Market Overview

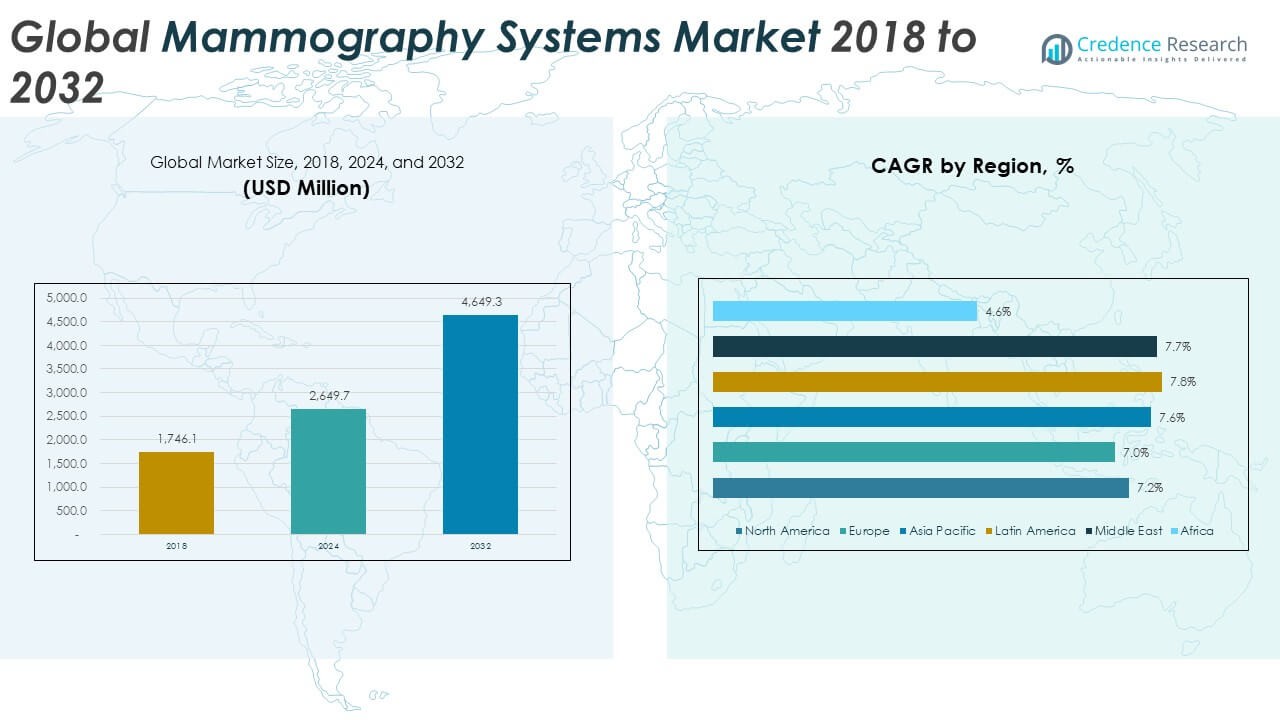

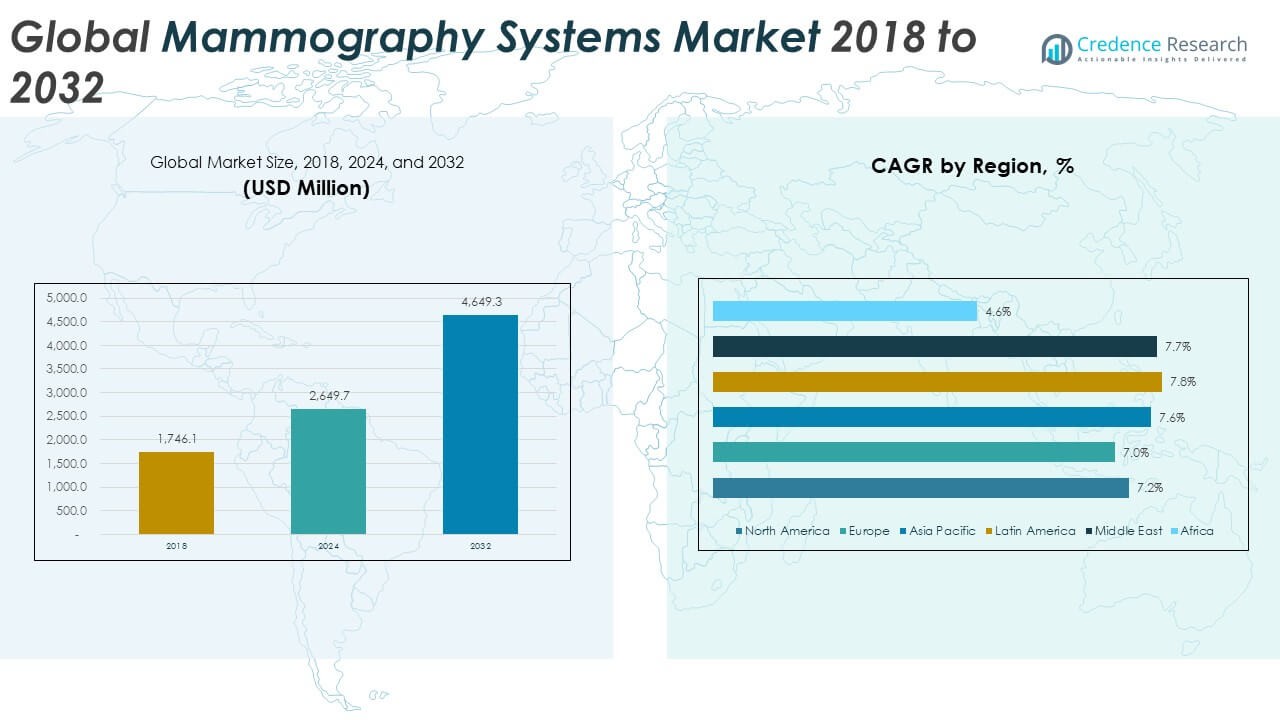

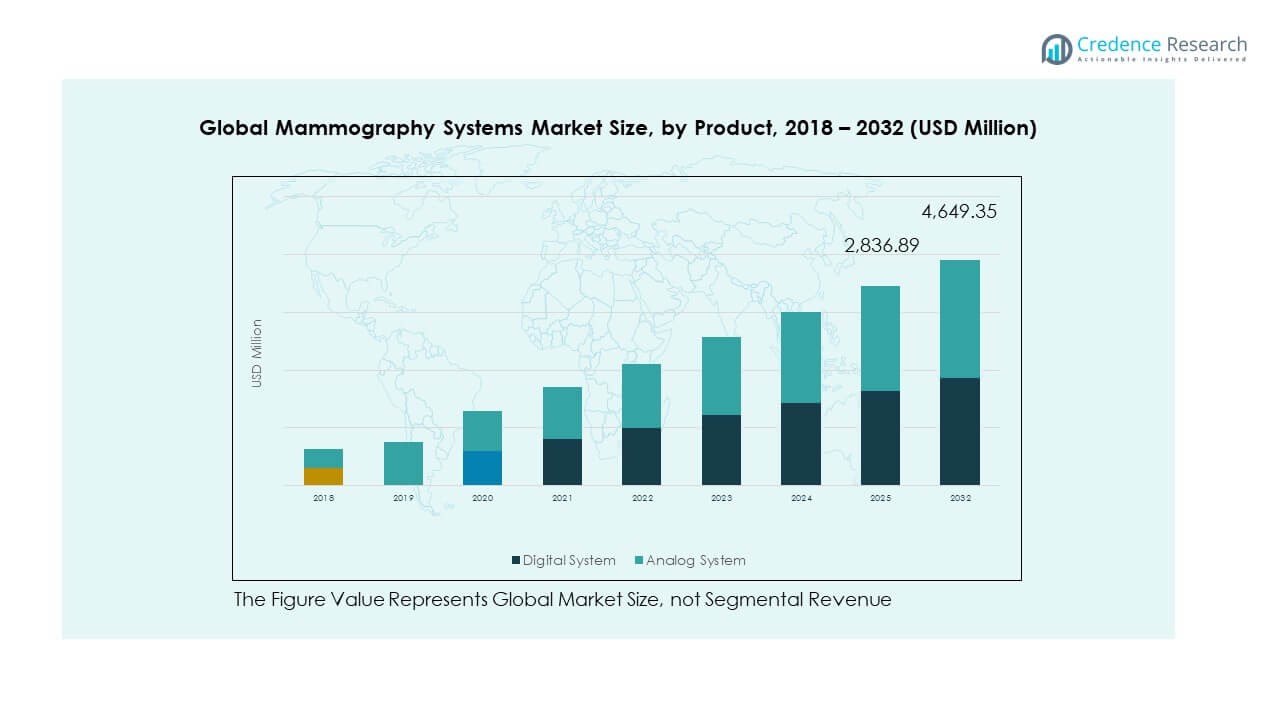

Global Mammography Systems Market size was valued at USD 1,746.1 million in 2018 to USD 2,649.7million in 2024 and is anticipated to reach USD 4,649.3 million by 2032, at a CAGR of 7.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mammography Systems Market Size 2024 |

USD 2,649.7 Million |

| Mammography Systems Market, CAGR |

7.31% |

| Mammography Systems Market Size 2032 |

USD 4,649.3 Million |

The Global Mammography Systems Market is shaped by key players including Fujifilm Holdings Corporation, GE HealthCare, Hologic Inc., Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems, Carestream Health, Agfa-Gevaert Group, and Metaltronica SpA. These companies maintain strong positions through advanced product portfolios, continuous innovation in digital and 3D tomosynthesis systems, and extensive global distribution networks. Strategic investments in artificial intelligence integration and low-dose imaging technologies further enhance their competitiveness. Regionally, North America led the market in 2024 with a 34.5% share, driven by robust healthcare infrastructure, favorable reimbursement policies, and high adoption of advanced diagnostic systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Mammography Systems Market grew from USD 1,746.1 million in 2018 to USD 2,649.7 million in 2024 and will reach USD 4,649.3 million by 2032.

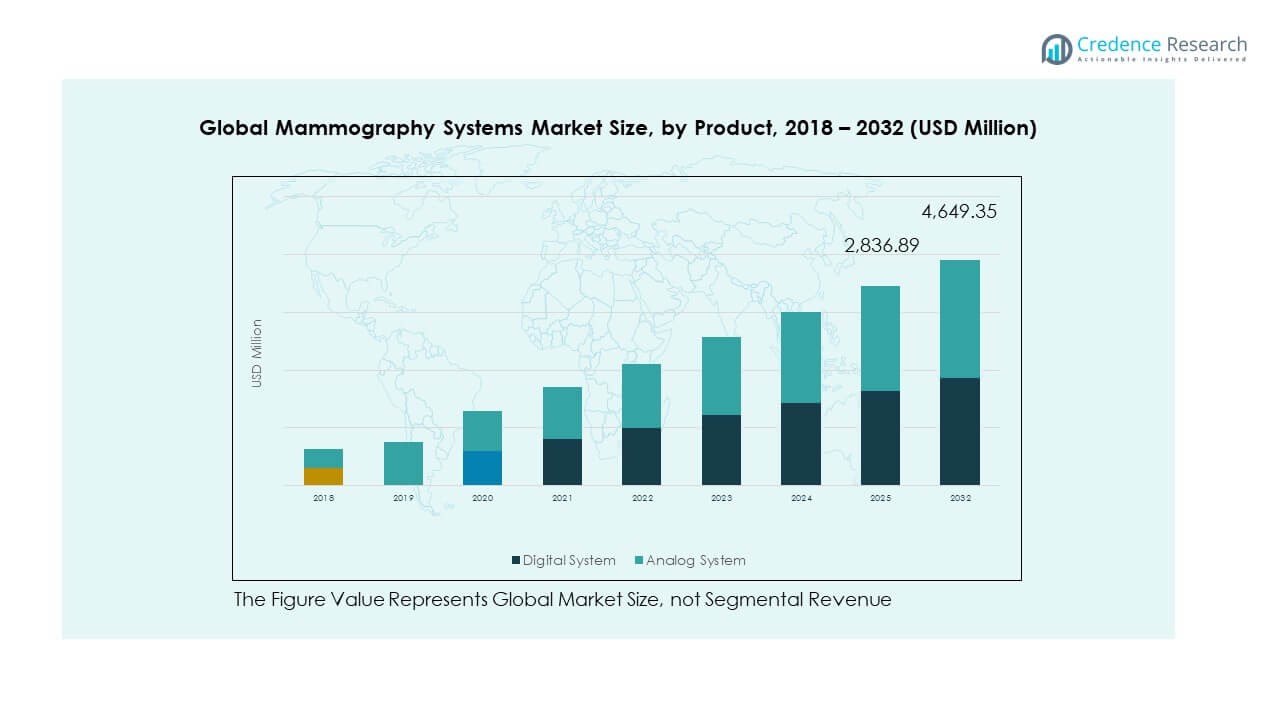

- Digital systems dominated with 82% share in 2024, supported by higher imaging accuracy, low radiation exposure, and government-backed digital screening initiatives.

- 3D mammography led with 61% share in 2024, driven by earlier cancer detection, reduced false positives, and clinical guidelines recommending advanced tomosynthesis.

- Hospitals accounted for the largest share of 47% in 2024, benefiting from higher patient inflow, advanced diagnostic facilities, and integrated treatment pathways.

- North America held the top position with a 5% market share in 2024, fueled by advanced infrastructure, favorable reimbursement, and strong adoption of 3D mammography.

Market Segment Insights

By Product

In the Global Mammography Systems Market, the digital system segment accounted for nearly 82% share in 2024, establishing clear dominance over analog systems. Digital systems are preferred due to higher imaging accuracy, lower radiation exposure, and advanced image storage capabilities that support AI-based diagnostics. Continuous upgrades in full-field digital mammography and government programs promoting digital screening further drive this segment, while analog systems maintain limited use in resource-constrained regions.

By Technology

The 3D mammography segment led the market with about 61% share in 2024, surpassing traditional 2D technology. The strong adoption of 3D systems is driven by their ability to detect cancers earlier, reduce false positives, and improve diagnostic confidence. Rising investment in tomosynthesis, alongside clinical guidelines recommending 3D adoption, reinforces its leadership, while 2D technology continues to serve basic screening needs in developing healthcare setups.

- For instance, GE HealthCare launched its Senographe Pristina with AI-enabled 3D tomosynthesis in Europe, aimed at reducing recall rates and enhancing image clarity in dense breast tissue.

By End User

The hospital segment dominated the Global Mammography Systems Market with a 47% share in 2024, supported by large-scale infrastructure and advanced diagnostic facilities. Hospitals benefit from higher patient inflow, integrated imaging centers, and the ability to conduct both screening and follow-up treatments. Diagnostic imaging centers followed closely, driven by outpatient demand for faster and cost-effective procedures, while ambulatory surgical centers and other facilities accounted for smaller shares, reflecting their niche roles in specific patient care settings.

- For instance, Siemens Healthineers received FDA clearance for its Mammomat B.brilliant mammography platform, designed for high-throughput hospital environments.

Key Growth Drivers

Rising Breast Cancer Prevalence

The increasing incidence of breast cancer worldwide is a major growth driver for the Global Mammography Systems Market. With breast cancer being one of the leading causes of mortality among women, governments and healthcare organizations emphasize early detection. This has led to large-scale screening programs, especially in developed regions, boosting the demand for mammography systems. Growing awareness campaigns, coupled with rising patient willingness to undergo preventive diagnostics, further accelerate adoption across hospitals and imaging centers.

- For instance, in April 2024, the United States Preventive Services Task Force updated its guidelines to recommend biennial mammography screening for women aged 40 to 74, supporting expanded screening programs in the U.S. and pushing hospitals to invest in advanced imaging technologies.

Technological Advancements in Imaging

Rapid technological innovations, including 3D tomosynthesis, AI-powered image interpretation, and low-dose radiation systems, are reshaping the market. These advancements significantly improve detection rates, reduce false positives, and enhance workflow efficiency for radiologists. Healthcare providers increasingly prefer advanced digital and 3D systems, which deliver more precise results compared to traditional 2D models. The integration of artificial intelligence in mammography also supports faster decision-making, making advanced technologies a core driver of adoption across both developed and emerging economies.

Government Support and Reimbursement Policies

Strong government support in the form of screening mandates, public health programs, and reimbursement policies plays a vital role in market expansion. Initiatives such as free or subsidized breast cancer screening for women above a certain age group have widened access. In the U.S. and Europe, favorable reimbursement for advanced mammography techniques like tomosynthesis has boosted utilization. Emerging economies are also increasing funding for diagnostic infrastructure, ensuring broader patient reach and driving higher adoption of mammography systems globally.

- For instance, Clairity, Inc. announced plans to launch Clairity Breast, an AI tool that predicts breast cancer risk using mammograms, enabling personalized screening and preventive care for patients through hospitals and imaging centers.

Key Trends & Opportunities

Integration of AI and Machine Learning

The adoption of artificial intelligence (AI) in mammography systems is a transformative trend, offering opportunities for improved efficiency and diagnostic accuracy. AI-powered tools assist radiologists in detecting subtle abnormalities, reducing human error, and improving workflow by automating image analysis. Vendors are increasingly focusing on AI integration, enabling faster reading of mammograms and greater consistency in results. This trend is particularly relevant in regions facing radiologist shortages, positioning AI-based mammography as a key opportunity for future growth.

- For instance, DeepHealth’s SmartMammo™, integrated into RadNet’s workflow, increased cancer detection rates by 21% and improved efficiency with AI-powered prioritization and instant image streaming across 230+ screening sites.

Expansion in Emerging Markets

Emerging economies across Asia Pacific, Latin America, and Africa present significant growth opportunities for mammography system providers. Rising disposable incomes, improving healthcare infrastructure, and growing awareness of early cancer detection are driving demand. Governments in these regions are also increasing investments in screening programs and partnering with private providers to expand access. As healthcare modernization continues, the uptake of digital and 3D mammography systems is expected to accelerate, making emerging markets a strategic growth frontier.

- For instance, Fujifilm Healthcare launched its Amulet Innovality digital mammography system in Brazil, strengthening access to advanced breast imaging in Latin America’s largest healthcare market.

Key Challenges

High Cost of Advanced Systems

The high initial cost of advanced mammography systems, particularly 3D tomosynthesis and AI-integrated models, remains a significant challenge. Many healthcare providers in low- and middle-income regions struggle to afford such systems, limiting adoption. Even in developed markets, budget constraints in smaller hospitals and clinics can delay upgrades to newer technologies. This cost barrier slows down market penetration, especially in regions where reimbursement policies are less favorable or healthcare budgets are restricted.

Shortage of Skilled Radiologists

A global shortage of trained radiologists and technicians poses another key challenge. Effective use of mammography systems requires specialized expertise to interpret complex imaging results accurately. In many developing countries, limited availability of skilled professionals reduces the efficiency of screening programs and affects diagnostic outcomes. This shortage also places a burden on existing radiologists, leading to longer turnaround times and potential errors, which can hinder the wider adoption of advanced mammography technologies.

Regulatory and Compliance Barriers

Strict regulatory requirements for product approval and compliance increase the complexity of bringing new mammography systems to market. Manufacturers must adhere to rigorous testing and certification processes, which can delay product launches and raise development costs. Variations in regulatory standards across regions add further hurdles for global players. Additionally, compliance with patient safety and data protection regulations, especially with AI-enabled systems, adds to operational challenges for companies operating in this market.

Regional Analysis

North America

North America generated USD 478.78 million in 2018, reaching USD 721.79 million in 2024, and is forecasted to achieve USD 1,255.32 million by 2032 at a CAGR of 7.2%. The region held the largest share of 34.5% in 2024, driven by strong adoption of 3D tomosynthesis, supportive reimbursement structures, and well-established screening programs. The U.S. remains the primary contributor with advanced healthcare infrastructure, AI integration in imaging, and government-backed awareness campaigns supporting continued market leadership.

Europe

Europe was valued at USD 386.06 million in 2018, increasing to USD 574.39 million in 2024, and projected to reach USD 981.01 million by 2032 at a CAGR of 7.0%. The region accounted for 27.5% market share in 2024, supported by population-based screening initiatives and strong public healthcare systems. Countries such as Germany, France, and the UK lead adoption, while investments in digital and 3D mammography strengthen Europe’s role as the second-largest global market.

Asia Pacific

Asia Pacific stood at USD 607.29 million in 2018, rising to USD 935.44 million in 2024, and expected to reach USD 1,673.77 million by 2032, registering a CAGR of 7.6%. The region captured 28.2% share in 2024, led by China, Japan, and India. Growth is fueled by rising healthcare investments, government-supported cancer screening initiatives, and expanding private sector diagnostic infrastructure. Increasing adoption of advanced digital and 3D imaging makes Asia Pacific the fastest-growing regional market.

Latin America

Latin America recorded USD 155.58 million in 2018, rising to USD 242.22 million in 2024, and anticipated to reach USD 439.36 million by 2032 at a CAGR of 7.8%. The region accounted for 7.3% share in 2024, with Brazil as the largest market. Expanding healthcare access, public-private partnerships, and introduction of mobile mammography units are driving adoption. Rising awareness campaigns and government focus on preventive screening further support growth in Latin America.

Middle East

The Middle East market was USD 83.46 million in 2018, growing to USD 129.38 million in 2024, and forecasted to reach USD 233.40 million by 2032, at a CAGR of 7.7%. Holding a 3.9% share in 2024, the region benefits from government investment in women’s health and expanding diagnostic infrastructure. GCC nations, particularly Saudi Arabia and the UAE, lead adoption, while technological upgrades and screening awareness initiatives enhance future demand.

Africa

Africa generated USD 34.92 million in 2018, rising to USD 46.52 million in 2024, and is set to reach USD 66.49 million by 2032, growing at a CAGR of 4.6%. It accounted for 2.2% share in 2024, the lowest among regions. Limited access to diagnostic infrastructure, affordability challenges, and low awareness levels restrict widespread adoption. South Africa and Egypt remain key contributors, while mobile units and NGO-led initiatives present incremental opportunities to expand screening programs across underserved areas.

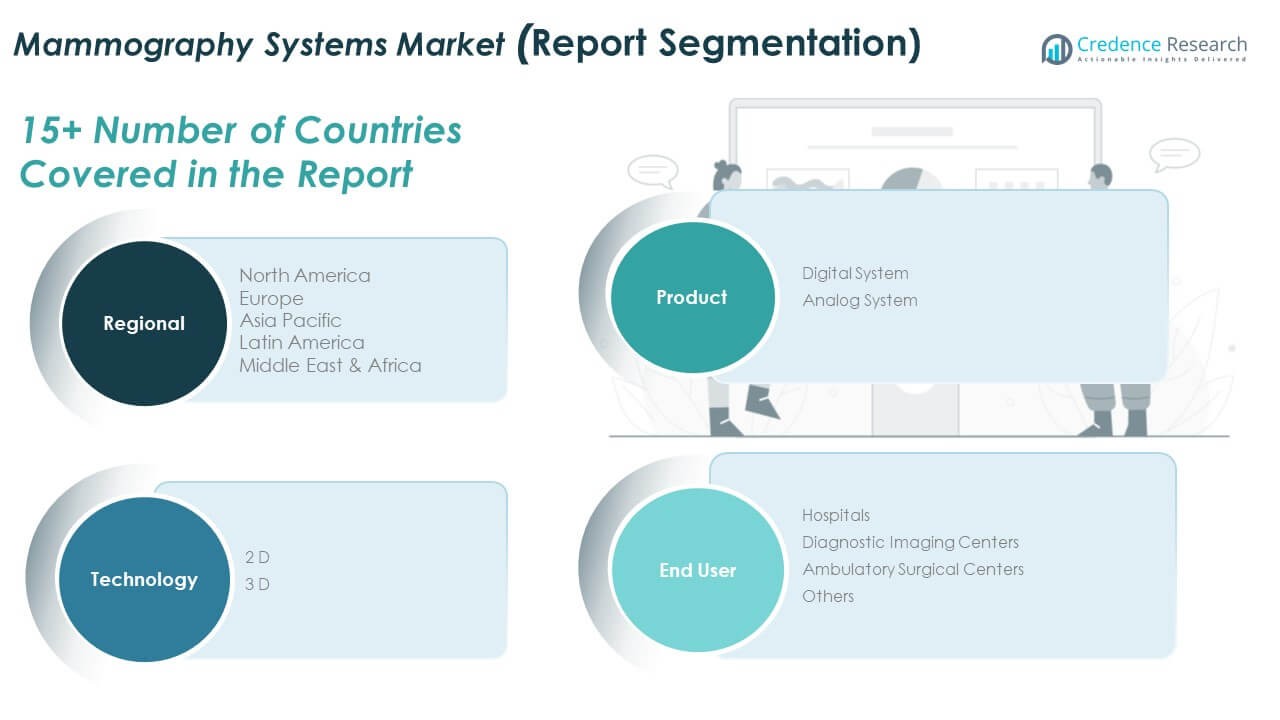

Market Segmentations:

By Product

- Digital System

- Analog System

By Technology

By End User

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Global Mammography Systems Market is highly competitive, with leading players focusing on technological innovation, strategic partnerships, and portfolio expansion to strengthen their positions. Key companies such as Fujifilm Holdings Corporation, GE HealthCare, Hologic Inc., Siemens Healthineers, Koninklijke Philips N.V., and Canon Medical Systems dominate the market with strong brand presence, advanced digital and 3D tomosynthesis solutions, and extensive global distribution networks. These firms invest heavily in research and development to integrate artificial intelligence, improve imaging accuracy, and reduce radiation exposure, catering to growing demand for early breast cancer detection. Mid-tier players like Carestream Health, Agfa-Gevaert Group, and Metaltronica SpA compete by offering cost-effective systems and expanding into emerging markets with localized solutions. Market competition is also shaped by regulatory approvals, clinical trial outcomes, and reimbursement policies, which influence adoption rates. Continuous product launches, mergers, and collaborations define the competitive landscape, creating opportunities for innovation while intensifying rivalry among global and regional participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In November 2024, GE HealthCare introduced the Pristina Via mammography system featuring enhanced breast screening experience and lower radiation doses across all breast thicknesses.

- In 2023, Siemens Healthineers launched Mammomat B.brilliant, a mammography system with wide-angle tomosynthesis.

- In April 2025, RadNet, Inc. through its DeepHealth unit, acquired iCAD, Inc. to strengthen AI-powered breast cancer detection solutions.

- In February 2025, DeepHealth launched new AI-driven radiology informatics and population screening tools at the European Congress of Radiology (ECR).

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of 3D tomosynthesis will expand due to higher accuracy in cancer detection.

- Artificial intelligence integration will improve diagnostic efficiency and reduce false positives.

- Emerging economies will drive demand with improving healthcare infrastructure and awareness programs.

- Portable and mobile mammography units will gain traction in rural and underserved areas.

- Hospitals will remain the primary end users due to comprehensive diagnostic facilities.

- Diagnostic imaging centers will increase adoption to serve outpatient and preventive care demand.

- Reimbursement policies and government screening initiatives will strongly influence market growth.

- Strategic partnerships and collaborations will accelerate innovation and market penetration.

- Cost-effective digital systems will see higher demand in developing regions.

- Rising public awareness campaigns will continue to support early detection and screening adoption.