Market Overview

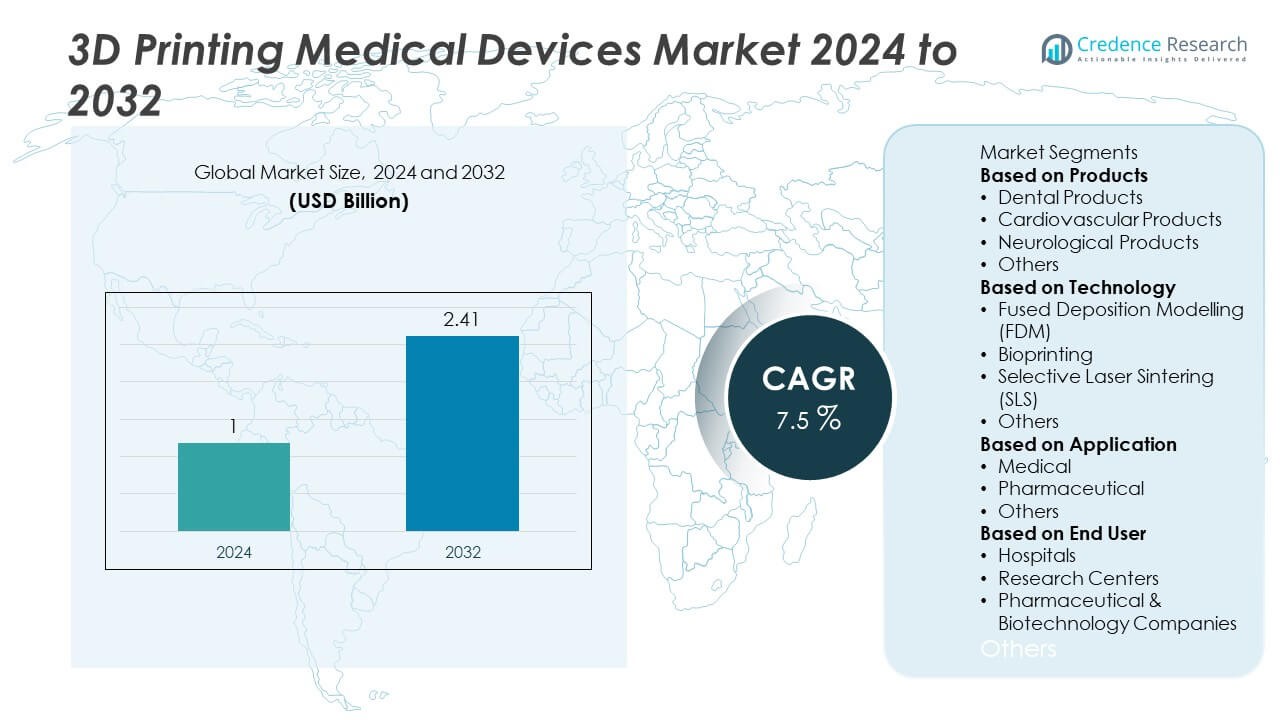

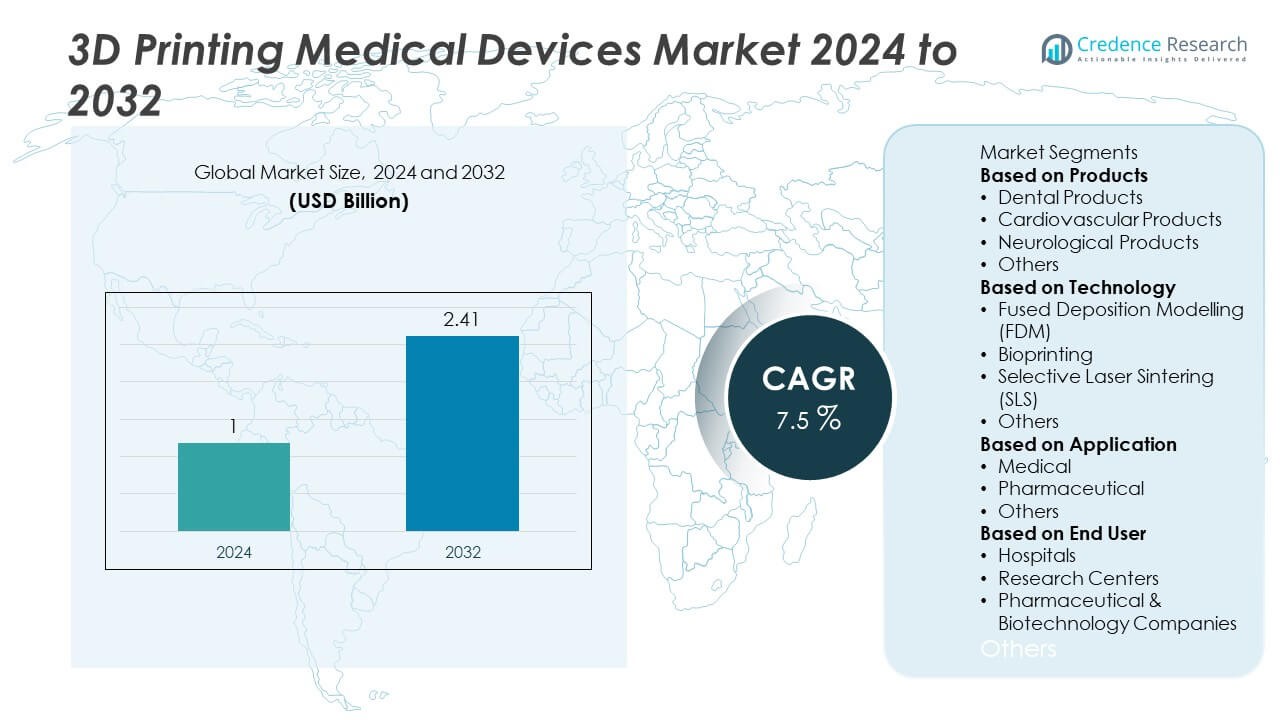

The 3D printing medical devices market was valued at USD 1 billion in 2024 and is projected to reach USD 2.41 billion by 2032, growing at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Printing Medical Devices Market Size 2024 |

USD 1 Billion |

| 3D Printing Medical Devices Market, CAGR |

7.5% |

| 3D Printing Medical Devices Market Size 2032 |

USD 2.41 Billion |

The 3D printing medical devices market is driven by leading players such as Stratasys Ltd., 3D Systems Corporation, Materialise NV, EOS GmbH, Renishaw plc, GE Additive, Prodways Group, SLM Solutions Group AG, EnvisionTEC (Desktop Health), and Formlabs Inc. These companies focus on developing advanced additive manufacturing technologies, biocompatible materials, and patient-specific implants to meet growing clinical demand. North America leads the market with 37% share, supported by strong adoption in hospitals and research institutions. Europe accounts for 30% share, driven by innovation in dental and orthopedic applications, while Asia-Pacific holds 25% share, emerging as the fastest-growing region due to rising healthcare investment and local manufacturing initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The 3D printing medical devices market was valued at USD 1 billion in 2024 and is projected to reach USD 2.41 billion by 2032, growing at a CAGR of 7.5% during the forecast period.

- Rising demand for personalized implants, prosthetics, and surgical models drives growth, with dental products leading the segment with over 35% share due to their precision and customization benefits.

- Key trends include the expansion of bioprinting research, integration of AI in 3D printing workflows, and use of advanced biocompatible materials for complex medical applications.

- The market is competitive, with players such as Stratasys Ltd., 3D Systems, Materialise NV, EOS GmbH, and GE Additive focusing on technology innovation, partnerships with hospitals, and regulatory approvals to expand market presence.

- North America holds 37% share, Europe 30%, and Asia-Pacific 25%, while Latin America and Middle East & Africa collectively account for 8% share, supported by growing healthcare infrastructure and adoption.

Market Segmentation Analysis:

By Products

Dental products dominated the 3D printing medical devices market in 2024, accounting for over 35% share, driven by the rising demand for customized dental implants, crowns, bridges, and aligners. 3D printing enables high precision, faster turnaround times, and cost-effective production of patient-specific solutions. Growing adoption by dental laboratories and clinics for chairside manufacturing further supports segment growth. Cardiovascular and neurological products are emerging segments, benefiting from advances in biocompatible materials and regulatory approvals for patient-specific surgical models and implants, which enhance pre-surgical planning and improve patient outcomes.

- For instance, Formlabs launched its Tough 1500 V2 Resin and a second-generation Form Cure system in March 2025. When used with the company’s Form 4 printer, the material enables the production of robust functional parts with an ultimate tensile strength of 34 MPa, similar to injection-molded polypropylene.

By Technology

Fused Deposition Modelling (FDM) held the largest share at over 40% in 2024, owing to its cost-efficiency, material versatility, and ability to produce complex prototypes quickly. FDM technology is widely used in orthopedic implants, surgical guides, and anatomical models. Bioprinting is gaining traction as research advances in tissue engineering and regenerative medicine accelerate, creating opportunities for functional tissue and organ printing. Selective Laser Sintering (SLS) also contributes significantly, preferred for producing high-strength, durable parts like cranio-maxillofacial implants and surgical instruments with superior mechanical properties.

- For instance, the Stratasys J5 Digital Anatomy 3D printer, released in June 2024, provides anatomical models with layer thickness down to 18 microns, enabling the reproduction of bone, muscle, and organ textures. The printer is used for surgical planning, education, and medical device development, with its biocompatible materials and hardware manufacturing sites being ISO 13485 certified.

By Application

Medical applications led the market with over 70% share in 2024, supported by rising use of 3D printing in surgical planning, prosthetics, orthopedics, and patient-specific implants. The technology improves treatment accuracy, reduces surgery time, and lowers healthcare costs by enabling highly tailored solutions. Pharmaceutical applications are growing steadily, with 3D printing being used to develop customized drug delivery systems, dosage forms, and rapid prototyping of medical devices. Other applications include research and education, where anatomical models printed in 3D are used for training healthcare professionals and improving clinical decision-making.

Key Growth Drivers

Rising Demand for Personalized and Patient-Specific Solutions

The market is driven by the growing need for personalized medical devices, contributing to over 40% of new 3D printing adoption in 2024. 3D printing enables production of customized implants, prosthetics, and surgical guides that improve patient outcomes and reduce recovery times. Healthcare providers are increasingly adopting these solutions to address anatomical variations and enhance treatment precision. This trend is particularly strong in dental, orthopedic, and cranio-maxillofacial applications where patient-specific designs are critical for functionality and comfort.

- For instance, Auxilium Biotechnologies used its AMP-1 Microfabrication Platform aboard the International Space Station to bioprint eight implantable medical devices simultaneously in two hours, demonstrating on-orbit manufacturing precision and drastically reducing production cycles for patient-specific implants.

Technological Advancements in 3D Printing Materials and Hardware

Continuous innovation in biocompatible materials, including polymers, metals, and bio-inks, drives over 35% share of market expansion. Advances in printing speed, accuracy, and scalability are making 3D printing more accessible for hospitals and research centers. Technologies such as FDM, SLS, and bioprinting are enabling production of complex structures like tissue scaffolds and surgical implants with improved mechanical strength and surface finish, expanding the range of medical applications.

- For instance, Nikon SLM Solutions multi-laser metal AM platform, used for producing custom medical implants, achieves high productivity and build rates and can produce titanium (Ti6Al4V) implants with an ultimate tensile strength well over 900 MPa, particularly after post-processing. The maximum laser scan speed can reach 10,000 mm/s on some systems, but the effective build speed is significantly lower.

Supportive Regulatory Approvals and Healthcare Investments

Regulatory bodies such as the FDA are increasingly approving 3D-printed devices, accelerating commercialization and adoption. Government and private sector investments in healthcare infrastructure and R&D are fostering innovation in additive manufacturing. This driver supports steady growth across hospitals and research institutions, encouraging the development of innovative solutions such as patient-specific models for surgical planning and drug delivery devices. Favorable reimbursement policies and collaborations between device manufacturers and healthcare providers further boost market penetration.

Key Trends & Opportunities

Growth of Bioprinting and Regenerative Medicine Applications

Bioprinting is emerging as a transformative trend, offering opportunities to create functional tissues and organ models. Research efforts are focused on printing cartilage, skin, and bone for transplant and drug testing applications. This trend attracts significant investment from biotechnology companies and academic institutions, positioning bioprinting as a key growth area over the next decade.

- For instance, researchers at the University of Galway successfully used a 4D bioprinting technique to create heart tissue constructs that undergo programmable shape-morphing. This shape-morphing process, driven by cell-generated forces, improved the structural and functional maturity of the heart tissues, resulting in stronger and faster contractions.

Integration of AI and Simulation in 3D Printing Workflows

AI-driven design tools and simulation software are being integrated into 3D printing processes, enabling faster prototyping and reducing material waste. Hospitals and research centers are using these tools to plan surgeries more accurately and optimize device performance before production. This integration opens opportunities for cost reduction and improved patient outcomes.

- For instance, 3D Systems has used its AI-powered Virtual Surgical Planning (VSP) solution for craniomaxillofacial surgical planning. In April 2024, the company announced FDA clearance for its 3D-printed PEEK cranial implants, noting that the manufacturing technology for patient-specific implants can use up to 85% less material than traditional methods.

Key Challenges

High Cost of Equipment and Materials

The significant capital investment required for advanced 3D printers, materials, and skilled labor remains a major challenge. This cost barrier limits adoption among smaller hospitals and clinics, particularly in developing regions. Maintaining production scalability while keeping costs competitive is critical for wider adoption.

Regulatory and Quality Assurance Complexities

Strict regulatory requirements for medical devices demand rigorous testing and validation, increasing time-to-market. Ensuring consistent quality, biocompatibility, and safety of 3D-printed devices is challenging due to variations in materials and printing processes. Companies must invest heavily in quality management systems to meet compliance standards, adding to operational costs.

Regional Analysis

North America

North America held 37% share in 2024, driven by strong adoption of 3D printing technologies in hospitals, dental clinics, and research centers. The United States leads with significant investments in additive manufacturing for patient-specific implants, surgical guides, and prosthetics. Favorable regulatory support from the FDA and collaborations between device manufacturers and healthcare providers accelerate innovation. High prevalence of chronic diseases and rising demand for advanced treatment solutions further boost adoption. Canada also contributes steadily with growing use of 3D printing for dental and orthopedic applications, supported by government-backed healthcare modernization programs.

Europe

Europe accounted for 30% share in 2024, supported by strong R&D capabilities and early adoption of medical 3D printing technologies. Countries like Germany, the U.K., and France lead in orthopedic and dental device production using additive manufacturing. EU initiatives promoting advanced healthcare technologies and investments in bioprinting research strengthen market growth. Regulatory alignment and focus on patient safety ensure smooth commercialization of 3D-printed devices. Increasing demand for customized implants and surgical models across hospitals is fueling consistent market expansion across both Western and Eastern European regions.

Asia-Pacific

Asia-Pacific captured 25% share in 2024, emerging as the fastest-growing regional market due to rising healthcare expenditure and rapid adoption of digital technologies. China, Japan, and India are leading markets with significant investments in 3D printing infrastructure for medical devices and research applications. Government initiatives to improve healthcare access and boost local manufacturing are supporting growth. Rising medical tourism and demand for cost-effective, patient-specific implants drive adoption across hospitals and dental clinics. Expanding partnerships between global players and regional manufacturers are helping accelerate technology transfer and market penetration.

Latin America

Latin America held 5% share in 2024, with growth supported by rising adoption of 3D printing in dental clinics, hospitals, and research centers. Brazil and Mexico lead the region, focusing on affordable orthopedic implants and surgical models. Expanding private healthcare infrastructure and increasing awareness of personalized treatment solutions are driving demand. However, limited access to high-end 3D printing equipment and skilled professionals can slow market expansion. Partnerships with global manufacturers and introduction of cost-effective printing solutions are creating opportunities for broader adoption across smaller healthcare facilities.

Middle East & Africa

The Middle East & Africa region accounted for 3% share in 2024, with demand concentrated in Gulf countries and South Africa. Investments in modernizing healthcare infrastructure, particularly in the UAE and Saudi Arabia, are encouraging adoption of 3D-printed prosthetics and surgical tools. Medical research institutions in the region are exploring bioprinting for regenerative medicine applications. Africa is witnessing gradual adoption with initiatives to improve access to affordable healthcare technologies. High equipment costs remain a barrier, but partnerships with technology providers and training programs are expected to boost growth in the coming years.

Market Segmentations:

By Products

- Dental Products

- Cardiovascular Products

- Neurological Products

- Others

By Technology

- Fused Deposition Modelling (FDM)

- Bioprinting

- Selective Laser Sintering (SLS)

- Others

By Application

- Medical

- Pharmaceutical

- Others

By End User

- Hospitals

- Research Centers

- Pharmaceutical & Biotechnology Companies

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the 3D printing medical devices market includes major players such as Stratasys Ltd., 3D Systems Corporation, Materialise NV, SLM Solutions Group AG, EOS GmbH, Renishaw plc, GE Additive, Prodways Group, EnvisionTEC (Desktop Health), and Formlabs Inc. These companies focus on advancing additive manufacturing technologies, expanding material portfolios, and delivering patient-specific solutions for dental, orthopedic, and surgical applications. Strategic initiatives include mergers, partnerships with hospitals and research institutes, and investments in bioprinting capabilities to develop functional tissues and implants. Players are also working on enhancing printing speed, precision, and cost efficiency to meet increasing demand from healthcare providers. Customization, regulatory compliance, and innovation in biocompatible materials remain key differentiators. With growing adoption of digital healthcare solutions and rising demand for personalized treatments, these players are positioned to strengthen their market presence and support the global shift toward precision medicine.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stratasys Ltd.

- 3D Systems Corporation

- Materialise NV

- SLM Solutions Group AG

- EOS GmbH

- Renishaw plc

- GE Additive

- Prodways Group

- EnvisionTEC (Desktop Health)

- Formlabs Inc.

Recent Developments

- In July 2025, GE HealthCare (via GE Additive) Entered a strategic collaboration with Ascension to improve clinical and care-delivery technology efficiency.

- In May 2025, Materialise Released a report on Point-of-Care trends, noting broader clinical adoption beyond early users.

- In March 2025, Formlabs Introduced a new “10× Tougher Resin” and a faster post-cure process.

Report Coverage

The research report offers an in-depth analysis based on Products, Technology, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for 3D printing medical devices will rise with growing focus on personalized healthcare solutions.

- Dental and orthopedic applications will remain leading segments supported by increasing adoption in clinics and hospitals.

- Bioprinting will gain momentum with advances in tissue engineering and regenerative medicine research.

- Development of new biocompatible materials will enable production of stronger, safer, and more functional implants.

- North America will maintain its lead, while Asia-Pacific will grow fastest due to rising healthcare investments.

- Integration of AI and simulation tools will enhance design accuracy and reduce production time.

- Costs will gradually decline as printing technology becomes more efficient and widely available.

- Partnerships between medical device manufacturers and research institutes will accelerate innovation.

- Regulatory approvals will become faster as authorities gain confidence in 3D-printed medical solutions.

- Adoption of point-of-care 3D printing in hospitals will expand, improving treatment speed and customization.