Market Overview

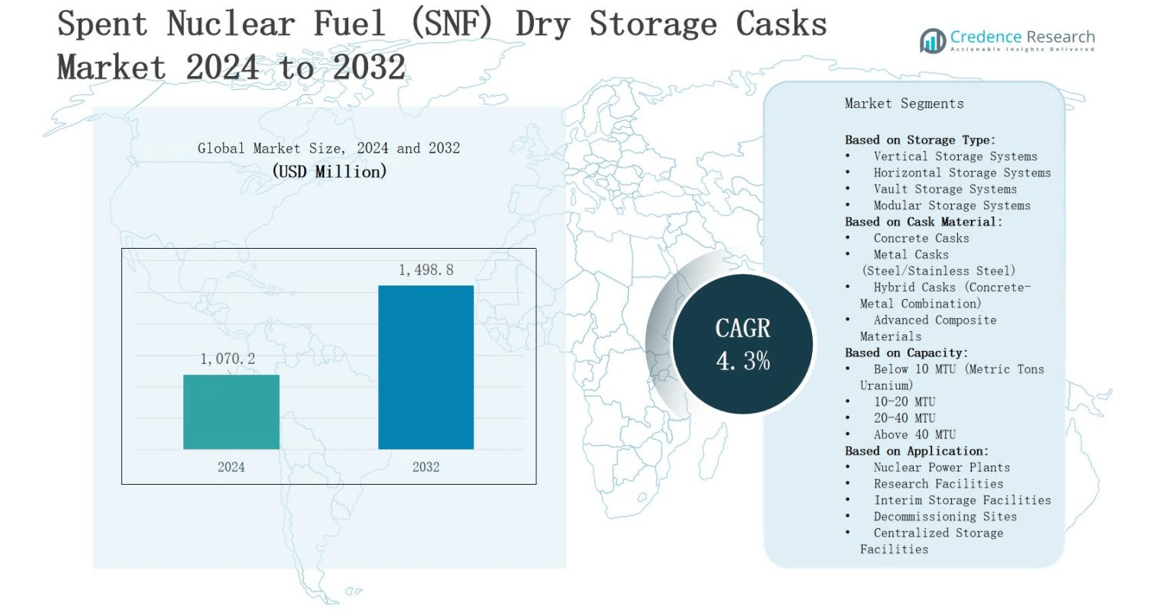

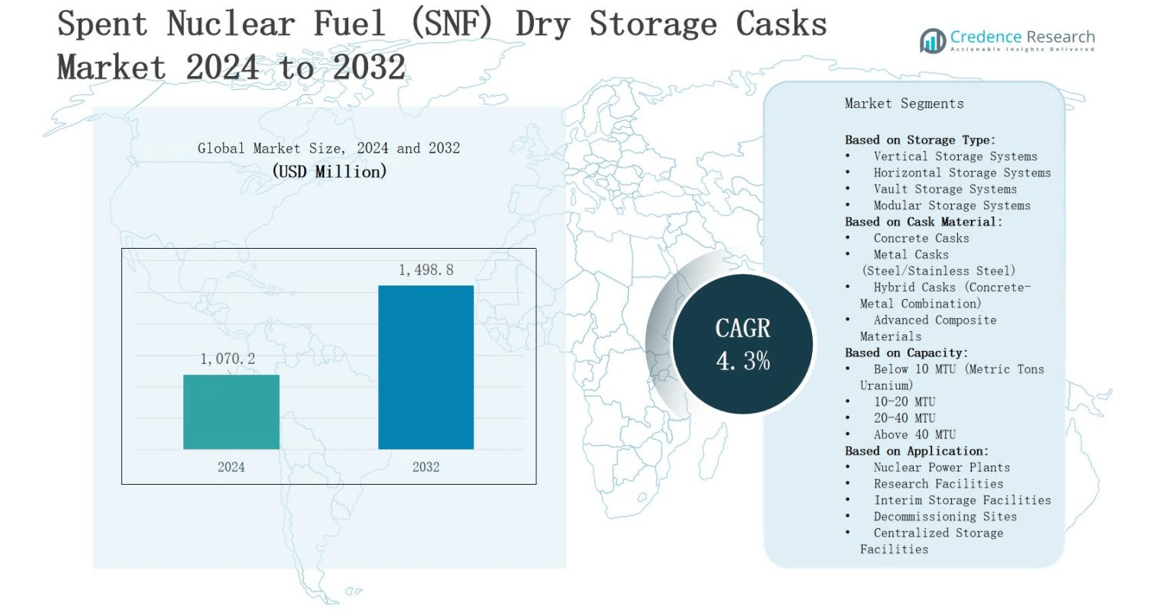

The spent nuclear fuel (SNF) dry storage casks market is projected to grow from USD 1,070.2 million in 2024 to USD 1,498.8 million by 2032, registering a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spent Nuclear Fuel (SNF) Dry Storage Casks Market Size 2024 |

USD 1,070.2 million |

| Spent Nuclear Fuel (SNF) Dry Storage Casks Market, CAGR |

4.3% |

| Spent Nuclear Fuel (SNF) Dry Storage Casks Market Size 2032 |

USD 1,498.8 million |

The spent nuclear fuel (SNF) dry storage casks market is driven by the rising demand for safe, long-term storage solutions for nuclear waste as global nuclear power generation capacity expands. Increasing decommissioning of aging nuclear reactors and delays in permanent repository projects are boosting reliance on dry cask storage systems. Stringent safety regulations and advancements in cask materials, thermal performance, and radiation shielding are enhancing adoption. Trends include the development of high-capacity, transportable cask designs, growing investment in modular storage facilities, and adoption of advanced monitoring technologies to ensure regulatory compliance and improve operational efficiency in nuclear waste management.

The spent nuclear fuel (SNF) dry storage casks market spans North America, Europe, Asia-Pacific, and the Rest of the World, each contributing distinct growth drivers. North America leads with advanced infrastructure and regulatory frameworks, while Europe emphasizes stringent safety compliance. Asia-Pacific experiences rapid growth from expanding nuclear power programs, and the Rest of the World sees rising adoption in emerging nuclear markets. Key players include Holtec International, Cameco Corporation, Orano, NAC International Inc., GNS Gesellschaft für Nuklear-Service mbH, Korea Hydro & Nuclear Power Co., Ltd., Transnuclear, Inc. (AREVA NP), Hitachi Zosen Corporation, Nuclear Fuel Industries, Ltd., and Nuvia Group.

Market Insights

- The spent nuclear fuel (SNF) dry storage casks market is projected to grow from USD 1,070.2 million in 2024 to USD 1,498.8 million by 2032, registering a CAGR of 4.3%, driven by rising nuclear power generation and the need for secure long-term waste storage.

- Increasing decommissioning of aging reactors and delays in permanent repository projects are boosting reliance on high-capacity dry cask systems for interim storage.

- Advancements in thermal performance, radiation shielding, and corrosion-resistant materials are enabling more compact, transportable, and cost-efficient cask designs.

- Stringent regulatory frameworks and enhanced safety compliance requirements are accelerating adoption of certified systems with advanced monitoring and inspection capabilities.

- High capital costs, long development timelines, and complex licensing processes remain major challenges, particularly for smaller utilities and developing markets.

- North America leads with 38% share, followed by Europe at 27%, Asia-Pacific at 24%, and Rest of the World at 11%, each with distinct growth drivers.

- Key players include Holtec International, Cameco Corporation, Orano, NAC International Inc., GNS Gesellschaft für Nuklear-Service mbH, Korea Hydro & Nuclear Power Co., Ltd., Transnuclear, Inc. (AREVA NP), Hitachi Zosen Corporation, Nuclear Fuel Industries, Ltd., and Nuvia Group.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Global Nuclear Power Generation and Waste Accumulation

The spent nuclear fuel (SNF) dry storage casks market is expanding due to the steady rise in global nuclear power generation, which increases the volume of spent fuel requiring secure storage. Many countries are extending reactor lifespans, further adding to waste accumulation. It addresses the urgent need for reliable interim storage solutions. Governments are prioritizing nuclear safety, prompting investment in robust cask systems. This trend ensures continuous demand for advanced containment technologies.

- For instance, Sweden has begun constructing a deep geological repository capable of permanently storing up to 6,000 specially designed copper canisters, each containing around 2 tonnes of spent nuclear fuel.

Decommissioning of Aging Nuclear Reactors

The accelerating decommissioning of older nuclear reactors is driving significant demand for dry storage casks to manage fuel removed during shutdowns. It provides an immediate, scalable solution while permanent disposal facilities remain limited. The market benefits from strict regulatory mandates requiring safe isolation of high-level waste. Operators are investing in high-capacity cask designs to optimize site storage. This creates ongoing opportunities for suppliers with proven safety and compliance credentials.

- For instance, Holtec International’s work at the Pilgrim Nuclear Power Station, which was permanently shut down in 2019 after 46 years, where dry cask storage solutions are integral to ongoing decommissioning efforts.

Advancements in Cask Design and Materials

Innovations in thermal performance, radiation shielding, and corrosion-resistant materials are boosting adoption in the spent nuclear fuel (SNF) dry storage casks market. It supports the industry’s shift toward more compact, transportable, and cost-efficient systems. Manufacturers are introducing modular and multi-purpose casks suitable for both storage and transport. Enhanced durability reduces lifecycle costs, increasing appeal to utilities. These advancements strengthen safety standards and align with evolving international guidelines for nuclear waste management.

Regulatory Frameworks and Safety Compliance Requirements

Stringent national and international regulations are reinforcing demand for certified cask systems capable of withstanding extreme conditions. It ensures utilities invest in proven technologies to meet safety inspections and licensing requirements. Governments are enforcing rigorous monitoring protocols, pushing for advanced sensors and inspection-ready designs. Compliance drives continuous upgrades and replacement cycles. The market benefits from this regulatory emphasis, creating consistent growth potential for suppliers meeting or exceeding performance benchmarks.

Market Trends

Shift Toward Transportable and Multi-Purpose Cask Designs

The spent nuclear fuel (SNF) dry storage casks market is witnessing a shift toward transportable and multi-purpose cask designs that can serve both interim storage and eventual transport to disposal facilities. It enables utilities to reduce costs by avoiding the need for separate storage and transport solutions. These designs feature enhanced shielding, modular construction, and compatibility with multiple reactor types. The approach supports operational flexibility and aligns with evolving nuclear waste logistics strategies.

- For instance, Ontario Power Generation in Canada is constructing a dry storage facility on the Darlington site, utilizing cask designs that are similar to those at Pickering and Bruce stations, combining vertical and horizontal storage modules optimized for multiple reactor types and transportability.

Integration of Advanced Monitoring and Inspection Technologies

The market is adopting advanced monitoring systems to track temperature, radiation levels, and structural integrity of casks in real time. It improves safety assurance and regulatory compliance by enabling early detection of anomalies. Wireless sensors, automated inspection tools, and AI-based data analytics are becoming standard features. These technologies reduce manual inspection requirements, improve efficiency, and ensure that storage facilities meet stringent safety standards over extended operational lifespans.

- For instance, Argonne National Laboratory’s ARG-US system uses RFID and sensor technology to continuously monitor radiation, temperature, and seal status of casks, sending alarms via SMS if thresholds are exceeded, which supports proactive safety management.

Expansion of Modular and Scalable Storage Facilities

Operators are increasingly investing in modular, scalable storage facilities that can be expanded as spent fuel inventories grow. The spent nuclear fuel (SNF) dry storage casks market benefits from this trend, as casks are designed for compatibility with modular layouts. It offers utilities flexibility in capital expenditure while ensuring compliance with safety requirements. Modular designs also facilitate relocation or expansion in response to changing regulatory or operational needs, supporting long-term adaptability.

Focus on Enhanced Thermal Performance and Space Optimization

Manufacturers are prioritizing improved thermal performance to extend cask service life and maintain fuel stability under varying environmental conditions. It involves using advanced heat-dissipation materials and optimizing internal configurations. Compact, high-capacity designs are gaining traction, allowing operators to maximize storage space without compromising safety. These innovations address both cost efficiency and land-use constraints, making them attractive for densely populated or geographically limited nuclear facility sites.

Market Challenges Analysis

High Capital Costs and Long Development Timelines

The spent nuclear fuel (SNF) dry storage casks market faces significant challenges due to the high capital costs involved in design, certification, and deployment. It requires substantial investment in advanced materials, manufacturing precision, and compliance testing to meet stringent safety standards. Long development and approval timelines add complexity, often delaying project execution. Smaller utilities and developing markets find it difficult to allocate sufficient funds for large-scale cask procurement. These financial barriers can limit adoption rates and slow market expansion despite growing nuclear waste storage needs.

Complex Regulatory Compliance and Public Perception Issues

Meeting diverse and stringent regulatory requirements across multiple jurisdictions remains a critical hurdle for the market. The spent nuclear fuel (SNF) dry storage casks market must align with evolving safety protocols, environmental standards, and security measures, often requiring costly redesigns or extended approval processes. It also faces challenges from public perception, with communities expressing concerns over long-term safety and environmental impact. Managing stakeholder trust while addressing regulatory complexities demands ongoing investment in transparency, safety assurance, and community engagement initiatives to secure operational acceptance and project continuity.

Market Opportunities

Expansion of Nuclear Power Capacity and Global Energy Transition

The spent nuclear fuel (SNF) dry storage casks market has significant growth potential driven by the global shift toward low-carbon energy and the expansion of nuclear power capacity. It benefits from rising investments in new reactors and the extension of existing reactor lifespans, which increase the volume of spent fuel requiring storage. Countries with growing nuclear programs, including China, India, and the Middle East, present substantial demand opportunities. This trend supports long-term procurement contracts for advanced storage solutions that meet both domestic and international safety standards.

Technological Innovation and International Collaboration

Advancements in cask materials, modular designs, and transportable configurations are creating new commercial prospects for manufacturers. The spent nuclear fuel (SNF) dry storage casks market can leverage partnerships between utilities, technology providers, and research institutions to accelerate innovation and enhance cost efficiency. It also benefits from cross-border collaboration to harmonize safety regulations, enabling access to multiple markets. Opportunities exist in developing casks with extended service lives, higher capacities, and integrated monitoring systems to address the evolving needs of global nuclear waste management strategies.

Market Segmentation Analysis:

By Storage Type

The spent nuclear fuel (SNF) dry storage casks market is segmented into vertical storage systems, horizontal storage systems, vault storage systems, and modular storage systems. Vertical systems hold a strong share due to their compact footprint and efficient thermal performance. Horizontal systems appeal to operators seeking simplified loading and inspection. Vault systems offer enhanced shielding in secure environments, while modular systems provide scalability for growing fuel inventories, enabling utilities to expand storage capacity with minimal infrastructure adjustments.

- For instance, Lithuania employs GNS CONSTOR vertical concrete dry storage casks at Ignalina, each holding about 90 fuel assemblies, emphasizing robust shielding and cost-optimized interim storage.

By Cask Material

Market segmentation by material includes concrete casks, metal casks, hybrid casks, and advanced composite materials. Concrete casks remain prevalent for their robust shielding and cost efficiency. Metal casks, typically made from steel or stainless steel, are valued for durability and transportability. Hybrid designs combine concrete’s shielding with metal’s structural strength, appealing to multi-purpose applications. Advanced composites are emerging for their lightweight properties and corrosion resistance, offering potential performance advantages in long-term storage.

- For instance, Kanadevia Corporation in Japan manufactures both metal and concrete casks, having delivered over 600 concrete casks mainly to U.S. nuclear power plants, combining metal canisters inside concrete shielding for effective radiation safety and heat removal.

By Capacity

The market by capacity includes below 10 MTU, 10–20 MTU, 20–40 MTU, and above 40 MTU segments. Lower-capacity casks are often used for specialized or smaller reactor sites. The 10–20 MTU segment sees steady demand for mid-scale operations balancing storage needs and space constraints. Casks with 20–40 MTU capacity dominate large reactor facilities, while above 40 MTU designs are gaining attention for reducing the number of units required, optimizing land use, and improving long-term operational efficiency.

Segments:

Based on Storage Type:

- Vertical Storage Systems

- Horizontal Storage Systems

- Vault Storage Systems

- Modular Storage Systems

Based on Cask Material:

- Concrete Casks

- Metal Casks (Steel/Stainless Steel)

- Hybrid Casks (Concrete-Metal Combination)

- Advanced Composite Materials

Based on Capacity:

- Below 10 MTU (Metric Tons Uranium)

- 10-20 MTU

- 20-40 MTU

- Above 40 MTU

Based on Application:

- Nuclear Power Plants

- Research Facilities

- Interim Storage Facilities

- Decommissioning Sites

- Centralized Storage Facilities

Based on Cooling Method:

- Passive Air Cooling

- Active Cooling Systems

- Hybrid Cooling Solutions

Based on Storage Duration:

- Short-term (0-20 years)

- Medium-term (20-60 years)

- Long-term (60-100 years)

- Extended Storage (100+ years)

Based on Reactor Type:

- Pressurized Water Reactor (PWR)

- Boiling Water Reactor (BWR)

- Heavy Water Reactor

- Advanced Reactor Types

Based on End-User:

- Electric Utilities

- Government Agencies

- Research Institutions

- Waste Management Companies

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 38% share of the spent nuclear fuel (SNF) dry storage casks market, driven by an extensive fleet of commercial nuclear reactors and aging infrastructure requiring reliable storage solutions. The United States leads the region with ongoing reactor operations, decommissioning projects, and established dry cask storage programs. Canada supports growth through its nuclear waste management initiatives. It benefits from strong regulatory frameworks, advanced manufacturing capabilities, and continuous investment in safety upgrades, fostering steady demand for certified, high-capacity storage systems.

Europe

Europe accounts for 27% share of the market, supported by active nuclear programs in countries such as France, the United Kingdom, and Finland. The region emphasizes compliance with stringent safety and environmental regulations, creating demand for advanced cask designs with enhanced shielding and monitoring systems. It experiences steady procurement for both operational reactors and decommissioned sites. Investments in long-term interim storage facilities further drive adoption, while cross-border regulatory harmonization encourages supplier participation across multiple national markets.

Asia-Pacific

Asia-Pacific holds 24% share of the spent nuclear fuel (SNF) dry storage casks market, fueled by rapid expansion of nuclear power capacity in China, India, and South Korea. The region prioritizes storage scalability to match growing reactor fleets. It is investing in both modular and high-capacity cask designs to optimize land use and improve operational flexibility. Domestic manufacturing and government-backed nuclear waste management policies enhance market potential, positioning Asia-Pacific as a high-growth region for advanced storage technologies.

Rest of the World

The Rest of the World captures 11% share of the market, with activity concentrated in the Middle East, Africa, and parts of Latin America. Emerging nuclear programs in the United Arab Emirates, Saudi Arabia, and Brazil are creating new opportunities for cask deployment. It benefits from international partnerships for technology transfer and safety compliance. Growing interest in nuclear power as a low-carbon energy source is expected to expand adoption of certified dry storage systems in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nuvia Group

- Nuclear Fuel Industries, Ltd.

- Holtec International

- Hitachi Zosen Corporation

- Cameco Corporation

- Transnuclear, Inc. (AREVA NP)

- Orano

- NAC International Inc.

- GNS Gesellschaft für Nuklear-Service mbH

- Korea Hydro & Nuclear Power Co., Ltd.

Competitive Analysis

The spent nuclear fuel (SNF) dry storage casks market is characterized by strong competition among established global players with advanced engineering capabilities and extensive regulatory certifications. It is driven by the need for proven safety, long service life, and compliance with diverse international standards. Key companies such as Holtec International, Cameco Corporation, Orano, NAC International Inc., GNS Gesellschaft für Nuklear-Service mbH, Korea Hydro & Nuclear Power Co., Ltd., Transnuclear, Inc. (AREVA NP), Hitachi Zosen Corporation, Nuclear Fuel Industries, Ltd., and Nuvia Group focus on expanding product portfolios with high-capacity, transportable, and corrosion-resistant designs. Strategic initiatives include securing long-term contracts with utilities, investing in modular and multi-purpose cask systems, and advancing materials technology to optimize thermal performance and shielding. Partnerships with nuclear operators and government agencies support market penetration, while competitive differentiation often relies on lifecycle cost efficiency, scalability, and innovation in monitoring and inspection systems. Strong R&D capabilities and compliance with evolving safety regulations enable these players to maintain leadership positions in both developed and emerging nuclear markets.

Recent Developments

- On April 3, 2025, Orano secured a contract at a southern U.S. nuclear facility to transfer used nuclear fuel assemblies from wet storage pools into 14 vertical dry storage cask systems already onsite. It will carry out the pool-to-pad transfer using its proven expertise in vertical cask operations.

- In 2023, Holtec International achieved a significant production milestone with the loading of its 2,000th spent fuel dry storage system at Entergy’s Arkansas Nuclear One facility in Russellville, Arkansas.

- On July 29, 2025, the U.S. Nuclear Regulatory Commission approved Amendment No. 4 to the Certificate of Compliance No. 1042 for the NUHOMS® EOS Dry Spent Fuel Storage System by TN Americas LLC, enabling licensed loading of spent fuel into modified casks under general licensing.

Market Concentration & Characteristics

The spent nuclear fuel (SNF) dry storage casks market is moderately consolidated, with a limited number of global players holding significant market share due to the highly specialized nature of design, manufacturing, and regulatory compliance. It demands advanced engineering capabilities, extensive safety certifications, and long-term operational reliability, creating high entry barriers for new competitors. Leading companies compete on technology innovation, cost efficiency, and lifecycle performance, often securing multi-year contracts with nuclear utilities and government agencies. The market is characterized by stringent safety standards, complex licensing procedures, and substantial capital investment requirements, which limit the pool of qualified suppliers. Strategic partnerships, research collaborations, and continual product development are critical for maintaining a competitive edge. Demand is sustained by ongoing reactor operations, decommissioning activities, and the absence of permanent disposal facilities in many countries, ensuring consistent need for certified, high-capacity, and transportable storage solutions in both developed and emerging nuclear energy markets.

Report Coverage

The research report offers an in-depth analysis based on Storage Type, Cask Material, Capaity, Application, Cooling Method, Storage Duration, Reactor Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with the continued expansion of global nuclear power capacity and reactor life extensions.

- Decommissioning projects will generate sustained need for high-capacity dry storage solutions.

- Advanced transportable and multi-purpose cask designs will see wider adoption.

- Regulatory requirements will drive integration of enhanced monitoring and inspection technologies.

- Modular storage systems will gain traction for scalability and cost efficiency.

- Innovations in materials will improve thermal performance and long-term durability.

- International collaboration will support harmonization of safety standards and cross-border market access.

- Emerging nuclear programs in developing regions will create new growth opportunities.

- Public acceptance efforts will remain essential to secure project approvals.

- Long-term interim storage will remain a priority until permanent disposal facilities become operational.