Market Overview

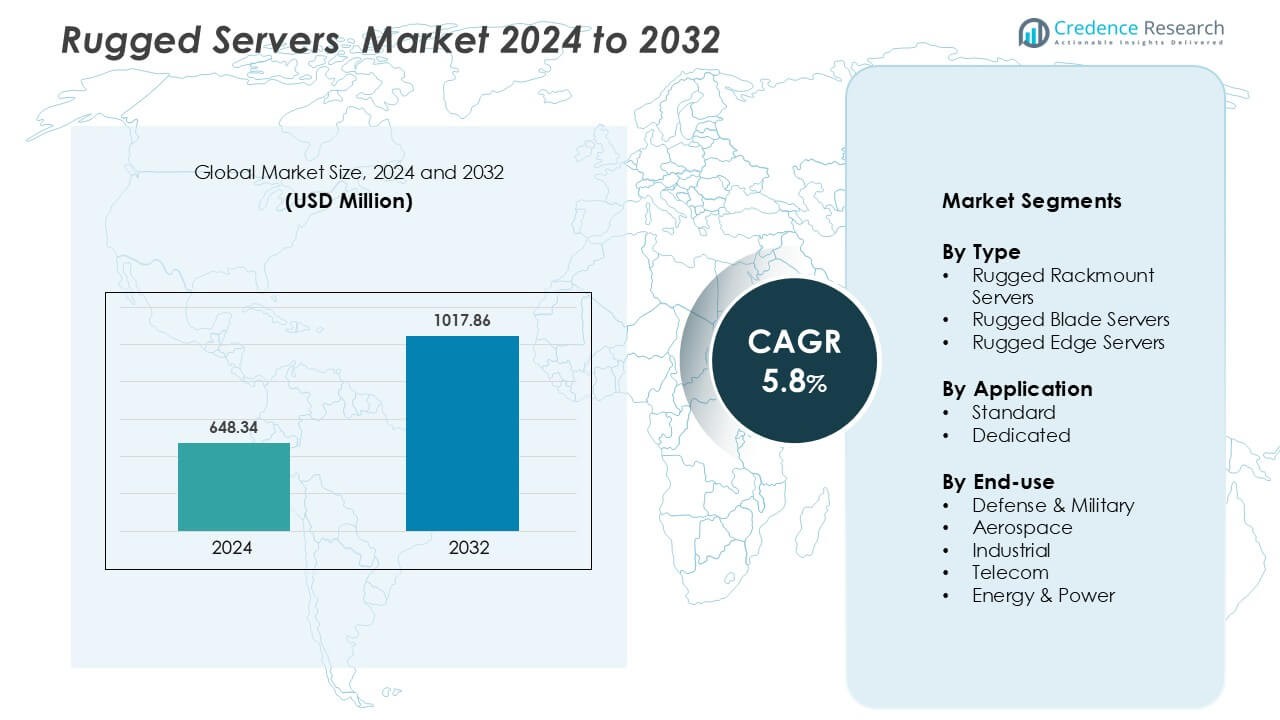

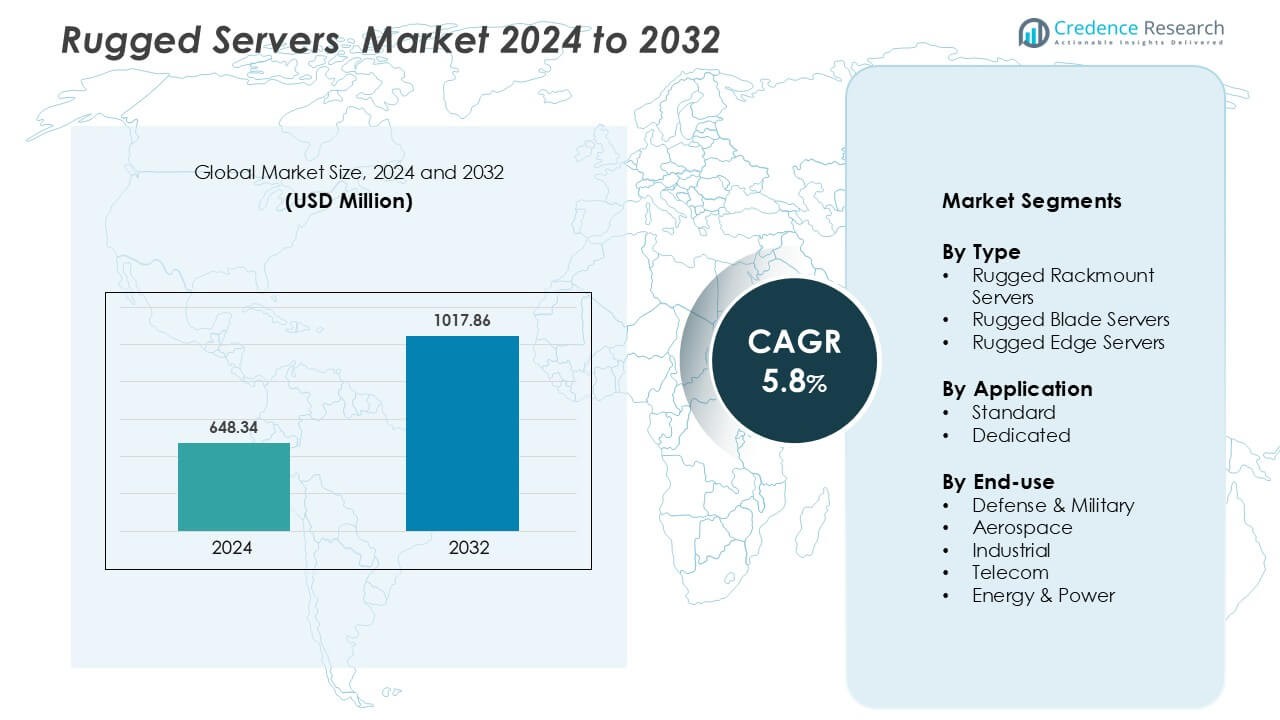

Rugged Servers Market was valued at USD 648.34 million in 2024 and is anticipated to reach USD 1017.86 million by 2032, growing at a CAGR of 5.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rugged Servers Market Size 2024 |

USD 648.34 Million |

| Rugged Servers Market, CAGR |

5.8 % |

| Rugged Servers Market Size 2032 |

USD 1017.86 Million |

The rugged servers market is characterized by strong competition among key players such as Trenton Systems, Mercury Systems, ADLINK Technology, Core Systems, GETAC, Westek Technology, Kontron, One Stop Systems, General Micro Systems, and Advantech Co., Ltd. These companies focus on developing high-performance, durable, and energy-efficient server systems designed for extreme environments. Their strategies include product innovation, defense-grade compliance, and expanding edge computing capabilities. North America leads the global rugged servers market with a 37% share, driven by high military expenditure, industrial automation, and early adoption of advanced computing technologies. Continuous investments in R&D and partnerships strengthen the market’s competitive landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rugged Servers Market was valued at USD 648.34 million in 2024 and is projected to reach USD 1017.86 million by 2032, registering a CAGR of 5.8% during the forecast period.

- Growing defense modernization, edge computing expansion, and industrial IoT adoption are the primary market drivers supporting robust demand.

- Key trends include the integration of AI-enabled processing, modular designs, and advanced thermal management for enhanced reliability in extreme environments.

- The competitive landscape features major players such as Trenton Systems, Mercury Systems, ADLINK Technology, and Advantech Co., Ltd., focusing on defense-grade compliance and product innovation.

- North America dominates the market with a 37% share, followed by Europe at 28% and Asia-Pacific at 22%, while rugged rackmount servers lead the type segment, and the defense and military sector remains the largest end-use segment globally.

Market Segmentation Analysis:

By Type

Rugged rackmount servers dominate the market due to their reliability, scalability, and modular design. These servers are widely used in defense, aerospace, and industrial sectors that demand consistent performance in extreme conditions. Their enhanced durability and ability to handle vibration, shock, and temperature variations make them ideal for mission-critical operations. The adoption of rugged rackmount servers continues to rise with the increasing deployment of edge computing systems in remote locations and military field bases, driven by growing data processing needs at the source.

- For instance, Trenton Systems, Inc.’ TRS10-22 server family supports 32 DIMM memory slots and up to 8 SSDs in 1U/2U form factors while operating over a temperature range of –40 °C to +50 °C.

By Application

The dedicated segment holds the largest share in the rugged servers market, supported by its role in specialized, high-performance applications. Dedicated rugged servers are engineered for secure data handling, real-time analytics, and continuous uptime in demanding environments. They offer enhanced customization, fault tolerance, and faster data transfer rates, making them suitable for defense missions and industrial automation. The demand for dedicated servers is further driven by growing adoption in AI-based field operations, remote sensing, and autonomous systems requiring uninterrupted processing power.

- For instance, Crystal Group’s RS41110L21 4U rugged server delivers support for up to 4 TB of DDR4 memory and includes ten modular SSD bays capable of housing 20 drives.

By End-use

The defense and military segment leads the rugged servers market, driven by extensive deployment in tactical communication, command, and control systems. These servers support advanced computing applications, including surveillance, intelligence, and weapon systems, where durability and data security are critical. Rugged servers in this segment are built to comply with military standards like MIL-STD-810 for temperature, vibration, and shock resistance. Rising defense modernization programs and battlefield digitization further accelerate adoption across global armed forces, making defense and military the dominant end-use category.

Key Growth Drivers

Rising Demand from Defense and Military Applications

The defense and military sector is a major growth driver for the rugged servers market. Increasing adoption of rugged computing systems in command, control, communications, and intelligence (C4I) operations enhances real-time decision-making in hostile environments. Rugged servers are essential for mission-critical tasks requiring high durability, data security, and continuous operation under extreme temperature and vibration. Military modernization programs across the U.S., Europe, and Asia-Pacific further boost demand for field-deployable systems. Governments are also investing in mobile data centers and tactical communication networks that rely on rugged servers to process and secure large volumes of sensitive data efficiently.

- For instance, Mercury Systems, Inc.’s RTBX05 rugged BuiltSECURE™ server supports up to 120 TB of storage and dual Intel® Xeon® E5-2600 v4 processors, designed for MIL-STD environments.

Expansion of Edge Computing and Industrial IoT Applications

The widespread adoption of edge computing and Industrial Internet of Things (IIoT) technologies is significantly driving rugged server demand. Industries such as energy, mining, and manufacturing require robust data-processing systems close to operational sites to minimize latency and improve analytics. Rugged edge servers enable real-time monitoring, predictive maintenance, and automation in challenging field environments. These systems withstand harsh industrial conditions including dust, heat, and electromagnetic interference. The growing focus on smart infrastructure and connected operations across industries is further encouraging enterprises to deploy ruggedized computing solutions that enhance productivity while reducing downtime and maintenance costs.

- For instance, ADLINK Technology Inc.’s MECS-7120 edge server supports six DDR5 DIMMs at 4800 MT/s and features 2× 25 G SFP28 Ethernet ports in a 1U 19″ form factor.

Technological Advancements in Rugged Server Design

Ongoing innovations in hardware design and component miniaturization are propelling market growth. Modern rugged servers now integrate advanced GPUs, multi-core processors, and solid-state drives to deliver enhanced computational power with reduced energy consumption. Manufacturers are introducing compact, modular designs with high resistance to shock, moisture, and temperature fluctuations. Integration of AI and cybersecurity features ensures secure and intelligent processing in remote or mission-critical applications. Companies are also focusing on compliance with standards such as MIL-STD and IP ratings to expand their product suitability for defense and industrial use. These advancements not only improve performance but also extend system longevity and operational reliability.

Key Trends & Opportunities

Growing Adoption of AI and Machine Learning Workloads

The integration of artificial intelligence (AI) and machine learning (ML) workloads into rugged server systems is transforming data-driven operations. Rugged servers equipped with GPUs and AI accelerators support real-time data analytics for defense surveillance, industrial automation, and autonomous vehicles. As demand for on-site computing grows, organizations are deploying these servers at the edge to process vast datasets locally. The opportunity lies in developing high-performance AI-enabled rugged systems capable of supporting low-latency computing and predictive analytics. This trend enhances operational intelligence, situational awareness, and autonomous decision-making across industries.

- For instance, The Power EdgeXE7745 is designed with a dual-socket configuration that supports AMD’s 5th Generation EPYC 9005 series CPUs.

Increasing Focus on Modular and Scalable Server Architectures

The trend toward modular and scalable rugged servers is creating new opportunities for manufacturers. End-users across defense, energy, and telecom sectors are seeking flexible architectures that allow quick customization based on application needs. Modular rugged servers support easy upgrades and integration of new hardware or software components without system replacement. This scalability improves cost efficiency and reduces downtime, aligning with organizations’ focus on long-term operational resilience. Vendors are responding by introducing systems that combine ruggedized design with adaptable configurations to serve both stationary and mobile mission environments effectively.

- For instance, The K3833-Q motherboard supports Intel Core i9/i7/i5/i3 (12th and 13th Gen) processors. While some high-end Intel i9 processors can have up to 24 cores (e.g., 13th gen), the specific board’s supported CPU range might have a lower limit.

Key Challenges

High Production and Maintenance Costs

The design and manufacturing of rugged servers involve advanced materials, specialized testing, and strict compliance with military and industrial standards. These factors substantially increase production costs compared to conventional servers. Additionally, maintenance and replacement of rugged components require skilled technicians and high-cost spare parts. Organizations with budget constraints, particularly in emerging economies, find it challenging to justify such investments. As a result, adoption remains limited in small and medium enterprises. Balancing performance, durability, and affordability remains a key challenge for manufacturers aiming to expand their market footprint.

Limited Standardization and Interoperability Issues

The rugged servers market faces ongoing challenges related to the lack of standardization and interoperability across platforms. Different industries and defense agencies employ diverse technical specifications, complicating system integration and deployment. This fragmentation increases design complexity and limits cross-compatibility between hardware and software solutions. Interoperability issues can also hinder seamless data exchange across multi-vendor environments, affecting operational efficiency. To address this challenge, manufacturers must align with global certification frameworks and develop open, interoperable systems that support broad compatibility without compromising performance or security.

Regional Analysis

North America

North America holds the largest share of 37% in the rugged servers market. The region’s dominance is driven by high defense spending, advanced aerospace programs, and the strong presence of key players like Dell Technologies, Crystal Group, and Mercury Systems. The U.S. military’s focus on digital battlefield transformation and reliable edge computing systems fuels consistent demand. Industrial sectors such as energy, mining, and oil and gas also increasingly deploy rugged servers for remote monitoring and predictive maintenance. Robust technological infrastructure and continuous innovation further strengthen the region’s leadership position.

Europe

Europe accounts for 28% of the rugged servers market share, supported by rising defense modernization and industrial automation initiatives. Countries such as Germany, the U.K., and France lead the adoption of ruggedized systems for aerospace, telecom, and manufacturing operations. The European Defense Fund and NATO programs are promoting advanced computing solutions for surveillance and communication. The region’s focus on secure, energy-efficient data systems drives innovation in modular and scalable rugged designs. Strategic partnerships among defense contractors and technology providers continue to enhance Europe’s competitive position in the global market.

Asia-Pacific

Asia-Pacific represents a 22% share of the rugged servers market, experiencing rapid growth driven by expanding industrial and military applications. China, India, Japan, and South Korea are investing heavily in defense infrastructure and edge computing solutions. The increasing adoption of IoT and AI technologies across manufacturing, energy, and telecom sectors supports market expansion. Local manufacturers are also strengthening supply chains to deliver cost-effective, high-performance rugged servers tailored for regional industries. Government initiatives promoting smart factories and industrial digitalization are further accelerating market penetration across emerging economies.

Middle East & Africa

The Middle East & Africa region captures an 8% share of the rugged servers market, with growth driven by energy and defense investments. Countries such as Saudi Arabia, the UAE, and Israel are deploying rugged servers for security surveillance, oil exploration, and mission-critical operations. The demand for durable, temperature-resistant systems aligns with the region’s challenging climatic and operational conditions. Growing defense expenditure and expanding industrial bases in North and Sub-Saharan Africa are fueling adoption. Continued investments in communication and infrastructure modernization enhance the long-term growth outlook.

Latin America

Latin America holds a 5% share of the rugged servers market, supported by rising defense, industrial, and energy applications. Brazil, Mexico, and Argentina are key contributors, driven by the adoption of ruggedized systems in oil and gas, transportation, and manufacturing sectors. The growing emphasis on disaster response, security monitoring, and field automation is boosting regional demand. Limited local manufacturing capabilities, however, result in dependence on imports from North American and European suppliers. Despite economic constraints, modernization initiatives and industrial digitization efforts are expected to support steady market expansion.

Market Segmentations:

By Type

- Rugged Rackmount Servers

- Rugged Blade Servers

- Rugged Edge Servers

By Application

By End-use

- Defense & Military

- Aerospace

- Industrial

- Telecom

- Energy & Power

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rugged servers market is highly competitive, with leading manufacturers focusing on reliability, performance, and customization for mission-critical applications. Trenton Systems, Inc. and Mercury Systems, Inc. dominate with U.S.-made, MIL-STD-certified servers designed for defense, aerospace, and industrial sectors. Advantech Co., Ltd. and ADLINK Technology Inc. lead in edge computing integration, offering compact rugged systems optimized for AI workloads and harsh environments. Kontron and General Micro Systems, Inc. specialize in modular, conduction-cooled platforms that deliver high thermal efficiency and long lifecycle support. Core Systems and One Stop Systems, Inc. emphasize scalable architectures and GPU-accelerated designs for real-time data processing in military and transportation uses. GETAC and Westek Technology strengthen the market with portable and field-deployable rugged solutions featuring IP65+ enclosures and wide-temperature operation. Continuous innovation in high-density storage, cybersecurity features, and AI-enabled rugged computing drives competition and supports growth across industrial and defense domains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trenton Systems, Inc.

- Mercury Systems, Inc.

- ADLINK Technology Inc.

- Core Systems

- GETAC

- Westek Technology

- Kontron

- One Stop Systems, Inc.

- General Micro Systems, Inc.

- Advantech Co., Ltd.

Recent Developments

- In May 2025, Kontron announced the release of the µDARC, an ultra-rugged, compact microserver designed for mission-critical mobile applications in challenging defense environments. Powered by a high-performance NXP Arm i.MX8X quad-core processor, the µDARC offers a lightweight, energy-efficient solution with extensive I/O capabilities, making it ideal for tactical edge computing. Tailored for real-time data collection and transmission, it supports a wide range of defense use cases, including wearable tech, UGVs with LiDAR and GPS, UAVs for object recognition and telemetry, and cybersecurity gateways and health monitoring systems.

- In April 2025, ADLINK Technology Inc. and Elma Electronic, a Switzerland-based high-performance backplanes and chassis solutions provider, formed a strategic alliance to offer rugged, ready-to-use system solutions tailored for railway and critical mission applications. By combining ADLINK’s cutting-edge computing platforms, such as CPCI, CPCI Serial, and VPX, with Elma’s strengths in chassis, backplane design, and system integration, the partnership delivers durable, scalable systems built to withstand harsh conditions. This collaboration is set to simplify integration processes, accelerate time-to-market, and ensure dependable performance over the long term.

- In May 2024, Crystal Group Inc., a leading provider of rugged high-performance edge computing solutions, secured a multimillion-dollar contract with a major defense contractor to supply cybersecurity-enabled rugged servers for advanced radar systems used by the U.S. Army.

- In April 2024, Advantech Co., Ltd., a pioneer in industrial computing, introduced a new range of industrial solutions and servers powered by 14th Generation Intel Core processors. This lineup includes the ASMB-610V3, ASMB-788, ASMB-588, and the Edge Accelerator Server HPC-6120 + ASMB-610V3, designed to significantly enhance industrial and edge computing applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for rugged servers will rise with expanding defense modernization programs worldwide.

- Increasing deployment of edge computing will drive adoption in industrial and telecom sectors.

- AI-enabled rugged servers will gain traction for real-time analytics and autonomous operations.

- Compact, modular designs will become preferred for mobile and field-based applications.

- Integration of cybersecurity features will strengthen data protection in mission-critical environments.

- Growth in smart manufacturing and IIoT initiatives will boost industrial usage.

- Energy and power sectors will increasingly adopt rugged servers for remote monitoring.

- Technological advancements will improve thermal efficiency and system performance.

- Collaborations between defense contractors and IT firms will enhance innovation pipelines.

- Asia-Pacific will emerge as the fastest-growing region, supported by industrial digitalization and defense spending.