| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Pea Proteins Market Size 2024 |

USD 44.66 Million |

| Spain Pea Proteins Market, CAGR |

10.26% |

| Spain Pea Proteins Market Size 2032 |

USD 97.58 Million |

Market Overview:

The Spain Pea Proteins Market is projected to grow from USD 44.66 million in 2024 to an estimated USD 97.58 million by 2032, with a compound annual growth rate (CAGR) of 10.26% from 2024 to 2032.

The growth of the Spain pea protein market is primarily driven by the increasing consumer demand for plant-based, sustainable, and healthy food alternatives. Health-conscious consumers are shifting towards plant-based proteins due to their nutritional benefits, such as being hypoallergenic, gluten-free, and easily digestible. The rising popularity of vegan, vegetarian, and flexitarian diets is further fueling this trend, as individuals look for protein sources that align with their dietary preferences and ethical values. Additionally, the environmental impact of food production is becoming a significant consideration, and pea protein offers a more sustainable alternative to animal-based proteins, requiring fewer resources to produce and contributing to lower carbon emissions. Product innovation in the pea protein sector, such as improvements in taste, texture, and functionality, has expanded its application in a wide range of products, including meat substitutes, dairy alternatives, and nutritional supplements, making it more appealing to a broader consumer base.

Spain holds a prominent position in the European pea protein market, benefiting from a combination of favorable agricultural conditions and a growing consumer base for plant-based foods. The country’s agriculture sector, particularly its pea cultivation, is well-developed, providing a strong domestic supply of raw materials for pea protein production. Spain’s strategic location within Europe also allows it to act as a key hub for the distribution of pea protein to other European markets. Furthermore, the increasing adoption of plant-based diets across Spain, especially in urban areas, is driving the demand for plant-based proteins like pea protein. As awareness around health and sustainability grows, Spanish consumers are increasingly choosing products that align with these values, positioning Spain as an important market for the continued growth of pea protein in Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Spain Pea Proteins Market is projected to grow from USD 44.66 million in 2024 to USD 97.58 million by 2032, with a CAGR of 10.26% from 2024 to 2032.

- The global pea proteins market is projected to grow from USD 2,229.15 million in 2024 to USD 5,618.92 million by 2032, at a CAGR of 12.25%.

- Increasing consumer demand for plant-based, sustainable, and healthy food alternatives is the primary driver of market growth, with health-conscious consumers turning to pea protein for its hypoallergenic, gluten-free, and easily digestible properties.

- The adoption of vegan, vegetarian, and flexitarian diets in Spain is contributing significantly to the demand for pea protein as consumers seek alternatives to animal-based proteins.

- Sustainability concerns are fueling the market’s expansion, as pea protein is seen as a more environmentally friendly option, requiring fewer resources and having a lower carbon footprint compared to animal-based proteins.

- Innovation in the pea protein sector has improved its versatility, with advances in taste, texture, and functionality expanding its application in meat substitutes, dairy alternatives, snacks, and supplements.

- Despite its growth potential, the market faces challenges related to the high cost of production, which can make pea protein-based products less competitive in price compared to other protein sources.

- Spain’s favorable agricultural conditions and strategic location within Europe provide a strong domestic supply of raw materials and an opportunity to expand pea protein distribution across the European market.

Market Drivers:

Health and Wellness Trends

The growing awareness of health and wellness among consumers is one of the primary drivers of the Spain pea protein market. As more individuals adopt healthier lifestyles, they are increasingly turning to plant-based diets, which are perceived as beneficial for overall well-being. Pea protein, being a hypoallergenic, gluten-free, and easily digestible protein source, aligns with the rising demand for clean-label, nutrient-dense foods. For instance, the British Nutrition Foundation notes that pea protein’s low fat and cholesterol content, high digestibility, and complete amino acid profile make it particularly attractive to health-conscious consumers seeking to maintain optimal nutrition while reducing animal protein consumption. Consumers are seeking alternatives to traditional animal-based proteins due to concerns about cholesterol, saturated fat, and the negative impact of animal agriculture on health. As a result, pea protein is gaining popularity, particularly among health-conscious individuals, athletes, and those with dietary restrictions.

Sustainability and Environmental Concerns

Environmental sustainability plays a significant role in driving the growth of the pea protein market in Spain. As concerns about climate change and resource depletion increase, consumers are becoming more conscious of the environmental impact of their food choices. Plant-based proteins, such as pea protein, are seen as more sustainable alternatives to animal-based proteins, requiring fewer resources such as land, water, and energy for production. For example, Nordzucker AG invested over EUR 100 million to expand its production site for sustainable yellow peas and installed a plant-based protein processing plant in Lower Saxony, Germany, focusing on locally cultivated peas to reduce carbon footprint and resource use. Moreover, pea protein cultivation has a lower carbon footprint compared to meat production, making it an attractive option for eco-conscious consumers. The shift toward plant-based diets, driven by sustainability concerns, is thus accelerating the adoption of pea protein in Spain.

Rising Popularity of Plant-Based Diets

The adoption of plant-based, vegetarian, and flexitarian diets is another key factor driving the demand for pea protein in Spain. As individuals seek to reduce their meat consumption for health or ethical reasons, plant-based proteins are gaining traction as viable alternatives. The flexibility of pea protein, which can be easily incorporated into various food applications such as meat substitutes, dairy-free products, and protein supplements, makes it particularly appealing to those transitioning to a plant-based diet. This dietary shift is further fueled by the growing availability of pea protein-based products in supermarkets and restaurants, making plant-based eating more accessible to the Spanish population.

Product Innovation and Versatility

Innovation within the pea protein sector is driving the market growth by enhancing the appeal of pea protein in a wide range of food products. Advances in food technology have significantly improved the texture, taste, and nutritional profile of pea protein, making it more versatile and suitable for various consumer preferences. These innovations have expanded its applications beyond traditional protein powders to include meat alternatives, dairy substitutes, snack foods, and ready-to-eat meals. The growing product diversification, coupled with ongoing improvements in the sensory qualities of pea protein, has attracted a broader consumer base, including those who are not strictly plant-based but seek to incorporate more plant proteins into their diets for health or environmental reasons. This continuous innovation strengthens the position of pea protein in the Spanish market, supporting its future growth prospects.

Market Trends:

Shift Towards Plant-Based Meat Alternatives

One of the prominent trends in the Spain pea protein market is the rising demand for plant-based meat alternatives. As Spanish consumers continue to embrace plant-based diets, the popularity of meat substitutes made from pea protein is increasing. These products, such as plant-based burgers, sausages, and nuggets, are becoming common in grocery stores and restaurants across the country. The demand for these alternatives is driven by both environmental concerns and health-conscious consumers seeking to reduce their meat consumption. As the quality and variety of these meat substitutes improve, with pea protein serving as a key ingredient, the market for plant-based meat products continues to expand, positioning Spain as a growing hub for plant-based innovation in Europe. For example, Zyrcular Foods opened a dedicated alternative protein facility in Barcelona province in 2020, with a capacity to produce up to 1,000,000 kg of alternative protein products annually for third parties, supermarkets, and restaurants.

Consumer Preference for Clean Label Products

Another significant trend is the rising consumer preference for clean label products, which are free from artificial ingredients, preservatives, and additives. This shift is particularly evident in the Spanish food and beverage sector, where consumers are becoming more discerning about the ingredients in the products they purchase. Pea protein, known for its natural origin and simple composition, aligns with the clean label movement. As more consumers seek products that are transparent in terms of their ingredients and nutritional value, pea protein is increasingly being incorporated into clean label offerings. This trend is shaping the way manufacturers develop and market plant-based products in Spain, with an emphasis on authenticity and sustainability.

Expanding Product Applications in Functional Foods

The growing trend of functional foods, which provide additional health benefits beyond basic nutrition, is another factor influencing the Spain pea protein market. Pea protein is being incorporated into a wide range of functional food products, such as protein-enriched snacks, dairy alternatives, and nutritional supplements. For example, Roquette’s Nutralys S85F is designed for use in nutritional beverages, while Nutralys S85M offers enhanced solubility and is suitable for functional food applications. This expansion is driven by the increasing demand for foods that support active lifestyles, weight management, and muscle recovery. As consumers become more aware of the benefits of consuming plant-based proteins, manufacturers are exploring innovative ways to incorporate pea protein into functional foods. This trend is particularly appealing to athletes, fitness enthusiasts, and health-conscious individuals seeking convenient, nutritious products.

Emerging Focus on Plant-Based Beverages

The demand for plant-based beverages, including protein-enriched plant milks and smoothies, is another significant trend shaping the Spain pea protein market. As more consumers turn to plant-based alternatives to dairy, pea protein is emerging as a preferred ingredient due to its neutral taste and high nutritional value. The growth of the plant-based beverage market in Spain is being fueled by rising lactose intolerance rates, as well as consumer interest in reducing dairy consumption for health or ethical reasons. Pea protein is being increasingly used in the formulation of plant-based milk, protein shakes, and smoothies, providing a sustainable and nutritious alternative to dairy-based options. This trend is contributing to the overall expansion of the pea protein market, with manufacturers capitalizing on the growing demand for plant-based beverages.

Market Challenges Analysis:

High Cost of Production

One of the key challenges facing the Spain pea protein market is the relatively high cost of production compared to other protein sources. While pea protein offers several health and environmental benefits, its production process involves significant costs, including the cultivation of peas, processing, and refinement. These higher costs are often passed on to consumers, which can make pea protein-based products less competitive in price compared to traditional animal-based proteins or other plant-based protein alternatives such as soy. As a result, price-sensitive consumers may be hesitant to fully embrace pea protein-based products, limiting the growth of the market in some segments.

Supply Chain and Raw Material Constraints

The supply chain for pea protein production in Spain faces certain limitations, particularly in terms of the availability and cost of raw materials. While Spain has favorable agricultural conditions for cultivating peas, the scale of production is still relatively small compared to major producers like Canada or the United States. This can result in supply shortages, price volatility, and reliance on imports to meet the growing demand for pea protein. Furthermore, fluctuations in the availability of peas due to weather conditions or agricultural challenges can disrupt the supply chain, impacting the overall market stability and production capacity in Spain. For instance, Europe suffered from low yields, with crops in France being severely damaged by wet weather during harvest

Consumer Awareness and Education

Despite the increasing popularity of plant-based diets, many Spanish consumers remain unaware of the benefits and versatility of pea protein. While the market is growing, there is still a need for greater consumer education around the nutritional advantages and functional uses of pea protein in food products. Without sufficient awareness, consumers may continue to favor more established alternatives, such as soy or whey protein, which can pose a barrier to broader adoption of pea protein. Manufacturers must invest in educating the market to overcome this challenge and drive demand.

Regulatory and Market Access Barriers

The regulatory landscape surrounding plant-based proteins in Spain and the European Union can also present challenges. Regulations related to food labeling, ingredient claims, and safety standards can vary across markets, potentially creating barriers to entry for new brands or product lines. Additionally, as the demand for pea protein increases, manufacturers may face challenges in meeting regulatory requirements for new formulations or product innovations. This could slow down market expansion and innovation in the sector.

Market Opportunities:

The Spain pea protein market presents significant opportunities driven by the growing demand for plant-based, sustainable, and health-conscious food products. As consumers increasingly adopt vegan, vegetarian, and flexitarian diets, there is a rising demand for high-quality plant-based protein alternatives. Pea protein, known for its nutritional benefits, hypoallergenic properties, and versatility, is well-positioned to meet these consumer preferences. The expanding trend of plant-based meat alternatives and dairy-free products offers a lucrative opportunity for manufacturers to innovate and create new products using pea protein. Furthermore, the market for functional foods, which provide additional health benefits, is rapidly growing, with pea protein serving as a key ingredient in protein-enriched snacks, beverages, and nutritional supplements.

Additionally, Spain’s strategic location within the European market offers access to a wide range of export opportunities. With increasing consumer awareness about environmental sustainability and the need for eco-friendly food options, pea protein’s lower environmental footprint compared to animal-based proteins positions it as a key player in the growing sustainable food sector. The Spanish market, with its established agricultural infrastructure and consumer demand for plant-based foods, presents an attractive entry point for companies looking to expand their presence in Europe. As product innovations continue to improve the texture, taste, and functionality of pea protein, new market segments and product categories will emerge, further driving growth in the Spain pea protein market.

Market Segmentation Analysis:

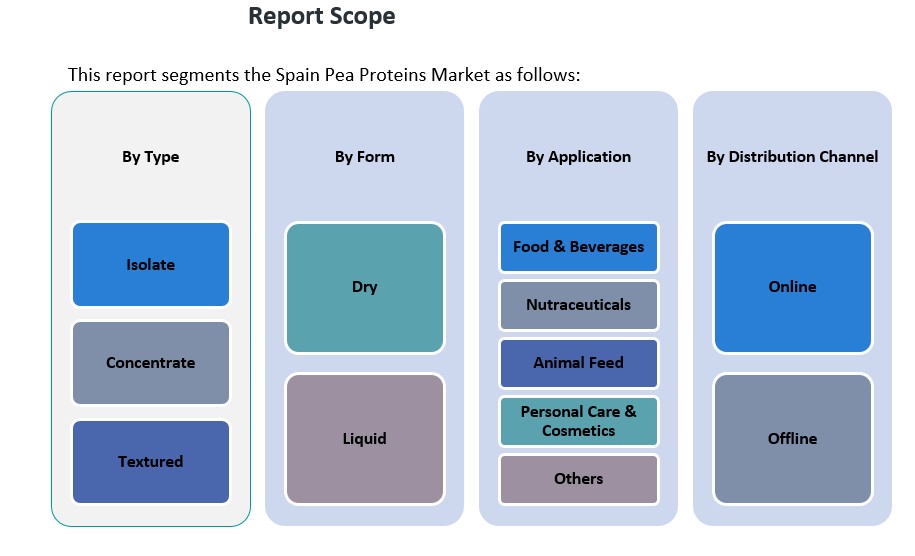

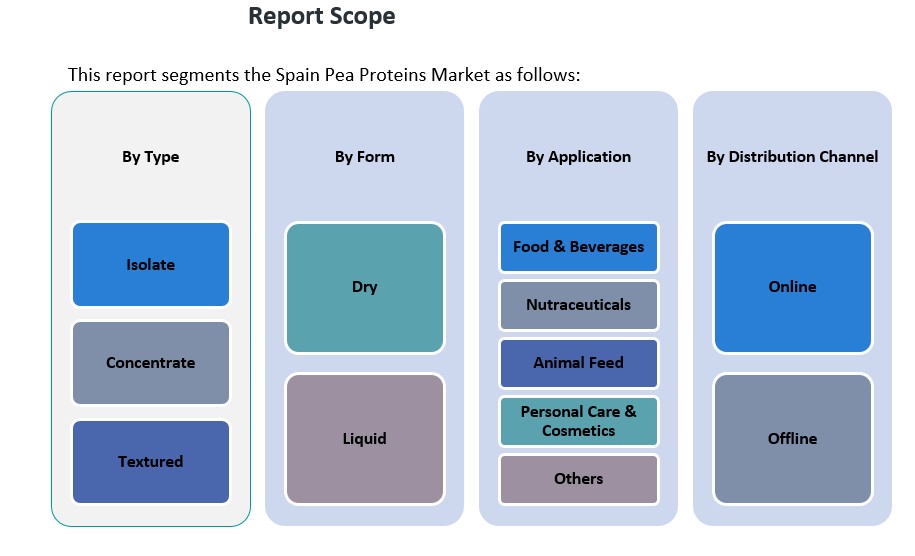

The Spain pea protein market can be segmented by type, application, form, and distribution channel.

By Type: The market is primarily divided into three types: isolate, concentrate, and textured. Isolate holds the largest market share due to its high protein content and versatility in various food products, particularly in meat alternatives and protein-enriched snacks. Concentrates are also gaining popularity for their cost-effectiveness and suitability in applications such as plant-based beverages and functional foods. Textured pea protein is increasingly used in meat substitutes, providing texture and structure to plant-based products, thus attracting interest from manufacturers looking to replicate the texture of animal-based proteins.

By Application: The major applications of pea protein include food & beverages, nutraceuticals, animal feed, and personal care & cosmetics. The food and beverage segment is the largest due to the increasing demand for plant-based meat and dairy alternatives. The nutraceuticals segment is growing as consumers seek plant-based protein supplements for health and wellness purposes. Pea protein’s use in animal feed is also expanding, driven by its nutritional benefits. In the personal care & cosmetics industry, pea protein is used in skin and hair care products due to its moisturizing and nourishing properties.

By Form: The market is segmented into dry and liquid forms. Dry pea protein is preferred for use in powders and functional food applications, while liquid pea protein is increasingly used in beverages and ready-to-eat products.

By Distribution Channel: The market is divided into online and offline channels, with the online segment experiencing rapid growth due to the rise of e-commerce and consumer preference for convenient shopping. The offline channel remains significant, with traditional retail outlets and health food stores continuing to drive sales.

Segmentation:

By Type

- Isolate

- Concentrate

- Textured

By Application

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

By Form

By Distribution Channel

Regional Analysis:

The Spain pea protein market is part of the broader European market, which is experiencing significant growth driven by shifting consumer preferences toward plant-based products. Spain, with its strategic location in Southern Europe, plays an important role in the regional expansion of the pea protein market. The market dynamics in Spain are influenced by a combination of health-conscious consumers, sustainability trends, and the increasing adoption of plant-based diets. Spain’s domestic demand for plant-based protein alternatives is fueled by the growing popularity of vegan, vegetarian, and flexitarian diets, which are also gaining traction across neighboring European markets.

Spain holds approximately 10% of the European pea protein market share, positioning it as one of the key players in the region. The demand for pea protein in Spain is driven by the rapid adoption of plant-based meat and dairy alternatives. Major urban areas such as Madrid and Barcelona are experiencing a surge in demand for plant-based products, with a growing number of restaurants, retailers, and consumers opting for plant-based food options. Additionally, the Spanish food industry is becoming more innovative, incorporating pea protein into new product categories such as protein-enriched snacks, beverages, and nutraceuticals, which further contributes to market growth.

In terms of regional influence, Spain is influenced by the broader European market trends, particularly in Western and Northern Europe. Countries such as Germany, the UK, and France lead the European market for pea protein, but Spain is poised to capture an increasing share due to its favorable agricultural conditions and the rising consumer preference for plant-based protein sources. Spain’s climate is conducive to pea cultivation, which supports the supply of raw materials for pea protein production. This enables local manufacturers to maintain a steady supply of pea protein, further strengthening Spain’s role in the European market.

Key Player Analysis:

- Roquette Frères

- Cosucra Groupe Warcoing

- Burcon NutraScience Corporation

- Emsland Group

- Shandong Jianyuan Group

- Naturz Organics

- Fenchem Biotek Ltd.

- Kerry Group

- Sotexpro

- Meelunie B.V.

Competitive Analysis:

The Spain pea protein market is experiencing significant growth, attracting both established international players and emerging local companies. Global leaders such as Roquette Frères, Ingredion Incorporated, and Cosucra Groupe Warcoing SA have a strong presence in the European market, leveraging their extensive research capabilities and established distribution networks to maintain market leadership. These companies offer a range of pea protein products, including isolates, concentrates, and textured variants, catering to the diverse needs of the food and beverage industry. In Spain, local companies are also making notable strides in the pea protein sector. For instance, Protein Gastronomy, founded by Toni Solé, focuses on producing 100% natural plant-based proteins using freeze-drying techniques to preserve nutritional properties. Their products, available in various flavors, are sold through their website, sports centers, and health stores, with plans to expand into supermarkets. This emphasis on transparency and quality control resonates with the growing consumer demand for clean-label, sustainable products. The competitive landscape in Spain’s pea protein market is characterized by a mix of global and local players, each contributing to the market’s expansion through innovation, quality, and strategic partnerships. As consumer preferences continue to shift towards plant-based diets, the market is expected to witness further diversification and growth.

Recent Developments:

- In July 2024, Barcelona-based food tech company Heüra Foods made a significant move in the Spain pea proteins market by securing €40 million in a Series B financing round. This investment was led by Dutch Upfield Holdings BV, with participation from Unovis Asset Management (New York), the European Circular Bioeconomy Fund (Germany), and Belgian New Tree Impact.

- In March 2025, Daily Harvest introduced its Organic Pea Protein Powder, designed to offer a clean, allergen-friendly protein boost for smoothies and breakfast bowls. This new product contains only USDA-certified organic pea protein, free from additives, fillers, artificial sweeteners, seed oils, and preservatives, and provides 24 grams of plant-based protein per serving. The powder is tested for heavy metals, is highly digestible, and is suitable for those with common allergies, continuing Daily Harvest’s commitment to clean, simple ingredients and meeting customer demand for high-quality, convenient protein options.

- In February 2024, Roquette expanded its NUTRALYS® plant protein range by launching four new multifunctional pea protein ingredients: NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured), and NUTRALYS® T Pea 700M (textured). These ingredients are designed to improve taste, texture, and application versatility in plant-based foods and high-protein nutritional products, enabling food manufacturers to develop innovative meat alternatives, nutritional bars, protein drinks, and dairy alternatives. This launch reflects Roquette’s ongoing investment in plant protein innovation and its mission to support food manufacturers in creating appealing plant-based products.

Market Concentration & Characteristics:

The Spain pea protein market is characterized by a moderate level of concentration, with a mix of established international players and emerging local companies. Global companies such as Roquette Frères, Ingredion Incorporated, and Cosucra Groupe Warcoing SA have a significant presence in the European market, leveraging their extensive research capabilities and established distribution networks. These companies offer a range of pea protein products, including isolates, concentrates, and textured variants, catering to the diverse needs of the food and beverage industry. In Spain, local companies like Protein Gastronomy are also making notable strides in the pea protein sector, focusing on producing 100% natural plant-based proteins using innovative techniques to preserve nutritional properties. This blend of global and local players contributes to a competitive market landscape, fostering innovation and catering to the growing demand for plant-based protein alternatives. The market is also characterized by its dynamic nature, driven by evolving consumer preferences and technological advancements. There is a notable shift towards plant-based diets, with increasing consumer awareness about health, sustainability, and ethical considerations. This has led to a surge in demand for plant-based protein sources like pea protein, which is recognized for its nutritional benefits and hypoallergenic properties.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Spain pea protein market is expected to continue its robust growth, with a projected increase in demand driven by plant-based dietary trends.

- Technological advancements in pea protein extraction and processing will improve product quality and increase production efficiency.

- The rise of flexitarian diets will lead to higher adoption of pea protein as a primary protein source in various food products.

- Increased consumer awareness of sustainability and the environmental benefits of pea protein will drive market demand.

- Investment in innovation, particularly in meat and dairy alternatives, will expand the market’s product offerings.

- The Spanish government’s support for sustainable agriculture will enhance local pea protein production capabilities.

- Collaboration between food manufacturers and pea protein producers will enhance market penetration in the food and beverage industry.

- The growing popularity of functional foods and nutraceuticals will further fuel the demand for pea protein.

- E-commerce will play a significant role in expanding the reach of pea protein products to a broader consumer base.

- The competitive landscape will see more regional players entering the market as consumer demand for plant-based products increases.