Market Overview

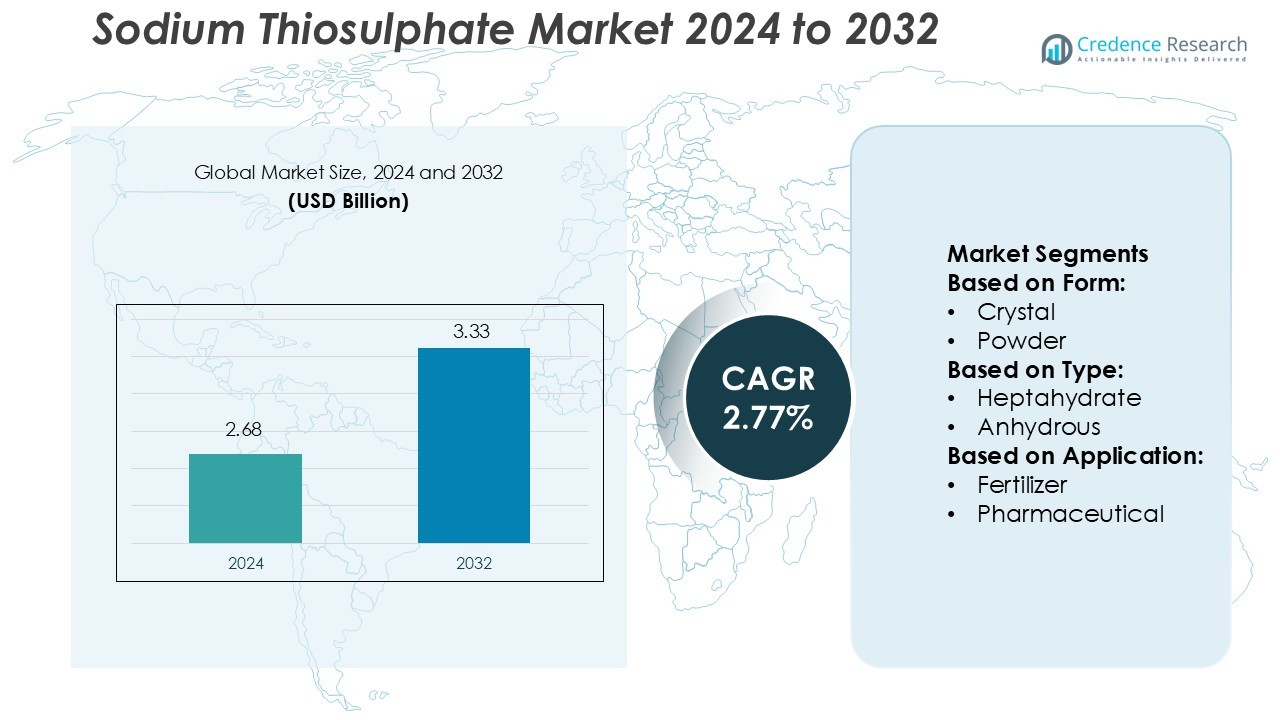

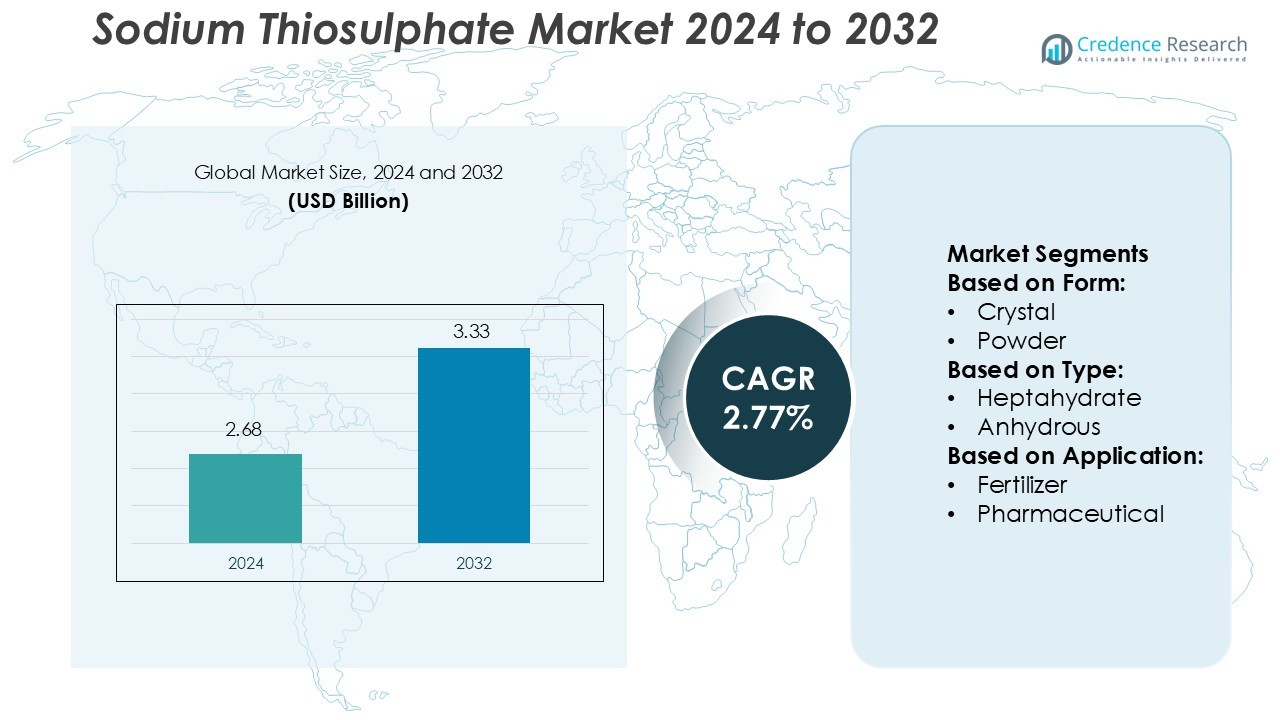

Sodium Thiosulphate Market size was valued USD 2.68 billion in 2024 and is anticipated to reach USD 3.33 billion by 2032, at a CAGR of 2.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Thiosulphate Market Size 2024 |

USD 2.68 Billion |

| Sodium Thiosulphate Market, CAGR |

2.77% |

| Sodium Thiosulphate Market Size 2032 |

USD 3.33 Billion |

The sodium thiosulphate market is driven by major players including Cooper Natural Resources, Tokyo Chemical Industry Pvt. Ltd., Elementis PLC, Bahubali Chemical Industries, LENZING AG, Sigma-Aldrich Solutions, Sun European Partners LLP, Nippon Chemical Industrial CO., LTD, SHIKOKU KASEI HOLDINGS CORPORATION, and Jiangsu Yinzhu Chemical Group Co., Ltd. These companies emphasize product innovation, purity enhancement, and sustainable production to strengthen global competitiveness. Continuous investments in R&D, capacity expansion, and regulatory compliance support their long-term growth strategies. Asia-Pacific leads the global sodium thiosulphate market with a 34% share in 2024, driven by strong manufacturing capabilities, rising agricultural applications, and growing pharmaceutical demand across China and India, making the region the key production and consumption hub worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sodium Thiosulphate Market size was valued at USD 2.68 billion in 2024 and is projected to reach USD 3.33 billion by 2032, growing at a CAGR of 2.77% during the forecast period.

- Rising pharmaceutical and agricultural applications drive demand, supported by its use in antidotes, fertilizers, and water treatment.

- Sustainable manufacturing trends and innovations in high-purity formulations enhance product performance and compliance with environmental standards.

- Market competition remains moderate, with key players focusing on R&D, capacity expansion, and long-term regulatory alignment to maintain global competitiveness.

- Asia-Pacific leads the market with a 34% share in 2024, driven by strong industrial output in China and India, while the heptahydrate type dominates the segment due to its high solubility and industrial adaptability.

Market Segmentation Analysis:

By Form

The crystal form dominates the sodium thiosulphate market, accounting for the largest share in 2024. Crystalline sodium thiosulphate offers superior purity, solubility, and stability, making it ideal for water treatment, photography, and chemical processing applications. Its consistent crystalline structure ensures efficient dissolution, crucial for precise dosage control in pharmaceutical formulations and industrial solutions. Powder and granular forms follow, driven by easier handling and faster reaction rates in fertilizers and automotive uses. Rising demand for accurate chemical performance enhances the preference for the crystal form across global industries.

- For instance, NanoMatriX emphasises that its solutions are certified under ISO 27001:2022, ISO 27701:2019, ISO 27017:2015 and ISO 27018:2019 standards, reflecting its capability for secure data handling in traceability systems.

By Type

The heptahydrate type holds the leading market share among sodium thiosulphate types due to its wide industrial and pharmaceutical applications. This form provides high solubility and reliable reactivity, making it essential in gold leaching, photographic fixing, and medical antidotes for cyanide poisoning. Heptahydrate’s stability and cost efficiency further boost its adoption in large-scale industrial processes. Anhydrous and monohydrate variants serve niche uses requiring moisture control and high concentration, while other types find limited applications in specialized formulations and laboratory reagents.

- For instance, SML developed two recyclable plastic films for flexible formats: a 60 µm PE/EVOH film enabling >30 % downgauging compared with PE/PET laminates, and an unlaminated MDO-PE cast film with 35-50 % thickness reduction compared to conventional deep-freeze bag structures.

By Application

The pharmaceutical segment leads the sodium thiosulphate market, holding the largest share in 2024. It is widely used in treating cyanide toxicity, cisplatin-induced nephrotoxicity, and topical dermatological applications. The compound’s proven therapeutic efficacy and inclusion in WHO’s essential medicines list drive global demand. The fertilizer segment follows, supported by its sulfur and sodium content improving crop yields. In food and beverage, sodium thiosulphate functions as a flavor stabilizer and additive, while the automotive sector benefits from its corrosion-inhibiting and dechlorination properties.

Key Growth Drivers

Rising Pharmaceutical Applications

The growing use of sodium thiosulphate in pharmaceutical formulations drives market expansion. It serves as an antidote for cyanide poisoning and a protective agent against cisplatin-induced toxicity. Increasing clinical approvals and WHO recognition of sodium thiosulphate as an essential medicine strengthen demand. Pharmaceutical manufacturers also explore its use in dermatological and renal therapies, further expanding its application base. The rising prevalence of chronic diseases and the global need for cost-effective antidotes continue to position this compound as a critical pharmaceutical ingredient.

- For instance, Avery Dennison showcased the AD Minidose U9 UHF inlay, AD TT Sensor Plus 2 temperature logger (with NFC/Bluetooth capability) and S2196 cold-chain adhesive rated down to -196 °C for small-format containers.

Growing Demand from the Fertilizer Industry

Sodium thiosulphate is increasingly used in fertilizers to enhance soil sulfur and nitrogen efficiency. Its ability to improve nutrient uptake and mitigate nitrogen loss through denitrification supports higher crop productivity. The compound’s compatibility with liquid fertilizers and ease of mixing into irrigation systems further boost its adoption. Rising global focus on sustainable agriculture and balanced fertilization promotes sodium thiosulphate use in large-scale farming. Expanding agricultural activities in emerging economies strengthen long-term market growth across Asia-Pacific and Latin America.

- For instance, 3M™ Health Care Label Material 7110 is specified for use on “small diameter vials” and “low surface energy (LSE) plastics”, with a construction of fragile facestock plus Adhesive 320.

Expansion in Industrial and Water Treatment Applications

The compound’s strong reducing and dechlorinating properties drive its demand in water treatment and industrial processes. Sodium thiosulphate efficiently neutralizes chlorine in municipal water systems and industrial effluents. Its application extends to photography, textile bleaching, and metal extraction processes. The push for sustainable and non-toxic water treatment chemicals further accelerates adoption. Increasing industrialization and environmental regulations supporting cleaner production processes continue to strengthen its market position in industrial and environmental applications.

Key Trends & Opportunities

Shift Toward Eco-Friendly Production Processes

Manufacturers increasingly adopt cleaner and more energy-efficient synthesis methods to reduce waste and emissions. Companies focus on closed-loop recycling of by-products and chemical recovery systems to meet environmental standards. Growing emphasis on green chemistry encourages innovations that minimize sulfur waste and optimize yield. Governments promoting sustainable chemical manufacturing through policy incentives also support market transformation. This shift presents opportunities for players investing in eco-compliant production infrastructure and renewable-powered chemical synthesis technologies.

- For instance, CCL Healthcare (a division of CCL) states it operates over 30 cGMP manufacturing facilities globally for pharmaceutical labelling and packaging. Within its smart-label product suite the company reports production of 2 mL-sized integrated RFID labels.

Rising Adoption in Food and Beverage Applications

The food and beverage sector presents emerging opportunities due to sodium thiosulphate’s role as a flavor stabilizer and preservative. Its ability to neutralize residual chlorine and maintain color stability makes it suitable for additive formulations. Growing consumer demand for processed and shelf-stable foods boosts adoption. Regulatory approvals for food-grade sodium thiosulphate across multiple regions further enhance its commercial viability. Producers focusing on high-purity, food-safe grades gain a competitive edge in this expanding segment.

- For instance, Authentix reports that over its 25-year fuel-marking programme it has marked more than 3 trillion liters of fuel and now services programmes treating over 150 billion liters annually.

Technological Advancements in Purification and Formulation

Continuous improvements in crystallization, filtration, and drying technologies enable higher product purity and consistent performance. Automated process controls and digital monitoring systems improve manufacturing precision and cost efficiency. Companies are developing customized formulations for specific industrial and medical needs, enhancing usability and safety. These innovations reduce impurities, improve shelf life, and expand potential applications in advanced pharmaceuticals and specialty chemicals.

Key Challenges

Price Volatility of Raw Materials

The sodium thiosulphate market faces instability due to fluctuations in sulfur and sodium carbonate prices. Supply chain disruptions and energy cost variations affect overall production economics. Dependence on imported raw materials in several regions further increases cost pressure. Manufacturers struggle to maintain competitive pricing while adhering to environmental and safety regulations. This volatility poses a key challenge for small and mid-sized producers with limited procurement flexibility.

Stringent Environmental and Safety Regulations

Compliance with evolving chemical safety and environmental standards increases operational costs for manufacturers. Regulations governing sulfur compound emissions, wastewater management, and chemical storage impose additional burdens. Non-compliance risks production delays or penalties, affecting profitability. Companies must invest in advanced treatment systems and safer production methods to meet these requirements. Adapting to region-specific regulations while maintaining global supply consistency remains a persistent challenge in market operations.

Regional Analysis

North America

North America holds a 29% share of the global sodium thiosulphate market in 2024, driven by strong pharmaceutical and water treatment demand. The U.S. leads the region due to established healthcare infrastructure and FDA-approved therapeutic uses. Industrial applications, including photographic fixing and metal recovery, also support steady consumption. Rising adoption of environmentally safe chemicals in wastewater management fuels additional growth. Key producers in the region focus on expanding production capacity and improving purity grades to meet regulatory standards, ensuring North America remains a key contributor to global sodium thiosulphate demand.

Europe

Europe accounts for 25% of the global sodium thiosulphate market in 2024, supported by robust pharmaceutical manufacturing and industrial base. Germany, the U.K., and France are the leading consumers, driven by stringent environmental regulations encouraging eco-friendly chemical usage. The region also benefits from strong demand in the water purification and food additive sectors. EU policies promoting sustainable production enhance the adoption of high-purity grades. Continuous R&D in specialty chemicals, along with the presence of leading producers, ensures Europe’s sustained role in the sodium thiosulphate value chain.

Asia-Pacific

Asia-Pacific dominates the sodium thiosulphate market with a 34% share in 2024, supported by rapid industrialization and growing agricultural activities. China and India lead regional production, benefiting from abundant raw material availability and low-cost manufacturing. Expanding pharmaceutical sectors and increased use in fertilizer formulations further drive growth. Rising investments in water treatment infrastructure across developing nations enhance product demand. Local producers increasingly adopt modern synthesis technologies to improve output efficiency, while favorable government policies supporting chemical exports strengthen the region’s leadership position in the global market.

Latin America

Latin America holds a 7% share of the sodium thiosulphate market in 2024, driven by agricultural and mining applications. Brazil and Mexico lead demand due to expanding fertilizer use and mineral extraction processes requiring sodium thiosulphate-based leaching agents. Government efforts to promote sustainable farming practices also support regional growth. The pharmaceutical and food processing industries are emerging as secondary contributors. Local manufacturers focus on improving product quality and distribution networks to meet rising domestic and export requirements, positioning Latin America as a growing participant in the global sodium thiosulphate trade.

Middle East & Africa

The Middle East & Africa region represents a 5% share of the global sodium thiosulphate market in 2024. Growth is driven by increasing investments in water treatment and industrial chemical sectors. The GCC countries prioritize desalination and wastewater recycling, where sodium thiosulphate plays a vital dechlorination role. South Africa contributes significantly through mining and fertilizer applications. Limited local production capacity encourages imports from Asian suppliers. Strategic government initiatives to strengthen local chemical manufacturing and environmental safety standards are expected to enhance market penetration across the region in the coming years.

Market Segmentations:

By Form:

By Type:

By Application:

- Fertilizer

- Pharmaceutical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sodium thiosulphate market is highly competitive, featuring key players such as Cooper Natural Resources, Tokyo Chemical Industry Pvt. Ltd., Elementis PLC., Bahubali Chemical Industries, LENZING AG, Sigma-Aldrich Solutions, Sun European Partners, LLP, Nippon Chemical Industrial CO., LTD, SHIKOKU KASEI HOLDINGS CORPORATION, and Jiangsu Yinzhu Chemical Group Co., Ltd. The sodium thiosulphate market remains moderately consolidated, with competition driven by technological advancement, product quality, and application diversification. Manufacturers focus on improving production efficiency, achieving high purity levels, and meeting pharmaceutical-grade standards to address rising healthcare and industrial demand. Companies increasingly invest in sustainable production methods, such as low-emission sulfur processing and waste recycling, to comply with global environmental regulations. Strategic expansions across Asia-Pacific and North America enhance supply chain resilience and cost competitiveness. Continuous innovation in purification, formulation, and automated production systems strengthens market positioning, enabling participants to capture emerging opportunities in water treatment, agriculture, and pharmaceuticals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cooper Natural Resources

- Tokyo Chemical Industry Pvt. Ltd.

- Elementis PLC.

- Bahubali Chemical Industries

- LENZING AG

- Sigma-Aldrich Solutions

- Sun European Partners, LLP

- Nippon Chemical Industrial CO., LTD

- SHIKOKU KASEI HOLDINGS CORPORATION

- Jiangsu Yinzhu Chemical Group Co., Ltd

Recent Developments

- In October 2024, Evonik and BASF established an agreement for the initial delivery of BASF’s ammonia BMBcertTM grade. This collaboration demonstrates both companies’ commitment to delivering products with a reduced carbon footprint (PCF). BASF’s ammonia BMBcert provides Evonik with a solution that has a PCF at least 65% lower than conventional products.

- In May 2024, Grasim Industries Ltd launched EcoSodium, an eco-friendly solution sourced from extracted Sodium Sulphate during Viscose Staple Fiber production. By minimizing wastewater discharge, EcoSodium reduces environmental impact. Compliant with REACH and ZDHC MRSL standards, it ensures responsible sourcing and manufacturing.

- In September 2023, Cinis Fertilizer announced plans to build a new sodium sulfate creation site in Hopkinsville, Kentucky. They partnered with Ascend Elements to obtain sodium sulfate for the project.

- In March 2023, Enva began construction of a fertilizer manufacturing facility in Greenogue, Dublin. The facility produces agricultural fertilizer pellets containing ammonium sulfate recovered from industrial liquid wastes. This initiative supports circular economy principles and increases Ireland’s domestic fertilizer production capacity, reducing dependence on imported raw materials.

Report Coverage

The research report offers an in-depth analysis based on Form, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sodium thiosulphate will rise with expanding pharmaceutical and healthcare applications.

- Increasing agricultural use in fertilizers will support steady market growth across developing economies.

- Adoption in eco-friendly water treatment processes will strengthen due to stricter environmental regulations.

- Technological advancements will improve product purity, efficiency, and large-scale production consistency.

- Expanding use in food preservation and flavor stabilization will create new commercial opportunities.

- Growth in mining and metal extraction industries will boost industrial-grade sodium thiosulphate demand.

- Strategic collaborations and capacity expansions will enhance the global supply chain network.

- Rising investment in R&D will promote the development of customized and high-purity formulations.

- Sustainability initiatives will drive innovation in low-emission and recyclable production methods.

- Growing awareness of safe chemical handling and regulatory compliance will shape market competitiveness.