Market Overview

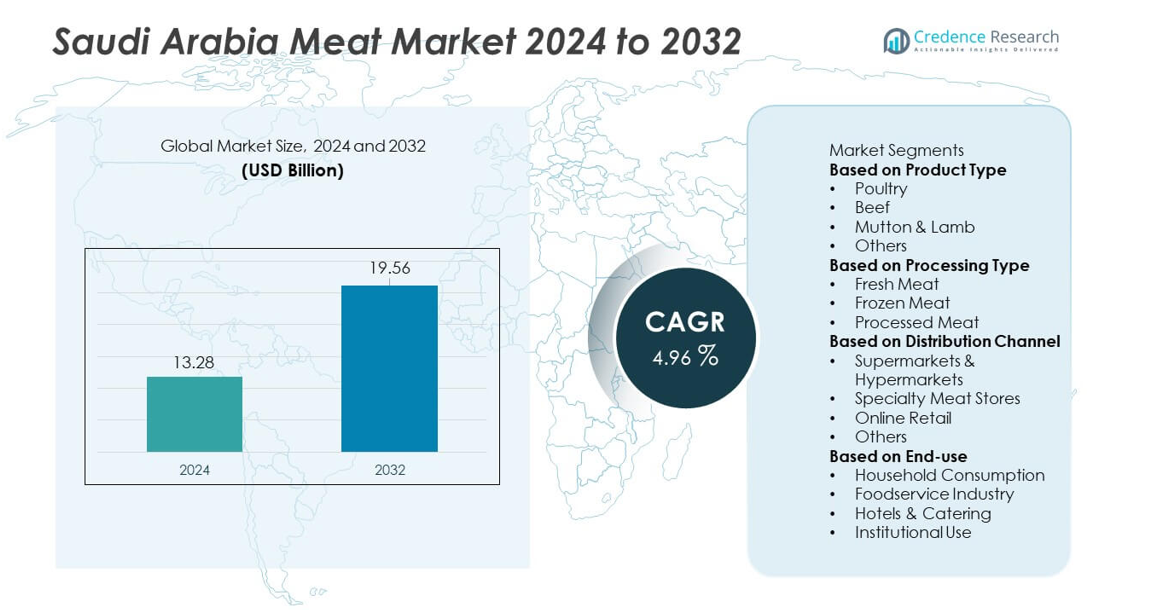

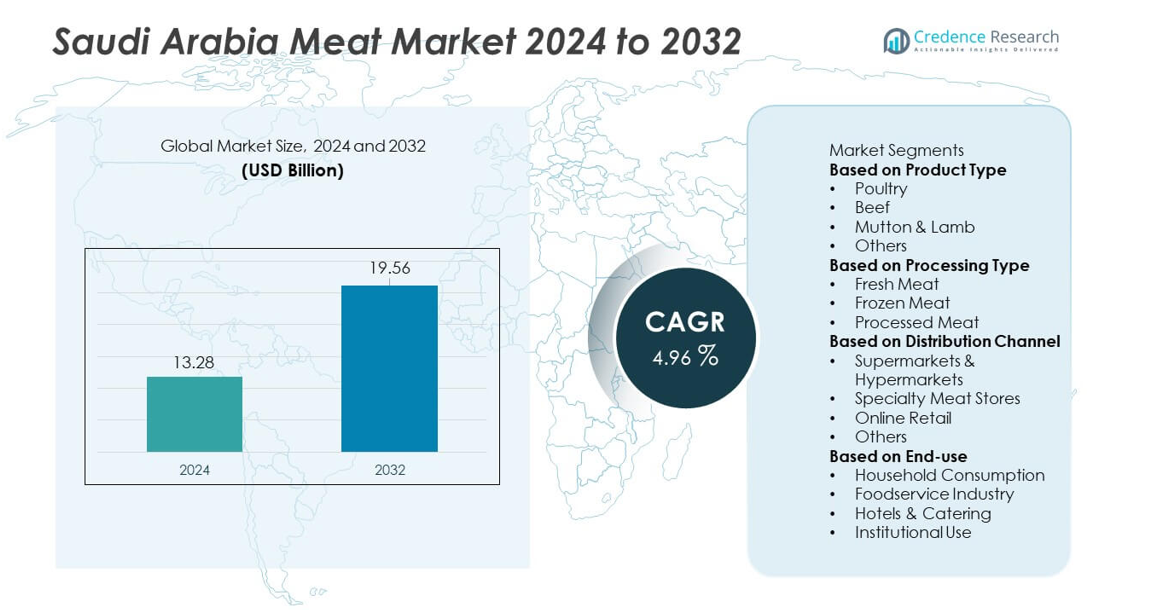

The Saudi Arabia Meat market was valued at USD 13.28 billion in 2024 and is projected to reach USD 19.56 billion by 2032, expanding at a CAGR of 4.96 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saudi Arabia Meat Market Size 2024 |

USD 13.28 billion |

| Saudi Arabia Meat Market, CAGR |

4.96% |

| Saudi Arabia Meat Market Size 2032 |

USD 19.56 billion |

The Saudi Arabia Meat market is driven by leading players such as Almarai Company, Tanmiah Food Company, Al-Watania Poultry, Almunajem Foods, Americana Foods, Sadia (BRF), Halwani Bros, Al Islami Foods, Atyab Food Industries, and Sunbulah Group. These companies expand their presence through strong production capabilities, extensive cold-chain networks, and diversified fresh, frozen, and processed meat portfolios tailored to local consumer preferences. The Central Region leads the market with a 36% share, supported by high population density and modern retail growth. The Western Region follows with a 29% share driven by tourism and hospitality demand, while the Eastern Region holds 21% thanks to strong industrial and household consumption.

Market Insights

- The Saudi Arabia Meat market reached USD 13.28 billion in 2024 and will grow at a CAGR of 4.96 percent through 2032.

- Strong population growth and rising per-capita protein intake drive demand, with poultry holding a 46 percent segment share due to affordability and wide availability.

- Fresh meat remains the preferred category with a 58 percent share, while trends such as ready-to-cook products, value-added cuts, and halal-certified processed meat continue to expand.

- Competition among Almarai, Tanmiah, Al-Watania Poultry, Almunajem Foods, Americana, Sadia, Halwani, Al Islami, Atyab, and Sunbulah is intense, though high import dependence and price volatility remain key restraints.

- The Central Region leads with a 36 percent share, followed by the Western Region at 29 percent and the Eastern Region at 21 percent, while supermarkets and hypermarkets dominate distribution with a 41 percent market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Poultry leads the Saudi Arabia meat market with a 46% share, driven by strong consumer preference for affordable protein and widespread availability across retail and foodservice channels. The segment benefits from domestic production growth supported by government initiatives promoting food security and modern poultry farming. Beef follows as demand rises in premium dining and hospitality, while mutton and lamb remain essential for traditional cuisines and festive consumption. Other meat types grow steadily but hold smaller shares. Rising population, shifting dietary habits, and expanding foodservice chains continue to strengthen demand across all product categories.

- For instance, Almarai upgraded its poultry operations with advanced processing equipment, and its main facility in Ha’il escalated to a 37,000 birds-per-hour (bph) capacity, enhancing quality, efficiency, and speed.

By Processing Type

Fresh meat dominates the market with a 58% share, supported by strong consumer preference for freshly slaughtered products aligned with cultural and halal standards. Local butcher shops, hypermarkets, and meat counters drive high-volume sales due to daily replenishment and direct sourcing from regional farms. Frozen meat expands as imports rise from Brazil, Australia, and India, offering cost advantages and long shelf life. Processed meat grows steadily with rising adoption of ready-to-cook and ready-to-eat products, particularly among urban households. Cold-chain improvements and modern retail expansion continue to support growth across all processing segments.

- For instance, Almunajem Foods utilizes state-of-the-art temperature-controlled warehouses with a total storage capacity of over 55,000 tons to maintain quality in imported frozen poultry.

By Distribution Channel

Supermarkets and hypermarkets lead with a 41% share, driven by their wide product assortment, strict quality controls, and rising consumer preference for packaged and hygienic meat. These outlets benefit from strong brand presence, temperature-controlled storage, and competitive pricing. Specialty meat stores follow as consumers seek premium cuts and customized butchery services. Online retail grows rapidly due to home delivery convenience and digital promotions. Other channels, including local butcher shops, remain relevant in traditional neighborhoods. Expanding modern retail infrastructure and growing interest in branded meat products continue to strengthen the dominant position of large-format stores.

Key Growth Drivers

Rising Per-Capita Meat Consumption and Population Growth

Saudi Arabia’s growing population and increasing per-capita meat consumption strongly drive market expansion. Poultry and beef demand rises as consumers shift toward protein-rich diets supported by higher disposable incomes. Urbanization boosts consumption through restaurants, catering, and fast-food chains. The country’s young demographic contributes to strong household meat purchases, especially during festivals and social gatherings. Government-backed food security initiatives and expanding domestic livestock farming further support long-term demand. These factors collectively strengthen the growth outlook for both fresh and processed meat segments.

- For instance, Tanmiah Food Company increased its broiler production capacity by 42 million birds annually through upgraded farms and feeders.

Expansion of Modern Retail and Cold-Chain Infrastructure

The rapid expansion of supermarkets, hypermarkets, and specialty meat stores boosts meat accessibility across major cities. Modern retail outlets offer improved storage, branded meats, and value-added packaging that meet hygiene expectations. Cold-chain upgrades ensure safer handling of fresh, frozen, and imported meat products. Import growth from Brazil, Australia, and neighboring countries supports affordable supply. The rise of online grocery platforms with temperature-controlled delivery enhances convenience for urban consumers. These developments contribute to a stronger and more efficient distribution ecosystem.

- For instance, BRF (Sadia) enhanced last-mile delivery through multi-temperature trucks capable of holding mixed-temperature products.

Government Initiatives Supporting Domestic Meat Production

Government programs aimed at enhancing food security and agricultural self-sufficiency accelerate domestic livestock and poultry production. Investments in advanced farming technologies, genetic improvement, and biosecurity standards help increase output quality. Subsidies for feed, farming equipment, and water-efficient livestock systems support local producers. Regulatory frameworks ensure halal compliance, strengthening consumer trust in domestic meat. These initiatives reduce reliance on imports and encourage expansion of local supply chains, contributing to long-term market stability and steady growth.

Key Trends & Opportunities

Rising Demand for Processed and Value-Added Meat Products

Urban lifestyle changes increase demand for ready-to-cook, marinated, and frozen meat options. Consumers prefer convenience-driven products that save preparation time while maintaining taste and quality. Foodservice operators expand menus with premium cuts, boneless products, and internationally inspired flavors. Modern packaging technologies extend shelf life and enhance freshness. Growing interest in high-quality processed meat opens opportunities for suppliers specializing in sausages, deli meats, and frozen meals. The trend aligns with rapid expansion of retail chains and rising influence of global cuisines.

- For instance, Al Islami Foods uses advanced packaging technologies, including modified-atmosphere packaging, to help extend the freshness and shelf life of their value-added chicken products.

Growth of E-Commerce and Technology-Enabled Meat Delivery Platforms

Online grocery and meat delivery platforms grow rapidly as consumers seek convenience, reliability, and transparent sourcing. Digital platforms offer real-time tracking, temperature-controlled delivery, and customizable meat selections. Promotions, subscription models, and mobile app integrations drive adoption, especially among younger households. E-commerce also supports smaller meat producers by giving them wider market reach. As digital payments and logistics networks mature, online meat retail becomes a key opportunity area, driving stronger engagement across urban markets.

- For instance, Carrefour Saudi Arabia added automated micro-fulfillment units that process up to 2,000 online orders per day, drastically reducing the processing time by up to 50%.

Key Challenges

High Dependence on Meat Imports and Price Volatility

Saudi Arabia relies heavily on imported meat, especially beef and frozen poultry, making the market vulnerable to global supply-chain disruptions. Fluctuations in international prices, freight charges, and currency exchange rates increase cost instability. Disease outbreaks in exporting countries affect availability and pricing. Import reliance also pressures local producers who face competition from low-cost global suppliers. Managing stable supply and maintaining price affordability remain ongoing challenges.

Limited Domestic Production Capacity and Environmental Constraints

Local livestock farming faces challenges such as water scarcity, high feed costs, and limited grazing land. These constraints restrict large-scale expansion and increase production costs. Climate conditions require controlled farming systems, adding operational expenses for poultry and livestock producers. Environmental sustainability concerns also push the need for modern, resource-efficient farming practices. Without continuous investment in technology and sustainable agriculture, domestic supply growth may remain slow, impacting long-term market balance.

Regional Analysis

Central Region

The Central Region holds a 36% market share, driven by high population density, strong purchasing power, and the dominance of Riyadh as the country’s largest consumption hub. Modern retail chains, hypermarkets, and large foodservice operators fuel continuous demand for poultry, beef, and processed meat products. The region benefits from major distribution centers and cold-chain facilities that support efficient supply flows from both domestic producers and import sources. Rising demand from restaurants, catering companies, and institutional buyers further strengthens market growth. Expanding urban households and diversified retail formats continue to shape meat consumption patterns across the region.

Western Region

The Western Region accounts for a 29% share, supported by strong tourism, hospitality, and religious travel in cities such as Jeddah, Makkah, and Madinah. High demand from hotels, restaurants, and HORECA services boosts consumption of premium beef, lamb, and specialty meat products. The region has well-developed ports that support large import volumes, enabling a consistent supply of fresh and frozen meats. Expanding supermarkets and specialty butcher outlets enhance retail availability. Growth in expatriate populations and rising preference for chilled and packaged meats contribute to a steady increase in regional consumption.

Eastern Region

The Eastern Region holds a 21% market share, supported by strong industrial development, high-income households, and a growing expatriate workforce in cities such as Dammam and Khobar. The region benefits from proximity to major ports and logistics hubs, which ensures stable import flows for beef, poultry, and frozen meat varieties. Foodservice growth driven by corporate hubs and residential expansion boosts demand for both fresh and processed meat. Retail modernization and increasing adoption of value-added meat products further support market expansion across urban neighborhoods and commercial zones.

Southern Region

The Southern Region represents an 8% share, with consumption influenced by moderate population density and reliance on traditional retail channels. Poultry and lamb demand remains strong due to cultural dietary habits and preference for fresh, halal-certified products. Infrastructure development in cities such as Abha and Jizan strengthens distribution networks and expands access to branded meat offerings. Although modern retail penetration is lower compared to major regions, rising urbanization and improving cold-chain connectivity support gradual market growth. Seasonal tourism also contributes to fluctuating but positive demand for premium meat products.

Northern Region

The Northern Region holds a 6% market share, driven by growing household consumption and increasing availability of packaged meat through emerging retail outlets. Economic development programs in cities such as Tabuk and Al Jouf support improved logistics and food distribution networks. Fresh meat remains the preferred category due to strong cultural influence and reliance on local butcher shops. However, rising imports and expanding supermarket presence introduce more processed and frozen options. Despite lower demand compared to larger regions, gradual urban expansion and government investment in regional development support steady market growth.

Market Segmentations:

By Product Type

- Poultry

- Beef

- Mutton & Lamb

- Others

By Processing Type

- Fresh Meat

- Frozen Meat

- Processed Meat

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Meat Stores

- Online Retail

- Others

By End-use

- Household Consumption

- Foodservice Industry

- Hotels & Catering

- Institutional Use

By Geography

- Central Region

- Western Region

- Eastern Region

- Southern Region

- Northern Region

Competitive Landscape

Competitive landscape in the Saudi Arabia Meat market features major players such as Almarai Company, Tanmiah Food Company, Al-Watania Poultry, Almunajem Foods, Americana Foods, Sadia (BRF), Halwani Bros, Al Islami Foods, Atyab Food Industries, and Sunbulah Group. These companies strengthen market presence through extensive product portfolios, strong distribution networks, and investments in modern processing and cold-chain infrastructure. Leading poultry producers expand high-capacity farms and automated processing facilities to meet rising domestic demand, while imported beef and frozen poultry players enhance supply reliability through global sourcing partnerships. Many companies focus on halal-certified, value-added, and ready-to-cook products to cater to evolving consumer preferences. Strategic mergers, retail partnerships, and expansion into premium and packaged meat segments further intensify competition. Increasing investment in food safety, sustainability, and digital supply chain systems enables leading brands to maintain quality consistency and widen their nationwide reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Tanmiah Food Company announced a partnership with McDonald’s Saudi Arabia to supply locally raised poultry, boosting its role in national food-security efforts.

- In May 2025, Almunajem Foods exhibited at the Saudi Food Show 2025, showcasing its products at a key industry event.

- In March 2025, Almarai Company was named among potential bidders to acquire Al Watania Poultry

Report Coverage

The research report offers an in-depth analysis based on Product Type, Processing Type, Distribution Channel, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for poultry will rise as consumers prefer affordable and lean protein options.

- Fresh meat consumption will grow due to strong cultural preference for freshly sourced products.

- Processed meat adoption will increase as urban lifestyles drive convenience-based food choices.

- Investments in local livestock farming will expand to reduce heavy reliance on meat imports.

- Halal-certified processing facilities will expand to support strict quality and religious standards.

- Cold-chain infrastructure will improve to ensure safe storage, handling, and transport of meat products.

- Online meat retailing will gain more traction as digital shopping becomes mainstream.

- Automation and modern slaughterhouse technologies will enhance production efficiency and hygiene.

- Government food security policies will support domestic meat production and supply diversification.

- Premium meat categories, including organic and antibiotic-free options, will see steady growth among high-income consumers.