| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Online Food Delivery Services Market Size 2024 |

USD 383,671.74 million |

| Online Food Delivery Services Market, CAGR |

8.89% |

| Online Food Delivery Services Market Size 2032 |

USD 756,208.31 million |

Market Overview:

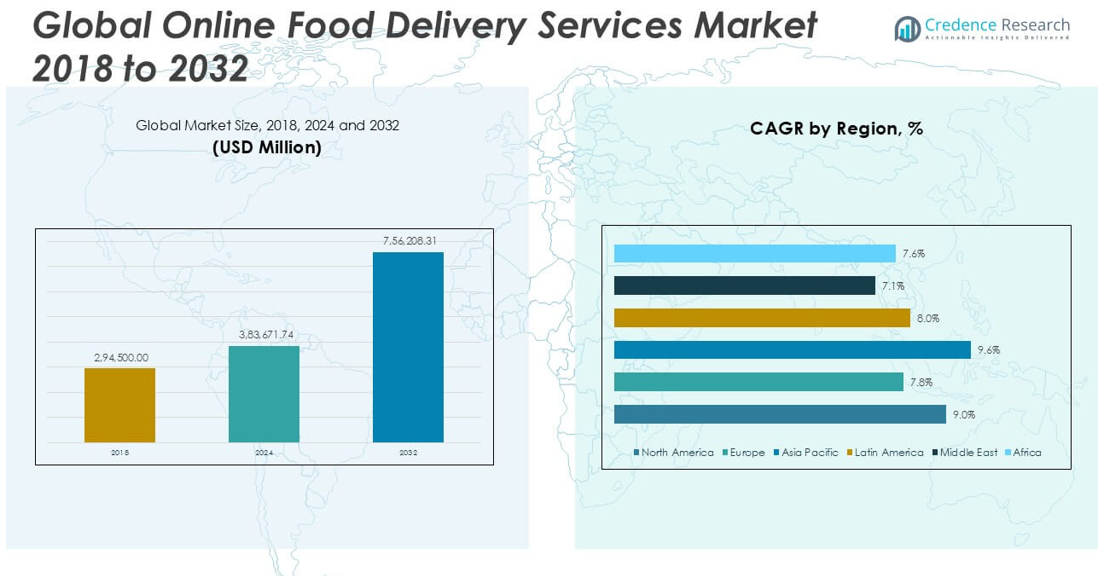

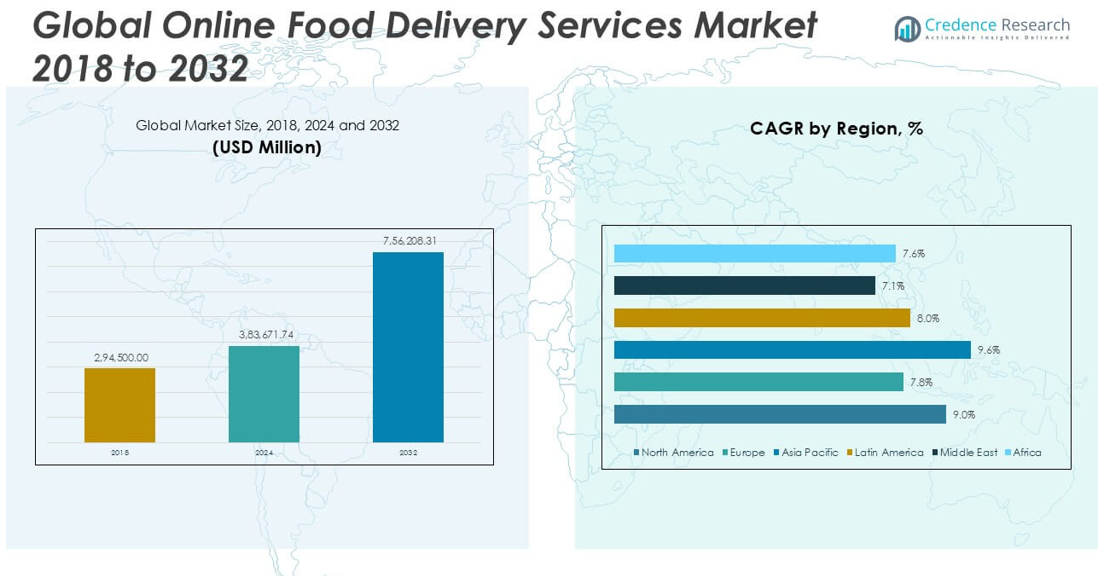

The Online Food Delivery Services market size was valued at USD 294,500.00 million in 2018, reached USD 383,671.74 million in 2024, and is anticipated to reach USD 756,208.31 million by 2032, growing at a CAGR of 8.89% during the forecast period.

The Online Food Delivery Services market is dominated by key players such as Deliveroo PLC, DoorDash Inc., Delivery Hero Group, Just Eat Limited, Uber Technologies Inc., Swiggy, Zomato, Delivery.com LLC, Yelp Inc., Rappi Inc., and Amazon.com Inc. These companies lead the market through extensive restaurant networks, innovative delivery models, and advanced mobile platforms that enhance user experience. Asia Pacific holds the largest regional share, accounting for 40.6% of the global market in 2024, driven by rapid urbanization, increasing smartphone penetration, and strong demand in countries like China and India. North America follows with a substantial share supported by high consumer spending and technological adoption.

Market Insights

- The Online Food Delivery Services market was valued at USD 294,500.00 million in 2018 and is projected to reach USD 756,208.31 million by 2032, growing at a CAGR of 8.89% during the forecast period.

- Growing consumer demand for convenience, fast delivery, and wide menu options is a key driver boosting market growth across both platform-to-consumer and restaurant-to-consumer models.

- Mobile applications dominate the channel segment with the largest market share in 2024 due to their user-friendly interfaces, real-time tracking, and seamless payment options.

- The market is highly competitive with major players like Uber Technologies Inc., DoorDash Inc., Swiggy, Zomato, and Deliveroo PLC investing in AI, route optimization, and loyalty programs to attract and retain customers.

- Asia Pacific leads the global market with a 40.6% share in 2024, followed by North America at 27.5% and Europe at 21.3%, while operational challenges and high competition restrain profit margins

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

In the Online Food Delivery Services market, the Platform-to-Consumer segment dominates, holding a significant market share due to its extensive variety, faster delivery options, and aggressive promotional strategies. Platforms such as Uber Eats, DoorDash, and Zomato have expanded their networks, allowing customers to order from multiple restaurants efficiently. The convenience of browsing multiple cuisines on a single platform and access to exclusive discounts continues to drive consumer preference for this model. Rising smartphone penetration and increasing demand for quick-service food further strengthen the growth of this dominant segment.

- For instance, DoorDash completed over 1.4 billion orders in 2022 alone, demonstrating the scale and efficiency of its platform-to-consumer network expansion.

By Channel

The Mobile Applications segment leads the market, capturing the largest share due to its superior user experience, real-time tracking, and seamless payment options. Mobile apps offer greater accessibility, personalized recommendations, and loyalty rewards, which enhance customer engagement. Increasing smartphone usage, coupled with high-speed internet availability, has significantly fueled mobile app-based food ordering. Consumers increasingly prefer mobile apps over websites due to convenience and user-friendly interfaces, which drives the continued dominance of this channel in the online food delivery services market.

- For instance, the Zomato app recorded over 70 million monthly active users in 2022, highlighting the platform’s ability to attract and retain mobile users at scale.

By Payment Method

The provided sub-segments “Fertility Clinics” and “Hospitals & Other Settings” seem to be inaccurately listed under payment methods and are likely a misclassification. Typically, payment methods in this market include Credit/Debit Cards, Digital Wallets, and Cash on Delivery. Assuming this correction, the Digital Wallets segment holds the dominant market share, driven by the growing adoption of cashless transactions and ease of use. Consumers favor digital wallets for their speed, security, and promotional offers like cashback and discounts. The rising trust in digital payment platforms and the surge in fintech innovations continue to support this segment’s growth.

Market Overview

Rising Smartphone Penetration and Internet Accessibility

The rapid increase in smartphone users and widespread internet connectivity significantly drive the growth of the online food delivery services market. Consumers now have easier access to mobile applications and online platforms, making food ordering more convenient and efficient. Enhanced digital infrastructure, particularly in emerging markets, supports this growth. Additionally, user-friendly interfaces and secure payment gateways encourage customers to adopt digital ordering methods, further boosting the market expansion.

- For instance, Swiggy reported over 50 million app downloads on Android by 2023, demonstrating how rising smartphone penetration directly expands user access to online food delivery platforms.

Growing Demand for Convenience and Fast Delivery

Consumers increasingly prioritize convenience, speed, and flexibility in their food purchasing decisions, which directly supports the rise of online food delivery services. The ability to quickly order meals from a wide variety of restaurants without leaving home or the workplace has made these services highly attractive. Busy urban lifestyles, long working hours, and the rising number of dual-income households are key factors propelling this demand for hassle-free and fast delivery options.

- For instance, Deliveroo’s fastest delivery in 2022 was completed in just 6 minutes, and its network handled over 300 million orders in the same year, showcasing the company’s strong response to consumer demand for speed and convenience.

Expansion of Platform-to-Consumer Models

The platform-to-consumer delivery model is expanding rapidly, offering consumers access to a broader range of restaurants through single platforms. Companies like Uber Eats, Swiggy, and DoorDash are aggressively partnering with local and international restaurant chains, enhancing their delivery networks. These platforms invest heavily in marketing, discounts, and loyalty programs to attract and retain customers. The scalability, extensive choices, and efficient logistics of this model continue to drive its strong market growth.

Key Trends & Opportunities

Increasing Integration of Contactless and Digital Payment Solutions

The growing preference for cashless transactions presents a significant opportunity for the online food delivery services market. Companies are integrating diverse digital payment solutions, including digital wallets, UPI, and credit/debit cards, to provide customers with seamless, fast, and secure payment experiences. This trend is further amplified by consumer trust in secure payment platforms and government initiatives promoting digital transactions, creating a strong foundation for long-term growth.

- For instance, Zomato processed over 500 million digital payment transactions through UPI, credit cards, and wallets in 2022, reflecting the company’s deep integration with contactless payment systems across its platform.

Adoption of AI and Data Analytics for Enhanced Customer Experience

Online food delivery platforms are increasingly leveraging artificial intelligence (AI) and data analytics to offer personalized recommendations, optimize delivery routes, and predict customer preferences. This technology-driven approach not only enhances user engagement but also improves operational efficiency. The ability to deliver more tailored experiences and reduce delivery times provides companies with a competitive edge, making AI integration a key trend and opportunity in the evolving market landscape.

- For instance, DoorDash’s real-time logistics optimization system, powered by machine learning, handled over 1.4 billion deliveries in 2022 and successfully reduced average delivery times by approximately 6 minutes across its major operating regions.

Key Challenges

High Competition and Pricing Pressure

The online food delivery services market faces intense competition, with numerous local and global players vying for market share. This competition leads to heavy discounting and promotional offers, which can erode profit margins. Companies often struggle to balance customer acquisition costs with profitability, making long-term financial sustainability a significant challenge in this highly competitive environment.

Logistics and Delivery Management Issues

Managing a reliable, fast, and cost-effective delivery system remains a critical challenge for market participants. Traffic congestion, variable delivery times, and maintaining food quality during transportation can impact customer satisfaction. Additionally, the need for a large, flexible delivery workforce creates logistical complexities, especially during peak hours or adverse weather conditions, which can hinder operational efficiency.

Regulatory Compliance and Food Safety Concerns

Strict government regulations regarding food safety, hygiene standards, and labor policies pose challenges for online food delivery service providers. Companies must ensure that restaurants and delivery personnel adhere to health and safety protocols to avoid penalties and reputational damage. Regulatory scrutiny, particularly in urban centers, increases operational oversight, adding to compliance costs and administrative burdens.

Regional Analysis

North America

North America holds a significant share in the global online food delivery services market, accounting for approximately 27.5% of the total market in 2024. The market was valued at USD 81,871.00 million in 2018 and is projected to reach USD 208,755.09 million by 2032, growing at a CAGR of 9.0%. The region’s growth is driven by high consumer spending power, advanced digital infrastructure, and the strong presence of major delivery platforms. Increasing demand for quick-service restaurants and growing reliance on mobile applications further contribute to the market expansion across the United States and Canada.

Europe

Europe captured around 21.3% market share in 2024, with its market size rising from USD 65,732.40 million in 2018 to an expected USD 148,952.36 million by 2032, registering a CAGR of 7.8%. The region’s growth is supported by increasing urbanization, rising disposable incomes, and evolving food consumption patterns. Consumers in Europe favor convenience and healthier meal options, prompting food delivery companies to diversify offerings. The market is also witnessing growth due to the expanding use of mobile apps and the introduction of sustainable and eco-friendly packaging by key players to attract environmentally conscious consumers.

Asia Pacific

Asia Pacific dominates the global online food delivery services market, holding the largest share of 40.6% in 2024. The market was valued at USD 116,327.50 million in 2018 and is expected to reach USD 324,654.45 million by 2032, growing at the highest CAGR of 9.6%. Rapid urbanization, a booming middle class, and increasing smartphone penetration drive this robust growth. Countries like China, India, and Japan are witnessing substantial increases in online food orders due to busy lifestyles and the availability of affordable delivery options. Strategic partnerships and technology adoption further accelerate the region’s market expansion.

Latin America

Latin America accounts for 6.0% of the global market in 2024, with its market size growing from USD 17,964.50 million in 2018 to an anticipated USD 42,627.46 million by 2032, at a CAGR of 8.0%. The market is driven by rising internet penetration, increasing mobile app usage, and a growing young consumer base that prefers convenient food delivery solutions. Countries such as Brazil and Mexico are key contributors to the region’s growth. Additionally, aggressive market entry by international delivery platforms and increasing investment in last-mile logistics are supporting the region’s expanding online food delivery ecosystem.

Middle East

The Middle East holds a modest but growing share of 2.3% in 2024, with the market size rising from USD 7,421.40 million in 2018 to an estimated USD 14,968.01 million by 2032, growing at a CAGR of 7.1%. The increasing demand for international cuisines, rising urban populations, and the region’s fast adoption of mobile technologies support market growth. Key cities such as Dubai, Riyadh, and Doha are experiencing a surge in online food orders due to high smartphone penetration and the convenience of app-based food delivery platforms. The market also benefits from a growing expatriate population.

Africa

Africa represents approximately 2.4% of the global market in 2024, with its size increasing from USD 5,183.20 million in 2018 to an expected USD 16,250.95 million by 2032, growing at a CAGR of 7.6%. Market growth is supported by the gradual improvement of internet infrastructure, growing smartphone adoption, and a rising middle-income population. Major urban centers such as Johannesburg, Lagos, and Nairobi are seeing increased demand for online food delivery, driven by convenience and changing dietary preferences. Despite infrastructure and logistical challenges, international food delivery platforms are steadily expanding operations in key African markets.

Market Segmentations:

By Type

- Restaurant-to-Consumer

- Platform-to-Consumer

By Channel

- Websites/Desktop

- Mobile Applications

By Payment Method

- Fertility Clinics

- Hospitals & Other Settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The online food delivery services market is highly competitive, characterized by the presence of several established global and regional players striving to enhance their market positions through technological advancements, strategic partnerships, and geographic expansions. Leading companies such as Deliveroo PLC, DoorDash Inc., Delivery Hero Group, Just Eat Limited, Uber Technologies Inc., Swiggy, Zomato, and Amazon.com Inc. focus on expanding their customer base by offering diverse cuisines, faster delivery times, and attractive loyalty programs. Intense competition drives continuous innovation, including the integration of AI, real-time tracking, and user-personalized recommendations to improve service efficiency and customer experience. Companies are also investing in sustainable delivery practices and contactless payment options to meet evolving consumer preferences. Regional players like Rappi Inc. and Delivery.com LLC are gaining market traction through localized strategies and competitive pricing. This dynamic market landscape encourages continuous service enhancements and consolidation activities as companies vie for greater market share and customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Deliveroo PLC

- DoorDash Inc.

- Delivery Hero Group

- Just Eat Limited

- Uber Technologies Inc.

- Swiggy

- Zomato

- com LLC

- Yelp Inc.

- Rappi Inc.

- com Inc.

Recent Developments

- In December 2024, Swiggy announced the expansion of its 10-minute food delivery service, Bolt, to tier 2 and 3 cities, including Roorkee, Patna, and Nashik. This initiative aims to enhance market share by offering rapid delivery options in smaller urban areas.

- In November 2024, Wonder completed the acquisition of Grubhub, a leading food ordering and delivery platform with over 375,000 merchants and 200,000 delivery partners across the U.S. This acquisition, valued at USD 650 million, aims to integrate Grubhub’s extensive network with Wonder’s innovative food hall concept, enhancing customer access to a diverse range of dining options.

- In June 2023, GrubHub, a food ordering and delivery platform, announced the expansion of its collaboration with Amazon. As part of this extended partnership, Grubhub will offer a one-year complimentary Grubhub+ membership to Amazon Prime members in the United States. This initiative is designed to provide added value to Amazon Prime members who have previously enrolled in Grubhub+ since its introduction in July 2022. These members will now receive an extra 12 months of free Grubhub+ membership.

- In February 2023, Zomato, a prominent online food delivery service provider, unveiled its latest offering called Zomato Every day, replacing its previously introduced 10-minute delivery feature from last year.

- In December 2022, Ultrafast grocery delivery giant Getir agreed to acquire rival Gorillas in a transaction reportedly valued at USD 1.2 billion.

- In December 2022, DoorDash Canada launched new Partnership Plans to support restaurant partners better nationwide. All Canadian local restaurant owners have the choice of three different plans, with commission rates that vary based on the inclusion of services provided. Additionally, DoorDash includes DoorDash Storefront, an Online Ordering Software, in all partnership plans that enables any restaurant to turn their website into an eCommerce store.

Market Concentration & Characteristics

The Online Food Delivery Services Market shows moderate to high market concentration, with several global players holding significant shares and regional companies contributing to localized growth. It features rapid technological advancement, price sensitivity, and strong consumer preference for convenience and speed. The market structure supports intense competition where leading companies such as Uber Technologies Inc., DoorDash Inc., Swiggy, Zomato, and Deliveroo PLC consistently improve service quality, delivery times, and user engagement through mobile applications and loyalty programs. It relies heavily on mobile penetration, secure digital payment platforms, and evolving consumer behavior driven by busy lifestyles. The market favors players who can balance aggressive pricing with sustainable profitability, while smaller providers often compete by focusing on niche services or regional specialties. Partnerships with a wide range of restaurants, efficient logistics, and customer trust in online transactions strengthen competitive positioning. The Online Food Delivery Services Market requires continuous investment in technology, delivery infrastructure, and customer experience to retain market share and drive long-term growth.

Report Coverage

The research report offers an in-depth analysis based on Type, Channel, Payment Method, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The online food delivery services market is expected to continue growing steadily driven by increasing consumer demand for convenience.

- Mobile applications will remain the preferred ordering channel due to their accessibility and user-friendly features.

- Platform-to-consumer delivery models will maintain dominance by offering a wide variety of restaurant options on a single platform.

- Digital payment adoption will further accelerate, reducing reliance on cash transactions.

- Companies will increasingly integrate artificial intelligence and data analytics to offer personalized customer experiences.

- The Asia Pacific region will continue to lead the market, followed by North America and Europe.

- Demand for healthier, customized, and premium food delivery options will rise among urban consumers.

- Sustainable packaging and eco-friendly delivery practices will gain importance across all regions.

- Competition will intensify, pushing companies to invest in faster delivery networks and improved customer service.

- Partnerships between delivery platforms and restaurants will expand to offer exclusive menus and faster delivery options.