Market Overview

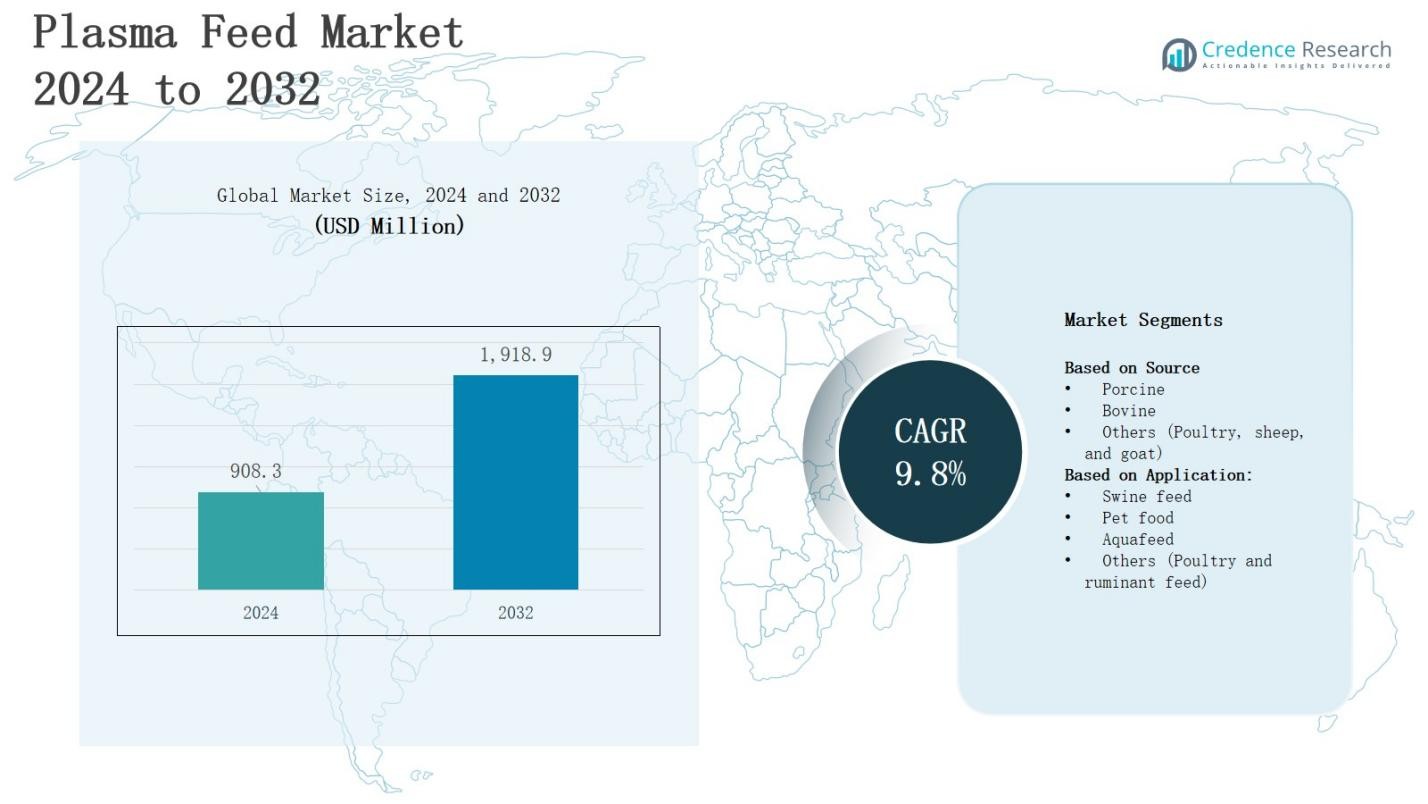

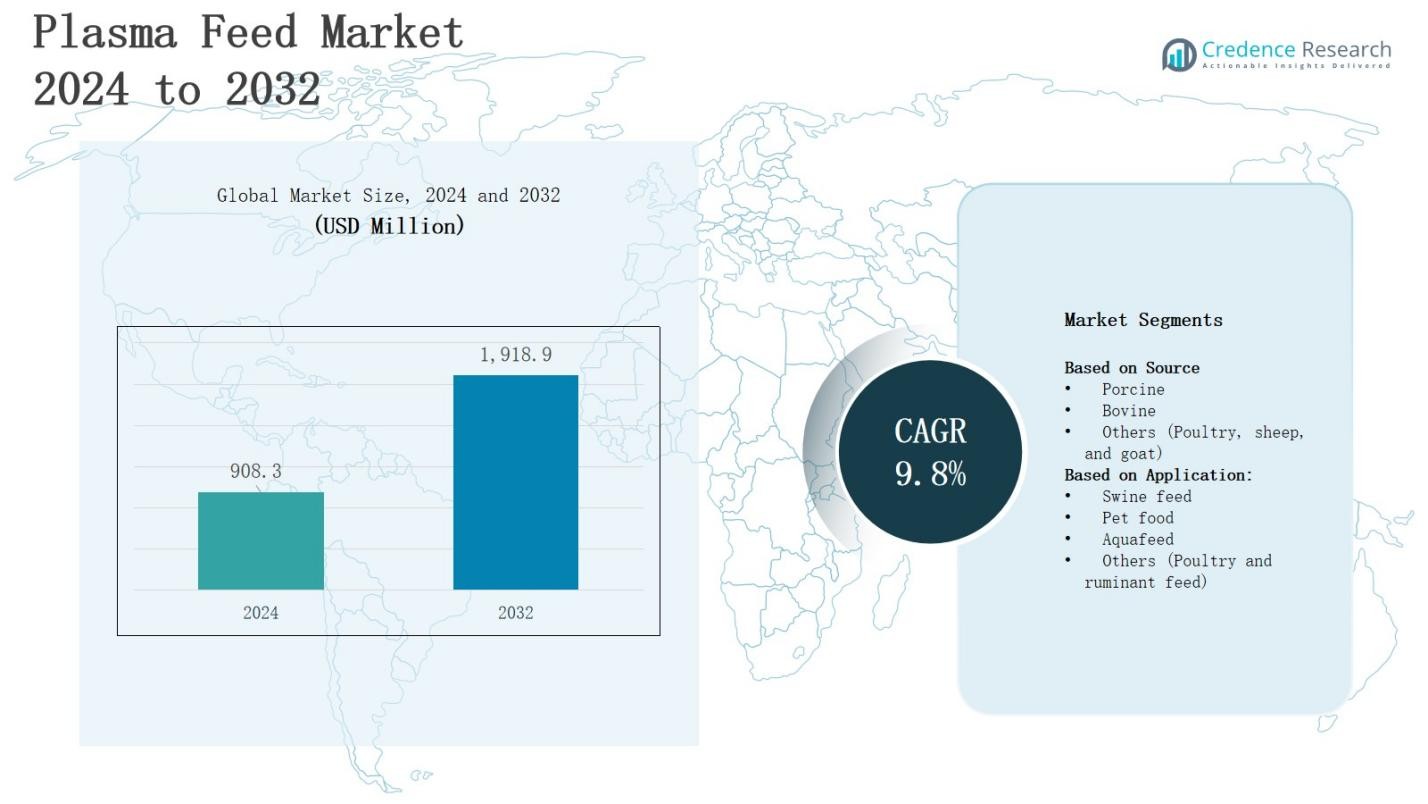

The plasma feed market is projected to grow from USD 908.3 million in 2024 to USD 1,918.9 million by 2032, registering a CAGR of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plasma Feed Market Size 2024 |

USD 908.3Million |

| Plasma Feed Market, CAGR |

9.8% |

| Plasma Feed Market Size 2032 |

USD 1,918.9 Million |

The plasma feed market is driven by rising demand for high-quality, protein-rich animal nutrition to enhance livestock health, immunity, and productivity. Growing adoption in swine, poultry, and aquaculture sectors, coupled with the shift toward natural feed additives, supports market expansion. Increasing focus on disease prevention and improved feed conversion efficiency further fuels demand. Trends include advancements in plasma processing technologies for better nutrient retention, expansion of sustainable and biosecure sourcing practices, and rising integration of plasma proteins in premium feed formulations. Expanding livestock production in emerging economies is also shaping the market’s growth trajectory.

The plasma feed market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with North America leading in adoption due to advanced processing capabilities and high demand in swine, poultry, and pet food sectors. Europe follows with strong regulatory compliance and sustainable sourcing practices, while Asia-Pacific records the fastest growth driven by expanding livestock and aquaculture production. Latin America benefits from a large livestock base, and the Middle East & Africa show gradual adoption. Key players include Darling Ingredients Inc., Veos Group, SARIA Group, and The Lauridsen Group Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The plasma feed market is projected to grow from USD 908.3 million in 2024 to USD 1,918.9 million by 2032, at a CAGR of 9.8%.

- Rising demand for protein-rich, high-quality feed ingredients drives adoption across swine, poultry, aquaculture, and pet food sectors.

- Advancements in plasma processing technologies improve nutrient retention, digestibility, and pathogen control.

- Regulatory compliance and biosecurity standards influence global trade and require significant investment in quality systems.

- North America holds 38% market share, followed by Europe (27%) and Asia-Pacific (24%), with Latin America (7%) and Middle East & Africa (4%) trailing.

- Emerging economies in Asia-Pacific and Latin America present strong growth opportunities through expanding livestock and aquaculture production.

- Key players include Darling Ingredients Inc., Veos Group, SARIA Group, and The Lauridsen Group Inc., focusing on innovation and sustainable sourcing.

Market Drivers

Rising Demand for High-Quality Animal Nutrition

The plasma feed market is fueled by increasing demand for nutrient-dense, protein-rich feed ingredients that improve animal health and growth performance. It offers a superior amino acid profile, supporting immunity and enhancing feed efficiency in livestock and aquaculture. Farmers prioritize high-quality feed to meet growing consumer expectations for safe, premium animal products. Rising global meat and dairy consumption strengthens market prospects, with feed producers incorporating plasma proteins into commercial formulations for better productivity.

- For instance, Darling Ingredients Inc., which efficiently processes animal blood into plasma proteins widely used in commercial swine and poultry feeds to enhance feed conversion rates and immune response.

Growing Focus on Disease Prevention and Immunity Enhancement

The plasma feed market benefits from its role in improving animal immunity and reducing disease outbreaks without relying on antibiotics. It contains bioactive components like immunoglobulins that enhance resistance to infections, supporting healthier livestock. Producers in swine, poultry, and aquaculture sectors integrate plasma-based feeds to address biosecurity challenges. This functional nutrition approach aligns with industry trends favoring natural health solutions, contributing to higher survival rates and consistent production yields across varied farming operations.

Technological Advancements in Plasma Processing

The plasma feed market is advancing through innovations in processing methods that retain maximum nutritional value while ensuring safety. Modern spray-drying and sterilization technologies improve protein digestibility and eliminate pathogens, meeting stringent regulatory standards. These advancements allow consistent product quality, encouraging wider adoption among feed manufacturers. Enhanced processing also supports scalability, enabling suppliers to meet rising demand across regions. It drives competitiveness by ensuring stable supply chains for livestock, poultry, and aquaculture feed industries.

- For instance, Actipro employs modern sterilization methods in plasma production that effectively eliminate pathogens while maintaining protein digestibility, ensuring adherence to strict regulations.

Expanding Livestock and Aquaculture Production in Emerging Economies

The plasma feed market is experiencing growth from increasing livestock and aquaculture operations in emerging economies. Rising incomes, urbanization, and dietary shifts toward protein-rich foods boost meat, poultry, and fish consumption. Governments and private sectors invest in modern farming practices, creating opportunities for plasma feed adoption. Its nutritional benefits support faster growth cycles and improved feed conversion ratios. Expanding production capacity in Asia-Pacific and Latin America strengthens market penetration and long-term demand sustainability.

Market Trends

Increasing Adoption of Plasma Proteins in Specialized Feed Formulations

The plasma feed market is witnessing a shift toward specialized feed formulations tailored for high-performance livestock and aquaculture. Plasma proteins are incorporated into diets for swine, poultry, and fish to enhance immunity, gut health, and growth rates. Feed producers target premium and functional nutrition segments, meeting demand from intensive farming systems. This adoption trend aligns with industry goals of improving productivity while minimizing antibiotic use, positioning plasma-based feed as a key component in advanced nutritional strategies.

- For instance, APC, the world’s largest manufacturer of plasma-based functional proteins, operates globally to provide plasma ingredients that support animal immune systems and overall health, helping producers maintain herd health while promoting growth in livestock and pets.

Advancements in Sustainable and Biosecure Sourcing Practices

Sourcing trends in the plasma feed market emphasize biosecurity and sustainability to ensure product safety and environmental responsibility. Suppliers invest in traceable collection systems and certified processing facilities that comply with international feed safety regulations. Sustainable sourcing practices reduce waste by utilizing animal by-products efficiently. Biosecure supply chains safeguard against disease transmission, enhancing market credibility. This approach resonates with both producers and consumers who value environmentally conscious and ethically produced feed ingredients.

- For instance, plasma feed aligns with sustainability by utilizing blood, a by-product of slaughtered animals that would otherwise be waste, supporting a circular economy model and reducing environmental impact.

Expansion of Applications Beyond Traditional Livestock Sectors

The plasma feed market is expanding into sectors beyond traditional swine and poultry, with aquaculture and pet nutrition gaining momentum. Aquafeed producers integrate plasma proteins to improve survival rates and feed efficiency in shrimp, salmon, and tilapia farming. Pet food manufacturers adopt plasma as a natural, highly digestible protein source. This diversification of applications broadens market potential, enabling suppliers to serve niche segments with specialized nutritional requirements while maintaining consistent growth across diverse animal industries.

Integration of Technological Innovations in Processing and Quality Control

Technological innovation is reshaping the plasma feed market through enhanced processing, sterilization, and quality control systems. Advanced spray-drying techniques preserve functional proteins while ensuring microbial safety. Automation in production facilities increases efficiency and consistency, meeting the growing demand for premium feed inputs. Real-time quality monitoring systems ensure compliance with global standards. These innovations not only improve product reliability but also strengthen customer confidence, supporting the expansion of plasma-based ingredients in competitive feed markets.

Market Challenges Analysis

Regulatory Compliance and Safety Concerns

The plasma feed market faces challenges in meeting stringent regulatory requirements related to animal by-product usage, processing standards, and feed safety certifications. It must comply with varied international regulations, which can differ significantly between regions, creating complexities for global trade. Strict protocols for pathogen elimination and traceability demand significant investment in processing technologies and quality assurance systems. Concerns over disease transmission, particularly in markets with heightened biosecurity measures, may slow adoption. Maintaining consistent safety standards across diverse supply chains is essential to sustaining industry credibility and market growth.

High Production Costs and Limited Awareness in Emerging Markets

The plasma feed market encounters cost-related challenges due to the advanced processing technologies, biosecure infrastructure, and quality control systems required for production. High capital and operational expenses can limit adoption among small and mid-sized feed manufacturers, particularly in cost-sensitive markets. It also struggles with limited awareness in emerging economies, where traditional feed ingredients remain dominant due to lower costs and established supply chains. Educating producers on the long-term productivity and health benefits of plasma-based feed is necessary to expand its penetration in underdeveloped regions and achieve broader industry acceptance.

Market Opportunities

Rising Demand for Functional and Natural Feed Additives

The plasma feed market has strong growth potential from the increasing demand for functional and natural feed additives that support animal health, immunity, and performance. It offers bioactive compounds such as immunoglobulins, peptides, and growth factors that align with industry trends toward antibiotic-free production. Producers in swine, poultry, aquaculture, and pet nutrition sectors are exploring plasma-based proteins to enhance feed efficiency and disease resistance. Growing consumer preference for high-quality, safe, and sustainable animal products further strengthens adoption across developed and emerging markets.

Expansion in Emerging Economies and Diversification of Applications

The plasma feed market has significant opportunities in emerging economies where livestock and aquaculture production are expanding rapidly to meet rising protein consumption. It can benefit from investments in modern farming practices, biosecure feed systems, and premium nutrition solutions. Expanding applications into aquaculture, companion animal feed, and niche livestock sectors open new revenue streams. Suppliers that adapt formulations to regional dietary requirements and invest in distribution networks can capture untapped demand, ensuring long-term market penetration and competitive advantage.

Market Segmentation Analysis:

By Source

The plasma feed market is segmented into porcine, bovine, and others, including poultry, sheep, and goat. Porcine-derived plasma holds the largest share due to its high protein content, balanced amino acid profile, and proven effectiveness in improving feed conversion ratios in swine and aquaculture. Bovine plasma is gaining traction in pet nutrition and ruminant feed for its digestibility and immune-boosting properties. The “others” segment provides niche opportunities in specialized diets, meeting diverse nutritional requirements across smaller livestock categories.

- For instance, The Lauridsen Group Inc. has developed spray-dried porcine plasma products used in commercial feed that support immune function and enhance growth performance in weaned pigs under commercial production conditions.

By Application

The plasma feed market is categorized into swine feed, pet food, aquafeed, and others such as poultry and ruminant feed. Swine feed dominates due to the extensive use of plasma proteins in enhancing piglet survival rates and growth performance. Pet food applications are expanding with the rising demand for natural, functional protein sources in premium formulations. Aquafeed is an emerging segment benefiting from improved survival rates in shrimp, salmon, and tilapia farming. The “others” category addresses poultry and ruminant sectors, offering tailored nutritional benefits.

- For instance, aquafeed producers have witnessed increased survival rates in shrimp and fish farming by incorporating plasma proteins that enhance immune responses, although specific company data on this is still emerging.

Segments:

Based on Source

- Porcine

- Bovine

- Others (Poultry, sheep, and goat)

Based on Application:

- Swine feed

- Pet food

- Aquafeed

- Others (Poultry and ruminant feed)

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 38% of the plasma feed market, supported by strong demand from swine, poultry, and pet food sectors. It benefits from advanced processing technologies, high biosecurity standards, and a well-established commercial livestock industry. Feed manufacturers focus on functional and natural additives to meet consumer preferences for antibiotic-free meat and premium pet food. The region’s aquaculture sector is also adopting plasma proteins to improve growth rates and survival outcomes. Government regulations ensure stringent safety compliance, which strengthens trust among end users. Expanding applications in pet nutrition further reinforce market dominance.

Europe

Europe accounts for 27% of the plasma feed market, driven by demand for sustainable and high-quality animal nutrition. It maintains strong adoption in swine and pet food segments, supported by strict feed safety regulations and animal welfare standards. Countries such as Spain, France, and Denmark lead in plasma protein integration for piglet diets. The aquaculture industry in Norway and Scotland is increasingly utilizing plasma proteins to enhance feed efficiency. Investments in research and product innovation are expanding application potential. It benefits from a mature market structure with established supply networks.

Asia-Pacific

Asia-Pacific represents 24% of the plasma feed market, fueled by rapid growth in livestock and aquaculture production. Rising incomes, urbanization, and dietary shifts toward protein-rich diets drive demand for advanced feed solutions. China, Vietnam, and India are major consumers, with swine and aquaculture sectors showing strong uptake. Local production capabilities are expanding, but imports from established suppliers remain significant. Feed producers adopt plasma-based ingredients to improve farm productivity and meet export quality standards. It is the fastest-growing regional market.

Latin America

Latin America holds 7% of the plasma feed market, supported by its large livestock base, particularly in Brazil and Mexico. Adoption is increasing in swine feed to enhance piglet survival and growth performance. Pet food applications are also expanding, targeting premium market segments. Regional aquaculture industries, including shrimp and tilapia farming, are integrating plasma proteins to improve yield. Infrastructure development in feed processing supports quality improvements. It benefits from rising export-oriented meat production.

Middle East & Africa

The Middle East & Africa account for 4% of the plasma feed market, with gradual adoption in poultry and aquaculture sectors. Countries such as South Africa and Egypt lead in integrating plasma proteins into animal diets. Growth is supported by efforts to improve food security and reduce reliance on imports. Pet food applications are emerging in urban markets with rising disposable incomes. Limited processing infrastructure poses challenges, but investment opportunities remain. It offers scope for long-term expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Veos Group (Belgium)

- Puretein Agri LLC (U.S.)

- Lican Food (Chile)

- Kraeber &C Co.GmbH (Germany)

- EcooFeed LLC (U.S.)

- SARIA Group (Germany)

- The Lauridsen Group Inc. (U.S.)

- Darling Ingredients Inc. (U.S.)

- Lihme Protein Solutions (Denmark)

- Sera Scandia (Denmark)

- Rocky Mountain Biologicals (U.S.)

Competitive Analysis

The plasma feed market is characterized by a competitive landscape where global and regional players focus on product quality, biosecurity, and innovation to strengthen market presence. It features established companies such as Darling Ingredients Inc. (U.S.), The Lauridsen Group Inc. (U.S.), SARIA Group (Germany), Veos Group (Belgium), Sera Scandia (Denmark), Lican Food (Chile), Puretein Agri LLC (U.S.), Kraeber &C Co.GmbH (Germany), Rocky Mountain Biologicals (U.S.), Lihme Protein Solutions (Denmark), and EcooFeed LLC (U.S.). These companies compete through advancements in plasma processing technology, expansion of production capacities, and strategic partnerships with feed manufacturers. They emphasize sustainable sourcing and compliance with international feed safety standards to build trust among end users. Innovation in product formulations to serve swine, poultry, aquaculture, and pet food markets enhances brand differentiation. Global leaders invest in research to improve digestibility, nutrient retention, and disease resistance benefits of plasma proteins. Regional players leverage local market knowledge and distribution networks to target niche applications, contributing to a dynamic and evolving competitive environment.

Recent Developments

- In June 2023, Solid Gold launched its Nutrient Boost dog food line. This line enhances existing recipes with a proprietary blend including plasma to improve nutrient absorption, gut health, and immunity. This launch is expected to boost the plasma feed market by increasing awareness and demand for plasma-enriched pet food products.

- In March 2023, Sonac introduced an ovine plasma powder for pet food, sourced from free‑range lamb and sheep. It offers a protein-rich option for limited‑ingredient wet pet foods, treats, and snacks.

- March 2023 – Sonac launched a novel ovine plasma powder for pet nutrition, designed especially for limited-ingredient wet foods and snacks.

Market Concentration & Characteristics

The plasma feed market exhibits a moderately consolidated structure, with a mix of global leaders and regional players competing on product quality, innovation, and biosecurity standards. It is dominated by established companies with strong processing capabilities, advanced sourcing systems, and extensive distribution networks. The market is characterized by high entry barriers due to the capital-intensive nature of processing facilities, strict regulatory compliance, and the need for consistent raw material supply. Competitive advantages stem from technological expertise in nutrient preservation, pathogen elimination, and functional protein development. Leading participants focus on strategic partnerships with feed manufacturers, expansion into emerging economies, and diversification of applications across swine, poultry, aquaculture, and pet food sectors. Sustainability, traceability, and premium feed formulations remain critical to differentiation. Demand patterns favor suppliers that can deliver consistent quality, meet international safety standards, and respond quickly to evolving livestock health and nutrition requirements across diverse regional markets.

Report Coverage

The research report offers an in-depth analysis based on Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with growing adoption of high-quality, protein-rich feed in livestock, aquaculture, and pet nutrition.

- Technological advancements in plasma processing will enhance nutrient retention and product safety.

- Expansion in emerging economies will create new opportunities for market penetration.

- Sustainable and traceable sourcing practices will gain greater importance in supplier selection.

- Diversification into niche applications such as specialty pet food will support growth.

- Partnerships between plasma producers and feed manufacturers will strengthen distribution reach.

- Regulatory compliance will remain a critical factor influencing global trade.

- Investments in research will lead to improved functional benefits of plasma proteins.

- Rising consumer preference for antibiotic-free animal products will drive market adoption.

- Competitive focus will shift toward innovation in premium and functional feed formulations.