Market Overview

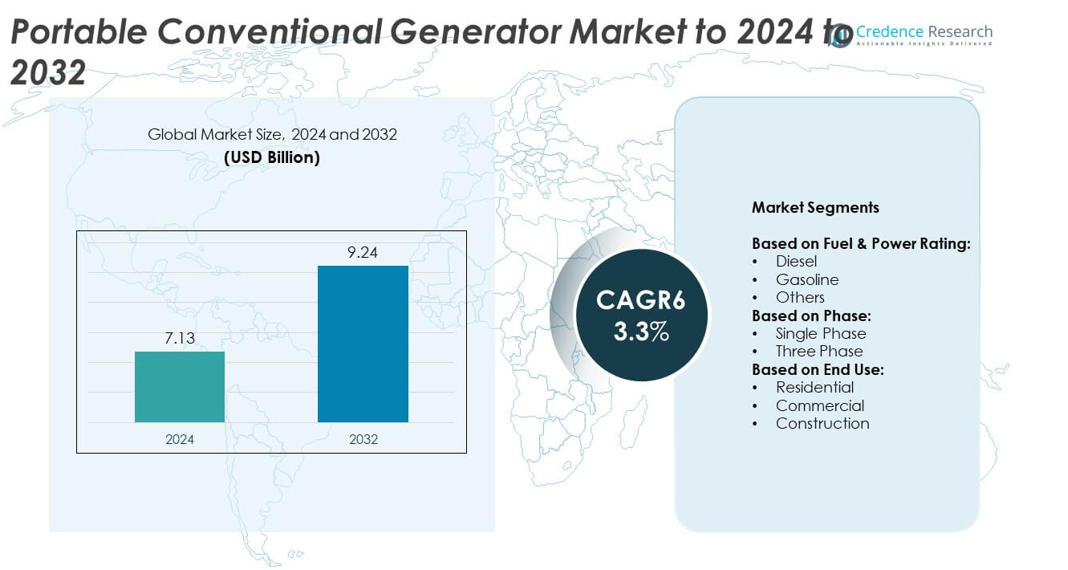

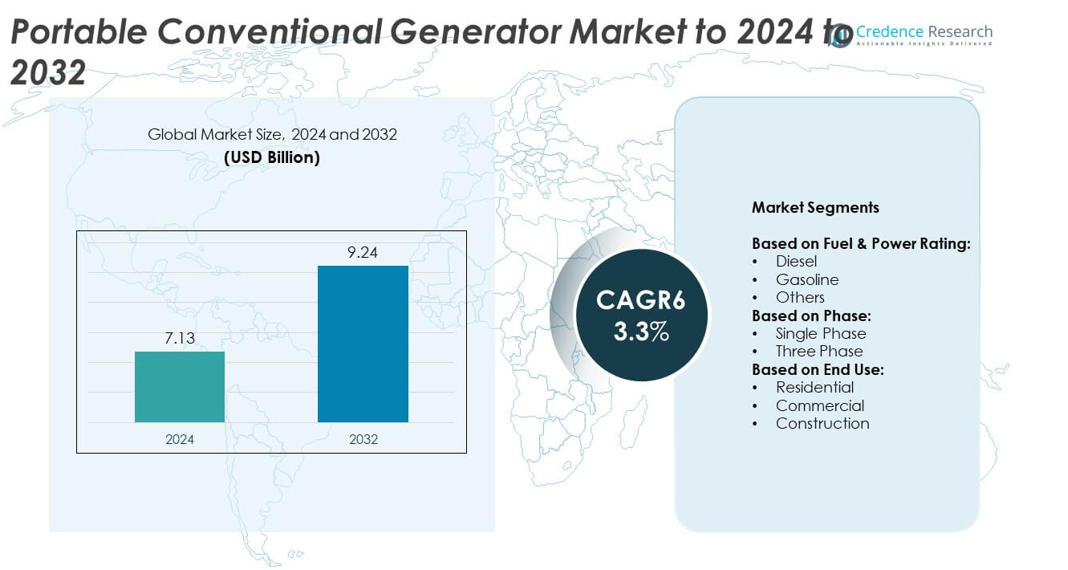

The Portable Conventional Generator Market size was valued at USD 7.13 Billion in 2024 and is anticipated to reach USD 9.24 Billion by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Conventional Generator Market Size 2024 |

USD 7.13 Billion |

| Portable Conventional Generator Market, CAGR |

3.3% |

| Portable Conventional Generator Market Size 2032 |

USD 9.24 Billion |

The Portable Conventional Generator Market is characterized by strong competition among major players such as Yamaha Motor, Cummins, Honda India Power Products, Caterpillar, Generac Power Systems, Kohler, Atlas Copco, and Briggs & Stratton. These companies focus on enhancing fuel efficiency, durability, and compliance with emission standards to strengthen their market position. Product innovations targeting residential, commercial, and construction applications drive their competitiveness. Regionally, Asia Pacific led the global market in 2024 with a 34% share, supported by rapid urbanization, infrastructure expansion, and frequent power shortages. North America followed with 32%, driven by rising demand for backup solutions during weather-related outages. Europe accounted for 24%, supported by stringent efficiency regulations and steady adoption in residential and commercial sectors.

Market Insights

- The Portable Conventional Generator Market was valued at USD 7.13 Billion in 2024 and is projected to reach USD 9.24 Billion by 2032, growing at a CAGR of 3.3%.

- Rising demand for reliable backup power solutions in residential and commercial sectors, coupled with expanding construction activities, is fueling market growth worldwide.

- The market is witnessing a shift toward fuel-efficient and low-emission models, with diesel generators leading by holding over 45% share in 2024 due to durability and load-handling capacity.

- Competition is intense, with global manufacturers focusing on product innovation, regulatory compliance, and strategic partnerships to strengthen presence across residential, commercial, and construction applications.

- Asia Pacific dominated the market with 34% share in 2024, followed by North America at 32% and Europe at 24%, while Latin America and Middle East & Africa contributed 6% and 4% respectively, highlighting strong growth prospects across both developed and emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fuel & Power Rating

Diesel generators dominated the Portable Conventional Generator Market in 2024, accounting for over 45% share. Their popularity is driven by durability, higher fuel efficiency, and ability to handle heavy loads, making them suitable for construction and commercial use. Gasoline units hold a notable share, mainly due to affordability and ease of availability for residential applications. Other fuel-based systems, including natural gas and hybrid models, serve niche needs. Increasing demand for reliable backup power in industrial and urban areas continues to sustain the growth of diesel-powered generators.

- For instance, Caterpillar offers its XQP100 portable diesel generator, featuring a Cat C4.4 engine that delivers 100 kVA (80 kW) prime power at both 50 and 60 Hz.

By Phase

Single-phase portable conventional generators held the leading position in 2024 with nearly 60% market share. They remain widely adopted in residential and small commercial setups because of easy installation, compact design, and cost-effectiveness. Three-phase models cater to larger industrial and construction projects where high power output and efficiency are essential. Rising urbanization and frequent residential power outages sustain single-phase dominance, while ongoing expansion of construction and infrastructure sectors fuels gradual growth of the three-phase segment, particularly in emerging economies requiring higher load capacities.

- For instance, Honda’s EU70is single-phase generator delivers a rated output of 5.5 kVA, making it a benchmark in residential and small commercial applications.

By End Use

The residential segment accounted for the largest share of the Portable Conventional Generator Market in 2024, exceeding 50% share. Growing reliance on home backup solutions during outages, coupled with rising adoption in suburban areas, drives demand. Compact design, portability, and affordable pricing make these generators suitable for households. The commercial segment follows, with applications in small businesses, offices, and healthcare facilities where continuity of operations is crucial. Construction sites also contribute significantly, leveraging generators for remote operations. However, residential demand remains dominant, supported by increasing grid instability and rising consumer awareness of power security.

Key Growth Drivers

Rising Demand for Backup Power Solutions

The increasing frequency of power outages due to aging grid infrastructure and extreme weather events has boosted demand for portable conventional generators. Residential and commercial users prioritize reliable backup systems to ensure uninterrupted operations and daily activities. Growing urbanization, coupled with rising dependence on electrical appliances, has further strengthened the adoption of these generators. This factor serves as the primary growth driver, particularly in developing regions with limited access to stable grid networks.

- For instance, Generac’s annual report for 2023 indicates a net sales figure of approximately $4.02 billion, a 12% decline from 2022, primarily due to a 29% drop in residential product sales. This was partially offset by a 19% growth in Commercial & Industrial product sales during the year.

Expanding Construction and Infrastructure Activities

The surge in global construction and infrastructure projects is significantly driving market growth. Portable conventional generators are widely deployed on job sites for powering equipment, lighting, and temporary offices. Their ease of transport, reliability, and capacity to provide uninterrupted energy supply make them critical assets for remote and large-scale projects. As infrastructure development accelerates in emerging economies, the construction sector continues to generate substantial demand, further strengthening the generator market outlook.

- For instance, the Atlas Copco QEP R series offers portable generators suitable for intensive construction site use, with models providing a range of power outputs. The QEP R12 gasoline generator, delivers 10.1 kVA nominal power at 50 Hz and a rated voltage of 230 V.

Growing Residential Adoption

Rising consumer focus on personal energy security has driven strong adoption of portable generators in households. Consumers increasingly invest in backup systems to manage prolonged outages, especially in suburban and rural areas. Compact design, affordability, and easy operability enhance their appeal for residential use. With the growth of home-based businesses and remote work models, households place greater emphasis on continuous power supply. This segment remains a major driver of market expansion, reinforcing the residential sector’s leadership in generator adoption.

Key Trends & Opportunities

Shift Toward Fuel Efficiency and Low Emissions

Manufacturers are increasingly focusing on developing fuel-efficient and low-emission portable generators to meet stricter environmental regulations. Diesel and gasoline models are being optimized for reduced consumption, longer runtime, and compliance with emission norms. Eco-friendly innovations also support sustainability goals, creating opportunities for companies to differentiate offerings. This trend positions energy-efficient and regulatory-compliant generators as a growing segment, particularly in regions adopting aggressive carbon-reduction policies.

- For instance, Briggs & Stratton introduced its Vanguard EFI portable generator series in 2023, achieving up to 25% lower fuel consumption compared to standard carburetor models.

Adoption in Small Businesses and Healthcare Facilities

Small businesses and healthcare facilities are increasingly investing in portable conventional generators to avoid disruptions in operations. Clinics, retail outlets, and restaurants rely on backup power to sustain services during outages. The healthcare sector, in particular, requires uninterrupted energy for critical equipment, making generators essential. This creates opportunities for targeted marketing and specialized product offerings tailored to institutional needs. The shift underscores expanding adoption beyond residential use, opening new revenue streams for manufacturers.

- For instance, the Hyundai Power Products DHY6000SE portable diesel generator is widely available in Europe and provides reliable power for various applications. Depending on the model variant, its rated continuous output is typically cited as 4.5 kVA or 5.0 kW, with a maximum output of 5.2 kW or 6.5 kVA.

Key Challenges

Stringent Environmental Regulations

Stringent environmental standards regarding emissions pose a significant challenge for portable conventional generator manufacturers. Diesel and gasoline models are under scrutiny due to higher carbon and particulate emissions. Compliance with evolving global and regional regulations requires continuous innovation, driving up R&D costs. Smaller manufacturers often struggle to meet these standards, creating barriers to entry and slowing market growth. This challenge is particularly evident in regions prioritizing sustainability and reducing reliance on fossil-fuel-based equipment.

Availability of Alternative Backup Solutions

The growing adoption of alternative backup solutions such as solar generators, battery storage systems, and inverter technologies threatens market growth. These solutions offer silent operation, lower emissions, and reduced operating costs, making them attractive to eco-conscious consumers. Increasing affordability and technological advances in renewable-powered systems further accelerate this transition. As consumer preferences shift toward sustainable and maintenance-free options, portable conventional generators face competitive pressure, especially in residential markets seeking cleaner power solutions.

Regional Analysis

North America

North America accounted for 32% of the Portable Conventional Generator Market in 2024, driven by strong adoption in residential and commercial sectors. Frequent power outages caused by hurricanes, wildfires, and aging infrastructure have heightened reliance on backup power solutions. The United States leads the region with widespread use across households, construction sites, and small businesses. Demand is also rising in Canada, supported by investments in infrastructure and rural electrification. Increasing emphasis on fuel-efficient models and consumer preference for compact designs further sustain regional growth, reinforcing North America’s leading position in the global market.

Europe

Europe held 24% of the Portable Conventional Generator Market share in 2024, supported by steady demand in residential and small-scale commercial applications. Stringent emission regulations encourage the adoption of advanced and fuel-efficient models, particularly in countries like Germany, France, and the UK. Construction and infrastructure development projects also drive growth, especially in Eastern Europe. However, the region faces competition from renewable-powered backup systems due to strong sustainability goals. Despite this challenge, demand for conventional generators remains stable in areas prone to seasonal weather disruptions and grid reliability issues, ensuring continued market presence across Europe.

Asia Pacific

Asia Pacific dominated the global Portable Conventional Generator Market with a 34% share in 2024, led by high demand in China, India, and Southeast Asia. Rapid urbanization, expanding construction activity, and frequent power shortages contribute to strong adoption across residential and industrial sectors. The affordability and availability of gasoline-powered units make them particularly attractive in price-sensitive markets. Growing investments in infrastructure projects further boost usage in construction sites. While the region is exploring renewable alternatives, conventional generators continue to lead due to their reliability and ease of deployment, maintaining Asia Pacific’s leadership in the global market.

Latin America

Latin America captured 6% of the Portable Conventional Generator Market share in 2024, driven by growing adoption in residential and small commercial applications. Countries such as Brazil and Mexico experience frequent power instability, prompting greater demand for affordable backup solutions. Expansion of infrastructure development also supports usage in construction activities. However, economic fluctuations and slower adoption of advanced fuel-efficient models limit faster market penetration. Despite these challenges, demand continues to rise in rural and suburban areas where access to reliable electricity remains limited, ensuring stable growth for portable conventional generators across the region.

Middle East and Africa

The Middle East and Africa region held 4% of the Portable Conventional Generator Market in 2024, supported by demand from residential, commercial, and construction sectors. Frequent blackouts and underdeveloped grid networks in parts of Africa make generators essential for everyday operations. The Middle East, particularly countries like Saudi Arabia and the UAE, drives demand from construction and infrastructure projects. However, market growth is challenged by the rising preference for renewable energy systems in urbanized regions. Despite this, the need for portable, affordable, and reliable power solutions ensures continued demand in off-grid and developing areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Fuel & Power Rating:

By Phase:

By End Use:

- Residential

- Commercial

- Construction

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Portable Conventional Generator Market is shaped by strong competition among leading players such as Yamaha Motor, HIMOINSA, Cummins, Westinghouse Electric Corporation, Mitsubishi Heavy Industries, Honda India Power Products, Kohler, Atlas Copco, Kirloskar, Wacker Neuson, Briggs & Stratton, YANMAR, Snapper, Caterpillar, Allmand Bros., Generac Power Systems, and Champion Power Equipment. Companies focus on expanding product portfolios with innovations in fuel efficiency, compact design, and compliance with emission standards. Strategic moves such as partnerships, acquisitions, and regional expansions strengthen their global presence. Manufacturers invest heavily in R&D to address consumer demand for reliable and eco-friendly solutions. Emphasis on customization for residential, commercial, and construction applications further differentiates offerings. Intense price competition in emerging economies drives firms to optimize production and distribution networks. The competitive landscape remains highly dynamic, with companies prioritizing sustainability and performance-driven features to capture long-term market share while addressing regulatory pressures and growing demand for backup power solutions.

Key Player Analysis

- Yamaha Motor

- HIMOINSA

- Cummins

- Westinghouse Electric Corporation

- Mitsubishi Heavy Industries

- Honda India Power Products

- Kohler

- Atlas Copco

- Kirloskar

- Wacker Neuson

- Briggs & Stratton

- YANMAR

- Snapper

- Caterpillar

- Allmand Bros.

- Generac Power Systems

- Champion Power Equipment

Recent Developments

- In 2024, Champion Power Equipment Introduced the all-new 22 kW Home Standby generator, designed to automatically handle whole-house power demands during outages.

- In 2023, Generac Unveiled its GP7500E Dual Fuel portable generator, designed to handle a wide range of tasks for residential use with 9,400 starting watts and 7,500 running watts.

- In 2023,Yamaha Delivered portable power generators to Ukraine to assist with power outages and provide electricity during the winter.

Report Coverage

The research report offers an in-depth analysis based on Fuel & Power Rating, Phase, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by rising demand for backup power.

- Diesel generators will remain dominant due to durability and higher efficiency.

- Residential users will continue driving demand for compact and portable models.

- Construction projects will fuel adoption in developing economies.

- Manufacturers will focus on fuel-efficient and low-emission designs.

- Asia Pacific will sustain leadership with strong infrastructure and residential demand.

- North America will expand adoption due to frequent weather-related outages.

- Competition from solar and battery storage solutions will intensify.

- Stricter emission regulations will push innovation in generator technologies.

- Emerging markets in Africa and Latin America will offer untapped growth opportunities.