Market Overview

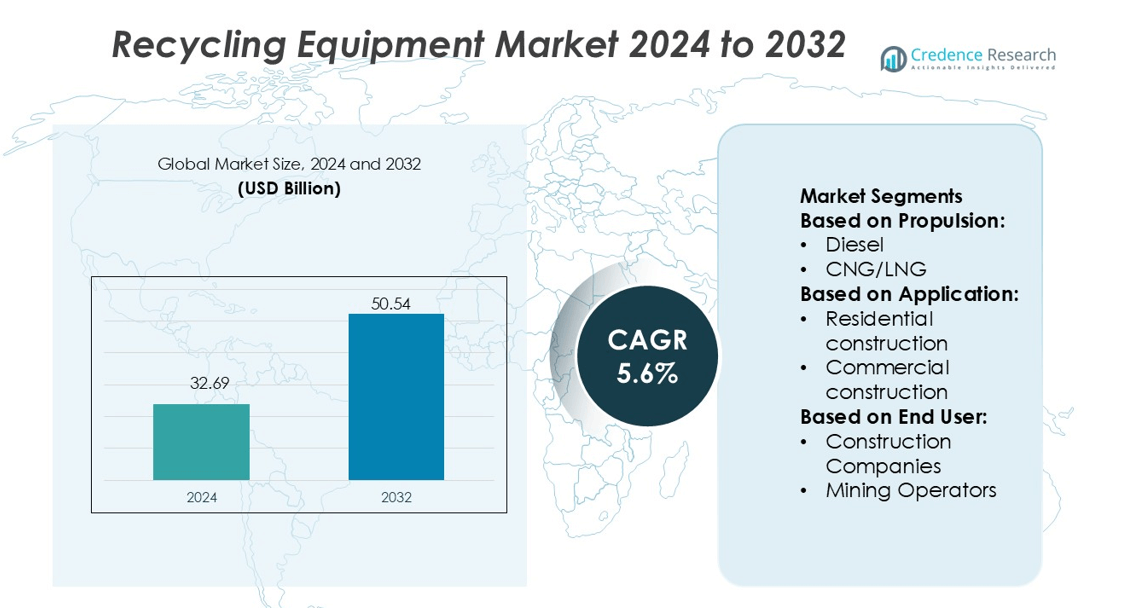

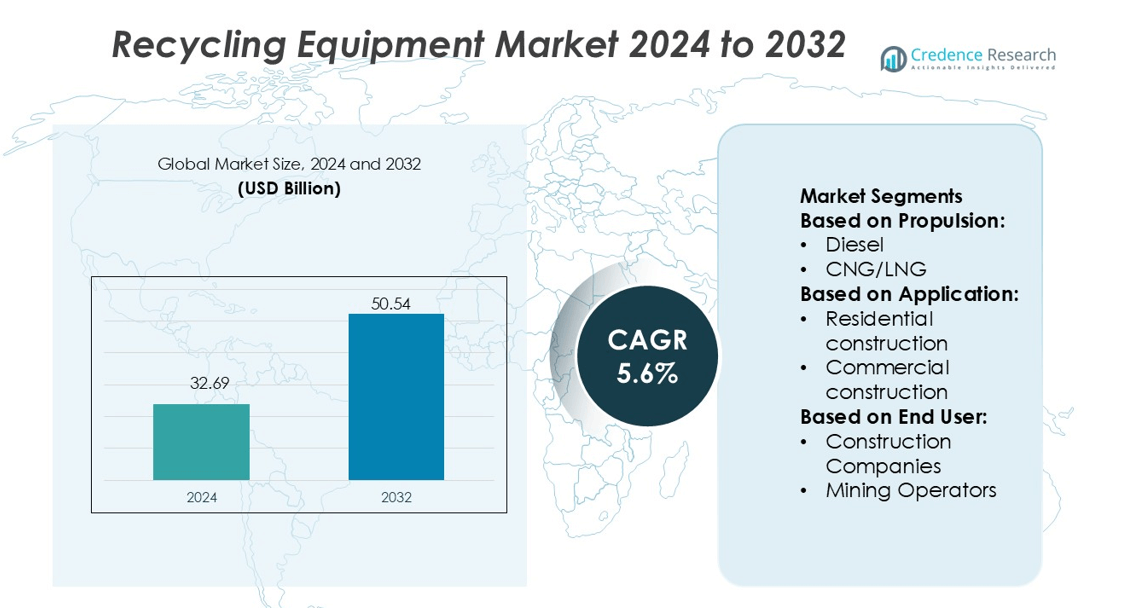

Recycling Equipment Market size was valued USD 32.69 billion in 2024 and is anticipated to reach USD 50.54 billion by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recycling Equipment Market Size 2024 |

USD 32.69 billion |

| Recycling Equipment Market, CAGR |

5.6% |

| Recycling Equipment Market Size 2032 |

USD 50.54 billion |

The recycling equipment market focus on advanced shredders, crushers, balers, sorting lines, and material handling systems for metal, plastic, paper, e-waste, and construction debris processing. Companies emphasize automation, AI-based sorting, telematics, and energy-efficient drives to improve throughput and lower operating costs. Strong service networks, rental fleets, and remote diagnostics help retain customers in municipal and industrial recycling plants. Asia-Pacific remains the leading region with 34% market share, driven by rapid industrialization, rising solid waste volumes, and increasing investment in high-capacity recycling facilities. Government regulations supporting circular economy goals further boost equipment deployment across the region.

Market Insights

- The Recycling Equipment Market was valued at USD 32.69 billion in 2024 and is expected to reach USD 50.54 billion by 2032 at a CAGR of 5.6%.

- Market drivers include rising waste generation, strict environmental regulations, and higher demand for metal, plastic, paper, and e-waste recovery systems, increasing installations of shredders, balers, crushers, and sorting units.

- Market trends highlight rapid adoption of automation, AI-based sorting, telematics, and energy-efficient drives, while rental fleets and remote monitoring improve operational efficiency and reduce downtime for industrial and municipal users.

- Competitive activity remains strong as global and regional manufacturers expand service networks, offer flexible leasing options, and develop modular, multi-material processing systems, but high capital cost and slow infrastructure development in emerging economies remain key restraints.

- Asia-Pacific leads with 34% regional share due to rising investment in high-capacity recycling plants, while shredding and sorting systems continue to gain dominant usage across construction debris, plastic, and e-waste recycling applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Propulsion

Diesel-powered recycling equipment holds the dominant share because construction and mining sites require high power, long operating hours, and strong load-handling capability. Heavy-duty shredders, crushers, and mobile sorting units run longer on diesel without frequent refueling, which suits remote job sites with limited charging points. CNG/LNG units grow with lower fuel costs and cleaner emissions. Electric units gain attention in urban areas that enforce noise and emission limits. Increasing battery capacity and fast-charging systems support adoption, but diesel remains the leading propulsion due to reliability in harsh conditions and heavy workloads.

- For instance, Hitachi Construction Machinery’s ZX470LCH-5G diesel excavator uses a 235 kW Isuzu 6WG1 engine (net power, per ISO 9249/14396) that delivers a maximum torque of 1,275 Nm and is designed for heavy-duty applications, including large-scale recycling and demolition work.

By Application

Industrial construction represents the leading application segment due to steady waste generation from factories, warehouses, and manufacturing facilities. Large volumes of concrete, metals, and demolition waste demand heavy recycling equipment, boosting the use of crushers, material handlers, and separation systems. Commercial construction follows, supported by renovation projects and retail expansion in urban areas. Residential projects mainly require smaller, mobile units for mixed debris. Mining and quarrying use specialized crushers and screens to process overburden and extracted rock, but the mass volume from industrial construction keeps this segment in the dominant position.

- For instance, Deere & Co. integrated its JDLink telematics system to monitor machines equipped with the 9.0-liter John Deere PowerTech PSS 6090 engine.

By End User

Construction companies account for the largest share because every infrastructure and building project creates bulk waste that needs crushing, screening, and separation. Strict waste disposal regulations and rising landfill charges push contractors to invest in on-site recycling. Government and municipalities expand waste management fleets for urban clean-up and road demolition programs. Rental companies grow as small contractors prefer leased crushers and shredders to reduce capital expenses. Mining operators and industrial users apply high-capacity machines for metal, stone, and concrete recovery, but construction companies remain dominant due to consistent project pipelines and compliance demands.

Key Growth Drivers

Rising Construction and Demolition Waste Generation

Rapid urban expansion and infrastructure upgrades generate large volumes of concrete, metals, asphalt, and mixed debris. Landfill restrictions and rising disposal costs push contractors to adopt crushers, shredders, and sorting systems to reclaim reusable materials. Recycling reduces haul-off trips and supports cost savings on new raw materials. Governments encourage on-site processing to lower carbon emissions linked to transport and quarrying. These factors increase equipment purchases across road building, commercial structures, and industrial sites. As new smart city and redevelopment projects accelerate, demand for high-capacity recycling machinery continues to rise.

- For instance, Abbott’s HeartMate 3 heart pump demonstrated significantly improved five-year outcomes compared to its predecessor, the HeartMate II. The five-year data, presented in 2022, showed that the overall survival rate was 58.4% for patients with the HeartMate 3, compared to 43.7% for those with the HeartMate II.

Government Regulations and Sustainability Targets

Many countries enforce stricter recycling mandates on construction waste, plastics, metals, and industrial by-products. Municipal authorities impose landfill diversion goals and require recycling audits for large projects. Companies invest in material recovery systems to meet green building certifications and environmental reporting rules. Financial benefits like tax credits, lower dumping fees, and recycled-content incentives strengthen equipment adoption. Rising investor pressure for ESG compliance also drives procurement of cleaner, efficient machines. These policy frameworks ensure consistent long-term demand for shredders, balers, screening plants, and automated sorting technologies.

- For instance, Henry Schein’s Blood Control IV Catheter 20-Gauge has a 1-inch beveled tip and comes 50 units per box, 4 boxes per case, ensuring standardization and ease of supply chain handling.

Technological Advancements in Recycling Machinery

Automation, AI-based sorting, and robotic arms improve recovery accuracy for metals, plastics, and aggregates. Modern crushers use variable speed drives and wear-resistant alloys to improve output and service life. Electric and hybrid recycling equipment gain traction in urban zones that enforce strict emission rules. Telematics allow remote monitoring of fuel use, tonnage processed, and maintenance schedules, reducing downtime and ownership costs. As processors demand higher throughput and precise separation, equipment makers offer smarter, modular, and energy-efficient solutions that increase productivity and expand market adoption.

Key Trends & Opportunities

Expansion of On-Site Recycling Solutions

Contractors prefer mobile crushers, compact screens, and small shredders to process waste directly at job sites. On-site crushing reduces trucking costs, noise restrictions, and landfill dependency. Many cities encourage contractors to reuse aggregates for roads, trenches, and backfilling. Rental companies stock mobile units for small builders that avoid capital investments. The trend supports modular and track-mounted systems that move between projects. As material reuse becomes part of tender requirements, portable recycling machines create strong market opportunities across residential, commercial, and municipal works.

- For instance, Terumo’s MEDISAFE WITH The main pump unit measures 77.9 mm x 40.1 mm x 18.9 mm and weighs 34 g (including the cartridge and holder but excluding insulin). The remote control measures 136.2 mm x 75.0 mm x 14.3 mm and weighs 152 g (including two AAA batteries).

Circular Economy Adoption in Manufacturing

Manufacturers redesign processes to recover metals, plastics, and industrial scrap for closed-loop production. Advanced balers, granulators, and pelletizers support recycled material quality that meets OEM standards. Electronics, automotive, and packaging industries increase recycled content demand, raising equipment sales for sorting and material refinement. Automation improves purity levels, helping meet customer and regulatory expectations. Circular economy initiatives attract investment in large-scale recycling plants, providing strong growth opportunities for high-capacity equipment makers and technology suppliers.

- For instance, BD’s primary IV administration sets for pediatric use often feature microbore tubing under 2 mm internal diameter, which minimizes priming volume and suits low-volume infusions.

Rising Use of Electric and Energy-Efficient Machinery

Cities with emission-control zones encourage electric crushers, screens, and conveyors. Quiet operation supports night-time construction and dense urban projects. Battery capacity and fast-charging improvements make electric units viable for multiple shifts. Manufacturers introduce hybrid powertrains to lower fuel use and reduce maintenance costs. Buyers focus on total cost of ownership, giving energy-efficient equipment a market edge. This trend benefits suppliers who invest in electrification, lightweight components, and smart power management systems.

Key Challenges

High Capital Investment and Maintenance Costs

Recycling equipment like mobile crushers, automated sorters, and industrial shredders require significant upfront spending. Small contractors and waste operators often choose rental options due to limited budgets. Wear parts, fuel consumption, and maintenance add long-term operating costs. Many small facilities struggle to justify investment without guaranteed waste volumes. These financial barriers slow adoption, especially in developing regions with low landfill fees and weak recycling policies.

Variability in Waste Stream Quality and Logistics

Mixed waste streams increase contamination, reducing output quality and equipment efficiency. Sorting heavy debris, metals, and plastics requires advanced screening and separation systems, raising cost and complexity. Transporting waste to centralized facilities adds logistical challenges, particularly in remote regions. Inconsistent material flows from seasonal construction activity affect utilization rates. These issues force operators to invest in better preprocessing and automation, but adoption remains uneven across smaller players.

Regional Analysis

North America

North America holds 31% of the global recycling equipment market due to strong waste management policies, high packaging waste generation, and rapid adoption of advanced shredders, balers, and sorting systems. The United States leads regional demand, supported by rising investment in material recovery facilities and automated recycling lines. Industrial sectors promote metal, paper, and plastic recovery to cut landfill pressure and comply with sustainability mandates. Equipment suppliers focus on robotics, AI-based sorting, and energy-efficient machinery. Government incentives for circular economy programs further boost sales. Increasing e-waste and construction debris recycling also support steady equipment replacement cycles across the region.

Europe

Europe accounts for 29% market share and remains a mature recycling technology hub. Strict landfill bans, packaging regulations, and extended producer responsibility laws drive machinery adoption across municipal and industrial sectors. Countries such as Germany, France, and the UK deploy advanced material recovery facilities using sensor-based sorting, high-capacity balers, and metal separators to improve recycling yield. Demand rises from construction and automotive industries for metal, concrete, and plastic reprocessing. Public investment in circular economy programs and urban waste treatment upgrades fuels sales. Recycling machinery makers in Europe emphasize automation, modular lines, and low-emission operation to meet environmental goals.

Asia-Pacific

Asia-Pacific leads the global market with 34% share, supported by rapid industrialization, high plastic waste volumes, and growing recycling regulations. China, Japan, and India expand plastic, metal, and paper recycling capacities to reduce landfill pressure and promote circular manufacturing. Manufacturers invest in shredders, crushers, and washing systems suitable for large-volume processing. Growth in packaging, e-commerce, automotive, and construction sectors increases waste output, pushing demand for high-capacity recycling solutions. Regional governments promote domestic recycling over waste exports, which boosts machinery installations. Local and global equipment suppliers expand production and service networks to meet rising demand from municipal and industrial users.

Latin America

Latin America holds 4% market share, driven by gradual adoption of recycling infrastructure across Brazil, Mexico, Chile, and Colombia. Urban solid waste generation increases demand for balers, crushers, and sorting systems in municipal facilities. Industrial users adopt metal and plastic reprocessing machinery to reduce disposal costs and comply with sustainability targets. Growth remains moderate due to funding constraints and limited recycling facilities, but public-private partnerships are expanding. International suppliers offer affordable, automated systems tailored to local operations. Rising awareness of landfill pollution, plastic waste, and resource recovery supports equipment growth across packaging, beverage, and construction sectors.

Middle East & Africa

Middle East & Africa represent 2% market share, with slow but rising adoption of recycling equipment. Gulf countries invest in modern waste treatment plants as part of zero-waste and sustainability agendas. Construction and demolition waste recycling drives demand for crushers, screeners, and separators. South Africa, UAE, and Saudi Arabia lead investments in plastic and metal recycling lines. Limited local manufacturing capacity increases dependence on international suppliers. Municipal modernization, tourism waste management, and landfill reduction programs support equipment installations. Although infrastructure gaps persist, rising environmental regulation and industrial recycling initiatives create long-term opportunities in the region.

Market Segmentations:

By Propulsion:

By Application:

- Residential construction

- Commercial construction

By End User:

- Construction Companies

- Mining Operators

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Recycling Equipment Market players such as Hitachi Construction Machinery, Deere & Co., Terex, Komatsu, CNH Industrial, Volvo, Liebherr, Caterpillar, Sany, and Doosan. The competitive landscape features global and regional manufacturers offering a wide mix of recycling machinery such as shredders, crushers, balers, sorters, washing lines, and material handlers. Competition centers on automation, durability, and energy-efficient operation, as recycling facilities demand higher throughput and lower processing costs. Companies invest in AI-based optical sorting, robotic pickers, and sensor-driven separation systems to increase material purity and reduce labor dependency. Electric and hybrid equipment is gaining traction as operators adopt low-emission fleets to meet environmental compliance standards. Strong aftersales support, rental fleets, and remote monitoring services enhance customer retention. Pricing competitiveness remains high in developing markets, where buyers prioritize affordability and simple maintenance. Strategic partnerships with waste processors, EPC contractors, and municipal bodies help manufacturers expand their installed base. Technology upgrades, modular designs, and multi-material processing capabilities continue to shape competition as recycling transitions toward smarter, automated, and cost-efficient operations worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, Honeywell’s Phoenix Controls released the Critical Spaces Control Platform, which uses automated venturi valves to manage airflow for enhanced safety and efficiency in sensitive environments like hospitals, labs, and cleanrooms. This platform provides precise environmental control by dynamically adjusting ventilation based on real-time data.

- In March 2024, Nederman’s MCP Air Purification Tower (APT) is designed to protect fabrication workers from airborne hazards, specifically welding fumes and fine dust. It is a continuous duty, ambient filtration solution used in industrial environments, particularly when source capture is not practical.

- In October 2023, General Kinematics, a vibratory equipment manufacturer in Crystal Lake, Illinois, announced the completion of a 42,000-square-foot expansion of its manufacturing space. The expansion includes high bay ceilings for 80-ton cranes, additional space for capital equipment, and increased storage, allowing the company to meet growing demand for larger machinery for the mining, foundry, and recycling industries

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated sorting systems will increase as recycling plants move toward higher material purity.

- More facilities will adopt electric and hybrid recycling machines to reduce emissions and fuel costs.

- Growth in e-waste recycling will boost sales of crushers, shredders, and separation units.

- Municipal waste modernization will expand installations of balers, compactors, and advanced sorting lines.

- Construction and demolition recycling will drive demand for heavy-duty crushers and screeners.

- Robotics and AI-based separation tools will reduce labor needs and improve accuracy in material recovery.

- Rising circular economy policies will encourage investment in high-capacity recycling plants.

- Cloud-based monitoring and predictive maintenance will support higher equipment uptime.

- Equipment rental and leasing models will expand as small operators seek lower capital costs.

- Manufacturers will focus on modular, flexible systems that can process multiple waste streams.