1. Preface

1.1. Report DeSCRiption

1.1.1. Purpose of the Report

1.1.2. Target Audience

1.1.3. USP and Key Offerings

1.2. Research Scope

1.3. Research Methodology

1.3.1. Phase I – Secondary Research

1.3.2. Phase II – DataModelling

1.3.2.1. Company Share Analysis Model

1.3.2.2. Revenue Based Modelling

1.3.3. Phase III – Primary Research

1.3.4. Research Limitations

1.3.5. Assumptions

1.4. Market Introduction

1.5. Market Research Scope

2. Executive Summary

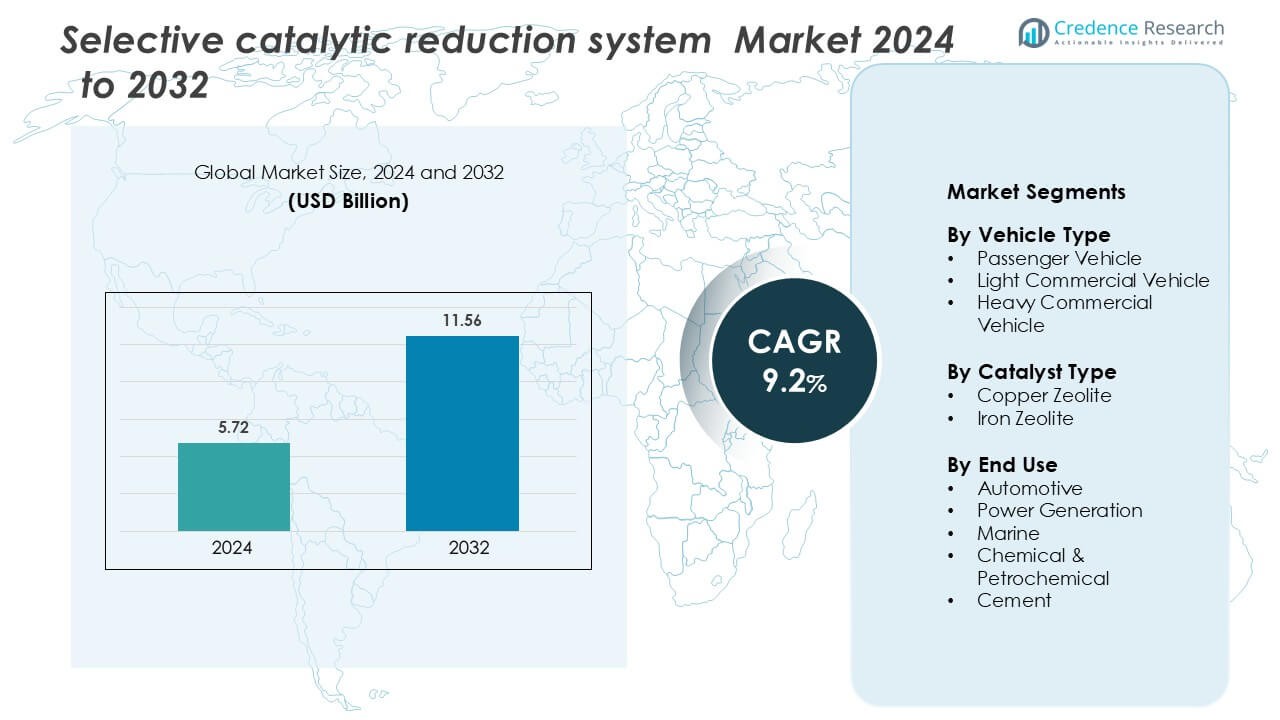

2.1. Market Snapshot: Global Selective catalytic reduction SCR market

2.2. Global Selective catalytic reduction SCR market, By Component

2.3. Global Selective catalytic reduction SCR market, By Vehicle Type

2.4. Global Selective catalytic reduction SCR market, By Fuel Type

2.5. Global Selective catalytic reduction SCR market, By Region

3. Market Dynamics & Factors Analysis

3.1. Introduction

3.1.1. Global Selective catalytic reduction SCR market Value, 2017-2030, (US$ Bn)

3.1.2. Y-o-Y Growth Trend Analysis

3.2. Market Dynamics

3.2.1. Market Drivers

3.2.2. Market Restraints

3.2.3. Market Opportunities

3.2.4. Major Industry Challenges

3.3. Growth and Development Patterns

3.4. Investment Feasibility Analysis

3.5. Market Opportunity Analysis

3.5.1. Component

3.5.2. Vehicle Type

3.5.3. Fuel Type

3.5.4. Geography

4. Premium Insights

4.1. STAR (Situation, Task, Action, Results) Analysis

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers/Consumers

4.2.3. Bargaining Power of Suppliers

4.2.4. Threat of Substitute Components

4.2.5. Intensity of Competitive Rivalry

4.3. Key Market Trends

4.3.1. Demand Side Trends

4.3.2. Supply Side Trends

4.4. Value Chain Analysis

4.5. Component Analysis

4.6. Analysis and Recommendations

4.7. Marketing Strategy Analysis

4.7.1. Passenger Vehicle Marketing

4.7.2. Indirect Marketing

4.7.3. Marketing Channel Development Trend

5. Market Positioning of Key Players, 2022

5.1. Company market share of key players, 2022

5.2. Competitive Benchmarking

5.3. Market Positioning of Key Vendors

5.4. Geographical Presence Analysis

5.5. Major Strategies Adopted by Key Players

5.5.1. Key Strategies Analysis

5.5.2. Mergers and Acquisitions

5.5.3. Partnerships

5.5.4. Product Launch

5.5.5. Geographical Expansion

5.5.6. Urea Pumps

6. Economic Impact Analysis

6.1. Recession Impact

6.1.1. North America

6.1.2. Europe

6.1.3. Asia Pacific

6.1.4. Latin America

6.1.5. Middle East and Africa

6.2. Ukraine-Russia War Impact

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East and Africa

6.3. COVID-19 Impact Analysis

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Latin America

6.3.5. Middle East and Africa

7. Global Selective catalytic reduction SCR market, By Component

7.1. Global Selective catalytic reduction SCR market Overview, by Component

7.1.1. Global Selective catalytic reduction SCR market Revenue Share, By Component, 2022 Vs 2030 (in %)

7.2. Urea Tank

7.2.1. Global Selective catalytic reduction SCR market, By Region, 2017-2030 (US$ Bn)

7.3. Urea Pumps

7.3.1. Global Selective catalytic reduction SCR market, By Region, 2017-2030 (US$ Bn)

7.4. Engine Control Unit (ECU)

7.4.1. Global Selective catalytic reduction SCR market, By Region, 2017-2030 (US$ Bn)

7.5. Injector

7.5.1. Global Selective catalytic reduction SCR market, By Region, 2017-2030 (US$ Bn)

7.6. Others

7.6.1. Global Selective catalytic reduction SCR market, By Region, 2017-2030 (US$ Bn)

8. Global Selective catalytic reduction SCR market, By Vehicle Type

8.1. Global Selective catalytic reduction SCR market Overview, by Vehicle Type

8.1.1. Global Selective catalytic reduction SCR market, By Vehicle Type, 2022 vs 2030 (in%)

8.2. Passenger Vehicle

8.2.1. Global Selective catalytic reduction SCR market, By Region, 2017-2030 (US$ Bn)

8.3. Commercial Vehicle

8.3.1. Global Selective catalytic reduction SCR market, By Region, 2017-2030 (US$ Bn)

9. Global Selective catalytic reduction SCR market, by Fuel Type, 2017-2030(US$ Bn)

9.1. Global Selective catalytic reduction SCR market Overview, by Fuel Type

9.1.1. Global Selective catalytic reduction SCR market, By Fuel Type, 2022 vs 2030 (in%)

9.2. Gasoline

9.2.1. Global Selective catalytic reduction SCR market, By Region, 2017-2030 (US$ Bn)

9.3. Diesel

9.3.1. Global Selective catalytic reduction SCR market, By Region, 2017-2030 (US$ Bn)

10. Global Selective catalytic reduction SCR market, By Region

10.1. Global Selective catalytic reduction SCR market Overview, by Region

10.1.1. Global Selective catalytic reduction SCR market, By Region, 2022 vs 2030 (in%)

10.2. Component

10.2.1. Global Selective catalytic reduction SCR market, By Component, 2017-2030 (US$ Bn)

10.3. Vehicle Type

10.3.1. Global Selective catalytic reduction SCR market, By Vehicle Type, 2017-2030 (US$ Bn)

10.4. Fuel Type

10.4.1. Global Selective catalytic reduction SCR market, By Fuel Type, 2017-2030 (US$ Bn)

11. North America Selective catalytic reduction SCR market Analysis

11.1. North America Selective catalytic reduction SCR market, by Component, 2017-2030(US$ Bn)

11.1.1. Overview

11.1.2. SRC Analysis

11.2. North America Selective catalytic reduction SCR market, by Vehicle Type, 2017-2030(US$ Bn)

11.2.1. Overview

11.2.2. SRC Analysis

11.3. North America Selective catalytic reduction SCR market, by Fuel Type, 2017-2030(US$ Bn)

11.3.1. Overview

11.3.2. SRC Analysis

11.4. North America Selective catalytic reduction SCR market, by Country, 2017-2030(US$ Bn)

11.4.1. North America Selective catalytic reduction SCR market, by Country, 2022 Vs 2030 (in%)

11.4.2. U.S.

11.4.2.1. U.S. Selective catalytic reduction SCRMarket Estimates and Forecast, 2017-2030(US$ Bn)

11.4.2.2. U.S. Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

11.4.2.3. U.S. Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

11.4.2.4. U.S. Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

11.4.3. Canada

11.4.3.1. Canada Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

11.4.3.2. Canada Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

11.4.3.3. Canada Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

11.4.3.4. Canada Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

11.4.4. Mexico

11.4.4.1. Mexico Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030 (US$ Bn)

11.4.4.2. Mexico Selective catalytic reduction SCR, By Component, 2017-2030 (US$ Bn)

11.4.4.3. Mexico Selective catalytic reduction SCR, By Vehicle Type, 2017-2030 (US$ Bn)

11.4.4.4. Mexico Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

12. Europe Selective catalytic reduction SCR market Analysis

12.1. Europe Selective catalytic reduction SCR market, by Component, 2017-2030(US$ Bn)

12.1.1. Overview

12.1.2. SRC Analysis

12.2. Europe Selective catalytic reduction SCR market, by Vehicle Type, 2017-2030(US$ Bn)

12.2.1. Overview

12.2.2. SRC Analysis

12.3. Europe Selective catalytic reduction SCR market, by Fuel Type, 2017-2030(US$ Bn)

12.3.1. Overview

12.3.2. SRC Analysis

12.4. Europe Selective catalytic reduction SCR market, by Country, 2017-2030(US$ Bn)

12.4.1. Europe Selective catalytic reduction SCR market, by Country, 2022 Vs 2030 (in%)

12.4.2. Germany

5.4.2.1. Germany Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

12.4.2.2. Germany Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

12.4.2.3. Germany Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

12.4.2.4. Germany Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

12.4.3. France

12.4.3.1. France Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

12.4.3.2. France Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

12.4.3.3. France Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

12.4.3.4. France Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

12.4.4. UK

12.4.4.1. UK Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

12.4.4.2. UK Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

12.4.4.3. UK Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

5.4.4.4. UK Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

12.4.5. Italy

12.4.5.1. Italy Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

12.4.5.2. Italy Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

12.4.5.3. Italy Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

12.4.5.4. Italy Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

12.4.6. Spain

12.4.6.1. Spain Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

12.4.6.2. Spain Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

12.4.6.3. Spain Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

12.4.6.4. Spain Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

12.4.7. Rest of Europe

12.4.7.1. Rest of Europe Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

12.4.7.2. Rest of Europe Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

12.4.7.3. Rest of Europe Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

12.4.7.4. Rest of Europe Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

13. Asia Pacific Selective catalytic reduction SCR market Analysis

13.1. Asia Pacific Selective catalytic reduction SCR market, by Component, 2017-2030(US$ Bn)

13.1.1. Overview

13.1.2. SRC Analysis

13.2. Asia Pacific Selective catalytic reduction SCR market, by Vehicle Type, 2017-2030(US$ Bn)

13.2.1. Overview

13.2.2. SRC Analysis

13.3. Asia Pacific Selective catalytic reduction SCR market, by Fuel Type, 2017-2030(US$ Bn)

13.3.1. Overview

13.3.2. SRC Analysis

13.4. Asia Pacific Selective catalytic reduction SCR market, by Country, 2017-2030(US$ Bn)

13.4.1. Asia Pacific Selective catalytic reduction SCR market, by Country, 2022 Vs 2030 (in%)

6.4.2. China

13.4.2.1. China Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

13.4.2.2. China Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

13.4.2.3. China Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

13.4.2.4. China Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

13.4.3. Japan

13.4.3.1. Japan Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

13.4.3.2. Japan Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

13.4.3.3. Japan Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

13.4.3.4. Japan Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

13.4.4. India

13.4.4.1. India Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

13.4.4.2. India Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

13.4.4.3. India Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

13.4.4.4. India Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

13.4.5. South Korea

13.4.5.1. South Korea Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

13.4.5.2. South Korea Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

13.4.5.3. South Korea Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

13.4.5.4. South Korea Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

13.4.6. South-East Asia

13.4.6.1. South-East Asia Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

13.4.6.2. South-East Asia Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

13.4.6.3. South-East Asia Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

13.4.6.4. South-East Asia Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

13.4.7. Rest of Asia Pacific

13.4.7.1. Rest of Asia Pacific Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

13.4.7.2. Rest of Asia Pacific Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

13.4.7.3. Rest of Asia Pacific Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

13.4.7.4. Rest of Asia Pacific Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

14. Latin America Selective catalytic reduction SCR market Analysis

14.1. Latin America Selective catalytic reduction SCR market, by Component, 2017-2030(US$ Bn)

14.1.1. Overview

14.1.2. SRC Analysis

14.2. Latin America Selective catalytic reduction SCR market, by Vehicle Type, 2017-2030(US$ Bn)

14.2.1. Overview

14.2.2. SRC Analysis

14.3. Latin America Selective catalytic reduction SCR market, by Fuel Type, 2017-2030(US$ Bn)

14.3.1. Overview

14.3.2. SRC Analysis

14.4. Latin America Selective catalytic reduction SCR market, by Country, 2017-2030(US$ Bn)

14.4.1. Latin America Selective catalytic reduction SCR market, by Country, 2022 Vs 2030 (in%)

14.4.2. Brazil

14.4.2.1. Brazil Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

14.4.2.2. Brazil Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

14.4.2.3. Brazil Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

14.4.2.4. Brazil Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

14.4.3. Argentina

14.4.3.1. Argentina Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

14.4.3.2. ArgentinaSelective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

14.4.3.3. Argentina Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

14.4.3.4. Argentina Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

14.4.4. Rest of Latin America

14.4.4.1. Rest of Latin America Selective catalytic reduction SCR market Estimates and Forecast, 2017-2030(US$ Bn)

14.4.4.2. Rest of Latin America Selective catalytic reduction SCR, By Component, 2017-2030(US$ Bn)

14.4.4.3. Rest of Latin America Selective catalytic reduction SCR, By Vehicle Type, 2017-2030(US$ Bn)

14.4.4.4. Rest of Latin America Selective catalytic reduction SCR, By Fuel Type, 2017-2030 (US$ Bn)

15. Middle East and Africa Selective catalytic reduction SCR market Analysis