| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Soy-Based Chemicals Market Size 2024 |

USD 580.99 Million |

| Spain Soy-Based Chemicals Market, CAGR |

5.69% |

| Spain Soy-Based Chemicals Market Size 2032 |

USD 904.28 Million |

Market Overview

The Spain Soy-Based Chemicals Market is projected to grow from USD 580.99 million in 2024 to an estimated USD 904.28 million by 2032, with a compound annual growth rate (CAGR) of 5.69% from 2025 to 2032. This growth is driven by increasing demand for sustainable and renewable alternatives to petroleum-based chemicals across various industries.

Key drivers of this market include stringent environmental regulations, rising consumer awareness about the harmful effects of fossil fuels, and the growing adoption of bio-based sources in industries such as biodiesel, plastics, and personal care. Technological advancements in soy processing and extraction methods are enhancing the efficiency and cost-effectiveness of soy-based chemicals, further boosting their appeal as sustainable alternatives.

Geographically, Spain is witnessing increased adoption of soy-based chemicals, particularly in regions like Catalonia, which is a significant hub for chemical production. Key players in this market include Cargill, Archer Daniels Midland (ADM), Bunge Limited, and Elevance Renewable Sciences, among others. These companies are focusing on innovation and strategic partnerships to expand their product offerings and strengthen their market presence in Spain and across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spain Soy-Based Chemicals Market is projected to grow from USD 580.99 million in 2024 to USD 904.28 million by 2032, at a CAGR of 5.69% from 2025 to 2032.

- The Global Soy-Based Chemicals Market is projected to grow from USD 28,996.80 million in 2024 to USD 52,069.72 million by 2032, with a CAGR of 7.59% from 2025 to 2032.

- Increasing demand for sustainable, eco-friendly chemicals, strict environmental regulations, and consumer awareness are driving the adoption of soy-based chemicals.

- Innovations in soy processing and extraction methods are improving production efficiency, making soy-based chemicals more cost-effective.

- High production costs and reliance on imported raw materials, such as soybeans, pose challenges to the widespread adoption of soy-based chemicals.

- Spain’s key regions, especially Catalonia, are seeing strong market growth due to the presence of a robust industrial base and advanced chemical production capabilities.

- Soy-based chemicals are increasingly used in biodiesel, plastics, personal care, and food packaging, aligning with global sustainability trends.

- Leading players like Cargill, ADM, Bunge Limited, and Elevance Renewable Sciences are expanding their market share through innovation and strategic partnerships.

Market Drivers

Technological Advancements in Soy Processing:

Technological advancements in the processing and extraction of soybeans are enhancing the efficiency of soy-based chemical production, thereby boosting market growth. Innovations in enzyme technologies, biorefining processes, and extraction methods have significantly improved the yield and purity of soy-based chemicals, making them more competitive with traditional fossil fuel-based chemicals. In Spain, the growing research in biotechnology and material science is leading to the development of new soy-based products with enhanced performance characteristics. This continuous technological progress lowers production costs, improves scalability, and accelerates market adoption across various industrial applications, from biodegradable plastics to biofuels.

Rising Consumer Awareness of Health and Environmental Impact:

Rising consumer awareness about the harmful effects of synthetic chemicals on health and the environment is driving the adoption of soy-based chemicals in Spain. Consumers are becoming more conscious of the ingredients in products they use, from cosmetics and cleaning products to food packaging and personal care items. Soy-based chemicals, known for their biodegradability and non-toxicity, are increasingly preferred in formulations designed to be both effective and environmentally friendly. In response to this trend, Spanish companies are expanding their product offerings to include soy-derived ingredients in a wide range of consumer goods. This growing consumer preference is creating a fertile market environment for soy-based chemicals as an essential alternative in the sustainable product landscape.

Growing Demand for Sustainable Alternatives:

The increasing demand for eco-friendly and sustainable alternatives to petroleum-based chemicals is a key driver for the Spain Soy-Based Chemicals Market. As environmental concerns rise, industries across the globe are focusing on reducing their carbon footprint and minimizing the environmental impact of their products. Soy-based chemicals, derived from renewable plant sources, offer a viable solution to this challenge. For instance, companies like Cargill and Archer Daniels Midland are investing heavily in developing soy-based products for various applications. With regulations tightening around emissions and sustainability, soy-based chemicals are becoming a preferred choice in sectors such as automotive, packaging, agriculture, and personal care. In Spain, this shift is being driven by consumer preferences for green products and the need for compliance with stringent environmental standards.

Government Policies and Regulatory Support:

Government policies and regulatory frameworks that encourage the use of renewable resources significantly contribute to the growth of the soy-based chemicals market in Spain. The European Union’s commitment to sustainable development and its emphasis on circular economies have led to various incentives for industries that invest in bio-based and renewable chemical products. Spain’s adoption of these policies, in alignment with EU regulations, promotes the production and consumption of soy-based chemicals. For instance, the EU’s policies have led to the establishment of over 70 tables and charts showcasing findings on soy-based chemicals markets across 22 countries. This regulatory support is also reflected in subsidies, tax incentives, and research funding, which encourage innovation and investment in the production of bio-based chemicals. Companies are leveraging these incentives to develop new soy-based products and expand their market presence.

Market Trends

Expansion of Bio-Based Product Applications

The Spain Soy-Based Chemicals Market is experiencing robust growth in the adoption of bio-based products across multiple industries. Soy-based chemicals such as polyols, fatty acids, and methyl soyate are increasingly used in the manufacturing of biodegradable plastics, adhesives, and coatings. For instance, in the construction and automotive sectors, soybean oil-based polyols are extensively utilized in spray foam insulation, adhesives, and durable polyurethane foams for seats and interior panels. Major automotive manufacturers like Toyota have integrated soy-based polyurethane foams into vehicle interiors, resulting in a reduction of component weight by 8 units and improved thermal stability. In the United States, Ford’s use of soy-based polyols in seat cushions and headrests has led to a reduction of over 5 million pounds in annual petroleum consumption. In Spain, companies such as Elian Barcelona process more than 740,000 tons of soybeans annually, primarily for the feed sector, but are now expanding into the production of concentrated and textured proteins for human consumption, targeting the alternative and plant-based foods market. Elian Barcelona plans to process at least 10,000 hectares of locally produced non-GMO soybeans annually once its second plant becomes operational, with a minimum of 500 hectares expected by 2025. These strategic moves not only support environmental sustainability but also enhance the marketability of products in environmentally conscious markets.

Technological Advancements in Soy Processing

Technological innovation in biotechnology and chemical engineering is significantly improving the efficiency and scalability of soy processing. Techniques such as enzyme-assisted extraction and advanced fermentation are increasing the yield and purity of soy-based chemicals, directly reducing production costs and making them more competitive with petrochemical alternatives. For instance, global leaders in soy oil extraction and processing, such as Cargill and ADM, have invested in developing specialized polyols for polyurethane foams, enhancing biodegradability and material performance. In Spain, the collaboration between research institutions like Agrotecnio and industry players such as Elian Barcelona is driving innovation. Their joint project aims to achieve a cultivation area of 10,000 hectares per year of high-protein soybeans, with comprehensive agronomic advisory and research activities to optimize yield and crop quality. This includes field trials to validate innovative practices that reduce costs and enhance productivity, as well as technical support for farmers at all stages of cultivation. Additionally, Spain’s soybean crushing capacity stands at nearly 3.5 million metric tons, divided among four major crushing plants operated by leading global companies. The average annual domestic soybean oil extraction is 550,000 metric tons, with most of the output exported to third countries, reflecting the country’s strategic role in the European soy supply chain.

Integration into Circular Economy Models

The integration of soy-based chemicals into circular economy models is gaining momentum in Spain. These chemicals are biodegradable and can be recycled or repurposed, minimizing waste and reducing environmental impact. Industries are increasingly adopting soy-based materials in packaging and product design to align with circular economy principles. This approach not only supports sustainability goals but also meets the growing regulatory requirements for waste reduction and resource efficiency. Spain’s commitment to circular economy initiatives is driving the adoption of soy-based chemicals as a viable solution for sustainable industrial practices.

Consumer Preference for Clean Label Products

There is a notable shift in consumer preference towards clean label products, which are perceived as healthier and more transparent. In Spain, this trend is influencing the food and personal care industries to incorporate soy-based ingredients, such as lecithin and isoflavones, into their formulations. These ingredients are valued for their natural origin and functional benefits. The demand for clean label products is prompting manufacturers to reformulate existing products and develop new offerings that cater to the health-conscious and environmentally aware consumer base. This shift is not only enhancing product appeal but also driving the growth of the soy-based chemicals market in Spain.

Market Challenges

High Production Costs and Raw Material Availability

One of the primary challenges in the Spain Soy-Based Chemicals Market is the relatively high production costs associated with soy-based chemicals. For instance, companies involved in the production of soybean oil must invest in complex processing steps that include cleansing, drying, and dehulling the soybeans before extracting the oil, a process that requires significant capital investment and operating expenses according to cost analysis reports from industry consultants. The supply chain for soy-based chemicals is notably intricate, often involving multiple intermediaries such as traders, crushers, and feed manufacturers before the product reaches end users in Spain. This multi-tiered structure increases logistical complexity and makes it difficult for companies to trace the origin of the soy used in their products, as highlighted in guidance for responsible sourcing. Furthermore, Spain’s heavy reliance on imported soybeans from South America exposes companies to additional risks, such as trade disruptions and fluctuating raw material availability. Companies processing soy into meal and oil for industrial applications must also contend with the challenge of ensuring traceability and compliance with environmental standards, given that batches are frequently mixed during international transit and storage. These operational realities, reported by procurement and sustainability experts, illustrate the persistent cost and supply chain barriers facing Spanish firms in the soy-based chemicals sector.

Limited Consumer Awareness and Market Education

Another significant challenge facing the Spain Soy-Based Chemicals Market is the limited consumer awareness of the benefits and applications of soy-based chemicals. While environmental sustainability is a growing concern among consumers, there remains a lack of widespread understanding of how soy-based chemicals can contribute to reducing the carbon footprint and promoting greener alternatives in everyday products. This challenge extends to industries that are traditionally reliant on petrochemical-based solutions, such as automotive, construction, and packaging. In many cases, the switch to soy-based chemicals is perceived as an unnecessary or costly investment, especially when companies are already established with conventional materials. To overcome this barrier, market players must invest in consumer education and awareness campaigns that highlight the benefits of soy-based products, both in terms of sustainability and performance. Collaboration between industry stakeholders, government bodies, and research institutions could help foster a more informed market that is better equipped to adopt and scale soy-based solutions. However, overcoming these hurdles requires time and concerted efforts to change perceptions and drive demand for sustainable products.

Market Opportunities

Expansion of Sustainable Packaging Solutions

A significant market opportunity in the Spain Soy-Based Chemicals Market lies in the growing demand for sustainable packaging solutions. As environmental concerns about plastic pollution and non-biodegradable materials intensify, industries are increasingly turning to bio-based alternatives for packaging. Soy-based chemicals, particularly soy-based polyols and resins, are gaining traction as ingredients in biodegradable packaging materials. These materials offer the dual benefit of reducing the environmental impact of packaging while maintaining the functionality and durability required by industries such as food and beverages, cosmetics, and e-commerce. Spain’s commitment to reducing plastic waste and meeting EU environmental regulations presents an ideal environment for the adoption of soy-based chemicals in packaging. With the global shift towards a circular economy, there is substantial growth potential for companies involved in the production of soy-derived packaging materials. Companies that innovate in this space can capture a share of the expanding eco-conscious consumer market, positioning themselves as leaders in sustainability.

Growth in Bio-Based Chemical Demand Across Multiple Industries

The demand for bio-based chemicals is expected to rise significantly across various industries, providing a lucrative opportunity for the Spain Soy-Based Chemicals Market. As sectors such as automotive, agriculture, personal care, and textiles continue to prioritize sustainability, the adoption of soy-based chemicals as an alternative to petrochemical-based products is becoming more prevalent. Soy-based chemicals offer environmental benefits, such as biodegradability and reduced toxicity, making them increasingly attractive to manufacturers in these industries. With growing consumer awareness of environmental issues, brands in Spain are under pressure to adopt more sustainable practices, further driving the demand for soy-based chemical solutions. The ability to cater to multiple industrial applications provides market players with diverse growth avenues, especially as regulatory frameworks continue to favor eco-friendly alternatives.

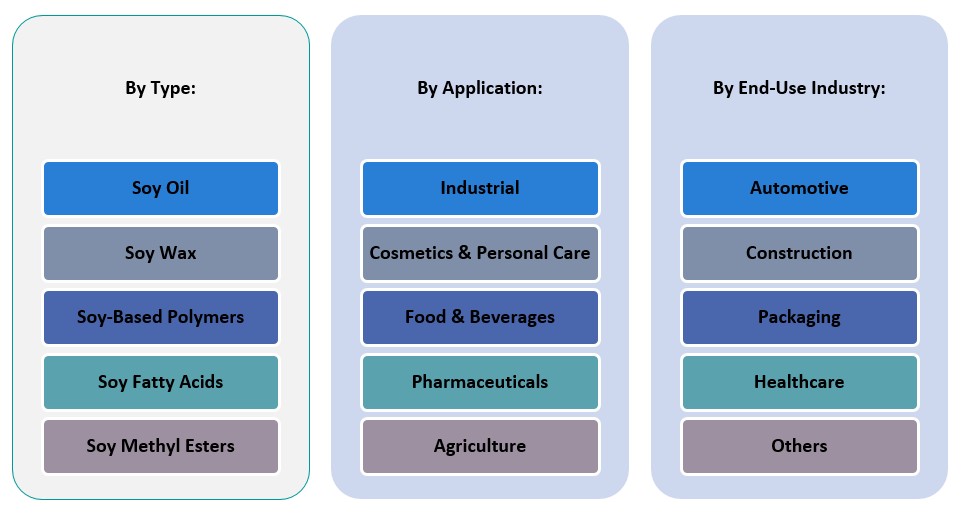

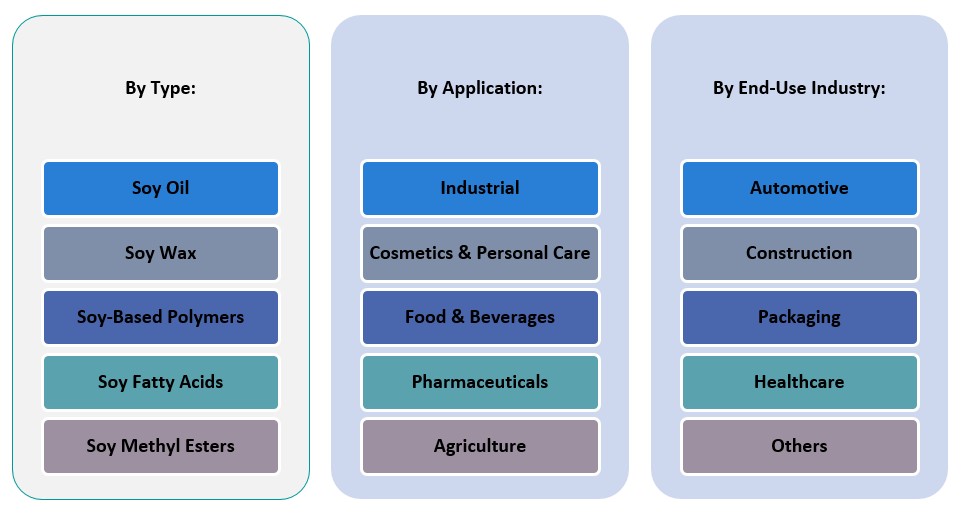

Market Segmentation Analysis

By Type:

The market includes key product types such as Soy Oil, Soy Wax, Soy-Based Polymers, Soy Fatty Acids, and Soy Methyl Esters. Soy oil remains a major component in the market due to its widespread use in industries such as food and cosmetics, owing to its moisturizing and emulsifying properties. Soy wax, derived from hydrogenated soybean oil, is gaining popularity in the candle-making and personal care industries due to its natural and biodegradable qualities. Soy-based polymers, primarily used in plastics and coatings, are growing in demand as companies transition towards more sustainable alternatives to traditional petrochemical-based plastics. Soy fatty acids are used in soaps, detergents, and lubricants, providing a renewable option with improved biodegradability. Finally, soy methyl esters, which are widely used in biodiesel production, are essential for the sustainable energy sector.

By Application:

The applications of soy-based chemicals span various industries, including Industrial, Cosmetics & Personal Care, Food & Beverages, Pharmaceuticals, and Agriculture. In the industrial sector, soy-based chemicals are employed in coatings, lubricants, and adhesives, thanks to their non-toxic, biodegradable, and sustainable properties. The cosmetics and personal care segment is rapidly adopting soy-derived ingredients like soy protein, oil, and wax in formulations for their nourishing properties. In the food and beverage sector, soy-based chemicals are used as emulsifiers, stabilizers, and fat replacements. Soy is also gaining ground in the pharmaceutical industry for the production of excipients and drug delivery systems. In agriculture, soy-based chemicals are used in fertilizers, pesticides, and herbicides, contributing to more eco-friendly farming practices.

Segments

Based on Type

- Soy Oil

- Soy Wax

- Soy-Based Polymers

- Soy Fatty Acids

- Soy Methyl Esters

Based on Application

- Industrial

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Agriculture

Based on End Use Industry

- Automotive

- Construction

- Packaging

- Healthcare

- Others

Based on Region

- Catalonia

- Andalusia

- Valencia

- Madrid

Regional Analysis

Catalonia (35%)

Catalonia is the leading region in the Spain Soy-Based Chemicals Market, commanding a significant share of approximately 35% of the market. This is largely due to the region’s established industrial infrastructure, which includes major chemical manufacturers and a strong presence of companies focusing on sustainable solutions. Barcelona, as the economic hub, serves as the center for innovation and research in bio-based chemicals, including soy derivatives. The region’s focus on green technologies and eco-friendly solutions, coupled with its proximity to Mediterranean ports, allows for efficient trade and distribution of soy-based chemicals. Catalonia’s progressive stance on sustainability and circular economy models positions it as a key player in the adoption of soy-based chemicals in the packaging, automotive, and consumer goods sectors.

Madrid (30%)

Madrid, as the capital and a commercial powerhouse, holds around 30% of the market share. The city’s strong commercial infrastructure, coupled with its role as a policymaking center, facilitates the implementation of government regulations that support sustainable industries. Madrid also has a thriving business environment that encourages innovation in soy-based chemicals, especially in industries like cosmetics and pharmaceuticals. The region’s role as a major center for corporate offices and research institutions also fosters collaborations and partnerships aimed at developing sustainable products. The growing demand for eco-friendly packaging solutions and bio-based ingredients in personal care products further accelerates the region’s market growth.

Key players

- BASF SE

- Solvay S.A.

- Evonik Industries AG

- Croda International Plc

- Clariant AG

- Oleon NV

- Arkema S.A.

- Akzo Nobel N.V.

- Neste Oyj

- Perstorp Holding AB

Competitive Analysis

The Spain Soy-Based Chemicals Market is highly competitive, with key players focusing on sustainable production and eco-friendly chemical solutions. BASF SE, a global leader in the chemical industry, offers a diverse portfolio of soy-based chemicals, with a strong emphasis on innovation and environmental impact reduction. Solvay S.A. and Evonik Industries AG are also significant players, leveraging their expertise in biotechnology and advanced materials to develop soy-derived products for industries such as automotive and agriculture. Croda International Plc and Clariant AG continue to enhance their product offerings by integrating bio-based alternatives into their supply chains, responding to the growing demand for sustainable solutions. Smaller players like Oleon NV and Perstorp Holding AB are strategically positioning themselves by focusing on high-value applications in cosmetics and pharmaceuticals. The market’s competitiveness is further intensified by new entrants from renewable energy sectors, such as Neste Oyj, which is pioneering the use of renewable feedstocks in chemical production.

Recent Developments

- On October 7, 2024, Evonik and BASF agreed on the first delivery of biomass-balanced ammonia, achieving a product carbon footprint reduction of over 65%. This collaboration supports Evonik’s sustainable product lines like VESTAMIN IPD eCO and VESTAMID eCO.

- On February 26, 2025, Arkema announced a 15% expansion of its polyvinylidene fluoride (PVDF) production capacity at its Calvert City, Kentucky plant. This $20 million investment aims to meet the growing demand for high-performance resins in electric vehicles and energy storage systems.

- On February 25, 2025, AkzoNobel offered to acquire powder coatings assets and the International Research Center from its subsidiary in India. This move is part of the company’s strategy to focus more on liquid paints and coatings in the Indian market.

- In February 2025, Perstorp Holding AB began ester production at its Amsterdam plant, marking a significant step in expanding its product offerings in the sustainable chemicals sector.

Market Concentration and Characteristics

The Spain Soy-Based Chemicals Market exhibits moderate market concentration, with a few large multinational companies dominating the industry alongside several regional players. Key industry leaders such as BASF SE, Solvay S.A., and Evonik Industries AG hold significant market shares due to their extensive product portfolios and strong global presence. These companies leverage advanced technologies and sustainable practices to maintain their competitive edge. However, there is also a growing presence of niche players like Oleon NV and Perstorp Holding AB, focusing on specific applications such as cosmetics and pharmaceuticals. The market is characterized by increasing demand for bio-based and environmentally friendly products, leading to innovation and a shift towards renewable feedstocks. As sustainability becomes a central theme, market players are investing in research and development to expand their soy-based chemical offerings and capitalize on the rising consumer preference for eco-friendly alternatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Spain Soy-Based Chemicals Market is projected to experience steady growth, driven by increasing demand for sustainable and bio-based alternatives across various industries.

- Ongoing innovations in soy chemical processing technologies are expected to enhance production efficiency and reduce costs, making soy-based chemicals more competitive with traditional petrochemical products.

- There is a growing trend towards the use of soy-based chemicals in bio-based plastics, polymers, and composites, particularly in the automotive and packaging industries, aligning with the shift towards circular economy models.

- Rising consumer awareness and preference for eco-friendly products are driving the adoption of soy-based chemicals in sectors such as cosmetics, personal care, and food packaging.

- Government policies and regulations promoting the use of renewable resources and reducing carbon emissions are expected to bolster the demand for soy-based chemicals in Spain.

- The increasing demand for renewable energy sources is anticipated to drive the growth of soy-based biodiesel production, contributing to the expansion of the soy chemicals market.

- Research and development efforts are focused on creating soy-based chemicals with enhanced performance characteristics, broadening their applicability across various industries.

- Collaborations between industry players, research institutions, and government bodies are expected to accelerate innovation and market penetration of soy-based chemical products.

- Key regions in Spain, such as Catalonia and Andalusia, are likely to see increased production and consumption of soy-based chemicals, driven by strong industrial bases and supportive infrastructure.

- The market is expected to witness intensified competition, with both established companies and new entrants focusing on innovation, sustainability, and cost-effectiveness to capture market share.