| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Single-Use Bio-Processing Systems Market Size 2024 |

USD 347.15 Million |

| Spain Single-Use Bio-Processing Systems Market, CAGR |

14.16% |

| Spain Single-Use Bio-Processing Systems Market Size 2032 |

USD 1,001.42 Million |

Market Overview

Spain Single-Use Bio-Processing Systems Market size was valued at USD 347.15 million in 2024 and is anticipated to reach USD 1,001.42 million by 2032, at a CAGR of 14.16% during the forecast period (2024-2032).

The Spain single-use bio-processing systems market is driven by increasing demand for cost-effective, flexible, and scalable solutions in biopharmaceutical manufacturing. The growing focus on minimizing contamination risks, reducing downtime, and lowering capital expenditures fuels the adoption of single-use technologies. Additionally, advancements in bioprocessing technology, including improved materials and integration with automation systems, contribute to enhanced operational efficiency. The rise of biologics, vaccines, and gene therapies further drives market growth, as single-use systems offer a faster, more adaptable approach to production. Regulatory support for innovation and the emphasis on sustainability, coupled with the rising trend of outsourcing production to contract manufacturing organizations (CMOs), strengthens the market’s expansion. As the pharmaceutical industry increasingly seeks efficient and environmentally friendly alternatives, single-use bio-processing systems are becoming integral to modern biomanufacturing strategies, ensuring long-term growth and evolution within the sector.

Geographically, Spain’s single-use bio-processing systems market is primarily driven by key industrial hubs such as Madrid and Barcelona, where a high concentration of biopharmaceutical companies and research institutions fosters innovation and adoption of advanced technologies. Coastal regions like Valencia and the Basque Country are also growing in importance due to their strategic locations for manufacturing and export, especially for biologics and vaccines. The market is supported by both large pharmaceutical companies and emerging small-to-medium enterprises (SMEs), which are increasingly turning to single-use technologies for flexibility and scalability. Key players in the Spain market include Sartorius AG, Merck KGaA, Eppendorf AG, Lonza Group AG, and Stedim Biotech. These companies are leading the market with their advanced solutions for single-use bioreactors, mixers, and other components that enhance biomanufacturing efficiency and reduce contamination risks. Their continuous innovation and strategic partnerships play a crucial role in shaping Spain’s bio-processing landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spain Single-Use Bio-Processing Systems market was valued at USD 347.15 million in 2024 and is expected to reach USD 1,001.42 million by 2032, growing at a CAGR of 14.16% from 2024 to 2032.

- The global single-use bio-processing systems market was valued at USD 17,326.05 million in 2024 and is projected to reach USD 57,663.39 million by 2032, growing at a CAGR of 16.22% from 2024 to 2032.

- Increasing adoption of disposable technologies in biopharmaceutical manufacturing is driving the demand for single-use systems in Spain.

- Cost-effectiveness and scalability are key market drivers, as single-use systems reduce capital investment and operational complexities.

- The trend toward biologics and personalized medicine is fueling market growth, creating a demand for flexible bioprocessing solutions.

- Key players such as Sartorius AG, Merck KGaA, and Lonza Group AG dominate the competitive landscape with their advanced product portfolios.

- Regulatory challenges and concerns over leachables and extractables in single-use systems are significant market restraints.

- Geographically, regions like Madrid, Barcelona, and Valencia are central to Spain’s bio-processing market due to strong infrastructure and industry presence.

Report Scope

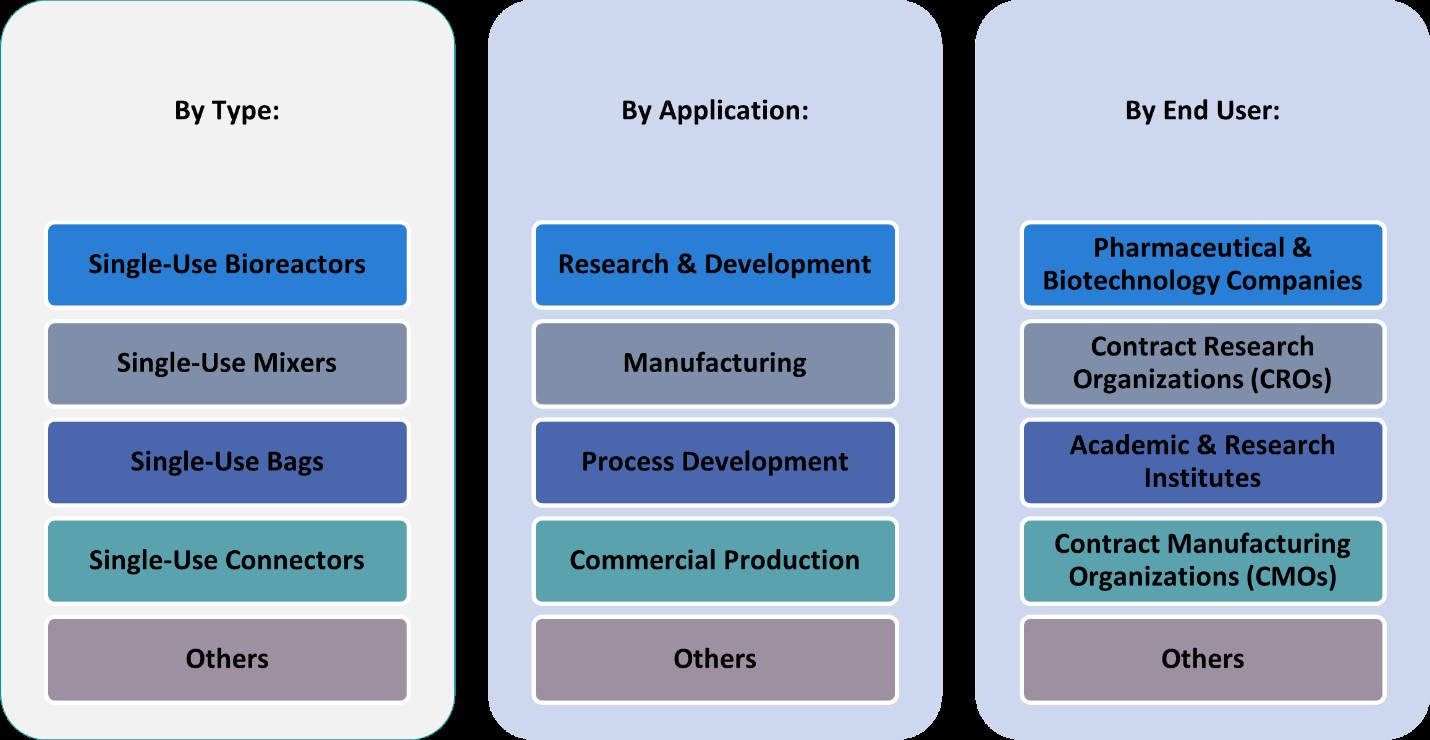

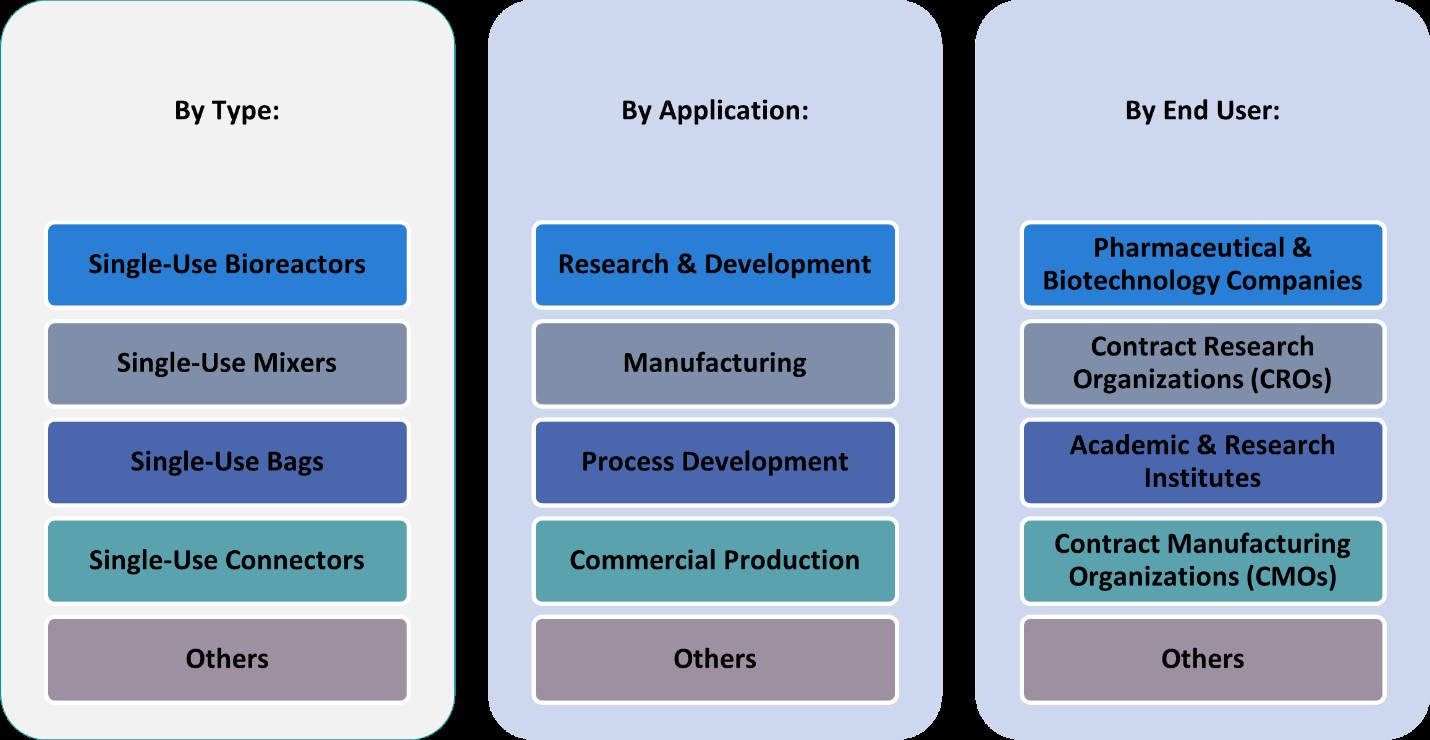

This report segments the Spain Single-Use Bio-Processing Systems Market as follows:

Market Drivers

Rising Demand for Biologics and Personalized Medicine

One of the primary drivers of the Spain single-use bio-processing systems market is the increasing demand for biologics and personalized medicine. As the global pharmaceutical industry shifts toward biologics—such as monoclonal antibodies, gene therapies, and vaccines there is a growing need for flexible, efficient, and scalable production methods. For instance, the Spanish Association of Biotech Companies (ASEBIO) has reported a significant increase in biologics production, driven by the rising prevalence of chronic diseases and the need for advanced manufacturing technologies. Single-use bio-processing systems offer a significant advantage by enabling faster development and production cycles, crucial for biologic therapies that require a highly tailored approach. In Spain, the expansion of biologics and personalized medicine has pushed manufacturers to adopt single-use systems, which streamline processes and allow for quicker scaling up, all while maintaining high-quality standards. This market growth is expected to accelerate as the trend toward biologics continues globally.

Cost Efficiency and Reduced Capital Investment

Another key driver for the market is the cost efficiency associated with single-use bio-processing systems. Traditional stainless-steel bioreactors and processing equipment require substantial capital investment, maintenance costs, and cleaning procedures. For instance, the Spanish Ministry of Industry, Trade, and Tourism has highlighted the cost-saving benefits of single-use systems in biomanufacturing, reducing cleaning and sterilization expenses while improving scalability. In contrast, single-use systems offer a more affordable alternative, particularly for small and medium-sized biopharmaceutical companies. They eliminate the need for costly cleaning and validation steps, reducing both operating and maintenance costs. These systems are also more flexible, enabling companies to quickly adapt to changing production demands without investing in new, expensive equipment. The financial flexibility and reduced time-to-market provided by single-use systems make them an attractive solution for biomanufacturers in Spain, particularly those focused on the production of small batches and niche therapies.

Advancements in Bioprocessing Technology

Technological advancements in bioprocessing are also driving the growth of single-use systems in Spain. Over the past few years, there have been significant innovations in single-use technologies, particularly in the areas of materials science, sensors, and automation. These improvements have enhanced the reliability, efficiency, and scalability of single-use systems, making them more suitable for large-scale production. For instance, the integration of advanced sensors for real-time monitoring and control of bioprocesses enhances product consistency and ensures regulatory compliance. Furthermore, automation of key functions, such as media preparation and filtration, reduces human error and increases operational efficiency. As these technological advancements continue, single-use systems will become even more critical in the Spanish biomanufacturing landscape.

Regulatory Support and Market Expansion

Regulatory support and increasing industry acceptance of single-use technologies are also playing a vital role in the market’s growth. In Spain, and across the European Union, regulatory bodies such as the European Medicines Agency (EMA) have shown a growing acceptance of single-use bio-processing systems as reliable and safe alternatives to traditional bioreactors. This regulatory approval facilitates faster adoption of these systems, as companies can confidently integrate them into their production processes. Additionally, the expansion of contract manufacturing organizations (CMOs) that specialize in biologics and gene therapies has further increased the demand for single-use systems. CMOs benefit from the reduced investment and greater operational flexibility offered by single-use technologies, allowing them to serve a broader range of clients with varying production needs. This regulatory backing and the growing presence of CMOs ensure that single-use systems will continue to play a pivotal role in Spain’s biopharmaceutical manufacturing sector.

Market Trends

Rapid Adoption of Single-Use Technologies

The rapid adoption of single-use technologies in Spain is one of the most prominent trends in the bioprocessing market. As the demand for biologics, such as monoclonal antibodies and vaccines, continues to rise, biopharmaceutical manufacturers are increasingly turning to single-use systems for their flexibility, scalability, and efficiency. For instance, Grifols has expanded its biologics manufacturing capabilities, integrating single-use systems to enhance production efficiency and scalability. These systems help reduce the complexity and costs associated with traditional stainless-steel bioreactors, which require extensive cleaning, validation, and maintenance. By adopting single-use technologies, manufacturers can accelerate production cycles, improve product yield, and reduce the risk of cross-contamination. In Spain, this trend is aligned with the broader European movement toward adopting single-use solutions for biomanufacturing, particularly in the production of small batch, personalized medicines. The flexibility of these systems allows manufacturers to quickly adapt to changing market demands, making them an ideal solution in the rapidly evolving biopharmaceutical landscape.

Integration of Automation and Data Analytics

Another emerging trend in Spain’s single-use bio-processing market is the increasing integration of automation and data analytics into biomanufacturing processes. The combination of single-use systems with automation technologies helps streamline operations, reducing manual intervention and improving consistency in production. Automation allows for real-time monitoring and optimization of critical process parameters such as temperature, pH, and nutrient levels, ensuring that the final product consistently meets quality standards. Data analytics also plays a vital role in enhancing process efficiency by enabling predictive maintenance, early detection of potential issues, and better resource management. As regulatory requirements become more stringent, data-driven insights help ensure compliance with industry standards. In Spain, as well as globally, the integration of these technologies is paving the way for more sophisticated, data-driven manufacturing strategies that improve product yield, reduce waste, and lower operational costs.

Advancements in Material Science

Advancements in material science are driving the continuous improvement of single-use bioprocessing systems. One of the key challenges in single-use technology has been ensuring that the materials used in bioprocessing are compatible with the product being produced and do not introduce contaminants into the system. For instance, Parker Hannifin has developed advanced single-use materials that minimize extractables and leachables, improving the chemical and mechanical properties of disposable bioprocessing components. Over the past few years, innovations in polymer technology, such as enhanced film materials, have addressed these concerns by improving the chemical and mechanical properties of single-use components. These advancements help minimize extractables and leachables, which are substances that may migrate from materials into the process, potentially affecting the quality of the biopharmaceutical product. Improved materials have made single-use systems more reliable and robust, increasing their adoption across all stages of biomanufacturing, including upstream processes like cell culture and downstream processes such as filtration and purification. In Spain, these innovations are contributing to the increasing applicability and efficiency of single-use systems, enabling them to handle a broader range of complex bioprocessing applications.

Emergence of Hybrid Biomanufacturing Models

The emergence of hybrid biomanufacturing models is another key trend in Spain’s single-use bio-processing market. Hybrid models combine the use of single-use systems with traditional stainless-steel equipment, offering manufacturers the benefits of both technologies. This approach allows for greater flexibility and optimization of production processes. For instance, companies can use stainless-steel bioreactors for large-scale production runs where cost-effectiveness is essential, while utilizing single-use systems for smaller, specialized batches that require flexibility and faster turnaround times. Hybrid systems are particularly advantageous for contract manufacturing organizations (CMOs), which need to cater to a wide range of clients with varying production needs. Small and medium-sized enterprises (SMEs) also benefit from this model, as it allows them to scale up production without the significant capital expenditure required for fully dedicated stainless-steel facilities. As the Spanish market continues to evolve, hybrid models are expected to become increasingly prevalent, providing an adaptable, cost-effective solution for biomanufacturers looking to meet diverse client demands while maintaining high standards of efficiency and quality.

Market Challenges Analysis

High Initial Capital Investment

Despite the cost advantages offered by single-use bio-processing systems in terms of reduced maintenance and operational costs, the initial capital investment can still pose a significant challenge for manufacturers in Spain. While single-use systems reduce the need for extensive cleaning, sterilization, and validation processes required by traditional stainless-steel systems, the upfront costs of acquiring these advanced technologies, including disposable components and associated equipment, can be substantial. Small and medium-sized enterprises (SMEs) may find it difficult to absorb these costs, particularly when transitioning from conventional production systems. This challenge can delay the widespread adoption of single-use technologies, especially among emerging biopharmaceutical companies or contract manufacturers that have limited capital resources. Moreover, the rapid pace of technological advancements in single-use systems may also require frequent updates or replacements of equipment, further contributing to capital expenditure concerns.

Regulatory and Quality Assurance Concerns

Another significant challenge for the Spain single-use bio-processing systems market is the ongoing regulatory scrutiny and quality assurance concerns surrounding these technologies. Although single-use systems are increasingly accepted, regulatory bodies, such as the European Medicines Agency (EMA), still have stringent requirements regarding the materials, performance, and safety of disposable components. For instance, the Bio-Process Systems Alliance (BPSA) has developed industry-wide standards for integrity testing to address concerns related to durability and compatibility in single-use systems. Manufacturers must ensure that single-use systems comply with evolving regulations to avoid potential product contamination or failure. Additionally, ensuring the integrity of single-use components during production and preventing leachables or extractables from affecting the product’s quality remains a concern. For biomanufacturers in Spain, staying ahead of regulatory changes and ensuring that disposable systems meet the necessary quality standards can be both time-consuming and costly. These challenges may slow down the adoption of single-use technologies and add complexity to the supply chain, as companies must ensure that their products meet strict compliance requirements.

Market Opportunities

The growing demand for biologics and personalized medicines presents a significant market opportunity for Spain’s single-use bio-processing systems. As the biopharmaceutical industry shifts towards more complex therapies, such as gene therapies, monoclonal antibodies, and cell-based treatments, the need for flexible, scalable, and efficient production methods becomes increasingly crucial. Single-use systems offer an ideal solution by enabling faster development cycles, reduced contamination risks, and the ability to quickly scale production to meet changing market demands. In Spain, the rising adoption of these therapies and the increasing trend towards small-batch and customized medicine positions single-use bio-processing systems as essential tools for manufacturers looking to optimize their production capabilities while maintaining high quality standards. This expanding market for biologics, combined with the cost and time advantages of single-use technologies, creates ample growth opportunities for companies operating in the Spanish market.

Additionally, Spain’s position as a key player in the European Union’s biopharmaceutical landscape further enhances the market potential for single-use bio-processing systems. The country’s growing focus on biomanufacturing innovation, coupled with supportive regulatory frameworks, offers an environment conducive to the adoption of advanced technologies. Furthermore, the increasing outsourcing of biomanufacturing processes to contract manufacturing organizations (CMOs) presents another opportunity for single-use systems. CMOs, which require flexible and efficient production solutions to cater to a diverse client base, are increasingly turning to single-use technologies to meet client needs while minimizing capital expenditures. As Spain continues to attract investment in its biopharmaceutical sector and strengthens its role as a hub for biologics production, the demand for single-use bio-processing systems is poised to grow, driving innovation and expanding market opportunities for manufacturers in this space.

Market Segmentation Analysis:

By Type:

The Spain single-use bio-processing systems market is segmented based on product types, including single-use bioreactors, single-use mixers, single-use bags, single-use connectors, and other components. Among these, single-use bioreactors dominate the market, driven by their pivotal role in upstream processes such as cell culture. Their ability to reduce contamination risks and shorten production times has led to increased adoption, particularly in the production of biologics and vaccines. Single-use mixers also play a crucial role in ensuring homogeneity in solutions during various stages of production, from cell culture to downstream processes. Single-use bags are widely used for storage, transportation, and mixing of biologics, offering convenience and safety in handling. Single-use connectors are essential for facilitating fluid transfer without the need for sterilization, contributing to overall system flexibility and efficiency. Other components, which include filters, sensors, and valves, are seeing growing demand as biomanufacturers seek to enhance process efficiency and scalability. This diverse product range underscores the growing reliance on single-use technologies to improve operational performance across various bioprocessing stages.

By Application:

The application segment of Spain’s single-use bio-processing systems market is equally diverse, with major applications in research & development, manufacturing, process development, commercial production, and other specialized areas. Research & development is a key area of growth, as pharmaceutical companies increasingly turn to single-use systems for quicker, more flexible testing and development of new therapeutics. Manufacturing accounts for a significant share, as the flexibility and cost-effectiveness of single-use systems make them ideal for both large and small-scale production of biologics and vaccines. Process development also benefits from single-use technologies, which enable faster optimization of biomanufacturing processes and reduce time-to-market for new therapies. Commercial production is increasingly adopting these systems for their ability to scale production while minimizing capital investment and contamination risks. Other specialized applications, such as cell therapy production, are expanding, particularly as biologics and personalized medicine continue to grow in importance. These applications reflect the broad utility of single-use bio-processing systems in supporting both the development and commercial production of advanced therapies in Spain.

Segments:

Based on Type:

- Single-Use Bioreactors

- Single-Use Mixers

- Single-Use Bags

- Single-Use Connectors

- Others

Based on Application:

- Research & Development

- Manufacturing

- Process Development

- Commercial Production

- Others

Based on End- User:

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

Based on the Geography:

- Urban Centers (Madrid, Barcelona)

- Rural Areas

- Coastal regions

Regional Analysis

Urban centers (Madrid and Barcelona)

Urban centers, particularly Madrid and Barcelona, dominate the market, collectively accounting for approximately 60% of the market share. These cities are hubs for biopharmaceutical innovation, housing major pharmaceutical companies, contract manufacturing organizations (CMOs), and research institutions. The proximity to cutting-edge technologies, research and development (R&D) capabilities, and a skilled workforce drives the adoption of single-use bio-processing systems in these regions. As the leading economic and industrial centers, Madrid and Barcelona are expected to maintain their dominant position due to continued investments in biomanufacturing and biologics production.

Rural areas

In rural areas, which contribute around 15% of the market share, the adoption of single-use bio-processing systems is less pronounced but steadily growing. These regions, often characterized by smaller-scale biomanufacturing plants and limited infrastructure, are beginning to see increased use of single-use technologies due to the lower capital investment required compared to traditional stainless-steel systems. Smaller biopharmaceutical companies operating in rural areas are increasingly adopting these systems for flexibility, cost-effectiveness, and ease of scalability. Furthermore, rural regions are benefiting from government incentives aimed at fostering growth in the biotechnology and pharmaceutical sectors, contributing to the gradual uptake of single-use systems.

Coastal regions

Coastal regions, including areas such as Valencia, Murcia, and the Basque Country, represent approximately 20% of the market share. These regions have a growing presence in biopharmaceutical manufacturing, particularly in vaccine production, biologics, and contract manufacturing. The availability of ports and proximity to international markets also positions coastal regions as strategic hubs for exporting biopharmaceutical products. The increasing establishment of manufacturing plants in these areas is driving the adoption of single-use bio-processing systems, as companies seek to streamline production processes and reduce operational costs. The coastal regions are expected to see continued growth in the use of single-use systems as demand for biologics and personalized medicine expands.

Key Player Analysis

- Sartorius AG

- Merck KGaA

- Eppendorf AG

- Celltainer Biotech BV

- Lonza Group AG

- Getinge AB

- RoSS GmbH

- Elveflow

- Finesse Solutions

- Stedim Biotech

Competitive Analysis

The competitive landscape of the Spain Single-Use Bio-Processing Systems market is dominated by key players that lead with their advanced technological offerings, strong market presence, and continuous innovation. Sartorius AG, Merck KGaA, Eppendorf AG, Lonza Group AG, and Stedim Biotech are at the forefront, providing cutting-edge solutions to support the growing demand for single-use bioprocessing technologies. These companies offer a wide range of products, including single-use bioreactors, mixers, bags, and connectors, which are crucial for flexible, scalable, and cost-effective biomanufacturing processes. The companies in this market focus on reducing costs, improving scalability, and minimizing contamination risks, making their products highly attractive to both small and large-scale biomanufacturers. The competition is fierce, with companies constantly advancing their technological capabilities to offer more efficient, integrated, and user-friendly systems. Strong research and development investments allow competitors to introduce new products and enhance existing ones, maintaining a competitive advantage. Additionally, the increasing demand for biologics and personalized medicine is pushing companies to innovate further, ensuring that their products meet the growing need for flexible, cost-effective, and scalable bioprocessing solutions. Strategic partnerships, mergers, and acquisitions also play a significant role in enhancing the market position of these companies. By expanding their reach and capabilities, market leaders strengthen their competitive edge and cater to the evolving demands of the Spanish bio-processing market.

Recent Developments

- In April 2025, Thermo Fisher Scientific launched the 5L DynaDrive Single-Use Bioreactor, a bench-scale system designed for seamless scalability from 1 to 5,000 liters. This new bioreactor offers a 27% productivity increase over glass bioreactors, enhanced sustainability with biobased films, and consistent performance across different scales, supporting both large and small biopharma manufacturers. The DynaDrive S.U.B. supports robust production across scales and has the flexibility to accommodate a variety of cell lines and processing modalities.

- In April 2025, Sartorius Stedim Biotech entered a strategic partnership with Tulip Interfaces to drive digital transformation in single-use bioprocessing. The collaboration introduced Biobrain® Operate powered by Tulip, a suite of digital manufacturing applications that integrate with Sartorius equipment to reduce process variability, digitize operations, and ensure regulatory compliance. This partnership aims to advance paperless manufacturing and optimize resource efficiency in bioprocessing.

- In March 2025, Corning introduced new technologies to support advanced therapy applications, including the Ascent™ Fixed Bed Reactor (FBR) and expanded cell expansion platforms like HYPERStack®, HYPERFlask®, and CellSTACK®. These platforms feature closed systems and automation to reduce contamination risk and enhance scalability for bioprocess applications.

- In April 2023, Merck KGaA launched the Ultimus® Single-Use Process Container Film, featuring ten times greater abrasion resistance than other films, improved durability, and leak resistance for single-use assemblies. The technology is now available in Mobius® 3D process containers, enhancing operational efficiency and cell growth performance.

Market Concentration & Characteristics

The Spain Single-Use Bio-Processing Systems market is characterized by moderate to high concentration, with a few dominant players controlling a significant share of the market. These key players possess strong technological capabilities and extensive product portfolios, allowing them to meet the diverse needs of biopharmaceutical companies. The market is highly competitive, driven by continuous innovation, and the development of advanced systems that enhance efficiency, scalability, and flexibility in biomanufacturing. Companies focus on providing cost-effective solutions, reducing contamination risks, and improving production timelines, which is crucial for meeting the growing demand for biologics and personalized medicine. Additionally, the market exhibits a trend toward consolidation, with strategic mergers, acquisitions, and partnerships playing an essential role in expanding market reach and improving technological expertise. As a result, the Spain Single-Use Bio-Processing Systems market reflects a dynamic environment with significant opportunities for both established players and emerging companies that can offer innovative, high-quality solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for single-use bio-processing systems in Spain will continue to grow due to the increasing production of biologics and personalized medicines.

- Advances in bioprocessing technologies, such as more efficient single-use bioreactors, will drive market expansion.

- The need for scalable and cost-effective production solutions will accelerate the adoption of single-use technologies across small and large-scale manufacturing facilities.

- Increased focus on reducing contamination risks in biomanufacturing will lead to continued innovation in single-use components.

- Biopharmaceutical companies in Spain will prioritize flexibility and shorter production timelines, further driving the market for disposable systems.

- Growing regulatory support for single-use technologies will enhance market adoption and reduce barriers to entry.

- Strategic partnerships and collaborations between industry leaders will foster innovation and expand product offerings.

- Small and medium-sized enterprises (SMEs) will play an increasingly vital role in adopting single-use systems for cost-effective production.

- Spain’s regional infrastructure and biotech industry presence will continue to attract investments, supporting market growth.

- The trend of sustainability in the biopharmaceutical sector will drive the development of eco-friendly, recyclable single-use systems in the near future.