Market Overview

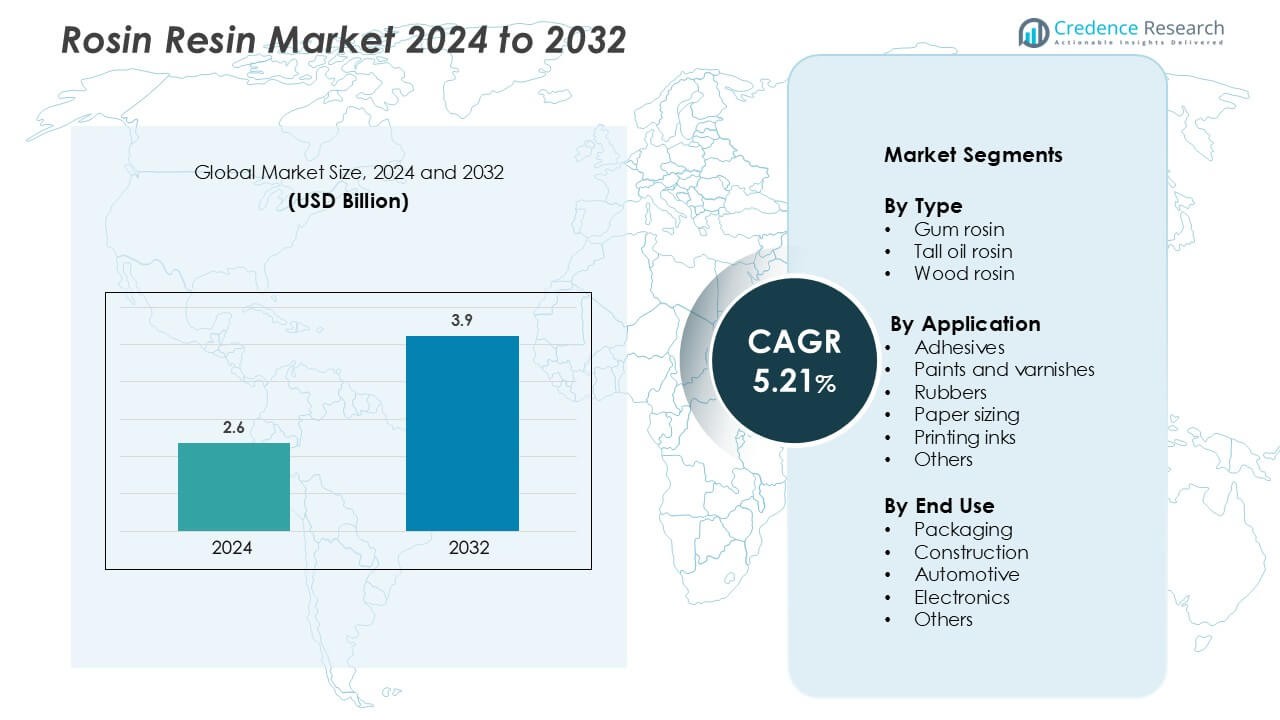

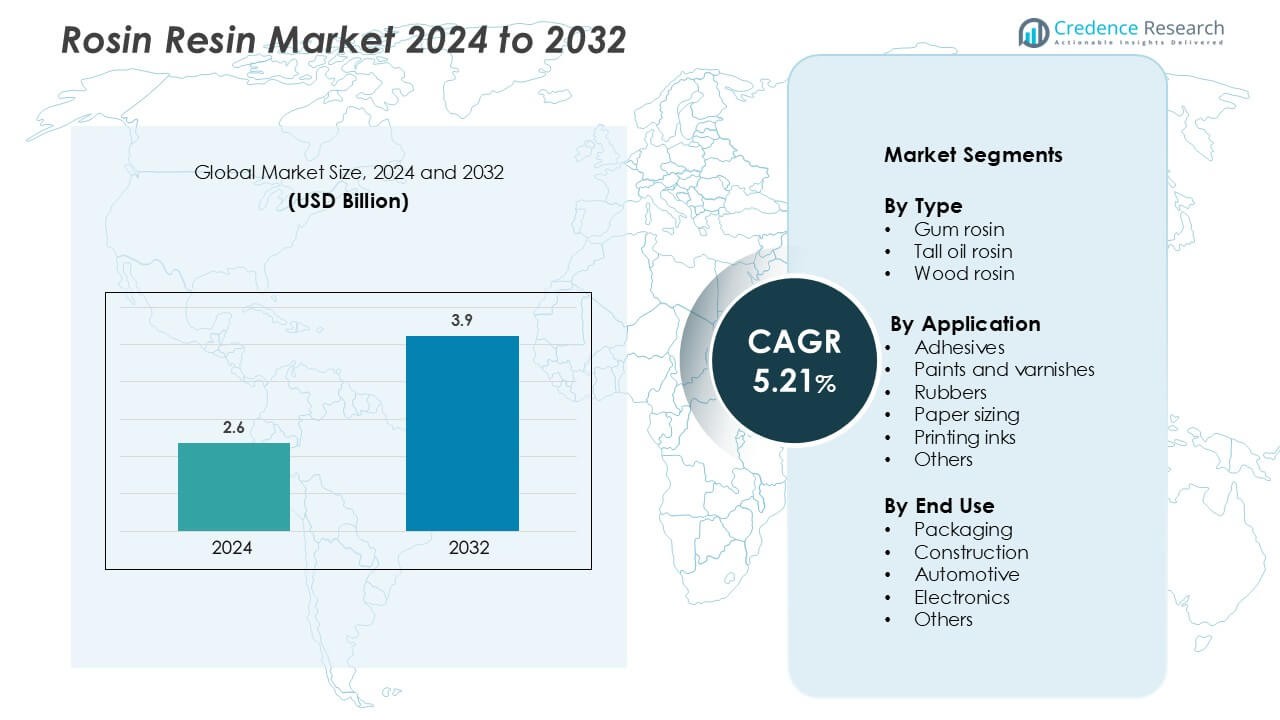

Rosin Resin Market system market size was valued USD 2.6 billion in 2024 and is anticipated to reach USD 3.9 billion by 2032, at a CAGR of 5.21 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rosin Resin Market Size 2024 |

USD 2.6 Billion |

| Rosin Resin Market, CAGR |

5.21 % |

| Rosin Resin Market Size 2032 |

USD 3.9 Billion |

The Rosin Resin Market is characterized by the presence of prominent players including Harima Chemicals Group, Foreverest Resources, Formosa Produce Corporation, BaoLin, Hindustan Resins and Terpenes, Eastman Chemical Company, Guilin Songquan Forest Chemical, Arakawa Chemical Industries, G.C. RUTTEMAN & Co., and GZFlyingDragon. These companies compete through innovations in rosin modification, sustainable sourcing, and global distribution partnerships. Continuous investment in eco-friendly resin technologies and process optimization enhances their competitive edge. Asia-Pacific leads the global market with a 36% share, driven by abundant raw material availability, strong manufacturing infrastructure, and increasing consumption in adhesives, coatings, and packaging applications across China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rosin Resin Market was valued at USD 2.6 billion in 2024 and is projected to reach USD 3.9 billion by 2032, growing at a CAGR of 5.21% during the forecast period.

- Increasing demand from the adhesives and sealants segment, holding a 38% share, drives market growth due to rosin’s strong bonding and flexibility properties.

- Technological advancements in resin modification and the rising adoption of bio-based and sustainable materials are shaping market trends globally.

- The market is competitive with key players such as Harima Chemicals Group, Eastman Chemical Company, and Foreverest Resources, focusing on eco-friendly innovations and regional expansion.

- Asia-Pacific dominates the global market with a 36% share, followed by North America (27%) and Europe (24%), driven by expanding industrial activities and increasing demand from packaging, coatings, and electronics applications.

Market Segmentation Analysis:

By Type

Gum rosin dominated the Rosin Resin Market with a 45% share in 2024, driven by its wide availability and cost efficiency. Derived from pine trees, gum rosin offers excellent adhesion and solubility, making it ideal for adhesives, coatings, and inks. Its renewable nature supports the increasing demand for sustainable materials. The segment’s growth is also fueled by rising applications in paper and packaging industries. Tall oil rosin and wood rosin follow, benefiting from industrial uses but face competition due to higher refining costs and limited raw material supply.

- For instance, Harima Chemicals Group developed a high-purity gum rosin derivative used in industrial adhesives, achieving a softening point of 78°C and acid value of 165 mg KOH/g.

By Application

The adhesives segment led the market with a 38% share in 2024, owing to rosin’s strong tackifying properties. Rosin-based adhesives are widely used in pressure-sensitive, hot melt, and construction applications. Growing demand from packaging and labeling industries boosts this segment. Paints and varnishes also show notable growth, supported by rosin’s film-forming capability and chemical resistance. Meanwhile, its use in printing inks and rubbers continues to expand due to rosin’s role in enhancing flexibility and durability of finished products.

- For instance, an IndiaMART listing for a Synthomer product, Tacolyn™ 3100, a different type of rosin ester, shows a viscosity of 900 cP (equal to 900 mPa·s), but this is for an aqueous dispersion and at a much lower temperature.

By End Use

The packaging industry dominated the market with a 34% share in 2024, supported by the extensive use of rosin-based adhesives and coatings. The sector benefits from increasing e-commerce activities and sustainable packaging initiatives. Construction follows closely, where rosin finds applications in sealants and protective coatings. Automotive and electronics industries also use rosin for insulation, soldering fluxes, and rubber compounds. Rising demand for high-performance and eco-friendly materials across these sectors continues to drive market expansion.

Key Growth Drivers

Rising Demand from Adhesives and Sealants Industry

The growing use of rosin resin in adhesives and sealants is a major driver for market growth. Rosin-based resins enhance tackiness, flexibility, and bonding strength, making them ideal for pressure-sensitive, hot melt, and construction adhesives. Increasing demand in packaging, labeling, and woodworking industries strengthens market expansion. The trend toward bio-based materials further boosts adoption, as rosin is derived from renewable pine trees. The construction sector’s steady growth, coupled with rapid industrialization, continues to fuel demand for high-performance and sustainable adhesive formulations, reinforcing rosin resin’s market position globally.

Expanding Applications in Paints, Varnishes, and Inks

Rosin resin’s excellent film-forming, gloss, and adhesion properties make it highly suitable for paints, coatings, and printing inks. The construction and automotive sectors increasingly use rosin-modified resins in protective coatings and surface finishes. Growth in packaging and decorative applications also contributes to demand. Rosin’s compatibility with alkyds, acrylics, and other resins enhances performance and durability in final products. The rise of eco-friendly and low-VOC coatings further supports rosin resin’s use as a natural alternative to petroleum-based binders in coatings and ink formulations.

- For instance, for architectural applications, low-VOC paints are typically defined as having a VOC content below 50 g/L, and this is a recognized eco-coating standard.

Increasing Shift Toward Sustainable and Bio-Based Materials

The shift toward renewable raw materials is driving rosin resin consumption across multiple industries. Rosin’s biodegradable and non-toxic characteristics align with growing environmental regulations and sustainability initiatives. Manufacturers are prioritizing natural resins over synthetic options to reduce carbon emissions and improve product life cycles. The packaging and electronics industries increasingly favor bio-based rosin resins due to their low environmental footprint. Furthermore, R&D efforts focused on modified rosin derivatives are expanding the resin’s usability across high-performance applications, including bioplastics and specialty coatings, thereby supporting long-term market growth.

- For instance, Arakawa Chemical Industries produces a wide variety of modified rosin derivatives, including products under the tradenames PINECRYSTAL, ARDYME, and TAMANOL.

Key Trends & Opportunities

Technological Advancements in Rosin Modification

Advances in chemical modification techniques are unlocking new applications for rosin resins. Hydrogenation, esterification, and polymerization methods improve stability, color, and compatibility with modern polymers. These innovations enable use in high-temperature and moisture-resistant applications such as electronics and automotive coatings. Emerging players are investing in hybrid resin formulations that combine rosin with synthetic polymers for better flexibility and performance. The trend toward advanced processing technologies not only enhances product quality but also broadens rosin’s scope in specialty chemicals, offering significant growth potential for manufacturers.

- For instance, Megawide Chemical Technology Co., Ltd. produces hydrogenated rosin esters for adhesive grades with a softening point range of 90–110 °C.

Rising Use in Electronics and Soldering Fluxes

The expanding electronics industry presents a strong opportunity for rosin resin. Its excellent insulation and non-corrosive properties make it ideal for soldering fluxes and electronic encapsulants. With increasing demand for consumer electronics, semiconductors, and renewable energy systems, the requirement for rosin-based fluxes continues to grow. Manufacturers are developing high-purity and low-residue rosin formulations to meet evolving electronic assembly standards. The shift toward lead-free soldering in compliance with global safety norms further boosts demand, positioning rosin resin as a critical material in advanced electronic manufacturing.

- For instance, Superior Flux offers a Type R rosin flux, specifically known as Superior No. 97. It is an alcohol-based, non-activated rosin flux.

Growing Penetration in Biodegradable Packaging Solutions

The push for eco-friendly packaging has opened significant opportunities for rosin resin producers. Its natural origin, biodegradability, and excellent adhesive performance make it a suitable substitute for synthetic polymers. Increasing regulatory pressure to reduce plastic waste encourages adoption in compostable coatings and adhesives used in paper-based packaging. Brands seeking sustainable packaging alternatives are collaborating with resin manufacturers to develop tailored bio-based formulations. This trend is expected to sustain strong growth in the coming years as industries align with circular economy goals and eco-conscious consumer demand.

Key Challenges

Volatility in Raw Material Supply and Pricing

The availability of pine-derived feedstock significantly affects rosin resin production. Fluctuations in pine tapping yields, seasonal variations, and supply chain disruptions cause instability in raw material prices. Regions dependent on imports face higher production costs due to logistics and sourcing constraints. This volatility poses challenges for consistent pricing and profitability across manufacturers. Companies are focusing on diversifying supply sources and investing in synthetic or hybrid resin alternatives to manage these fluctuations. However, maintaining supply stability remains a key hurdle for long-term market sustainability.

Competition from Synthetic Resin Alternatives

Rosin resin faces growing competition from petroleum-based resins, which often offer superior consistency and lower production costs. Synthetic resins like phenolic, epoxy, and acrylic alternatives exhibit enhanced thermal stability and durability, making them preferred in high-performance applications. Despite increasing demand for bio-based materials, the slower adoption rate in cost-sensitive sectors limits rosin’s market penetration. Continuous R&D investment is required to improve performance and scalability of natural resins. Manufacturers must balance cost efficiency with sustainability goals to remain competitive in an industry dominated by synthetic substitutes.

Regional Analysis

North America

North America held a 27% share of the Rosin Resin Market in 2024, driven by strong demand from the adhesives, coatings, and printing industries. The United States leads the region due to its well-established packaging and construction sectors. The growing preference for bio-based and sustainable materials supports regional expansion. Technological advancements in resin modification and R&D investment in eco-friendly adhesives also contribute to market growth. Canada and Mexico are witnessing rising demand from automotive and electronics applications, enhancing North America’s overall contribution to global rosin resin consumption.

Europe

Europe accounted for 24% of the global Rosin Resin Market in 2024, supported by strict environmental regulations promoting bio-based materials. Germany, France, and the U.K. dominate the region with growing adoption of rosin resins in coatings, adhesives, and printing inks. The increasing shift toward sustainable packaging and reduced carbon emissions enhances demand. Investments in modified rosin derivatives and renewable resin technologies also strengthen the market. Additionally, the expanding construction and automotive sectors in Eastern Europe contribute to steady regional growth, positioning Europe as a key contributor to global revenue.

Asia-Pacific

Asia-Pacific led the global Rosin Resin Market with a 36% share in 2024, driven by large-scale production and high consumption in China, India, and Japan. Strong industrial bases, coupled with rising demand from packaging, paints, and electronics industries, support regional dominance. China remains the leading producer due to abundant pine resources and advanced processing facilities. The rapid expansion of the construction sector and increasing preference for bio-based materials further accelerate growth. Growing export potential and favorable government initiatives aimed at sustainable manufacturing continue to strengthen Asia-Pacific’s leadership position.

Latin America

Latin America captured an 8% share of the Rosin Resin Market in 2024, with Brazil and Mexico being major contributors. Expanding industrialization, construction activities, and growing packaging demand drive regional growth. The shift toward renewable raw materials and local adhesive manufacturing supports market development. Rosin’s use in paints, inks, and rubber applications is rising, particularly in automotive and consumer goods sectors. Increasing investment in forestry-based chemical production and strategic partnerships with international resin manufacturers are expected to further strengthen Latin America’s role in the global market.

Middle East & Africa

The Middle East & Africa region accounted for a 5% share of the global Rosin Resin Market in 2024. Demand is primarily driven by the packaging, construction, and coatings industries. Countries like the UAE, Saudi Arabia, and South Africa are witnessing increased consumption due to expanding infrastructure projects and industrial activities. The growing focus on sustainable materials and investments in green manufacturing technologies support market penetration. However, limited local production capacity and dependence on imports remain key challenges. Rising regional demand presents opportunities for future capacity expansion and strategic collaborations.

Market Segmentations:

By Type

- Gum rosin

- Tall oil rosin

- Wood rosin

By Application

- Adhesives

- Paints and varnishes

- Rubbers

- Paper sizing

- Printing inks

- Others

By End Use

- Packaging

- Construction

- Automotive

- Electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rosin resin market features a diverse mix of global and regional players focused on resin quality, application versatility, and sustainable sourcing. Harima Chemicals Group and Arakawa Chemical Industries lead with high-performance rosin esters tailored for adhesives, inks, and coatings, emphasizing consistency and low VOC emissions. Eastman Chemical Company strengthens its global footprint through advanced hydrogenated resin technologies ensuring superior color stability and thermal resistance. Foreverest Resources and Formosa Produce Corporation focus on bio-based production and efficient supply chains across Asia. Hindustan Resins and Terpenes and BaoLin expand market presence through cost-effective solutions catering to packaging and rubber industries. European firms such as G.C. RUTTEMAN & Co. maintain strong distribution networks in specialty chemical markets. Guilin Songquan Forest Chemical and GZFlyingDragon leverage China’s abundant pine resources to support high-volume exports. Continuous R&D in modified rosin derivatives and eco-friendly formulations remains key to gaining a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Harima Chemicals Group

- Foreverest Resources

- Formosa Produce Corporation

- BaoLin

- Hindustan Resins and Terpenes

- Eastman Chemical Company

- Guilin Songquan Forest Chemical

- Arakawa Chemical Industries

- C. RUTTEMAN & Co.

- GZFlyingDragon

Recent Developments

- In September 2023, Foreverest Resources Ltd. launched a new rosin resin product specifically designed for use in the production of bioplastics.

- In September 2023, the owners of Sunnyside dispensaries and a market leader in branded cannabis products, Cresco Labs Inc., recently announced the addition of the FloraCal and Cresco brands to its portfolio of nationally recognized brands.

- In April 2023, the planned merger, including the demerger of Haldiram Snacks and Haldiram Foods FMCG business into Haldiram Snacks Food, was authorized by the Competition Commission of India (CCI).

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand steadily, driven by growing demand in adhesives and coatings.

- Manufacturers will focus on developing bio-based and sustainable rosin resin formulations.

- Technological advancements in resin modification will enhance product performance and versatility.

- Increasing use of rosin in electronics and soldering applications will create new opportunities.

- The packaging industry will remain a major consumer due to the shift toward eco-friendly materials.

- Asia-Pacific will maintain its dominance, supported by strong production and consumption growth.

- Europe will see rising adoption due to strict environmental and sustainability regulations.

- Continuous R&D investments will support innovation in high-performance and specialty resin products.

- Strategic collaborations between global and regional players will strengthen supply chains.

- Expanding applications in construction, automotive, and renewable materials will drive long-term growth.