| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saudi Arabia Plastic Welding Equipment Market Size 2024 |

USD 28.45 Million |

| Saudi Arabia Plastic Welding Equipment Market, CAGR |

4.23% |

| Saudi Arabia Plastic Welding Equipment Market Size 2032 |

USD 39.62 Million |

Market Overview

Saudi Arabia Plastic Welding Equipment Market size was valued at USD 28.45 million in 2024 and is anticipated to reach USD 39.62 million by 2032, at a CAGR of 4.23% during the forecast period (2024-2032).

The Saudi Arabia plastic welding equipment market is experiencing significant growth, driven by increasing demand across industries such as automotive, construction, packaging, and electronics. Rapid industrialization and infrastructure development under Vision 2030 are boosting the need for durable and high-performance plastic components, thereby fueling equipment adoption. Additionally, the shift towards automation and precision manufacturing is propelling the use of advanced plastic welding technologies, including ultrasonic, laser, and hot plate welding. Environmental regulations promoting plastic recycling and the growing preference for lightweight materials in transportation further contribute to market expansion. Moreover, ongoing investments in renewable energy and water management sectors are creating new opportunities for plastic welding applications in pipelines and storage systems. The trend toward smart manufacturing and integration of IoT in welding machinery enhances operational efficiency and quality control, positioning Saudi Arabia as a key emerging market for plastic welding equipment in the Middle East.

The geographical landscape of the Saudi Arabia plastic welding equipment market is predominantly centered around key industrial hubs such as Riyadh, Jeddah, and the Eastern Province. These regions are home to large-scale manufacturing, construction, and automotive industries, all of which drive significant demand for advanced plastic welding technologies. Riyadh, being the capital, remains a key market due to its role as the heart of business and industrial growth, while Jeddah serves as a vital port city with strong demand from packaging, electronics, and automotive sectors. The Eastern Province, with its significant petrochemical industry, is another crucial region driving the adoption of plastic welding equipment. Key players in the market include global companies such as Leister Technologies AG, RITMO S.p.A., and Emerson Electric Co., among others, who provide a range of welding technologies including ultrasonic, laser, and hot plate welding, meeting the growing demand across various industries in Saudi Arabia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Saudi Arabia plastic welding equipment market was valued at USD 28.45 million in 2024 and is expected to reach USD 39.62 million by 2032, growing at a CAGR of 4.23% during the forecast period (2024-2032).

- The global plastic welding equipment market was valued at USD 11,340.00 million in 2024 and is projected to reach USD 19,842.36 million by 2032, growing at a CAGR of 7.24% from 2024 to 2032.

- The market is driven by increasing demand across automotive, construction, and packaging industries, with infrastructure development under Vision 2030 playing a key role.

- Technological advancements in automation, laser, and ultrasonic welding are enhancing efficiency and precision in manufacturing processes.

- The growing focus on sustainability and recycling practices is increasing demand for plastic welding solutions, especially in eco-friendly applications.

- Major players like Leister Technologies AG and Emerson Electric Co. are intensifying competition, focusing on innovation and regional market penetration.

- High initial investment and a limited skilled workforce are challenges affecting the market’s growth potential.

- Riyadh, Jeddah, and the Eastern Province are the key regions, with Riyadh holding the largest market share due to its industrial base.

Report Scope

This report segments the Saudi Arabia Plastic Welding Equipment Market as follows:

Market Drivers

Industrial Diversification and Vision 2030 Initiatives

Saudi Arabia’s ambitious Vision 2030 plan is a significant driver for the plastic welding equipment market. The government’s push toward economic diversification has led to the expansion of non-oil sectors, including manufacturing, construction, and logistics. These industries rely heavily on plastic components and infrastructure that require efficient and durable welding solutions. As industrial activities increase, the demand for reliable plastic welding equipment grows in parallel, supporting the production and assembly of high-quality plastic products. Moreover, incentives for foreign direct investment (FDI) and the establishment of industrial zones further contribute to a favorable business environment, accelerating the adoption of advanced manufacturing technologies such as plastic welding.

Sustainability Goals and Growth in Plastic Recycling

The growing emphasis on environmental sustainability is contributing to the increased use of plastic welding equipment, particularly in recycling applications. As global and local regulations promote the circular economy and reduction of plastic waste, recycling initiatives are gaining momentum in Saudi Arabia. For instance, environmental agencies in Saudi Arabia report that manufacturers in the water management sector are adopting vibration welding technologies to repair and reuse plastic components, aligning with sustainability goals. Plastic welding plays a critical role in reprocessing and repairing plastic components, which is vital for recycling operations. Additionally, sectors like water management and renewable energy, which align with the Kingdom’s sustainability goals, are adopting welded plastic solutions for pipelines, storage systems, and protective components. The alignment of plastic welding with eco-friendly manufacturing and recycling practices positions it as an indispensable technology in the country’s sustainable industrial transformation.

Rising Demand in Automotive and Construction Sectors

The expanding automotive and construction sectors are playing a pivotal role in driving the market. The automotive industry, in particular, is witnessing increased adoption of lightweight plastic materials to improve fuel efficiency and reduce emissions. Plastic welding equipment is essential in assembling various automotive components such as fuel tanks, bumpers, and interior panels. Concurrently, the construction sector is experiencing robust growth with large-scale infrastructure projects across the Kingdom. For instance, government-backed initiatives like the NEOM project are utilizing butt fusion welding technologies for the installation of durable plastic pipelines. These developments require the installation of plastic pipes, panels, and fixtures, all of which depend on efficient plastic welding processes. The rising demand for durable and cost-effective solutions in these sectors continues to elevate the need for high-performance welding equipment.

Technological Advancements and Automation Trends

Technological innovation is a key market driver, with manufacturers increasingly adopting automated and precision-based welding systems. The integration of advanced technologies such as ultrasonic, hot plate, and laser welding has significantly enhanced the speed, accuracy, and quality of plastic welding. Automation reduces human error, improves production efficiency, and ensures consistent output, making it especially attractive for high-volume manufacturing sectors. Additionally, the incorporation of IoT and smart monitoring systems into welding equipment enables real-time diagnostics and predictive maintenance, reducing downtime and operational costs. As industries in Saudi Arabia modernize their production lines, the demand for intelligent and technologically advanced plastic welding equipment is set to rise.

Market Trends

Rising Infrastructure Development and Construction Activities

Saudi Arabia’s ongoing infrastructure boom, driven by Vision 2030, is one of the most prominent trends shaping the plastic welding equipment market. Mega-projects like NEOM, the Red Sea Project, and Qiddiya are creating massive demand for durable plastic-based systems used in water supply, drainage, and HVAC installations. Plastic welding plays a vital role in the fabrication and installation of pipelines, panels, tanks, and structural supports made from thermoplastics. As the construction sector continues to grow, there is an increasing preference for high-performance plastic components due to their cost-efficiency, corrosion resistance, and ease of handling. This shift is translating into heightened demand for reliable, precise, and portable welding equipment. Furthermore, government support for sustainable construction practices is encouraging the use of welded plastic materials over traditional metal, reinforcing this trend.

Expanding Applications in Automotive and Electronics Manufacturing

The diversification of Saudi Arabia’s economy is also fueling growth in the automotive and electronics sectors, which increasingly rely on precision plastic welding. Lightweight plastics are being widely used in automotive components like fuel tanks, bumpers, and lighting systems to meet fuel efficiency and emissions standards. Plastic welding ensures these components maintain structural integrity under demanding conditions. Simultaneously, the consumer electronics sector is expanding, driven by growing digital adoption and domestic manufacturing. For instance, government-backed initiatives are supporting the adoption of ultrasonic welding systems in electronics manufacturing to ensure precision in assembling intricate plastic components. Precision welding techniques such as ultrasonic and vibration welding are essential for assembling small, intricate plastic parts without damaging sensitive electronics. As these industries continue to expand, supported by favorable government policies and investment incentives, the demand for specialized welding equipment is poised to rise.

Integration of Advanced and Automated Welding Technologies

Another significant trend is the technological evolution of plastic welding equipment. The market is witnessing a growing inclination towards automation, precision, and energy-efficient systems. Technologies such as ultrasonic, laser, hot plate, and infrared welding are being increasingly adopted to meet industry-specific requirements for strength, speed, and precision. Laser plastic welding, in particular, is gaining traction due to its contactless process, clean aesthetics, and suitability for complex assemblies. This trend is supported by the rising implementation of Industry 4.0 principles, where automation and real-time monitoring are becoming essential for operational efficiency. Smart welding machines equipped with sensors and IoT capabilities are enabling predictive maintenance, quality control, and process optimization. Manufacturers in Saudi Arabia are gradually shifting towards these solutions to increase productivity, minimize downtime, and maintain international quality standards.

Focus on Sustainability and Circular Economy Practices

Sustainability is becoming a central theme across Saudi industries, and plastic welding plays a key role in enabling environmentally responsible manufacturing and recycling practices. The government’s commitment to reducing plastic waste and encouraging resource efficiency is pushing manufacturers to adopt methods that support the circular economy. For instance, environmental agencies in Saudi Arabia report that manufacturers in the packaging sector are utilizing vibration welding technologies to repair and recycle plastic components, aligning with circular economy principles. Plastic welding facilitates the repair, reuse, and recycling of plastic components, thereby extending product life cycles and reducing the need for virgin plastic production. Additionally, the demand for eco-friendly infrastructure, such as energy-efficient water management systems and solar energy installations, is promoting the use of welded plastic components in place of metal. This trend is expected to gain further momentum as environmental regulations tighten and consumer awareness of sustainable products grows.

Market Challenges Analysis

High Initial Investment and Limited Skilled Workforce

One of the primary challenges facing the plastic welding equipment market in Saudi Arabia is the high initial investment associated with advanced welding technologies. Sophisticated machines such as laser and ultrasonic welders come with substantial capital costs, making them less accessible to small and medium-sized enterprises (SMEs). In addition to equipment costs, the integration of automation and smart technologies requires investment in compatible infrastructure and training, which can strain the budgets of developing manufacturers. Another significant hurdle is the shortage of skilled labor proficient in operating and maintaining modern welding equipment. Although technical training programs are gradually expanding, the current pace of workforce development is insufficient to meet the growing demand. As a result, many businesses rely on foreign expertise, which increases operational costs and may delay project timelines, especially in remote or newly industrialized zones.

Fluctuating Raw Material Prices and Regulatory Pressures

Fluctuations in raw material prices, particularly thermoplastics such as polyethylene and polypropylene, pose another major challenge to market stability. These materials are directly linked to global petrochemical markets, which are often volatile due to geopolitical events, supply chain disruptions, and shifts in oil prices. This volatility can lead to inconsistent demand for plastic welding equipment as manufacturers adjust production based on material costs. Furthermore, the growing stringency of environmental regulations in Saudi Arabia is placing additional pressure on plastic manufacturers and equipment suppliers. For instance, environmental agencies in Saudi Arabia report that compliance with new waste management regulations has required manufacturers to upgrade their welding equipment to meet sustainability standards, increasing operational costs. While sustainability goals are promoting the use of recyclable plastics, they are also driving up compliance costs and requiring frequent upgrades to equipment in order to meet evolving standards. Companies must navigate complex regulatory frameworks related to emissions, waste management, and product safety, all of which can impact the pace of adoption and expansion of plastic welding technologies. These factors combined make long-term planning and investment more challenging for industry players.

Market Opportunities

The Saudi Arabia plastic welding equipment market presents significant opportunities driven by the country’s ongoing industrial transformation and diversification strategy under Vision 2030. As the Kingdom continues to reduce its dependence on oil and invests in expanding non-oil sectors such as manufacturing, construction, water management, and renewable energy, the demand for plastic-based components and systems is growing rapidly. This shift opens doors for plastic welding equipment manufacturers and suppliers to cater to a wide range of applications, including pipe systems, tanks, insulation panels, and automotive parts. Additionally, the rapid development of mega-infrastructure projects and industrial zones across the country is increasing the need for efficient, durable, and cost-effective joining solutions that plastic welding technologies offer. Companies that can deliver specialized, high-performance equipment suited to these complex and large-scale projects are well-positioned to capture significant market share.

Furthermore, the increasing adoption of sustainable practices and circular economy models across industries creates additional opportunities for plastic welding in recycling and repair applications. As government regulations encourage more responsible plastic use and waste management, demand is growing for equipment that enables the reuse and refurbishment of plastic components in sectors such as packaging, construction, and logistics. Moreover, the ongoing digitization of manufacturing processes—driven by Industry 4.0—presents potential for the integration of smart welding systems with IoT capabilities, real-time monitoring, and data analytics. These features improve operational efficiency, reduce downtime, and enhance quality control, making them particularly attractive to advanced manufacturing operations. With rising demand for automation, localization of manufacturing, and a favorable investment climate, there is strong potential for international and local players to introduce innovative welding solutions tailored to Saudi Arabia’s evolving industrial landscape.

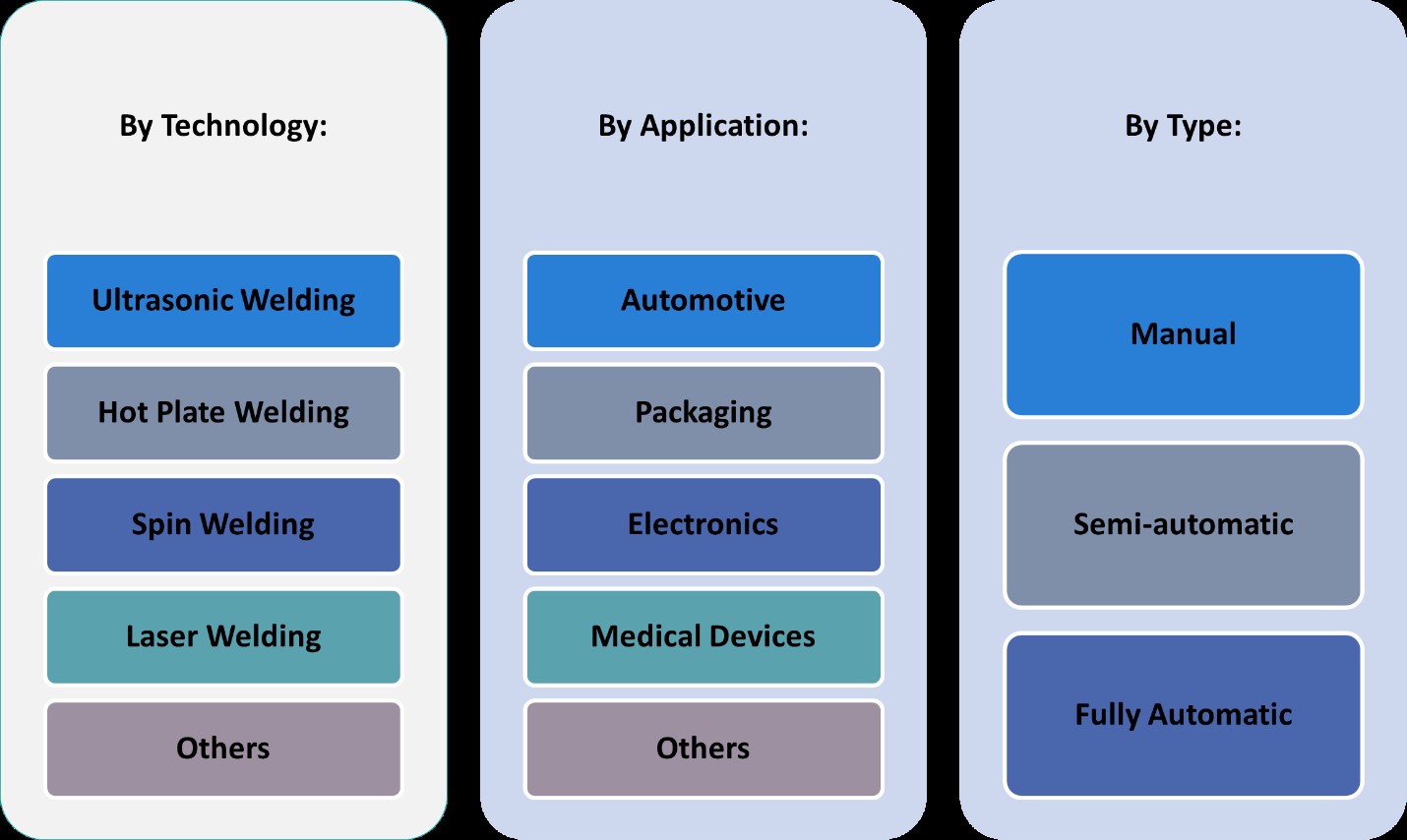

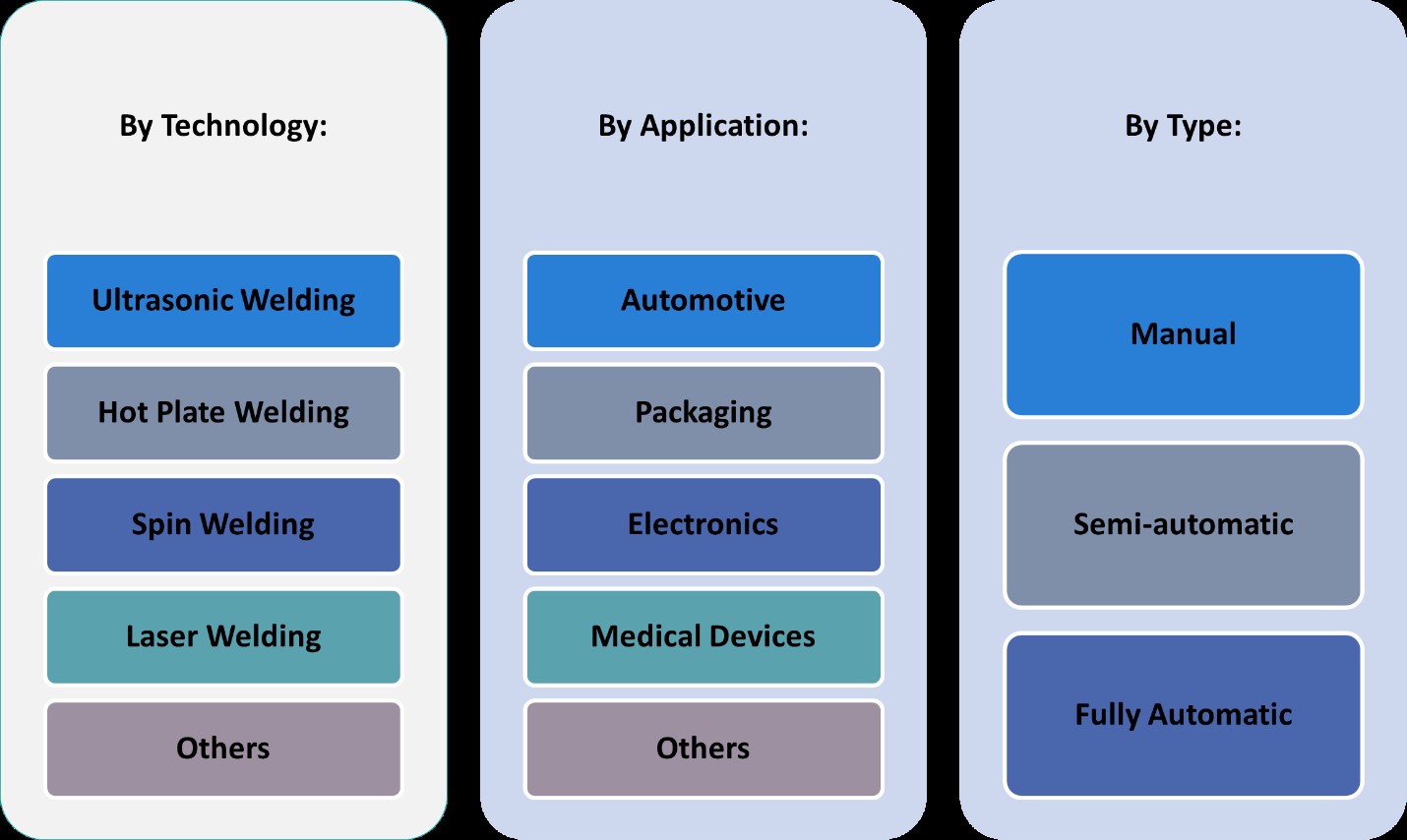

Market Segmentation Analysis:

By Type:

The Saudi Arabia plastic welding equipment market can be segmented into manual, semi-automatic, and fully automatic systems, each catering to different operational needs and industry scales. Manual plastic welding equipment remains widely used, particularly among small-scale manufacturers and workshops where budget constraints and customization are key. These systems offer flexibility and control but require skilled labor, which can be a limiting factor in productivity. Semi-automatic machines strike a balance between manual precision and automation efficiency. They are favored in mid-scale operations where consistent output and moderate volume production are required. Fully automatic plastic welding equipment, however, is gaining rapid traction, especially in industries where high-volume, precision welding is essential, such as automotive and electronics manufacturing. These systems integrate advanced features like real-time quality monitoring and minimal human intervention, aligning well with Saudi Arabia’s growing shift toward smart manufacturing and Industry 4.0. As industries modernize, the demand for semi-automatic and fully automatic solutions is expected to rise significantly over the coming years.

By Application:

Based on application, the plastic welding equipment market in Saudi Arabia is diversified across electronics, packaging, automotive, medical devices, and other sectors. The automotive industry is one of the leading segments, driven by the increasing use of plastic components in vehicles to meet fuel efficiency standards. Plastic welding is essential for assembling parts such as fuel tanks, bumpers, and door panels. The electronics sector also shows robust demand, particularly for precision welding in compact assemblies. Packaging is another key application area, where plastic welding is used to seal and shape containers, pouches, and wrapping materials, benefiting from the country’s growing food and consumer goods sectors. Meanwhile, the medical devices industry, though smaller in scale, is expanding steadily and requires high-precision, contamination-free welding methods for products such as tubing and housings. Other segments, including construction and water management, contribute to market growth due to the extensive use of plastic pipes and fittings. This broad application base underscores the versatility and critical importance of plastic welding technologies across Saudi industries.

Segments:

Based on Type:

- Manual

- Semi-automatic

- Fully Automatic

Based on Application:

- Electronics

- Packaging

- Automotive

- Medical Devices

- Others

Based on Technology:

- Ultrasonic Welding

- Hot Plate Welding

- Spin Welding

- Laser Welding

- Others

Based on the Geography:

- Riyadh

- Jeddah

- Eastern Province

- Other Regions

Regional Analysis

Riyadh

Riyadh holds the largest market share, accounting for approximately 40% of the overall market. This is driven by the capital city’s role as a hub for business, trade, and industrial activity. Riyadh is home to a number of manufacturing, automotive, and construction industries, which require advanced welding equipment for plastic components. Additionally, the ongoing development of infrastructure and urbanization projects in Riyadh continues to drive demand for reliable and efficient plastic welding technologies.

Jeddah

Jeddah follows as the second-largest market in Saudi Arabia, contributing around 30% to the total market share. As a major port city, Jeddah plays a critical role in trade and logistics, facilitating the import of high-tech machinery and equipment, including plastic welding systems. The city’s strategic position near the Red Sea also positions it as a key center for industries such as packaging, food processing, and electronics, all of which require precision plastic welding. Jeddah’s dynamic growth in sectors like automotive manufacturing and consumer goods packaging further boosts the demand for advanced welding technologies. The strong industrial base in Jeddah makes it a major player in the regional plastic welding equipment market.

Eastern Province

Eastern Province, representing about 20% of the market share, is another important region for plastic welding equipment in Saudi Arabia. The region’s significance lies in its oil and petrochemical industries, which are highly reliant on plastic components for pipes, tanks, and storage systems. As these industries expand and diversify, the need for plastic welding technologies increases, particularly for high-performance solutions that ensure long-lasting, leak-proof, and durable welds. Furthermore, Eastern Province’s proximity to key industrial zones and ports fosters easy access to international suppliers, enhancing the region’s position in the plastic welding market.

Other regions

Other regions collectively contribute approximately 10% to the market share, with areas like Mecca, Medina, and Tabuk showing growing interest in plastic welding equipment. Although these regions are less industrialized compared to Riyadh, Jeddah, and Eastern Province, ongoing infrastructure projects and industrialization efforts are gradually boosting their market presence. The demand for plastic welding equipment in these areas is rising, particularly in construction and water management sectors. As these regions continue to develop, the need for reliable welding technologies is expected to grow, further driving the market in the coming years.

Key Player Analysis

- Leister Technologies AG

- RITMO S.p.A.

- Emerson Electric Co.

- Herrmann Ultraschalltechnik GmbH & Co. KG

- Frimo Group GmbH

- Bielomatik Leuze GmbH & Co. KG

- Mecasonic Group

- CEMAS Elettra

- CHN-TOP Machinery Group

- Haitian International Holdings Ltd.

Competitive Analysis

The competitive landscape of the Saudi Arabia plastic welding equipment market is dominated by several global and regional players offering a range of advanced welding solutions. Leading companies such as Leister Technologies AG, RITMO S.p.A., Emerson Electric Co., Herrmann Ultraschalltechnik GmbH & Co. KG, Frimo Group GmbH, Bielomatik Leuze GmbH & Co. KG, Mecasonic Group, CEMAS Elettra, CHN-TOP Machinery Group, and Haitian International Holdings Ltd. are all contributing to market growth through technological innovation and strategic market penetration. Companies in the market are focusing on product innovation and the integration of smart technologies to meet the evolving needs of the industry. In particular, the shift towards automation, such as the integration of IoT capabilities for real-time monitoring, predictive maintenance, and process optimization, is a major factor in staying competitive. Additionally, as industries in Saudi Arabia become more focused on sustainability, the demand for eco-friendly and energy-efficient plastic welding solutions is increasing. Manufacturers are thus prioritizing the development of welding systems that align with environmental regulations and support recycling initiatives. Furthermore, companies that offer comprehensive support services, including installation, maintenance, and training, have an edge in gaining long-term customer loyalty in a market that values reliability and operational efficiency. Price sensitivity remains a critical factor for some market segments, particularly in the small to medium-sized enterprises sector, adding another layer of competition among suppliers to offer cost-effective solutions without compromising on quality and performance.

Recent Developments

- In March 2025, Leister transferred its laser plastic welding business to Hymson Novolas AG, a subsidiary of Hymson Laser Technology Group Co. Ltd. The transition ensures continuity and further development of existing product lines, with a new Laser Technology Center established in Switzerland. Leister will now focus more on its core competencies: plastic welding (hot air, infrared) and industrial process heat.

- In February 2025, Herrmann continues to set industry standards with its ultrasonic welding solutions, particularly for medical devices and sensitive components. The company emphasizes individualized process development, intelligent process control, and digital quality monitoring for reproducible, high-strength welds. Herrmann will showcase new applications and integration options at K 2025, focusing on automation and sustainability in medical and packaging industries.

- In January 2025, Dukane highlighted its patented Q-Factor, Melt-Match®, Low Amplitude Preheat, and Ultra-High Frequency (260–400 Hz) vibration welding technologies, emphasizing their leadership in process control and diagnostics.

- In May 2024, Emerson launched the Branson™ GLX-1 Laser Welder, designed for the automated assembly of small, intricate plastic parts. The GLX-1 features a compact, modular design suitable for cleanroom environments, advanced servo-based actuation, and the ability to “un-weld” plastics for closed-loop recycling. It uses Simultaneous Through-Transmission Infrared® (STTlr) laser-welding technology for high efficiency, weld strength, and aesthetics. Enhanced connectivity, security, and data collection features support Industry 4.0 integration.

Market Concentration & Characteristics

The Saudi Arabia plastic welding equipment market exhibits a moderate level of concentration, with a mix of established global players and emerging local suppliers. The market is characterized by intense competition, with leading international companies offering advanced, automated, and energy-efficient welding solutions to cater to the growing demand across various industries, including automotive, packaging, and construction. While a few large players dominate the high-end segment, there is also significant participation from regional and local companies that provide cost-effective solutions for small to medium-sized enterprises. The characteristics of the market include a strong focus on technological innovation, particularly in automation, laser, and ultrasonic welding, to meet the evolving demands for precision, efficiency, and sustainability. Additionally, customer support services such as installation, maintenance, and training are crucial for gaining a competitive edge. The market is gradually shifting towards more sustainable and eco-friendly plastic welding solutions, aligning with global trends in environmental responsibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Saudi Arabia’s plastic welding equipment market is expected to grow due to increasing industrialization and infrastructure development.

- The demand for plastic welding equipment will rise as industries shift towards automation for higher productivity and precision.

- The rise in manufacturing of plastics for automotive and packaging sectors will boost the need for advanced welding technology.

- The growth of renewable energy projects in Saudi Arabia will require high-quality plastic welding solutions for piping and tanks.

- The expansion of the construction sector in the region will drive demand for plastic welding equipment for water management and sewage systems.

- Technological advancements in plastic welding processes such as ultrasonic welding and hot air welding will see widespread adoption.

- A growing focus on sustainability and recycling will lead to innovations in plastic welding equipment designed for recyclable plastics.

- The oil and gas industry’s requirement for specialized plastic welding solutions will support the market growth.

- Increased investment in research and development will improve the efficiency and durability of plastic welding machinery.

- Collaboration with global suppliers and manufacturers will enable the adoption of cutting-edge welding technologies in Saudi Arabia.