Market Overview

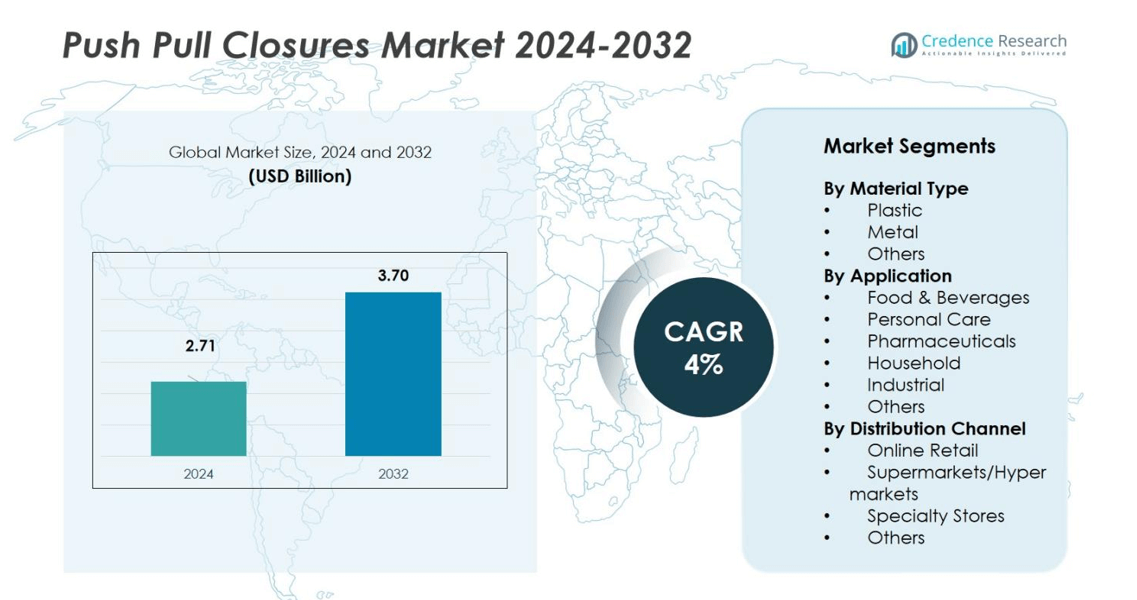

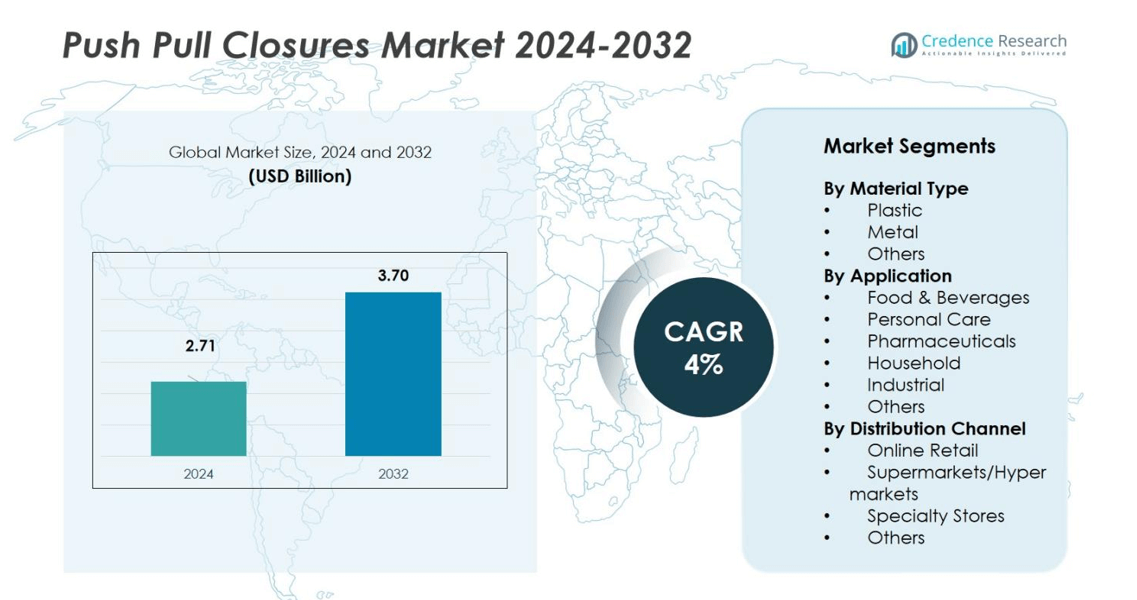

The Push Pull Closures Market size was valued at USD 2.71 billion in 2024 and is anticipated to reach USD 3.70 billion by 2032, growing at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Push Pull Closures Market Size 2024 |

USD 2.71 billion |

| Push Pull Closures Market, CAGR |

4% |

| Push Pull Closures Market Size 2032 |

USD 3.70 billion |

The Push Pull Closures Market features leading players including Amcor plc, Silgan Holdings Inc., Bericap, United Caps, Mold-Rite Plastics, CL Smith, Coral Products, Georg MENSHEN, O. Berk Company, and Caps & Closures Pty Ltd. These companies compete on ergonomic design, tamper-evidence, and recyclable, mono-material solutions, supported by automation and strong FMCG partnerships. Asia Pacific leads with 33% market share, followed by North America at 31% and Europe at 28%, while Latin America holds 5% and the Middle East & Africa accounts for 3%, reflecting mature demand in developed regions and rapid consumption growth across Asian markets.

Market Insights

- The Push Pull Closures Market was valued at USD 2.71 billion in 2024 and is projected to reach USD 3.70 billion by 2032, growing at a CAGR of 4%.

- Increasing demand for spill-proof, easy-to-use closures in food, beverages, and personal care products drives market expansion.

- Rising adoption of sustainable materials and smart dispensing designs highlights ongoing trends across global packaging industries.

- Key players such as Amcor plc, Silgan Holdings, and United Caps focus on recyclable solutions and technological innovation to strengthen competitiveness.

- Asia Pacific leads with a 33% share, followed by North America at 31% and Europe at 28%, while the food and beverage segment dominates with a 46% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Plastic dominates the push pull closures market with a 72% share in 2024, driven by its versatility, lightweight nature, and cost efficiency. Manufacturers prefer polypropylene and polyethylene due to their durability, chemical resistance, and moldability. For instance, leading brands such as Amcor plc and Silgan Holdings use high-density plastics to ensure product safety and recyclability. Metal closures, holding 18% share, cater to premium packaging segments, while other materials like biopolymers and composites, accounting for 10%, are gaining traction due to sustainability and eco-friendly initiatives.

- For instance, AptarGroup introduced its SimpliCycle™ closure made from recyclable polypropylene, enhancing both sustainability and product safety.

By Application

The food and beverages segment leads the market with a 46% share in 2024, fueled by growing use in condiments, sauces, and ready-to-drink packaging. Rising demand for hygienic, spill-proof designs boosts adoption among major FMCG brands. Personal care applications hold 27% share, supported by increased cosmetic and hygiene product consumption. Pharmaceutical packaging accounts for 12%, while household and industrial applications collectively represent 10%, emphasizing ease of dispensing and product preservation across diverse usage environments.

- For instance, Coca-Cola in 2024 redesigned some of their bottle sizes to be lightweighted from 21 to 18.5 grams, improving sustainability without compromising usability.

By Distribution Channel

Supermarkets and hypermarkets dominate with a 44% share in 2024, driven by strong shelf visibility and consumer preference for physical product selection. Specialty stores account for 28% share, catering to niche and premium packaging needs. Online retail, growing at the fastest pace with 20% share, benefits from e-commerce expansion and customizable bulk orders for small manufacturers. Other channels, representing 8%, include direct B2B supply and contract packaging firms that support industrial and institutional packaging distribution globally.

Key Growth Drivers

Rising Demand from Food and Beverage Packaging

Growing consumption of on-the-go and convenience food products drives the demand for push pull closures. These closures offer spill prevention and controlled dispensing, making them ideal for sauces, syrups, and beverages. Food manufacturers prefer lightweight, tamper-evident plastic closures for better hygiene and portability. Brands such as Coca-Cola and Nestlé increasingly use these closures to improve product usability and consumer satisfaction. This growing application scope continues to expand the market’s presence across both premium and mass-market packaging categories.

- For instance, Heinz rolled out push-pull caps across its 400ml and larger ketchup bottles, reducing plastic lid waste by approximately 300 million units annually.

Expanding Personal Care and Pharmaceutical Applications

The personal care and pharmaceutical sectors significantly boost market growth as demand for controlled dispensing and hygienic packaging rises. Push pull closures are used in shampoos, lotions, antiseptics, and topical creams to ensure precise application and product safety. Manufacturers such as United Caps and Mold-Rite Plastics design closures with enhanced sealing and ergonomic features. Increasing product differentiation, coupled with global health and hygiene awareness, strengthens demand for smart, user-friendly closure systems across these industries.

- For instance, United Caps offers tethered closures with audible and tactile (haptic) signals that enhance user experience while ensuring compliance with safety directives, specifically the European Union’s Single-Use Plastics (SUP) Directive.

Shift Toward Sustainable Packaging Solutions

Sustainability has become a major growth catalyst for the push pull closures market. Companies are investing in recyclable and bio-based materials to reduce environmental impact. For instance, Amcor plc and Bericap have developed lightweight, mono-material caps compatible with circular economy goals. Governments’ plastic waste reduction policies and consumer preference for eco-conscious brands accelerate this shift. This trend encourages innovation in design and material science, helping producers align with sustainability standards while maintaining cost efficiency and product performance.

Key Trends and Opportunities

Adoption of Smart and Functional Closure Designs

The integration of smart features, such as anti-leak systems, child safety locks, and easy-open mechanisms, shapes the market trend. Consumers prefer closures that combine convenience with safety and reusability. Manufacturers focus on ergonomic designs that enhance user experience while reducing material use. Digital printing and laser coding enable better traceability and brand differentiation. This technological advancement supports premiumization and improves consumer trust, particularly in food, beverage, and healthcare applications.

- For instance, Ajax Systems has implemented wireless water leak detectors paired with automatic shutoff valves that stop water supply within seven seconds of leak detection, minimizing damage in buildings.

Growth of E-Commerce Packaging Demand

Rapid expansion of online retail creates strong opportunities for push pull closures. E-commerce packaging requires durable, leak-proof, and lightweight solutions that maintain product integrity during transit. Companies are developing closures with tamper-evident and pressure-resistant features to address this need. The rise of direct-to-consumer personal care and nutraceutical brands further drives innovation in customized closure designs. The increasing volume of online orders supports sustained growth for manufacturers catering to global digital supply chains.

- For instance, Aptar introduced its SimpliCycle™ recyclable valve technology for e-commerce-ready packaging, designed to ensure leak-proof and tamper-evident protection during long-distance shipping of liquid products.

Key Challenges

Fluctuating Raw Material Prices

The market faces challenges due to instability in raw material costs, particularly polypropylene and polyethylene. Price volatility directly affects production expenses and profit margins for manufacturers. Limited supply of recycled resins and global petroleum price fluctuations add uncertainty. Small and mid-scale producers struggle to maintain competitive pricing while adopting sustainable alternatives. Consistent sourcing strategies and supplier collaborations have become essential to mitigate these cost-related risks.

Environmental Regulations and Recycling Limitations

Stringent environmental regulations on single-use plastics create compliance challenges for closure manufacturers. Many regions impose extended producer responsibility (EPR) schemes and recycling mandates, pushing companies to redesign closures for easier recyclability. However, recycling infrastructure in developing markets remains limited, hindering widespread adoption of eco-friendly materials. Balancing sustainability goals with performance standards and cost control remains a critical hurdle, especially for high-volume FMCG packaging applications.

Regional Analysis

North America

North America holds a 31% share of the global push pull closures market in 2024, driven by high demand from the food, beverage, and personal care industries. The United States leads the region with strong packaging innovation and a focus on sustainable materials. Key manufacturers like Silgan Holdings and Mold-Rite Plastics contribute to regional dominance through advanced closure technologies. Rising demand for lightweight and recyclable packaging in bottled beverages and condiments continues to support market growth. The expanding e-commerce and homecare sectors further enhance regional consumption.

Europe

Europe accounts for a 28% share of the market, supported by robust demand from personal care, pharmaceutical, and food packaging applications. Countries such as Germany, the UK, and France drive market expansion through strong consumer awareness of eco-friendly products. Leading companies including Amcor plc, Bericap, and United Caps emphasize recyclable and bio-based closures aligned with EU sustainability goals. Innovation in tamper-proof and reusable packaging further propels adoption. Government regulations encouraging reduced plastic waste continue to foster long-term market stability and promote circular packaging initiatives.

Asia Pacific

Asia Pacific dominates the market with a 33% share in 2024, led by rapid industrialization, urbanization, and growing consumer goods consumption. Countries such as China, India, and Japan experience surging demand for affordable, durable, and user-friendly closures in beverages, personal care, and household segments. Expanding manufacturing capacity and low production costs make the region a key production hub. Companies like Caps & Closures Pty Ltd and local Asian producers invest in automation and sustainable material development, further strengthening market competitiveness. The region’s population growth fuels consistent packaging demand.

Latin America

Latin America captures a 5% share of the push pull closures market, with Brazil and Mexico leading consumption in food, beverage, and household products. Expanding FMCG and pharmaceutical sectors boost the need for cost-effective closure solutions. Local manufacturers focus on increasing output efficiency and product standardization to match global packaging trends. Economic development, coupled with urban population growth, enhances regional demand. Sustainable packaging initiatives are gradually emerging, with multinational brands introducing recyclable plastic closures to meet evolving consumer preferences and environmental standards.

Middle East & Africa

The Middle East and Africa hold a 3% share of the global market, supported by the growth of personal care, beverage, and healthcare packaging industries. Rising disposable income and expanding retail networks increase the adoption of convenient dispensing systems. The UAE, Saudi Arabia, and South Africa lead regional consumption, driven by increased packaged product penetration. However, limited local manufacturing capacity and high import dependency constrain growth. Global packaging firms are investing in regional partnerships to meet the growing need for high-quality, recyclable closures in consumer goods.

Market Segmentations:

By Material Type

By Application

- Food & Beverages

- Personal Care

- Pharmaceuticals

- Household

- Industrial

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Push Pull Closures Market is characterized by the presence of leading players such as Amcor plc, Silgan Holdings Inc., Bericap, United Caps, Mold-Rite Plastics, CL Smith, Coral Products, Georg MENSHEN GmbH & Co. KG, O. Berk Company LLC, and Caps & Closures Pty Ltd. These companies compete through innovations in closure design, material efficiency, and sustainability. Manufacturers are investing in lightweight, recyclable, and tamper-evident closures to meet eco-regulatory standards and shifting consumer preferences. Strategic initiatives such as capacity expansion, product diversification, and mergers strengthen global market positioning. For instance, key producers are developing bio-based polymers and integrating advanced molding technologies to reduce material waste. Strong supply networks across food, personal care, and pharmaceutical sectors enhance brand reliability. Partnerships with FMCG companies and packaging converters remain essential for maintaining steady market share and expanding presence in emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2024, SnapSlide introduced a child-resistant closure with single-handed operation for Rx Amber Vials, showcasing advancements in pharmaceutical caps and closures.

- In March 2024, Xuliang Cap Co., Ltd. unveiled a 28 mm push-pull closure specifically designed for dish soap packaging, enhancing durability and ergonomic performance.

- In 2023, AptarGroup, Inc. launched its “Pull & Go” 28-410 push-pull cap designed for personal care and home-care applications, offering ergonomic dispensing and simplified user experience

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising demand for convenient packaging solutions.

- Plastic closures will remain dominant, while bio-based alternatives will gain wider adoption.

- Manufacturers will focus on lightweight, recyclable designs to meet sustainability goals.

- Smart and tamper-evident closures will see increased use in food and pharmaceutical sectors.

- Automation and precision molding technologies will improve production efficiency and consistency.

- E-commerce expansion will create new opportunities for durable and leak-proof closure designs.

- Asia Pacific will continue leading due to strong manufacturing capacity and consumer base.

- Collaboration between closure producers and FMCG brands will drive product innovation.

- Regulatory pressure on single-use plastics will accelerate transition toward circular materials.

- Customization and aesthetic appeal will become key differentiators in premium product packaging.