introduce a comprehensive open data solution. This solution will enable customers to build a complete data cloud, integrating data from their enterprise systems via SAP Datasphere and Google’s data cloud

Report Coverage

The research report offers an in-depth analysis based on Type, Platform, Pricing Model and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue shifting toward AI-driven automation to improve targeting accuracy and campaign optimization.

- Privacy-focused advertising models will expand as brands adopt first-party data strategies and contextual targeting.

- Video and short-form content advertising will grow rapidly due to rising mobile engagement and platform monetization.

- Programmatic advertising adoption will deepen across emerging markets as infrastructure and digital maturity improve.

- Retail media networks will gain prominence as e-commerce platforms expand their advertising ecosystems.

- Immersive ad formats such as AR and interactive experiences will become more mainstream across consumer-facing sectors.

- Cross-platform measurement and attribution tools will advance to support unified campaign analysis.

- Social commerce and in-app advertising will accelerate as consumers increasingly shop within digital platforms.

- Connected TV and OTT advertising will strengthen as streaming penetration rises globally.

- Brand safety, fraud detection, and transparent reporting will remain priority investment areas for advertisers and platforms.