Market Overview

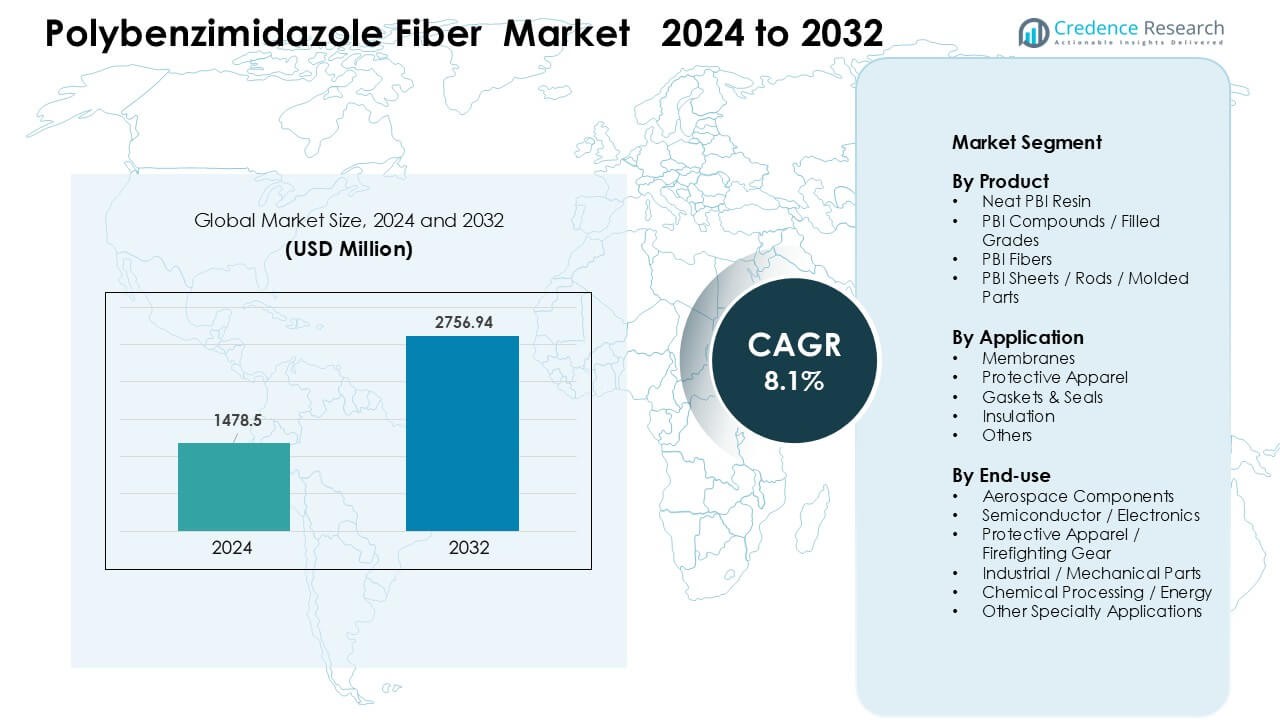

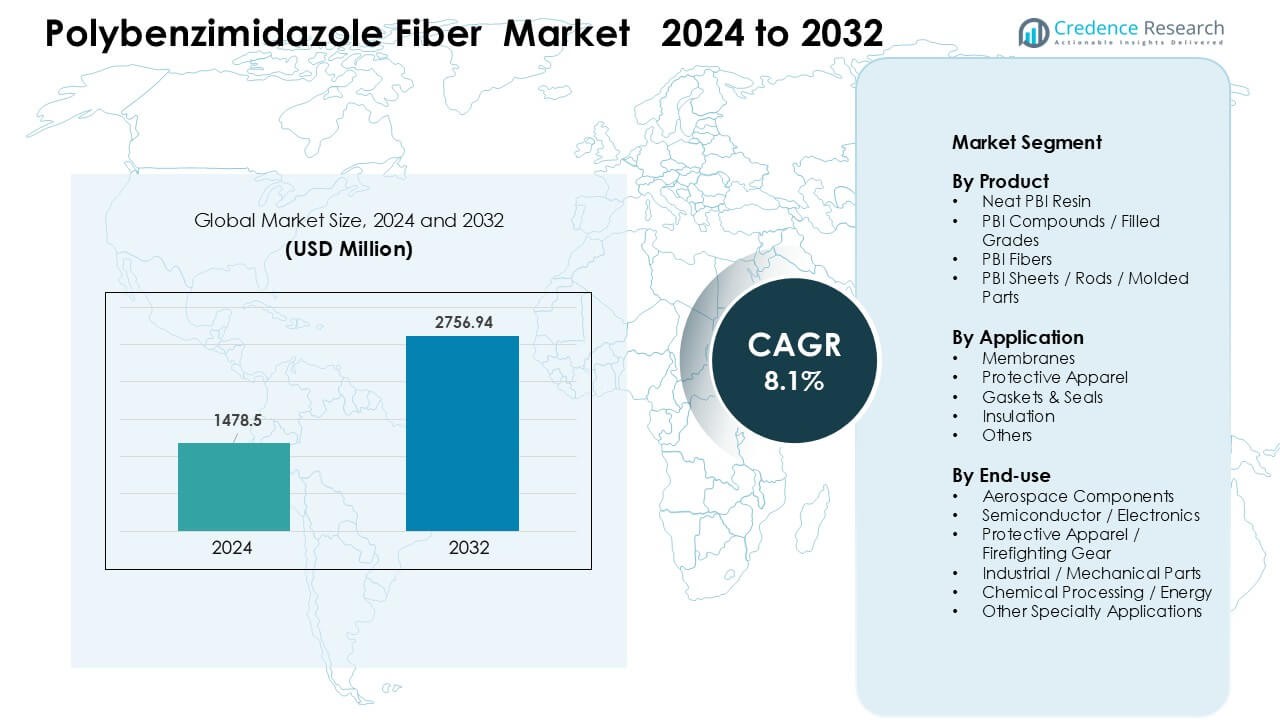

Polybenzimidazole Fiber Market was valued at USD 1478.5 million in 2024 and is anticipated to reach USD 2756.94 million by 2032, growing at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polybenzimidazole Fiber Market Size 2024 |

USD 1478.5 Million |

| Polybenzimidazole Fiber Market, CAGR |

8.1% |

| Polybenzimidazole Fiber Market Size 2032 |

USD 2756.94 Million |

The Polybenzimidazole Fiber Market features strong competition among leading players such as PBI Performance Products, Inc, Mitsubishi Chemical Advanced Materials AG, Victrex plc, Polymics Ltd, Bally Ribbon Mills, Goodfellow Corporation, Shanghai Songhan Plastics Technology Co., Ltd, Atkins & Pearce, TenCate Protective Fabrics, and Swicofil AG. These companies strengthen market reach through advanced PBI fiber technologies, high-purity resin development, and tailored solutions for aerospace, defense, semiconductor, and protective apparel applications. North America remained the leading region in 2024 with about 38% share, supported by strong aerospace programs, high firefighter gear procurement, and extensive semiconductor manufacturing activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Polybenzimidazole Fiber Market reached USD 1478.5 million in 2024 and is projected to hit USD 2756.94 million by 2032 at a 8.1% CAGR during 2025–2032.

- Strong drivers include rising demand for heat-resistant materials in aerospace, firefighting gear, and semiconductor manufacturing, with PBI fibers holding the largest product share at about 42%.

- Key trends include increased adoption of PBI in next-generation protective apparel and expanding use in high-temperature membranes for fuel-cell and energy systems.

- The competitive landscape features players such as PBI Performance Products, Mitsubishi Chemical Advanced Materials, Victrex, Polymics, and TenCate Protective Fabrics, with companies focusing on high-performance fiber engineering and cleanroom-grade materials.

- North America led the market with about 38% share, followed by Europe at 28% and Asia-Pacific at 26%, while protective apparel dominated applications with nearly 48% share in 2024.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

PBI fibers held the dominant share in 2024 with about 42% of the Polybenzimidazole Fiber Market. Strong heat resistance, flame stability, and low off-gassing supported wide use across aerospace, defense, and industrial safety gear. Neat PBI resin and filled grades gained steady traction in precision parts due to better dimensional stability. Sheets, rods, and molded parts also expanded in niche engineering uses where high mechanical endurance mattered. Broader adoption of advanced polymers in aircraft and semiconductor tools further strengthened the lead of PBI fibers.

- For instance, PBI Advanced Materials Co.,Ltd. is a separate company and a member of the Japanese Sato Group, which manufactures and sells PBI materials under license from PBI Performance Products (a U.S. company that is the raw material supplier), not Toray Advanced Materials.

By Application

Protective apparel led the market in 2024 with nearly 48% share due to strict safety standards in firefighting, military operations, and industrial handling. Demand rose as end users adopted high-temperature and flame-stable suits to improve worker protection. Membranes grew in filtration and fuel-cell systems, while gaskets and seals advanced in harsh-environment operations. Insulation and other specialty uses gained support from rising thermal management needs. Strong regulatory pressure and rising workplace safety compliance helped maintain the leadership of protective apparel.

- For instance, Zylon® is a trademarked name for poly(p-phenylene-2,6-benzobisoxazole) (PBO) fiber, and it is manufactured solely by the Japanese company Toyobo Co., Ltd.

By End-use

Protective apparel and firefighting gear dominated in 2024 with about 46% share, driven by higher procurement in defense, aviation, and hazardous-industry sectors. Aerospace components expanded with wider use of lightweight, heat-resistant materials in cabins and engine surroundings. Semiconductor and electronics uses grew due to demand for low-contamination materials. Industrial mechanical parts and chemical processing applications saw gradual adoption as firms upgraded to higher-performance polymers. Broad focus on thermal safety and material reliability kept protective apparel as the leading end-use category.

Key Growth Drivers

High Demand for Advanced Heat-Resistant Materials

The Polybenzimidazole Fiber Market grows strongly due to rising demand for high-temperature resistant materials across aerospace, defense, and industrial safety applications. Many end users now replace conventional aramid and carbon-based materials with PBI due to stronger flame stability, superior thermal endurance above 400°C, and lower smoke generation. These advantages support wider use in firefighter turnout gear, aircraft interiors, and high-risk industrial environments where reliability matters. Growth also comes from expanding aerospace production and increased global defense spending, which push manufacturers to source materials with higher performance margins. Strong regulatory pressure on worker safety further boosts adoption.

- For instance, Toray Advanced Composites supplies a wide range of advanced materials for these industries, including flame-retardant materials for aircraft interiors and high-performance composites for critical defense applications. PBI fibers are well-documented for their use in firefighter gear, astronaut suits, and aircraft fire-blocking layers.

Expansion of Semiconductor and Electronics Manufacturing

The semiconductor and electronics sector drives demand for PBI fibers because of their low outgassing, chemical resistance, and dimensional stability. These attributes are vital in wafer handling systems, plasma processing equipment, and cleanroom components where contamination control stays essential. Rapid growth in chip fabrication capacity in Asia, the U.S., and Europe increases the need for high-purity engineering materials. PBI fibers support next-generation lithography platforms and advanced packaging lines, which operate under high heat and harsh plasma conditions. More investments in fabs and rising demand for high-performance electronics keep this driver strong.

- For instance, Celanese PBI fibers are used in wafer handling and plasma etching components, offering low outgassing and chemical resistance critical for maintaining cleanroom standards in semiconductor fabs.

Increased Adoption in High-Performance Filtration and Energy Systems

PBI fibers gain traction in membranes, filters, and insulation systems used in fuel cells, energy storage, and chemical processing. Their chemical stability and heat tolerance allow longer operating life in aggressive environments. Growth in hydrogen fuel-cell development boosts demand for PBI-based proton exchange membranes and hot-gas filtration units. Industrial gas separation and hazardous chemical handling also rely on robust materials, supporting higher consumption. As global energy systems shift toward cleaner technologies, many firms adopt PBI due to its long-term durability and reduced maintenance needs. These factors make high-performance filtration and energy systems a strong market driver.

Key Trends & Opportunities

Rising Use in Protective Apparel Innovation

A major trend is the use of PBI fibers in next-generation protective apparel designed for lighter weight, improved heat shielding, and better wearer comfort. Fire departments, industrial facilities, and military units invest in upgraded turnout gear that can withstand intense thermal exposure and provide longer escape times. Manufacturers pair PBI with para-aramid and FR viscose blends to improve flexibility and moisture management. Growing incidents of industrial fires and higher global safety standards push rapid replacement of older gear. This opportunity expands as emerging economies raise compliance norms and modernize fire and rescue infrastructure.

- For instance, Celanese originally developed PBI fiber in partnership with NASA and the U.S. Air Force and commercialized it in the 1980s.

Growth of Aerospace and Space Applications

Aerospace manufacturers adopt PBI fibers for insulation blankets, thermal barriers, and structural components that require low flammability and long-term reliability. Weight reduction and safety enhancement remain core goals in commercial aviation and defense aircraft programs, which increases the appeal of high-performance polymers. The expanding space sector creates new opportunities in launch vehicles, satellites, and re-entry systems that operate under extreme temperatures. PBI supports stability in oxygen-rich environments, making it valuable in crewed missions. As global aircraft production rises and space exploration accelerates, the market gains significant long-term opportunities.

- For instance, Solvay is a producer of high-performance polymers, including PBI (which it acquired from Celanese) and PVDF products, but the Zylon® brand (PBO fiber) is owned and manufactured by the Japanese company Toyobo.

Advancements in High-Temperature Membrane Technology

Development of advanced membrane technologies offers strong opportunity for PBI fibers as industries pursue higher efficiency in chemical separation, hydrogen production, and fuel-cell energy systems. Companies aim to create membranes that maintain performance under high heat and corrosive conditions, where PBI excels. Growing investment in hydrogen infrastructure, carbon capture, and industrial filtration supports these advancements. PBI’s ability to retain mechanical strength at elevated temperatures makes it a preferred material for next-generation membrane designs. This trend continues as sustainability goals drive demand for durable materials with longer service life.

Key Challenges

High Production Costs and Limited Raw Material Availability

One key challenge is the high production cost of PBI due to complex synthesis, specialized processing, and limited raw material supply. Manufacturing requires controlled polymerization and high-temperature spinning, which raises capital and operational costs. These expenses often restrict adoption to high-value applications, slowing wider commercialization. Few producers operate at scale, creating supply concentration risks and long lead times. New entrants face high technical barriers, limiting competition. Such constraints reduce price flexibility, making it harder for industries with cost-sensitive operations to adopt PBI-based solutions.

Competition from Lower-Cost High-Performance Materials

Another challenge stems from strong competition against lower-cost alternatives such as aramid fibers, polyimide fibers, and advanced carbon-based materials. Many of these substitutes offer acceptable thermal and mechanical performance at significantly lower prices, which makes them preferred in medium-risk applications. Industries often choose materials based on cost-performance balance, and PBI’s premium position limits adoption outside critical environments. Continuous improvements in alternative FR materials further intensify this challenge. To remain competitive, PBI suppliers must enhance production efficiency, expand application benefits, and develop blended solutions with better cost-effectiveness.

Regional Analysis

North America

North America held about 38% share of the Polybenzimidazole Fiber Market in 2024, driven by strong demand across aerospace, defense, and firefighter protection systems. The U.S. led adoption due to high safety standards, advanced aircraft production, and wider procurement of premium firefighting gear. Semiconductor fabrication growth in the region also supported the use of PBI in cleanroom components and high-heat processing tools. Rising investment in high-temperature filtration and hydrogen energy systems strengthened material demand. Strong regulatory compliance and a well-established industrial base kept North America the leading regional market.

Europe

Europe accounted for nearly 28% share in 2024, supported by strict industrial safety norms, high automotive engineering activity, and advanced aerospace programs. Germany, France, and the U.K. showed strong adoption in protective apparel, aircraft interiors, and chemical-resistant components. The region’s growth in hydrogen fuel-cell research and high-temperature membrane development further boosted PBI use. Strong compliance requirements for flame-resistant gear and worker protection encouraged procurement across industrial facilities. Expansion of semiconductor packaging operations and aerospace modernization helped Europe maintain stable market growth.

Asia-Pacific

Asia-Pacific captured about 26% share in 2024 and remained the fastest-growing regional market due to expanding electronics manufacturing, semiconductor fabrication, and industrial production. China, Japan, South Korea, and Taiwan increased the use of PBI materials in cleanroom systems, plasma processing tools, and thermal-resistant components. Rising investments in aerospace development and firefighter equipment modernization supported further demand. Growing chemical processing capacity also boosted requirements for high-temperature seals and membranes. Strong industrial expansion and technology upgrades helped Asia-Pacific accelerate PBI consumption across diverse applications.

Latin America

Latin America held close to 5% share in 2024, with gradual growth driven by rising adoption of industrial safety gear and selective aerospace procurement. Brazil and Mexico led the region due to expanding manufacturing bases and stronger workplace safety regulations. Demand increased in refinery operations, chemical handling, and high-risk industrial zones requiring flame-resistant protective apparel. Limited domestic production capacity slowed wider uptake, but imports from North America and Europe supported steady consumption. Growing interest in advanced filtration and energy systems added further market potential.

Middle East & Africa

The Middle East & Africa region accounted for around 3% share in 2024, supported mainly by the oil, gas, and chemical processing sectors. Countries such as Saudi Arabia, the UAE, and South Africa adopted PBI-based protective apparel for high-temperature and hazardous operations. Rising investments in aerospace services and industrial infrastructure offered moderate growth opportunities. Limited local manufacturing capacity kept dependence on imports high, slowing broader adoption. However, ongoing upgrades in safety protocols and industrial modernization helped maintain steady regional demand.

Market Segmentations:

By Product

- Neat PBI Resin

- PBI Compounds / Filled Grades

- PBI Fibers

- PBI Sheets / Rods / Molded Parts

By Application

- Membranes

- Protective Apparel

- Gaskets & Seals

- Insulation

- Others

By End-use

- Aerospace Components

- Semiconductor / Electronics

- Protective Apparel / Firefighting Gear

- Industrial / Mechanical Parts

- Chemical Processing / Energy

- Other Specialty Applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Polybenzimidazole Fiber Market is shaped by key players such as PBI Performance Products, Inc, Mitsubishi Chemical Advanced Materials AG, Victrex plc, Polymics Ltd, Bally Ribbon Mills, Goodfellow Corporation, Shanghai Songhan Plastics Technology Co., Ltd, Atkins & Pearce, TenCate Protective Fabrics, and Swicofil AG. These companies focus on advanced PBI fiber formulations, high-purity resin production, and supply expansion for aerospace, defense, electronics, and protective apparel applications. Many manufacturers invest in improving thermal stability, mechanical strength, and chemical resistance to support next-generation firefighting gear, semiconductor components, and high-temperature filtration systems. Strategic partnerships with aerospace contractors, defense agencies, and industrial safety suppliers strengthen market presence. Several players also explore PBI blends to reduce costs and improve fabric comfort, enabling wider adoption in protective clothing. Rising demand for cleanroom materials and high-performance membranes pushes companies to enhance production capacity and global distribution networks.

Key Player Analysis

- PBI Performance Products, Inc

- Mitsubishi Chemical Advanced Materials AG

- Victrex plc

- Polymics Ltd

- Bally Ribbon Mills

- Goodfellow Corporation

- Shanghai Songhan Plastics Technology Co., Ltd

- Atkins & Pearce

- TenCate Protective Fabrics

- Swicofil AG

Recent Developments

- In May 2025, Victrex plc Victrex’s interim results (H1 2025, published May 2025) emphasise progress in its Aerospace Composites / high-performance polymer programmes (e.g., LMPAEK grade qualification with OEMs and “mega-programme” progress that targets aerospace and trauma markets). While Victrex is best known for PAEK/PEEK rather than PBI, these statements show continued R&D/commercial push into high-temperature, aerospace polymer applications relevant context for PBI demand even if not a direct PBI-fiber announcement from Victrex.

- In April 2025, PBI Performance Products, Inc. PBI remains the world’s dedicated producer of PBI fiber and continues to market its Celazole®/PBI family for extreme-temperature and protective applications (company product pages and “about” information). I could not find a fresh April-2025 company press release about a change of ownership or a new plant on PBI’s site; historical ownership by InterTech dates back to 2005.

- In July 2024, TenCate Protective Fabrics launched the PBI® Peak5® ultra-lightweight fire-resistant outer shell in partnership with PBI Performance Products, targeting structural firefighting gear and strengthening TenCate’s position in high-end PBI-based protective fabrics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ultra-high-temperature fibers will rise as aerospace and defense programs expand.

- Adoption of advanced firefighter and industrial protective gear will strengthen due to stricter safety norms.

- Semiconductor manufacturing growth will increase the need for low-outgassing, heat-stable PBI components.

- Fuel-cell and hydrogen systems will create new opportunities for PBI membranes and filtration units.

- Manufacturers will invest in cost-efficient processing to reduce production complexity and improve scalability.

- Blended PBI fabrics will gain traction to balance performance, comfort, and affordability in protective apparel.

- Growth in cleanroom infrastructure will drive higher consumption of contamination-resistant PBI materials.

- Chemical processing and energy sectors will expand usage of PBI seals, gaskets, and insulation under harsh conditions.

- Emerging markets will adopt PBI more widely as safety regulations and industrial modernization improve.

- Material innovation will enhance mechanical strength and thermal endurance, supporting broader high-performance applications.

Market Segmentation Analysis:

Market Segmentation Analysis: