| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solid Glycine Market Size 2024 |

USD 1,345.41 million |

| Solid Glycine Market, CAGR |

8.66% |

| Solid Glycine Market Size 2032 |

USD 2,739.46 million |

Market Overview:

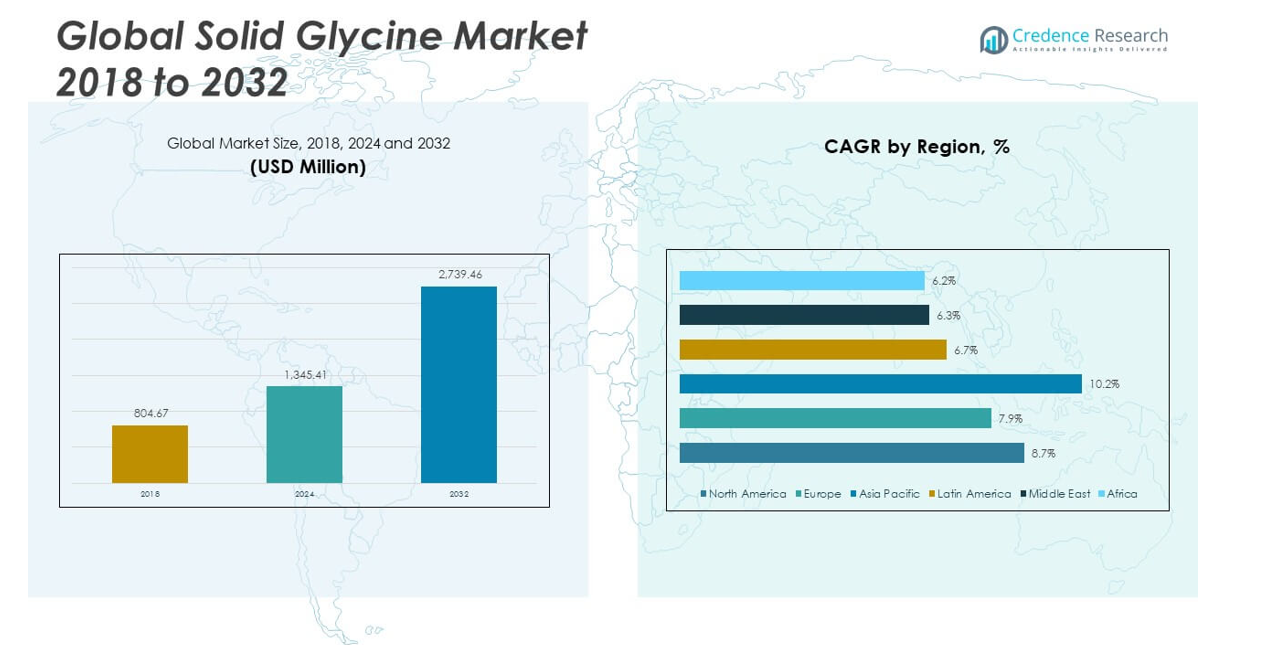

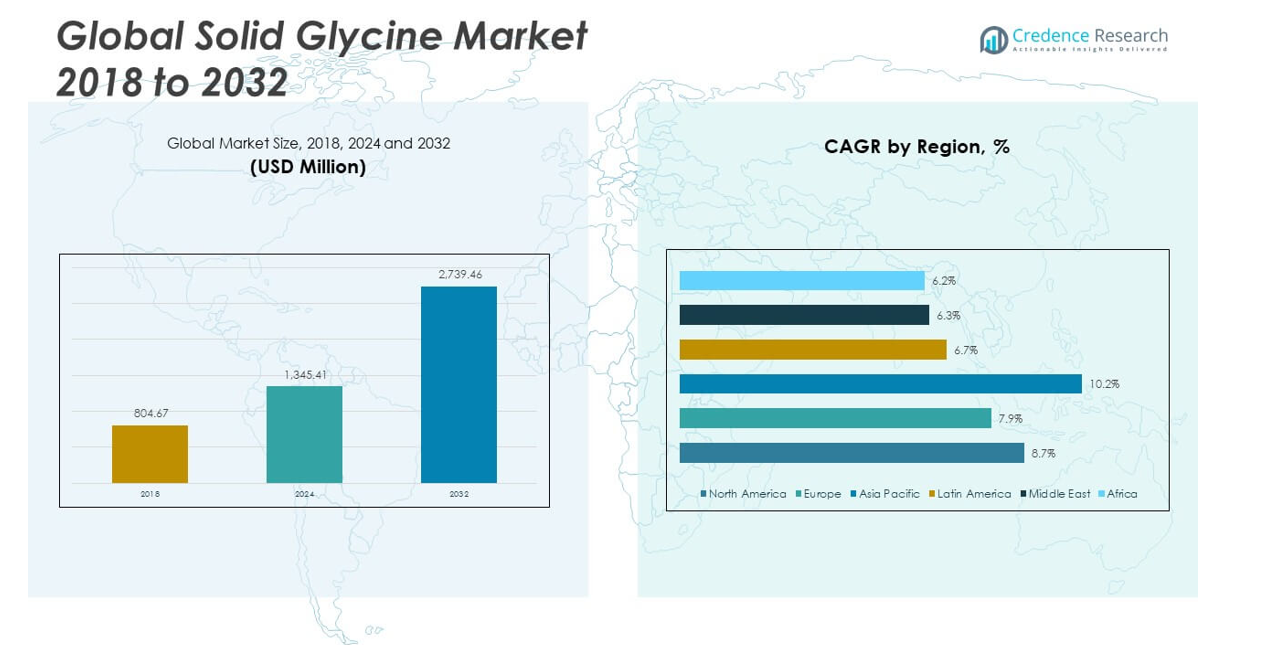

The Global Solid Glycine Market size was valued at USD 804.67 million in 2018 to USD 1,345.41 million in 2024 and is anticipated to reach USD 2,739.46 million by 2032, at a CAGR of 8.66% during the forecast period.

Several key factors are propelling the expansion of the solid glycine market. In the pharmaceutical sector, glycine’s utilization as a buffering agent and its incorporation into drug formulations are significant contributors to market growth. The food and beverage industry also plays a pivotal role, where glycine is employed as a flavor enhancer and preservative, particularly in processed foods and dietary supplements. Additionally, the growing demand for glycine in animal feed, owing to its nutritional benefits, is further driving market expansion. Collectively, these factors highlight the multifaceted applications of solid glycine and its integral role in various industries.

Regionally, Asia-Pacific stands out as the dominant market for solid glycine, accounting for a substantial share due to the presence of major pharmaceutical manufacturers in countries like China and India. North America and Europe also hold significant market shares, driven by robust pharmaceutical and food and beverage sectors. In particular, the United States and Germany are notable contributors to the market’s growth in these regions. Emerging markets in Latin America and the Middle East & Africa are expected to witness increased demand for solid glycine, attributed to industrialization and a growing focus on health and nutrition. This regional diversification indicates a broadening of the market’s global footprint, with varying growth dynamics across different geographies.

Market Insights:

- The Global Solid Glycine Market was valued at USD 804.67 million in 2018 and is projected to reach USD 2,739.46 million by 2032, growing at a CAGR of 8.66% during the forecast period.

- The pharmaceutical industry is a major driver, with glycine used as a buffering agent and stabilizer in drug formulations, particularly in biologic therapies and injectable medications.

- The food and beverage sector significantly contributes to market growth, where glycine serves as a natural flavor enhancer and preservative, especially in processed foods and dietary supplements.

- Increasing demand for glycine in animal feed is driving the market, as it enhances feed efficiency, promotes healthy livestock growth, and supports sustainable farming practices.

- Technological advancements in glycine production have improved product quality and accessibility, expanding its use in pharmaceuticals, food, and agriculture.

- Regulatory challenges and compliance with stringent guidelines in various sectors pose barriers to market expansion, especially in emerging markets with evolving regulations.

- Raw material price fluctuations and availability remain a challenge, as glycine production depends on natural sources subject to price volatility and geopolitical factors, impacting production costs and market supply.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand in Pharmaceutical Applications

The demand for solid glycine is significantly influenced by its widespread use in the pharmaceutical sector. It acts as a buffering agent, stabilizer, and excipient in various drug formulations. Solid glycine is particularly valuable in injectable medications, enhancing their stability and shelf life. The increasing prevalence of chronic diseases, such as cardiovascular disorders and diabetes, has amplified the need for effective pharmaceutical interventions. As a critical ingredient in the development of biologic therapies and personalized medicine, glycine’s role in improving drug efficacy is integral to the growth of the Global Solid Glycine Market. Its application in intravenous fluids and vaccines further solidifies its importance in modern medicine.

Rising Applications in Food and Beverage Industry

The food and beverage industry has become one of the significant drivers of the solid glycine market. Glycine serves as a natural flavor enhancer and preservative in processed food products. Its ability to improve texture and provide a smooth, sweet flavor profile contributes to its increasing adoption. In addition, the rising consumer preference for clean-label products that contain minimal synthetic additives further boosts glycine’s demand. With growing health-consciousness among consumers, solid glycine’s incorporation into dietary supplements and functional foods supports its expansion. Its role in enhancing protein synthesis also adds to its appeal as a nutritional ingredient in products aimed at improving overall wellness.

Expanding Use in Animal Feed and Agriculture

Solid glycine’s use in animal nutrition is another key driver propelling the market. It is increasingly used in animal feed to improve feed efficiency and enhance the growth of livestock, particularly in poultry, aquaculture, and swine. Glycine contributes to better muscle development and overall animal health, making it an essential additive in modern animal husbandry. The rising demand for animal-based protein, including meat and dairy products, directly correlates with the growing need for glycine in animal feed formulations. With the global emphasis on sustainable farming practices, glycine’s role in optimizing nutrient utilization and reducing feed waste further strengthens its position in the market.

- For instance, Hebei Donghua Jiheng Chemical has introduced a new glycine formulation specifically for animal feed applications, focusing on improving livestock growth and immunity, and has partnered with research institutions to develop eco-friendly production methods.

Technological Advancements and Product Innovations

Advancements in manufacturing technologies have led to the production of high-quality solid glycine, making it more accessible and cost-effective for various industries. Innovations in synthesis processes have improved the purity and bioavailability of glycine, expanding its range of applications. The development of specialized glycine variants that cater to specific needs in the pharmaceutical, food, and agricultural sectors enhances its versatility. These technological advancements not only improve product performance but also contribute to market growth by meeting the rising demand for functional and high-grade glycine in diverse applications. As industries continue to innovate, the need for more refined glycine products will drive further market expansion.

- For instance, in the field of electronic grade glycine, Evonik Industries AG has introduced a new generation of high-purity glycine for advanced semiconductor manufacturing.

Market Trends:

Rising Demand from the Animal Feed Industry Driven by Nutritional and Health Benefits

The Global Solid Glycine Market is experiencing growth due to increasing demand in the animal feed industry. Glycine is used as a vital additive for improving digestion and boosting protein synthesis in livestock and poultry. With rising global meat consumption and intensifying livestock farming, the demand for high-quality animal nutrition solutions is expanding. The market benefits from strict regulatory norms emphasizing safe and effective feed ingredients, encouraging manufacturers to adopt glycine in feed formulations. It plays a role in enhancing immunity and promoting healthier growth in animals, which drives its adoption further. The Global Solid Glycine Market is responding to this demand with expanded production and innovation in feed-grade glycine formulations.

- For instance, Evonik Industries AG offers glycine-based feed additives designed to improve feed efficiency and animal health. Showa Denko K.K. provides glycine feed additives that support sustainable farming practices.

Expanding Application Scope in Pharmaceuticals and Personal Care Supports Market Penetration

The Global Solid Glycine Market is witnessing increased use across pharmaceutical and personal care sectors due to its biochemical importance and functional versatility. In pharmaceuticals, glycine functions as an excipient, buffering agent, and component in intravenous formulations, while in skincare it serves as a pH adjuster and conditioning agent. Its natural origin and safety profile align with consumer preferences for clean-label and hypoallergenic ingredients. Pharmaceutical companies are investing in glycine-based formulations to meet the demand for better-tolerated therapeutics. Growth in the global wellness industry also increases demand for glycine-infused products that promote collagen production and skin repair. It continues to gain traction across these high-value applications, strengthening its global footprint.

Manufacturers Shift Toward Bio-Based Production Processes and Sustainable Practices

The Global Solid Glycine Market is seeing a shift toward more sustainable and bio-based production methods due to mounting environmental concerns and evolving regulatory landscapes. Traditional synthetic glycine manufacturing involves chemical processes that generate waste and emissions, prompting producers to explore greener alternatives. Bio-fermentation and enzymatic synthesis are emerging as preferred routes for eco-friendly glycine production. Companies are investing in process innovation to reduce carbon footprints and comply with global sustainability standards. It supports the market’s credibility among environmentally conscious buyers and aligns with the growing push for circular economy models. This transition enhances operational efficiency and creates differentiation in a competitive market.

- For instance, Zymtronix Catalytic Systems develops enzyme-based, eco-friendly glycine production methods. Newtrend Group has adopted advanced purification technologies to meet international standards.

Asia Pacific Remains the Growth Engine Due to Expanding Industrial Base and Consumption Rates

The Global Solid Glycine Market continues to witness robust expansion in the Asia Pacific region, driven by rising industrial activity, growing population, and strong demand from feed, food, and pharma sectors. China and India lead in both production and consumption, supported by large-scale livestock farming and pharmaceutical manufacturing hubs. Regional governments support chemical and biotech industries through favorable policies and infrastructure investments. It also benefits from lower labor and raw material costs, which attract global manufacturers seeking cost-effective production. Export opportunities to North America and Europe further fuel regional output. Asia Pacific’s expanding influence will remain central to the market’s global trajectory.

Market Challenges Analysis:

Regulatory Challenges and Compliance Issues

One of the significant challenges facing the Global Solid Glycine Market is the complex regulatory environment. The use of glycine in various sectors, such as pharmaceuticals, food, and animal feed, is subject to stringent regulations and quality control standards. These regulations vary by region and often require manufacturers to adhere to specific guidelines regarding safety, purity, and labeling. Compliance with these standards can be costly and time-consuming, particularly for small and medium-sized enterprises. Regulatory approvals for new formulations or product applications can delay market entry, hindering the potential for innovation and growth. Navigating these regulatory frameworks is essential but can be a considerable barrier to market expansion, particularly in emerging markets with evolving regulations.

Price Fluctuations and Raw Material Availability

Another challenge is the fluctuation in the prices of raw materials used to produce solid glycine. Glycine is derived from natural sources, and its production depends on the availability of key raw materials, which are susceptible to price volatility. Variations in raw material costs can impact the overall production cost, affecting the pricing strategy for glycine-based products. Market participants may struggle to maintain profit margins while also competing with low-cost alternatives in various industries. Additionally, geopolitical factors and supply chain disruptions can exacerbate these challenges, leading to inconsistencies in production timelines and market supply. These factors can create uncertainty in the market, hindering long-term planning for manufacturers and consumers alike.

Market Opportunities:

Expansion in Emerging Markets

The Global Solid Glycine Market presents significant opportunities in emerging markets, where the demand for both pharmaceutical and agricultural applications is increasing. Growing healthcare infrastructure, rising disposable incomes, and expanding middle-class populations in regions such as Asia-Pacific, Latin America, and the Middle East are expected to drive demand for glycine-based products. In particular, the increasing prevalence of chronic diseases and the need for higher-quality animal feed present new avenues for growth. Manufacturers can capitalize on these trends by introducing affordable, high-quality glycine products tailored to the specific needs of these regions, fostering market penetration and long-term demand.

Growth in Personalized and Preventive Healthcare

The expanding focus on personalized and preventive healthcare offers substantial opportunities for the solid glycine market. As the healthcare sector shifts towards more individualized treatments, glycine’s role in drug formulations and biologic therapies is becoming increasingly important. The rising popularity of functional foods, dietary supplements, and nutraceuticals also contributes to this trend, as consumers seek products that improve overall health and wellness. Companies that innovate and develop glycine-based solutions for these markets can leverage the growing interest in health optimization to expand their product offerings and reach new consumer segments.

Market Segmentation Analysis:

The Global Solid Glycine Market is segmented by type and application, each contributing significantly to its growth.

By type, the market includes glycine grades such as Food Grade, Tech Grade, and Pharma Grade. Food Grade glycine is widely used in the food and beverage industry as a preservative and flavor enhancer, catering to the growing demand for clean-label products. Tech Grade glycine is primarily used in industrial applications, such as in the production of resins and coatings. Pharma Grade glycine, being the purest form, is essential in pharmaceutical formulations, especially as a buffering agent in drug development.

- For instance, Food Grade Glycine is extensively utilized in the food and beverage industry, where it functions as a preservative and flavor enhancer. Its adoption is driven by the rising demand for clean-label and additive-free products, responding to consumer preferences for transparency and safety in food ingredients.

By application segments of the Global Solid Glycine Market cover diverse industries. The pesticide industry utilizes glycine as a key ingredient in herbicides and other agrochemicals, owing to its effectiveness in controlling weeds and pests. In the feed industry, glycine is vital for enhancing feed efficiency and promoting healthy livestock, especially in poultry and aquaculture. The food industry benefits from glycine’s role in improving the taste and texture of processed foods. The pharmaceuticals industry relies heavily on glycine for its stabilizing properties in injectable medications and vaccines. Other applications include its use in cosmetics, personal care products, and laboratory processes, further demonstrating its versatile utility. This wide range of applications drives the continued growth and diversification of the market.

- For instance, the pharmaceutical industry relies on glycine for its stabilizing properties, especially in injectable medications and vaccines, where it helps maintain product integrity during storage and administration.

Segmentation:

By Type:

- Glycine – Food Grade

- Glycine – Tech Grade

- Glycine – Pharma Grade

By Application:

- Pesticide Industry

- Feed Industry

- Food Industry

- Pharmaceuticals Industry

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Solid Glycine Market

The North America Solid Glycine Market size was valued at USD 322.95 million in 2018, to USD 533.87 million in 2024, and is anticipated to reach USD 1,090.32 million by 2032, at a CAGR of 8.70% during the forecast period. The market in this region is primarily driven by the robust pharmaceutical and food industries. North America holds a significant share of the global solid glycine market due to the high demand for glycine in drug formulations, dietary supplements, and animal feed. The presence of well-established pharmaceutical companies and increasing health-consciousness among consumers further fuels market growth. The United States, in particular, is a key contributor, with its expanding healthcare infrastructure and growing demand for nutraceuticals. Canada also shows notable growth potential as its agricultural and food processing sectors continue to adopt solid glycine.

Europe Solid Glycine Market

The Europe Solid Glycine Market size was valued at USD 233.00 million in 2018, to USD 375.82 million in 2024, and is anticipated to reach USD 721.39 million by 2032, at a CAGR of 7.90% during the forecast period. The market in Europe is supported by increasing consumer demand for clean-label food products and natural additives. Regulatory support for health and wellness products, along with a strong pharmaceutical industry, contributes to the region’s market dominance. Countries like Germany, the UK, and France are significant players, with increasing adoption of glycine in food, beverages, and animal feed formulations. The rise in chronic diseases, such as diabetes and cardiovascular disorders, further drives the pharmaceutical applications of solid glycine in the region.

Asia Pacific Solid Glycine Market

The Asia Pacific Solid Glycine Market size was valued at USD 178.02 million in 2018, to USD 319.36 million in 2024, and is anticipated to reach USD 725.98 million by 2032, at a CAGR of 10.20% during the forecast period. The market in this region is experiencing the highest growth rate, driven by the rapid industrialization of countries such as China and India. The increasing demand for glycine in pharmaceuticals, animal feed, and food applications is contributing to the growth. The expanding middle-class population and rising disposable incomes are boosting the demand for dietary supplements and functional foods. Asia Pacific also benefits from a growing healthcare infrastructure and an increased focus on sustainable agricultural practices, further accelerating the market’s expansion.

Latin America Solid Glycine Market

The Latin America Solid Glycine Market size was valued at USD 33.18 million in 2018, to USD 54.69 million in 2024, and is anticipated to reach USD 96.67 million by 2032, at a CAGR of 6.70% during the forecast period. The market is primarily driven by the agricultural and food industries, where solid glycine is used in animal feed and as a preservative in food products. Brazil and Mexico are the largest markets, with an expanding agricultural sector and a growing demand for high-quality animal feed. The increasing awareness of health and wellness also supports the use of glycine in functional foods and dietary supplements. The region’s market growth is bolstered by the rising middle class and improvements in healthcare systems, increasing the demand for pharmaceutical applications of glycine.

Middle East Solid Glycine Market

The Middle East Solid Glycine Market size was valued at USD 22.09 million in 2018, to USD 33.69 million in 2024, and is anticipated to reach USD 57.65 million by 2032, at a CAGR of 6.30% during the forecast period. The market in this region is expanding due to the increasing demand for glycine in food and pharmaceutical applications. The growing healthcare sector and rising awareness of nutrition and wellness products are key drivers for market growth. Countries such as the UAE and Saudi Arabia are seeing an increase in the consumption of functional foods and dietary supplements, fueling the demand for glycine. The agricultural sector, particularly in animal feed, also presents substantial growth potential as the demand for livestock products continues to rise.

Africa Solid Glycine Market

The Africa Solid Glycine Market size was valued at USD 15.44 million in 2018, to USD 27.99 million in 2024, and is anticipated to reach USD 47.46 million by 2032, at a CAGR of 6.20% during the forecast period. The market in Africa is driven by growing industrialization and increased demand for glycine in pharmaceuticals and agriculture. The rising prevalence of chronic diseases has spurred the adoption of glycine-based drug formulations, while the demand for animal feed continues to grow, especially in countries like South Africa. The expanding middle class and rising disposable incomes are fueling demand for functional foods and dietary supplements, contributing to the market’s growth. Africa’s emerging healthcare infrastructure presents an opportunity for glycine manufacturers to expand their market presence in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ajinomoto Co., Inc.

- Evonik Industries AG

- Showa Denko K.K.

- GEO Specialty Chemicals, Inc.

- Chattem Chemicals, Inc.

- Yuki Gosei Kogyo Co., Ltd.

- Shijiazhuang Donghua Jinlong Chemical Co., Ltd.

- Hebei Donghua Jiheng Chemical Co., Ltd.

- Hubei Xingfa Chemicals Group Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

Competitive Analysis:

The Global Solid Glycine Market is characterized by intense competition among key players striving to capture market share through innovation, quality, and strategic partnerships. Leading manufacturers focus on improving production processes to reduce costs while maintaining high-quality standards. Major players such as Ajinomoto Co., Inc., Showa Denko K.K., and Solvay S.A. hold significant market positions due to their established presence in the pharmaceutical and food industries. These companies invest heavily in research and development to expand the applications of solid glycine, particularly in the growing sectors of personalized medicine and functional foods. Smaller players are increasingly entering the market by offering specialized glycine products tailored to regional demands. Strategic collaborations and acquisitions are common, as companies seek to strengthen their market presence and meet the rising demand across various regions. The market’s competitive landscape remains dynamic, with key players focusing on innovation and geographic expansion.

Recent Developments:

- In May 2025, Ajinomoto Co., Inc. completed the sale of its entire equity stake in Ajinomoto Althea, a US-based aseptic fill-finish contract development and manufacturing organization (CDMO), to Packaging Coordinators Inc. (PCI). This move aligns with Ajinomoto’s strategy to focus on high value-added services in healthcare and further develop its proprietary technologies, particularly in the biopharma sector.

- In January 2025, Evonik Industries AG entered into a partnership with ST Pharm to expand its offerings for RNA and nucleic acid therapeutics, integrating ST Pharm’s customized nucleic acids with Evonik’s lipid and lipid nanoparticle drug product development services. This partnership aims to streamline the development process for nucleic acid therapeutics and enhance Evonik’s system solutions portfolio.

Market Concentration & Characteristics:

The Global Solid Glycine Market exhibits moderate concentration, with a few dominant players controlling a substantial share of the market. Leading companies, such as Ajinomoto Co., Inc., Showa Denko K.K., and Solvay S.A., have a strong market presence due to their extensive production capabilities and wide product portfolios. These companies focus on expanding their reach through innovation, strategic acquisitions, and geographical expansion. Despite this, the market also features a growing number of smaller, specialized players catering to niche segments. The market is characterized by high competition, with a focus on product quality, cost-efficiency, and regulatory compliance. Companies are investing in improving manufacturing technologies to enhance product purity and meet the rising demand across multiple industries, including pharmaceuticals, food, and agriculture. The market’s competitive dynamics are shaped by the need for continuous innovation and the ability to adapt to changing industry trends.

Report Coverage:

The research report offers an in-depth analysis based on type and application, It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Solid Glycine Market is expected to continue growing at a robust pace, driven by increasing demand from pharmaceuticals and nutraceuticals.

- The market will see significant expansion in emerging economies, particularly in Asia-Pacific, due to rising healthcare spending and agricultural development.

- Growing consumer preference for natural and clean-label ingredients will boost demand for solid glycine in the food and beverage sector.

- Technological advancements in glycine production processes will improve efficiency, product quality, and cost-effectiveness, enhancing market growth.

- Increasing adoption of personalized medicine will lead to higher demand for glycine in biologic drug formulations.

- The rising global demand for protein-rich animal products will contribute to a growing need for glycine in animal feed applications.

- Regulatory changes and the need for compliance will drive the development of higher-quality glycine formulations across industries.

- Rising awareness of chronic diseases and the need for better treatments will foster pharmaceutical applications of solid glycine.

- Investments in research and development will lead to new product innovations and expanded applications across various industries.

- Strategic partnerships and acquisitions will help key players strengthen their market positions and increase production capabilities.