| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saudi Arabia Industrial Packaging Market Size 2024 |

USD4,528.35 million |

| Saudi Arabia Industrial Packaging Market, CAGR |

4.83% |

| Saudi Arabia Industrial Packaging Market Size 2032 |

USD6,789.23 million |

Market Overview

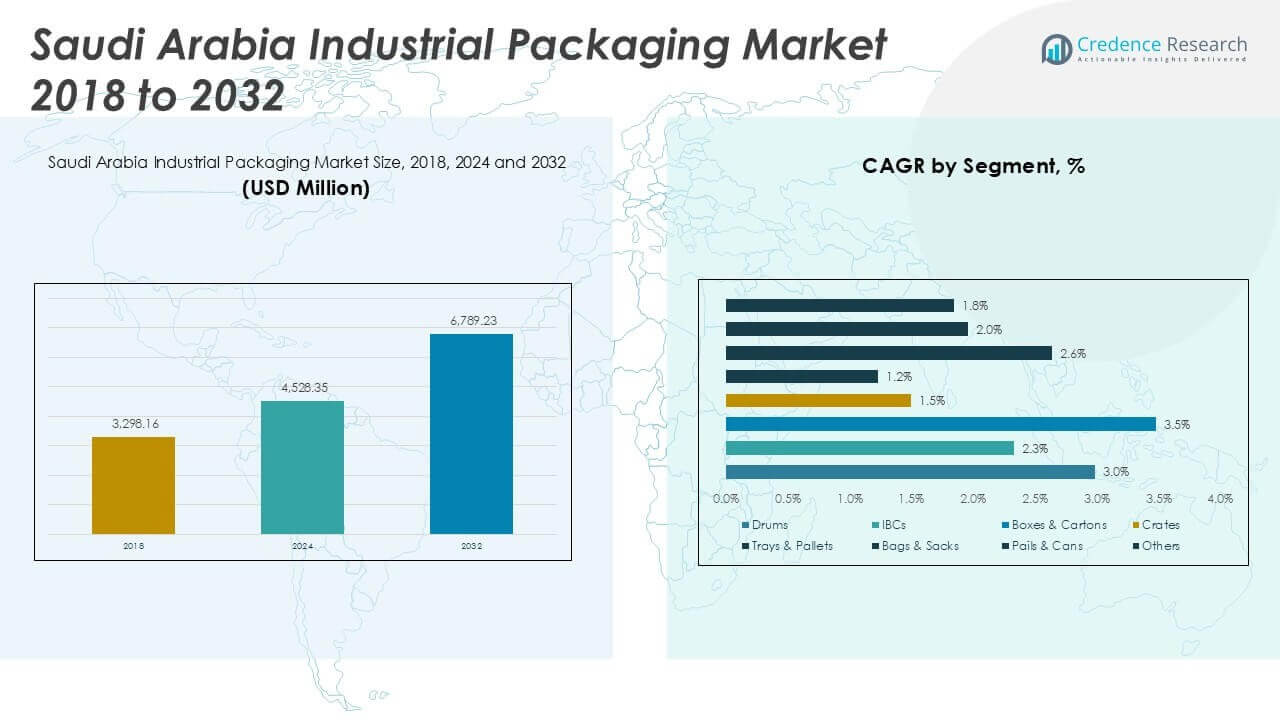

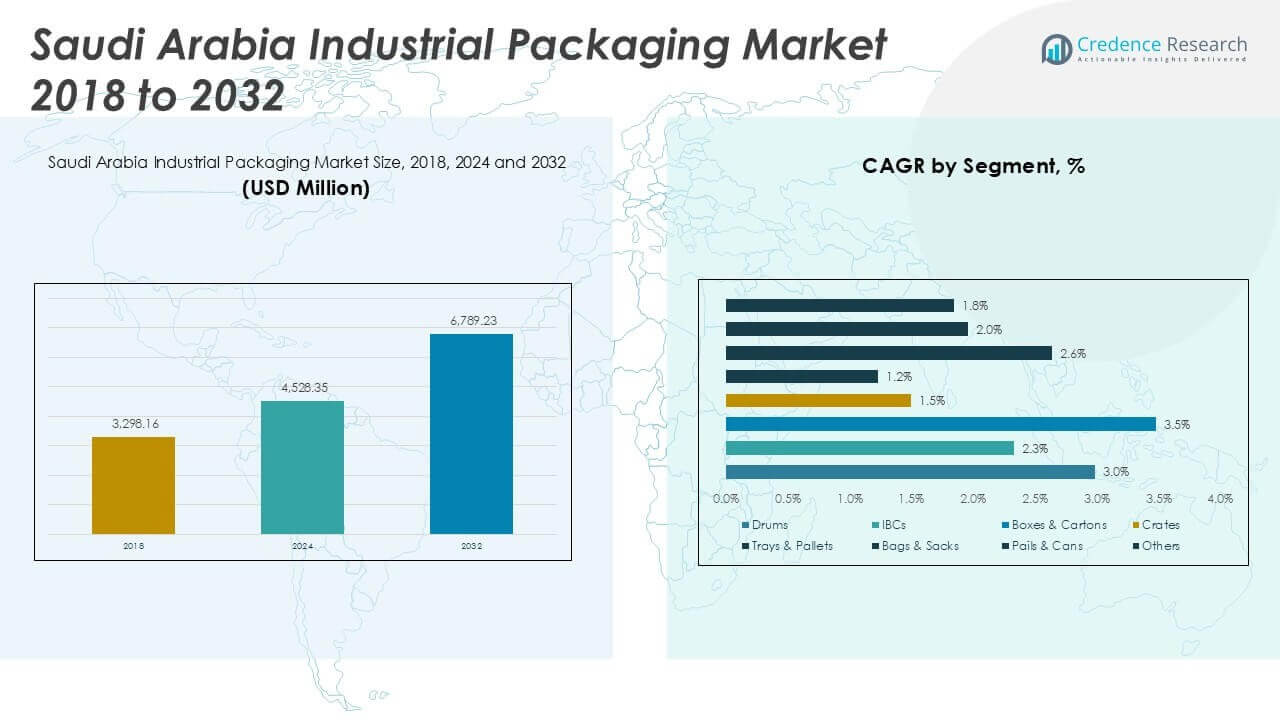

The Saudi Arabia Industrial Packaging Market is projected to grow from USD4,528.35 million in 2024 to an estimated USD6,789.23 million based on 2032, with a compound annual growth rate (CAGR) 4.83% from 2025 to 2032.

Key drivers of the market include the growth of export-oriented industries and rising demand for efficient logistics and supply chain solutions. Trends such as automation in packaging, rising use of eco-friendly and recyclable materials, and the adoption of bulk and flexible packaging formats are shaping the market dynamics. Moreover, the increasing focus on product safety and minimizing material waste is pushing manufacturers to invest in advanced packaging technologies tailored for industrial applications.

Geographically, the Eastern Province holds a significant share of the market due to the concentration of petrochemical and manufacturing hubs. The Central and Western regions are also witnessing rising demand due to ongoing urbanization and commercial activity. Key players operating in the Saudi Arabia industrial packaging market include Napco National, Obeikan Investment Group, Gulf Packaging Industries Limited, and Hotpack Global. These companies are actively investing in capacity expansion, sustainable material development, and digital integration to strengthen their market position and meet evolving industry requirements

Market Insights

- The Saudi Arabia Industrial Packaging Market is projected to grow from USD 4,528.35 million in 2024 to USD 6,789.23 million by 2032, at a CAGR of 4.83%.

- Rising demand from petrochemical, food, beverage, and pharmaceutical sectors is fueling long-term market expansion.

- Increased focus on sustainable, durable, and efficient packaging solutions is a key driver of innovation across product segments.

- Volatile raw material prices and underdeveloped recycling infrastructure continue to pose challenges to market stability.

- The Eastern Province dominates the market share due to its concentration of industrial and petrochemical operations.

- Central and Western regions are experiencing growth driven by urbanization, commercial activity, and manufacturing expansion.

- Market participants are investing in digital integration, eco-friendly materials, and capacity expansion to strengthen competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Petrochemical and Manufacturing Sectors Fuels Packaging Innovation

The Saudi Arabia Industrial Packaging Market benefits significantly from the country’s strong petrochemical and manufacturing base. These industries require high-performance packaging to support the transportation and storage of chemicals, machinery parts, and bulk materials. Industrial packaging ensures safety, durability, and resistance to environmental factors, which are crucial for sensitive products. The rise in oil and gas-related activities continues to generate demand for containers, drums, IBCs, and bulk bags. It strengthens the need for standardized packaging solutions that comply with regulatory and safety norms. The market responds to these sectoral needs by introducing enhanced materials and protective designs.

- For instance, a leading petrochemical firm implemented 300+ high-performance bulk containers to enhance storage and transportation efficiency.

Infrastructure Expansion and Logistics Growth Drive Usage of Industrial Packaging

Saudi Arabia’s infrastructure projects, part of Vision 2030, are intensifying the demand for reliable packaging solutions. Industrial materials including construction components, cement, steel, and electrical equipment require robust packaging for secure delivery and storage. The Saudi Arabia Industrial Packaging Market addresses this need with scalable solutions for palletizing, wrapping, and bulk containment. Increased construction of industrial zones, transport corridors, and smart cities contributes to packaging volume growth. It also strengthens supplier relationships within domestic and international logistics networks. Packaging players are improving supply efficiency to support these expanding operations.

- For instance, the expansion of transport corridors under Vision 2030 led to the deployment of 2,500+ new palletizing and wrapping solutions to support logistics growth.

Food Processing and Pharmaceuticals Encourage Hygienic and Regulatory-Compliant Packaging

The food processing and pharmaceutical industries are expanding rapidly due to population growth and increased healthcare spending. The Saudi Arabia Industrial Packaging Market serves these sectors by offering contamination-resistant and regulatory-compliant packaging materials. Pharmaceutical companies seek sterile and tamper-evident formats, while food processors demand moisture-resistant and lightweight options. It adapts to stringent hygiene standards and product safety expectations. Packaging companies are developing specialized containers and barrier films to fulfill these requirements. Government support for local manufacturing strengthens packaging demand further.

Sustainability Mandates and Consumer Expectations Influence Packaging Material Choice

Growing awareness of environmental impact drives a shift toward recyclable and biodegradable packaging materials. The Saudi Arabia Industrial Packaging Market faces mounting pressure to reduce plastic use and improve sustainability credentials. Companies focus on producing eco-friendly alternatives without compromising strength or functionality. It includes replacing virgin plastic with post-consumer resin and introducing reusable packaging formats. Industrial users increasingly select suppliers based on environmental performance. Regulatory trends and corporate ESG targets intensify the focus on green packaging solutions.

Market Trends

Shift Toward Sustainable and Recyclable Packaging Materials Gains Traction

The Saudi Arabia Industrial Packaging Market is witnessing a clear shift toward sustainable and recyclable materials. Companies are under increasing pressure to align with environmental regulations and consumer preferences. Demand is growing for materials such as paper-based composites, biodegradable plastics, and reusable industrial containers. It leads manufacturers to innovate in product design and material sourcing. Many firms are investing in circular economy models to reduce landfill waste and enhance material recovery. This trend supports long-term sustainability goals and improves the corporate image of packaging suppliers.

- For instance, Saudi Arabia has implemented over 40 national sustainability initiatives targeting packaging waste reduction, with more than 6.3 million metric tonnes of recyclable material processed annually.

Adoption of Smart Packaging Technologies Enhances Operational Efficiency

Smart packaging is emerging as a transformative trend, particularly in sectors requiring real-time tracking and condition monitoring. The Saudi Arabia Industrial Packaging Market is responding by integrating RFID tags, QR codes, and IoT-based sensors into industrial containers and pallets. These technologies offer enhanced visibility across the supply chain and reduce the risk of damage or loss. It helps manufacturers and distributors streamline inventory management and improve product traceability. Smart packaging also allows condition monitoring for temperature-sensitive or fragile products. This innovation supports compliance with safety and quality standards.

- For instance, more than 850 manufacturing facilities across Saudi Arabia have adopted RFID-enabled packaging solutions to improve logistics efficiency and product security.

Rise of Flexible and Lightweight Packaging Solutions Supports Cost Optimization

Demand for flexible and lightweight packaging is increasing due to its advantages in handling, storage, and transport. The Saudi Arabia Industrial Packaging Market benefits from this shift by introducing bulk bags, shrink wraps, and collapsible containers. These formats reduce shipping costs and optimize warehouse space. It appeals to industries focused on cost control without sacrificing durability or protection. Packaging companies are designing solutions that balance flexibility with strength and usability. This trend reflects a practical approach to meet evolving logistics needs.

Customization and Industry-Specific Solutions Drive Competitive Differentiation

Industries are seeking packaging solutions tailored to their unique operational requirements. The Saudi Arabia Industrial Packaging Market supports this trend by offering customizable packaging formats, dimensions, and safety features. It enables businesses to optimize compatibility with automated systems and minimize material waste. Sector-specific solutions for chemicals, electronics, and heavy machinery enhance value for end users. Packaging providers are leveraging data insights and client feedback to refine their offerings. This focus on customization strengthens long-term client relationships and competitive positioning.

Market Challenges

Volatile Raw Material Prices and Supply Chain Disruptions Restrain Market Stability

Fluctuations in the prices of key raw materials such as plastics, resins, and metals challenge profit margins for packaging manufacturers. The Saudi Arabia Industrial Packaging Market depends on consistent input costs to maintain pricing competitiveness and operational predictability. It faces additional pressure from global supply chain disruptions, which can delay production and increase lead times. External factors such as geopolitical tensions, trade restrictions, and transport bottlenecks further complicate procurement. Manufacturers must balance cost efficiency with product quality while managing inventory risks. These uncertainties hinder long-term planning and investment.

- For instance, Saudi Arabia’s packaging industry saw over 44.5 billion units of packaging materials used in 2023, with rigid plastics and flexible packaging being the most consumed.

Limited Domestic Recycling Infrastructure Hampers Sustainable Packaging Goals

Efforts to adopt eco-friendly and circular packaging models face obstacles due to underdeveloped recycling systems. The Saudi Arabia Industrial Packaging Market encounters difficulties in sourcing high-quality recycled materials locally. It often relies on imports or limited regional supply, which increases costs and complexity. A lack of standardized recycling protocols and public awareness slows progress toward environmental targets. Packaging firms struggle to scale up sustainable solutions without adequate infrastructure support. These gaps undermine the transition to greener alternatives and affect regulatory compliance initiatives.

Market Opportunities

Expansion of Non-Oil Industrial Sectors Opens New Avenues for Packaging Demand

Saudi Arabia’s strategic shift toward economic diversification under Vision 2030 presents strong growth opportunities for packaging providers. The Saudi Arabia Industrial Packaging Market can expand its reach across emerging sectors such as pharmaceuticals, renewable energy, electronics, and automotive manufacturing. These industries require tailored packaging for high-value and sensitive products. It creates demand for specialized containers, protective wraps, and durable pallets. Companies that align their solutions with sector-specific standards and safety requirements can gain a competitive edge. Packaging suppliers have the chance to build long-term partnerships by supporting localization and industrial growth.

Digital Transformation and Automation Create Scope for Smart Packaging Solutions

The acceleration of digital technologies in logistics and manufacturing opens pathways for advanced packaging innovations. The Saudi Arabia Industrial Packaging Market can leverage this shift by integrating smart features into industrial containers and tracking systems. It supports the adoption of automation, predictive maintenance, and real-time inventory management. Packaging embedded with RFID, IoT sensors, or QR codes meets the growing need for supply chain transparency and efficiency. These advancements offer value-added services to industrial clients focused on precision and safety. Companies investing in digital packaging capabilities can capture demand from tech-forward sectors.

Market Segmentation Analysis

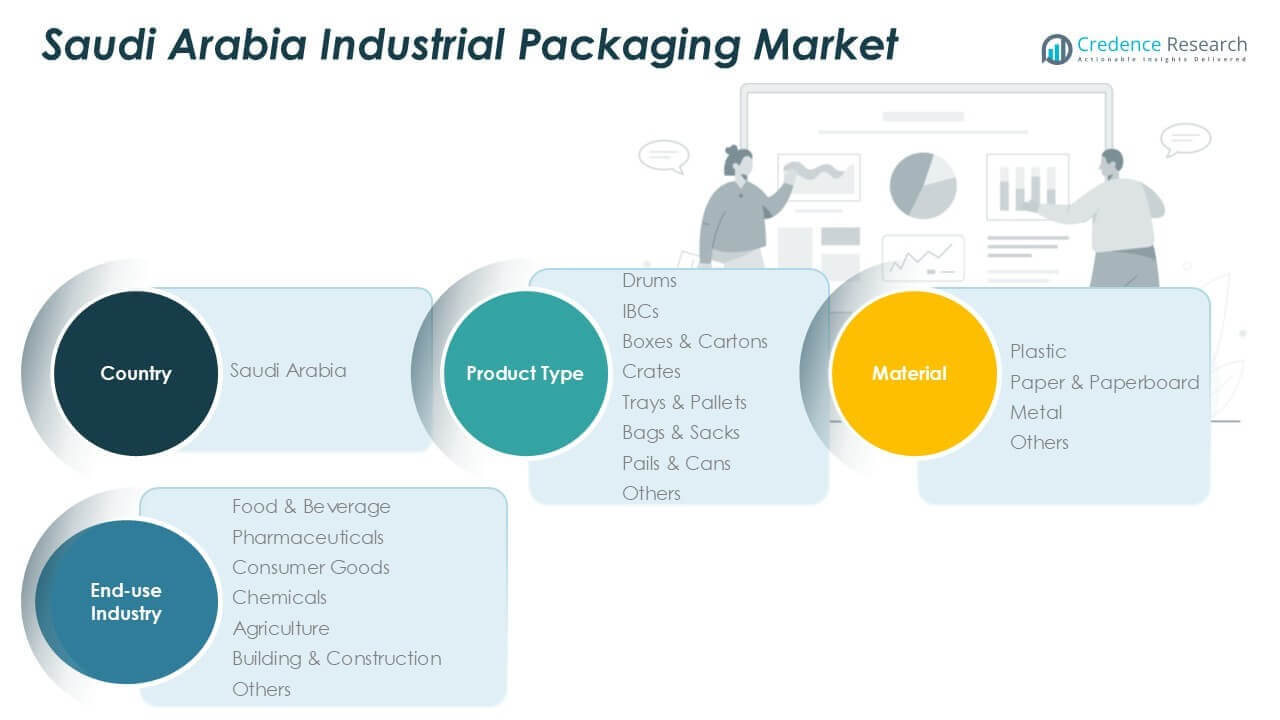

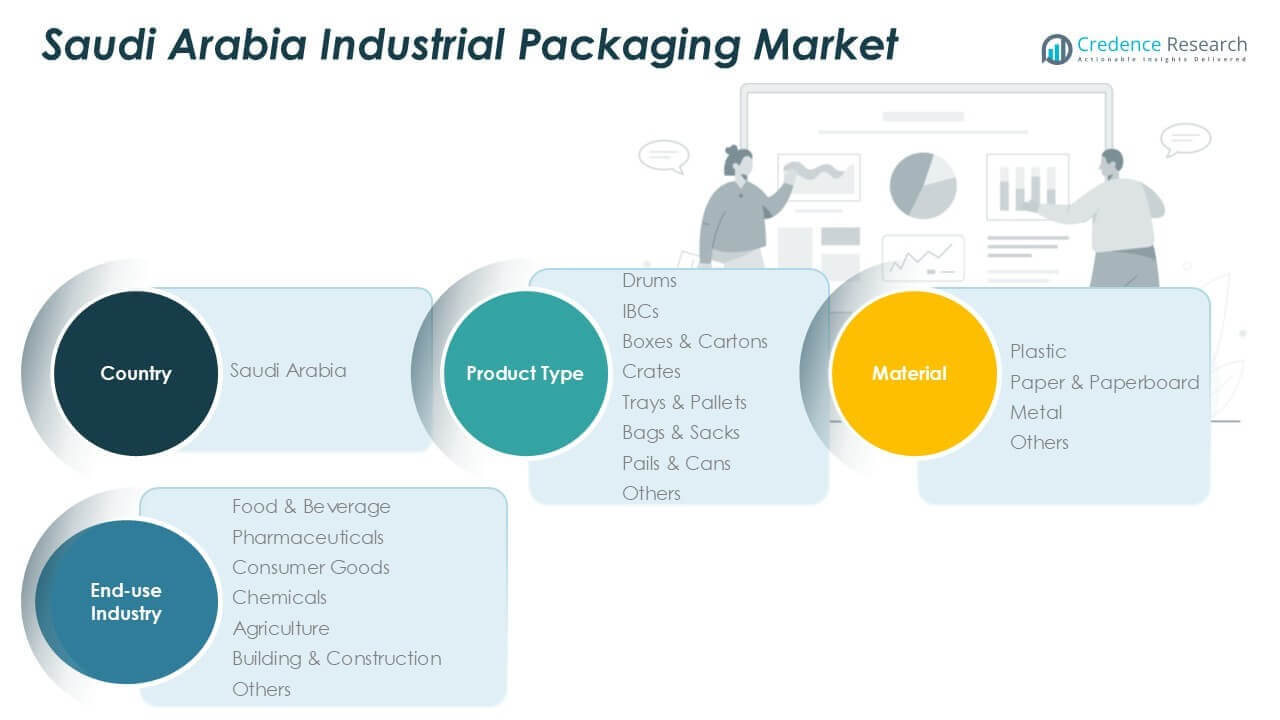

By Product Type

The Saudi Arabia Industrial Packaging Market is segmented into drums, IBCs, boxes & cartons, crates, trays & pallets, bags & sacks, pails & cans, and others. Drums and IBCs hold a significant share due to their widespread use in transporting hazardous and bulk liquids in petrochemical and chemical industries. Boxes, cartons, and crates offer versatile solutions across consumer goods and pharmaceuticals, while trays and pallets support efficient stacking and warehousing. Bags and sacks are prevalent in the agriculture and food sectors for bulk commodities. Pails and cans serve niche requirements in paints, adhesives, and specialty chemicals. It continues to diversify offerings based on durability, reusability, and load-bearing capacity.

By Material

Based on material, the market is classified into plastic, paper & paperboard, metal, and others. Plastic dominates due to its lightweight nature, cost-effectiveness, and durability across various industrial applications. The Saudi Arabia Industrial Packaging Market is witnessing rising demand for recyclable plastic variants aligned with environmental goals. Paper & paperboard materials are gaining preference in consumer goods and food sectors due to sustainability trends. Metal packaging remains essential in high-strength applications such as drums and IBCs used in chemical transport. Other materials include composites and biodegradable alternatives addressing niche sustainability requirements.

By End-use Industry

The end-use industry segmentation includes food & beverage, pharmaceuticals, consumer goods, chemicals, agriculture, building & construction, and others. The chemical and oil-related sectors drive a substantial portion of demand due to their reliance on heavy-duty and safe packaging. It also supports food and beverage growth through moisture-resistant and hygienic packaging. Pharmaceuticals require sterile, tamper-evident formats, while agriculture depends on bags and bulk sacks for grains and fertilizers. Construction material packaging such as crates, pallets, and drums is rising with ongoing infrastructure expansion. Each end-use sector shapes demand through specific performance and regulatory needs.

Segments

Based on Product Type

- Drums

- IBCs

- Boxes & Cartons

- Crates

- Trays & Pallets

- Bags & Sacks

- Pails & Cans

- Others

Based on Material

- Plastic

- Paper & Paperboard

- Metal

- Others

Based on End-use Industry

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Chemicals

- Agriculture

- Building & Construction

- Others

Based on Region

- Eastern Saudi Arabia

- Western Saudi Arabia

- Southern Saudi Arabia

- Northern Saudi Arabia

- Central Saudi Arabia

Regional Analysis

Eastern Saudi Arabia Industrial Packaging Market

The Eastern region holds the largest share in the Saudi Arabia Industrial Packaging Market, accounting for over 38% of the national revenue in 2024. It hosts a majority of the country’s petrochemical and oil refining facilities, including those in Jubail and Dammam. The demand for drums, IBCs, and metal containers is highest here, driven by the transportation needs of hazardous and bulk liquids. It supports large-scale industrial output with strong logistics infrastructure and access to key ports. Packaging companies in this region prioritize safety and compliance due to strict handling requirements. Continued expansion of the downstream sector reinforces its leadership in industrial packaging.

Central Saudi Arabia Industrial Packaging Market

The Central region, contributing around 25% of the market share in 2024, benefits from the presence of Riyadh’s growing industrial and manufacturing base. It plays a vital role in food processing, pharmaceuticals, and consumer goods packaging. The Saudi Arabia Industrial Packaging Market sees strong uptake of boxes, cartons, and flexible solutions in this region. Riyadh’s logistics and warehousing networks increase the demand for trays, pallets, and recyclable containers. It also benefits from government investments in non-oil industrial zones. Central Saudi Arabia is becoming a key distribution hub, creating sustained demand for industrial packaging formats.

Western Saudi Arabia Industrial Packaging Market

The Western region holds nearly 18% of the market share and includes cities such as Jeddah, Mecca, and Medina. It supports packaging demand across tourism, hospitality, and retail-linked industrial operations. Industrial packaging requirements here center on lightweight, consumer-facing formats and crates for food and beverage logistics. The Saudi Arabia Industrial Packaging Market responds to demand from port-based activities and warehousing zones near the Red Sea. Jeddah’s King Abdullah Economic City adds momentum through its manufacturing clusters. It acts as a strategic link for domestic and international supply chains.

Southern Saudi Arabia Industrial Packaging Market

The Southern region, with a smaller share of nearly 10%, reflects modest industrial activity concentrated in cities like Abha and Jazan. Growth in agriculture and small-scale manufacturing sectors drives demand for sacks, bags, and crates. It caters primarily to local needs with limited export-linked packaging demand. The Saudi Arabia Industrial Packaging Market sees potential for regional expansion as infrastructure improves. It focuses on cost-effective solutions and access to rural supply chains. The development of special economic zones could unlock future market gains.

Northern Saudi Arabia Industrial Packaging Market

The Northern region accounts for less than 6% of the total market but has seen increased investment under national industrial diversification plans. Mining and energy-related activities around cities like Arar and Turaif support gradual packaging demand growth. It relies on standardized packaging for minerals, chemicals, and construction materials. The Saudi Arabia Industrial Packaging Market in this region is still developing but offers long-term prospects. Improved road connectivity and industrial hubs could elevate demand. It remains a strategic focus for future expansion in packaging logistics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Napco National

- ASPCO

- Al-Shams Printing Packaging & Trading Co.

- PRINTOPACK

- Saudi Arabian Packaging Industry WLL

- Takween Advanced Industries

- Zahrat Al Waha For Trading Company

- Filling and Packing Materials Manufacturing Company (FIPCO)

Competitive Analysis

The Saudi Arabia Industrial Packaging Market features a competitive landscape marked by a mix of large-scale manufacturers and specialized regional players. Companies such as Napco National and Takween Advanced Industries maintain strong positions due to their diverse product portfolios and established distribution networks. Local firms like FIPCO and Zahrat Al Waha focus on industry-specific packaging, catering to sectors such as chemicals, beverages, and construction. The market shows active investment in sustainable and recyclable packaging solutions to align with national environmental goals. It emphasizes innovation, automation, and customization to gain market share and build long-term client partnerships. Leading firms are expanding production capacity and enhancing logistics capabilities to serve emerging industrial zones. Competitive advantage stems from operational scale, product innovation, regulatory compliance, and strategic geographic presence.

Recent Developments

- In February 2025, Napco National participated in SustPack MENA 2025 to showcase its sustainable packaging solutions and discuss future trends with regional stakeholders.

- In May 2024, Al-Shams Printing Packaging & Trading Co. upgraded its operations by installing the Heidelberg Speedmaster XL 106, improving print quality and production efficiency.

- In 2024, Saudi Arabian Packaging Industry WLL (SAPIN) received the EcoVadis Committed Badge, recognizing its environmental and ethical business practices.

- In May 2025, Takween Advanced Industries reported first-quarter earnings and confirmed its continued operations in plastic packaging manufacturing for industrial markets.

- In February 2025, Zahrat Al Waha For Trading Company announced the launch of its new printing and packaging plant operations, aligned with a strategic expansion plan to diversify revenue.

Market Concentration and Characteristics

The Saudi Arabia Industrial Packaging Market shows moderate concentration with a blend of large, integrated manufacturers and regionally focused players. It is characterized by strong demand from petrochemicals, chemicals, and food processing industries, which require reliable, durable, and safe packaging formats. The market favors companies with diverse product lines, scalable operations, and strong distribution capabilities. It supports both standardized and customized packaging, reflecting the varied needs of end-use sectors. Regulatory compliance, sustainability initiatives, and innovation in material use influence competitive dynamics. Firms with established supply chain networks and proximity to industrial zones hold a strategic advantage.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady expansion driven by industrial diversification under Vision 2030. Increased investments in manufacturing and non-oil sectors will generate sustained demand for industrial packaging.

- Packaging providers will focus on eco-friendly and recyclable materials to align with national sustainability targets. Companies are likely to adopt closed-loop recycling systems and bio-based alternatives to reduce environmental impact.

- The use of automation and digital packaging solutions will grow across the value chain. Integration of smart technologies like RFID and IoT will improve inventory tracking, safety, and supply chain efficiency.

- Regional manufacturing hubs in the Eastern and Central provinces will continue to dominate packaging demand. Packaging suppliers will increase capacity near industrial zones to ensure faster service and reduce logistics costs.

- Food and pharmaceutical sectors will drive demand for sterile, moisture-resistant, and tamper-evident packaging formats. The market will respond with tailored designs meeting hygiene and regulatory requirements.

- Lightweight and flexible packaging formats such as bulk bags, shrink wraps, and collapsible containers will gain traction. These solutions offer cost and space savings, supporting efficient logistics and storage.

- Market consolidation may occur through mergers or partnerships among local and regional players. Firms will pursue strategic alliances to expand product lines, technology access, and customer reach.

- Demand for customized packaging solutions will rise across industries with unique handling and storage needs. Companies offering tailored products will strengthen client retention and differentiation.

- Government policies promoting local manufacturing and industrial zones will create new packaging opportunities. Firms aligning with localization and national development goals will secure competitive advantages.

- The Saudi Arabia Industrial Packaging Market will remain responsive to international trade trends and global supply chain shifts. Flexibility and innovation will define long-term market positioning and growth potential.