Market Overview

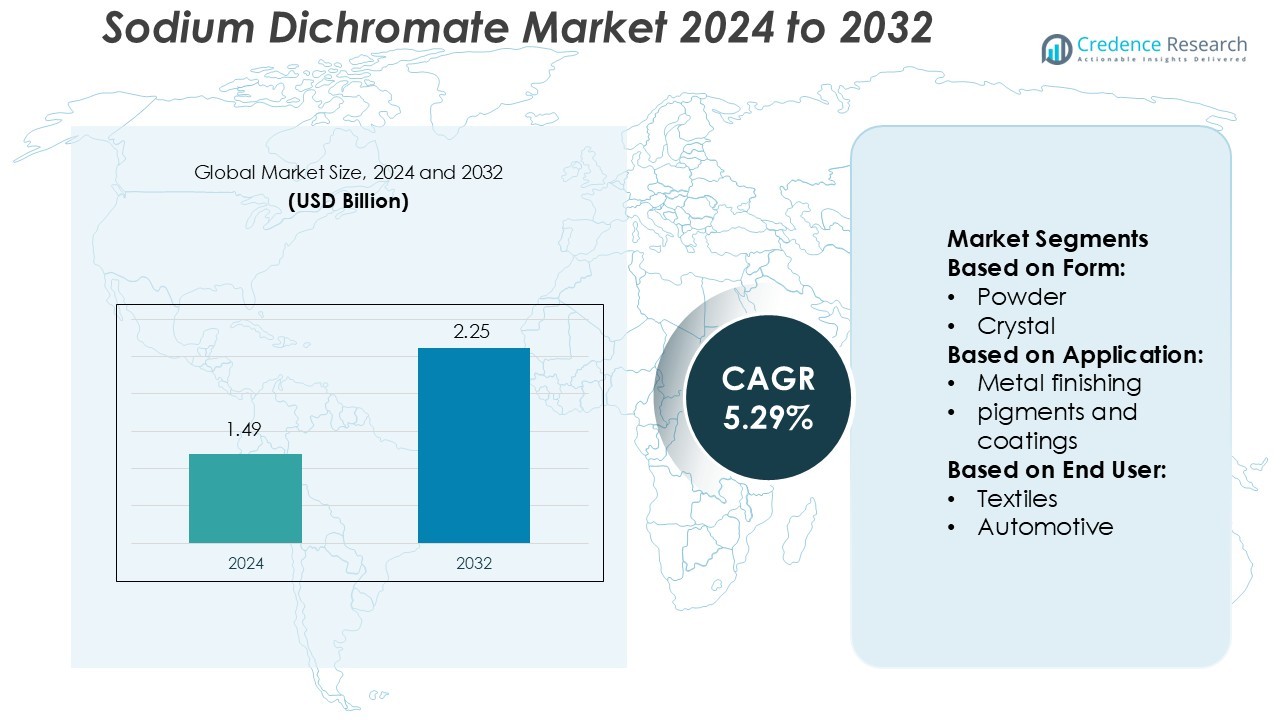

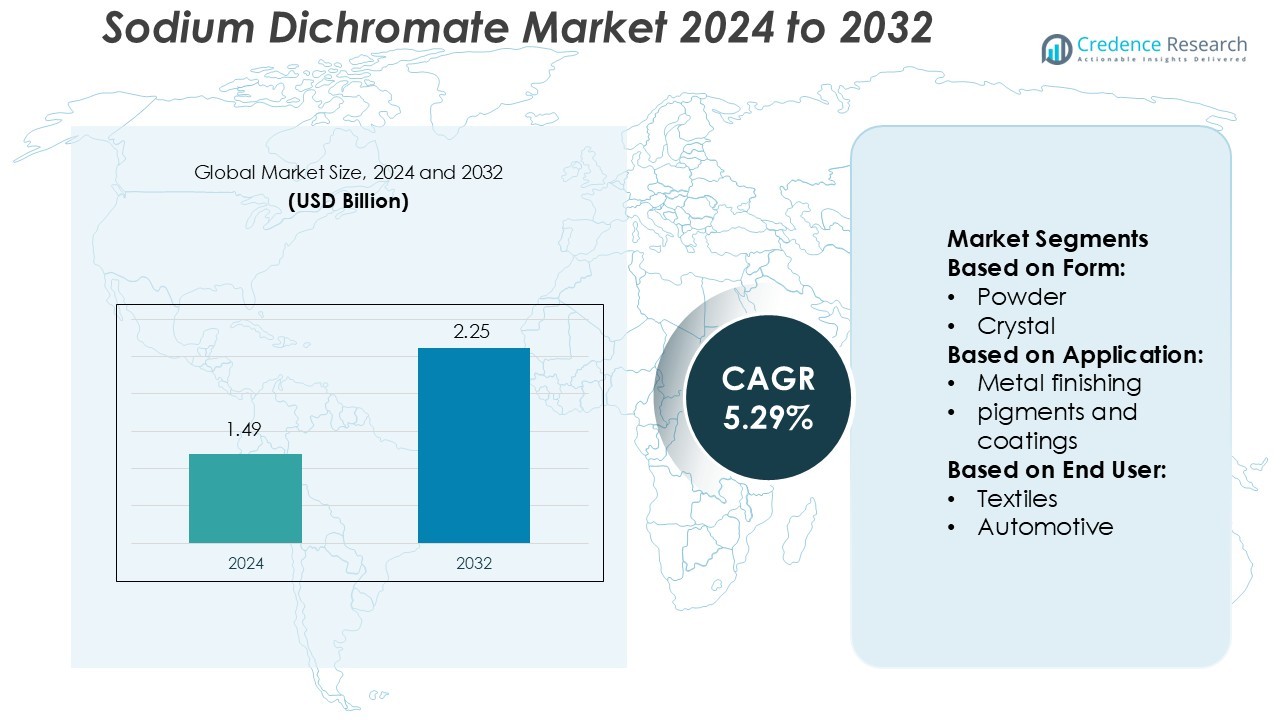

Sodium Dichromate Market size was valued USD 1.49 billion in 2024 and is anticipated to reach USD 2.25 billion by 2032, at a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Dichromate Market Size 2024 |

USD 1.49 Billion |

| Sodium Dichromate Market, CAGR |

5.29% |

| Sodium Dichromate Market Size 2032 |

USD 2.25 Billion |

The sodium dichromate market is highly competitive, with major players including Vishnu Chemicals, Brother Enterprises, Minfeng Chemical, TNJ Chemical, Yinhe Group, Dhairya International, Nippon Chemical Industrial, Chongqing Changyuan, AD International, and Choice Organochem. These companies focus on expanding production capacity, improving process safety, and developing high-purity formulations to meet rising global demand. Continuous innovation in eco-friendly manufacturing and chromium recovery technologies supports their market leadership. Asia-Pacific dominates the global sodium dichromate market with a 38% share, driven by extensive industrial activity in China and India, cost-effective production, and strong exports to Europe and North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sodium Dichromate Market size was valued at USD 1.49 billion in 2024 and is expected to reach USD 2.25 billion by 2032, growing at a CAGR of 5.29%.

- Increasing demand from metal finishing, pigments, and leather tanning industries drives consistent market growth worldwide.

- The market trend is shifting toward sustainable production technologies and chromium recovery systems to meet environmental regulations.

- The market is moderately consolidated, with leading players focusing on product innovation, capacity expansion, and eco-friendly process advancements.

- Asia-Pacific dominates with a 38% share, followed by North America at 32% and Europe at 27%, while the powder form segment holds the largest share due to its widespread use in coatings, catalysts, and chemical intermediates.

Market Segmentation Analysis:

By Form

The powder form dominates the Sodium Dichromate Market with a 62% share in 2024. Its superior solubility and easy handling make it suitable for large-scale industrial applications such as metal treatment and pigment manufacturing. The form ensures consistent chemical reactivity, supporting efficient oxidation processes in production lines. High demand from end-use sectors such as leather and textile industries drives steady consumption. Crystal form follows, primarily used in laboratory and specialized chemical synthesis where purity levels and reaction control are essential for precision-based applications.

- For instance, Vishnu Chemicals Annual Report 2023–24 explicitly states an installed capacity of “~ 80,000 MTPA” for its chromium chemicals, with capacity measured in terms of sodium dichromate (SDC).

By Application

The metal finishing segment holds the largest share of 38% in 2024, driven by its extensive use in electroplating and corrosion resistance. Sodium dichromate enhances metal durability and surface hardness, making it vital for aerospace and automotive parts. Pigments and coatings form the second key segment due to their wide use in decorative and protective applications. Growing adoption in tanning, wood preservation, and as a chemical intermediate also contributes to market growth across industrial and manufacturing sectors.

- For instance, TNJ Chemical lists Sodium dichromate (CAS 10588-01-9) at a purity of ≥ 99 % assay in one of its resolution-grade listings. The product specification further shows chloride (Cl) content of ≤ 0.10 % and sulfate (SO₄) content of ≤ 0.30 %.

By End User

The metal and surface treatment industry leads the Sodium Dichromate Market with a 34% share in 2024. Strong demand from automotive and construction sectors for rust-resistant components boosts product adoption. The chemical sector follows, utilizing sodium dichromate as an intermediate for chromic acid and other derivatives. Textile and leather industries also contribute notably, using the compound for dye fixation and tanning processes. Expanding use in specialized industries such as aerospace and paints further supports the market’s long-term growth trajectory.

Key Growth Drivers

Rising Demand from Metal Finishing and Pigment Industries

The increasing use of sodium dichromate in metal finishing, pigments, and coatings industries drives market expansion. The compound’s high oxidation properties enable effective corrosion resistance and vibrant coloration. Demand from automotive and construction sectors further boosts consumption for surface treatment and durable coatings. For instance, Akzo Nobel N.V. and BASF SE utilize sodium dichromate derivatives to enhance pigment brightness and adhesion in metal coatings, supporting long-lasting finishes across industrial applications.

- For instance, Dhairya International lists “Powder Sodium Dichromate” with a purity of 99%. The company website indicates it offers “Laboratory Grade Crystals Sodium Dichromate” and lists it under industrial chemicals.

Expanding Use in Leather Tanning and Wood Preservation

Sodium dichromate plays a key role in tanning agents and wood preservatives due to its strong anti-fungal and anti-corrosive properties. Its ability to crosslink collagen fibers enhances leather durability and texture. Growing demand for high-quality leather products and wood materials for furniture and construction sustains market growth. For instance, Lanxess AG employs sodium dichromate in its leather chemicals division to ensure uniform tanning performance and environmental compliance across global manufacturing sites.

- For instance, Zeon’s planned SSBR output expansion will bring combined installed capacity to 125,000 tonnes per annum across its Japan and Singapore plants.

Growth in Chemical Intermediate Applications

Sodium dichromate serves as an essential intermediate in producing chromic acid, pigments, and catalysts. Its wide use in manufacturing organic chemicals and oxidizing agents accelerates adoption in the chemical industry. Continuous research in catalytic oxidation and polymer synthesis expands its use in specialty chemicals. For instance, Elementis PLC and Nippon Chemical Industrial Co., Ltd. integrate sodium dichromate in oxidation reactions for producing high-purity chromium-based catalysts used in chemical and plastics manufacturing.

Key Trends & Opportunities

Shift Toward Sustainable Production Technologies

Manufacturers are adopting cleaner production technologies to reduce environmental hazards linked to chromium(VI) compounds. The focus is on developing low-waste and closed-loop systems for chromium recovery and reuse. Regulatory pressure from environmental agencies accelerates this transition. For instance, LANXESS introduced Cr-free alternatives in its leather treatment portfolio, while companies like Tata Chemicals Ltd. invest in green processing units to minimize waste discharge and comply with REACH standards.

- For instance, Versalis expanded its patent portfolio to 436 patent families, of which 268 protect technologies or products derived from bio-sources or circular economy models.

Increasing Focus on Product Quality and Purity Standards

The market sees a rising emphasis on producing high-purity sodium dichromate to meet industrial-grade specifications. Advanced filtration and crystallization methods improve product consistency and reactivity. This trend supports its use in sensitive chemical synthesis and high-end pigment manufacturing. For instance, Elementis Specialties upgraded its processing lines in the UK to achieve 99.9% purity sodium dichromate, catering to precision coating and catalyst industries.

- For instance, Asahi Kasei expanded its Singapore S-SBR production capacity by 30,000 metric tons per year in 2017, bringing the plant’s total capacity to 130,000 metric tons annually to address growing industrial demand.

Expanding Applications in Emerging Economies

Rapid industrialization in Asia-Pacific and Latin America creates strong demand for sodium dichromate in chemical synthesis, textiles, and metal finishing. Infrastructure growth and rising export of leather goods enhance regional consumption. For instance, Yunnan Yunwei Company Limited expanded production capacity in China to meet domestic and international demand, strengthening its supply capability and export potential.

Key Challenges

Stringent Environmental and Health Regulations

Sodium dichromate faces strict global regulations due to its toxic and carcinogenic nature. Authorities such as OSHA and the European Chemicals Agency have imposed limits on exposure and production. Compliance with safety standards increases operational costs and may limit manufacturing flexibility. For instance, the European Union’s REACH regulations restrict chromium(VI) compounds, compelling producers like Solvay S.A. to invest heavily in safer substitutes and process containment systems.

Rising Availability of Eco-Friendly Alternatives

The growing use of non-chromium-based oxidizing agents and tanning chemicals poses a competitive threat. Industries are shifting toward safer compounds that offer comparable performance without environmental risks. This trend could reduce sodium dichromate demand over time. For instance, DyStar Group and Stahl Holdings B.V. are introducing chrome-free tanning systems and alternative pigments, aiming to replace sodium dichromate in leather and coating applications.

Regional Analysis

North America

North America holds a 32% market share in the sodium dichromate market, driven by robust demand from metal finishing, chemical synthesis, and pigment production industries. The United States leads the region due to advanced industrial infrastructure and stringent product quality standards. Environmental regulations have prompted major players to adopt eco-friendly production methods, improving efficiency and sustainability. For instance, American Elements and Elementis PLC focus on developing low-emission chromium compounds to meet regulatory norms. The region’s stable industrial output and growing adoption of chromium-based catalysts in chemical manufacturing support steady market growth.

Europe

Europe accounts for 27% of the market share, supported by high consumption in leather tanning, coatings, and wood preservation sectors. Germany, France, and Italy dominate due to strong automotive and construction industries that rely heavily on corrosion-resistant coatings. However, environmental restrictions under REACH regulations encourage companies to adopt cleaner manufacturing technologies. For instance, LANXESS AG and Solvay S.A. are investing in chromium recovery systems and waste-minimization processes to comply with EU directives. Continuous technological upgrades and demand for high-performance coatings sustain regional sodium dichromate usage despite regulatory challenges.

Asia-Pacific

Asia-Pacific leads the global market with a 38% share, fueled by large-scale industrialization and expanding chemical and leather industries. China, India, and South Korea are key producers and consumers due to abundant raw materials and cost-effective production facilities. Infrastructure expansion, rising exports of leather goods, and growing pigment manufacturing drive regional consumption. For instance, Yunnan Yunwei Company Limited and Tata Chemicals Ltd. have expanded sodium dichromate capacities to meet increasing domestic and export demand. The region’s competitive pricing and large industrial base make it the fastest-growing market during the forecast period.

Latin America

Latin America captures a 2% market share, primarily driven by Brazil and Mexico’s growing leather and wood treatment industries. Rising construction activities and demand for durable coatings are supporting regional market expansion. Manufacturers focus on improving local production efficiency and reducing import dependency. For instance, Química Anastacio in Brazil has enhanced its chromium compound portfolio to serve regional chemical and leather producers. Despite limited production capacity, the region benefits from increasing foreign investments and industrial reforms aimed at modernizing chemical manufacturing infrastructure, driving steady sodium dichromate consumption growth.

Middle East & Africa

The Middle East & Africa hold a 1% market share, with gradual growth driven by developing industrial sectors and infrastructure investments. Demand is concentrated in South Africa, the UAE, and Saudi Arabia, where sodium dichromate is used in metal finishing, water treatment, and wood preservation. The region faces import reliance but benefits from growing industrial diversification. For instance, Saudi Basic Industries Corporation (SABIC) is investing in partnerships to expand specialty chemical production capacity. Government initiatives to attract chemical manufacturing and enhance industrial safety standards are expected to strengthen regional market growth.

Market Segmentations:

By Form:

By Application:

- Metal finishing

- pigments and coatings

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sodium dichromate market features key players such as Vishnu Chemicals, Brother Enterprises, Minfeng Chemical, TNJ Chemical, Yinhe Group, Dhairya International, Nippon Chemical Industrial, Chongqing Changyuan, AD International, and Choice Organochem. The sodium dichromate market is characterized by strong competition among global and regional manufacturers focused on process optimization and product innovation. Companies are increasingly investing in advanced oxidation and purification technologies to enhance product quality and meet stringent environmental regulations. The market is also witnessing a shift toward sustainable and closed-loop production systems to reduce chromium waste and emissions. Strategic initiatives such as capacity expansions, long-term supply partnerships, and vertical integration are helping players strengthen their value chains. Moreover, growing demand from metal finishing, leather tanning, and pigment industries continues to drive competitive differentiation and technological advancements across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vishnu Chemicals

- Brother Enterprises

- Minfeng Chemical

- TNJ Chemical

- Yinhe Group

- Dhairya International

- Nippon Chemical Industrial

- Chongqing Changyuan

- AD International

- Choice Organochem

Recent Developments

- In August 2024, Vishnu Chemicals announced its board approved the acquisition of a 100% stake in Jayansree Pharma Private Limited (JPPL) for ₹51.99 crore, with the deal scheduled to be completed in three months.

- In July 2024, Elementis, a leading supplier of specialty chemicals, announced the successful expansion of its NiSAT (Non-Ionic Synthetic Associative Thickeners) technology production in China. This initiative enhanced eco-friendly features and performance for the Chinese architectural market and beyond.

- In May 2024, Altris and Clarios signed a Joint Development Agreement to enhance SIB technology for low-voltage mobility applications. Altris will develop the sodium-ion cells, while Clarios will apply its expertise in Battery Management Systems, software, and system integration to design the complete battery system.

- In November 2023, Northvolt, a Swedish battery manufacturer, announced a breakthrough in sodium-ion battery technology. The new batteries have an energy density of 160 watt-hours per kilogram, which is comparable to some LFP batteries.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to rising demand from metal finishing and coating industries.

- Adoption of eco-friendly and closed-loop production systems will gain significant momentum.

- Asia-Pacific will continue to dominate global production and consumption levels.

- Increasing investments in chromium recovery and recycling technologies will improve sustainability.

- Strict environmental regulations will push manufacturers toward safer chemical alternatives.

- Growth in the leather and textile industries will sustain sodium dichromate consumption.

- Technological advancements will enhance purity levels and process efficiency.

- Strategic collaborations and joint ventures will strengthen global supply chains.

- Demand from developing economies will rise with rapid industrialization and infrastructure growth.

- Ongoing R&D efforts will focus on minimizing toxicity while retaining sodium dichromate’s performance benefits.