Market overview

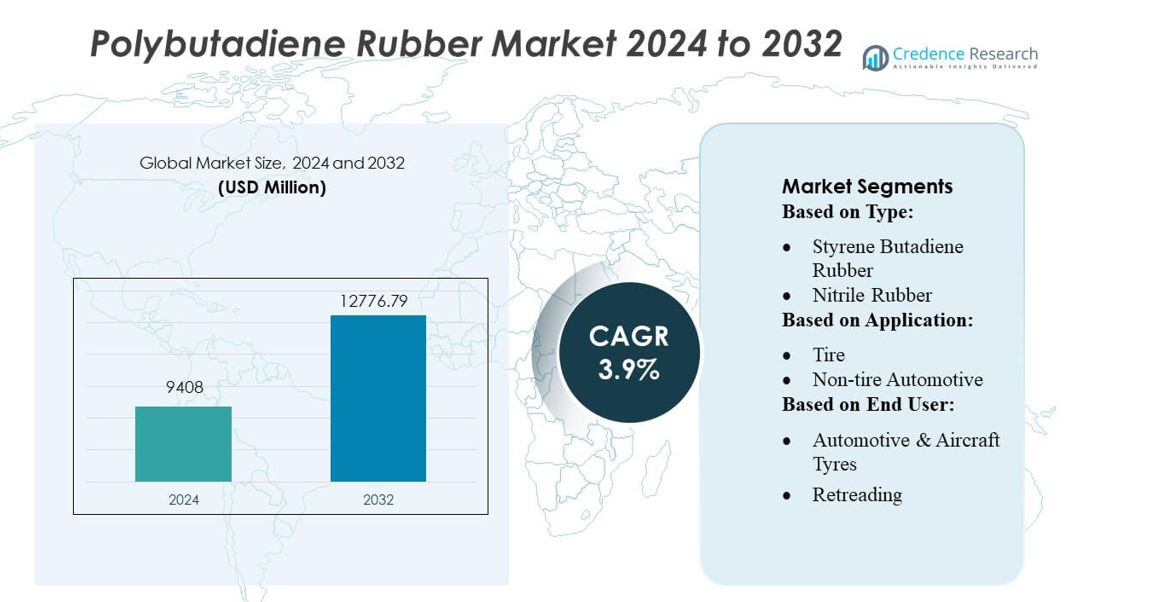

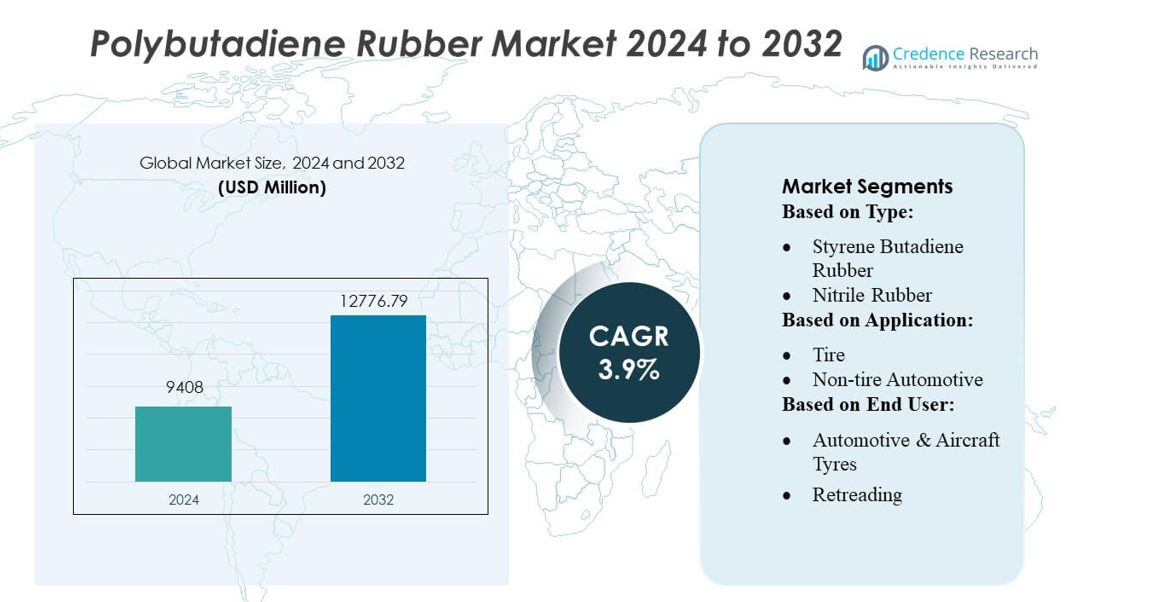

Polybutadiene Rubber Market size was valued USD 9408 million in 2024 and is anticipated to reach USD 12776.79 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polybutadiene Rubber Market Size 2024 |

USD 9408 million |

| Polybutadiene Rubber Market, CAGR |

3.9% |

| Polybutadiene Rubber Market Size 2032 |

USD 12776.79 million |

The Polybutadiene Rubber market is shaped by major global producers such as Lanxess AG, JSR Corporation, Kumho Petrochemical, Sibur, and PetroChina, which compete through capacity expansion, technological upgrades, and long-term supply partnerships with tire manufacturers. These companies emphasize high-performance grades, particularly solution-polymerized PBR, to meet rising demand for fuel-efficient and EV-optimized tires. Asia-Pacific leads the global market with an estimated 55–60% share, supported by its dominant tire manufacturing base, extensive petrochemical infrastructure, and continuous investment in synthetic rubber production. The region’s strong automotive output and cost-efficient manufacturing reinforce its position as the primary growth hub for PBR.

Market Insights

- The Polybutadiene Rubber Market size reached USD 9408 million in 2024 and is projected to attain USD 12776.79 million by 2032, registering a CAGR of 3.9%, supported by steady demand from tire, industrial, and polymer modification applications.

- Strong market drivers include rising global tire production, growing EV-related demand for low-rolling-resistance compounds, and increasing consumption of PBR as an impact modifier in HIPS and ABS across consumer electronics and packaging.

- Key market trends highlight a shift toward solution-polymerized PBR, sustainability-focused production upgrades, and capacity expansions by major players such as Lanxess AG, JSR Corporation, Kumho Petrochemical, Sibur, and PetroChina.

- Market restraints include volatile butadiene feedstock prices, competition from alternative elastomers, and operational challenges stemming from regulatory pressures on emissions and energy efficiency.

- Asia-Pacific dominates with 55–60% regional share, while the tire segment contributes over 70% of total demand, driven by extensive automotive manufacturing strength and integrated petrochemical capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Polybutadiene Rubber (PBR) dominated the type segment with the largest market share, accounting for over 35%, driven by its high resilience, low rolling resistance, and superior abrasion resistance, which make it essential for tire manufacturing. Styrene Butadiene Rubber and Butyl Rubber follow due to their applications in diverse industrial and automotive components. Demand for nitrile rubber remains steady due to oil-resistant properties, supporting its use in industrial seals and hoses. Growth across types is reinforced by increasing automotive production, rising need for fuel-efficient tires, and expanding industrial applications requiring durable synthetic rubber materials.

- For instance, SRI Impex Pvt. Ltd. sources PBR grades produced using continuous solution polymerization lines capable of operating at reactor throughputs above 40,000 tons annually—equipment commonly used by advanced producers to ensure consistent microstructure control and high cis-content required in premium tire compounds.

By Application

The tire segment captured the dominant share of more than 65% owing to PBR’s strong adoption in tread and sidewall manufacturing, supported by its excellent wear resistance and ability to improve fuel efficiency. Non-tire automotive applications, including engine mounts and bushings, show steady growth due to vibration-damping characteristics. Industrial rubber goods and footwear sectors also contribute to demand, benefitting from PBR’s flexibility and durability. The segment’s expansion is primarily driven by rising global tire replacement cycles, commercial vehicle production, and increasing preference for high-performance tires in passenger and off-road vehicles.

- For instance, SRI Impex Pvt. Ltd. sources polybutadiene rubber (PBR) grades produced using continuous solution polymerization lines capable of operating at reactor throughputs above 40,000 tons annually.

By End-User

Automotive & Aircraft Tyres emerged as the leading end-user segment, holding over 60% of the market share, attributed to the reliance of premium and radial tire manufacturers on PBR for enhanced elasticity, heat resistance, and tread life. The retreading segment gains traction as fleet operators prioritize cost-effective tire restoration solutions. Belts & hoses benefit from PBR’s mechanical strength, supporting demand in industrial machinery. The footwear segment shows consistent growth due to increasing use in sports and safety shoes. Market expansion across end-users is driven by rising mobility trends, infrastructure development, and growth in automotive fleets globally.

Key Growth Drivers

Rising Global Tire Production

The Polybutadiene Rubber market grows significantly due to expanding global tire production, driven by rising vehicle ownership, commercial fleet expansion, and increasing demand for high-performance tires. Manufacturers prefer PBR for its excellent abrasion resistance, high resilience, and low rolling resistance, which enhances fuel efficiency. Rapid production capacity additions across Asia-Pacific, particularly in China, India, and Southeast Asia, further strengthen demand. Additionally, greater emphasis on radial and eco-friendly tires accelerates PBR consumption, positioning the material as a critical input in modern tire manufacturing.

- For instance, Minar Reclamation Private Limited uses ISO-certified reclaiming systems and high-temperature autoclaves to produce reclaimed rubber that meets established international standards for Mooney viscosity (ML 1+4 @ 100°C), tensile strength, and elongation at break.

Expanding Demand from Industrial and Mechanical Applications

Industrial sectors increasingly adopt Polybutadiene Rubber for belts, hoses, gaskets, vibration-damping products, and industrial rubber goods due to its durability and superior elastic properties. Growing investments in manufacturing infrastructure, mining operations, and heavy-duty equipment support market expansion. The material’s ability to perform under high fatigue and stress conditions makes it ideal for dynamic mechanical components. Additionally, industrial modernization initiatives in emerging economies amplify consumption, while technological improvements in PBR processing enable stronger and more resilient industrial-grade compounds.

- For instance, Fishfa Rubbers Ltd., an ISO 9001:2015–certified producer, manufactures reclaimed rubber grades with Mooney viscosity values typically ranging from 45 to 70 MU and tensile strengths reaching up to 12 MPa, as specified in its technical datasheets.

Growth in Polymer Modification and Plastics Compounding

The use of PBR as an impact modifier in plastics—especially High-Impact Polystyrene (HIPS) and Acrylonitrile Butadiene Styrene (ABS)—drives market growth. Increasing production of consumer electronics, household appliances, and packaging materials boosts demand for these polymers, directly supporting PBR consumption. Manufacturers rely on PBR to improve toughness, flexibility, and impact resistance in engineering plastics. With more industries shifting toward lightweight, durable polymer solutions, PBR’s role in compounding applications continues to rise, especially in high-volume markets across Asia and North America.

Key Trends & Opportunities

Rising Shift Toward Sustainable and Bio-Based Rubber Solutions

A strong industry trend focuses on developing sustainable PBR alternatives through bio-based butadiene sourced from biomass, ethanol, or bio-naphtha. Growing environmental regulations and corporate sustainability targets encourage manufacturers to invest in low-emission technologies and renewable feedstocks. Opportunities arise for producers that commercialize green PBR grades with lower carbon footprints. Partnerships among chemical firms, biotechnology companies, and research institutions further accelerate innovation, positioning eco-friendly PBR as a long-term growth opportunity in automotive and industrial applications.

- For instance, Tianyu (Shandong) Rubber & Plastic Products Co., Ltd. has demonstrated environmental commitment by operating dual facilities in Tianjin and Shandong, which together produce an average of 200 tonnes of reclaimed rubber per day, derived from end-of-life tires.

Advancements in High-Performance Tire Technologies

Increasing adoption of high-performance, low-rolling-resistance, and fuel-efficient tires creates a major opportunity for advanced PBR grades. Tire manufacturers aim to meet stricter regulatory standards regarding fuel economy, wear resistance, and emission reduction. This trend drives demand for solution-polymerized PBR (SPBR), known for enhanced uniformity and better dynamic properties. As electric vehicles grow in popularity, EV-optimized tires requiring superior resilience and reduced heat generation further expand opportunities for innovative PBR formulations.

- For instance, Rolex Reclaim Pvt. Ltd. operates a facility with an installed capacity of 7,200 metric tonnes per annum, according to its company profile.

Capacity Expansions and Strategic Collaborations in Asia-Pacific

Asia-Pacific continues to witness large-scale plant expansions, long-term supply contracts, and joint ventures among raw material producers and tire manufacturers. The region’s dominance in automotive manufacturing, coupled with government incentives for petrochemical growth, creates favorable conditions for PBR producers. Companies increasingly invest in technologically advanced production lines to improve quality consistency and operational efficiency. These developments open opportunities for long-term supply partnerships and greater penetration of specialty PBR grades across regional value chains.

Key Challenges

Volatility in Butadiene Prices and Supply Constraints

The market faces considerable challenges due to fluctuations in butadiene prices, driven by crude oil volatility, supply disruptions, and imbalances in global cracker operations. Sharp variations in feedstock availability impact production costs and profit margins for PBR manufacturers. Periodic shortages caused by refinery maintenance cycles or geopolitical uncertainties further restrict market stability. These constraints force buyers to diversify sourcing strategies, rely on long-term contracts, and explore alternative feedstock technologies to mitigate risk.

Competition from Substitute Materials and Synthetic Rubber Variants

Polybutadiene Rubber competes with alternative synthetic rubbers such as Styrene-Butadiene Rubber (SBR), natural rubber, and advanced elastomers that provide comparable performance in certain applications. As manufacturers seek cost-effective and multifunctional materials, the availability of competing elastomers with tailored properties poses a challenge to PBR demand, particularly in non-tire sectors. Innovations in newer rubber formulations with improved environmental and mechanical properties further intensify competition, requiring PBR producers to differentiate through quality, performance, and sustainability-driven innovations.

Regional Analysis

North America

North America accounts for approximately 12–15% of the Polybutadiene Rubber market, supported by robust demand from tire replacement, industrial rubber goods, and polymer modification applications. The U.S. leads regional consumption due to a well-established automotive ecosystem and steady investment in petrochemical infrastructure. Strong adoption of HIPS and ABS in consumer appliances and packaging strengthens non-tire demand. While mature in structure, the region benefits from technological advancements in high-performance PBR grades, particularly solution-polymerized variants. However, fluctuating butadiene prices and competition from imported synthetic rubber impact production economics and overall regional competitiveness.

Asia-Pacific

Asia-Pacific dominates the Polybutadiene Rubber market with an estimated 55–60% share, driven by large-scale tire production, rapid industrialization, and strong petrochemical capacity. China, India, Japan, and South Korea remain major consumers due to expanding automotive manufacturing and continuous capacity additions by regional producers. Strong demand for high-impact polystyrene (HIPS) and ABS in electronics and packaging further fuels PBR consumption. Government-supported investments in synthetic rubber plants and integration with upstream butadiene facilities enhance supply stability. APAC’s role as a global tire manufacturing hub ensures sustained PBR demand across OEM and replacement markets.

Europe

Europe holds around 18–20% of the global Polybutadiene Rubber market, driven by stringent quality standards in automotive and industrial applications. Germany, France, Italy, and Central European countries remain key demand centers due to strong automotive manufacturing and established polymer processing industries. Demand for solution-PBR is rising as tire manufacturers prioritize fuel efficiency and emission compliance. The region also benefits from advanced R&D capabilities in specialty rubber formulations. However, energy cost pressures and environmental regulations challenge production economics, prompting companies to optimize operations and import competitively priced PBR from Asia and the Middle East.

Latin America

Latin America captures approximately 5–7% of the global Polybutadiene Rubber market, driven by the automotive and industrial manufacturing base in Brazil, Mexico, and Argentina. Regional demand is supported by tire production, replacement needs, and growth in consumer goods requiring HIPS and ABS. Brazil remains the primary market due to its strong petrochemical capabilities and domestic rubber processing industry. Economic fluctuations and inconsistent automotive output, however, constrain long-term market stability. Rising investments in industrial rubber products and import substitution policies offer growth opportunities, particularly as regional producers seek greater integration with global supply chains.

Middle East & Africa (MEA)

The Middle East & Africa region represents 6–8% of the PBR market, supported by expanding petrochemical capacities and increasing industrialization. Countries such as Saudi Arabia, the UAE, and South Africa contribute to steady demand through investments in tire manufacturing, automotive assembly, and industrial rubber goods. The region’s strategic advantage lies in abundant feedstock availability and emerging synthetic rubber production hubs. Growing infrastructure and mining activities also increase consumption of mechanical rubber components. However, limited downstream diversification and dependence on imported tire technologies restrain faster market expansion compared to Asia and Europe.

Market Segmentations:

By Type:

- Styrene Butadiene Rubber

- Nitrile Rubber

By Application:

By End User:

- Automotive & Aircraft Tyres

- Retreading

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Polybutadiene Rubber (PBR) market features a competitive landscape shaped by a mix of established global and regional players, including SRI Impex Pvt. Ltd., HUXAR, Minar Reclaimation Private Limited, Fishfa Rubbers Ltd., Tianyu (Shandong) Rubber & Plastic Products Co., Ltd., Rolex Reclaim Pvt. Ltd., SNR Reclamations Pvt. Ltd., GRP Ltd, Swani Rubber Industries, and J. Allcock & Sons Ltd. The Polybutadiene Rubber (PBR) market exhibits a competitive environment characterized by continuous capacity expansion, technological upgrades, and a strong focus on high-performance product development. Manufacturers prioritize solution-polymerized grades to meet the rising demand for low-rolling-resistance and fuel-efficient tires, particularly in the automotive and EV sectors. Competitive differentiation increasingly depends on supply-chain integration, consistent feedstock availability, and the ability to deliver customized compounds for tire, industrial rubber, and polymer modification applications. Companies also invest in sustainability initiatives, including energy-efficient production and reduced emissions, to align with regulatory expectations. Strategic partnerships, long-term contracts with tire producers, and expansion into emerging Asian and Latin American markets further define the competitive landscape, reinforcing industry resilience and promoting innovation-driven growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Indonesia increased its forest monitoring and launched new traceability tools like Ground Truthed.id (GTID) to comply with the EU Deforestation Regulation (EUDR), which will require the rubber industry to adapt significantly.

- In November 2024, Ecore International received a significant investment from General Atlantic’s BeyondNetZero fund to enhance its rubber recycling operations. This funding aims to support Ecore’s efforts in developing sustainable solutions for recycling rubber materials.

- In February 2023, Arlanxeo inaugurated a new 65 kilotonne per annum (ktpa) polybutadiene rubber (PBR) production line in Brazil. The new line is located in the Triunfo petrochemical complex in Rio Grande do Sul, and it signifies Arlanxeo’s strategic commitment to expanding its production and supply chain within Latin America to meet growing local demand

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily as global tire production expands and demand for high-performance rubber compounds increases.

- Manufacturers will intensify investments in solution-polymerized PBR to meet efficiency requirements for fuel-efficient and electric vehicle tires.

- Sustainability initiatives will accelerate the development of bio-based and low-emission PBR grades across major production hubs.

- Advancements in polymer modification will strengthen PBR usage in HIPS and ABS applications within consumer electronics and packaging.

- Capacity expansions in Asia-Pacific will reinforce the region’s dominance and improve supply stability for global customers.

- Companies will increasingly integrate backward into feedstock sourcing to mitigate price volatility of butadiene.

- Automation and digitalization in production plants will improve product consistency and reduce operational costs.

- Strategic alliances between tire manufacturers and PBR suppliers will support long-term supply security and co-developed performance grades.

- Regulatory pressure on emission reduction will push manufacturers to adopt cleaner technologies and energy-efficient processes.

- Growth in industrial and mechanical rubber applications will further diversify PBR demand beyond the automotive industry.