| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prefilled Syringes MarketSize 2024 |

USD 9,049.40 Million |

| Prefilled Syringes Market, CAGR |

9.01% |

| Prefilled Syringes Market Size 2032 |

USD 18,018.87 Million |

Market Overview

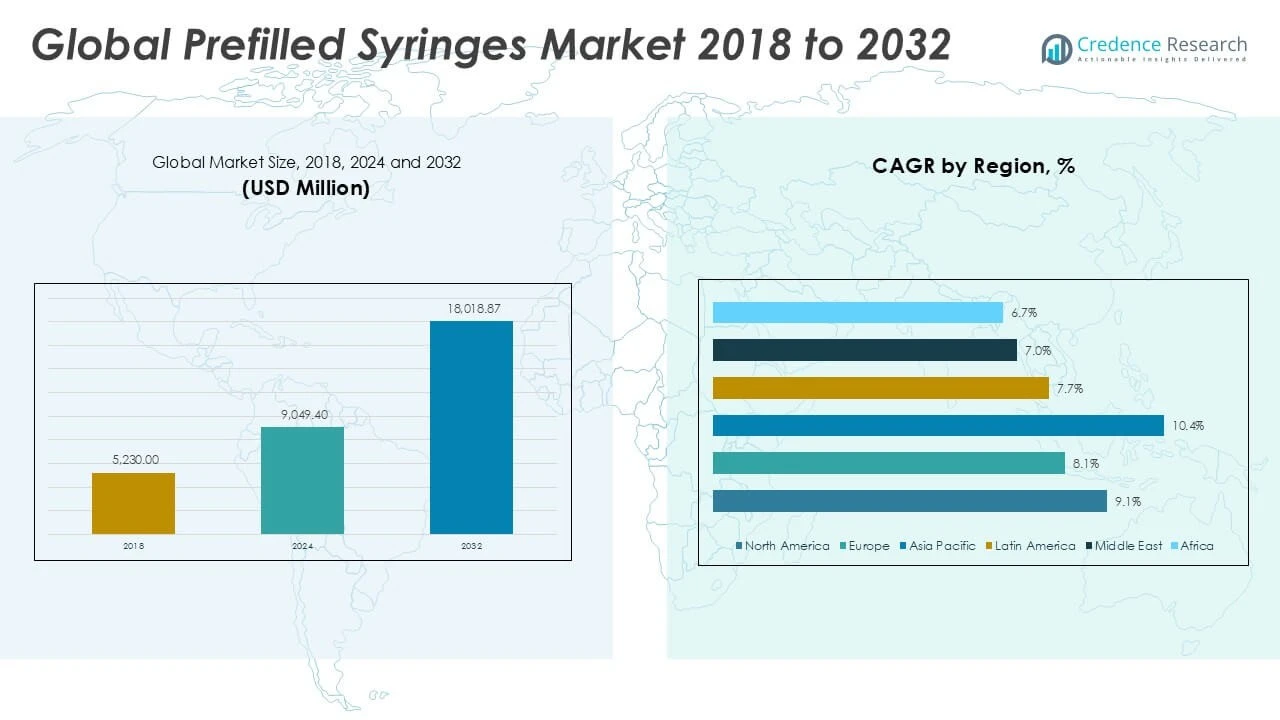

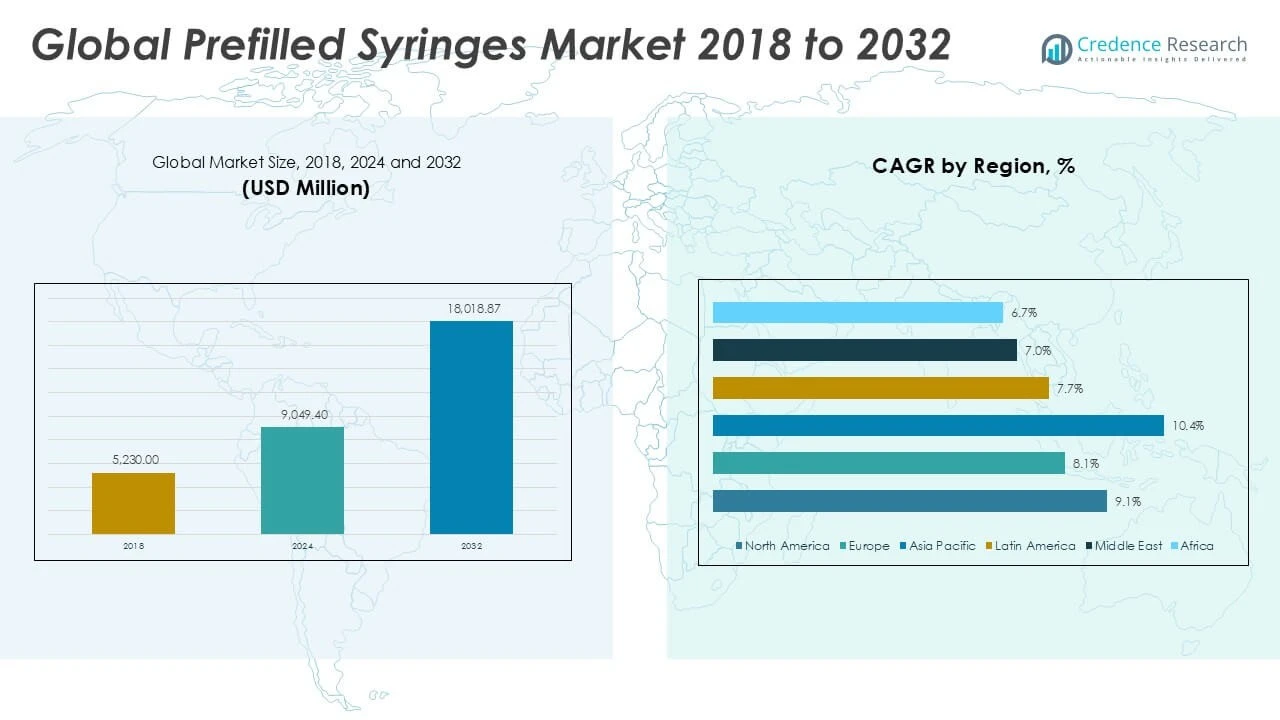

Prefilled Syringes Market size was valued at USD 5,230.00 million in 2018 to USD 9,049.40 million in 2024 and is anticipated to reach USD 18,018.87 million by 2032, at a CAGR of 9.01% during the forecast period.

The Prefilled Syringes Market is experiencing strong growth driven by the rising adoption of self-administration and home healthcare solutions, which enhance patient convenience and safety. The increasing prevalence of chronic diseases such as diabetes and autoimmune disorders has led to a greater demand for efficient and ready-to-use drug delivery systems. Stringent regulations promoting the use of single-use and sterile medical devices to minimize the risk of infections further support market expansion. Pharmaceutical companies are investing in advanced manufacturing technologies and developing innovative materials, such as polymer-based syringes, to improve product safety and compatibility. In addition, the market is witnessing a shift toward biologics and biosimilars, which require specialized prefilled syringes for accurate dosing. As healthcare providers focus on reducing medication errors and enhancing operational efficiency, the adoption of prefilled syringes continues to increase globally, establishing them as a preferred choice in modern drug delivery practices.

The Prefilled Syringes Market demonstrates strong growth across major regions, including North America, Europe, and Asia Pacific, each contributing significantly to the market’s expansion. North America and Europe benefit from advanced healthcare systems, rapid adoption of innovative drug delivery solutions, and a high prevalence of chronic diseases that drive demand for prefilled syringes. Asia Pacific is experiencing accelerated growth due to rising healthcare investments, expanding patient populations, and large-scale immunization programs, especially in countries such as China, Japan, and India. Key players shaping the competitive landscape of the Prefilled Syringes Market include Becton, Dickinson and Company (BD), Gerresheimer AG, and Schott AG, each recognized for their robust product portfolios and global reach. These companies invest in research, technology, and strategic partnerships to maintain their leadership, driving the continuous development and commercialization of safe, high-quality prefilled syringes worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Prefilled Syringes Market was valued at USD 9,049.40 million in 2024 and is projected to reach USD 18,018.87 million by 2032, registering a CAGR of 9.01% during the forecast period.

- Rising demand for convenient, safe, and accurate drug delivery methods is fueling market expansion across both developed and emerging healthcare markets.

- The market is witnessing significant adoption of polymer-based prefilled syringes and patient-centric designs, responding to evolving safety standards and end-user needs.

- Becton, Dickinson and Company (BD), Gerresheimer AG, and Schott AG lead the competitive landscape, leveraging strong portfolios, global distribution, and continuous innovation to maintain market dominance.

- Stringent regulatory requirements, high production costs, and challenges related to material compatibility with sensitive drugs act as barriers to market entry for new players and may slow overall growth.

- North America, Europe, and Asia Pacific are the most prominent regions for market growth, with Asia Pacific exhibiting the fastest expansion due to growing healthcare investments and large-scale immunization initiatives.

- The market benefits from trends in biologic and biosimilar drugs, government vaccination programs, and a global shift toward home-based care, positioning prefilled syringes as a preferred drug delivery solution across various medical applications.

Market Drivers

Rising Demand for Self-Administration and Home Healthcare Drives Adoption

The shift toward self-administration and home healthcare is a significant driver for the Prefilled Syringes Market. Patients and healthcare providers prefer convenient, ready-to-use devices that support at-home treatment, reducing dependency on clinical visits. Prefilled syringes offer ease of use, which benefits those managing chronic conditions and elderly patients. These devices lower the risk of dosing errors and contamination, improving patient outcomes. Healthcare systems worldwide recognize the value of empowering patients to self-administer medication safely. Growing emphasis on reducing hospital stays and healthcare costs also fuels the transition to home-based therapies. Prefilled syringes support this trend by providing accurate dosing and minimizing preparation time.

For instance, the global market for prefilled syringes is projected to reach $13.3 billion by 2030, driven by increasing adoption of self-administration and expansion in home healthcare.

Rising Prevalence of Chronic Diseases Accelerates Market Expansion

Increasing rates of chronic diseases such as diabetes, cancer, and autoimmune disorders continue to accelerate the growth of the Prefilled Syringes Market. These conditions require regular and often lifelong medication administration, making efficient drug delivery crucial. Prefilled syringes address this need by offering a reliable and sterile method for frequent dosing. The global burden of chronic illnesses pushes pharmaceutical companies to develop advanced injectable therapies packaged in prefilled formats. The convenience and safety of prefilled syringes appeal to both patients and caregivers. Rapid urbanization and changing lifestyles contribute to a higher incidence of these diseases. This shift supports long-term growth for the market.

For instance, diabetes alone affects over 77 million people in India, driving demand for injectable medications.

Stringent Regulatory Standards Promote Safe and Sterile Drug Delivery

Governments and regulatory bodies enforce strict guidelines on single-use medical devices to ensure patient safety and infection control. The Prefilled Syringes Market benefits from these standards, which encourage the adoption of sterile, ready-to-inject solutions over traditional vials and ampoules. Regulatory initiatives emphasize reducing healthcare-associated infections and medication errors. Pharmaceutical manufacturers respond by investing in quality control and advanced sterilization technologies. Compliance with these regulations enhances product reliability and boosts market confidence. Healthcare providers align with these standards to maintain best practices in medication delivery. Prefilled syringes fit these evolving expectations by providing consistent sterility and ease of use.

Innovations in Material Science and Drug Formulations Support Market Growth

Advancements in material science and drug formulations contribute to the strong growth trajectory of the Prefilled Syringes Market. Manufacturers introduce polymer-based syringes that offer improved compatibility with sensitive biologic drugs, reducing risks of interaction and breakage. Innovations in needle technology and drug stability further enhance product performance. Pharmaceutical companies invest in new formulations that require specialized prefilled syringe packaging. These developments address challenges posed by complex and high-value biologic therapies. The focus on delivering precise, contamination-free doses supports the adoption of prefilled solutions. Ongoing research and development ensure the market remains agile and responsive to emerging healthcare needs.

Market Trends

Expansion of Biologic and Biosimilar Drugs Elevates Demand for Advanced Syringes

The rise in biologic and biosimilar drug approvals has emerged as a defining trend in the Prefilled Syringes Market. Pharmaceutical manufacturers require prefilled syringes capable of handling sensitive formulations with strict dosing accuracy. It supports the growing adoption of injectable biologics for oncology, diabetes, and autoimmune diseases. Pharmaceutical companies collaborate with device manufacturers to design syringes that maintain drug stability and reduce the risk of contamination. This focus on specialized packaging fuels innovation and drives premiumization in the market. Healthcare providers choose prefilled syringes to ensure precise delivery and patient safety. The trend continues to push market participants toward more advanced, custom-engineered solutions.

For instance, the increasing adoption of biologic and biosimilar drugs for complex diseases like cancer and autoimmune disorders has fueled the need for easy-to-use delivery systems.

Polymer-Based Prefilled Syringes Gain Traction over Traditional Glass

Transition from glass to polymer-based prefilled syringes is accelerating in the Prefilled Syringes Market. Polymer materials offer improved break resistance, enhanced drug compatibility, and lower risk of particulate contamination. It enables pharmaceutical companies to address safety and stability concerns linked to sensitive formulations. Polymer syringes support evolving needs for lightweight, shatterproof packaging and easier transport. Manufacturers invest in developing innovative polymers that extend shelf life and maintain drug purity. The shift benefits stakeholders by reducing wastage and ensuring consistent product performance. This material transition sets the stage for broader adoption of polymer-based delivery devices.

For instance, cyclic olefin copolymer (COC) and cyclic olefin polymer (COP) syringes are gaining popularity due to their superior drug stability and reduced contamination risks.

Emphasis on Patient-Centric Designs and Needle Safety Technology

Patient-centric product designs are shaping trends in the Prefilled Syringes Market. Companies integrate ergonomic features and needle safety mechanisms to minimize user discomfort and needlestick injuries. It addresses the growing demand for safer self-administration tools among patients with chronic conditions. Regulatory agencies prioritize devices that promote safety and simplify handling, prompting manufacturers to upgrade design standards. Needle shield technology and intuitive mechanisms improve the injection experience and boost compliance. Focus on end-user needs drives continuous improvement in device design and functionality. This trend highlights the industry’s commitment to advancing patient safety and usability.

Sustainability Initiatives and Eco-Friendly Packaging Solutions

Environmental sustainability is influencing product development in the Prefilled Syringes Market. Companies pursue eco-friendly packaging and manufacturing methods to reduce waste and environmental impact. It includes developing recyclable components, reducing material usage, and minimizing carbon footprints during production. Healthcare providers and pharmaceutical firms align purchasing decisions with green initiatives. The trend motivates the adoption of biodegradable materials and energy-efficient processes across the supply chain. Corporate social responsibility drives investment in sustainable innovation. This shift positions the market to meet regulatory expectations and consumer demand for environmentally responsible solutions.

Market Challenges Analysis

Complex Manufacturing and Stringent Regulatory Requirements Hinder Growth

The Prefilled Syringes Market faces notable challenges due to the complexity of manufacturing processes and strict regulatory requirements. Production of prefilled syringes demands advanced technology and rigorous quality control to ensure product sterility, precision, and compatibility with diverse drug formulations. It must meet varying international standards for safety, which requires significant investment in compliance, testing, and validation. Regulatory changes can lead to delays in product launches or require costly adaptations to manufacturing lines. Smaller manufacturers may struggle to keep pace with evolving guidelines, creating barriers to market entry. These obstacles can slow innovation and limit the availability of new products in global markets.

For instance, compliance with FDA, EMA, and ISO standards requires rigorous testing and validation, increasing production costs.

Material Compatibility Issues and Supply Chain Disruptions Affect Market Stability

Material compatibility remains a persistent challenge in the Prefilled Syringes Market, particularly for biologics and sensitive drug compounds. Glass syringes may react with certain medications, leading to contamination or loss of drug efficacy. It prompts the need for continuous research and adoption of alternative materials, such as advanced polymers, to address these concerns. Disruptions in global supply chains, including shortages of raw materials and logistical delays, can hinder consistent production and delivery. Manufacturers must manage complex supplier networks and adapt to volatile market conditions. These challenges impact product availability and can increase operational costs, affecting overall market stability.

Market Opportunities

Expansion in Emerging Healthcare Markets Offers Significant Growth Potential

Rising healthcare investments in emerging economies create strong opportunities for the Prefilled Syringes Market. Governments and private organizations focus on expanding access to advanced medical treatments, which drives demand for innovative drug delivery solutions. It benefits from the increasing prevalence of chronic diseases and a growing patient population in countries across Asia-Pacific, Latin America, and the Middle East. Rapid improvements in healthcare infrastructure and awareness about infection control further accelerate market adoption. Pharmaceutical companies can tap into these regions by forming strategic partnerships and establishing local manufacturing facilities. Tailoring products to meet specific regional needs unlocks new revenue streams and strengthens market presence.

Technological Advancements and Innovation in Drug Delivery Solutions Drive Market Expansion

Continuous advancements in drug delivery technologies present significant opportunities for the Prefilled Syringes Market. Companies invest in research and development to create syringes with improved safety features, enhanced compatibility with biologics, and greater user convenience. It responds to the demand for precision dosing, self-administration, and patient-centric solutions. Growth in biologics and biosimilars further fuels the need for specialized prefilled devices. Development of sustainable materials and smart syringes with integrated digital monitoring capabilities opens new avenues for market differentiation. Manufacturers that embrace innovation position themselves to capture evolving healthcare needs and regulatory expectations.

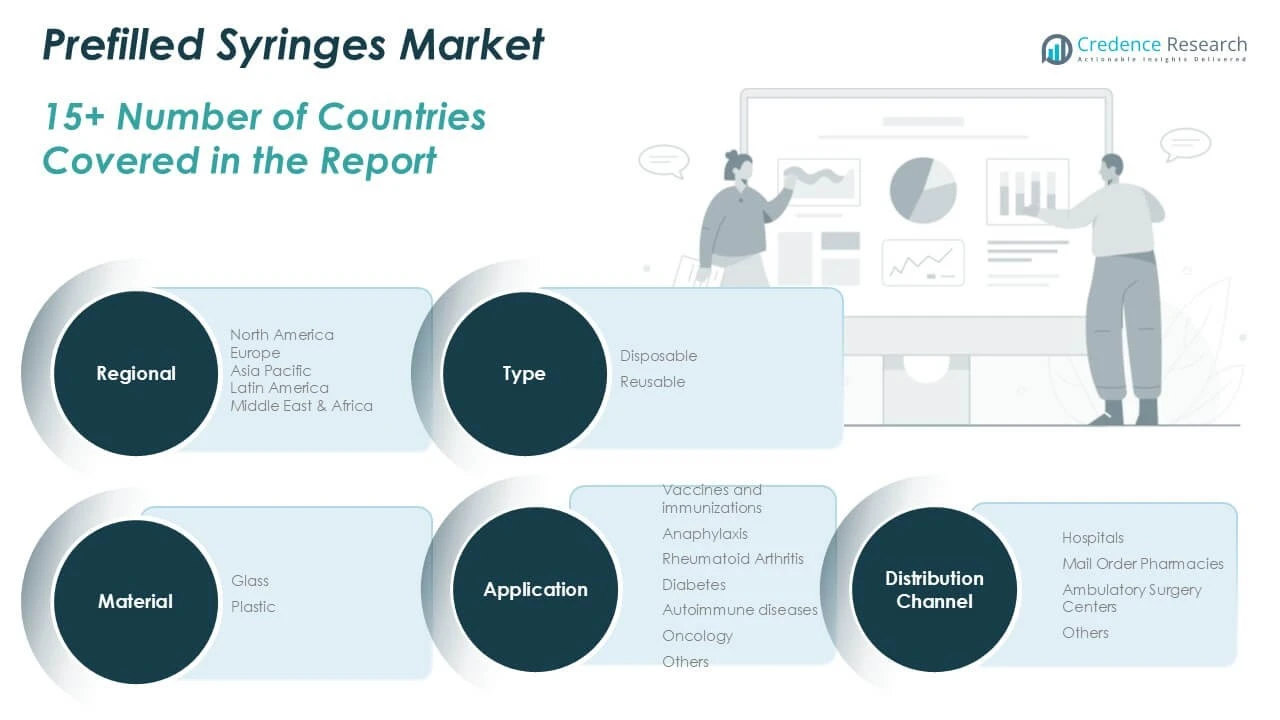

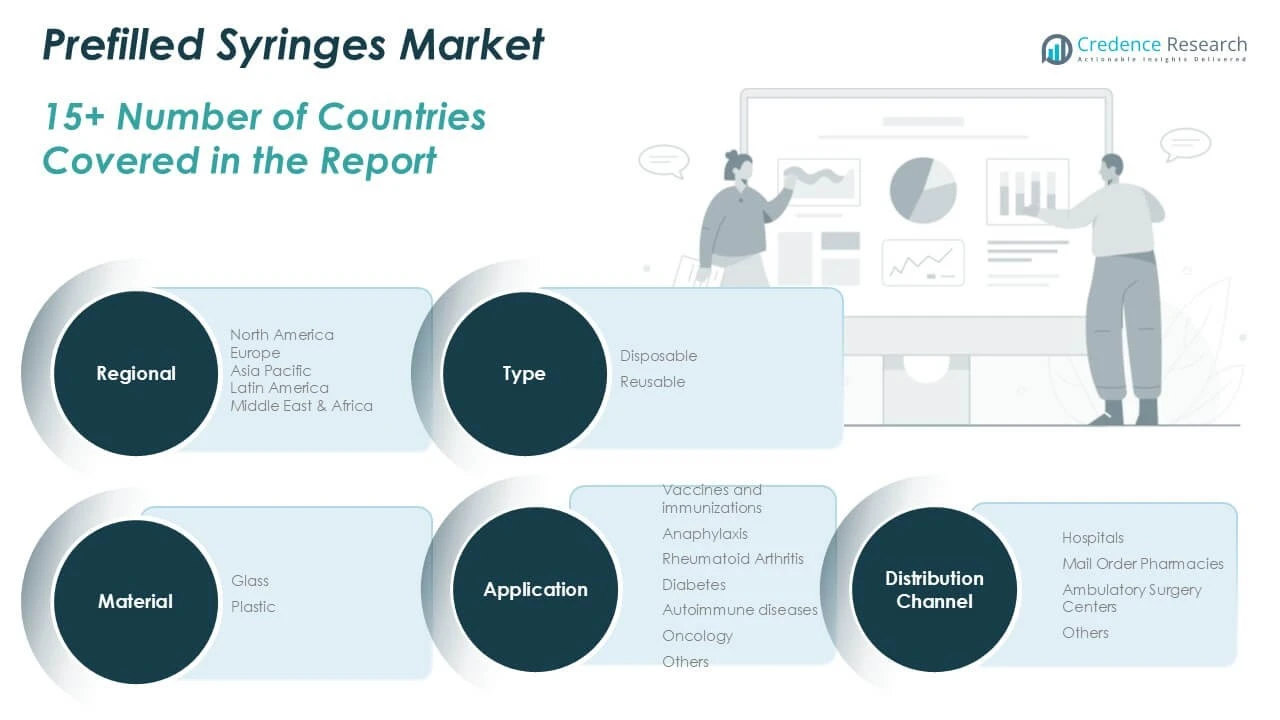

Market Segmentation Analysis:

By Type:

The Prefilled Syringes Market is segmented by type into disposable and reusable syringes. Disposable prefilled syringes dominate the market due to their widespread use in single-dose applications and their ability to minimize the risk of contamination and cross-infection. Healthcare providers favor disposable options for their convenience, safety, and regulatory compliance, particularly in high-volume vaccination programs and emergency settings. Reusable prefilled syringes, while representing a smaller share, serve specialized clinical needs where repeated dosing is required under controlled conditions.

By Application:

The Prefilled Syringes Market covers vaccines and immunizations, anaphylaxis, rheumatoid arthritis, diabetes, autoimmune diseases, oncology, and others. Vaccines and immunizations represent a major segment, reflecting the global emphasis on mass immunization campaigns and routine vaccination programs. Prefilled syringes offer healthcare professionals precise dosing and rapid administration, making them essential during outbreaks or large-scale preventive efforts. The anaphylaxis segment benefits from the need for fast, reliable delivery of life-saving medications, positioning prefilled syringes as a preferred solution in emergency care. Rheumatoid arthritis, diabetes, and autoimmune diseases drive further demand for these devices, as patients require regular, self-administered injectable therapies that are both user-friendly and reliable. Oncology applications continue to grow as targeted and biologic drugs increasingly require prefilled syringes for stability and ease of use.

By Material:

The Prefilled Syringes Market divides by material into glass and plastic. Glass prefilled syringes hold a significant share due to their longstanding compatibility with a wide range of drugs and established use in pharmaceutical manufacturing. It offers excellent barrier properties and chemical stability, making glass the material of choice for sensitive medications and biologics. Plastic prefilled syringes, however, are gaining ground as manufacturers seek lightweight, break-resistant alternatives suitable for newer drug formulations. The flexibility of plastic materials enables the design of innovative features that enhance user safety and product durability. The shift toward polymer-based solutions continues as healthcare providers and pharmaceutical companies pursue safer and more versatile drug delivery systems.

Segments:

Based on Type:

Based on Application:

- Vaccines and Immunizations

- Anaphylaxis

- Rheumatoid Arthritis

- Diabetes

- Autoimmune Diseases

- Oncology

- Others

Based on Material:

Based on Distribution Channel:

- Hospitals

- Mail Order Pharmacies

- Ambulatory Surgery Centers

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Prefilled Syringes Market

North America Prefilled Syringes Market grew from USD 1,710.73 million in 2018 to USD 2,925.90 million in 2024 and is projected to reach USD 5,853.88 million by 2032, reflecting a compound annual growth rate (CAGR) of 9.1%. North America is holding a 32% market share. The United States leads regional demand, supported by strong adoption of advanced drug delivery systems and a high prevalence of chronic diseases. Canada contributes to the region’s growth through expanded vaccination programs and robust pharmaceutical investments. Strategic partnerships between healthcare providers and leading manufacturers further support market expansion. North American healthcare regulations prioritize patient safety, which accelerates the shift to prefilled and single-use devices. Innovation and the growing presence of biosimilars support ongoing demand.

Europe Prefilled Syringes Market

Europe Prefilled Syringes Market grew from USD 1,376.54 million in 2018 to USD 2,289.25 million in 2024 and is projected to reach USD 4,269.98 million by 2032, reflecting a CAGR of 8.1%. Europe holds a 24% market share. Germany, France, and the United Kingdom are the key countries driving growth through investments in pharmaceutical research and universal healthcare access. The region has seen rising demand for self-administration and home-based care. Strict regulatory standards emphasize product quality and encourage the use of safe, ready-to-use drug delivery systems. Expansion of biologic and biosimilar drugs further elevates market potential across Europe. Cross-border collaborations and research consortia enable rapid adoption of innovative solutions.

Asia Pacific Prefilled Syringes Market

Asia Pacific Prefilled Syringes Market grew from USD 1,435.64 million in 2018 to USD 2,606.00 million in 2024 and is projected to reach USD 5,741.08 million by 2032, registering the highest CAGR of 10.4%. Asia Pacific holds a 32% market share. China, Japan, and India remain leading contributors due to growing healthcare investments, an expanding patient base, and increased chronic disease incidence. The region benefits from government vaccination initiatives and public health campaigns. Pharmaceutical manufacturing is rapidly advancing, boosting both domestic supply and export capacity. Regulatory bodies support market entry by streamlining approval processes for prefilled devices. Local partnerships and rising awareness about infection control fuel ongoing growth.

Latin America Prefilled Syringes Market

Latin America Prefilled Syringes Market grew from USD 319.03 million in 2018 to USD 546.69 million in 2024 and is projected to reach USD 991.97 million by 2032, with a CAGR of 7.7%. Latin America holds a 6% market share. Brazil and Mexico lead regional demand, backed by expanding healthcare coverage and public immunization programs. Growing investments in hospital infrastructure and rising awareness about safe drug administration support wider adoption. Import dependence remains high, but regional manufacturers are increasing production capacity. Improvements in regulatory standards enhance product quality and patient safety. Cross-border collaborations promote access to innovative technologies.

Middle East Prefilled Syringes Market

Middle East Prefilled Syringes Market grew from USD 165.27 million in 2018 to USD 264.18 million in 2024 and is projected to reach USD 453.96 million by 2032, reflecting a CAGR of 7.0%. The Middle East holds a 3% market share. The United Arab Emirates and Saudi Arabia are key growth engines, investing in healthcare modernization and public vaccination drives. Government initiatives focus on infection control and chronic disease management. Local distributors work with multinational pharmaceutical companies to improve access to advanced drug delivery systems. Market players prioritize training and awareness campaigns for healthcare professionals. Expanding insurance coverage supports demand for safe and reliable injection solutions.

Africa Prefilled Syringes Market

Africa Prefilled Syringes Market grew from USD 222.80 million in 2018 to USD 417.37 million in 2024 and is projected to reach USD 707.99 million by 2032, achieving a CAGR of 6.7%. Africa holds a 4% market share. South Africa, Egypt, and Nigeria are the primary markets, supported by ongoing improvements in healthcare access and immunization programs. International health organizations partner with governments to supply essential prefilled syringes for vaccines and critical care drugs. Local challenges include infrastructure gaps and affordability constraints. International donor programs help bridge supply gaps and introduce quality standards. The market is expanding steadily with increased focus on public health and infection prevention.

Key Player Analysis

- Becton, Dickinson and Company (BD)

- Gerresheimer AG

- Schott AG

- Baxter International Inc.

- Cardinal Health, Inc.

- Terumo Corporation

- West Pharmaceutical Services, Inc.

- Nipro Corporation

- SGD Pharma

- Stevanato Group

- Medtronic plc

- Fresenius Kabi AG

- Braun Melsungen AG

- ARaymondlife SAS

Competitive Analysis

The Prefilled Syringes Market is highly competitive, with several global players driving innovation and market expansion. Leading companies such as Becton, Dickinson and Company (BD), Gerresheimer AG, Schott AG, Baxter International Inc., Cardinal Health, Inc., Terumo Corporation, and West Pharmaceutical Services, Inc. dominate the landscape with robust product portfolios and extensive distribution networks. These companies focus on advancing syringe technology, improving material compatibility, and ensuring the highest standards of product safety and sterility. Strategic investments in research and development allow these players to introduce new solutions tailored to the needs of both biologic and traditional drug formulations. They form partnerships with pharmaceutical manufacturers to support large-scale vaccination and chronic disease management programs. Competitive advantages include strong brand recognition, global presence, and an ability to scale manufacturing capacity rapidly in response to surges in demand. The market also witnesses ongoing consolidation through mergers, acquisitions, and collaborations, which help leading firms enhance their capabilities and address regulatory requirements efficiently. By consistently investing in quality and innovation, these companies sustain their leadership positions and shape the future trajectory of the prefilled syringes industry.

Recent Developments

- In January 2025, SCHOTT Pharma (Germany) introduced the next generation of SCHOTT TOPPAC infuse polymer syringes, enhancing safety, efficiency, and sustainability in healthcare. The system consisted of a new tamper-evident cap, a functional label with RFID integration for inventory management, and carton packaging that eliminates traditional blister packs, reducing waste. This innovative design streamlines hospital workflows, minimizes medication errors, and ensures drug stability.

- In December 2024, Baxter (US) launched five new injectable products thereby expanding its pharmaceuticals portfolio in the US. Regadenoson Injection pre-filled syringe is one of the five new injectables, available in 0.4 mg/5 mL strength. It is a ready-to-use formulation that enhances convenience for healthcare professionals by reducing preparation steps and potential errors.

- In November 2024, Amsino International Inc. (US) acquired MedXL Inc. (Canada) and Liebel-Flarsheim Canada Inc., expanding its North American manufacturing capabilities and doubling production capacity. This acquisition enhances Amsino’s product portfolio with MedXL’s Praxiject and CitraFlow prefilled syringes.

- In December 2024, Owen Mumford Ltd. (UK) and Nipro (Japan) signed an agreement for the distribution UniSafe, in Japan. This adoption is attributed to UniSafe’s strong reputation for ease of use, springless features, and passive safety design that ensures reliability, intuitive handling, and needlestick injury prevention.

Market Concentration & Characteristics

The Prefilled Syringes Market demonstrates moderate to high concentration, with a few multinational corporations holding a significant share due to their established manufacturing capabilities, broad product lines, and global distribution networks. It is characterized by a strong emphasis on technological innovation, regulatory compliance, and stringent quality standards to meet the needs of pharmaceutical partners and healthcare providers. Market participants invest heavily in research and development to enhance syringe safety, material compatibility, and user convenience, while addressing the evolving demands of biologic and specialty drugs. The market’s structure favors companies with the scale and resources to adapt to rapidly changing regulatory environments and supply chain challenges. High barriers to entry, driven by capital investment requirements and strict regulatory approval processes, further consolidate the market around established players. Continuous product innovation and the integration of advanced features define the market’s competitive landscape and support its steady growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to grow significantly, driven by the increasing demand for safe and efficient drug delivery systems.

- The rising prevalence of chronic diseases such as diabetes and rheumatoid arthritis is expected to boost the adoption of prefilled syringes.

- Technological advancements, including the development of dual-chamber and safety-engineered syringes, are anticipated to enhance market growth.

- The shift towards self-administration of injectable drugs is likely to increase the demand for user-friendly prefilled syringe designs.

- The growing use of biologics and biosimilars necessitates the use of prefilled syringes for accurate dosing and improved patient compliance.

- Regulatory support for single-use and sterile medical devices is expected to favor the expansion of the prefilled syringes market.

- Emerging markets in Asia-Pacific and Latin America are projected to offer substantial growth opportunities due to improving healthcare infrastructure.

- The adoption of eco-friendly materials and sustainable manufacturing practices is anticipated to become a significant trend in the market.

- Collaborations between pharmaceutical companies and device manufacturers are likely to drive innovation and product development.

- Challenges such as high production costs and stringent regulatory requirements may impact market growth, but ongoing research and development efforts aim to address these issues.