Market Overview:

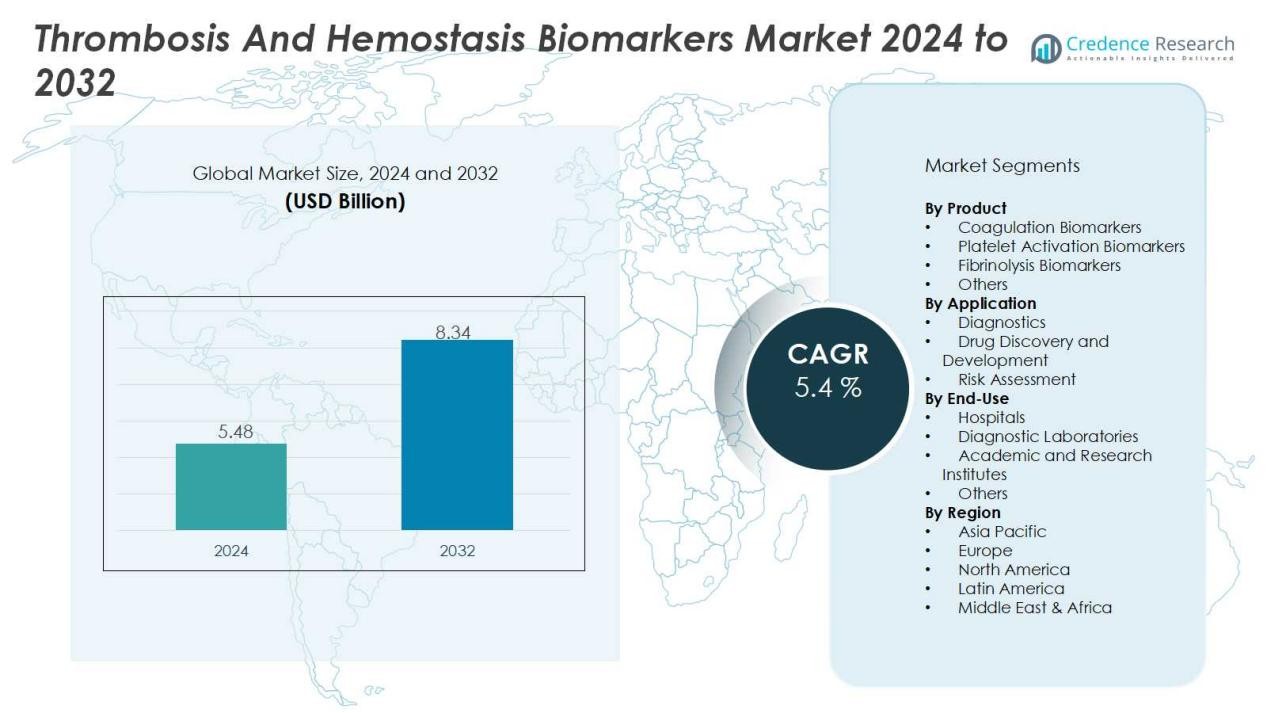

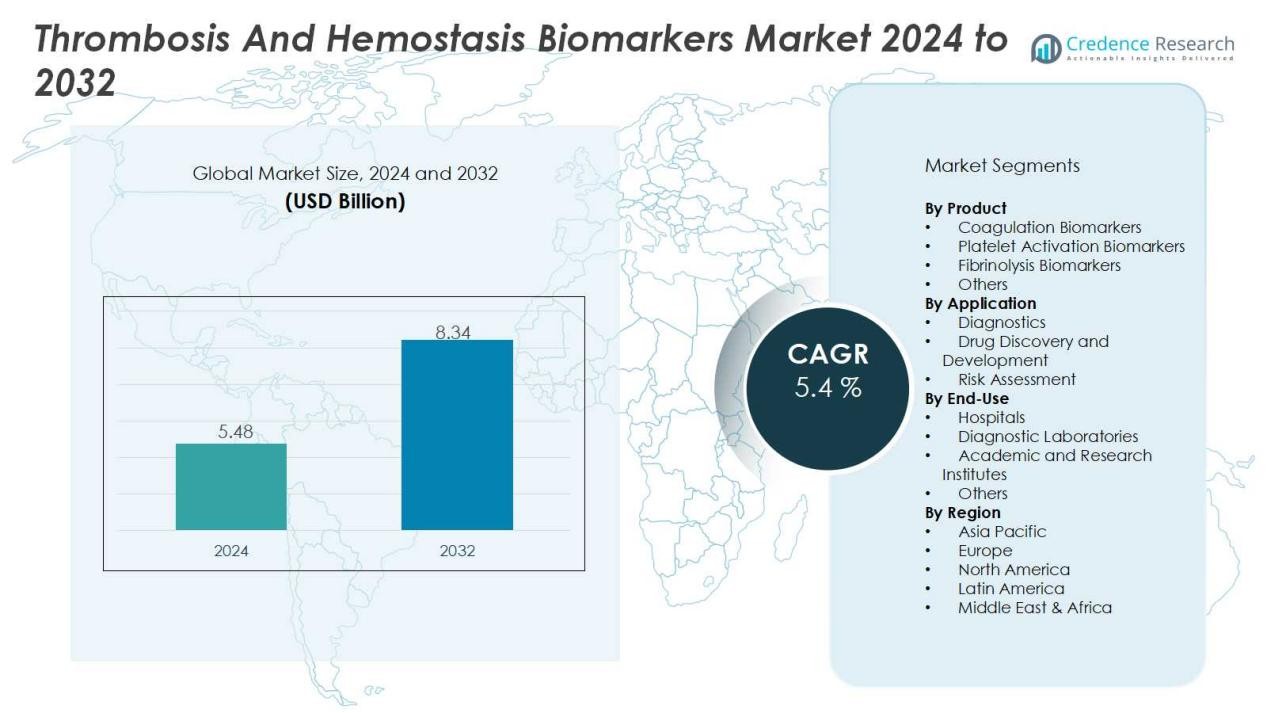

The thrombosis and hemostasis biomarkers market size was valued at USD 5.48 billion in 2024 and is anticipated to reach USD 8.34 billion by 2032, at a CAGR of 5.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thrombosis and Hemostasis Biomarkers Market Size 2024 |

USD 5.48 Billion |

| Thrombosis and Hemostasis Biomarkers Market, CAGR |

5.4% |

| Thrombosis and Hemostasis Biomarkers Market Size 2032 |

USD 8.34 Billion |

Market growth is driven by multiple factors, including the increasing prevalence of thrombotic disorders such as deep vein thrombosis, pulmonary embolism, and stroke. Advancements in molecular diagnostics and biomarker discovery are enabling faster and more accurate detection of clotting abnormalities. Strong emphasis on preventive healthcare, rising geriatric population, and higher healthcare spending are further accelerating adoption. In addition, pharmaceutical companies are investing in biomarker-based clinical trials, fueling integration into personalized treatment approaches.

Regionally, North America dominates due to its advanced healthcare infrastructure, high incidence of cardiovascular diseases, and strong regulatory support for biomarker testing. Europe follows with widespread use of advanced diagnostics and supportive reimbursement policies. Asia-Pacific is emerging as the fastest-growing market, driven by rising healthcare investments, growing awareness of preventive diagnostics, and increasing burden of thrombotic disorders in populous countries like China and India. Latin America and the Middle East & Africa show gradual but consistent progress supported by improving healthcare systems.

Market Insights:

- The thrombosis and hemostasis biomarkers market was valued at USD 5.48 billion in 2024 and is projected to reach USD 8.34 billion by 2032, growing at a CAGR of 5.4%.

- Rising prevalence of cardiovascular and thrombotic disorders, including deep vein thrombosis and pulmonary embolism, continues to drive strong demand for reliable diagnostics.

- Advancements in molecular diagnostics and personalized medicine are enhancing accuracy and enabling tailored treatment approaches for patients.

- Growing healthcare expenditure and preventive care initiatives are pushing adoption of biomarker-based screening across hospitals and laboratories.

- Pharmaceutical research and clinical trials are expanding applications, with biomarkers playing a key role in patient selection and therapy monitoring.

- High costs, regulatory hurdles, and technical complexities remain key challenges that limit broader accessibility in emerging healthcare systems.

- North America led with 42% share in 2024, followed by Europe with 29%, while Asia-Pacific captured 21% and is set to grow fastest with strong investments and rising disease burden.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Cardiovascular and Thrombotic Disorders:

The thrombosis and hemostasis biomarkers market is fueled by the growing burden of cardiovascular diseases, strokes, and thromboembolic conditions worldwide. Increasing cases of deep vein thrombosis, pulmonary embolism, and atrial fibrillation have created strong demand for reliable diagnostic tools. Biomarkers offer early detection and monitoring, reducing risks of severe complications. This rising prevalence drives both clinical adoption and research investments.

- For instance, Roche’s CARDIAC D-Dimer test strips used with the cobas h 232 device deliver quantitative D-dimer results from a 150 µL whole blood sample in approximately 10 minutes at the point of care.

Advancements in Diagnostic Technologies and Personalized Medicine:

Rapid innovation in molecular diagnostics and biomarker discovery is transforming clinical practice. It allows healthcare providers to detect clotting abnormalities with higher sensitivity and specificity. Personalized medicine strategies further strengthen biomarker adoption by tailoring treatment to individual patient risk profiles. The shift toward precision healthcare enhances the clinical and commercial value of biomarker testing.

- For Instance, Roche Diagnostics’ Tina-quant D-dimer Gen.2 assay is a high-sensitivity laboratory test performed on automated analyzers, such as the cobas c 303 unit, not a point-of-care test.

Growing Healthcare Expenditure and Preventive Care Initiatives:

Healthcare systems worldwide are investing in advanced diagnostic solutions to lower long-term treatment costs. Preventive care models promote early diagnosis, making biomarkers essential in routine screening for at-risk populations. Rising healthcare spending across developed and emerging economies supports the integration of these tools in hospital and laboratory workflows. It improves patient outcomes while addressing economic pressures on healthcare providers.

Expanding Pharmaceutical Research and Clinical Trial Applications:

Pharmaceutical and biotech companies are increasing the use of biomarkers in drug discovery and development. Their role in clinical trials ensures better patient selection and therapeutic monitoring. This integration reduces trial costs and improves success rates for targeted therapies. Expanding applications across research, combined with industry collaboration, continue to boost growth in the thrombosis and hemostasis biomarkers market.

Market Trends:

Integration of Advanced Technologies and Point-of-Care Diagnostics:

The thrombosis and hemostasis biomarkers market is witnessing strong momentum from the adoption of advanced diagnostic technologies. The use of molecular assays, high-throughput platforms, and next-generation sequencing is enabling rapid and precise detection of coagulation disorders. Point-of-care testing is also gaining traction, offering faster turnaround times and wider accessibility in emergency and critical care settings. Hospitals and diagnostic centers increasingly rely on these solutions to improve efficiency and reduce delays in treatment decisions. Growing investments in digital health tools, such as AI-powered diagnostic platforms, further support the market’s transition toward more personalized and data-driven care. It enhances the accuracy of diagnosis while lowering the burden on healthcare systems.

- For Instance, Sysmex Corporation has been marketing its CN-6500 and CN-3500 automated blood coagulation analyzers since 2020 and 2021, depending on the market.

Rising Role of Biomarkers in Research, Drug Development, and Preventive Care:

Pharmaceutical and biotechnology companies are expanding biomarker applications in drug discovery, patient stratification, and therapeutic monitoring. This trend strengthens collaborations between diagnostic developers and pharmaceutical firms, creating integrated solutions for both clinical and research environments. Preventive healthcare strategies are also promoting biomarker-based screening for at-risk populations, particularly the elderly and those with chronic conditions. Governments and health organizations are emphasizing early detection to curb the growing incidence of thrombosis-related diseases. The shift toward preventive and precision medicine accelerates innovation in biomarker discovery, validation, and commercialization. It positions the thrombosis and hemostasis biomarkers market as a critical component of modern healthcare delivery.

- For instance, Roche’s Foundation Medicine division had already generated over 1.3 million comprehensive genomic profile reports by the end of 2024, continuing to support personalized cancer therapy decisions worldwide

Market Challenges Analysis:

High Costs, Regulatory Barriers, and Limited Accessibility:

The thrombosis and hemostasis biomarkers market faces challenges linked to the high costs of advanced diagnostic tests and equipment. Many healthcare systems, especially in low- and middle-income regions, struggle to adopt these technologies due to budget constraints. Stringent regulatory requirements slow down the approval process for novel biomarkers, delaying commercialization and limiting availability. Lack of standardized protocols across laboratories creates variations in test results, reducing clinical confidence. Limited awareness among patients and general practitioners further restricts adoption in preventive care. It highlights the need for cost-effective solutions and harmonized regulatory frameworks.

Technical Complexities, Data Interpretation, and Infrastructure Gaps:

Clinical use of biomarkers often requires specialized expertise, advanced laboratory infrastructure, and trained personnel. Smaller hospitals and diagnostic centers may lack the technical capacity to implement these tests effectively. Complex data interpretation creates barriers for clinicians, leading to underutilization of biomarker insights in treatment planning. Integration with digital health systems remains uneven, reducing the potential for real-time clinical decision support. Emerging economies face infrastructure gaps that slow market penetration despite rising disease burden. It underscores the importance of education, training, and supportive policies to overcome these structural limitations in the thrombosis and hemostasis biomarkers market.

Market Opportunities:

Expansion into Preventive Healthcare and Point-of-Care Testing:

The thrombosis and hemostasis biomarkers market holds strong opportunities in preventive healthcare and early disease detection. Rising awareness of cardiovascular risk management is driving interest in routine biomarker screening for high-risk populations. Point-of-care testing offers rapid results and accessibility in emergency and outpatient settings, expanding market reach. Growing demand from primary care centers, urgent care facilities, and pharmacies is creating new adoption pathways. Integration of biomarkers into regular health checkups strengthens their role in reducing long-term treatment costs. It positions biomarker testing as a vital tool for proactive healthcare strategies.

Innovation in Research Collaborations and Emerging Market Adoption:

Pharmaceutical companies and diagnostic developers are increasing collaborations to expand biomarker applications in clinical trials and personalized medicine. These partnerships enhance drug development efficiency and broaden therapeutic options for patients. Emerging economies with rising healthcare investments, particularly in Asia-Pacific and Latin America, present strong growth potential. Governments and private providers are focusing on advanced diagnostic infrastructure, fueling biomarker adoption. Expanding telemedicine platforms further support the integration of remote diagnostic testing in underserved areas. It creates a favorable environment for innovation, commercialization, and wider accessibility in the thrombosis and hemostasis biomarkers market.

Market Segmentation Analysis:

By Product:

The thrombosis and hemostasis biomarkers market is segmented into coagulation biomarkers, platelet activation biomarkers, fibrinolysis biomarkers, and others. Coagulation biomarkers hold the largest share due to their central role in detecting clotting disorders and guiding treatment decisions. Platelet activation biomarkers are gaining importance with their growing use in cardiovascular risk assessments. Fibrinolysis biomarkers support monitoring of thrombolytic therapies, strengthening their clinical relevance. It continues to see demand from both diagnostic and research settings where accuracy and sensitivity are critical.

- For instance, Siemens Healthineers’ Atellica COAG 360 system enables rapid coagulation testing with turnaround times reduced to under 12 minutes per assay, improving diagnostic speed for clotting disorders in clinical settings.

By Application:

Applications include diagnostics, drug discovery and development, and risk assessment. Diagnostics dominate the segment, supported by high clinical use in hospitals and laboratories for early detection of thrombotic conditions. Drug discovery and development applications are expanding with the rise of personalized medicine, where biomarkers guide clinical trial design and therapeutic validation. Risk assessment is becoming more widespread as preventive healthcare initiatives focus on identifying high-risk populations. It benefits from increasing integration into routine checkups and disease management protocols.

- For Instance, The Roche cobas 6000 analyzer series offers consolidated STAT sample processing, which can improve turnaround times for priority tests by 5 to 7 minutes compared to traditional methods.

By End-Use:

End-use segmentation covers hospitals, diagnostic laboratories, academic and research institutes, and others. Hospitals remain the leading end-use segment due to high patient inflow and availability of advanced testing infrastructure. Diagnostic laboratories are expanding rapidly with the demand for specialized tests and outsourced services. Academic and research institutes drive innovation by focusing on biomarker discovery and validation. It reflects strong participation across both clinical and research domains, ensuring sustained market growth.

Segmentations:

By Product:

- Coagulation Biomarkers

- Platelet Activation Biomarkers

- Fibrinolysis Biomarkers

- Others

By Application:

- Diagnostics

- Drug Discovery and Development

- Risk Assessment

By End-Use:

- Hospitals

- Diagnostic Laboratories

- Academic and Research Institutes

- Others

By Region:

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis:

North America:

North America held 42% share of the thrombosis and hemostasis biomarkers market in 2024, supported by advanced healthcare systems and high diagnostic adoption. The region benefits from strong investments in research, advanced laboratory infrastructure, and favorable reimbursement policies. High incidence of cardiovascular and thromboembolic disorders continues to drive demand for biomarker-based testing. Leading companies maintain a strong presence through partnerships and clinical collaborations. Regulatory bodies support innovation while ensuring safety and reliability of diagnostic tools. It remains the largest contributor to revenue with strong growth prospects in preventive care and personalized medicine.

Europe:

Europe accounted for 29% share of the thrombosis and hemostasis biomarkers market in 2024, driven by strict healthcare standards and clinical integration. The region has established protocols for biomarker testing across hospitals and diagnostic centers. Countries such as Germany, France, and the U.K. show high adoption supported by public health initiatives. Pharmaceutical and diagnostic firms collaborate with research institutes to expand applications in therapeutic monitoring and clinical trials. Rising awareness of preventive care strengthens demand for routine biomarker screening. It continues to demonstrate steady growth supported by structured healthcare policies and cross-border diagnostic networks.

Asia-Pacific:

Asia-Pacific captured 21% share of the thrombosis and hemostasis biomarkers market in 2024, with rapid expansion expected in the forecast period. Growing healthcare investments in China, India, and Southeast Asia are fueling demand for advanced diagnostics. Rising incidence of thrombotic and cardiovascular diseases increases reliance on biomarker-based testing. Governments are strengthening healthcare infrastructure and supporting digital health adoption to expand accessibility. Multinational companies are targeting the region with strategic partnerships and localized manufacturing. It positions Asia-Pacific as the fastest-growing market, supported by increasing healthcare spending and growing focus on early disease detection.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- bioMérieux SA

- Hoffmann-La Roche Ltd.

- Biomedica Diagnostics

- Siemens Healthineers

- Abbott

- HORIBA Ltd.

- Werfen

- Quidel Corporation

- Diazyme Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

Competitive Analysis:

The thrombosis and hemostasis biomarkers market is highly competitive, with global and regional players focusing on innovation, partnerships, and expanded clinical applications. Key companies include bioMérieux SA, F. Hoffmann-La Roche Ltd., Biomedica Diagnostics, Siemens Healthineers, Abbott, HORIBA Ltd., and Werfen. These companies compete by strengthening diagnostic portfolios, advancing biomarker assays, and enhancing accuracy and speed of results. Strategic collaborations with hospitals, research institutions, and pharmaceutical firms support product development and market reach. Investments in automation and point-of-care technologies enable faster adoption across healthcare settings. Companies are also expanding into emerging economies, supported by rising healthcare investments and demand for preventive diagnostics. It reflects strong competition shaped by product differentiation, regulatory compliance, and global distribution networks.

Recent Developments:

- In January 2025, bioMérieux acquired SpinChip Diagnostics ASA, a company specializing in Point-of-Care immunoassays technology.

- In June 2025, bioMérieux strengthened its next-generation sequencing capabilities by acquiring the assets of Day Zero Diagnostics.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The thrombosis and hemostasis biomarkers market will experience strong momentum from increasing demand for early disease detection and preventive care.

- It will benefit from continuous advancements in molecular diagnostics, high-throughput testing, and digital health integration.

- Growing focus on personalized medicine will drive wider use of biomarkers in risk assessment and treatment monitoring.

- Pharmaceutical companies will expand biomarker use in clinical trials, improving drug development efficiency and patient targeting.

- Point-of-care testing will gain traction, enabling faster decision-making in emergency and critical care settings.

- Healthcare providers will integrate biomarker-based testing into routine screening programs for at-risk populations.

- Emerging markets will see rapid adoption, supported by healthcare infrastructure upgrades and government initiatives.

- Collaborations between diagnostic firms, research institutes, and pharmaceutical companies will accelerate innovation and commercialization.

- Regulatory agencies will streamline approval pathways, supporting faster market entry for new biomarker-based tests.

- Artificial intelligence and data analytics will enhance interpretation, creating opportunities for precision diagnostics and improved clinical outcomes.