| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saudi Arabia Industrial Fasteners Market Size 2024 |

USD 247.91 Million |

| Saudi Arabia Industrial Fasteners Market, CAGR |

3.14% |

| Saudi Arabia Industrial Fasteners Market Size 2032 |

USD 317.49 Million |

Market Overview:

The Saudi Arabia Industrial Fasteners Market is projected to grow from USD 247.91 million in 2024 to an estimated USD 317.49 million by 2032, with a compound annual growth rate (CAGR) of 3.14% from 2024 to 2032.

Several factors are propelling the growth of the industrial fasteners market in Saudi Arabia. The government’s Vision 2030 initiative has led to significant investments in infrastructure projects, including the development of the NEOM city, expansion of transportation networks, and enhancement of energy facilities. These projects necessitate a substantial demand for durable and high-quality fasteners. Additionally, the oil and gas sector continues to be a major consumer of industrial fasteners, requiring specialized products that can withstand harsh environments. The automotive and manufacturing industries are also contributing to market growth, with an increasing need for precision-engineered fasteners to meet evolving technological standards. Furthermore, advancements in manufacturing processes and materials are leading to the production of lightweight and corrosion-resistant fasteners, expanding their applications across various industries.

Within the Middle East and Africa (MEA) region, Saudi Arabia stands as a dominant player in the industrial fasteners market. The country’s strategic location, coupled with its robust industrial base, positions it as a key hub for fastener production and distribution. The government’s commitment to economic diversification and industrialization has further bolstered the demand for fasteners across multiple sectors. Neighboring countries, such as the UAE and Qatar, are also witnessing growth in their respective fastener markets, driven by infrastructure development and industrial expansion. However, Saudi Arabia’s substantial investments in mega-projects and its focus on local manufacturing capabilities give it a competitive edge in the regional market

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Saudi Arabia Industrial Fasteners Market is set to grow from USD 247.91 million in 2024 to USD 317.49 million by 2032, with a CAGR of 3.14%.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- Vision 2030 has spurred significant infrastructure developments, including NEOM and expanded transportation networks, driving the demand for durable fasteners.

- Growth in the automotive and manufacturing sectors increases the need for precision-engineered fasteners to meet evolving technological standards.

- The oil and gas industry remains a major driver, requiring specialized fasteners for equipment used in extreme environments.

- Innovations in fastener materials, such as lightweight and corrosion-resistant options, are expanding their applications across various industries.

- High production costs and reliance on imported raw materials pose challenges, especially for smaller manufacturers.

- Regional growth, particularly in the Western and Eastern regions, is fueled by infrastructure projects and the oil & gas sector, positioning Saudi Arabia as a key fastener hub in the MEA region.

Market Drivers:

Expansion of Infrastructure and Construction Projects

The rapid growth of infrastructure and construction projects in Saudi Arabia, driven by the government’s Vision 2030 initiative, is one of the key factors fueling the demand for industrial fasteners in the country. For example, the NEOM megacity project alone is expected to require an estimated 4 million metric tons of fasteners during its construction phase, illustrating the unprecedented scale of fastener demand in the region. These large-scale initiatives require high-quality fasteners that can withstand extreme environmental conditions, ensuring the stability and longevity of critical infrastructure such as bridges, roads, and buildings. As a result, the construction sector remains a significant consumer of industrial fasteners, driving market growth.

Growing Automotive and Manufacturing Sectors

The automotive and manufacturing sectors are also significant contributors to the growth of the Saudi Arabian industrial fasteners market. With increasing production in both industries, the demand for specialized fasteners has risen substantially. Automotive manufacturers require precision-engineered fasteners to meet stringent safety and performance standards, while the manufacturing sector relies on fasteners for the assembly of machinery and equipment. As the automotive industry continues to evolve, particularly with the shift toward electric vehicles, the demand for lightweight and corrosion-resistant fasteners is expected to grow, further boosting market prospects.

Oil and Gas Sector Demand

Saudi Arabia’s oil and gas sector plays a crucial role in the demand for industrial fasteners. The country’s significant oil reserves and the continued development of new oil and gas infrastructure necessitate the use of high-performance fasteners that can endure the harsh operating conditions typical of the industry. These fasteners are essential for the maintenance and assembly of equipment used in drilling, refining, and distribution processes. As the oil and gas industry expands and modernizes its facilities, particularly in offshore and remote areas, the need for specialized fasteners will remain a major driver in the market.

Technological Advancements and Material Innovations

Advancements in fastener technology and material innovation are contributing significantly to the growth of the industrial fasteners market in Saudi Arabia. Manufacturers are increasingly producing fasteners that are lightweight, corrosion-resistant, and capable of performing under extreme conditions. These innovations are driven by the need for high-quality, long-lasting solutions that can meet the evolving requirements of various industries. For instance, Prince Fastener Manufacturing Co., Ltd. utilizes high-precision CNC machine tools, automatic lathes, and advanced testing equipment such as salt spray testers and torsion testers to ensure fastener reliability and performance. As industries such as aerospace, automotive, and construction continue to embrace new technologies, the demand for advanced fasteners that meet higher performance standards is expected to increase, supporting long-term market growth.

Market Trends:

Technological Advancements in Fastener Manufacturing

The Saudi Arabian industrial fasteners market is experiencing a significant transformation driven by technological advancements in manufacturing processes. The adoption of automation, robotics, and precision engineering has enhanced the efficiency and quality of fastener production. These innovations enable manufacturers to produce high-precision fasteners that meet stringent industry standards, catering to the evolving demands of sectors such as automotive, aerospace, and construction. For instance, companies like Metal Fasteners Mfr. Co. Ltd. utilize high-precision CNC machine tools, automatic lathes, and CNC milling machines to produce fasteners that meet international standards such as ASTM, ASME, DIN, and ISO. The integration of advanced manufacturing technologies not only improves product quality but also reduces production costs, making Saudi-made fasteners more competitive in the global market.

Shift Towards Lightweight and Corrosion-Resistant Materials

There is a noticeable shift in the Saudi industrial fasteners market towards the use of lightweight and corrosion-resistant materials. For example, Wasim Fastener manufactures stainless steel fasteners in grades such as SS 316/316L, known for their high resistance to corrosion and suitability for marine, construction, and industrial applications. Industries such as automotive and aerospace are increasingly demanding fasteners made from materials like aluminum, titanium, and advanced alloys to enhance performance and durability. This trend aligns with the global push towards sustainability and energy efficiency, as lightweight materials contribute to fuel savings and reduced emissions. The growing preference for these materials is prompting local manufacturers to invest in research and development to innovate and meet the specific requirements of these industries.

Localization and Self-Sufficiency Initiatives

In line with Saudi Arabia’s Vision 2030 objectives, there is a concerted effort to localize the production of industrial fasteners. The government is implementing policies to encourage domestic manufacturing, aiming to reduce dependency on imports and bolster the local economy. This shift is fostering the growth of local fastener manufacturing plants, which are increasingly meeting the needs of various sectors, including construction, automotive, and oil and gas. The focus on localization is also creating job opportunities and stimulating innovation within the industry.

Emergence of E-Commerce Platforms for Fastener Distribution

The distribution landscape of industrial fasteners in Saudi Arabia is evolving with the rise of e-commerce platforms. These digital platforms are providing businesses and consumers with convenient access to a wide range of fastener products, streamlining the procurement process. The growth of online marketplaces is particularly beneficial for small and medium-sized enterprises (SMEs) that may not have extensive distribution networks. E-commerce is also facilitating better price transparency and competition, ultimately benefiting end-users with more options and potentially lower costs.

Market Challenges Analysis:

High Production Costs

One of the key challenges facing the Saudi Arabian industrial fasteners market is the high production costs associated with manufacturing. The production of high-quality fasteners requires advanced raw materials, such as high-strength alloys and titanium, which are often imported at premium prices. Additionally, the cost of energy, skilled labor, and maintaining advanced manufacturing technologies further contributes to the overall expense. These elevated costs can impact the profitability of fastener manufacturers, particularly for smaller players in the market who may struggle to compete with larger, more established companies. The ongoing inflationary pressures on raw materials and logistics also exacerbate this issue, challenging the sustainability of cost-effective production.

Dependency on Imported Raw Materials

Despite significant strides toward localizing production, Saudi Arabia’s industrial fasteners market still relies heavily on imported raw materials, such as steel and specialized alloys. This dependency introduces supply chain risks, particularly in times of global material shortages or price fluctuations. Geopolitical tensions, trade barriers, and transportation delays can disrupt the availability of essential materials, leading to production delays and higher costs. Moreover, the reliance on international suppliers limits the country’s ability to fully control production timelines and costs, making the market vulnerable to external disruptions.

Limited Availability of Skilled Labor

The Saudi Arabian industrial fasteners market faces a challenge in terms of a limited pool of skilled labor. For instance, advanced fastener manufacturing processes in Saudi Arabia, especially in sectors like aerospace, require highly specialized skills that are currently in short supply. While the country is making strides in education and training programs, there remains a shortage of workers proficient in the technical aspects of fastener manufacturing. The complexities of precision engineering, quality control, and material science require specialized skills, which are often in short supply. As a result, companies in the sector must invest in training programs or rely on foreign workers, adding to operational costs and slowing down the expansion of local manufacturing capabilities.

Market Opportunities:

The Saudi Arabian industrial fasteners market presents significant opportunities for growth driven by the country’s economic diversification plans under Vision 2030. As the government invests in mega infrastructure projects, including the development of NEOM and the expansion of transportation networks, the demand for industrial fasteners is poised to increase. These projects require high-quality, durable fasteners capable of withstanding extreme environmental conditions, which presents a lucrative opportunity for local manufacturers and suppliers. The government’s push for local manufacturing and self-sufficiency further strengthens this opportunity, as companies can capitalize on the increasing need for domestically produced fasteners, reducing the dependency on imports and enhancing the competitiveness of Saudi-made products.

Additionally, the shift towards lightweight and corrosion-resistant materials in industries such as automotive, aerospace, and construction opens new avenues for innovation in the fasteners market. As Saudi Arabia continues to modernize its manufacturing sectors, the demand for specialized fasteners made from advanced materials like aluminum and titanium is growing. Manufacturers who invest in research and development to produce fasteners that meet these evolving needs stand to benefit from increased market share. Furthermore, the rise of e-commerce platforms in the region offers an opportunity for fastener companies to expand their reach and diversify their customer base, particularly among small and medium-sized enterprises. By leveraging digital distribution channels, businesses can tap into new markets and increase their sales potential.

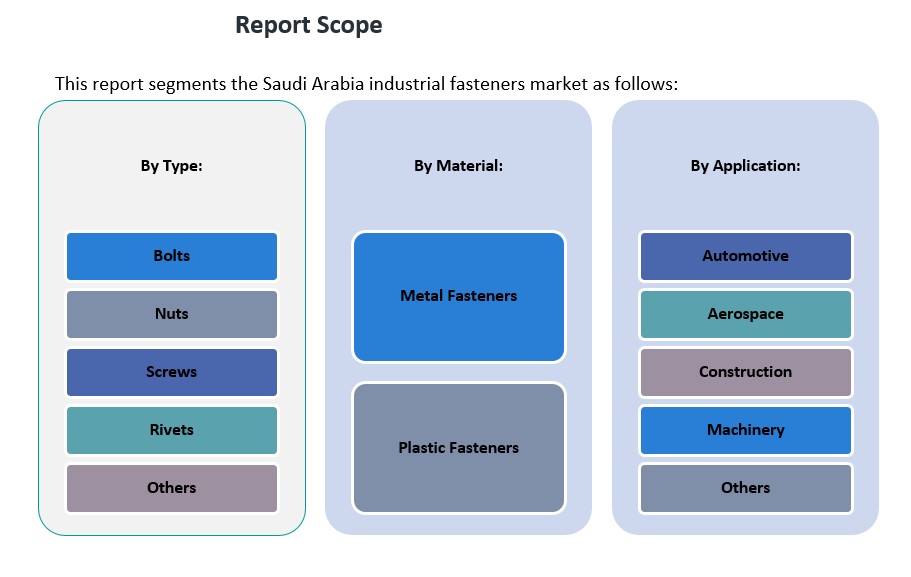

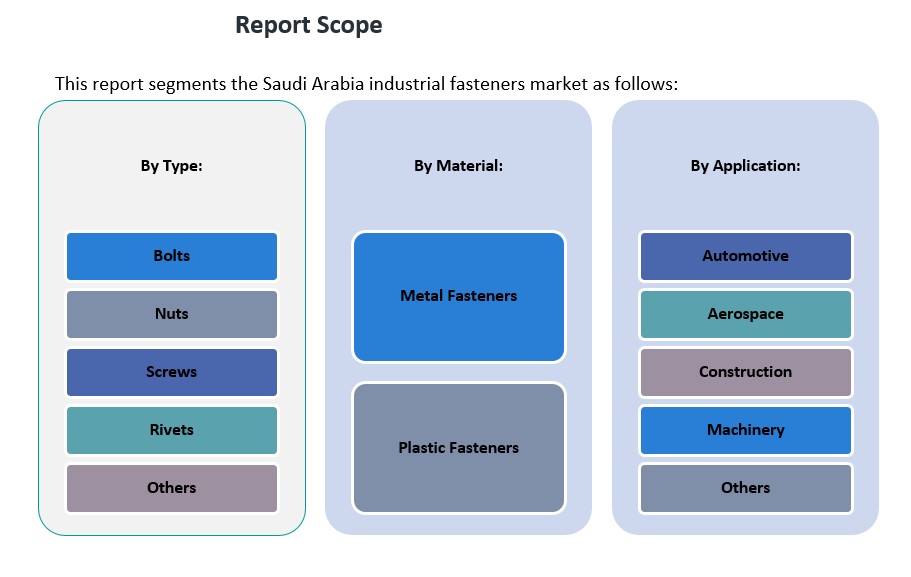

Market Segmentation Analysis:

By Type Segment

The Saudi Arabian industrial fasteners market is segmented by type into bolts, nuts, screws, rivets, and others. Among these, bolts and screws hold the largest share due to their widespread use in various industries, including automotive, construction, and machinery. Bolts are primarily used for securing heavy machinery and infrastructure components, while screws are critical in precision assembly applications. Nuts and rivets also play significant roles, especially in the aerospace and automotive sectors where high-strength fastening solutions are required. The “others” category includes specialized fasteners such as washers and anchors, which are increasingly used in niche applications requiring custom solutions.

By Application Segment

The application segment of the Saudi industrial fasteners market includes automotive, aerospace, construction, machinery, and others. The automotive sector is a major consumer of fasteners, driven by the growing demand for lightweight and durable fastening solutions, particularly in the production of electric vehicles. The aerospace sector also contributes significantly, with specialized fasteners used in aircraft assembly requiring high precision and reliability. The construction sector is another key application area, with fasteners essential for the stability of large infrastructure projects. The machinery industry, which includes manufacturing plants and heavy equipment, also heavily relies on industrial fasteners for assembly and maintenance.

By Material Segment

The material segment is divided into metal fasteners and plastic fasteners. Metal fasteners dominate the market due to their strength and durability, making them suitable for high-performance applications in automotive, aerospace, and construction industries. Plastic fasteners, while less common, are gaining traction due to their lightweight and corrosion-resistant properties, particularly in industries where weight reduction is a priority, such as in automotive and electronics manufacturing.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The Saudi Arabia Industrial Fasteners Market is experiencing significant growth due to the expanding construction, automotive, and manufacturing sectors in the region. The market is segmented into key regions, each contributing differently to the overall industry landscape.

Western Region: The Western region holds the largest market share, driven primarily by the booming construction and infrastructure projects in cities such as Jeddah and Mecca. The region benefits from the government’s focus on urban development, including large-scale residential, commercial, and industrial projects. The automotive sector, especially in Jeddah, further fuels the demand for industrial fasteners. It accounts for approximately 35% of the market share in Saudi Arabia’s industrial fasteners industry.

Eastern Region: The Eastern region, home to key oil and gas industries, also plays a significant role in the market. The region’s industrial activities, including petrochemical plants and refineries, create a robust demand for high-quality fasteners. The ongoing development of the King Salman Energy Park (SPARK) is expected to drive fastener demand further. The Eastern region contributes roughly 30% to the market share, with a considerable portion of its demand coming from the oil and gas sector.

Central Region: Riyadh, the capital city in the Central region, is experiencing rapid growth in the manufacturing and construction sectors, with several new industrial parks and residential complexes under development. This urbanization has increased the need for fasteners in both commercial and residential construction. The Central region accounts for about 25% of the market share in Saudi Arabia. Government initiatives aimed at enhancing industrial infrastructure and residential housing contribute to this growth.

Southern Region: While the Southern region is smaller in comparison, it is showing steady growth due to ongoing infrastructural developments in cities such as Abha and Jizan. The demand for fasteners here is driven mainly by local construction and smaller-scale manufacturing projects. This region holds approximately 10% of the total market share in the country.

Key Player Analysis:

- EJOT Middle East FZE

- Fischer Fixings Middle East

- Al Jazeera Bolts Industries LLC

- Dubai Bolt and Screw Company LLC

- Bolt Master Middle East

- Fast Trade Est.

- Al Maha Fasteners

- Al-Rajhi Industrial Group

- Petrofast Middle East LLC

- Saudi Fasteners Company

Competitive Analysis:

The competitive landscape of the Saudi Arabian industrial fasteners market is characterized by a mix of local and international players vying for market share. Leading global manufacturers such as Stanley Black & Decker, Fastenal, and Würth Group have established a strong presence in the region, offering a wide range of fasteners for industries such as automotive, aerospace, and construction. However, local companies are increasingly expanding their manufacturing capabilities to align with the Saudi Government’s Vision 2030 initiative, which aims to promote self-sufficiency and reduce dependency on imports. Key local players, such as Alwaha Group and Fathi Hassan Al-Hassan, are focusing on enhancing production capacity and diversifying their product offerings. They are capitalizing on the growing demand for high-quality, corrosion-resistant fasteners, especially in infrastructure and energy projects. To remain competitive, both international and local players are investing in innovation, material advancements, and supply chain efficiency to meet the evolving needs of the market.

Recent Developments:

- On February 25, 2025, Miller Electric Mfg. LLC, a wholly-owned subsidiary of Illinois Tool Works (ITW), announced a strategic partnership with Novarc Technologies. This collaboration focuses on developing AI-powered welding solutions under the Miller® Copilot™ line, aiming to enhance productivity, address labor shortages, and improve precision in industries such as shipbuilding and heavy equipment manufacturing.

- In January 2023, Hilti North America announced the addition of more than 30 new cordless tools to its Nuron battery-powered platform, expanding its portfolio to over 100 tools. This expansion, showcased at the World of Concrete event, includes advanced tools such as a diamond core rig, rotating lasers, and cut-off saws, reinforcing Hilti’s leadership in cordless jobsite solutions

Market Concentration & Characteristics:

The Saudi Arabia Industrial Fasteners Market exhibits moderate concentration, characterized by a mix of established global players and emerging local manufacturers. As of 2023, the Herfindahl-Hirschman Index (HHI) stands at 1462, indicating a moderately concentrated market structure. Key international companies such as ITW, Arconic, and Nifco Inc. dominate the market, leveraging their extensive product portfolios and technological advancements. These players benefit from economies of scale and established distribution networks, enabling them to meet the diverse demands of sectors like construction, automotive, and oil & gas. Additionally, local manufacturers are gaining traction by offering customized solutions tailored to regional specifications, thereby enhancing their competitive edge. The market is characterized by a diverse product range, including bolts, nuts, washers, and rivets, catering to various industrial applications. Materials such as metal and plastic are prevalent, with plastic fasteners experiencing the fastest growth due to their lightweight and corrosion-resistant properties. The demand for high-quality, durable fasteners is driving innovation, with companies investing in research and development to produce advanced products that meet stringent industry standards. Despite the presence of established players, the market remains competitive, with opportunities for new entrants to capitalize on niche segments and regional demands. Strategic partnerships, technological advancements, and a focus on quality are essential for companies aiming to strengthen their position in the Saudi Arabian industrial fasteners market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Saudi Arabia Industrial Fasteners Market is expected to witness steady growth, driven by large-scale infrastructure projects under Vision 2030.

- Increased demand for high-quality, durable fasteners will arise from the expansion of transportation networks and energy facilities.

- The oil and gas sector will continue to be a major consumer of specialized fasteners, particularly for harsh environments.

- Technological advancements in fastener manufacturing will lead to lightweight and corrosion-resistant solutions for diverse applications.

- The automotive industry will drive the need for precision-engineered fasteners as vehicle designs evolve.

- Growth in manufacturing and construction will further amplify demand for fasteners in both residential and commercial sectors.

- The shift towards local manufacturing capabilities will reduce dependency on imports and strengthen the domestic market.

- Advancements in materials, such as the adoption of plastics and composites, will diversify the fastener market.

- Increased foreign investments in mega-projects will enhance the market’s competitive landscape and attract international players.

- As neighboring markets like the UAE and Qatar expand, Saudi Arabia’s strategic location will cement its role as a regional hub for fastener production and distribution.