Market Overview

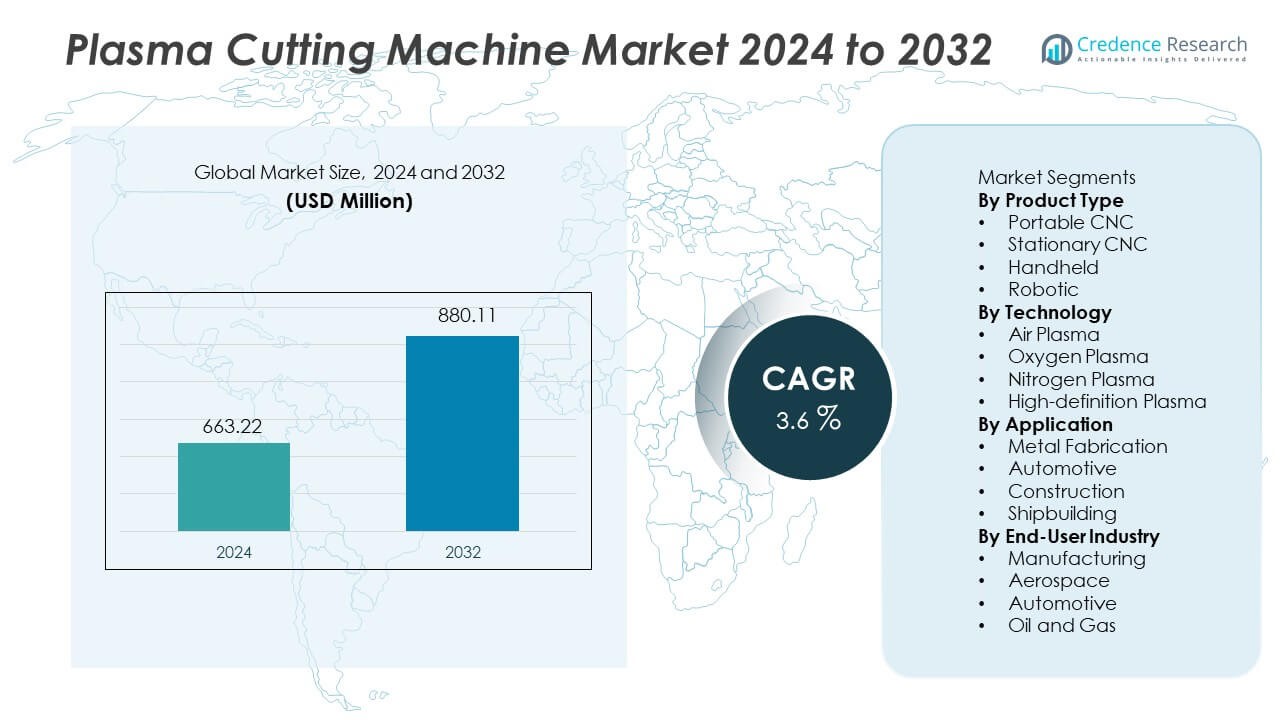

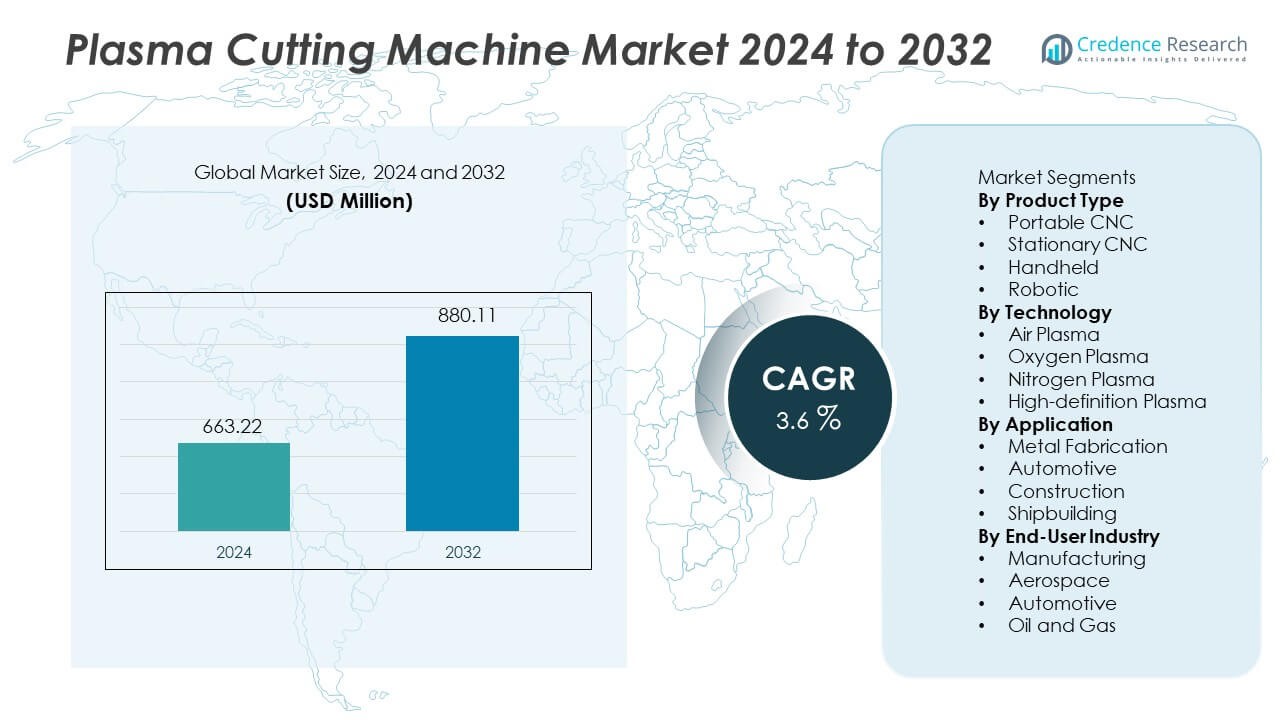

The Plasma Cutting Machine Market was valued at USD 663.22 million in 2024 and is projected to reach USD 880.11 million by 2032, registering a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plasma Cutting Machine Market Size 2024 |

USD 663.22 Million |

| Plasma Cutting Machine Market, CAGR |

3.6% |

| Plasma Cutting Machine Market Size 2032 |

USD 880.11 Million |

Top players in the Plasma Cutting Machine market include Hypertherm Associates, Lincoln Electric, ESAB Corporation, Komatsu, Kjellberg Cutting Technology, Koike Aronson, Messer Cutting Systems, Voortman Steel Machinery, Hornet Cutting Systems, and Shandong Huayuan Welding and Cutting. These companies strengthen their position with CNC platforms, high-definition cutting, and automated solutions that support consistent metal processing across fabrication and construction. Asia Pacific remains the leading regional market with a 38% share, driven by strong industrialization, expanding construction, and growing automotive production across China, Japan, South Korea, and India. North America and Europe continue to invest in advanced systems and automated solutions that improve productivity, precision, and operating efficiency in metal fabrication environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Plasma Cutting Machine market reached USD 663.22 million in 2024 and is poised to reach USD 880.11 million by 2032 at a CAGR of 3.6% during the forecast period.

- Rising demand for precision metal processing and automation adoption in fabrication units strengthen growth across product types, with Portable CNC holding a 39% share due to flexible use in workshops and onsite applications.

- Market trends highlight increasing use of high-definition plasma and portable systems that support clean cutting, higher productivity, and reduced finishing time across automotive, construction, and machinery sectors.

- Competitive activity centers on technology upgrades, automated CNC integration, gas-efficient torches, and robotics that enhance cutting consistency, while cost sensitivity and competition from fiber lasers remain major restraints for small workshops.

- Asia Pacific leads regional demand with a 38% share, followed by North America at 26% and Europe at 22%, supported by strong metal fabrication bases and steady expansion across construction and industrial applications.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Portable CNC systems hold a 39% share in this segment due to rising use in small and mid-scale fabrication units that focus on flexible cutting needs and mobile operations. Portable models support field maintenance and onsite repair work across metals. Stationary CNC machines follow because large plants require continuous accuracy in thick plate cutting. Handheld tools serve repair jobs that need fast set-up in low-volume sites. Robotic cutting expands in automated welding lines where safety and repeat precision remain critical. Demand rises as manufacturers seek faster changeovers and compact footprints to support lean production goals.

- For instance, Hypertherm Associates introduced Powermax45 XP that provides professional grade power and supports reliable cutting of mild steel with superior cut and gouge quality, reducing the need for secondary preparation.

By Technology

Air plasma technology leads this segment with a 42% share due to lower operating cost and the ability to cut mild steel at higher speeds in metal workshops. Oxygen plasma supports stainless and carbon steel cutting where oxide layer removal matters during fabrication. Nitrogen plasma serves aluminum and non-ferrous metals used in transport and machinery components. High-definition plasma grows through precision cutting in automotive and aerospace, supported by cleaner edge quality and tight tolerances. Adoption improves because energy-efficient systems reduce power usage without lowering cut performance in high-duty cycles.

- For instance, Lincoln Electric’s Spirit II high-definition plasma platform achieves rapid cutting speeds on common steel thicknesses and provides a consistent kerf width, ensuring high-quality, virtually dross-free cuts with a minimal edge bevel.

By Application

Metal fabrication remains the dominant application with a 47% share due to increasing demand for plate processing, custom metal panels, and structural steel components across industrial clusters. The automotive sector adopts plasma cutting to support chassis parts and body repair in service centers. Construction uses plasma in bridges, heavy frames, and structural beams where fast profile cutting supports project timelines. Shipbuilding requires wider plates and corrosion-resistant processing that benefit from accurate cutting speeds for hull sections. Growth accelerates as fabrication plants expand capacity and seek higher throughput with reduced thermal distortion on thick metals.

Key Growth Drivers

Rising Demand for Precision Metal Processing

Industrial firms seek accurate metal cutting for fabrication. Plasma systems support clean edges on many alloys. Manufacturers invest in advanced controls that lower errors and reduce rework cycles. Growing infrastructure and automotive production raise demand for high throughput operations across many regions. The shift from manual cutting to CNC units accelerates adoption in metal workshops. Companies focus on flexible machines that handle varied thickness without losing speed. Energy-efficient models lower running cost and improve shop margins. These benefits encourage many users to upgrade older equipment in phased steps.

- For instance, ESAB’s Cutmaster 60 marks a tested cutting capacity of 20 mm steel and reaches a maximum severance of 32 mm during continuous operation under certified industrial test conditions.

Automation Adoption Across Production Lines

Modern factories adopt automated plasma for repetitive and complex patterns. Robotic arms guide torches with constant speed for stable quality. Firms use vision systems and improved sensors to monitor cut paths in real time. Automated machine cells reduce manual handling and improve safety in high heat areas. Large workshops deploy integrated software to manage nesting, scheduling, and consumable planning. The link between CAD files and CNC tables lowers setup time for many parts. This change enables faster delivery cycles for fabrication partners that serve construction and vehicles.

- For instance, implementation of robotic plasma cutting cells combines CNC programming (G-code based) with automated torch control to cut complex shapes reliably across multiple metal types while maintaining consistent cut quality.

Expansion of Heavy Engineering and Construction Projects

Global construction growth increases demand for steel beams and structural frames. Plasma systems cut thick plates at high speeds that support project timelines in many sites. Heavy engineering uses the technology for machinery parts and equipment frames. Shipyards depend on plasma for hull sections that need wide panels. National infrastructure plans drive material demand for bridges, rail, and energy facilities. Fabricators require scalable capacity that portable and stationary systems can support. This creates strong orders from mid and large production houses that work under long contracts.

Key Trends and Opportunities

Shift Toward High-Definition and Clean Cutting

High-definition plasma improves edge quality and lowers secondary finishing work. Users seek narrow kerf and reduced slag on premium materials. Adoption grows in aerospace, transport, and heavy machinery that require precision. Vendors develop torches that manage heat input and gas control with better accuracy. This trend opens replacement demand for older models in many regions. Clean cutting reduces grinding time and improves worker safety. The focus on thin sheet quality strengthens adoption in automotive service centers and part suppliers. Technology advances in control systems unlock new precision gains across many metals.

- For instance, Kjellberg’s HiFocus 280i neo achieves an excellent certified cut on mild steel and maintains a narrow kerf in high-definition mode, confirmed through testing under the relevant EN ISO 9013 cut quality classification.

Growth of Portable Systems for Onsite Jobs

Portable CNC machines support field repairs in construction sites and offshore operations. Demand rises for compact tables that handle many thickness levels. Service firms use handheld options for emergency breakdown work. Portable systems reduce transport time and improve productivity during remote work. Mining and energy projects adopt mobile cutting to support field maintenance. The rise of rental services opens new business models for suppliers. Portable machines also support small workshops that lack floor area for large tables. This creates steady growth in entry level systems across developing markets.

- For instance, Miller Electric’s Spectrum 625 X-treme provides robust performance on mild steel up to its rated cutting capacity and uses Auto-Refire control that keeps arc transfer stable during multi-pierce cycles.

Key Challenges

High Initial Investment and Operating Cost

Many users face higher upfront cost for advanced CNC and robotic systems. Small shops find consumables and gas requirements costly during peak loads. Maintenance needs proper training and replacement parts that raise total expense. Energy consumption increases operating bills in long duty cycles. Firms compare plasma against laser options as prices fall for fiber units. The return on investment depends on production volume and material mix. This challenge slows adoption among small fabrication companies that rely on manual options.

Competition from Laser Cutting Technologies

Fiber laser machines provide high precision and minimal heat affected zones. Many industries adopt laser for thin sheet and complex contours. Laser delivers clean edges that lower grinding steps in premium segments. Suppliers of plasma respond with high-definition options to defend market share. Users evaluate cut quality, power needs, and gas usage before selection. Competition pressures pricing and limits margin for mid-range plasma models. This challenge encourages vendors to bundle software, service, and training to stay competitive.

Regional Analysis

North America

North America holds a 26% share driven by widespread adoption of CNC plasma systems across metal fabrication, construction, and automotive repair services. The United States supports demand from machinery workshops that require precision cutting for heavy equipment and custom metal projects. Energy and oil service companies use plasma for pipe sections and field repairs. Replacement of manual units with automated cutting strengthens market expansion. Canada invests in plant upgrades that improve processing efficiency and safety standards. Strong presence of fabrication clusters, robotics integration, and skilled labor encourages suppliers to introduce advanced control technologies across the region.

Europe

Europe accounts for a 22% share, supported by strong industrial bases in Germany, Italy, and France that prioritize clean cutting and accuracy for automotive, machinery, and structural steel applications. Growth in fabricated components for electric vehicles and renewable energy increases demand for efficient cutting systems in the region. EU regulations encourage energy-efficient equipment and low-emission industrial processes, driving interest in advanced torches and optimized gas use. High-definition systems gain traction in aerospace and high-strength steel processing. Vendors expand service networks to support automated cutting in advanced manufacturing clusters.

Asia Pacific

Asia Pacific leads the market with a 38% share due to strong metal fabrication industries in China, Japan, South Korea, and India. Expanding construction projects and rapid industrialization drive investment in CNC plasma equipment for structural steel, machinery parts, and heavy engineering. Automotive production encourages demand for precise cutting of body panels and underbody components. Local manufacturers introduce cost-competitive systems that accelerate adoption among small and mid-scale workshops. Government initiatives for industrial modernization and smart factories support automated processes. Increasing application in shipbuilding and large infrastructure projects strengthens long-term growth across the region.

Latin America

Latin America holds an 8% share led by rising industrial activity in Brazil and Mexico. Metal fabrication companies adopt plasma systems for construction steel, automotive components, and heavy equipment frames. Growing investment in industrial infrastructure and energy projects drives demand for thicker plate processing. Vendors expand distribution channels to serve mid-scale fabrication workshops that seek affordable CNC units. Handheld and portable equipment see rising use in field repairs across mining operations. Gradual modernization of metal workshops encourages demand for automated tables and high-capacity machines, although cost sensitivity and financing barriers remain key factors in adoption.

Middle East and Africa

Middle East and Africa represent a 6% share driven by oil, gas, and construction projects that require metal fabrication for pipelines, platforms, and structural steel. Gulf countries invest in advanced cutting systems for industrial maintenance, offshore structures, and heavy engineering equipment. Ship repair yards in the region rely on plasma cutting for hull plates and corrosion-resistant materials. Africa shows gradual growth supported by infrastructure upgrades and industrial investment in key markets such as South Africa. Demand for portable and handheld systems rises in field jobs, while limited technical skills and capital investment restrain wider adoption.

Market Segmentations:

By Product Type

- Portable CNC

- Stationary CNC

- Handheld

- Robotic

By Technology

- Air Plasma

- Oxygen Plasma

- Nitrogen Plasma

- High-definition Plasma

By Application

- Metal Fabrication

- Automotive

- Construction

- Shipbuilding

By End-User Industry

- Manufacturing

- Aerospace

- Automotive

- Oil and Gas

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Plasma Cutting Machine market features key players such as Hypertherm Associates, Lincoln Electric, ESAB Corporation, Komatsu, Kjellberg Cutting Technology, Koike Aronson, Messer Cutting Systems, Voortman Steel Machinery, Hornet Cutting Systems, and Shandong Huayuan Welding and Cutting. Leading companies focus on expanding product portfolios with advanced CNC control, high-definition cutting, and gas-efficient systems that strengthen precision and reduce operational cost in high-duty industrial use. Vendors invest in R&D to introduce automated tables, robotics integration, and IoT-based monitoring that support predictive maintenance and improve uptime in fabrication lines. Many suppliers expand global service networks to support after-sales, consumables, and training offerings, especially in Asia Pacific and North America where fabrication growth remains strong. Strategic partnerships, regional distribution agreements, and technology upgrades drive differentiation, while competition from laser cutting encourages plasma vendors to enhance cut quality and efficiency across multiple production settings.

Key Player Analysis

- Hypertherm Associates

- Lincoln Electric

- ESAB Corporation

- Komatsu

- Kjellberg Cutting Technology

- Koike Aronson

- Messer Cutting Systems

- Voortman Steel Machinery

- Hornet Cutting Systems

- Shandong Huayuan Welding and Cutting

Recent Developments

- In September 2025, Machitech expanded its U.S. manufacturing footprint and improved service capabilities by acquiring Victory CNC Plasma Systems, aiming to meet growing domestic demand and enhance product customization.

- In May 2024, Hypertherm Associates introduced the Powermax45 SYNC, featuring an innovative single-piece cartridge system designed to extend consumable life, reduce downtime, and simplify operator training for improved productivity.

- In 2024, Hypertherm launched the XPR460, integrated with advanced X-Definition technology, specifically engineered for cutting thicker metals with faster speeds, enhanced beveling precision, and improved cut quality.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Future demand will rise as industries seek precise metal cutting capabilities.

- CNC systems will gain wider use in fabrication and automotive workshops.

- High-definition technology will expand in aerospace and machinery applications.

- Portable units will grow due to onsite repairs and field maintenance needs.

- Automation and robotics integration will increase for repetitive cutting tasks.

- Energy-efficient designs will support lower operating costs for users.

- Smart controls will improve cut quality and minimize material waste.

- Service providers will expand training and after-sales support in major regions.

- Regional manufacturing growth in Asia Pacific will drive new installations.

- Competition with laser cutting will push vendors to enhance cut performance.

Market Segmentation Analysis:

Market Segmentation Analysis: