Market Overview

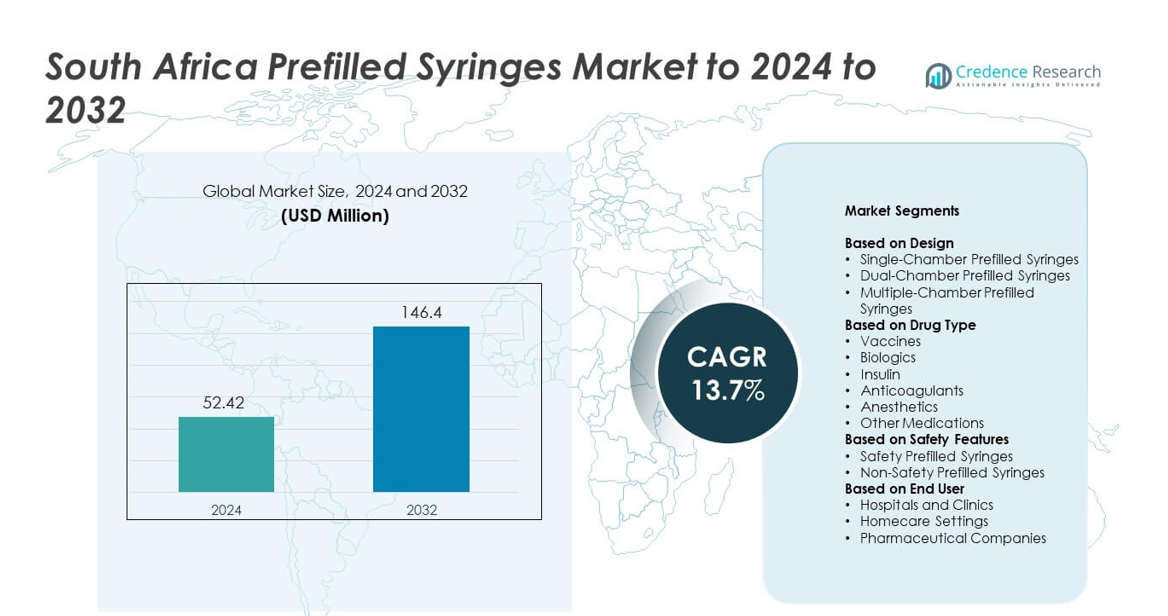

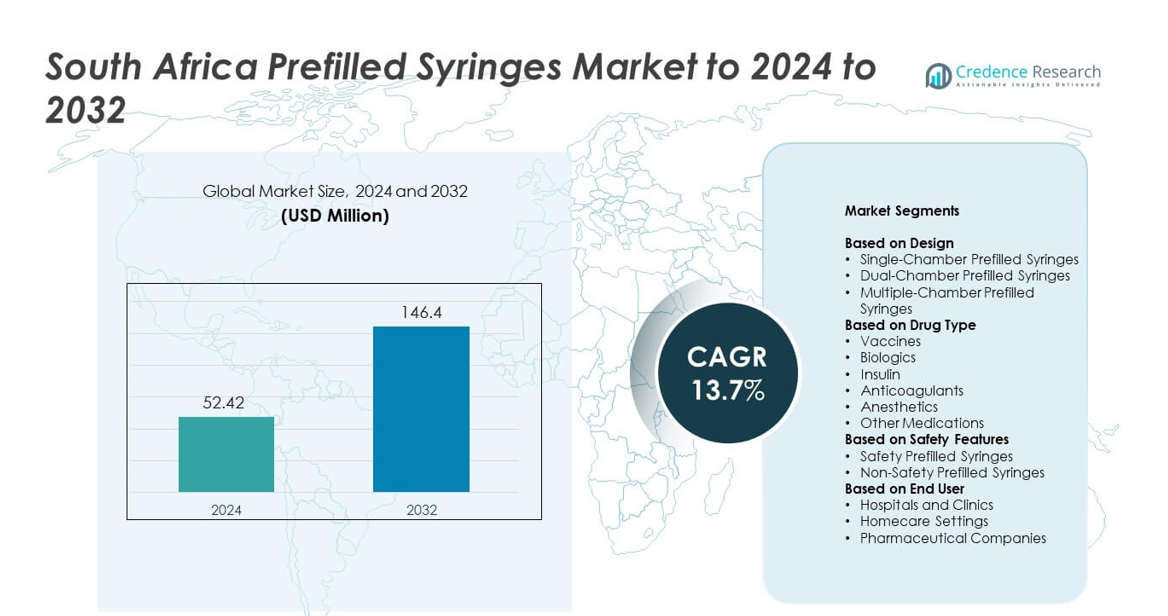

South Africa Prefilled Syringes Market size was valued at USD 52.42 million in 2024 and is anticipated to reach USD 146.4 million by 2032, at a CAGR of 13.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Africa Prefilled Syringes Market Size 2024 |

USD 52.42 million |

| South Africa Prefilled Syringes Market, CAGR |

13.7% |

| South Africa Prefilled Syringes MarketSize 2032 |

USD 146.4 million |

The South Africa Prefilled Syringes Market is shaped by leading companies such as SCHOTT Pharma, Ypsomed AG, Owen Mumford Ltd., Terumo Corporation, Aptar Pharma, Wirthwein Medical, Gerresheimer AG, SHL Medical, Nipro Corporation, West Pharmaceutical Services, Inc., and BD (Becton, Dickinson and Company). These players strengthen the market through safer injection technologies, stronger supply chains, and wider support for biologics and vaccine delivery. Gauteng remains the leading region because of its strong healthcare infrastructure, high patient load, and advanced hospital networks. Western Cape and KwaZulu-Natal follow with steady expansion, supported by rising chronic disease treatment needs and increasing adoption of ready-to-use injectable systems.

Market Insights

- South Africa Prefilled Syringes Market reached USD 52.42 million in 2024 and is projected to hit USD 146.4 million by 2032, growing at a CAGR of 13.7%.

- Growth is driven by rising use of ready-to-administer syringes, expanding biologics adoption, and higher demand from vaccination programs across public and private healthcare facilities.

- Key trends include wider uptake of safety-engineered syringes, rising self-administration for chronic therapies, and growing preference for single-chamber formats, which held the dominant 72% share in 2024.

- The competitive landscape strengthens as major manufacturers expand sterile production, enhance safety mechanisms, and deepen distribution capabilities to meet rising hospital and clinic demand.

- Gauteng holds the largest regional share due to advanced healthcare networks, followed by Western Cape and KwaZulu-Natal with steady growth supported by strong chronic disease treatment needs and expanding vaccine-driven usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Design

Single-chamber prefilled syringes dominated the South Africa Prefilled Syringes Market in 2024 with about 72% share. Demand stayed strong because these formats support routine injections for vaccines, biologics, and chronic therapies. Healthcare providers preferred single-chamber designs due to easy handling, low preparation time, and reduced contamination risk. Wider adoption in public immunization programs and chronic disease management helped strengthen leadership. Dual-chamber and multiple-chamber formats grew at a steady pace as specialty drugs and lyophilized formulations expanded across hospitals and clinics.

- For instance, BD manufactures over 3 billion prefillable syringes per year for injectable therapies.

By Drug Type

Vaccines held the leading position in 2024 with nearly 38% share of the South Africa Prefilled Syringes Market. Strong government immunization drives and higher uptake of injectable preventive therapies supported this lead. Biologics also expanded as South Africa saw rising prescriptions for autoimmune and oncology treatments. Insulin and anticoagulants gained momentum with the growing diabetic and cardiovascular patient base. Wider hospital preference for ready-to-administer formats across anesthetics and other medications further reinforced category growth.

- For instance, Gerresheimer’s Querétaro expansion adds capacity for several 100 million ready-to-fill glass syringes annually for injectable biopharmaceuticals.

By Safety Features

Safety prefilled syringes accounted for about 61% share in 2024 and remained the dominant segment. Demand increased as hospitals and clinics adopted safer injection devices to reduce needle-stick injuries and meet occupational safety norms. Rising preference for tamper-evident and retractable-needle formats also supported strong uptake. Non-safety prefilled syringes continued to serve cost-sensitive settings but grew slower due to compliance pressure and broader transition toward safety-engineered solutions across South Africa’s healthcare network.

Key Growth Drivers

Rising Shift Toward Ready-to-Use Injectable Delivery

South Africa is witnessing a strong transition toward ready-to-use injectable formats as hospitals and clinics aim to reduce preparation steps and contamination risks. Prefilled syringes support faster administration and improve dose accuracy across vaccines, biologics, and chronic therapies. Growing healthcare workloads and rising patient volumes push providers to adopt devices that reduce handling time. Government-led immunization and chronic disease programs further strengthen demand, as single-use prefilled formats enhance safety and workflow efficiency in both public and private healthcare settings.

- For instance, SCHOTT Pharma products enable on average more than 25,000 injections per minute worldwide.

Expansion of Biologics and Chronic Disease Treatments

The rise in biologic therapies for autoimmune disorders, cancer care, and long-term treatment needs has increased reliance on prefilled syringes across South Africa. Prefilled formats ensure stability and dosing precision for sensitive biologic drugs, which supports broader clinical use. The growing burden of diabetes, hypertension, and cardiovascular diseases is also driving adoption of ready-to-administer injectables. As treatment regimens shift toward long-term outpatient care, demand for user-friendly, self-injection-ready systems continues to accelerate among both patients and healthcare providers.

- For instance, Terumo’s Yamaguchi facility is expanding so its prefilled syringe CDMO capacity becomes 3.5 times the 2016 level.

Increasing Focus on Injection Safety and Needlestick Prevention

Healthcare facilities are prioritizing safer injection systems to reduce needlestick injuries and contamination events. Safety-engineered prefilled syringes with retractable needles and tamper-evident features are gaining rapid traction, supported by stricter occupational safety norms. Hospitals prefer devices that lower injury risk for staff and enhance sterility during medication handling. Growing awareness around infection prevention and improved clinical outcomes has encouraged broader adoption of safety prefilled syringes, reinforcing their leadership in the market and supporting continuous product innovation.

Key Trends & Opportunities

Rising Use of Prefilled Syringes in Vaccination Programs

South Africa’s expanding immunization framework has boosted the use of prefilled syringes for faster, safer, and more consistent vaccine delivery. Public health agencies prefer standardized ready-to-administer options that streamline mass vaccination drives. Prefilled systems also improve dose accuracy and reduce wastage, making them ideal for high-volume campaigns. As new vaccines enter the national schedule and private healthcare uptake grows, opportunities expand for manufacturers to supply high-quality, sterile prefilled formats tailored for large-scale immunization needs.

- For instance, Aptar Pharma’s global expansion program is designed to supply over 10 billion injectable component units annually.

Growing Adoption of Self-Administration and Home Healthcare

Self-injection has increased as chronic disease patients seek convenient treatment at home. Prefilled syringes enable simple, precise dosing without preparation, which supports adherence in long-term therapies such as insulin, anticoagulants, and biologics. Expansion of home-care services and rising focus on patient comfort create strong opportunities for intuitive, patient-centric syringe designs. Manufacturers are introducing ergonomic, safety-focused, and pre-measured formats that appeal to both home users and outpatient services, expanding market reach across South Africa.

- For instance, Haselmeier, acquired by Sulzer, aims to double its self-injection device sales over 5 years.

Key Challenges

Regulatory Compliance and Quality Assurance Pressure

Manufacturers face strict regulatory requirements for sterility, material safety, drug compatibility, and device reliability. Compliance with evolving guidelines requires high investments in testing, manufacturing upgrades, and documentation. Local and imported products must meet rigorous standards to ensure safe delivery of biologics and vaccines. Smaller suppliers often struggle to match these expectations, which creates barriers to expansion. Delays in approvals and quality audits can slow product availability and increase overall market entry costs.

High Production Costs and Pricing Constraints

Prefilled syringes require advanced filling, sterilization, and quality-control systems, driving up manufacturing expenses. South Africa’s price-sensitive healthcare environment limits the ability to pass these costs on to hospitals and patients. Imported components and fluctuating material costs add additional pressure. Public hospitals often opt for lower-priced options, slowing adoption of premium safety-engineered syringes. These cost challenges can restrict market penetration for advanced formats, making affordability a key barrier for widespread uptake.

Regional Analysis

Gauteng

Gauteng led the South Africa Prefilled Syringes Market in 2024 due to its dense healthcare network, large patient population, and concentration of advanced hospitals and private clinics. The province adopted prefilled syringes widely for vaccines, biologics, and chronic disease therapies, supported by strong procurement systems and higher spending capacity. Expansion of specialized care centers and strong presence of pharmaceutical distributors further strengthened demand. Growing adoption of safety-engineered devices and high immunization activity continued to shape the market’s dominance. Gauteng’s robust infrastructure and consistent investment kept the region at the forefront of prefilled syringe usage.

Western Cape

Western Cape recorded strong growth in the market, driven by well-developed healthcare services, high chronic disease burden, and strong public-private healthcare collaboration. Prefilled syringes gained traction in major hospitals in Cape Town as they supported improved dosing accuracy, reduced contamination risk, and faster administration for routine vaccinations and biologics. The province also showed rising adoption of home-care treatments, increasing demand for ready-to-use injectable formats. Expansion of specialty clinics and increased focus on safety injection systems supported regional momentum. Western Cape’s strong research and medical ecosystem continued to attract innovation-driven suppliers.

KwaZulu-Natal

KwaZulu-Natal saw growing demand for prefilled syringes due to its large public healthcare population and rising immunization needs. Hospitals in Durban and surrounding districts adopted ready-to-administer syringes to reduce workload, improve injection safety, and support chronic disease management programs. Higher prevalence of diabetes, cardiovascular diseases, and infectious illnesses further increased demand for consistent dosing solutions. Public health campaigns accelerated vaccine-based syringe usage, while private clinics expanded biologic and long-term therapy adoption. KwaZulu-Natal’s improving supply chain and growing focus on safe injection devices continued to shape market expansion.

Eastern Cape

Eastern Cape showed moderate but steady adoption of prefilled syringes as healthcare facilities focused on improving medication safety and reducing dose preparation time. Growth was driven by rising chronic disease treatment needs and ongoing immunization initiatives across both urban and rural districts. Prefilled formats supported better workflow efficiency in understaffed facilities and reduced risk of dosage errors. Expansion of provincial health programs and gradual infrastructure upgrades helped improve access to sterile injectable products. Although pricing sensitivity remains high, increasing awareness of safety-engineered syringes continued to support market penetration.

Market Segmentations:

By Design

- Single-Chamber Prefilled Syringes

- Dual-Chamber Prefilled Syringes

- Multiple-Chamber Prefilled Syringes

By Drug Type

- Vaccines

- Biologics

- Insulin

- Anticoagulants

- Anesthetics

- Other Medications

By Safety Features

- Safety Prefilled Syringes

- Non-Safety Prefilled Syringes

By End User

- Hospitals and Clinics

- Homecare Settings

- Pharmaceutical Companies

By Geography

- Gauteng

- Western Cape

- KwaZulu-Natal

- Eastern Cape

Competitive Landscape

The South Africa Prefilled Syringes Market features major players such as SCHOTT Pharma, Ypsomed AG, Owen Mumford Ltd., Terumo Corporation, Aptar Pharma, Wirthwein Medical, Gerresheimer AG, SHL Medical, Nipro Corporation, West Pharmaceutical Services, Inc., and BD (Becton, Dickinson and Company). These companies compete by expanding portfolio depth, improving device safety, and strengthening supply capabilities across public and private healthcare channels. Market participants are focusing on advanced materials, tighter sterility controls, and streamlined filling technologies to enhance product reliability. Investments in safety-engineered formats, including systems with needle-protection and tamper-evident features, continue to shape differentiation. Firms are also enhancing distribution networks to meet rising demand from vaccination programs and chronic disease treatment centers. Local partnerships, regulatory alignment, and expansion of patient-centric injection solutions are emerging as strategic priorities. Growing emphasis on home-care usage and consistent procurement cycles further intensifies competition among leading manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SCHOTT Pharma

- Ypsomed AG

- Owen Mumford Ltd.

- Terumo Corporation

- Aptar Pharma

- Wirthwein Medical

- Gerresheimer AG

- SHL Medical

- Nipro Corporation

- West Pharmaceutical Services, Inc.

- BD (Becton, Dickinson and Company)

Recent Developments

- In May 2023, SCHOTT Pharma introduced the SCHOTT TOPPAC® freeze, a prefillable polymer syringe made of Cyclic Olefin Copolymer (COC) specifically engineered to safely store and transport sensitive drug formulations, such as those that are mRNA-based, at deep-cold temperatures down to -100°C.

- In 2023, BD’s major launches in the Biosciences (BDB) segment were the BD FACSDiscover™ S8 Cell Sorter instruments and the PIVO™ Pro Needle-free Blood Collection Device in the Medical segment.

- In 2023, Wirthwein Medical launched a complete set of prefillable plastic syringes with a Luer-lock connection, branded as WIM Ject®.

Report Coverage

The research report offers an in-depth analysis based on Design, Drug Type, Safety Features, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for safety-engineered prefilled syringes will rise as hospitals prioritize injury prevention.

- Vaccine programs will continue driving high-volume use of single-chamber prefilled formats.

- Growth in biologics and chronic disease therapies will expand adoption across private clinics.

- Self-administration at home will increase demand for user-friendly and ergonomic syringe designs.

- Local manufacturing opportunities will grow as suppliers aim to reduce reliance on imports.

- Automation in filling and packaging will improve quality and production efficiency.

- Adoption of prefilled syringes in rural healthcare will rise with improved distribution networks.

- Digital tracking and serialization features will gain traction for safety and supply monitoring.

- Environmental concerns will encourage development of recyclable and low-waste syringe materials.

- Collaboration between public health agencies and private suppliers will strengthen market expansion.