Market Overview

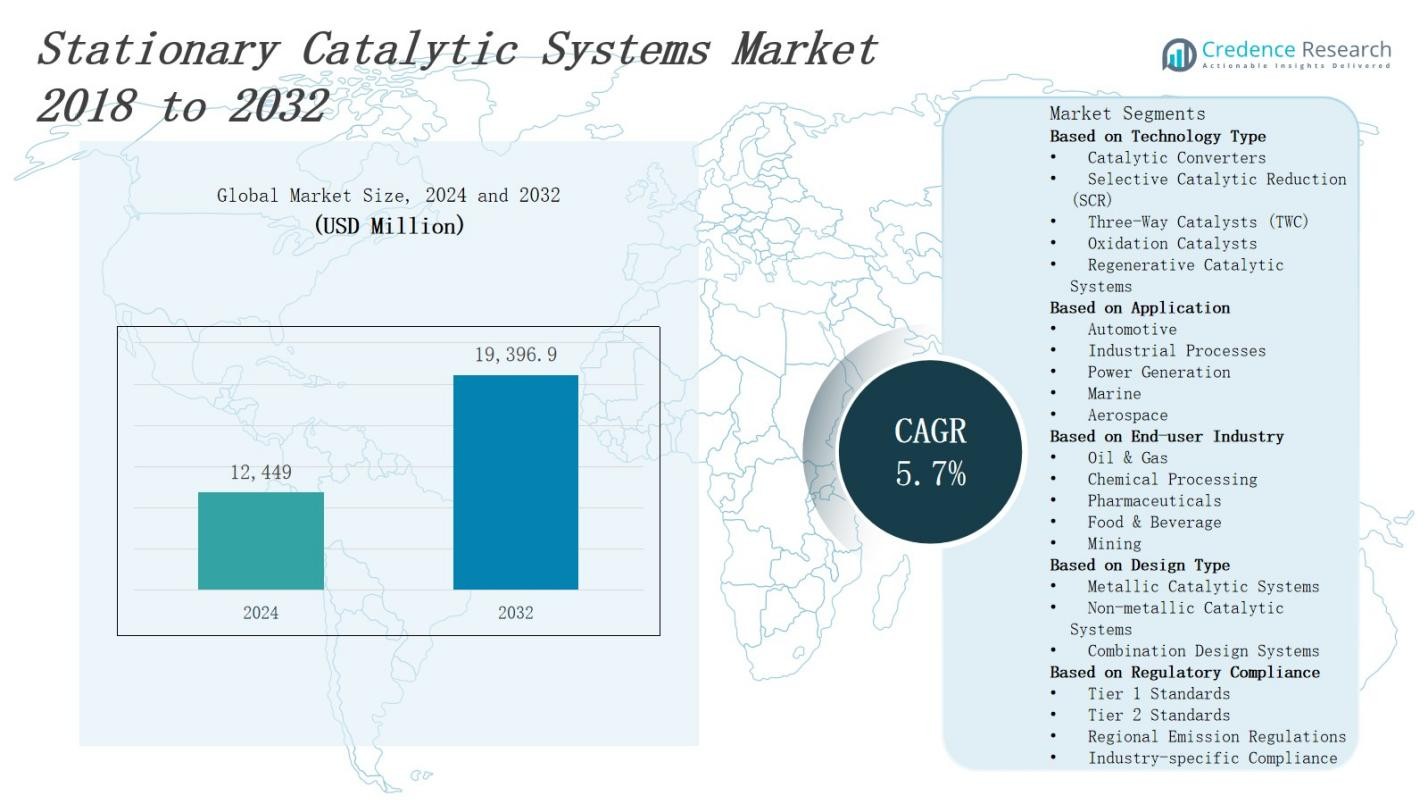

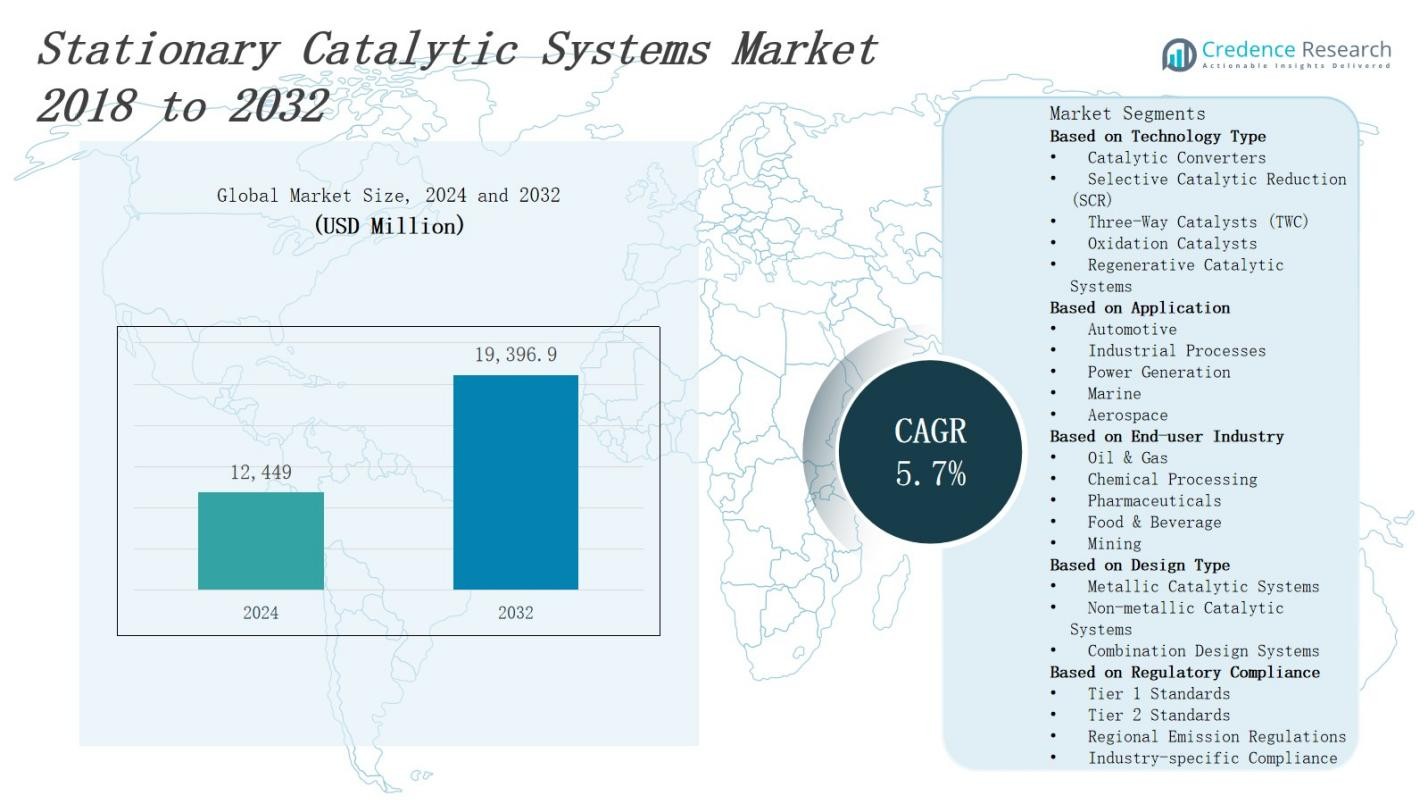

The Stationary Catalytic Systems Market is projected to grow from USD 12,449 million in 2024 to USD 19,396.9 million by 2032, expanding at a CAGR of 5.7%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stationary Catalytic Systems Market Size 2024 |

USD 12,449 Million |

| Stationary Catalytic Systems Market, CAGR |

5.7% |

| Stationary Catalytic Systems Market Size 2032 |

USD 19,396.9 Million |

The stationary catalytic systems market grows driven by increasing demand for efficient emission control solutions in industrial processes and power generation. Stricter environmental regulations worldwide compel industries to adopt advanced catalytic technologies to reduce harmful pollutants. Rising investments in refining and chemical manufacturing further support market expansion. Innovations in catalyst materials enhance system durability and performance, lowering operational costs. Growing focus on sustainable industrial practices and energy efficiency drives adoption across emerging and developed economies. Trends include integration of digital monitoring for real-time system optimization and development of eco-friendly catalysts, reinforcing the market’s steady growth trajectory.

The stationary catalytic systems market shows strong geographical diversity, with Asia-Pacific leading at 35%, followed by North America at 30%, Europe at 25%, and the Rest of the World at 10%. Rapid industrialization in Asia-Pacific drives significant demand, while North America and Europe benefit from stringent environmental regulations and advanced infrastructure. The Rest of the World presents emerging opportunities with growing industrial activities. Key players in the market include Johnson Matthey, GE Vernova, Babcock & Wilcox, CECO Environmental, MAN Energy Solutions, Ducon, and others, focusing on innovation and regional expansion to capture market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The stationary catalytic systems market is projected to grow from USD 12,449 million in 2024 to USD 19,396.9 million by 2032, expanding at a CAGR of 5.7%.

- Increasing demand for efficient emission control in industrial processes and power generation drives market growth, supported by stricter global environmental regulations.

- Rising investments in refining and chemical manufacturing boost market expansion, while innovations in catalyst materials improve durability and lower operational costs.

- Growing focus on sustainable industrial practices and energy efficiency promotes adoption across emerging and developed economies.

- Asia-Pacific leads the market with a 35% share, followed by North America at 30%, Europe at 25%, and the Rest of the World at 10%.

- Key players such as Johnson Matthey, GE Vernova, Babcock & Wilcox, and CECO Environmental emphasize innovation and regional expansion to capture market share.

- Challenges include high initial investment, maintenance costs, and catalyst deactivation, requiring advanced materials and protective technologies to enhance system reliability.

Market Drivers

Stringent Environmental Regulations Driving Demand

The stationary catalytic systems market benefits significantly from the enforcement of strict environmental regulations worldwide. Governments impose tighter emission standards on industries such as power generation, oil refining, and chemical manufacturing to curb air pollution. It compels companies to implement efficient catalytic solutions to meet compliance and avoid penalties. Regulatory bodies encourage the adoption of low-emission technologies, promoting sustainable industrial growth. This regulatory pressure creates a strong, ongoing demand for advanced stationary catalytic systems across regions.

- For instance, Johnson Matthey, a global leader in emission control technologies, has supplied selective catalytic reduction (SCR) systems to multiple power plants, enabling NOx reductions of up to 95% to comply with stringent environmental regulations.

Rising Industrialization and Energy Production Needs

Rapid industrialization and expanding energy production contribute to the growth of the stationary catalytic systems market. Emerging economies increase manufacturing output, power generation capacity, and chemical production to support economic development. It drives demand for emission control technologies to maintain environmental standards and operational efficiency. Industries invest in catalytic systems to optimize processes and reduce hazardous emissions. The increasing industrial activities fuel steady market growth by requiring reliable and scalable catalytic solutions.

- For instance, Babcock & Wilcox Enterprises, Inc. supplies Selective Catalytic Reduction (SCR) systems extensively to coal-fired power plants, enabling them to reduce nitrogen oxides (NOx) emissions by up to 90% while complying with stringent environmental regulations.

Technological Advancements Enhancing System Performance

Technological innovation plays a crucial role in advancing the stationary catalytic systems market. Improvements in catalyst materials and system design enhance durability, selectivity, and conversion efficiency. It enables industries to reduce operational costs and improve environmental performance simultaneously. The development of digital monitoring and control systems allows real-time optimization of catalytic reactions. These advancements encourage broader adoption and support long-term market expansion by providing cost-effective and eco-friendly solutions.

Growing Focus on Sustainability and Energy Efficiency

The stationary catalytic systems market experiences growth from heightened awareness of sustainability and energy efficiency. Industries seek solutions that minimize environmental impact while optimizing resource use and energy consumption. It promotes the integration of catalytic systems in existing and new facilities to meet sustainability goals. Companies prioritize technologies that align with global efforts to reduce carbon footprints and promote cleaner production. This focus on green initiatives and responsible manufacturing drives consistent market demand.

Market Trends

Integration of Digital Technologies for Real-Time Monitoring

The stationary catalytic systems market increasingly adopts digital technologies to improve operational efficiency and system reliability. It integrates advanced sensors and IoT-enabled devices for continuous real-time monitoring of catalyst performance and emissions. This enables prompt detection of system inefficiencies and preventive maintenance, reducing downtime. Data analytics supports optimized process control and enhances catalytic reactions. The digital transformation trend improves cost-effectiveness and supports predictive maintenance strategies across industries.

- For instance, BASF incorporates IoT-enabled sensors in their catalyst monitoring systems to provide real-time data on catalyst activity and emission levels, enabling timely adjustments and maintenance.

Development of Eco-Friendly and Sustainable Catalysts

Eco-friendly catalyst development represents a major trend in the stationary catalytic systems market. Manufacturers focus on creating catalysts with lower environmental impact through reduced use of precious metals and toxic substances. It supports circular economy principles by enabling catalyst recycling and reusability. New formulations also improve catalytic efficiency and longevity, decreasing waste generation. This shift toward sustainable materials aligns with global environmental goals and regulatory demands, driving innovation and market growth.

- For instance, Clariant Catalysts develops catalysts that lower CO2 emissions and energy use, enhancing hydrogen purification and emission control to support the transition to net-zero and renewable energy.

Expansion in Emerging Markets and Industrial Sectors

Emerging markets exhibit rapid adoption of stationary catalytic systems due to expanding industrial activities and stricter emission regulations. It benefits from increasing investments in power plants, refineries, and chemical manufacturing in Asia-Pacific, Latin America, and the Middle East. These regions emphasize upgrading existing infrastructure with advanced catalytic solutions to comply with environmental standards. The growing industrial base fuels demand, positioning emerging economies as critical drivers of market expansion.

Focus on Customization and Modular System Designs

Customization and modularity emerge as key trends within the stationary catalytic systems market. It responds to diverse industry requirements by offering tailored catalytic solutions optimized for specific processes and emission profiles. Modular designs facilitate easier installation, maintenance, and scalability, reducing capital expenditure and operational disruption. Customers benefit from flexible systems that adapt to evolving regulatory and operational needs. This trend enhances customer satisfaction and supports long-term adoption across multiple sectors.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

The stationary catalytic systems market faces challenges related to the high capital expenditure required for system installation and ongoing maintenance. Industries often hesitate to invest due to substantial upfront costs, including catalyst materials and complex engineering requirements. It demands skilled personnel and regular upkeep to maintain optimal performance, increasing operational expenses. The cost barrier slows adoption, especially among small and medium-sized enterprises. Balancing cost efficiency with regulatory compliance remains a significant obstacle for widespread deployment.

Catalyst Deactivation and Limited Lifespan Issues

Catalyst deactivation poses a critical challenge in the stationary catalytic systems market. Prolonged exposure to high temperatures, poisoning by impurities, and physical wear reduce catalyst effectiveness over time. It forces frequent replacement or regeneration, increasing downtime and operational costs. Variability in feedstock quality and operating conditions further complicates system reliability. Overcoming catalyst degradation requires advanced materials and protective technologies, which are still under development, limiting long-term sustainability and efficiency.

Market Opportunities

Expansion into Emerging Economies with Growing Industrial Sectors

The stationary catalytic systems market holds significant opportunities in emerging economies driven by rapid industrialization and infrastructure development. It can capitalize on rising investments in power generation, petrochemical, and manufacturing sectors that require advanced emission control technologies. Increasing regulatory enforcement in these regions creates demand for upgrading existing facilities with efficient catalytic systems. Targeted market entry and localized solutions can accelerate adoption and revenue growth. Expanding presence in these high-growth markets offers long-term strategic benefits.

Innovation in Catalyst Materials and System Design

Innovation presents a major opportunity for the stationary catalytic systems market through development of advanced catalyst materials and modular system designs. It can introduce catalysts with enhanced durability, higher selectivity, and reduced precious metal content to lower costs and improve sustainability. Modular designs allow easier customization and scalability, appealing to diverse industry needs. Collaborations with technology providers and research institutions can accelerate product development and differentiation. Investing in R&D strengthens competitive advantage and meets evolving environmental standards.

Market Segmentation Analysis:

By Technology Type

The stationary catalytic systems market segments include catalytic converters, selective catalytic reduction (SCR), three-way catalysts (TWC), oxidation catalysts, and regenerative catalytic systems. Catalytic converters and SCR hold significant shares due to their efficiency in reducing nitrogen oxides and harmful emissions. TWCs are widely used in automotive and industrial applications for simultaneous control of carbon monoxide, hydrocarbons, and nitrogen oxides. Regenerative systems offer energy savings by recovering heat, driving demand in energy-intensive industries. Each technology addresses specific emission challenges, supporting diversified adoption.

- For instance, catalytic converters such as those used in the 1975 Toyota Crown were among the first to significantly reduce nitrogen oxides (NOx) by converting them into nitrogen and oxygen, helping cut pollution from vehicle exhaust gases.

By Application

The stationary catalytic systems market serves diverse applications such as automotive, industrial processes, power generation, marine, and aerospace sectors. Industrial processes and power generation demand robust catalytic solutions to comply with stringent environmental standards. Automotive applications focus on emission control from stationary engines used in auxiliary power units and large vehicles. Marine and aerospace sectors require specialized systems tailored for fuel types and operational conditions. The broad application range expands market reach and promotes technology adaptation.

- For instance, Johnson Matthey installed selective catalytic reduction (SCR) systems in power plants and chemical manufacturing facilities, achieving up to 95% NOx emission reduction, ensuring compliance with strict environmental standards.

By End-User Industry

The stationary catalytic systems market targets end-user industries including oil & gas, chemical processing, pharmaceuticals, food & beverage, and mining. Oil & gas and chemical processing dominate due to high emission volumes and regulatory compliance requirements. Pharmaceuticals and food & beverage industries require precise emission control to maintain product quality and environmental safety. Mining operations benefit from catalytic systems to reduce pollutants in extraction and processing activities. Industry-specific needs drive customization and innovation within the market.

Segments:

Based on Technology Type

- Catalytic Converters

- Selective Catalytic Reduction (SCR)

- Three-Way Catalysts (TWC)

- Oxidation Catalysts

- Regenerative Catalytic Systems

Based on Application

- Automotive

- Industrial Processes

- Power Generation

- Marine

- Aerospace

Based on End-user Industry

- Oil & Gas

- Chemical Processing

- Pharmaceuticals

- Food & Beverage

- Mining

Based on Design Type

- Metallic Catalytic Systems

- Non-metallic Catalytic Systems

- Combination Design Systems

Based on Regulatory Compliance

- Tier 1 Standards

- Tier 2 Standards

- Regional Emission Regulations

- Industry-specific Compliance

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America commands a significant share of the stationary catalytic systems market, holding 30% of the global market. It benefits from stringent environmental regulations imposed by agencies such as the EPA, driving demand for advanced emission control technologies. The region’s well-established industrial and power generation sectors invest heavily in upgrading infrastructure with efficient catalytic systems. High adoption of digital monitoring technologies further supports market growth. Continuous innovation by key market players enhances system performance and regulatory compliance, sustaining North America’s leadership position.

Europe

Europe accounts for 25% of the stationary catalytic systems market, driven by strong regulatory frameworks like the EU Emissions Trading Scheme and stringent industrial emission standards. It has a mature industrial base, including chemical processing and automotive manufacturing, that relies heavily on catalytic technologies. The growing focus on sustainable industrial practices and energy efficiency fuels demand. It encourages manufacturers to develop eco-friendly catalysts and modular system designs. Regional initiatives to reduce carbon footprints support steady market expansion across Europe.

Asia-Pacific

Asia-Pacific holds 35% market share in the stationary catalytic systems market, representing the fastest-growing region. Rapid industrialization, urbanization, and rising power generation capacity in countries like China and India drive demand. It faces increasing regulatory enforcement to combat severe air pollution, prompting widespread adoption of catalytic systems. Expanding oil & gas, chemical, and manufacturing sectors fuel growth opportunities. Investments in upgrading outdated infrastructure and adopting advanced technologies position Asia-Pacific as a key market driver.

Rest of the World

The Rest of the World captures 10% of the stationary catalytic systems market, including regions such as Latin America, the Middle East, and Africa. It benefits from growing industrial activities and increasing environmental awareness. It faces challenges due to less stringent regulations but shows rising demand for emission control solutions in key sectors like oil & gas and power generation. Infrastructure development and environmental initiatives provide opportunities for market expansion. The region remains an emerging market with significant potential for future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ducon

- Kwangsung

- CECO Environmental

- Johnson Matthey

- Babcock & Wilcox

- GE Vernova

- MAN Energy Solutions

- Agriemach

- Environmental Energy Services

- Hug Engineering

- Cormetech

- DCL International

Competitive Analysis

The stationary catalytic systems market features a competitive landscape dominated by established global and regional players. Key companies focus on innovation, product quality, and strategic partnerships to strengthen market presence. It experiences continuous investment in research and development to improve catalyst efficiency and system durability. Companies differentiate through customized solutions catering to diverse industry needs and regulatory requirements. Market leaders emphasize expanding geographic reach, especially in emerging economies with growing industrial sectors. Competitive pricing and after-sales support also influence customer decisions. This dynamic competition drives technological advancements and market growth, benefiting end users through improved performance and sustainability. Strong collaborations with technology providers and increased focus on eco-friendly catalysts further enhance competitive positioning. Embracing digitalization and modular system designs helps companies meet evolving customer demands and regulatory challenges, sustaining long-term market relevance.

Recent Developments

- In 2024, MAN Energy Solutions was selected by Ren-Gas for its Tampere Power-to-Gas project in Finland, providing catalytic methanation technology to convert green hydrogen and biogenic CO₂ into renewable e-methane.

- In 2024, Honeywell UOP and Johnson Matthey announced a partnership to offer an end-to-end solution for sustainable fuels production, combining expertise to reduce costs and enhance deployment.

- In November 2024, Honeywell UOP and Johnson Matthey announced a collaboration to provide an end-to-end solution for sustainable fuels production, combining their expertise in syngas solutions and fuel upgrading technologies.

- In March 2024, MAN Energy Solutions delivered its largest-ever Selective Catalytic Reduction (SCR) system to Mitsui E&S Co., Ltd., designed to reduce nitrogen oxide emissions by 90% in marine applications.

Market Concentration & Characteristics

The stationary catalytic systems market exhibits a moderately concentrated structure dominated by a few global players and several regional companies. It features key participants such as Johnson Matthey, GE Vernova, Babcock & Wilcox, and CECO Environmental, which hold significant market shares through extensive product portfolios and strong technological capabilities. It benefits from continuous investments in research and development to enhance catalyst efficiency, durability, and environmental compliance. The market demands high customization to meet diverse industry requirements, encouraging collaboration between technology providers and end users. Competitive strategies focus on innovation, geographic expansion, and strategic partnerships to capture emerging opportunities. Smaller regional players contribute by offering localized solutions and flexible service models. The market’s growth depends on balancing high capital costs with operational efficiencies, driving players to develop cost-effective and sustainable catalytic technologies. This competitive yet collaborative environment fosters ongoing technological advancements and robust market dynamics.

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Applicaton, End-User Industry, Design Type, Regulatory Compliance and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The stationary catalytic systems market will expand due to increasing environmental regulations worldwide.

- Industries will adopt advanced catalytic technologies to reduce emissions and meet compliance standards.

- Innovation in catalyst materials will improve system durability and operational efficiency.

- Digital monitoring and control systems will become integral for real-time process optimization.

- Emerging economies will drive demand through rapid industrialization and infrastructure development.

- Sustainable and eco-friendly catalysts will gain prominence to support green industrial practices.

- Modular and customizable system designs will enhance adoption across diverse applications.

- Collaboration between technology providers and end users will accelerate product innovation.

- High initial investment challenges will encourage development of cost-effective catalytic solutions.

- Expansion into new industries and regions will create fresh growth opportunities for market players.