| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Industrial Fasteners Market Size 2024 |

USD 1980.13 Million |

| Spain Industrial Fasteners Market, CAGR |

4.24% |

| Spain Industrial Fasteners Market Size 2032 |

USD 2761.08 Million |

Market Overview:

The Spain Industrial Fasteners Market is projected to grow from USD 1980.13 million in 2024 to an estimated USD 2761.08 million by 2032, with a compound annual growth rate (CAGR) of 4.24% from 2024 to 2032.

Several factors are driving the expansion of Spain’s industrial fasteners market. The automotive industry, a significant consumer of fasteners, is experiencing growth, necessitating high-strength and lightweight fastening solutions. Additionally, the construction sector’s resurgence, marked by increased infrastructure projects and residential developments, is fueling demand for various fasteners. Technological advancements, including the integration of Industry 4.0 practices, are enhancing manufacturing efficiency and product quality, further propelling market growth. The increasing adoption of electric vehicles is also creating new requirements for innovative fastening systems tailored to lightweight and modular designs. Moreover, the growing preference for advanced materials, such as composites and alloys, is influencing the development of specialized fasteners to meet evolving industry standards.

Regionally, Spain’s industrial fasteners market benefits from its strategic location within Europe, facilitating trade and distribution. The country’s well-established manufacturing hubs, particularly in regions like Catalonia and the Basque Country, serve as key centers for fastener production and distribution. Moreover, Spain’s participation in the European Union allows for seamless access to neighboring markets, bolstering export opportunities. The emphasis on sustainability and adherence to stringent EU regulations also drive innovation in eco-friendly fastening solutions, positioning Spain as a competitive player in the European industrial fasteners landscape. Investment initiatives in logistics infrastructure, including major port expansions, further enhance Spain’s export competitiveness. Additionally, the rise of smart manufacturing clusters across Spanish regions is helping companies to boost efficiency and reduce production costs, strengthening the market’s regional outlook.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Spain Industrial Fasteners Market is expected to grow from USD 1980.13 million in 2024 to USD 2761.08 million by 2032, reflecting a CAGR of 4.24%.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- Growth in the automotive sector, especially with the rise of electric vehicles, is significantly boosting demand for lightweight and high-strength fastening solutions.

- The construction industry’s resurgence, driven by infrastructure modernization and smart city projects, is fueling steady demand for specialized fasteners.

- Technological advancements, including the integration of Industry 4.0 practices and adoption of advanced materials, are reshaping fastener manufacturing processes.

- Rising investments in renewable energy and aerospace sectors are generating strong opportunities for high-durability, corrosion-resistant, and precision fasteners.

- Fluctuations in raw material prices and increasing competition from adhesives and bonding technologies pose key challenges for market players.

- Regionally, Catalonia and the Basque Country dominate Spain’s industrial fasteners market, benefiting from strong manufacturing hubs and strategic European trade access.

Market Drivers:

Growth in the Automotive Industry

The automotive industry continues to be a major driver for the Spain industrial fasteners market. Spain ranks among the top automobile producers in Europe, creating sustained demand for high-performance fastening solutions. As automotive manufacturers increasingly focus on lightweight vehicles to meet fuel efficiency and emission standards, the need for advanced fasteners made from high-strength materials is expanding. Moreover, the transition toward electric vehicles (EVs) is reshaping fastening requirements, prompting innovations that enhance durability, reduce weight, and accommodate modular vehicle designs. Companies are investing in research and development to offer fastening systems compatible with new automotive architectures, further fueling market growth. For instance, Gestamp, a leading Spanish multinational specializing in metal components for automotive manufacturers, reported investing over €140 million in 2023 in new production technologies and lightweight materials.

Expansion of the Construction and Infrastructure Sectors

Spain’s construction sector has shown strong recovery in recent years, bolstered by infrastructure modernization programs and residential development projects. Investments in transportation networks, renewable energy installations, and smart city initiatives are contributing significantly to the growing demand for industrial fasteners. Construction activities require a diverse range of fasteners for structural applications, HVAC systems, and equipment assemblies, thus creating multiple avenues for market expansion. Additionally, the government’s focus on sustainable construction practices and the integration of prefabricated building techniques is increasing the adoption of specialized, corrosion-resistant, and high-load-bearing fasteners, accelerating market momentum across the sector.

Technological Advancements and Industry 4.0 Adoption

Technological advancements are playing a pivotal role in transforming the Spain industrial fasteners market. The implementation of Industry 4.0 technologies, such as automation, robotics, and smart manufacturing systems, has improved production efficiency and product precision. For instance, Danobat, a Spanish machinery supplier, participated in an Industry 4.0 smart factory pilot for aerospace fastener production, integrating five smart factory machines to automate different stages of the manufacturing process. Fastener manufacturers are leveraging advanced materials, 3D printing, and surface treatment technologies to produce components that meet the evolving needs of various end-use industries. Furthermore, digitalization across manufacturing processes allows companies to streamline quality control, reduce operational costs, and meet the growing demand for customized fastening solutions. As Spanish industries embrace innovation to enhance competitiveness, the demand for technologically advanced fasteners is set to witness substantial growth.

Rising Demand from Renewable Energy and Aerospace Sectors

The renewable energy sector, particularly wind and solar energy, is emerging as a significant contributor to the demand for industrial fasteners in Spain. Wind turbines and solar panel installations require highly durable and weather-resistant fasteners capable of withstanding extreme environmental conditions. Likewise, Spain’s well-established aerospace industry demands specialized fasteners that offer superior strength-to-weight ratios and enhanced reliability for critical applications. The increasing investments in renewable energy projects and aerospace manufacturing are providing robust growth opportunities for the fastener market. As industries place greater emphasis on safety, efficiency, and sustainability, the role of high-performance fastening solutions becomes even more critical, ensuring steady market expansion over the coming years.

Market Trends:

Increased Adoption of Lightweight and Sustainable Materials

One of the prominent trends shaping the Spain industrial fasteners market is the rising adoption of lightweight and sustainable materials. Manufacturers are increasingly moving toward aluminum, titanium, and advanced composites to produce fasteners that reduce overall system weight without compromising performance. For instance, companies such as Arconic Corp are at the forefront, offering high-performance fasteners made from advanced aluminum and titanium alloys specifically designed to reduce system weight while maintaining strength and reliability. This trend aligns with Spain’s broader commitment to meeting EU sustainability targets and reducing carbon emissions across industries. As industries such as automotive, aerospace, and construction prioritize lightweight designs, the demand for fasteners that contribute to material efficiency and recyclability is steadily rising. This shift is encouraging fastener producers to invest in new manufacturing techniques and material innovation.

Growing Preference for Custom and Application-Specific Fasteners

There is a noticeable trend toward custom-designed and application-specific fasteners in the Spanish market. End-users in sectors like energy, electronics, and medical devices are increasingly requesting tailor-made fastening solutions to meet specific operational requirements. Standardized fasteners often fall short when industries demand higher precision, resistance to extreme environments, or specialized mechanical properties. Companies are responding by offering fasteners with customized dimensions, coatings, and performance characteristics. For instance, companies like SNK System and Delta Fitt Inc provide bespoke fasteners tailored to client specifications, offering a wide variety of sizes, dimensions, and coatings to suit unique operational requirements. This move toward personalization not only adds value but also enhances product lifespan and operational safety, fostering deeper collaboration between fastener manufacturers and industry stakeholders.

Advancements in Coating Technologies

Advancements in coating technologies represent another major trend impacting the Spain industrial fasteners market. Protective coatings, such as zinc-nickel plating, powder coating, and Teflon coatings, are becoming essential to improve the durability, corrosion resistance, and aesthetic appeal of fasteners. The harsh operating conditions faced in marine, energy, and infrastructure sectors necessitate fasteners with extended lifespans and reduced maintenance costs. Spanish manufacturers are adopting state-of-the-art coating solutions to meet both domestic and international quality standards. The increased use of eco-friendly coatings, which minimize the environmental footprint while offering high performance, is also gaining momentum in response to stringent environmental regulations.

Integration of Digital Supply Chains and Smart Inventory Systems

The digitalization of supply chains is increasingly influencing how fasteners are produced, distributed, and stocked across Spain. Companies are implementing smart inventory management systems powered by IoT technologies to monitor fastener usage, predict demand fluctuations, and optimize procurement strategies. This trend is helping manufacturers and distributors reduce inventory carrying costs and enhance responsiveness to market needs. Digital platforms are also streamlining logistics and improving visibility across the supply chain, enabling Spanish fastener companies to serve both domestic clients and international markets more efficiently. As the manufacturing sector embraces digital transformation, the role of technology-driven supply chain management is becoming a critical competitive differentiator in the industrial fasteners market.

Market Challenges Analysis:

Fluctuations in Raw Material Prices

Volatility in raw material prices remains a significant challenge for the Spain industrial fasteners market. Steel, aluminum, and other essential materials used in fastener production are subject to frequent price fluctuations due to global supply-demand imbalances, trade policies, and geopolitical tensions. Rising material costs directly impact manufacturing expenses, reducing profit margins for fastener producers and leading to potential price increases for end-users. Small and medium-sized enterprises (SMEs) are particularly vulnerable to these cost pressures, as they have limited capacity to absorb sudden material price hikes. As a result, maintaining consistent pricing strategies while ensuring product quality poses an ongoing challenge for market participants in Spain.

Intense Competition and Threat of Substitutes

The Spain industrial fasteners market faces intense competition, both from domestic manufacturers and international players operating within the European Union. Price-based competition has intensified, particularly in the standardized fasteners segment, making differentiation increasingly difficult. For example, the market has seen increased adoption of plastic fasteners and automotive tapes, which are gaining favor due to their lightweight and corrosion-resistant properties, especially in automotive manufacturing. These alternatives can offer comparable strength and performance while reducing assembly time, posing a challenge to traditional fastening solutions. To sustain market share, Spanish manufacturers must continuously innovate, enhance product quality, and deliver value-added solutions tailored to emerging industry needs.

Market Opportunities:

The Spain industrial fasteners market is poised to benefit significantly from the country’s growing emphasis on renewable energy infrastructure and technological innovation. With Spain setting ambitious targets for renewable energy capacity, there is a rising demand for high-performance fasteners used in wind turbines, solar panels, and associated infrastructure projects. Fasteners that offer enhanced durability, corrosion resistance, and the ability to withstand extreme environmental conditions are increasingly sought after. This transition toward sustainable energy sources creates a strong growth avenue for manufacturers capable of developing specialized fastening solutions tailored to the unique requirements of the energy sector. Moreover, the expansion of offshore wind projects provides additional opportunities for fastener suppliers to introduce advanced products designed for marine and harsh weather conditions.

Another promising opportunity lies in the advancement of smart manufacturing and automation across Spain’s industrial sectors. As companies invest in Industry 4.0 practices to optimize production efficiency and product quality, there is a growing need for precision-engineered fasteners that integrate seamlessly into automated assembly lines. Demand for customized, application-specific fasteners is increasing, particularly in high-growth sectors such as aerospace, electronics, and medical devices. Furthermore, the shift toward lightweight vehicles and electric mobility continues to create new requirements for innovative fastening solutions. Spanish manufacturers that invest in research and development to offer technologically advanced, eco-friendly, and cost-effective fastening systems are well-positioned to capture emerging market demand and strengthen their presence in both domestic and international markets.

Market Segmentation Analysis:

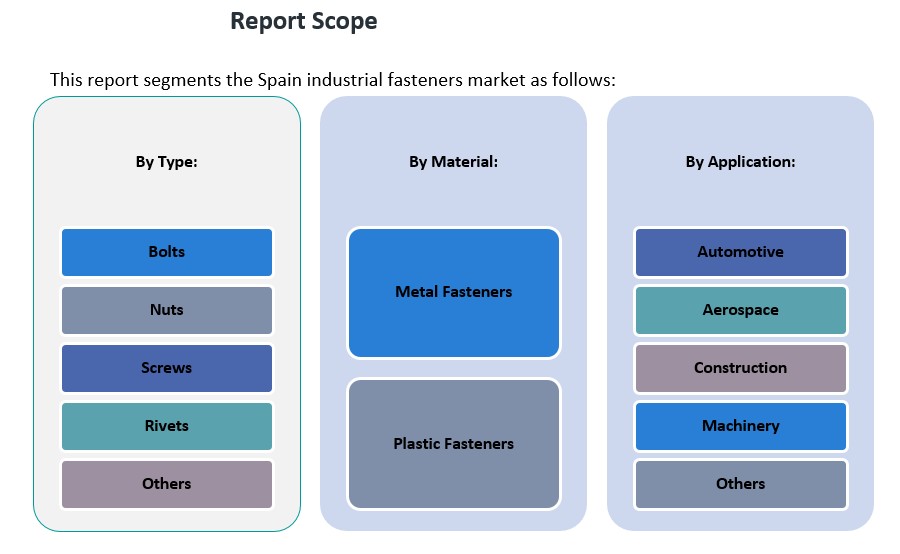

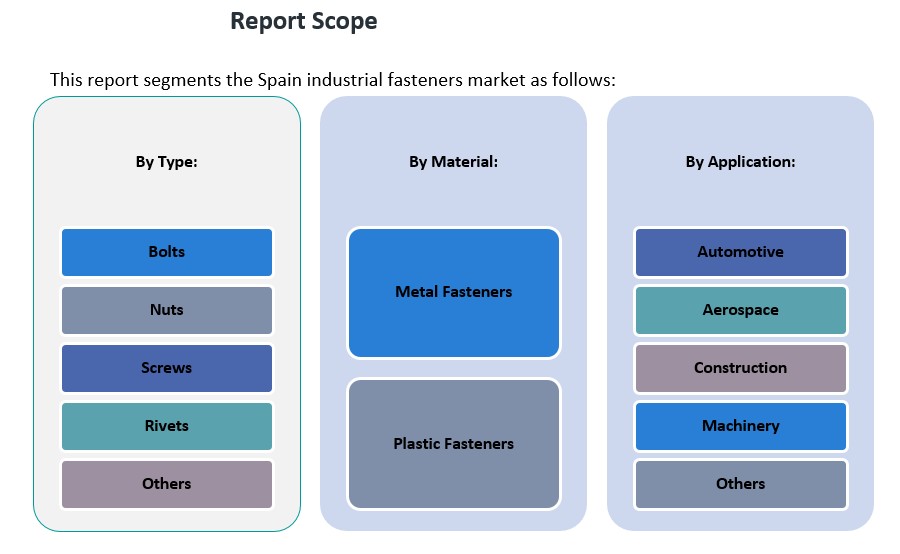

The Spain industrial fasteners market is segmented by type, application, and material, each contributing uniquely to overall market growth.

By type, bolts hold a dominant share due to their extensive use in construction, automotive, and machinery sectors, where high-strength and secure fastening is critical. Screws also account for a significant portion of demand, driven by their versatility across diverse applications. Nuts and rivets maintain steady demand, particularly in the aerospace and heavy machinery industries, while the ‘others’ segment, including washers and pins, supports specialized fastening needs.

By application, the automotive sector leads the market, propelled by Spain’s strong automotive manufacturing base and increasing adoption of lightweight vehicle designs. The construction segment follows closely, supported by robust investments in infrastructure projects and residential development. Aerospace represents a growing application area, with demand for precision-engineered fasteners capable of withstanding extreme conditions. The machinery sector continues to rely heavily on durable fastening solutions to support industrial equipment production, while the ‘others’ segment, including electronics and medical devices, presents emerging opportunities for customized fasteners.

By material, metal fasteners dominate the Spain market, offering superior strength, reliability, and durability across industrial applications. However, plastic fasteners are witnessing faster growth, particularly in sectors where weight reduction, corrosion resistance, and electrical insulation are prioritized. The increasing demand for eco-friendly and lightweight solutions is encouraging manufacturers to expand their plastic fastener portfolios, reflecting evolving market preferences.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The Spain industrial fasteners market exhibits significant regional variation, reflecting the country’s diverse industrial landscape. Catalonia leads with approximately 30% market share, driven by its robust automotive, machinery, and electronics sectors. The region’s well-established manufacturing infrastructure and proximity to European markets enhance its position as a central hub for fastener production and distribution.

The Basque Country accounts for around 25% of the market, underpinned by its strong presence in the automotive and aeronautics industries. Notably, the region contributes over 45% to Spain’s automobile production volume, with major OEMs and a dense network of suppliers operating in the area. This industrial concentration fosters demand for high-performance fasteners tailored to advanced manufacturing requirements.

Madrid holds approximately 20% of the market share, benefiting from its diversified industrial base and strategic location. The region’s emphasis on innovation and technology integration supports the adoption of specialized fastening solutions across various sectors. Andalusia contributes about 15% to the market, with its aerospace industry accounting for a significant portion of the region’s GDP. The presence of over 130 aerospace companies in Andalusia drives demand for precision-engineered fasteners capable of meeting stringent industry standards.

The remaining 10% of the market is distributed among other regions, including Valencia and Asturias, which have emerging industrial activities in construction and machinery manufacturing. These areas are gradually increasing their share in the fasteners market through investments in infrastructure and industrial development.

Key Player Analysis:

- LISI Group

- The Würth Group

- Bulten AB

- Bossard Group

- EJOT Holding GmbH & Co. KG

- Fabory Group

- Bolt & Nut Industry Ltd

- Precision Castparts Corp.

- Bufab Group

- Fischer Holding GmbH & Co.

Competitive Analysis:

The Spain industrial fasteners market is highly competitive, characterized by the presence of both domestic manufacturers and international players. Leading companies focus on technological innovation, quality enhancement, and expanding product portfolios to meet the evolving demands of end-use industries such as automotive, construction, and aerospace. Local firms benefit from proximity to key manufacturing hubs, enabling faster response times and customized solutions for clients. Meanwhile, global brands leverage advanced technologies, strong distribution networks, and strategic partnerships to strengthen their market position. Competition is further intensified by rising demand for application-specific and eco-friendly fastening solutions, encouraging companies to invest in research and development. Pricing strategies, product differentiation, and adherence to European quality standards remain critical factors influencing market leadership. As sustainability and digitalization continue to reshape industry dynamics, companies that adapt swiftly to these trends are expected to secure a competitive edge in the Spanish industrial fasteners landscape.

Recent Developments:

- In Dec 2024, Bulten AB announced a strategic partnership to establish a new manufacturing presence in Vietnam, in collaboration with ZJK Vietnam Precision Components Co., Ltd. This move is designed to meet growing demand for micro screws in the electronics industry, particularly from international customers with production in India and Vietnam. The partnership follows a similar venture in India and aligns with Bulten’s strategy to expand beyond automotive into consumer electronics and other sectors. Production in Vietnam is expected to begin in 2025, and this expansion reflects Bulten’s broader ambitions for growth in global markets, which could influence supply and competitiveness in Spain.

- In April 2024, TR Fastenings, a leading provider of industrial fasteners, launched the Plas-Tech 30-20 screws. These screws are made from modified polyphthalamide, making them particularly suitable for demanding applications in the automotive, electronics, and industrial sectors. The new product offers increased strength, reduced weight, and exceptional resistance to chemicals and moisture, addressing the challenges of harsh operating conditions. This launch highlights TR Fastenings’ commitment to expanding its portfolio with innovative solutions tailored for advanced manufacturing needs

Market Concentration & Characteristics:

The Spain industrial fasteners market exhibits moderate market concentration, with a mix of large multinational corporations and a significant number of small to medium-sized domestic players. While major international brands dominate standardized and high-volume production segments, local manufacturers are highly competitive in delivering customized and application-specific fastening solutions. The market is characterized by high product differentiation, technological innovation, and a strong emphasis on quality compliance with European standards. Flexibility, responsiveness to customer requirements, and the ability to innovate with lightweight and corrosion-resistant materials are defining features of successful players. Additionally, the market reflects a growing shift toward sustainable manufacturing practices and digitalized production processes. Strategic partnerships, mergers, and acquisitions are common, as companies seek to strengthen their regional presence and expand technological capabilities. Overall, the Spanish industrial fasteners market maintains a dynamic and innovation-driven environment, positioning it strongly within the broader European manufacturing ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand for lightweight fasteners will drive innovation in material development.

- Expansion of the electric vehicle sector will boost requirements for advanced fastening systems.

- Growth in renewable energy projects will create opportunities for corrosion-resistant fasteners.

- Rising adoption of Industry 4.0 practices will enhance manufacturing efficiency and customization.

- Sustainability initiatives will encourage the production of eco-friendly and recyclable fasteners.

- Ongoing infrastructure modernization will support consistent demand in the construction sector.

- Aerospace industry growth will fuel demand for precision-engineered and high-strength fasteners.

- Digital supply chain integration will streamline distribution and inventory management processes.

- Rising investment in R&D will accelerate the introduction of application-specific fastening solutions.

- Stronger emphasis on export strategies will help Spanish manufacturers expand into new European markets.