Market Overview

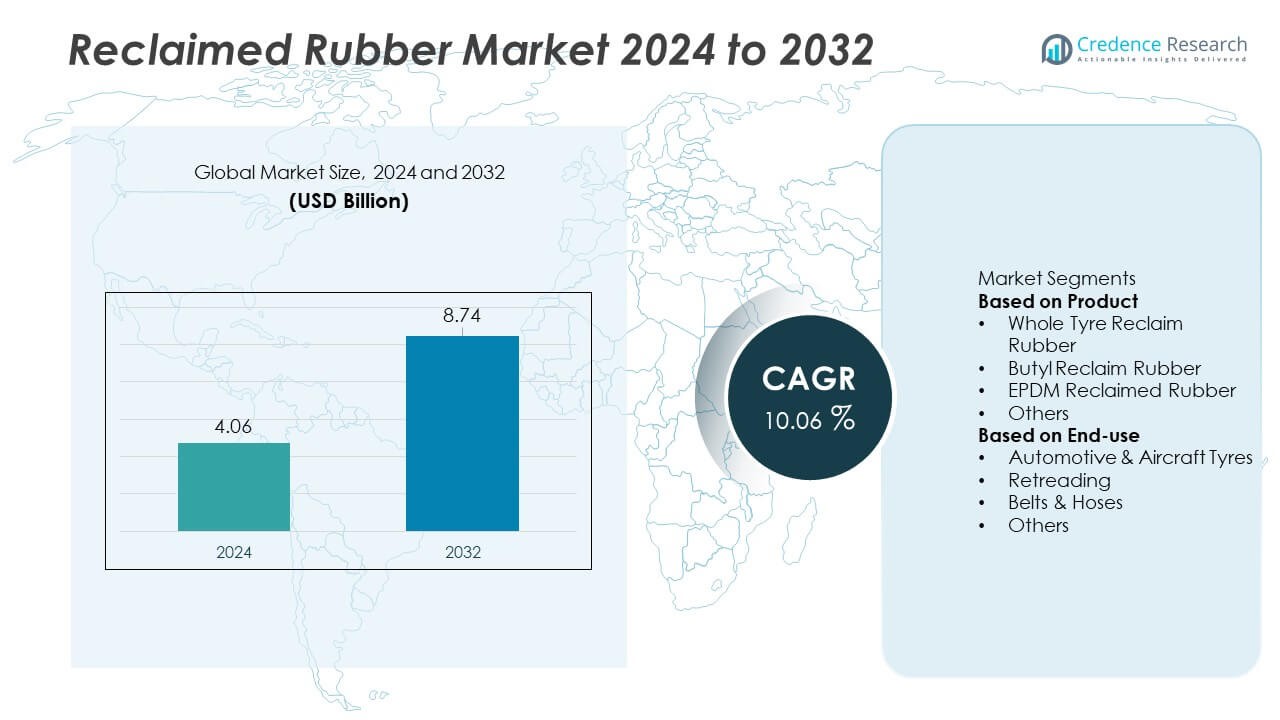

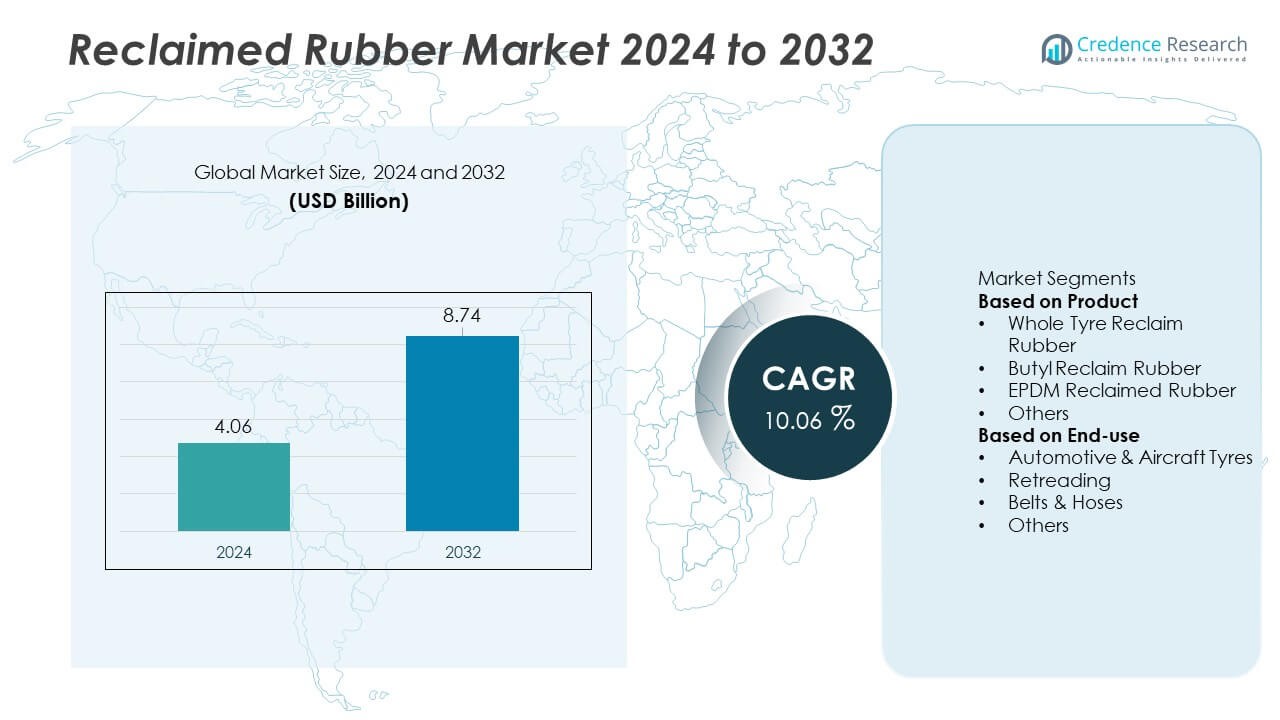

The Reclaimed Rubber market was valued at USD 4.06 billion in 2024 and is projected to reach USD 8.74 billion by 2032, growing at a CAGR of 10.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reclaimed Rubber Market Size 2024 |

USD 4.06 Billion |

| Reclaimed Rubber Market, CAGR |

10.06% |

| Reclaimed Rubber Market Size 2032 |

USD 8.74 Billion |

Top players in the Reclaimed Rubber market include Minar Reclaimation Private Limited, J. Allcock & Sons Ltd, HUXAR, Tianyu (Shandong) Rubber & Plastic Products Co., Ltd., Rolex Reclaim Pvt. Ltd., SNR Reclamations Pvt. Ltd., Swani Rubber Industries, Fishfa Rubbers Ltd., SRI Impex Pvt. Ltd., and GRP Ltd. These companies strengthen their position through advanced recycling technologies, strong raw material sourcing networks, and expanding production capabilities. Asia Pacific leads the market with a 41% share, driven by large tyre manufacturing bases and high scrap availability. Europe follows with a 22% share, supported by strict recycling regulations and circular economy policies. North America holds a 24% share, driven by strong tyre retreading activity and rising demand for sustainable rubber alternatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Reclaimed Rubber market reached USD 4.06 billion in 2024 and is projected to reach USD 8.74 billion by 2032 at a 10.06% CAGR, reflecting strong demand for cost-efficient and sustainable rubber alternatives.

- Growth is driven by rising adoption of reclaimed rubber in tyres and automotive applications, with whole tyre reclaim rubber holding a 52% segment share due to its durability, tensile strength, and wide industrial compatibility.

- Market trends include increasing investment in advanced devulcanization technologies, enabling higher-quality reclaimed rubber grades suitable for premium automotive, construction, and industrial applications.

- Competition intensifies as leading companies expand production capacity, strengthen scrap-collection networks, and focus on consistent product quality to meet regulatory and sustainability requirements.

- Regionally, Asia Pacific leads with 41%, followed by North America at 24% and Europe at 22%, supported by strong tyre recycling activity, environmental regulations, and rising demand for circular-economy materials.

Market Segmentation Analysis:

By Product

Whole Tyre Reclaim Rubber leads the segment with a 52% share, driven by its wide availability, strong durability, and cost-efficient performance in various industrial applications. Manufacturers prefer this product due to its high tensile strength, elasticity, and compatibility with multiple rubber blends used in tyres, molded goods, and general rubber products. Butyl reclaim rubber shows rising demand in inner tubes and sealing applications because of its superior air retention properties. EPDM reclaimed rubber grows steadily, supported by its heat and weather resistance for automotive and construction uses. Expanding recycling initiatives and growing pressure to reduce raw material costs continue to strengthen the dominance of whole tyre reclaim rubber in global markets.

- For instance, GRP Ltd operates with an installed capacity to handle 81,200 metric tonnes per annum to service the needs of the global polymer industry. The company focuses on the circular economy, recycling end-of-life tyres, tubes, and other rubber and nylon waste to produce materials like reclaim rubber and repurposed polyolefins.

By End-use

Automotive & Aircraft Tyres dominate this segment with a 61% share, driven by high consumption of reclaimed rubber in tyre manufacturing and replacement cycles. Tyre producers adopt reclaimed materials to reduce production costs, improve sustainability scores, and comply with circular economy standards. The retreading segment also contributes steady growth as fleet operators use reclaimed rubber to extend tyre life and reduce operational expenses. Belts and hoses show increasing adoption due to strong abrasion resistance and flexibility offered by reclaimed rubber variants. Growing emphasis on waste reduction, rising tyre scrap volumes, and expanding automotive production continue to reinforce the leading position of the tyre segment in global reclaimed rubber demand.

- For instance, Michelin enhanced its retreading division capabilities, a process which significantly improves reclaimed compound utilization and saves natural resources.

Key Growth Drivers

Rising Demand for Cost-Effective and Sustainable Rubber Alternatives

Manufacturers increasingly adopt reclaimed rubber to reduce reliance on virgin rubber and lower production costs. Growing pressure to minimize waste and meet sustainability targets encourages industries to integrate recycled materials into tyre, automotive, and industrial rubber goods. Reclaimed rubber provides strong elasticity, durability, and affordability, making it a practical substitute in high-volume applications. Expanding tyre scrap generation also ensures steady raw material availability. As companies focus on reducing carbon footprints, reclaimed rubber gains strong traction across both developed and emerging markets.

- For instance, Fishfa Rubbers Ltd operates four manufacturing units and has a total production capacity of 24,000 tonnes of reclaim rubber annually, utilizing 95% of this capacity.

Growth of the Automotive and Tyre Manufacturing Sector

The expanding automotive industry strengthens demand for reclaimed rubber due to high consumption in tyres, tubes, belts, and molded components. Tyre manufacturers use reclaimed rubber to improve cost efficiency and support eco-friendly production practices. Retreading also grows as fleet operators seek cost-effective maintenance solutions. Increasing vehicle production in Asia Pacific and Latin America further boosts reclaimed rubber usage. As global mobility needs rise, reclaimed rubber becomes a critical material supporting large-scale tyre manufacturing.

- For instance, Bridgestone is building a pilot demonstration plant in Seki City, Gifu Prefecture, to advance precise pyrolysis technology for chemical recycling of end-of-life tires, with the goal of processing approximately 7,500 tonnes per year once operations begin in 2027.

Favorable Government Policies Supporting Recycling and Circular Economy

Governments promote tyre recycling, waste reduction, and circular economy initiatives, driving higher adoption of reclaimed rubber. Regulations encourage industries to increase recycled content in manufacturing and reduce landfill waste. Incentives for recycling plants and strict disposal norms help strengthen supply chains for reclaimed rubber production. Public awareness of environmental protection also accelerates acceptance of sustainable materials. These policies create long-term opportunities for manufacturers to scale capacity and expand reclaimed rubber applications.

Key Trends & Opportunities

Expansion of High-Performance Reclaimed Rubber Grades

Technological advancements enable the development of refined reclaimed rubber with improved tensile strength, flexibility, and heat resistance. These high-performance grades open new opportunities in automotive components, industrial goods, and construction applications. Manufacturers invest in advanced devulcanization technologies to enhance material quality and enable wider substitution of virgin rubber. As customers seek reliable and sustainable materials, demand for premium reclaimed grades continues to rise. This trend creates strong opportunities for innovation across product lines.

- For instance, Rolex Reclaim Pvt. Ltd. manufactures reclaimed rubber from various rubber scraps, including natural rubber tubes, butyl rubber tubes, and whole tire scrap, utilizing modernized machinery and focusing on meeting specific customer requirements and quality standards

Increasing Adoption Across Non-Tyre Industrial Applications

Reclaimed rubber finds growing use in conveyor belts, hoses, gaskets, flooring, and molded goods due to its durability and cost benefits. Construction, mining, and manufacturing industries adopt reclaimed rubber to reduce material expenses and meet sustainability standards. Expanding industrialization in Asia Pacific and Africa further supports adoption. Manufacturers also explore new blends for consumer products such as mats, footwear, and insulation materials. This diversification enhances market resilience and opens long-term growth avenues.

- For instance, SNR Reclamations Pvt. Ltd. expanded its industrial rubber division to achieve a total annual production capacity of 10,800 tonnes of Butyl reclaim rubber, 3,600 tonnes of Whole Tyre reclaim rubber, and 2,400 tonnes of EPDM reclaim rubber across its units.

Key Challenges

Quality Variability and Performance Limitations

Reclaimed rubber often shows performance variations due to differences in raw scrap quality and processing methods. These inconsistencies limit usage in high-performance applications where strength and precision are critical. Manufacturers must invest in advanced processing technologies to improve consistency and meet stringent industry standards. Without proper quality control, reclaimed rubber may face adoption barriers in premium automotive and industrial sectors. Addressing this challenge is essential to expand market reach.

Competition from Virgin Rubber and Synthetic Alternatives

Virgin rubber and advanced synthetic rubbers offer superior performance characteristics, creating strong competition for reclaimed rubber in technical applications. Many industries prefer high-grade materials for critical components requiring heat resistance, elasticity, and long service life. Price fluctuations in natural rubber markets also influence the competitiveness of reclaimed rubber. To overcome this challenge, producers must enhance product quality, invest in innovation, and focus on cost-efficiency to maintain market appeal.

Regional Analysis

North America

North America holds a 24% share, supported by strong demand from the automotive sector and well-established tyre recycling programs. The region benefits from advanced waste-management infrastructure, which ensures steady availability of raw materials for reclaimed rubber production. Manufacturers adopt reclaimed rubber to reduce costs and meet corporate sustainability targets. Growth is further driven by increasing tyre retreading activity among commercial fleets seeking long-term savings. Rising awareness of eco-friendly materials and strict landfill regulations promote wider use of reclaimed rubber across industrial goods, molded products, and construction applications.

Europe

Europe accounts for a 22% share, driven by stringent environmental regulations, circular economy policies, and high recycling compliance across major countries such as Germany, France, Italy, and the U.K. Industries use reclaimed rubber to reduce carbon emissions and align with EU sustainability targets. The tyre and automotive component sectors show strong adoption as manufacturers incorporate recycled materials to manage production costs. Expanding applications in flooring, insulation, and molded goods also support growth. Robust waste-collection systems and advanced devulcanization technologies contribute to consistent supply and high-quality reclaimed rubber availability across the region.

Asia Pacific

Asia Pacific leads the market with a 41% share, driven by large-scale tyre production, rapid industrial growth, and high availability of scrap rubber. China, India, Thailand, and Indonesia are major contributors due to expanding automotive manufacturing and strong demand for cost-effective raw materials. Reclaimed rubber is widely used in tyres, conveyor belts, footwear, and molded products across the region. Government initiatives supporting recycling and rising awareness of waste reduction strengthen adoption. Competitive production costs and growing investments in recycling facilities further cement Asia Pacific’s leadership in global reclaimed rubber consumption.

Latin America

Latin America holds a 9% share, supported by increasing tyre recycling activities and growing use of reclaimed rubber in tyres, retreading, footwear, and industrial goods. Brazil and Mexico dominate demand due to expanding automotive sectors and improving waste-management initiatives. Manufacturers adopt reclaimed rubber to reduce production expenses and meet environmental guidelines. Rising construction activity also boosts usage in flooring, mats, and molded components. Although technological advancement remains gradual, ongoing investments in recycling infrastructure are expected to enhance product quality and regional supply capability.

Middle East & Africa

The Middle East & Africa region accounts for a 4% share, driven by gradual improvements in recycling systems and increasing demand from automotive and industrial applications. Gulf countries show higher adoption due to stronger manufacturing bases and interest in sustainable materials. African nations contribute through rising tyre scrap volumes and growing use of reclaimed rubber in footwear, mats, and low-cost industrial goods. Limited processing capacity remains a constraint, but expanding urbanization and government initiatives promoting waste reduction support slow but steady market growth. As recycling infrastructure develops, reclaimed rubber usage is expected to rise across multiple end-use sectors.

Market Segmentations:

By Product

- Whole Tyre Reclaim Rubber

- Butyl Reclaim Rubber

- EPDM Reclaimed Rubber

- Others

By End-use

- Automotive & Aircraft Tyres

- Retreading

- Belts & Hoses

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes key players such as Minar Reclaimation Private Limited, J. Allcock & Sons Ltd, HUXAR, Tianyu (Shandong) Rubber & Plastic Products Co., Ltd., Rolex Reclaim Pvt. Ltd., SNR Reclamations Pvt. Ltd., Swani Rubber Industries, Fishfa Rubbers Ltd., SRI Impex Pvt. Ltd., and GRP Ltd. These companies strengthen their market position by expanding production capacity, improving devulcanization processes, and enhancing product consistency to meet rising demand for sustainable rubber solutions. Many manufacturers invest in advanced recycling technologies to achieve higher tensile strength and better performance across tyre, automotive, and industrial applications. Strategic partnerships with tyre manufacturers and OEMs support long-term supply stability. Companies also focus on efficient scrap collection systems and cost-effective processing to maintain competitive pricing. Growing environmental regulations push players to adopt eco-friendly production practices and circular economy models. Continuous innovation and regional expansion remain central to maintaining competitiveness in the global reclaimed rubber market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Minar Reclaimation Private Limited

- Allcock & Sons Ltd

- HUXAR

- Tianyu (Shandong) Rubber & Plastic Products Co., Ltd.

- Rolex Reclaim Pvt. Ltd.

- SNR Reclamations Pvt. Ltd.

- Swani Rubber Industries

- Fishfa Rubbers Ltd.

- SRI Impex Pvt. Ltd.

- GRP Ltd

Recent Developments

- In August 2025, GRP Ltd commenced commercial production of eco-friendly tyre-recycling products including reclaimed rubber from used tyres.

- In February 2025, J. Allcock & Sons Ltd (UK) sold its rubber curatives & additives business to Virdis Chemicals Ltd, while retaining its broader recycling operations.

- In December 2024, GRP Ltd (India) received a €15 million line of credit from Proparco to expand its tyre-recycling and circular-economy activities.

Report Coverage

The research report offers an in-depth analysis based on Product, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for reclaimed rubber will rise as industries push for lower-cost and eco-friendly materials.

- Advanced devulcanization technologies will improve product quality and expand high-performance applications.

- Tyre manufacturers will increase reclaimed rubber usage to meet sustainability and recycling mandates.

- Retreading activities will grow as fleet operators seek cost-efficient tyre life extension.

- Industrial sectors will adopt reclaimed rubber for belts, hoses, flooring, and molded goods.

- Circular economy regulations will accelerate recycling and boost supply chain development.

- Companies will expand capacity to meet rising demand from Asia Pacific and emerging markets.

- Partnerships between recyclers and OEMs will strengthen long-term product integration.

- Technological innovations will reduce performance gaps between reclaimed and virgin rubber.

- Consumer awareness of sustainable materials will support broader adoption of reclaimed rubber products.