Market Overview:

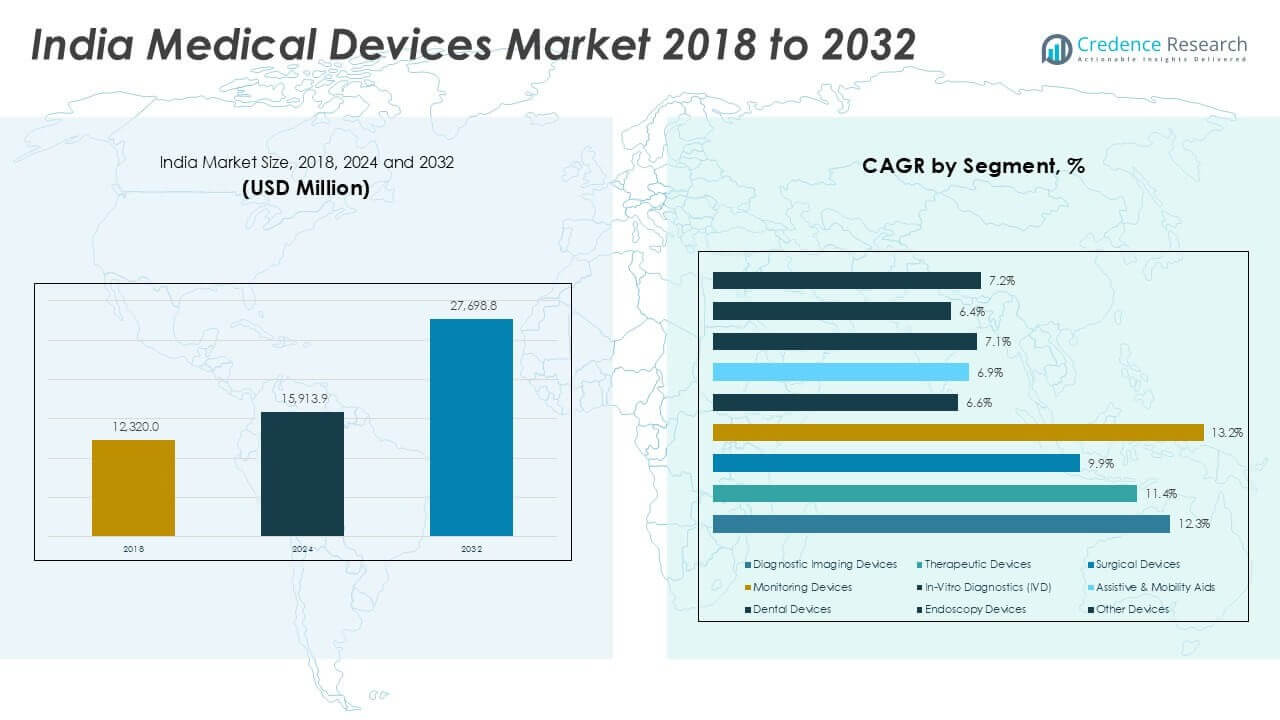

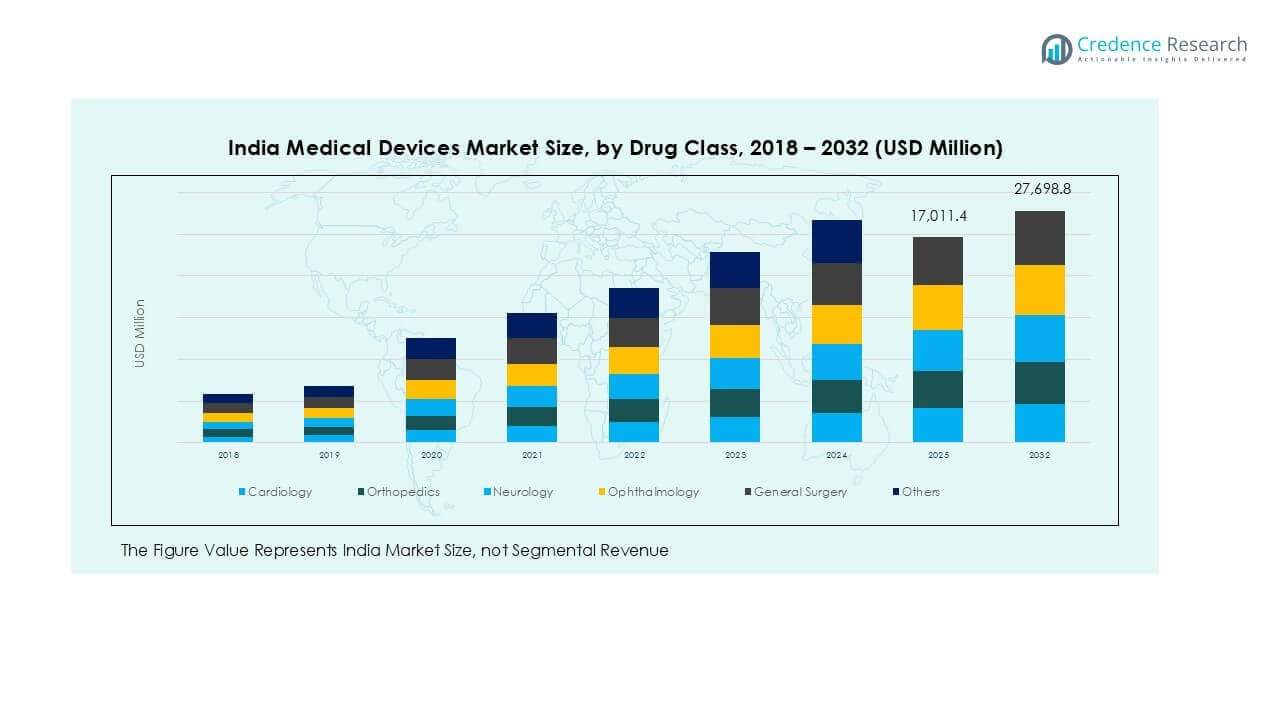

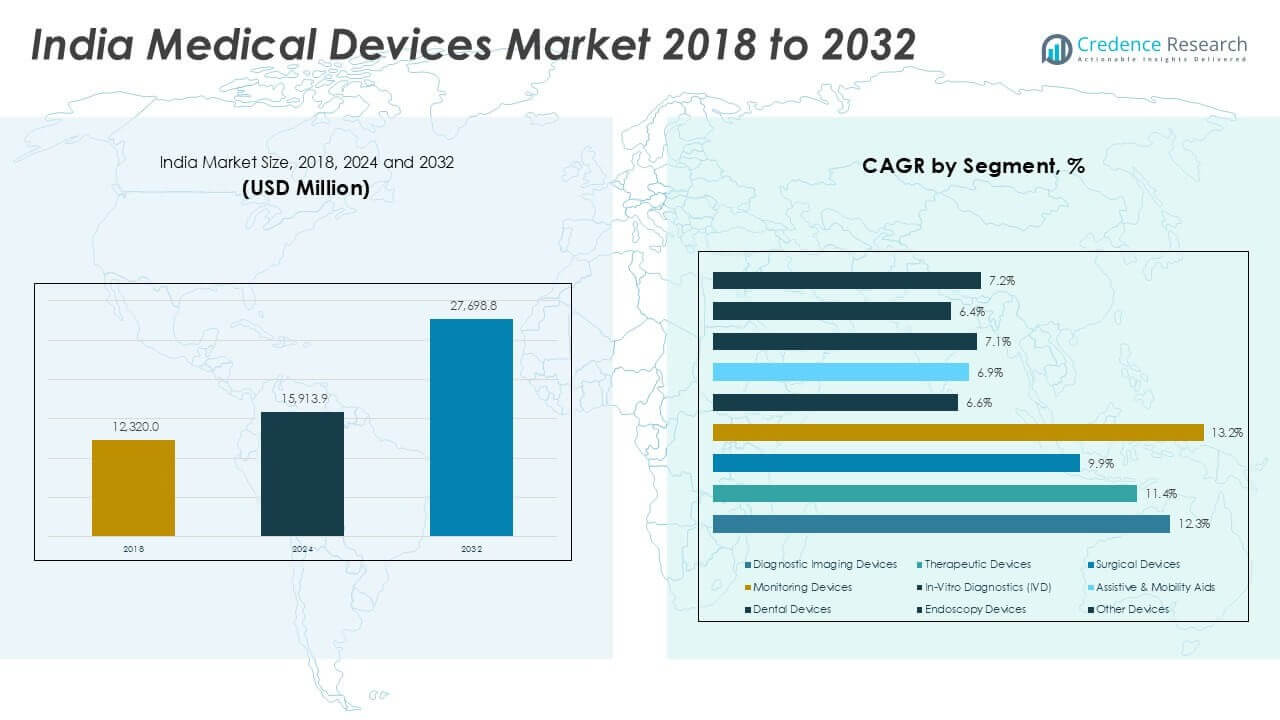

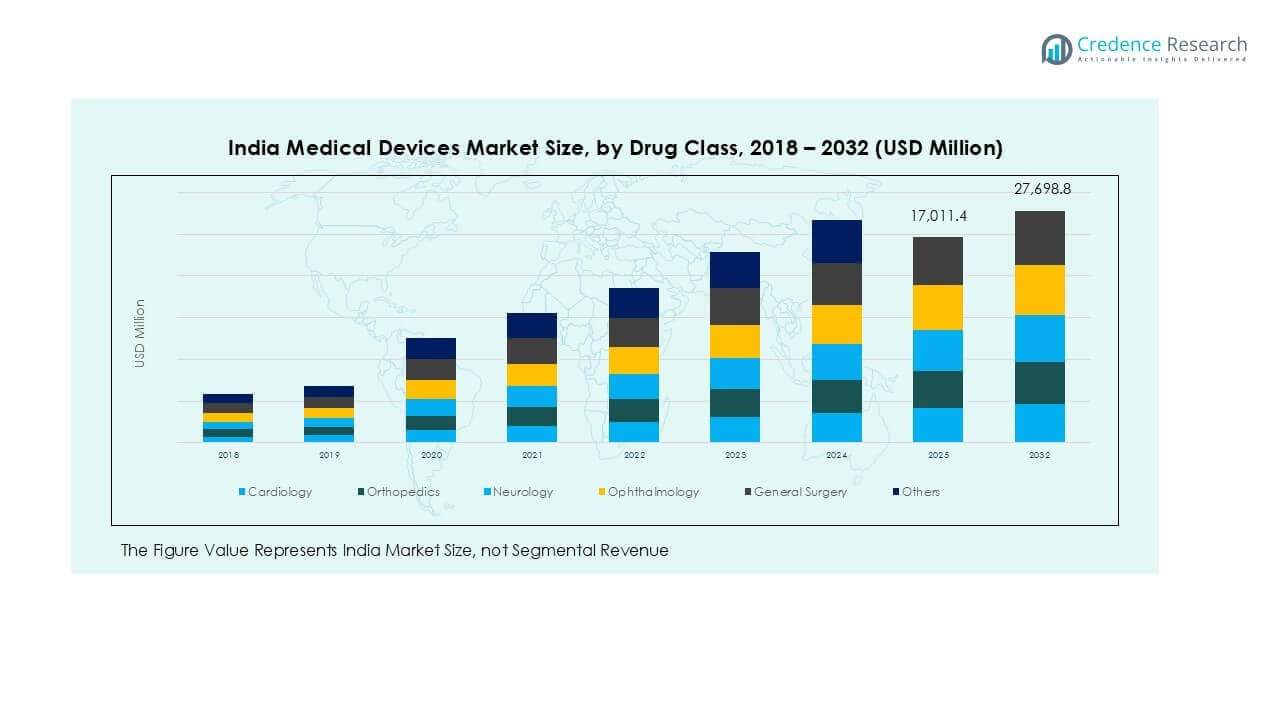

India Medical Devices market size was valued at USD 12,320.00 million in 2018, reaching USD 15,913.90 million in 2024. The market is anticipated to reach USD 27,698.78 million by 2032, registering a CAGR of 7.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Medical Devices Market Size 2024 |

USD 15,913.90 million |

| India Medical Devices Market, CAGR |

7.21% |

| India Medical Devices Market Size 2032 |

USD 27,698.78 million |

The India medical devices market is led by major players including Abbott Laboratories, GE Healthcare, Medtronic plc, Siemens Healthineers, Johnson & Johnson, and Trivitron Healthcare, supported by strong domestic companies such as Poly Medicure Ltd. and Hindustan Syringes & Medical Devices. These players dominate key segments like diagnostic imaging, surgical devices, and in-vitro diagnostics through innovation and extensive distribution networks. North India leads the market with 32% share, driven by strong hospital infrastructure and medical tourism, followed by West India with 26% and South India with 24%, supported by advanced healthcare clusters and specialty centers.

Market Insights

- The India medical devices market was valued at USD 15,913.90 million in 2024 and is projected to reach USD 27,698.78 million by 2032, growing at a CAGR of 7.21% during the forecast period.

- Rising prevalence of chronic diseases such as cardiovascular disorders and diabetes is boosting demand for diagnostic imaging devices, in-vitro diagnostics, and therapeutic solutions. Expanding health insurance coverage and government initiatives like Ayushman Bharat are further driving adoption.

- Technological trends such as AI-based imaging, portable monitoring devices, and telemedicine platforms are reshaping care delivery and increasing demand for connected, patient-centric solutions.

- The market is competitive with key players including Abbott Laboratories, GE Healthcare, Medtronic, Siemens Healthineers, and Trivitron Healthcare focusing on innovation, local manufacturing, and strategic partnerships to strengthen their position.

- North India leads with 32% share, followed by West India at 26% and South India at 24%, with diagnostic imaging devices as the dominant product segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Device Type

Diagnostic imaging devices held the largest share of the India medical devices market in 2024, contributing over 30% of total revenue. Rising prevalence of chronic diseases, growing demand for early diagnosis, and increasing installations of advanced imaging modalities such as MRI and CT scanners are driving growth. Therapeutic devices and surgical devices follow closely, fueled by rising surgical procedures and expanding minimally invasive surgery adoption. Monitoring devices and in-vitro diagnostics (IVD) are gaining traction with the rise in home healthcare and point-of-care testing, supporting a shift toward preventive care and patient-centric solutions.

- For instance, in 2024, Siemens Healthineers expanded its presence in the Indian market to increase access to advanced diagnostics by strengthening its local manufacturing and partnering with Indian healthcare providers.

By Therapeutic Application

Cardiology emerged as the dominant therapeutic application segment, accounting for more than 28% market share in 2024. Increasing cardiovascular disease prevalence, rapid adoption of interventional cardiology devices, and expanding access to cardiac care facilities support this growth. Orthopaedics and neurology represent the next major segments, driven by aging population and rising orthopedic implants and neurostimulation procedures. Ophthalmology and general surgery segments are witnessing steady adoption of advanced surgical and diagnostic tools, supported by government healthcare schemes and growing demand for cataract and laparoscopic procedures across Tier-II and Tier-III cities.

- For instance, Alcon engages in corporate social responsibility initiatives and training programs, such as its Phaco Development Program and partnerships with medical institutions, to expand access to advanced eye care technology and training for surgeons in India and other developing markets. In August 2024, the company launched a Centre of Excellence in Chennai to provide phacoemulsification training to ophthalmologists in partnership with Aravind Eye Care System.

By End-User

Hospitals accounted for the largest share of India’s medical devices market, capturing over 60% revenue share in 2024. Their dominance is driven by increasing hospital infrastructure, higher patient inflow, and adoption of technologically advanced devices across diagnostic, therapeutic, and surgical departments. Clinics and diagnostic centers are growing rapidly, driven by rising demand for outpatient services and cost-effective care options. Home-care settings are expanding steadily due to the adoption of remote monitoring devices, home dialysis systems, and telemedicine solutions, improving access for chronic patients and reducing the burden on hospital resources.

Market Overview

Rising Prevalence of Chronic Diseases

India faces a growing burden of chronic conditions such as cardiovascular diseases, diabetes, cancer, and respiratory disorders, which are fueling demand for advanced medical devices. Increasing cases of lifestyle-related illnesses have boosted the need for diagnostic imaging devices, in-vitro diagnostics, and therapeutic solutions. The government’s emphasis on early detection and screening programs, along with private healthcare players expanding specialty centers, has supported higher adoption rates. Rising health insurance penetration and greater patient awareness are further accelerating demand for technologically advanced devices, enabling improved outcomes and better disease management across urban and semi-urban areas.

- For instance, Philips Healthcare continues to strengthen India’s diagnostic capabilities with the installation of new CT and MRI systems, including AI-enabled devices, to support early diagnosis of cancer and cardiovascular diseases.

Government Initiatives and Healthcare Infrastructure Expansion

Supportive government policies such as the Production Linked Incentive (PLI) scheme, make in India initiative, and medical device parks are encouraging domestic manufacturing and reducing import dependency. Investment in public healthcare infrastructure, including new hospitals and diagnostic centers, is driving device installations. Public-private partnerships are enabling better access to advanced equipment in Tier-II and Tier-III cities. Increased budget allocation to the healthcare sector, coupled with improved reimbursement frameworks, is making medical devices more affordable. This infrastructure expansion is creating a robust environment for both global and local players to penetrate the Indian market effectively.

- For instance, Wipro GE Healthcare expanded its Bengaluru manufacturing facility in 2024 to produce 120,000 patient monitoring systems annually under the Make in India initiative.

Technological Advancements and Digital Health Adoption

Rapid advancements in medical technology, including AI-enabled diagnostics, portable imaging systems, and minimally invasive surgical devices, are reshaping the market. The adoption of telemedicine platforms and remote monitoring solutions is expanding access to care in rural regions. Companies are focusing on developing cost-effective, user-friendly devices tailored to India’s healthcare needs. Growth of healthtech startups, coupled with increasing use of wearable devices and smartphone-based diagnostics, is supporting the shift toward personalized healthcare. This technology-driven evolution is improving clinical efficiency, reducing hospital stays, and enhancing patient experience, which strengthens market growth potential.

Key Trends & Opportunities

Shift Toward Home Healthcare and Preventive Care

India is witnessing a rising preference for home healthcare solutions, especially for chronic disease management and post-surgical recovery. Portable diagnostic equipment, home dialysis systems, glucose monitors, and remote patient monitoring devices are gaining traction. This trend is supported by the expansion of telehealth platforms, affordable internet access, and increasing adoption of wearable health devices. Preventive healthcare initiatives by government and insurers are encouraging regular health checkups, driving demand for point-of-care devices. The shift toward home-based care is expected to reduce the load on hospitals and open opportunities for device manufacturers to offer compact, cost-efficient, and connected solutions.

- For instance, in 2024, Fresenius Medical Care continued to serve the Indian market as a major supplier of dialysis products and services, including for home-based therapies, as part of the country’s growing focus on home healthcare for end-stage renal disease.

Localization and Manufacturing Opportunities

The government’s focus on reducing medical device imports, which account for over 70% of market demand, is creating opportunities for domestic production. Initiatives like 100% FDI allowance in medical devices and creation of medical device parks are attracting global and local manufacturers. Companies are investing in R&D to design devices suited for India’s price-sensitive market while maintaining international quality standards. This localization trend is expected to improve affordability, reduce lead times, and strengthen the supply chain. The opportunity for export-oriented manufacturing is also significant, as India positions itself as a global hub for low-cost medical device production.

Key Challenges

High Dependence on Imports and Pricing Pressure

India’s heavy reliance on imported medical devices leads to vulnerability in pricing and supply chain disruptions. High import duties and fluctuating currency rates often raise the cost of advanced devices, limiting accessibility for smaller hospitals and rural healthcare centers. Price control regulations for certain categories, like stents and orthopedic implants, create challenges for global players seeking profitability. Balancing affordability for patients while sustaining innovation and margins remains a significant challenge, forcing companies to optimize cost structures and explore local manufacturing options.

Regulatory Complexity and Compliance Barriers

Although India is aligning its regulatory framework with global standards, compliance remains a challenge for manufacturers. Complex approval processes, varying state-level regulations, and evolving quality certification requirements delay product launches. Lack of harmonization with global regulatory norms adds extra time and cost for companies looking to introduce new technologies. Small and mid-sized domestic players face difficulty in meeting stringent quality standards due to limited resources. This regulatory complexity can slow market entry, deter innovation, and hinder faster adoption of advanced medical devices.

Regional Analysis

North India

North India led the India medical devices market in 2024, accounting for around 32% share. The dominance is driven by the presence of major healthcare hubs in Delhi NCR, Chandigarh, and Lucknow, along with large government healthcare spending. The region benefits from high patient inflow, a dense network of multispecialty hospitals, and rapid adoption of advanced diagnostic imaging systems. Growing medical tourism in cities like Gurugram and Noida further contributes to demand. Favorable state government initiatives and expanding private hospital chains are boosting installation of therapeutic, surgical, and monitoring devices across urban and semi-urban areas.

West India

West India captured approximately 26% market share in 2024, supported by strong growth in states like Maharashtra and Gujarat. Mumbai and Pune are leading centers for advanced healthcare services, hosting several tertiary care hospitals and diagnostic chains. Rising industrialization and higher disposable incomes are driving healthcare spending, particularly for minimally invasive surgical devices and monitoring equipment. Government investments in smart city projects and healthcare infrastructure expansion are fueling adoption of modern medical technology. Gujarat’s emerging medical device manufacturing hubs under the Make in India initiative are further supporting availability and lowering costs for regional healthcare providers.

South India

South India accounted for nearly 24% share of the India medical devices market in 2024. The region is home to leading healthcare destinations like Bengaluru, Chennai, and Hyderabad, which attract domestic and international patients. High concentration of super-specialty hospitals, advanced diagnostic centers, and medical research institutions supports steady adoption of in-vitro diagnostics and surgical devices. Rising demand for telemedicine, home-care devices, and preventive health checkups is further driving growth. The region also benefits from medical technology startups and innovation clusters, particularly in Karnataka, which are introducing cost-effective solutions tailored for local healthcare needs.

East India

East India contributed about 10% market share in 2024, with Kolkata and Bhubaneswar serving as major healthcare centers. Market growth is driven by increasing government focus on public health infrastructure and rising penetration of diagnostic chains. Efforts to improve maternal and child health programs, as well as control infectious diseases, are encouraging demand for diagnostic and monitoring devices. The region is witnessing gradual adoption of advanced medical technologies, though at a slower pace compared to western and southern regions. Rising private sector investments in hospitals and diagnostic laboratories are expected to accelerate future market expansion.

Central India

Central India held a 8% market share in 2024, with states like Madhya Pradesh and Chhattisgarh showing improving healthcare infrastructure. The market is gradually growing due to government investment in district hospitals, health insurance penetration under Ayushman Bharat, and rising awareness about diagnostic screening. Demand for portable imaging devices, basic surgical instruments, and affordable therapeutic devices is increasing in rural and semi-urban areas. Public-private partnerships are helping bridge the healthcare gap, creating opportunities for low-cost device manufacturers. Continued expansion of secondary care facilities and diagnostic centers is expected to strengthen the region’s contribution over the forecast period.

Market Segmentations:

By Device Type

- Diagnostic Imaging Devices

- Therapeutic Devices

- Surgical Devices

- Monitoring Devices

- In-Vitro Diagnostics (IVD)

- Assistive & Mobility Aids

- Dental Devices

- Endoscopy Devices

- Other Devices

By Therapeutic Application

- Cardiology

- Orthopaedics

- Neurology

- Ophthalmology

- General Surgery

- Others

By End-User

- Hospitals

- Clinics

- Home-Care Settings

- Other End-Users

By Geography

- North India

- West India

- South India

- East India

- Central India

Competitive Landscape

The India medical devices market is highly competitive, featuring a mix of global leaders and strong domestic players. Key companies such as Abbott Laboratories, Medtronic plc, GE Healthcare, Siemens Healthineers, and Johnson & Johnson dominate advanced device segments like diagnostic imaging, surgical, and therapeutic solutions. Local firms including Trivitron Healthcare, Poly Medicure Ltd., and Hindustan Syringes & Medical Devices hold a significant share in consumables and cost-effective devices tailored to India’s needs. Players focus on strategic partnerships, local manufacturing under Make in India, and product innovation to strengthen market presence. Mergers, acquisitions, and capacity expansions are common strategies to expand distribution networks and improve affordability. Continuous investment in R&D for AI-based diagnostics, portable monitoring solutions, and minimally invasive surgical devices is shaping the competitive dynamics, while government incentives for domestic production are attracting new entrants and encouraging existing players to scale operations across Tier-II and Tier-III cities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Abbott Laboratories

- Allengers Medical Systems

- Boston Scientific Corporation

- BPL Medical Technologies

- Cardinal Health

- F. Hoffmann-La Roche Ltd.

- GE Healthcare

- Hindustan Syringes & Medical Devices

- Johnson & Johnson

- Koninklijke Philips N.V.

- Medtronic plc

- Omron Corporation

- Opto Circuits (India) Ltd.

- Poly Medicure Ltd.

- Sahajanand Medical Technologies

- Siemens Healthineers

- Smith & Nephew

- Stryker Corporation

- Trivitron Healthcare

Recent Developments

- In February 2024, Fresenius Medical Care AG received the U.S. FDA clearance for its 5008X Hemodialysis System.

- In February 2024, Boston Scientific Corporation received U.S. FDA approval for its WaveWriter spinal cord stimulator systems used in the treatment of chronic lower back and leg pain.

- In January 2024, GE Healthcare entered into an agreement to acquire MIM Software, one of the leading providers of medical imaging analysis and AI solutions. The company specializes in areas such as radiation oncology, molecular radiotherapy, diagnostic imaging, and urology in various healthcare settings.

- In January 2024, Boston Scientific Corporation announced the acquisition of Axonics, Inc. This acquisition expanded the company’s product portfolio, especially for urology devices.

- In January 2024, BD collaborated with Techcyte, a leading provider of artificial intelligence (AI)-based digital diagnostics, to offer an AI-based algorithm digital cervical cytology system for PAP testing.

Report Coverage

The research report offers an in-depth analysis based on Device Type, Therapeutic Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced diagnostic imaging devices will continue to rise with growing chronic disease cases.

- Adoption of AI-driven diagnostics and remote monitoring solutions will improve early disease detection.

- Growth in minimally invasive surgical procedures will boost demand for surgical and therapeutic devices.

- Expansion of healthcare infrastructure in Tier-II and Tier-III cities will increase device installations.

- Government incentives for domestic manufacturing will reduce import dependence and improve affordability.

- Rising health awareness will drive demand for preventive care and point-of-care testing devices.

- Increased use of telemedicine and home-care equipment will support decentralized healthcare delivery.

- Collaborations between global players and local firms will enhance product availability and innovation.

- Growing medical tourism will drive investments in high-end diagnostic and treatment devices.

- Regulatory harmonization will create a more streamlined approval process and attract global manufacturers.