Market Overview

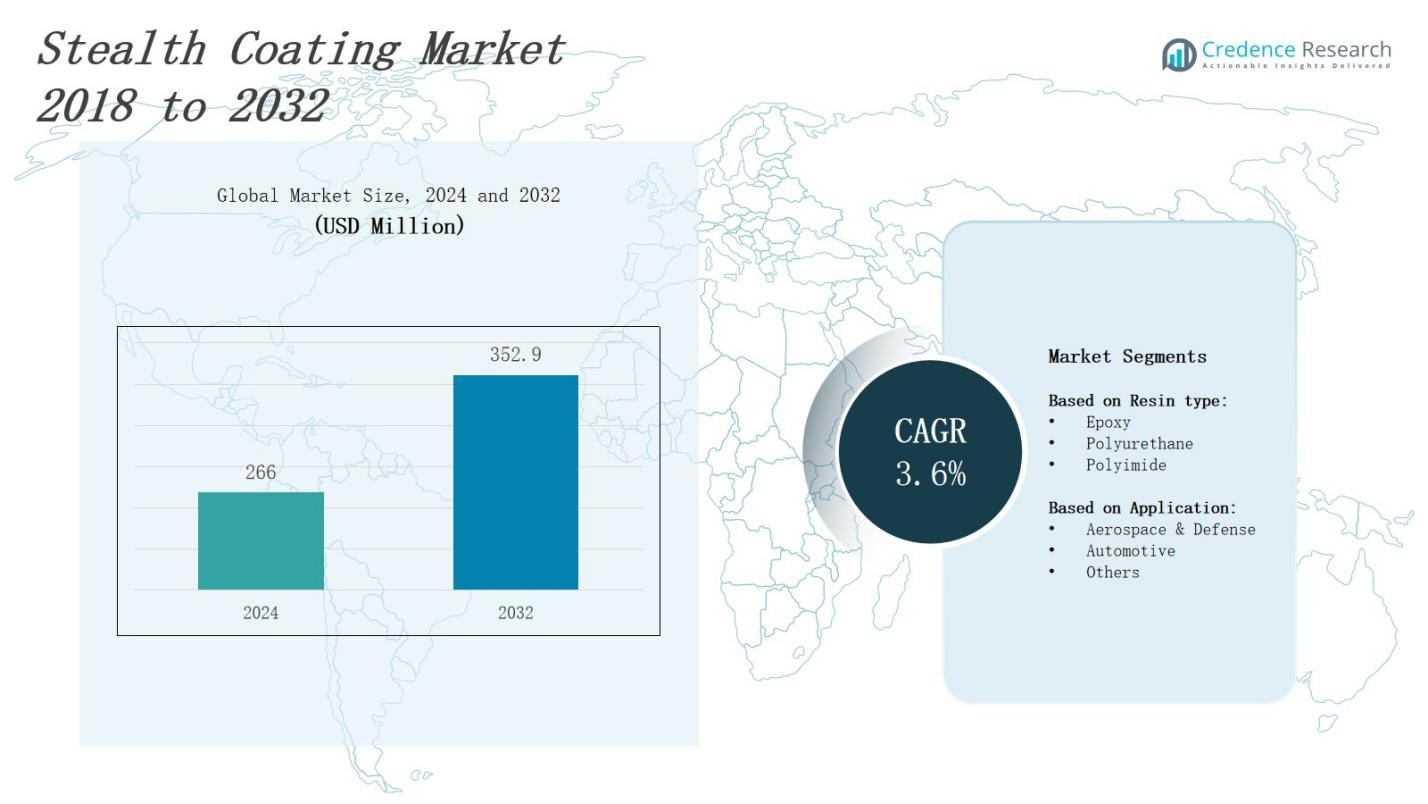

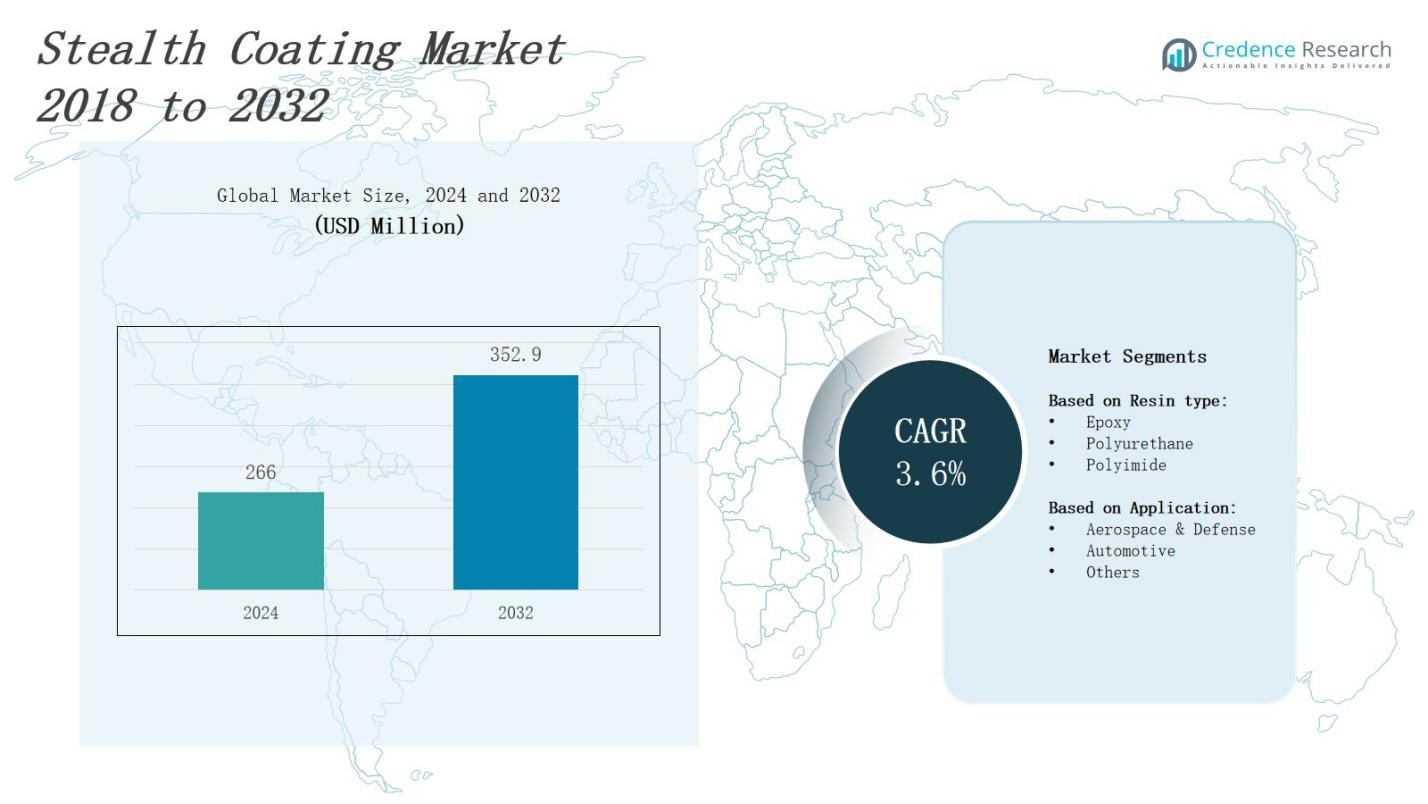

The Stealth Coating Market is projected to grow from USD 266 million in 2024 to USD 352.9 million by 2032, expanding at a CAGR of 3.6%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stealth Coating Market Size 2024 |

USD 266 Million |

| Stealth Coating Market, CAGR |

3.6% |

| Stealth Coating Market Size 2032 |

USD 352.9 Million |

The stealth coating market grows driven by increasing defense modernization programs and rising demand for advanced military technologies to enhance aircraft and vehicle survivability. Governments worldwide prioritize reducing radar detection, fueling investments in stealth materials. Technological advancements improve coating durability, thermal resistance, and radar-absorbing efficiency, boosting adoption across aerospace and defense sectors. Market trends include development of multifunctional coatings combining stealth with corrosion resistance and environmental protection. Additionally, growing emphasis on lightweight materials to enhance fuel efficiency and maneuverability supports market expansion. Increasing collaborations between defense contractors and research institutions accelerate innovation, strengthening the stealth coating market’s growth trajectory.

The stealth coating market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World, with North America leading at 35% market share followed by Asia-Pacific at 30%, Europe at 25%, and the Rest of the World at 10%. Major players such as AkzoNobel N.V., BASF SE, Lockheed Martin Corporation, and PPG Industries, Inc. dominate the competitive landscape. These companies focus on innovation, strategic partnerships, and regional expansions to strengthen their presence and address the diverse demands across these global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The stealth coating market will grow from USD 266 million in 2024 to USD 352.9 million by 2032 at a CAGR of 3.6%.

- Increasing defense modernization programs and demand for advanced military technologies drive growth by enhancing aircraft and vehicle survivability.

- Technological improvements boost coating durability, thermal resistance, and radar-absorbing efficiency, expanding use in aerospace and defense sectors.

- Multifunctional coatings that combine stealth with corrosion resistance and environmental protection gain traction, supporting market expansion.

- Lightweight materials receive growing emphasis to improve fuel efficiency and maneuverability of defense platforms.

- Collaborations between defense contractors and research institutions accelerate innovation, strengthening market growth.

- North America leads with 35% market share, followed by Asia-Pacific at 30%, Europe at 25%, and the Rest of the World at 10%.

Market Drivers

Rising Defense Modernization and Military Expenditure

The stealth coating market benefits from increased defense budgets worldwide focused on modernizing military assets. Countries invest heavily in upgrading aircraft, naval vessels, and ground vehicles to improve survivability against advanced detection systems. It supports governments’ strategic goals to maintain technological superiority and enhance national security. Rising geopolitical tensions drive procurement of stealth technologies to counter evolving radar and sensor threats. This demand encourages manufacturers to develop advanced coatings with improved radar-absorbing properties. Stealth coatings play a critical role in maintaining stealth capabilities in next-generation defense platforms.

Technological Advancements in Coating Materials

Innovation in stealth coating materials propels market growth by enhancing performance and durability. Manufacturers develop coatings with superior radar absorption, thermal resistance, and environmental protection. These advancements extend the operational lifespan of military equipment under harsh conditions. Lightweight formulations also improve fuel efficiency and maneuverability of defense vehicles. The ability to customize coatings for specific applications strengthens their adoption across aerospace, naval, and land platforms. It enables defense forces to optimize stealth performance without compromising other functional requirements.

- For instance, Qingdao Air++ New Materials Co Ltd created a stealth coating combining a reinforced chopped fiber matrix with pressure-resistant hollow microspheres and wave-absorbing agents to provide both thermal insulation and full-frequency radar absorption for aircraft surfaces.

Growing Demand for Multifunctional Coatings

The market experiences strong demand for stealth coatings that offer additional protective features beyond radar absorption. Combining stealth properties with corrosion resistance, anti-icing, and UV protection reduces maintenance costs and operational downtime. This multifunctionality increases coating value and operational efficiency for defense organizations. Manufacturers respond by integrating nanotechnology and advanced polymers into their products. The trend encourages continuous research to meet stringent military specifications and environmental regulations. It also opens opportunities for coating applications in commercial aviation and security sectors.

- For instance, Weihua Cao’s stealth aircraft carrier coating integrates a dual-layered system of polyurethane foam and graphene-based radiation-absorbing layers, delivering combined radar-absorbent and acoustic protection

Strategic Collaborations and Government Initiatives

Collaborations between defense contractors, research institutions, and governments accelerate stealth coating innovations. Joint development projects focus on next-generation materials and application technologies that enhance coating effectiveness. Governments support such initiatives through funding and policy frameworks that prioritize stealth technology advancement. It helps reduce development timelines and lower costs for defense agencies. These partnerships promote knowledge sharing and technological breakthroughs essential for maintaining competitive advantages. The combined efforts strengthen the stealth coating market’s global growth potential.

Market Trends

Rising Defense Modernization and Military Expenditure

The stealth coating market benefits from increased defense budgets worldwide focused on modernizing military assets. Countries invest heavily in upgrading aircraft, naval vessels, and ground vehicles to improve survivability against advanced detection systems. It supports governments’ strategic goals to maintain technological superiority and enhance national security. Rising geopolitical tensions drive procurement of stealth technologies to counter evolving radar and sensor threats. This demand encourages manufacturers to develop advanced coatings with improved radar-absorbing properties. Stealth coatings play a critical role in maintaining stealth capabilities in next-generation defense platforms.

- For instance, Intermat Defense in France produces nanostructured stealth paints and radar-absorbing films used in European defense programs to manage thermal and radar signatures of military platforms.

Technological Advancements in Coating Materials

Innovation in stealth coating materials propels market growth by enhancing performance and durability. Manufacturers develop coatings with superior radar absorption, thermal resistance, and environmental protection. These advancements extend the operational lifespan of military equipment under harsh conditions. Lightweight formulations also improve fuel efficiency and maneuverability of defense vehicles. The ability to customize coatings for specific applications strengthens their adoption across aerospace, naval, and land platforms. It enables defense forces to optimize stealth performance without compromising other functional requirements.

Growing Demand for Multifunctional Coatings

The market experiences strong demand for stealth coatings that offer additional protective features beyond radar absorption. Combining stealth properties with corrosion resistance, anti-icing, and UV protection reduces maintenance costs and operational downtime. This multifunctionality increases coating value and operational efficiency for defense organizations. Manufacturers respond by integrating nanotechnology and advanced polymers into their products. The trend encourages continuous research to meet stringent military specifications and environmental regulations. It also opens opportunities for coating applications in commercial aviation and security sectors.

Strategic Collaborations and Government Initiatives

Collaborations between defense contractors, research institutions, and governments accelerate stealth coating innovations. Joint development projects focus on next-generation materials and application technologies that enhance coating effectiveness. Governments support such initiatives through funding and policy frameworks that prioritize stealth technology advancement. It helps reduce development timelines and lower costs for defense agencies. These partnerships promote knowledge sharing and technological breakthroughs essential for maintaining competitive advantages. The combined efforts strengthen the stealth coating market’s global growth potential.

- For instance, Intermat, a company with over 20 years of in-house R&D, serves as a single-source stealth coating provider for various military applications. Their expertise reflects long-term strategic development aimed at advancing stealth technology coatings for defense use.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes Limit Market Expansion

The stealth coating market faces challenges due to the high costs associated with raw materials and advanced manufacturing techniques. Producing radar-absorbing coatings requires specialized materials that often involve expensive polymers and nanomaterials, which increase overall expenses. Complex application processes demand precision and skilled labor, raising production time and cost. These factors restrict widespread adoption, especially in cost-sensitive defense budgets or emerging markets. Manufacturers must balance performance requirements with affordability to gain broader acceptance. The need for strict quality control and compliance with military standards adds further complexity. It often slows down production scaling and limits rapid deployment across platforms.

Environmental and Durability Concerns Impact Long-Term Performance and Regulatory Compliance

Stealth coatings must endure harsh environmental conditions, including extreme temperatures, moisture, and UV exposure, without degrading performance. Maintaining radar-absorbing efficiency while providing corrosion resistance and mechanical strength presents technical difficulties. Coatings can deteriorate under operational stress, requiring frequent maintenance or reapplication, which increases lifecycle costs. Regulatory frameworks targeting environmental safety impose restrictions on hazardous substances used in coatings, complicating formulation development. Manufacturers face challenges in meeting these evolving regulations without compromising stealth capabilities. It demands continuous innovation to develop eco-friendly and durable coatings. Failure to address these issues could hinder market growth and acceptance in global defense sectors.

Market Opportunities

Expansion of Defense Modernization Programs and Increasing Military Expenditure Drive Growth Prospects

The stealth coating market benefits from growing investments in defense modernization across multiple regions. Countries focus on upgrading their military assets to enhance survivability and operational capabilities against advanced detection technologies. Rising geopolitical tensions and strategic defense priorities boost demand for radar-absorbing coatings in aircraft, naval vessels, and ground vehicles. It creates opportunities for manufacturers to introduce advanced products with improved performance and customized solutions. Governments’ commitment to strengthening national security encourages long-term procurement contracts. The increasing shift toward lightweight and multifunctional coatings further supports market expansion. This environment fosters innovation and broad adoption of stealth coatings worldwide.

Technological Innovation and Diversification into Commercial Applications Open New Revenue Streams

Advancements in material science and nanotechnology present significant opportunities to improve stealth coating properties and reduce costs. Manufacturers develop coatings with enhanced durability, thermal resistance, and environmental protection, meeting stringent military standards. It enables stealth technology integration into emerging platforms such as unmanned aerial vehicles and next-generation fighter jets. Expanding applications beyond defense into commercial aerospace, automotive, and security sectors offer additional growth avenues. Customized formulations tailored for specific operating environments create competitive advantages. Collaborations between research institutions and industry players accelerate product development and commercialization. These factors position the stealth coating market for sustained innovation and market penetration.

Market Segmentation Analysis:

By Resin Type

The stealth coating market segments by resin type primarily into epoxy, polyurethane, and polyimide. Epoxy resins dominate because they offer excellent adhesion, chemical resistance, and mechanical strength, making them suitable for harsh operational environments. Manufacturers prefer epoxy coatings for their durability and ability to maintain radar-absorbing properties under extreme conditions. Polyurethane resins gain traction due to flexibility and weather resistance, supporting applications that require impact absorption and corrosion protection. Polyimide coatings serve niche applications requiring high thermal stability. It remains critical for producers to optimize resin formulations to meet evolving military specifications and enhance overall stealth effectiveness.

- For instance, BAE Systems uses polyurethane and radar-absorbing materials for electromagnetic signature management on naval vessels and combat aircraft, supporting multi-spectrum stealth with corrosion resistance and durability.

By Application

The stealth coating market divides applications into aerospace & defense, automotive, and others. Aerospace and defense hold the largest market share due to the high demand for radar-absorbing coatings on military aircraft, naval vessels, and armored vehicles. It plays a vital role in reducing radar signatures and enhancing platform survivability in combat scenarios. The automotive segment shows growth potential with increasing interest in security and advanced coating technologies for specialized vehicles. The others category includes industrial equipment and commercial sectors exploring stealth coatings for niche uses. Expanding defense budgets and technological advancements sustain strong demand across these application segments.

- For instance, the F-117 Nighthawk stealth fighter employs specialized coatings to significantly reduce its radar cross-section, enhancing its survivability in combat.

Segments:

Based on Resin type:

- Epoxy

- Polyurethane

- Polyimide

Based on Application:

- Aerospace & Defense

- Automotive

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the stealth coating market with a 35% share driven by its advanced defense infrastructure and significant military expenditure. The region’s strong focus on upgrading air and naval fleets with cutting-edge stealth technologies supports continuous demand. The presence of major defense contractors and ongoing research initiatives fosters innovation in radar-absorbing materials. Government policies prioritize enhancing national security and investing in next-generation defense platforms, which stimulates market growth. It also benefits from a well-established supply chain and skilled workforce capable of producing high-performance coatings. The increasing adoption of unmanned systems and advanced fighter jets further strengthens the region’s market position.

Europe

Europe holds 25% of the stealth coating market, supported by robust defense budgets and modernization programs among NATO members. Countries in the region actively invest in upgrading military assets to maintain operational superiority and counter emerging threats. It experiences steady demand for stealth coatings in aerospace, naval, and land platforms. The emphasis on environmental regulations encourages manufacturers to develop eco-friendly and durable coating solutions. Collaborative projects among European defense firms and research institutions accelerate technology advancement. The region’s strategic location and geopolitical dynamics contribute to consistent market activity and growth potential.

Asia-Pacific

Asia-Pacific commands 30% of the stealth coating market due to rapid military modernization in countries such as China, India, and South Korea. The expanding defense expenditure in this region aims to enhance stealth capabilities for aircraft, naval vessels, and armored vehicles. It benefits from increasing domestic production capabilities and government support for indigenous defense technologies. Growing geopolitical tensions drive procurement of advanced radar-absorbing coatings to strengthen national security. The rising number of defense contracts and partnerships with global suppliers boost market development. Expanding aerospace and defense manufacturing hubs also contribute to sustained growth.

Rest of the World

The Rest of the World accounts for 10% of the stealth coating market, driven by emerging economies investing in defense modernization and security enhancements. Countries in Latin America, the Middle East, and Africa seek to upgrade military platforms with stealth technology to improve defense readiness. It faces challenges due to limited domestic manufacturing infrastructure and budget constraints but shows potential through increasing foreign collaborations and technology transfers. The region also explores applications beyond defense, such as commercial aerospace and security systems, expanding market opportunities. Government initiatives and strategic partnerships will remain key to advancing stealth coating adoption in these markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Lockheed Martin Corporation

- Stealth Veils Inc.

- AkzoNobel N.V.

- The Sherwin-Williams Company

- Intermat Defense

- PPG Industries, Inc.

- Axalta Coating Systems

- BAE Systems

- Hentzen Coatings, Inc.

Competitive Analysis

The stealth coating market features intense competition among leading global players focusing on innovation, product quality, and strategic partnerships. Key companies such as AkzoNobel N.V., BASF SE, Lockheed Martin Corporation, and PPG Industries, Inc. invest heavily in research and development to enhance coating performance, durability, and radar-absorbing efficiency. It drives continuous technological advancements to meet stringent military standards and evolving defense requirements. Companies prioritize expanding their product portfolios with multifunctional coatings that provide corrosion resistance and environmental protection alongside stealth capabilities. Market participants also engage in collaborations with defense agencies and research institutions to accelerate product development and deployment. Competitive differentiation relies on the ability to customize solutions for specific platforms and operational environments. Firms focus on strengthening their global supply chains and enhancing manufacturing capabilities to meet rising demand. The stealth coating market remains dynamic, with companies pursuing mergers, acquisitions, and regional expansions to increase market share and geographical presence.

Recent Developments

- In July 2023, Intermat Defense introduced a new line of stealth coatings designed for military applications. These coatings are engineered to effectively reduce radar signatures, enhancing the stealth capabilities of various defense platforms.

- In late May 2023, Boeing Defense, Space & Security’s Phantom Works division announced the construction of a new Advanced Coating Center in St. Louis, set to be operational in 2025.

- In April 2024, BASF’s Coatings division launched a new portfolio of eco-efficient clearcoats and undercoats. These products promise improved quality, enhanced productivity, and substantial CO₂ emission reductions, aligning with the growing demand for sustainable solutions in the coatings industry.

Market Concentration & Characteristics

The stealth coating market exhibits a moderately concentrated structure dominated by a few key players such as AkzoNobel N.V., BASF SE, Lockheed Martin Corporation, and PPG Industries, Inc. These companies hold significant market share due to their strong research capabilities, advanced technologies, and extensive defense industry relationships. It demands high capital investment and specialized expertise, creating substantial barriers for new entrants. The market emphasizes continuous innovation to meet stringent military standards and evolving operational requirements. Customization and multifunctionality in coatings drive competitive differentiation. Companies focus on expanding their global footprint through strategic partnerships and regional manufacturing facilities to address diverse customer needs. The stealth coating market relies heavily on government contracts and long-term procurement agreements, which influence market dynamics and stability. This competitive environment fosters technological advancements and promotes steady growth across aerospace, defense, and emerging commercial sectors.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Defense modernization programs will continue driving demand for advanced stealth coatings.

- Technological innovation will focus on improving coating durability and radar absorption.

- Lightweight and multifunctional coatings will gain prominence across defense platforms.

- Collaboration between manufacturers and research institutions will accelerate product development.

- Emerging economies will increase investments in stealth coating technologies.

- Environmental regulations will push the development of eco-friendly coating formulations.

- Customization of coatings for specific applications will enhance market competitiveness.

- Expansion into commercial aerospace and security sectors will create new growth avenues.

- Strategic partnerships and regional expansions will strengthen global market presence.

- Integration of nanotechnology will improve performance and reduce production costs.