| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Autonomous Off-Road Vehicles And Machinery Market Size 2023 |

USD 474.92 Million |

| Spain Autonomous Off-Road Vehicles And Machinery Market, CAGR |

10.8% |

| Spain Autonomous Off-Road Vehicles And Machinery Market Size 2032 |

USD 1,196.34 Million |

Market Overview:

Spain Autonomous Off-Road Vehicles And Machinery Market size was valued at USD 474.92 million in 2023 and is anticipated to reach USD 1,196.34 million by 2032, at a CAGR of 10.8% during the forecast period (2023-2032).

Several factors are propelling the adoption of autonomous off-road vehicles and machinery in Spain. Technological advancements in artificial intelligence (AI), machine learning, and sensor technologies are enhancing the capabilities of autonomous systems, enabling them to navigate complex terrains with increased precision and safety. These innovations are empowering autonomous vehicles to make real-time decisions, ensuring greater accuracy in challenging environments. Additionally, the growing emphasis on operational efficiency and safety in sectors such as agriculture, mining, and construction is driving the demand for autonomous solutions. These vehicles offer benefits like reduced labor costs, minimized human error, and the ability to operate in hazardous environments, thereby improving overall productivity. With increasing concerns about workforce safety and environmental sustainability, autonomous machinery is seen as a viable solution to meet these challenges. These trends further accelerate the integration of autonomous technology into various industries across Spain.

Spain’s strategic location in Europe positions it as a key player in the regional autonomous off-road vehicle market. As a result, Spain stands to benefit from the rising demand for these technologies in key sectors like agriculture, construction, and mining. Spain’s automotive sector is actively adapting to this trend, with initiatives aimed at enhancing competitiveness in the global ecosystem. In particular, the Spanish government and private enterprises are investing heavily in the development and deployment of autonomous vehicle technology. The country’s focus on innovation and sustainability further supports the integration of autonomous technologies into its industrial operations. Spain is also exploring collaborations with other European countries, enabling cross-border adoption of autonomous systems and fostering innovation through shared resources and expertise.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Spain’s autonomous off-road vehicle market is projected to grow from USD 474.92 million in 2023 to USD 1,196.34 million by 2032, at a CAGR of 10.8%, driven by advancements in AI, machine learning, and sensor technologies.

- Global Autonomous Off-road Vehicles and Machinery size was valued at USD 23,300.00 million in 2023 and is anticipated to reach USD 68,887.09 million by 2032, at a CAGR of 12.80% during the forecast period (2023-2032).

- Technological innovations, including 5G connectivity, enable autonomous vehicles in Spain to operate more efficiently, improving safety and real-time decision-making, particularly in complex terrains.

- The demand for operational efficiency and safety in sectors like agriculture, mining, and construction is propelling the adoption of autonomous machinery, reducing labor costs and minimizing human errors.

- Autonomous off-road vehicles are seen as vital for environmental sustainability, with electric and hybrid technologies helping reduce emissions and align with Spain’s carbon neutrality goals by 2050.

- Government policies and investments play a crucial role in driving market growth, with initiatives supporting the development of autonomous technologies and cleaner alternatives in agriculture and mining sectors.

- High initial investment costs pose a challenge, as small and medium-sized enterprises (SMEs) struggle with the upfront financial burden of adopting advanced autonomous machinery.

- Regulatory uncertainty and safety concerns, including potential malfunctions and cybersecurity threats, hinder the widespread implementation of autonomous off-road vehicles in various industries.

Market Drivers:

Technological Advancements

The adoption of autonomous off-road vehicles and machinery in Spain is heavily driven by significant technological advancements. Breakthroughs in artificial intelligence (AI), machine learning, and sensor technologies have greatly improved the efficiency and reliability of these systems. These innovations enable autonomous vehicles to navigate complex terrains, perform intricate tasks, and adapt to dynamic environments in real-time. AI-powered systems allow vehicles to make decisions based on sensor data, improving safety and operational efficiency. For instance, TTTech Auto Iberia, based in Barcelona, specializes in safe software and hardware platforms for automated driving and currently offers Level 3 automation, with ongoing development toward Levels 4 and 5. With advancements such as 5G connectivity, autonomous vehicles in Spain can operate with reduced latency, ensuring smoother and safer functionality. As the technology continues to evolve, it opens up new opportunities for more industries to integrate autonomous systems into their operations, paving the way for further growth in the Spanish market.

Demand for Operational Efficiency and Safety

The growing demand for operational efficiency and safety in sectors such as agriculture, mining, construction, and forestry is a key driver of autonomous vehicle adoption in Spain. Autonomous off-road vehicles can operate continuously without breaks, significantly improving productivity and reducing downtime. This feature is particularly beneficial in industries where manual labor is both time-consuming and costly. Additionally, these vehicles minimize the risks associated with human errors and operator fatigue, leading to a safer working environment. In hazardous environments like mines and construction sites, autonomous machinery can work in conditions that are unsafe for human workers, further driving the demand for automation. As businesses seek to optimize their operations, autonomous off-road vehicles are increasingly seen as essential tools for meeting the efficiency and safety demands of these sectors.

Environmental Sustainability Initiatives

Environmental sustainability is another key factor driving the adoption of autonomous off-road vehicles and machinery in Spain. The growing emphasis on reducing carbon footprints and minimizing environmental impact is prompting industries to shift toward greener alternatives. For instance, Spain’s commitment to carbon neutrality by 2050 is further reinforced by the MOVES III programme, which provides up to €7,000 in grants for electric vehicle purchases and up to 70% of the cost of private charging points. Autonomous vehicles are often equipped with advanced energy-efficient technologies, such as electric or hybrid powertrains, making them more environmentally friendly than traditional fuel-powered machines. In sectors like agriculture and construction, where large machines typically consume significant amounts of fuel, autonomous vehicles help to reduce emissions and promote sustainable practices. Spain’s commitment to achieving carbon neutrality by 2050 aligns with this trend, as businesses and government initiatives encourage the integration of cleaner technologies. Autonomous vehicles, with their potential for enhanced fuel efficiency and minimal emissions, are well-positioned to play a critical role in the country’s environmental goals.

Supportive Government Policies and Investments

The Spanish government has shown strong support for the development and integration of autonomous technologies across various sectors, including off-road vehicles and machinery. Government incentives, subsidies, and investments aimed at encouraging technological innovation are fueling the market’s growth. For example, Spain has introduced initiatives to promote the use of clean technologies and automation in industries such as agriculture and mining, making autonomous systems a viable option for many companies. Additionally, Spain’s commitment to sustainable development and its strategic position within the European Union has led to greater collaboration with neighboring countries. These efforts not only enhance the development of autonomous systems but also facilitate the adoption of such technologies by reducing financial barriers for businesses. As the Spanish government continues to support these technologies through regulations, funding, and infrastructure development, the market for autonomous off-road vehicles and machinery is expected to expand rapidly.

Market Trends:

Integration of Artificial Intelligence and Machine Learning

One of the most significant trends in the Spanish autonomous off-road vehicles and machinery market is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies. For example, Nissan’s Seamless Autonomous Mobility system, developed in partnership with NASA, leverages AI to combine real-time sensor data and remote human input, enabling vehicles to navigate complex environments and resolve situations that automated systems alone cannot handle. These technologies are enhancing the operational capabilities of autonomous systems, enabling them to process large volumes of data and make real-time decisions with minimal human intervention. AI-powered systems are also improving predictive maintenance, where autonomous machines can detect early signs of malfunction and alert operators or take preventive measures autonomously. In Spain, as AI continues to evolve, manufacturers are increasingly incorporating it into their machinery to ensure that operations are more adaptive, efficient, and capable of handling complex terrains and diverse conditions.

Shift Toward Electrification and Sustainable Solutions

Another key trend in Spain’s autonomous off-road vehicle market is the shift toward electrification and sustainable solutions. With Spain’s increasing commitment to achieving carbon neutrality by 2050, the demand for electric and hybrid autonomous vehicles is on the rise. For instance, the government’s Strategic Projects for Economic Recovery and Transformation (PERTE) initiative has committed over €24 billion to support electric and connected vehicles, aiming for 250,000 electric vehicles in the country, up from nearly 109,900 registered in 2022. These vehicles help to reduce greenhouse gas emissions and reliance on fossil fuels, aligning with both governmental sustainability goals and private industry objectives. In sectors like agriculture and mining, where large off-road machines traditionally use diesel fuel, there is a growing push to adopt electric or hybrid alternatives. Spain’s market is seeing an increasing number of manufacturers and operators adopting electric autonomous vehicles to meet environmental regulations and reduce operating costs related to fuel consumption.

Increased Focus on Safety and Remote Monitoring

Safety continues to be a significant trend driving the adoption of autonomous off-road vehicles and machinery in Spain. Autonomous systems are increasingly equipped with advanced safety features, such as collision avoidance, obstacle detection, and real-time hazard assessment. These safety enhancements not only protect human workers but also ensure that machinery operates more effectively in hazardous environments, such as mines, construction sites, and large agricultural fields. The integration of remote monitoring systems allows operators to keep track of vehicle performance and potential safety concerns from a distance, providing a more efficient and safer working environment. This trend is particularly important in sectors where machinery operates in dangerous or inaccessible locations, reducing the need for human presence in risky areas.

Rise in Data Analytics and Automation

The use of data analytics and automation is rapidly becoming a trend in the Spanish autonomous off-road vehicles and machinery market. With the increasing availability of sensors and real-time data collection, autonomous systems are generating vast amounts of data that can be used to optimize performance, improve decision-making, and enhance maintenance schedules. In industries such as construction, agriculture, and mining, data analytics is helping operators predict machine performance and reduce costs by improving maintenance processes and reducing downtime. Automation, combined with advanced data analytics, is also enhancing supply chain management and operational efficiency, as autonomous systems can coordinate tasks without requiring constant human oversight. This trend is driving demand for more advanced, data-driven solutions in Spain’s off-road vehicle market.

Market Challenges Analysis:

High Initial Investment Costs

One of the primary challenges in the Spanish autonomous off-road vehicle market is the high initial investment required for acquiring and implementing autonomous machinery. For instance, the cost of a fully autonomous Level 4 or 5 vehicle can reach upwards of $100,000 per vehicle solely for the added autonomous components, including advanced AI systems, LiDAR, radar, high-resolution cameras, and powerful computing units. The advanced technology and systems needed for autonomous vehicles, including AI, machine learning algorithms, sensors, and electric or hybrid powertrains, significantly increase the upfront costs. These high capital expenditures can be a significant barrier for small and medium-sized enterprises (SMEs) that may struggle to afford the necessary investment. While these vehicles promise long-term cost savings through improved efficiency and reduced labor, the initial financial outlay remains a challenge for widespread adoption, especially in price-sensitive industries like agriculture and construction.

Regulatory and Safety Concerns

Another significant restraint for the adoption of autonomous off-road vehicles in Spain is the evolving regulatory landscape and safety concerns. As autonomous technology continues to develop, regulatory frameworks are still catching up, and there is a lack of clear, standardized guidelines for deploying these systems in industries like agriculture, mining, and construction. The absence of consistent regulations could lead to delays in implementation and uncertainty for manufacturers and operators. Additionally, safety remains a major concern. Although autonomous systems are designed to operate independently, there are still potential risks, including system malfunctions, cybersecurity threats, and human error during system oversight. The development of robust regulatory measures to address these safety and legal challenges is critical for ensuring the market’s growth.

Technological Limitations and Integration Challenges

While technological advancements are driving the adoption of autonomous systems, there are still some limitations regarding the integration of these vehicles into existing operations. Many industries in Spain rely on legacy equipment and processes, and transitioning to autonomous machinery requires significant adjustments in both infrastructure and workforce management. The complexity of integrating autonomous vehicles with existing systems, such as fleet management and remote monitoring tools, can pose significant operational hurdles. Additionally, ensuring the reliability and robustness of autonomous systems in harsh, unpredictable environments remains an ongoing challenge.

Market Opportunities:

The autonomous off-road vehicle market in Spain presents significant growth opportunities, particularly in industries such as agriculture, mining, and construction. As these sectors increasingly focus on improving productivity, reducing operational costs, and enhancing safety, autonomous technology offers a compelling solution. The ability of autonomous vehicles to operate continuously without human intervention leads to higher efficiency and reduced downtime, which is crucial for large-scale operations. Moreover, Spain’s commitment to sustainability provides further opportunities, as autonomous vehicles often incorporate electric and hybrid technologies, helping to meet stringent environmental regulations. As businesses look to reduce their carbon footprints, the integration of autonomous, energy-efficient vehicles will be essential in meeting both regulatory and market demands for greener solutions.

Additionally, Spain’s strong focus on technological innovation and its strategic position within the European Union creates a conducive environment for the adoption of autonomous systems. With government incentives and supportive policies promoting the development of advanced machinery, the market is ripe for further expansion. The increasing availability of AI, machine learning, and IoT technologies opens up avenues for even more advanced autonomous solutions that can provide real-time data analytics, predictive maintenance, and improved performance optimization. This technological evolution creates opportunities for manufacturers to develop more sophisticated autonomous systems tailored to specific industry needs, accelerating the growth of the market and positioning Spain as a key player in the global autonomous vehicle landscape.

Market Segmentation Analysis:

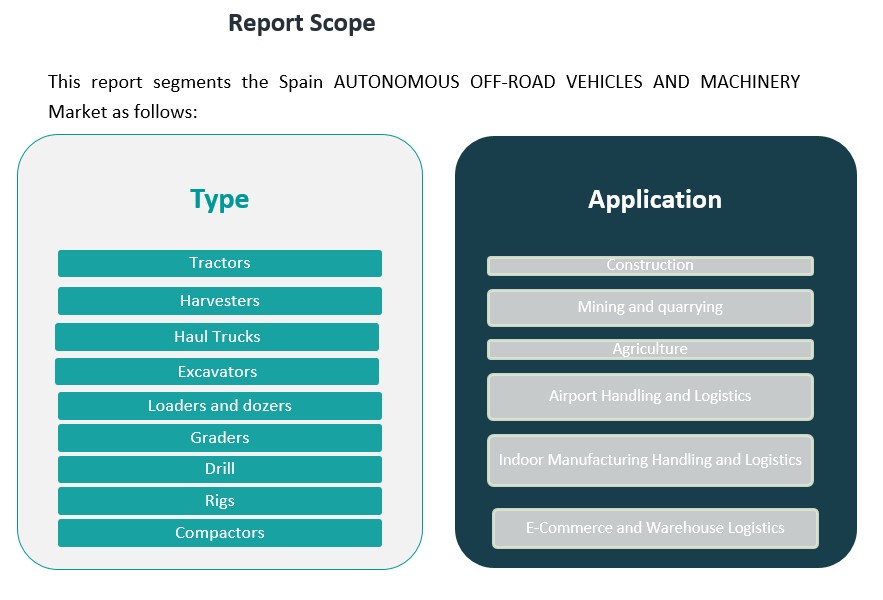

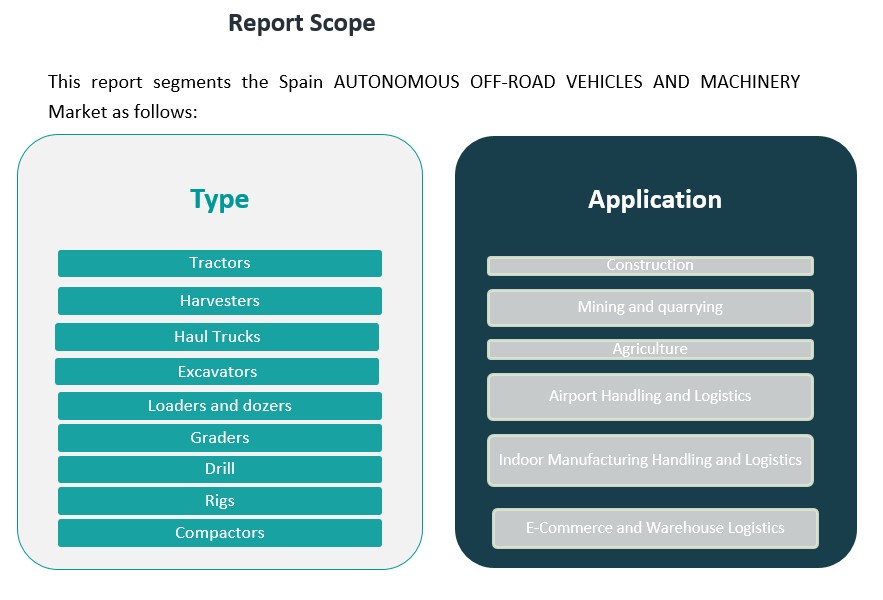

The Spain autonomous off-road vehicle and machinery market is segmented by type and application, each offering unique growth opportunities.

By type segment, the market is primarily divided into various categories, including tractors, harvesters, haul trucks, excavators, loaders and dozers, graders, drills, rigs, and compactors. Tractors and harvesters dominate the agriculture sector, where autonomous systems are increasingly adopted to enhance productivity and reduce labor costs. Haul trucks and excavators are crucial for the mining and construction industries, offering increased safety and operational efficiency. Autonomous loaders and dozers are gaining popularity in large-scale earthmoving operations, while graders, drills, and rigs are being integrated into projects requiring high precision, such as road construction and drilling operations. Compactors, essential in construction, are also becoming autonomous to ensure consistent performance and minimize human error.

By application segment, autonomous off-road vehicles are finding increasing adoption in several industries. The construction sector benefits from enhanced productivity and safety through autonomous machinery, particularly in large-scale infrastructure projects. Mining and quarrying applications also drive market growth, as autonomous vehicles can operate in hazardous conditions, reducing the need for human workers in dangerous environments. The agriculture sector is leveraging autonomous tractors and harvesters to optimize land use and crop production, while airport handling and logistics are increasingly utilizing autonomous vehicles to streamline ground operations. Indoor manufacturing handling and logistics and e-commerce and warehouse logistics are also adopting autonomous systems to automate material handling and transportation, improving efficiency and reducing costs.

Segmentation:

By Type Segment:

- Tractors

- Harvesters

- Haul Trucks

- Excavators

- Loaders and Dozers

- Graders

- Drill

- Rigs

- Compactors

By Application Segment:

- Construction

- Mining and Quarrying

- Agriculture

- Airport Handling and Logistics

- Indoor Manufacturing Handling and Logistics

- E-Commerce and Warehouse Logistics

Regional Analysis:

Spain’s autonomous off-road vehicles and machinery market exhibits regional disparities influenced by industrial concentration, technological adoption, and infrastructure development. While comprehensive regional market share data specific to autonomous off-road vehicles in Spain is limited, insights can be drawn from broader industry trends and regional economic activities.

Central Spain: Madrid and Castilla y León

Central Spain, encompassing Madrid and Castilla y León, is a significant hub for autonomous vehicle development and testing. Madrid, as the capital, leads in technological innovation and infrastructure, fostering advancements in autonomous systems. Castilla y León, with its expansive agricultural lands, provides a conducive environment for deploying autonomous machinery in farming operations. The region’s focus on precision agriculture and sustainable practices drives the adoption of autonomous tractors and harvesters.

Northern Spain: Catalonia and Basque Country

Catalonia and the Basque Country are at the forefront of industrial automation in Spain. Catalonia’s robust automotive sector, exemplified by companies like SEAT, facilitates the integration of autonomous technologies into off-road vehicles. The Basque Country’s emphasis on innovation and manufacturing excellence supports the development and deployment of autonomous construction and mining machinery. These regions are pivotal in advancing autonomous systems across various industrial applications.

Southern Spain: Andalusia and Extremadura

Southern Spain, particularly Andalusia and Extremadura, is experiencing a gradual adoption of autonomous off-road machinery, primarily in agriculture. The regions’ extensive agricultural activities, including olive and citrus farming, benefit from the efficiency gains offered by autonomous vehicles. While adoption rates are currently lower compared to other regions, the potential for growth is substantial as technology becomes more accessible and cost-effective.

Eastern Spain: Valencia and Murcia

Eastern Spain, encompassing Valencia and Murcia, is witnessing increased interest in autonomous machinery within the agriculture and logistics sectors. The regions’ focus on horticulture and logistics infrastructure presents opportunities for deploying autonomous vehicles to enhance operational efficiency. As technological advancements continue, the adoption of autonomous systems in these regions is expected to rise, contributing to overall market growth.

Key Player Analysis:

- Caterpillar Inc

- Komatsu Ltd

- Sandvik AB

- John Deere

- Liebherr Group

- Jungheinrich AG

- Daifuku Co. Ltd.

- KION Group

- NAVYA

- EasyMile

- Goggo Network

- Robotnik

- SMARLOGY

- AMS Robotics

Competitive Analysis:

The competitive landscape of Spain’s autonomous off-road vehicles and machinery market is characterized by the presence of both global and regional players. Leading companies such as Volvo Group, Caterpillar Inc., Komatsu Ltd., and John Deere dominate the market, leveraging advanced technologies like AI, GPS, and machine learning to enhance the performance of their autonomous systems. These firms are investing heavily in R&D to integrate automation into off-road machinery, providing solutions for industries such as agriculture, construction, and mining. In addition to these global giants, Spanish companies like Linde Material Handling and Magni Telescopic Handlers are actively developing autonomous solutions tailored to local market needs. These companies are capitalizing on Spain’s growing emphasis on technological innovation and sustainability to enhance their market positions. As demand for autonomous off-road vehicles rises, competition is intensifying, with companies focusing on reducing costs, improving safety features, and expanding their product portfolios to meet industry demands.

Recent Developments:

- In March 2025, Caterpillar Inc. announced a strategic collaboration with Luminar to integrate advanced Iris LiDAR technology into Caterpillar’s next-generation autonomous off-highway trucks. This partnership aims to enhance the navigation and obstacle detection capabilities of Caterpillar’s autonomous machines, specifically for Command hauling operations in quarry and aggregate sites.

- In May 2023, Komatsu Ltd. launched a joint project with Toyota Motor Corporation to develop an Autonomous Light Vehicle (ALV) that will operate on Komatsu’s Autonomous Haulage System (AHS). The initiative focuses on improving safety and productivity in mining operations by integrating autonomous haul trucks and automated light vehicles under a unified control system.

- In March 2025, WeRide, an autonomous driving technology company, and Renault Group launched their first autonomous Robobus trial in Spain, offering a free public service in the center of Barcelona from March 10th to 14th. This initiative marked the debut of Level-4 autonomous vehicle technology for public transport in Spain, following successful demonstrations at the Roland-Garros 2024 tennis tournament. The Robobus operated on a 2–2.2 kilometer circular route with four stops, allowing passengers to experience fully autonomous mobility in real urban traffic.

Market Concentration & Characteristics:

The Spanish autonomous off-road vehicles and machinery market exhibits a moderate to high concentration, with several prominent global manufacturers leading the sector. Companies such as Caterpillar Inc., Komatsu Ltd., John Deere, and Volvo Group dominate the market, leveraging advanced technologies like AI, GPS, and machine learning to enhance the performance of their autonomous systems. These firms are investing heavily in R&D to integrate automation into off-road machinery, providing solutions for industries such as agriculture, mining, and construction. In addition to these global giants, Spanish companies like Linde Material Handling and Magni Telescopic Handlers are actively developing autonomous solutions tailored to local market needs. These companies are capitalizing on Spain’s growing emphasis on technological innovation and sustainability to enhance their market positions. As demand for autonomous off-road vehicles rises, competition is intensifying, with companies focusing on reducing costs, improving safety features, and expanding their product portfolios to meet industry demands.The market is characterized by rapid technological advancements and increasing adoption across various sectors. However, challenges such as high initial investment costs, regulatory hurdles, and the need for infrastructure development remain significant considerations for stakeholders. Despite these challenges, the market’s growth prospects are promising, driven by the potential for increased efficiency, safety, and sustainability in off-road operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and Application It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Spain’s autonomous off-road vehicle market is expected to experience steady growth driven by technological advancements in AI and automation.

- The agriculture sector will see significant adoption of autonomous machinery, improving productivity and sustainability.

- Increased demand for automation in mining and construction will boost the need for advanced off-road vehicles.

- Spain’s focus on environmental sustainability will accelerate the adoption of electric and hybrid autonomous vehicles.

- Government incentives and regulations supporting green technology will further encourage investment in autonomous systems.

- The integration of AI-powered predictive maintenance features will enhance operational efficiency and reduce downtime.

- Advancements in machine learning will improve the accuracy and precision of autonomous vehicles, expanding their application scope.

- The adoption of autonomous vehicles will reduce labor costs, particularly in hazardous working environments.

- Spanish manufacturers will increasingly collaborate with global players to innovate and expand their product offerings.

- The market will face challenges in infrastructure development and regulatory standardization, but these will be mitigated by technological improvements and policy support.