Market Overview:

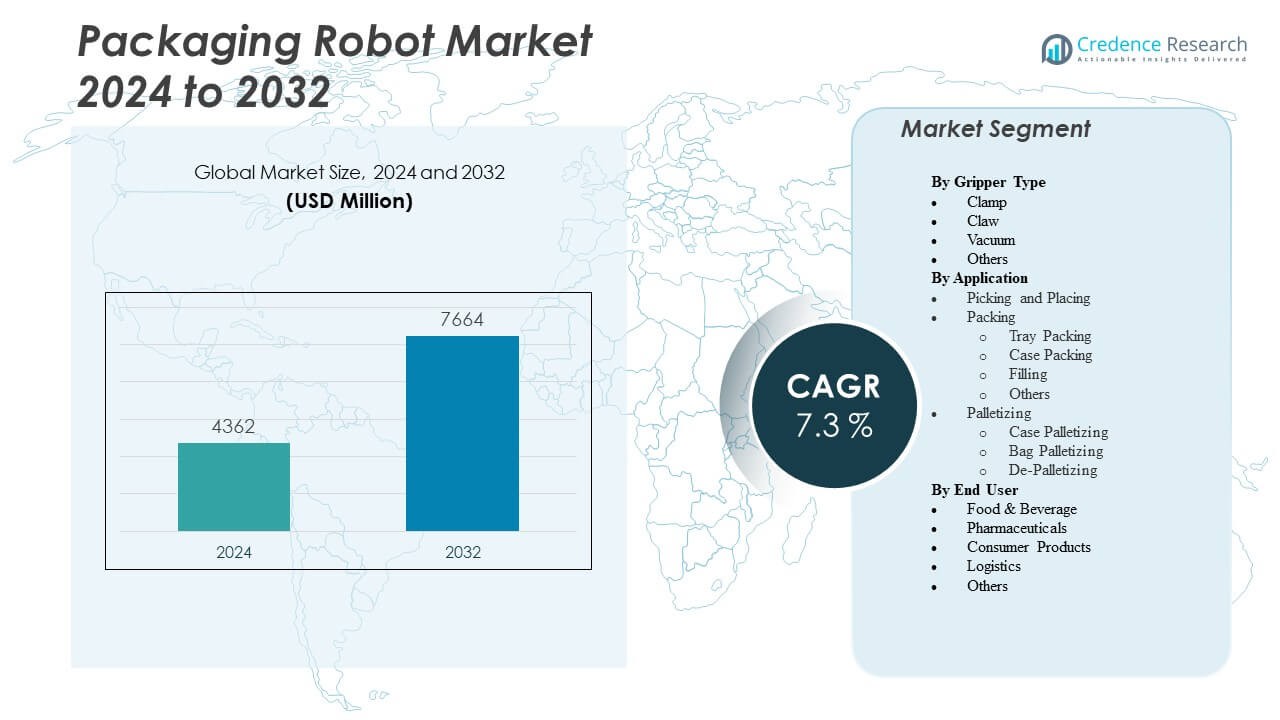

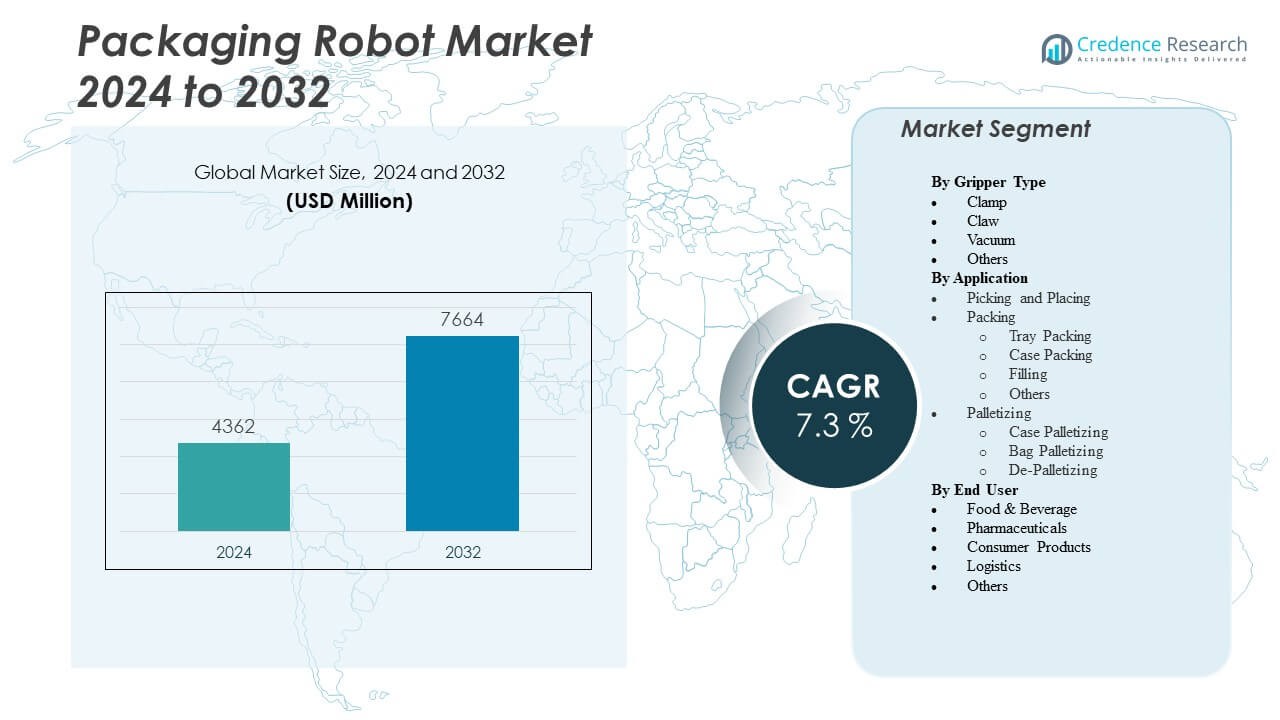

The Packaging Robot Market is projected to grow from USD 4,362 million in 2024 to an estimated USD 7,664 million by 2032, with a compound annual growth rate (CAGR) of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Robot Market Size 2024 |

USD 4,362 Million |

| Packaging Robot Market, CAGR |

7.3% |

| Packaging Robot Market Size 2032 |

USD 7,664 Million |

The market is experiencing robust growth due to the increasing adoption of automation across industries to improve productivity, reduce labor costs, and enhance packaging efficiency. As consumer demand for fast and error-free packaging rises, manufacturers are integrating robotic systems that offer precision and speed. Moreover, the expansion of e-commerce and food & beverage sectors has further accelerated the need for advanced packaging solutions. Technological innovations in sensors, vision systems, and artificial intelligence are also contributing to the growing demand for smart and flexible packaging robots capable of handling diverse tasks with minimal human intervention.

Regionally, Asia-Pacific dominates the Packaging Robot Market, driven by rapid industrial automation in countries such as China, Japan, and South Korea. These nations are heavily investing in advanced manufacturing infrastructure and robotics integration. North America follows closely due to its strong logistics and food processing industries that require high-speed packaging systems. Meanwhile, Europe maintains steady growth supported by stringent labor laws and a focus on workplace safety. Emerging markets like India and Southeast Asia are witnessing increased adoption as local manufacturers modernize operations to stay competitive, benefiting from falling robot prices and government support for industrial automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Packaging Robot Market was valued at USD 4,362 million in 2024 and is projected to reach USD 7,664 million by 2032, growing at a CAGR of 7.3%.

- Rising demand for automation in food, beverage, and pharmaceutical sectors is driving the adoption of packaging robots for higher efficiency and product consistency.

- Technological advancements in machine vision, AI, and gripper systems are enhancing robot flexibility and enabling multi-functional packaging applications.

- High initial investment and integration costs continue to restrain adoption, particularly among small and medium enterprises with limited capital.

- Asia Pacific holds the largest share at 41%, driven by rapid industrialization and strong automation policies in China, Japan, and South Korea.

- Europe captures 28% of the market, supported by automation maturity, labor cost concerns, and a strong manufacturing base in Germany and Italy.

- North America accounts for 22%, with growing investments in packaging automation across logistics, consumer goods, and food processing industries.

Market Drivers:

Rising Demand for Operational Efficiency and Cost Reduction Across Manufacturing Units

The Packaging Robot Market is witnessing growth driven by the need for cost-effective and efficient manufacturing operations. Companies are actively replacing manual labor with robotic systems to reduce errors and lower labor costs. Robots provide consistent output and improve cycle times, enhancing productivity in packaging lines. Industries such as food, pharmaceuticals, and consumer goods are investing in automation to maintain uniformity in packaging quality. Robotics also minimizes waste and ensures accuracy in tasks like pick-and-place, palletizing, and sealing. This drives higher return on investment and shortens payback periods. Manufacturers prefer automation to remain competitive in both local and global markets. It creates a strong foundation for long-term operational scalability.

- For example, in 2024, Fanuc released its M-410iC/500 palletizing robot, designed to handle payloads up to 500 kg with a reach of 3,143 mm.

Expansion of the E-commerce and Retail Sectors Accelerates Robot Integration

The explosive growth of the e-commerce and retail sectors has amplified the demand for automated packaging solutions. These sectors require high-speed packaging with minimal downtime and high adaptability. Robotic systems can handle a wide variety of product sizes, shapes, and packaging types without compromising speed or quality. The Packaging Robot Market benefits from this trend as businesses aim to meet rapid delivery timelines. Warehouse automation with robotic packaging ensures efficient order fulfillment and inventory management. It supports fluctuating demand patterns and seasonal spikes in online shopping. Robots optimize space utilization and streamline workflow in distribution centers. These advantages fuel adoption in large-scale fulfillment hubs worldwide.

- For example, Ocado’s Smart Platform employs thousands of autonomous grid‑based robots, delivering up to 1,200 bin presentations per hour per pick‑station. Across fulfilment centres, 50‑item orders are processed in around five minutes, with AI‑powered robotic arms ensuring high accuracy and real‑time packing optimization.

Increasing Adoption of Robotics in Food and Beverage Packaging Processes

Strict hygiene regulations and the need for contamination-free packaging push the food and beverage industry towards robotic solutions. Robots ensure consistent product handling while reducing human contact. This transition supports compliance with food safety standards and minimizes spoilage. In the Packaging Robot Market, the food sector remains one of the most dominant end users. It uses robots for tasks such as sorting, tray loading, primary and secondary packaging. The high-volume nature of this sector aligns with the capabilities of high-speed robotic systems. Automation in food packaging also facilitates traceability and quality control. Businesses in this industry use robotics to meet regulatory, operational, and consumer requirements efficiently.

Technological Advancements in Vision Systems and Artificial Intelligence Integration

Technological innovation is propelling the Packaging Robot Market by making robots smarter and more adaptable. Integration of vision systems enables precise object identification and orientation. Artificial intelligence supports real-time decision-making and flexibility in handling various packaging formats. These improvements allow robots to perform more complex tasks with minimal programming. Robotics vendors are enhancing user interfaces for easy customization and reduced training needs. Plug-and-play models with modular configurations are becoming popular among mid-sized businesses. The fusion of IoT, sensors, and AI transforms packaging robots into intelligent assets. It drives wider adoption across industries seeking performance, reliability, and adaptability in automation.

Market Trends

Rise of Collaborative Robots (Cobots) for Lightweight and Flexible Packaging Tasks

The Packaging Robot Market is experiencing an increasing deployment of collaborative robots in packaging environments. These robots work safely alongside human operators without extensive safety barriers. Cobots are especially suited for repetitive, lightweight tasks like sorting, labeling, or carton loading. Small and mid-sized enterprises find cobots appealing due to their lower cost and flexibility. These systems allow easy integration into existing lines without significant reconfiguration. They also provide high ROI with lower maintenance and setup efforts. Their compact footprint fits constrained production spaces, expanding adoption across varied manufacturing scales. This trend reflects the shift toward user-friendly automation solutions in packaging.

- For instance, Techman Robot reports that cobots deliver high efficiency and operational flexibility in packaging environments, with global adoption pushing the market value from $1.9 billion in 2024 to a projected $11.8 billion by 2030, driven largely by small and mid-sized enterprises (SMEs).

Customization in Packaging Robotics Tailored to Specific Industry Requirements

Manufacturers seek highly tailored robotic packaging systems aligned with unique product and industry demands. This trend leads to modular and application-specific robot solutions in the Packaging Robot Market. Vendors now offer systems optimized for items ranging from delicate electronics to perishable foods. Customization ensures precise handling, reduces waste, and matches varying speed or batch sizes. Industries demand robots that can integrate with upstream and downstream processes for seamless flow. Packaging formats continue to evolve, prompting the need for robots that adapt without major hardware changes. Companies rely on these solutions to preserve brand integrity and packaging consistency. It promotes more sophisticated use cases and drives niche market growth.

Adoption of Mobile and Scalable Robotic Systems in Dynamic Warehousing Environments

Dynamic warehousing environments are embracing scalable robotic packaging solutions that adapt to changing floor layouts and workflows. Mobile robotic units with onboard packaging capabilities are gaining traction in logistics and 3PL operations. These systems reduce conveyor dependence and enhance adaptability to shifting operational requirements. The Packaging Robot Market reflects this shift through product innovations in autonomous mobile platforms. These robots support decentralized packaging stations and help manage high SKU diversity. Their mobility facilitates easy deployment in multi-location storage and distribution setups. It also minimizes downtime and accelerates throughput. Businesses deploying such systems gain competitive agility in order handling and fulfillment.

Increased Integration of Packaging Robots with Digital Twin and Predictive Analytics Platforms

Digital transformation influences the Packaging Robot Market through integration with digital twin models and predictive analytics. Companies deploy simulations of robotic packaging processes to optimize workflows before implementation. Predictive analytics helps in proactive maintenance, reducing unexpected downtimes and enhancing machine longevity. Robots with real-time monitoring features send performance data to centralized dashboards. It allows data-driven decision-making across production, quality control, and maintenance. This trend supports continuous improvement initiatives and reduces operational inefficiencies. It also aligns with broader Industry 4.0 strategies. Businesses using this integration gain visibility into robotic operations and improve packaging productivity and uptime.

- For example, Unilever’s use of factory digital twins led to savings of $52 million annually in operational costs and cut unplanned downtime by nearly two-thirds. These digital tools allow manufacturers to simulate and optimize packaging workflows before deployment, continuously refine processes with live feedback, and drive quality control with real-time adjustments.

Market Challenges Analysis

High Initial Capital Investment and ROI Concerns for Small and Medium Enterprises

The upfront cost of purchasing, installing, and integrating packaging robots presents a significant challenge, especially for small and medium enterprises. These companies often operate with limited capital and longer return-on-investment cycles. The Packaging Robot Market faces resistance from businesses hesitant to allocate large budgets toward automation. Customization needs, maintenance contracts, and skilled labor for programming also increase expenses. Businesses with short product life cycles may not fully utilize the robots’ capabilities. High setup costs create barriers in industries that rely on seasonal or low-volume production. Many firms delay automation due to these financial constraints. It restricts market penetration in developing economies and smaller manufacturing segments.

Lack of Skilled Workforce to Operate and Maintain Advanced Robotic Systems

Despite technological improvements, operating advanced robotic systems requires specialized knowledge in programming, calibration, and troubleshooting. Many companies struggle to find or retain skilled personnel with these capabilities. The Packaging Robot Market suffers when businesses underutilize robotic systems due to lack of technical expertise. Delays in maintenance or improper handling can reduce robot performance and reliability. Training programs are often costly and time-consuming, further disincentivizing adoption. Industries in remote or low-education regions face steeper hurdles. Without a competent workforce, companies may not achieve the intended efficiency gains. It undermines the value proposition of robotic packaging investments.

Market Opportunities

Rising Demand for Eco-Friendly and Sustainable Packaging Automation Solutions

Sustainability trends create a strong opportunity for robotic systems that enable precise, minimal-material packaging. Companies seek to reduce waste, optimize material usage, and improve recyclability. The Packaging Robot Market supports this shift by offering systems that ensure consistent, right-sized packaging. Automated lines minimize human error and material overuse, aligning with green packaging goals. Robotics also facilitates the use of biodegradable and alternative materials through precise sealing and handling. Businesses adopting sustainable practices leverage packaging robots to enhance brand value and meet regulatory compliance. This shift opens new product categories for robot manufacturers. It also drives investments in innovation focused on low-impact automation.

Untapped Growth Potential in Emerging Markets with Expanding Manufacturing Sectors

Developing economies in Asia, Latin America, and Africa present untapped potential for robotic packaging adoption. These regions are investing in industrial modernization and automation as part of national development plans. The Packaging Robot Market can benefit from this shift through strategic partnerships, localized production, and training services. Falling robot prices and increased awareness are encouraging adoption in mid-tier manufacturers. Government incentives for Industry 4.0 and smart manufacturing support market expansion. Rising labor costs and shortages in urban centers further push businesses to automate. Vendors entering these markets early gain first-mover advantage and long-term customer loyalty. The growth outlook remains promising in these regions.

Market Segmentation Analysis:

The Packaging Robot Market features a diverse segmentation structure tailored to meet the complex demands of automated packaging systems.

By gripper type, vacuum grippers dominate due to their efficiency in handling lightweight, delicate items, while clamp and claw grippers serve heavier or irregularly shaped products. Each gripper type plays a vital role in enhancing speed and precision across varied packaging environments.

- For example, SCHMALZ’s ECBPi vacuum gripper, widely deployed in automated food and pharmaceuticals lines, enables reliable pick-and-place of items weighing up to 12 kilograms with a gripping cycle as fast as 0.5 seconds.

By application, picking and placing operations lead adoption owing to their widespread use in high-speed production lines. Packing applications, including tray packing, case packing, and filling, support industries requiring accuracy and product integrity. Palletizing, especially case and bag palletizing, addresses bulk handling and outbound logistics demands, with de-palletizing gaining traction in reverse logistics.

- For example, Yaskawa’s MOTOMAN MPL800 II (PL800 series) is a high‑capacity 4‑axis palletizing robot capable of handling up to 800 kg per lift, with a horizontal reach of around 3,159 mm and vertical reach of about 3,024 mm. It features ±0.5 mm repeatability, high acceleration, and includes PalletSolver software to efficiently generate palletizing patterns.

By end user, the food and beverage sector remains the largest contributor, driven by high-volume needs and strict hygiene standards. Pharmaceuticals follow closely, relying on robots for cleanroom-compatible, contamination-free packaging. Consumer products and logistics sectors adopt robots for flexibility and efficiency in fast-moving distribution environments. It continues to evolve through broader adoption in electronics, personal care, and retail.

Segmentation:

By Gripper Type

By Application

- Picking and Placing

- Packing

- Tray Packing

- Case Packing

- Filling

- Others

- Palletizing

- Case Palletizing

- Bag Palletizing

- De-Palletizing

By End User

- Food & Beverage

- Pharmaceuticals

- Consumer Products

- Logistics

- Others (such as electronics, personal care, retail, etc.)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific leads the Packaging Robot Market with a market share of 41%, driven by rapid industrialization and high automation rates in countries such as China, Japan, and South Korea. The presence of major electronics, food processing, and automotive manufacturing hubs fosters strong demand for robotic packaging solutions. China continues to invest in smart manufacturing under government initiatives, while Japan maintains leadership in robotics innovation and deployment. Growing labor costs and tightening production timelines push companies toward automation. Rising e-commerce activity and a strong logistics infrastructure further accelerate adoption. It remains the most dominant and fastest-growing region in the market.

Europe holds a 28% share of the Packaging Robot Market, supported by stringent regulatory frameworks and a well-established industrial base. Countries like Germany, Italy, and France prioritize energy efficiency, worker safety, and process optimization, which encourages automation across packaging operations. The region’s focus on sustainable manufacturing aligns with the integration of robotics in eco-friendly packaging lines. Robotics usage is especially prominent in the pharmaceutical and food sectors. Advanced robotics R&D and collaborative projects between governments and private players strengthen market maturity. It continues to grow steadily with technological advancement and demand for high-precision packaging systems.

North America accounts for 22% of the market, led by the United States, which drives demand across food, consumer goods, and logistics sectors. The region shows strong adoption of AI-integrated and vision-enabled packaging robots. Labor shortages and a push for reshoring manufacturing operations contribute to automation investments. The presence of global robotics manufacturers and system integrators supports innovation and deployment. Canada and Mexico also show growing interest in packaging robotics for their expanding manufacturing and export industries. It remains a key contributor to global revenues through innovation, high per capita automation spending, and a mature industrial infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB Ltd.

- FANUC Corporation

- KUKA AG / KUKA Robotics

- Yaskawa Electric Corporation (Yaskawa America Inc.)

- Mitsubishi Electric Corporation

- Brenton Engineering (Brenton, LLC)

- Bosch Packaging Technology / Syntegon Technology GmbH

- Remtec Automation LLC

- Epson Robots

- BluePrint Automation

- Yamaha Robotics

- Universal Robots

- Kawasaki Robotics Inc.

- NACHI-FUJIKOSHI CORP.

- Fuji Yusoki Kogyo

Competitive Analysis:

The Packaging Robot Market features a competitive landscape dominated by established industrial automation leaders and specialized packaging solution providers. Key players such as ABB Ltd., FANUC Corporation, KUKA AG, and Yaskawa Electric Corporation focus on high-performance robotic arms and integrated packaging systems. Companies like Brenton Engineering, Syntegon Technology GmbH, and BluePrint Automation offer end-of-line packaging solutions tailored to industry-specific requirements. Competitors invest in advanced technologies including AI, vision systems, and collaborative robotics to enhance product capabilities. Strategic collaborations, regional expansions, and continuous innovation remain central to gaining market share. It remains innovation-driven, with players leveraging automation trends in food, beverage, and logistics sectors to strengthen their position. Firms compete on customization, reliability, speed, and integration flexibility.

Recent Developments:

- In July 2025, ABB Ltd. launched three new robot families—Lite+, PoWa, and IRB1200—engineered specifically for the Chinese market. These robots are aimed at automating packaging and other factory tasks for mid-sized customers. The new robots can handle diverse functions such as pick-and-place and basic inspections, with fast setup and the ability to be programmed by demonstration or voice command, helping to address labor shortages and enhance automation for packaging operations.

- In April 2025, Yaskawa Electric Corporation unveiled the MOTOMAN NEXT, a new product concept designed for easy integration of AI-based automation into packaging and other industries. Debuting at Automatica 2025, this range contains both Yaskawa and partner components, promoting simplified deployment of robotics for businesses seeking scalable, intelligent packaging automation.

- In March 2025, FANUC Corporation announced the demonstration of its latest industrial and collaborative robots for warehouse applications designed to improve efficiency and productivity. Highlighted products include the CRX-10iA/L collaborative robot combined with an autonomous mobile robot (AMR) for order fulfillment and the M-410/800F-32C industrial robot with a new high-payload palletizing system—both intended to streamline warehouse and packaging environments.

- In March 2025, Mitsubishi Electric Corporation introduced its new MELFA RH-10CRH and RH-20CRH SCARA robots. These compact, high-speed robots are designed to increase flexibility and efficiency in packaging, assembly, and conveyance, featuring innovative battery-less motors and easy integration for applications demanding space and operational versatility

Market Concentration & Characteristics:

The Packaging Robot Market demonstrates moderate to high concentration, with a few global players controlling significant market share. It is characterized by strong technological focus, high entry barriers, and demand for specialized solutions across diverse industries. Global players maintain leadership through proprietary technologies and expansive service networks, while regional players cater to customized applications. High capital investment, need for technical expertise, and regulatory compliance shape competitive dynamics. The market favors automation-ready environments and emphasizes reliability, scalability, and low maintenance in robotic systems. It supports both high-speed mass production and flexible small-batch operations across packaging lines.

Report Coverage:

The research report offers an in-depth analysis based on Gripper Type, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Packaging Robot Market is expected to witness expanded adoption across small and mid-sized enterprises due to falling automation costs and user-friendly interfaces.

- Demand for robots with advanced AI and machine vision will rise, enhancing flexibility and decision-making in complex packaging environments.

- Growth in sustainable packaging practices will drive the need for precision robotics that optimize material usage and reduce waste.

- Increasing product diversity in e-commerce will encourage development of adaptable, multi-functional robotic packaging systems.

- Integration of robotics with cloud-based monitoring and predictive maintenance platforms will enhance operational efficiency.

- Manufacturers will prioritize modular and scalable robotic systems to accommodate evolving production requirements.

- The food, pharmaceutical, and cosmetics industries will continue to lead demand due to their hygiene standards and volume-driven needs.

- Expansion of smart factories and Industry 4.0 initiatives will accelerate the deployment of fully automated packaging lines.

- Regional markets in Latin America, Southeast Asia, and Eastern Europe will gain momentum as automation adoption spreads.

- Strategic partnerships between robotics firms and packaging OEMs will shape new solution ecosystems tailored to end-user applications.