Market Overview

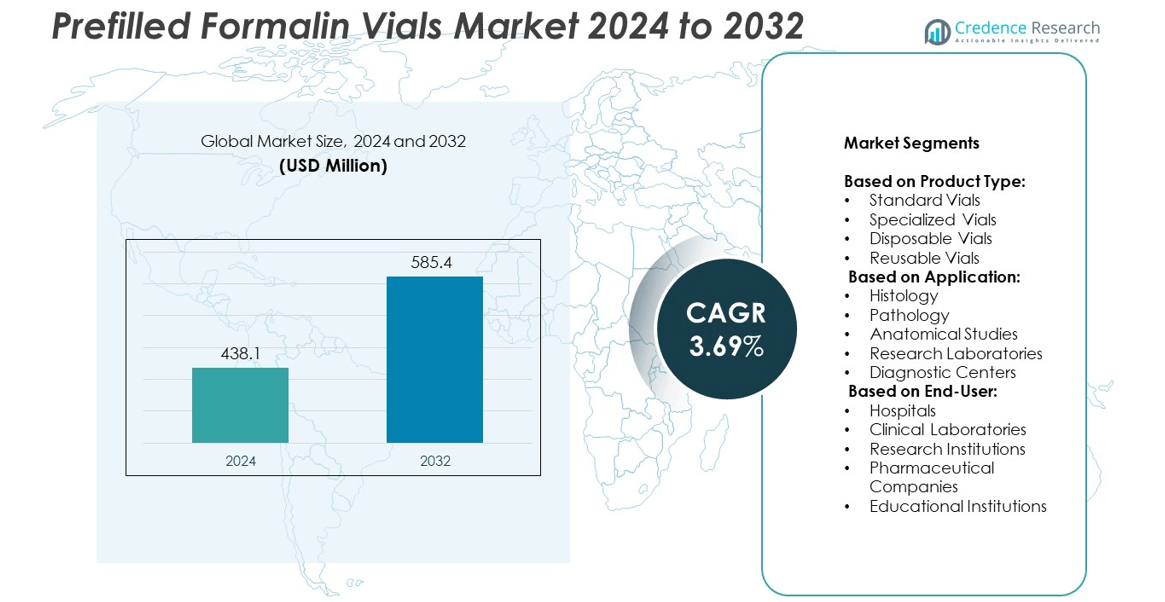

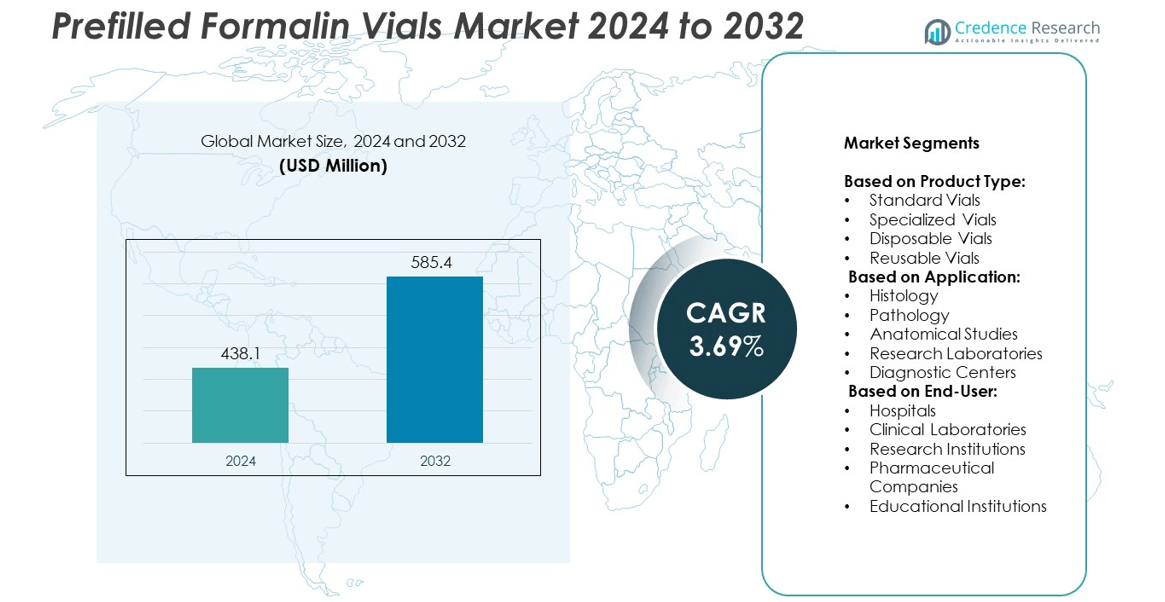

Prefilled Formalin Vials Market size was valued at USD 438.1 million in 2024 and is anticipated to reach USD 585.4 million by 2032, at a CAGR of 3.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prefilled Formalin Vials Market Size 2024 |

USD 438.1 million |

| Prefilled Formalin Vials Market, CAGR |

3.69% |

| Prefilled Formalin Vials Market Size 2032 |

USD 585.4 million |

The Prefilled Formalin Vials market is driven by rising demand for standardized specimen preservation, stricter regulatory compliance, and heightened focus on safety in handling hazardous chemicals. Hospitals, diagnostic centers, and research institutions adopt prefilled formats to reduce errors, improve workflow efficiency, and ensure reliable test outcomes. The trend toward automation in laboratories further supports the need for consistent, ready-to-use solutions. Growing emphasis on eco-friendly packaging and sustainable materials shapes product innovation, while expanding healthcare infrastructure in emerging regions accelerates adoption.

The Prefilled Formalin Vials market demonstrates strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, supported by expanding healthcare infrastructure and rising demand for safer specimen preservation. North America and Europe benefit from advanced laboratory networks and stringent safety regulations, while Asia-Pacific shows rapid growth with increasing hospital and diagnostic capacities. Key players driving the market include Medline Industries Inc., Leica Microsystems (Danaher Corporation), Diapath S.p.A., and Cardinal Health Inc., each focusing on innovation and distribution strength.

Market Insights

- The Prefilled Formalin Vials market was valued at 438.1 million in 2024 and is projected to reach 585.4 million by 2032, growing at a CAGR of 3.69%.

- Growing demand for standardized specimen preservation and compliance with strict safety regulations drives consistent adoption across hospitals, laboratories, and research institutions.

- Rising emphasis on automation in diagnostic processes encourages the use of prefilled vials compatible with advanced laboratory equipment.

- Competitive dynamics are shaped by global players such as Medline Industries Inc., Leica Microsystems, Diapath S.p.A., and Cardinal Health Inc., alongside regional firms offering specialized solutions.

- Health and safety concerns related to formalin exposure, along with cost pressures in resource-limited regions, act as restraints limiting broader adoption.

- North America leads with well-established healthcare infrastructure, Europe advances through eco-friendly product innovation, and Asia-Pacific grows rapidly with expanding hospital and diagnostic networks.

- Latin America and the Middle East & Africa show gradual progress supported by rising healthcare investments and adoption in academic and research institutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Standardization in Sample Preservation

The Prefilled Formalin Vials market benefits from the increasing requirement for standardized specimen preservation across diagnostic and research facilities. Laboratories seek consistency in fixation processes to avoid variability in test outcomes. Prefilled vials minimize manual errors by providing exact formalin volumes, ensuring reliable results. Hospitals and diagnostic centers adopt it to maintain compliance with regulatory guidelines. Growing concerns regarding sample integrity reinforce this shift. Standardization enhances operational efficiency and supports high-quality pathology and histology services.

- For instance, Azer Scientific offers prefilled 7 mL polypropylene vials that come with exactly 5 mL of 10% neutral buffered formalin, reducing preparation errors at collection sites

Growing Emphasis on Safety and Compliance in Healthcare

The Prefilled Formalin Vials market experiences strong growth due to heightened focus on safety and compliance in handling hazardous chemicals. Formalin is toxic, and its manual preparation exposes healthcare workers to risks. Prefilled vials reduce direct contact, lowering occupational hazards. Regulatory bodies promote safer handling methods, prompting wider adoption. It provides controlled packaging that aligns with occupational safety standards. The emphasis on worker safety continues to shape procurement decisions. Compliance-driven demand strengthens the market presence across hospitals and laboratories.

- For instance, Caplugs Evergreen History™ prefilled vials are statically tested to withstand up to 95 kPa of pressure—ensuring leak resistance and safe specimen transport in regulated environments

Expanding Applications in Research and Academic Institutions

The Prefilled Formalin Vials market gains momentum from rising adoption in research institutions and universities. Academic centers increasingly rely on fixed tissue samples for experimental and educational purposes. Prefilled vials offer convenience and consistency in preserving specimens for long-term studies. It supports diverse applications in anatomical research and advanced laboratory work. The availability of varied vial sizes helps institutions manage different study requirements. Reliable sample preservation methods remain essential for maintaining research credibility. Broader use across research ecosystems enhances growth prospects.

Rising Healthcare Infrastructure and Diagnostic Expansion

The Prefilled Formalin Vials market advances with global expansion of healthcare infrastructure and diagnostic facilities. Emerging economies invest heavily in laboratory capacity and pathology networks. These expansions demand reliable tools for specimen fixation, driving consistent consumption of prefilled vials. It serves the rising number of diagnostic centers focusing on timely disease detection. Growing patient volumes require efficient sample handling methods, reinforcing adoption. The alignment of infrastructure development with laboratory demand sustains market momentum. Increasing healthcare access continues to generate new opportunities for market players.

Market Trends

Adoption of Ready-to-Use Packaging Solutions

The Prefilled Formalin Vials market shows a clear trend toward ready-to-use packaging that simplifies laboratory workflows. Laboratories and diagnostic centers prioritize solutions that reduce preparation time and eliminate the risk of handling errors. Prefilled formats provide consistent concentration levels, improving reliability in testing. It helps streamline operations, particularly in high-volume pathology labs. The preference for user-friendly designs continues to shape product development strategies. Manufacturers focus on innovative packaging that enhances safety and convenience.

- For instance, Richard‑Allan Scientific supplies prefilled 20 mL vials of 10% neutral buffered formalin in cases of 192 units—offering repeatable supply at scale for high-use academic labs

Integration of Automation in Laboratory Processes

The Prefilled Formalin Vials market aligns with the rising integration of automation in laboratory operations. Automated tissue processors and robotic systems require uniform sample preparation to function effectively. Prefilled vials provide the precision needed for compatibility with these automated platforms. It supports laboratories seeking higher throughput without compromising accuracy. Consistency in prefilled formats reduces workflow interruptions and supports scalable diagnostic processes. The push toward automation strengthens the demand for standardized consumables.

- For instance, Fisher Anatomical Form‑Vial® containers have a 1,900 mL polypropylene body, half-filled with 1,000 mL of buffered zinc formalin—suitable for high-volume anatomical specimen processing in large-scale labs

Shift Toward Safer and Eco-Friendly Materials

The Prefilled Formalin Vials market reflects growing emphasis on sustainability and safety through eco-friendly packaging innovations. Manufacturers explore recyclable materials and safer sealing methods to address environmental and health concerns. Prefilled formats minimize spillage risks and reduce exposure to formalin fumes. It also aligns with institutional policies favoring greener laboratory practices. Increased awareness of occupational safety reinforces adoption of compliant and sustainable packaging. The trend toward eco-conscious designs becomes a competitive differentiator in the market.

Diversification of Applications Across End-Users

The Prefilled Formalin Vials market expands through diversification into new applications beyond traditional histology and pathology. Pharmaceutical companies, academic institutions, and contract research organizations adopt prefilled vials for clinical trials and research studies. Broader use cases drive manufacturers to offer multiple vial sizes and custom volumes. It caters to both large-scale institutions and smaller laboratories with specific needs. Demand from varied end-users encourages ongoing product differentiation. The expansion of applications contributes significantly to overall market growth.

Market Challenges Analysis

Health and Safety Concerns with Formalin Exposure

The Prefilled Formalin Vials market faces challenges due to health and safety concerns related to formalin exposure. Formaldehyde, the key component, is classified as a hazardous chemical with potential carcinogenic effects. Regulatory agencies impose strict handling, storage, and disposal rules that increase operational complexity for healthcare facilities. It creates reluctance among some institutions to expand usage despite the convenience of prefilled solutions. Concerns over occupational hazards require continuous training and monitoring, raising operational costs. Growing awareness of safer alternatives places pressure on manufacturers to develop compliant and less toxic solutions.

High Cost Pressures and Limited Alternatives

The Prefilled Formalin Vials market encounters cost-related challenges driven by production expenses, packaging innovation, and compliance requirements. Hospitals and laboratories often face budget constraints, making bulk adoption difficult in resource-limited settings. It also competes with lower-cost, manually prepared formalin solutions that remain common in smaller facilities. Limited availability of widely accepted alternatives further complicates the transition toward safer and eco-friendly options. Manufacturers must balance affordability with innovation to remain competitive. Economic pressures across developing regions highlight the need for cost-effective yet compliant solutions to sustain growth.

Market Opportunities

Expansion into Emerging Healthcare Markets

The Prefilled Formalin Vials market presents significant opportunities through expansion in emerging healthcare systems. Rapid growth of diagnostic laboratories and hospitals in Asia-Pacific, Latin America, and the Middle East creates consistent demand for ready-to-use specimen preservation solutions. It supports institutions striving to meet global standards of pathology and histology practices. Rising healthcare investments in these regions create long-term opportunities for suppliers to establish strong distribution networks. Increased adoption in smaller clinics and regional laboratories expands the customer base. The ability to provide standardized products at scalable volumes strengthens market penetration in developing economies.

Innovation in Safer and Sustainable Product Designs

The Prefilled Formalin Vials market benefits from opportunities in developing safer, eco-friendly, and compliance-driven product designs. Growing demand for packaging that reduces exposure risks pushes manufacturers to innovate sealing technologies and adopt recyclable materials. It enables laboratories to align with occupational safety rules and sustainability policies. Integration of tamper-proof features and user-centric vial formats enhances adoption across diverse end-users. Customized solutions for pharmaceutical research and academic applications further expand usage. Companies that invest in innovation and align with regulatory priorities secure competitive advantages in a growing global market.

Market Segmentation Analysis:

By Product Type:

Standard vials, specialized vials, disposable vials, and reusable vials. Standard vials remain widely used due to their cost-effectiveness and suitability for routine specimen preservation in hospitals and laboratories. Specialized vials gain traction in advanced research and clinical applications where precise concentrations and unique packaging formats are essential. Disposable vials are increasingly preferred in institutions focusing on safety and infection control, minimizing risks of contamination. Reusable vials cater to organizations seeking cost efficiency in high-volume operations, though their adoption requires strict sterilization processes. The diversity across product types highlights how each category supports specific operational needs across healthcare and research ecosystems.

- For instance, automated tissue processors are often designed with 50 mL reagent containers (for formalin, alcohol, etc.), highlighting standardization needs that align well with prefilled vial usage

By Application:

The Prefilled Formalin Vials market serves histology, pathology, anatomical studies, research laboratories, and diagnostic centers. Histology and pathology applications dominate due to their critical role in tissue fixation and disease detection. Anatomical studies rely on these vials to preserve specimens for teaching and research purposes in academic environments. Research laboratories require prefilled formats for accuracy and efficiency in experimental workflows. Diagnostic centers adopt them to streamline sample preparation in high-volume testing. It demonstrates versatility across varied medical and scientific applications, supporting both routine and specialized practices.

- For instance, Cancer Diagnostics, Inc. offers 7 mL screw-top vials prefilled with 7 mL of 10% neutral buffered formalin, certified to meet 95 kPa leak-resistant O-ring standards for safer sample storage jars.

By End-User:

The Prefilled Formalin Vials market is segmented into hospitals, clinical laboratories, research institutions, pharmaceutical companies, and educational institutions. Hospitals remain the largest end-users due to their consistent demand for reliable specimen preservation. Clinical laboratories follow closely, focusing on efficient workflow management and regulatory compliance. Research institutions and pharmaceutical companies adopt prefilled vials to support innovation in drug development and advanced studies. Educational institutions rely on them for anatomical training and practical teaching purposes. It shows how demand spans across clinical, academic, and industrial settings, reinforcing the market’s broad utility and long-term growth potential.

Segments:

Based on Product Type:

- Standard Vials

- Specialized Vials

- Disposable Vials

- Reusable Vials

Based on Application:

- Histology

- Pathology

- Anatomical Studies

- Research Laboratories

- Diagnostic Centers

Based on End-User:

- Hospitals

- Clinical Laboratories

- Research Institutions

- Pharmaceutical Companies

- Educational Institutions

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a strong position in the Prefilled Formalin Vials market, accounting for 34% of the global share in 2024. The region benefits from advanced healthcare infrastructure, a high concentration of diagnostic centers, and strong regulatory frameworks that promote adoption of safer and standardized specimen preservation methods. Hospitals and clinical laboratories across the United States and Canada increasingly rely on prefilled vials to reduce manual preparation errors and ensure compliance with strict safety standards. It is further driven by ongoing investments in pathology and histology services, supported by well-established academic and research institutions. The presence of leading market players and continuous product innovations also contribute to strengthening regional demand. With an emphasis on automation and quality assurance, North America continues to remain a primary hub for consumption and innovation in prefilled vial solutions.

Europe

Europe captures 28% of the Prefilled Formalin Vials market, reflecting strong adoption across hospitals, research institutions, and pharmaceutical companies. The region benefits from advanced healthcare systems and a strong focus on compliance with safety regulations, particularly in handling hazardous chemicals like formalin. Pathology and anatomical studies represent significant areas of application due to the presence of established medical universities and research hubs in countries such as Germany, France, and the United Kingdom. It is also supported by growing investments in medical education, which increase the use of prefilled vials in training and academic settings. Manufacturers in Europe place emphasis on developing eco-friendly and recyclable packaging to align with regional sustainability goals. The market outlook remains steady, driven by regulatory compliance, innovation in product formats, and expansion into academic and pharmaceutical sectors.

Asia-Pacific

Asia-Pacific accounts for 22% of the Prefilled Formalin Vials market and is witnessing rapid growth due to rising investments in healthcare infrastructure and diagnostic capacity. Countries such as China, India, and Japan are expanding hospital networks and pathology labs to meet increasing patient demand. It supports greater use of standardized specimen preservation methods, particularly in fast-growing urban healthcare centers. Academic and research institutions across the region adopt prefilled vials to enhance reliability and safety in anatomical and biomedical studies. The presence of a large patient population further drives consumption across diagnostic centers and hospitals. Market players see Asia-Pacific as a high-potential region due to its cost-sensitive environment, encouraging the development of affordable yet compliant product offerings. The rising focus on safety and modernization ensures strong long-term opportunities in the region.

Latin America

Latin America holds 9% of the Prefilled Formalin Vials market, driven by gradual improvements in healthcare infrastructure and rising awareness of safety in specimen preservation. Brazil and Mexico represent the largest contributors, supported by expanding hospital networks and growing investments in diagnostic laboratories. It faces certain challenges due to budget limitations and reliance on manually prepared formalin solutions in smaller facilities. However, urban hospitals and academic centers increasingly adopt prefilled vials for greater efficiency and safety. Market penetration remains uneven but shows promise with ongoing healthcare reforms and international collaborations. Over time, rising training initiatives and regulatory harmonization are expected to improve adoption rates across the region.

Middle East & Africa

The Middle East & Africa region accounts for 7% of the Prefilled Formalin Vials market, reflecting early adoption trends in selected countries with advanced healthcare infrastructure such as the United Arab Emirates and Saudi Arabia. It is supported by ongoing healthcare modernization projects that prioritize pathology and diagnostic services. South Africa also contributes, with expanding academic and research institutions adopting standardized laboratory tools. Broader regional adoption is slowed by cost pressures and limited access to advanced laboratory technologies in several countries. Nevertheless, international suppliers focus on building distribution networks and training initiatives to improve regional penetration. Growing government investments in healthcare and education provide future opportunities to expand usage across hospitals, research institutions, and diagnostic centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Prefilled Formalin Vials market features strong competition among leading players such as Medline Industries Inc., Leica Microsystems Sales GmbH (Danaher Corporation), Genta Environmental Ltd., Diapath S.p.A., Global Scientific Inc., Cardinal Health Inc., Thomas Scientific, Histo-Line Laboratories Srl., and Azer Scientific, Inc.The competitive environment is shaped by product quality, compliance with safety regulations, and innovation in packaging formats. Companies focus on delivering ready-to-use vials that enhance accuracy, reduce exposure risks, and streamline laboratory workflows. It enables them to build long-term partnerships with hospitals, clinical laboratories, and research institutions. Leading players invest in eco-friendly designs and recyclable materials to align with sustainability demands, strengthening their position among environmentally conscious buyers. Price differentiation remains important, particularly in cost-sensitive regions, where affordable and compliant solutions drive wider adoption. Strong distribution networks and customer support services enhance market reach and brand loyalty. The competition also emphasizes research collaborations, strategic acquisitions, and technological advancements to broaden portfolios and cater to both large-scale healthcare systems and smaller laboratories. By balancing affordability, safety, and innovation, players sustain their competitive edge while addressing the diverse needs of the global market.

Recent Developments

- In 2025, Leica Microsystems has announced a new strategic and commercial partnership with Fisher Scientific

- In 2025, Diapath S.p.A. notable development strengthened supply chain and manufacturing for pre-analytical pathology products.

- In 2023, Thermo Fisher Scientific launched a new line of prefilled formalin containers designed to improve safety and convenience for healthcare professionals.

Market Concentration & Characteristics

The Prefilled Formalin Vials market demonstrates moderate concentration, with a mix of global corporations and specialized regional manufacturers competing for share. It is characterized by the presence of established healthcare suppliers offering wide product portfolios alongside niche players focusing on tailored vial formats for research and academic applications. Competitive dynamics emphasize product safety, regulatory compliance, and innovative packaging solutions that minimize exposure risks and improve efficiency in specimen preservation. It also reflects growing differentiation through eco-friendly designs and tamper-proof features, which appeal to both hospitals and research institutions. Large players leverage scale, distribution networks, and brand reputation to maintain dominance, while smaller firms focus on cost-effective and customized solutions to penetrate price-sensitive markets. The structure combines stability from established leaders with innovation driven by emerging companies, creating a competitive environment shaped by safety, compliance, and performance standards across global healthcare and research ecosystems.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing adoption in hospitals, laboratories, and research institutions.

- Demand for safer and ready-to-use packaging formats will increase across diagnostic and pathology services.

- Eco-friendly and recyclable vial materials will gain preference due to stricter sustainability regulations.

- Automation in laboratories will drive the need for standardized prefilled vials compatible with advanced equipment.

- Research institutions and universities will strengthen usage for anatomical and biomedical studies.

- Emerging economies will witness faster adoption supported by rising healthcare investments.

- Regulatory compliance will remain a decisive factor influencing purchasing decisions.

- Product innovations such as tamper-proof and dual-seal designs will enhance market competitiveness.

- Strategic collaborations and acquisitions will shape expansion strategies of leading players.

- Digital supply chain integration will improve distribution efficiency and global accessibility of prefilled vials.