Market Overview

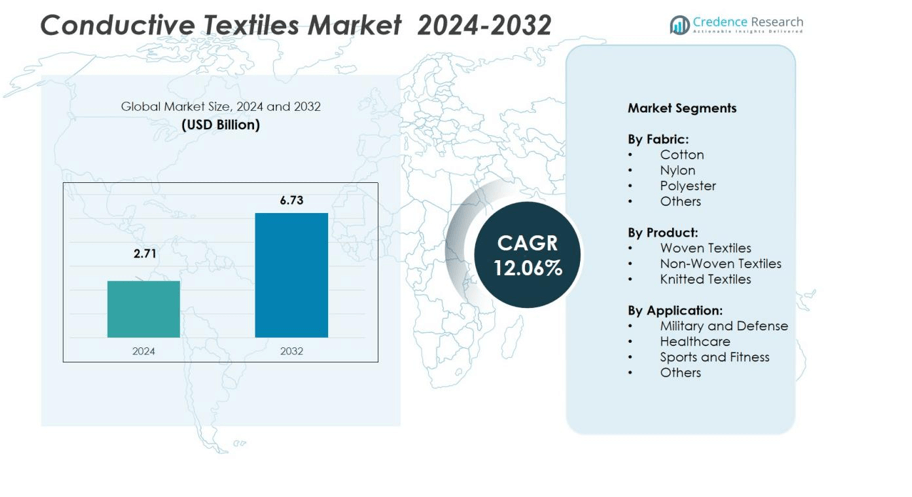

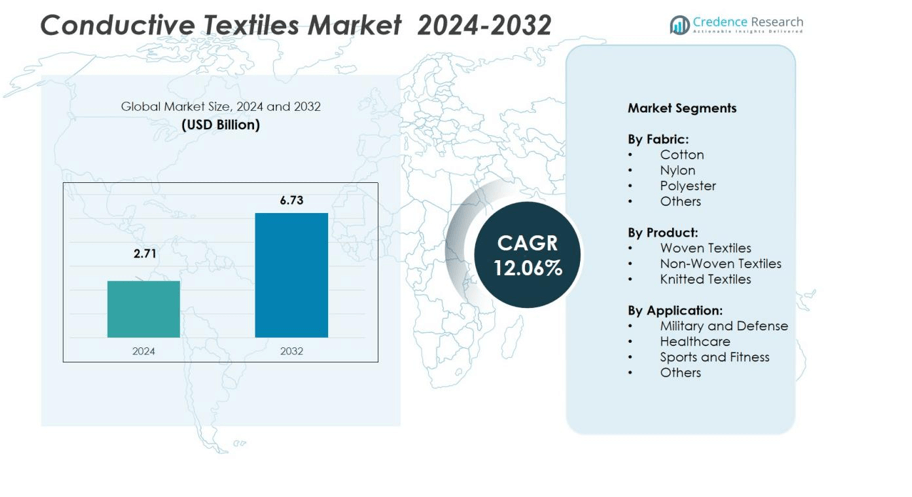

The Conductive Textiles Market size was valued at USD 2.71 billion in 2024 and is anticipated to reach USD 6.73 billion by 2032, growing at a CAGR of 12.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conductive Textiles Market Size 2024 |

USD 2.71 billion |

| Conductive Textiles Market, CAGR |

12.06% |

| Conductive Textiles Market Size 2032 |

USD 6.73 billion |

The Conductive Textiles Market is shaped by prominent players such as 3M Company, Bekaert S.A., Herculite Inc., Kinetic Polymers, Seiren Co. Ltd., Statex Produktions- und Vertriebs GmbH, Swicofil AG, TIBTECH Innovations, Toray Industries Inc., and UBE Industries Ltd. These companies focus on material innovation, advanced coating technologies, and strategic collaborations to strengthen global reach. Asia-Pacific leads the market with a 34% share, supported by strong textile manufacturing capabilities in China, Japan, and South Korea. North America follows with 31%, driven by defense and healthcare applications, while Europe holds 28%, emphasizing sustainable and high-performance textile solutions.

Market Insights

- The Conductive Textiles Market was valued at USD 71 billion in 2024 and is expected to reach USD 6.73 billion by 2032, growing at a CAGR of 12.06% during the forecast period.

- Rising demand for smart wearables, defense uniforms, and medical monitoring fabrics drives market growth, with polyester fabric leading the segment at 38% share due to its durability and conductivity.

- Market trends highlight growing adoption of nanomaterials, graphene coatings, and sustainable production methods improving flexibility and environmental performance.

- The market is moderately consolidated, with key players such as 3M Company, Toray Industries Inc., and Bekaert S.A. focusing on R&D and collaborations to expand product efficiency and global presence.

- Asia-Pacific leads with 34% share, followed by North America (31%) and Europe (28%), reflecting high adoption in defense, healthcare, and electronics applications across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fabric

Polyester dominates the conductive textiles market with over 38% share in 2024. Its high durability, lightweight nature, and cost-efficiency drive extensive use across military and sportswear applications. Polyester-based conductive fabrics also provide superior moisture resistance and consistent conductivity when coated with metallic or polymeric compounds. Cotton follows closely, favored for comfort and breathability in smart apparel and healthcare garments. Nylon and other specialty fabrics, including aramid and spandex blends, gain traction in high-performance environments requiring flexibility, strength, and electrostatic dissipation.

- For instance, Swift Textile Metalizing supplies silver-coated nylon knit scrim with electrical resistance around 0.3 ohms per square, tensile strength near 1700 psi, and excellent RF shielding effectiveness above 55 dB at 1 GHz, widely used in aerospace and defense applications.

By Product

Woven textiles hold the largest market share of 45% due to their superior structural strength, dimensional stability, and excellent electrical conductivity after metal or carbon fiber integration. These fabrics are widely used in military uniforms, electromagnetic shielding, and industrial safety clothing. Knitted textiles show growing adoption, supported by their flexibility and comfort for wearable sensors and fitness applications. Non-woven textiles account for a smaller but expanding share, driven by their lightweight properties and suitability for disposable medical and filtration uses in healthcare and hygiene sectors.

- For instance, Freudenberg Performance Materials introduced biodegradable meltblown nonwovens optimized for HVAC filtration that maintain high filtration efficiency, while WPT Nonwovens produces biodegradable nonwovens used in medical masks and gloves, contributing to sustainable healthcare solutions.

By Application

The military and defense segment leads the market with 42% share, driven by rising demand for conductive fabrics in uniforms, communication systems, and radar-absorbing materials. These textiles enhance soldier safety through electromagnetic shielding and energy transmission capabilities. Healthcare follows, supported by increasing use in smart medical garments and biosensors for real-time monitoring. Sports and fitness applications are expanding rapidly, integrating conductive fibers in smart clothing for activity tracking. Other applications, including automotive and aerospace, also contribute to steady growth through advanced material integration for static control and signal transmission.

Key Growth Drivers

Rising Demand for Smart and Wearable Electronics

The rapid expansion of wearable devices drives the use of conductive textiles in smart clothing and health monitoring systems. These fabrics enable seamless integration of sensors for data tracking, temperature regulation, and wireless connectivity. Growing consumer interest in health and fitness monitoring further accelerates adoption. Manufacturers such as Toray Industries and Statex develop advanced conductive yarns to improve durability and signal reliability, supporting broader commercial use across consumer electronics and healthcare applications.

- For instance, Statex Produktions- und Vertriebs GmbH produces Shieldex® conductive yarns, such as the 117/17 x2 twisted yarn, which features a linear electrical resistance of less than 1.5 kΩ/m and is widely used in smart textiles for sensor integration and EMI shielding applications.

Increasing Adoption in Military and Defense Applications

Conductive textiles experience strong demand from defense sectors due to their shielding, camouflage, and communication functionalities. These fabrics are crucial for electromagnetic interference protection and stealth technology integration. Governments increasingly invest in high-performance uniforms that enhance soldier safety and situational awareness. Companies like Bekaert and 3M focus on metal-coated fibers with superior conductivity and lightweight properties. The rising focus on electronic warfare resilience and battlefield communication networks continues to strengthen market growth within the defense domain.

- For instance, 3M’s metal-coated fibers employed in defense applications demonstrate temperature tolerances up to 600°C with copper-alloy coatings, which also provide fatigue resistance with static fatigue parameters exceeding 100.

Expansion in Medical and Healthcare Applications

The healthcare industry’s growing adoption of smart medical textiles propels market expansion. Conductive fabrics are integrated into wearable devices for monitoring heart rate, muscle activity, and respiration. Hospitals and clinics favor these materials for their flexibility, comfort, and biocompatibility. Companies such as Seiren Co. Ltd. and Herculite Inc. innovate conductive coatings and polymers for reusable and sterilizable medical garments. Increasing healthcare digitization and demand for continuous patient monitoring foster long-term opportunities for conductive fabric integration in medical diagnostics.

Key Trends and Opportunities

Advancement in Material Innovation and Fabric Engineering

Continuous innovation in conductive fibers and coating technologies enhances performance, flexibility, and wash durability. Nanomaterials such as graphene and silver nanoparticles are increasingly adopted to improve electrical conductivity without compromising comfort. Industry leaders invest in hybrid composites combining metals with synthetic polymers to achieve optimal strength and flexibility. These innovations enable wider use in sportswear, automotive interiors, and industrial equipment. Material breakthroughs create significant opportunities for new product differentiation and cost-effective large-scale production.

- For instance, Nanographene used by companies in the automotive interior segment has enabled the production of lightweight, high-strength components by optimizing fiber architecture with nanosurface engineering using graphene derivatives.

Growing Focus on Sustainability and Eco-Friendly Production

Sustainability trends shape the conductive textiles market as manufacturers shift toward recyclable and bio-based materials. Companies adopt eco-friendly coating techniques and energy-efficient processes to reduce carbon emissions. Polyester and nylon recycling initiatives are gaining momentum, aligning with global environmental goals. Brands emphasizing sustainable innovation attract eco-conscious consumers and institutional buyers. This transition supports long-term competitiveness by integrating conductivity with environmental responsibility, driving adoption across healthcare, consumer electronics, and defense industries.

- For instance, Hilaturas Ferre produces yarns blending 90% recycled cotton with 10% other fibers such as polyester and nylon, significantly reducing virgin material usage

Key Challenges

High Manufacturing and Material Costs

The production of conductive textiles involves complex processes, including metal coating, nanomaterial deposition, and composite weaving, which significantly raise costs. Silver and copper commonly used conductive agents add to material expenses. Manufacturers face challenges balancing conductivity, flexibility, and cost-effectiveness for large-scale adoption. Smaller firms struggle to compete with established players due to high capital requirements. Achieving affordable mass production remains a key hurdle limiting broader use in consumer and industrial applications.

Durability and Performance Limitations

Conductive textiles often face degradation in electrical properties after repeated washing, stretching, or exposure to harsh conditions. Ensuring long-term conductivity while maintaining softness and comfort poses a technical challenge. Wear and environmental exposure can reduce the performance of coatings and embedded fibers, affecting reliability in critical applications such as defense or healthcare. Industry players continue investing in advanced coating technologies and material stabilization techniques to overcome these durability barriers and extend product lifespan.

Regional Analysis

North America

North America holds a 31% market share in the conductive textiles market, driven by strong demand across defense, healthcare, and wearable electronics industries. The United States leads regional growth with advanced R&D capabilities and a robust presence of key players such as 3M Company and Herculite Inc. Rising military expenditure and integration of smart fabrics in uniforms and medical wearables further support adoption. Canada and Mexico also contribute steadily, supported by growing automotive and sportswear applications emphasizing durability, comfort, and electrical conductivity.

Europe

Europe accounts for a 28% market share, supported by growing investments in sustainable and high-performance textile manufacturing. Germany, France, and the United Kingdom lead innovation in electromagnetic shielding fabrics and smart clothing. Companies like Bekaert S.A. and Statex Produktions- und Vertriebs GmbH drive advancements in metal-coated fibers and conductive yarns. The European Union’s emphasis on eco-friendly production processes and recycling strengthens market prospects. Expanding defense modernization programs and adoption of conductive materials in automotive interiors further enhance regional demand.

Asia-Pacific

Asia-Pacific dominates the global market with a 34% share, propelled by large-scale textile production and expanding electronics manufacturing hubs. China, Japan, South Korea, and India lead in both volume and innovation. Toray Industries, Seiren Co. Ltd., and UBE Industries Ltd. spearhead product development with focus on flexible, lightweight, and cost-efficient conductive fabrics. Increasing use of smart textiles in healthcare monitoring, consumer wearables, and industrial applications fuels regional momentum. Rapid urbanization and favorable government policies toward advanced material innovation further boost growth across Asia-Pacific.

Latin America

Latin America represents a 4% market share, with gradual adoption driven by emerging applications in healthcare and sportswear. Brazil and Mexico lead regional activity, supported by growing investments in smart textile imports and defense modernization. Local manufacturers are exploring opportunities in conductive coatings and lightweight synthetic materials to enhance product versatility. Rising awareness of wearable technologies and improvements in textile processing infrastructure are expected to stimulate market expansion. However, limited R&D capacity and higher production costs continue to challenge broader regional penetration.

Middle East & Africa

The Middle East & Africa hold a 3% market share, characterized by increasing use of conductive fabrics in defense, aerospace, and industrial safety applications. Countries like the United Arab Emirates and Saudi Arabia invest in military modernization and smart uniform technologies. Growing healthcare and sports industries create additional opportunities for conductive textile imports. Regional manufacturers focus on partnerships with global suppliers to strengthen material availability and technical expertise. Despite slower adoption, government-led industrial diversification programs continue to support market expansion across this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Fabric:

- Cotton

- Nylon

- Polyester

- Others

By Product:

- Woven Textiles

- Non-Woven Textiles

- Knitted Textiles

By Application:

- Military and Defense

- Healthcare

- Sports and Fitness

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the conductive textiles market features leading players such as 3M Company, Bekaert S.A., Herculite Inc., Kinetic Polymers, Seiren Co. Ltd., Statex Produktions- und Vertriebs GmbH, Swicofil AG, TIBTECH Innovations, Toray Industries Inc., and UBE Industries Ltd. The market remains moderately consolidated, with established companies focusing on advanced material innovation, coating technologies, and strategic collaborations to enhance product performance. Firms actively invest in R&D to develop lightweight, flexible, and durable conductive fabrics suitable for defense, healthcare, and smart wearable applications. Mergers, acquisitions, and partnerships strengthen global supply capabilities and technology integration. Manufacturers increasingly target sustainability through recyclable polymers and eco-friendly production methods, aligning with global environmental regulations. Regional expansions across Asia-Pacific and North America reflect growing production capacities and demand diversification. The competition continues to intensify as new entrants leverage nanotechnology and hybrid fiber composites to capture niche market segments in performance and technical textiles.

Key Player Analysis

- Toray Industries Inc.

- Herculite Inc.

- Bekaert S.A.

- TIBTECH Innovations

- Seiren Co. Ltd.

- Swicofil AG

- 3M Company

- UBE Industries Ltd.

- Kinetic Polymers

- Statex Produktions- und Vertriebs GmbH

Recent Developments

- In July 2025, the Global Electronics Association (formerly IPC) issued the IPC-8911 standard for conductive e-textile yarns. The standard defines classification, testing, and performance criteria to streamline supply chains and enhance product reliability.

- In December 2024, Bally Ribbon Mills introduced E-WEBBINGS® smart textile products designed for aerospace use. These conductive fabrics integrate embedded electronics that transmit power and data while reducing product weight, size, and material cost.

- In May 2023, Seiko Epson Corporation and its subsidiary Epson X Investment Corporation invested in AI Silk through the EP-GB Investment Limited Partnership. The partnership focuses on developing LEAD SKIN®, a next-generation conductive fabric with high performance for wearable applications.

Report Coverage

The research report offers an in-depth analysis based on Fabric, Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of smart wearables and medical monitoring fabrics.

- Integration of nanomaterials and graphene coatings will improve conductivity and flexibility.

- Defense modernization programs will continue to drive large-scale procurement of conductive uniforms.

- Healthcare digitization will boost demand for smart patient monitoring garments.

- Sustainable production methods will gain traction with recycled and bio-based conductive fibers.

- Asia-Pacific will maintain leadership supported by strong textile manufacturing capabilities.

- Collaboration between electronics and textile firms will accelerate product innovation.

- Miniaturization of sensors will enable thinner, more comfortable smart fabrics.

- Research in wash-durable coatings will enhance long-term performance and reliability.

- Expanding use in automotive and aerospace interiors will create new commercial opportunities.