Market Overview

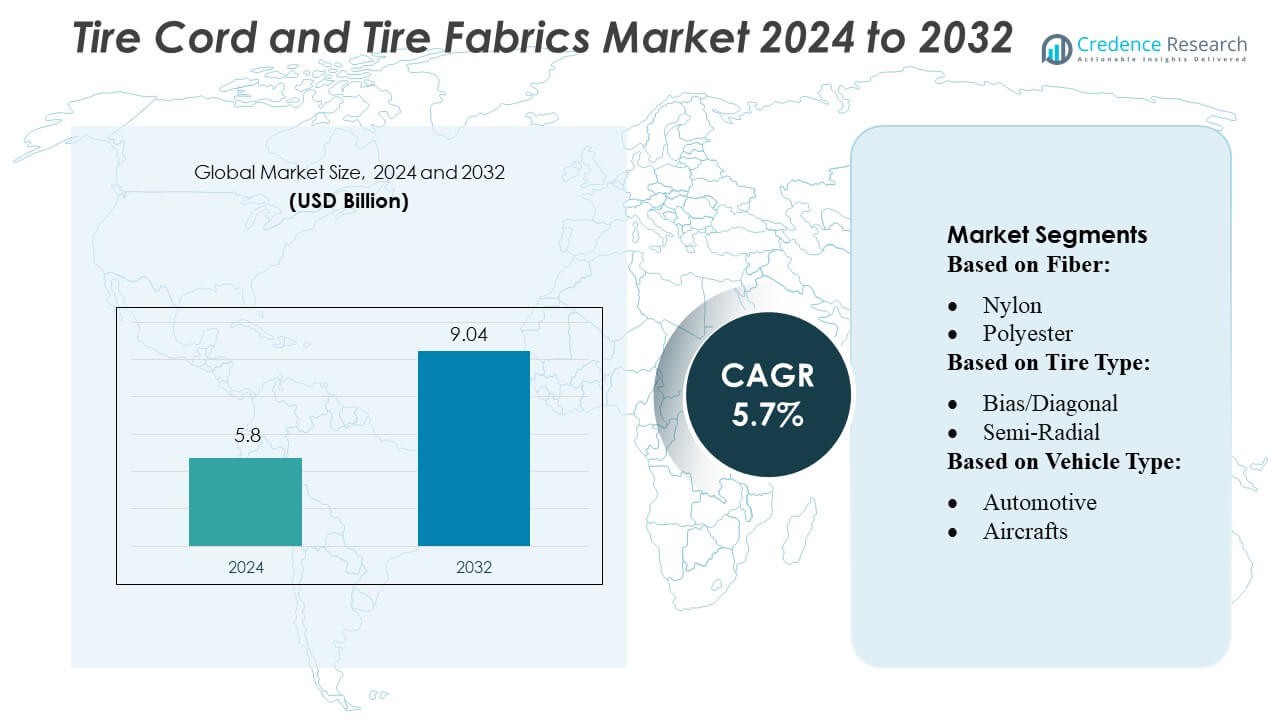

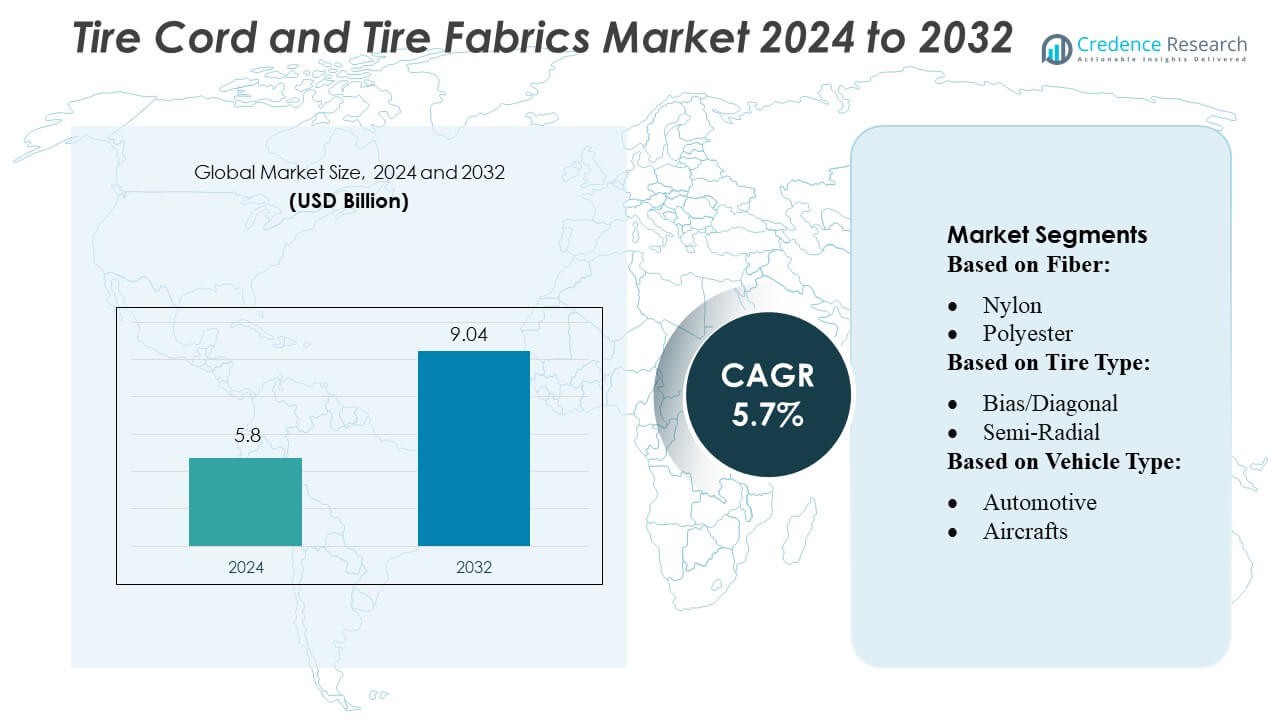

Tire Cord and Tire Fabrics Market size was valued USD 5.8 billion in 2024 and is anticipated to reach USD 9.04 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Switchable Smart Film Market Size 2024 |

USD 5.8 Billion |

| Tire Cord and Tire Fabrics Market, CAGR |

5.7% |

| Tire Cord and Tire Fabrics Market Size 2032 |

USD 9.04 Billion |

The tire cord and tire fabrics market including Toray Industries, Hengli Petrochemical, Far Eastern New Century, Eclat Textile, Vardhman Textiles, Chargeurs SA, Sasa Polyester, Shenzhou International, Inditex, and TJX Companies — actively compete on innovation, quality, and global scale. These leaders invest in high-strength polyester, nylon, and aramid fibers to meet demanding OEM specifications and advance tire performance. Many firms expand capacity, improve dipping technologies, and form strategic partnerships to optimize cost and sustainability. The Asia-Pacific region leads the market, accounting for approximately 45 % of global demand, driven by surging vehicle production, expanding electric-vehicle adoption, and robust tire manufacturing infrastructure across China, India, and Southeast Asia.

Market Insights

- The tire cord and tire fabrics market reached USD 5.8 billion in 2024 and is projected to hit USD 9.04 billion by 2032, growing at a CAGR of 5.7%, supported by rising demand for durable and high-performance tire reinforcement materials.

- Increasing vehicle production and the shift toward radial and electric-vehicle tires drive strong demand for high-strength polyester, nylon, and aramid cords across both OEM and replacement tire segments.

- Advanced material innovations, capacity expansions, and improved dipping technologies strengthen competition as leading companies focus on durability, sustainability, and cost efficiency.

- Challenges arise from fluctuating raw-material prices, high production costs, and the need for continuous quality upgrades, which pressure manufacturers to improve efficiency and adopt modern processing systems.

- The Asia-Pacific region holds about 45% of the global market share and remains the fastest-growing region, while the polyester cord segment leads overall consumption, driven by its cost-effectiveness, strength, and wide applicability in passenger and commercial vehicle tires.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fiber

Nylon dominates the Tire Cord and Tire Fabrics market, holding the largest share due to its high tensile strength, fatigue resistance, and suitability for heavy-duty applications. Its strong adhesion to rubber compounds and cost-effectiveness drive extensive use in truck, bus, and two-wheeler tires. Polyester follows as a rapidly expanding segment because of its dimensional stability and lower shrinkage, supporting its adoption in passenger car tires. Rayon, aramid, glass, and PVA fibers serve niche applications where enhanced heat resistance, superior stiffness, or premium reinforcement is required, further diversifying material demand across tire categories.

- For instance, high-tenacity nylon 6 tire cord fabrics from various manufacturers generally exhibit a tenacity within the typical industry range of about 7.8–8.5 cN/tex for standard specifications. Meanwhile, in high-denier tire cords, a common specification like a 1260/3 nylon cord typically achieves an average breaking strength of around 303–305 N/end across the industry.

By Tire Type

Radial tires account for the dominant market share, propelled by their superior fuel efficiency, reduced rolling resistance, and longer service life. Their strong preference in passenger vehicles, commercial fleets, and off-road equipment reinforces sustained demand for radial-specific cords and fabrics. Bias/diagonal tires continue to hold measurable adoption in agricultural machinery, industrial vehicles, and select off-road segments due to their durability and load-bearing capability. Semi-radial tires represent a smaller but steadily developing category as manufacturers explore hybrid structures that balance flexibility and strength for targeted performance needs.

- For instance, Eagle Roofing Products launched Secure Guard 60, a self-adhering polymer-modified bituminous underlayment, in 2024. The product is indeed called Secure Guard 60, a 60 mil self-adhering, polymer-modified bituminous underlayment.

By Vehicle Type

The automotive segment leads the market with the highest share, driven by large-scale global tire production for passenger cars, SUVs, and commercial vehicles. Rising vehicle parc, replacement tire demand, and OEM emphasis on lightweight reinforcement materials strengthen this dominance. Aircraft tires contribute a specialized segment requiring high-strength aramid and nylon cords to withstand extreme landing forces and thermal stress. Industrial products—including forklifts, mining machinery, and construction equipment—maintain consistent demand due to heavy load cycles, while the “others” category supports specialty applications such as bicycles, defense vehicles, and high-performance racing tires.

Key Growth Drivers

- Rising Global Tire Production and Replacement Demand

Growing vehicle ownership across emerging and developed markets continues to accelerate tire production volumes, directly boosting demand for tire cords and fabrics. The increasing replacement cycle of passenger and commercial tires further supports consistent procurement of reinforcement materials. Manufacturers prioritize materials that enhance durability, improve load-bearing capacity, and reduce rolling resistance, strengthening the use of advanced fiber reinforcements. Expanding logistics networks and e-commerce activities also drive higher commercial vehicle utilization, amplifying tire wear rates and reinforcing long-term demand for high-performance tire cords.

- For instance, Eagle Roofing’s Secure Guard 60 is a 60-mil thick, self-adhering underlayment launched in July 2024 to serve as a robust leak barrier for steep-slope roofs.

- Shift Toward High-Performance and Fuel-Efficient Tires

Automakers and tire manufacturers increasingly adopt reinforcement materials that support low rolling resistance and lightweight construction to meet stringent fuel-efficiency and emission standards. High-modulus polyester, aramid, and hybrid composite cords gain traction due to their ability to enhance tire strength while reducing weight. This shift aligns with the rising adoption of radial tires in passenger and commercial vehicles. Technological improvements in cord-fabric bonding, thermal stability, and fatigue resistance further encourage the integration of advanced fabrics in next-generation tires designed for superior performance and safety.

- For instance, Arctech (full name: Arctech Solar Holding Co., Ltd.) has deployed more than 100 GW of solar tracking and racking systems globally, with utility-level projects accounting for the majority of this capacity, showcasing its technological ability to scale renewable integration.

- Expansion of Electric and Off-Highway Vehicle Markets

The growing electrification of mobility significantly influences tire design, with EVs requiring stronger reinforcement materials to handle higher torque, heavier battery loads, and increased heat generation. Tire cords with enhanced stiffness and improved cyclic endurance witness rising adoption in EV tire production. Parallelly, the expansion of construction, agriculture, and mining sectors accelerates demand for off-highway tires that require heavy-duty reinforcement fabrics. These specialized applications stimulate innovation in nylon, polyester, and aramid cords optimized for extreme operating conditions, promoting sustained market growth.

Key Trends & Opportunities

- Rapid Adoption of High-Strength Synthetic and Hybrid Materials

A key trend shaping the market is the increased use of advanced fiber blends and hybrid cords that combine materials such as aramid, rayon, and nylon to achieve optimized stiffness and fatigue resistance. Manufacturers explore hybrid reinforcement technologies to meet performance requirements for high-speed, ultra-high-performance, and EV tires. This trend creates opportunities for material innovation and strategic partnerships between fiber producers and tire companies. The push toward enhanced durability, thermal stability, and sustainability fosters further development of next-generation synthetic reinforcement systems.

- For instance, AllEarth Renewables’ Fixed Ground Mount system supports between 12 and 60 solar modules per structure, with system widths ranging from 18.8 feet to 93.8 feet and a maximum installed height of 7.5 feet, demonstrating a scalable and durable solution for cost-effective deployment.

- Growing Focus on Sustainable and Eco-Efficient Manufacturing

Sustainability initiatives across the tire industry drive opportunities for bio-based fibers, recyclable reinforcement materials, and energy-efficient production processes. Tire manufacturers seek materials with lower environmental impact while maintaining strength and performance. Polyester made from recycled PET bottles and emerging bio-rayon fibers gains attention as viable alternatives. Improving process efficiency in dipping, weaving, and bonding also supports reduced emissions and waste. These trends open new avenues for environmentally conscious suppliers and position sustainability as a competitive differentiator in the reinforcement materials market.

- For instance, Product datasheets and reports confirm that panels in the LG NeON H series typically came in configurations of 120 or 144 half-cells [1, 4]. LG NeON H BiFacial 72-cell module (equivalent to 144 half-cells) was a specific product configuration.

- Increasing Automation and Digitalization in Fabric Production

Manufacturers increasingly integrate automated weaving, precision dipping, and AI-enabled quality control systems to improve consistency and reduce material waste. Advanced digital monitoring solutions enhance real-time defect detection, optimizing throughput and ensuring uniform fiber reinforcement. These technologies support higher productivity, lower operational costs, and improved tensile quality of tire fabrics. As tire companies demand tighter performance tolerances, automation and smart manufacturing create a significant opportunity for suppliers to upgrade production capabilities and deliver premium, high-precision reinforcement materials.

Key Challenges

- Volatile Raw Material Prices and Supply Chain Pressures

Fluctuations in the prices of nylon, polyester, rayon, and aramid feedstock impose cost pressures on manufacturers. Supply disruptions stemming from geopolitical factors, energy price volatility, or logistical constraints further complicate procurement planning. Since tire cords require specialized chemical treatments and precision manufacturing, any instability in raw material availability increases production costs and affects profitability. Manufacturers must balance price volatility with consistent quality standards, making long-term strategic sourcing and supply chain resilience critical challenges for the industry.

- Increasing Performance Requirements and Compliance Standards

Tire manufacturers face stricter performance, safety, and sustainability regulations, pushing reinforcement material suppliers to continually upgrade their product specifications. Meeting advanced heat resistance, fatigue endurance, and bonding requirements demands substantial investment in R&D and process optimization. Additionally, tires for EVs, aircraft, and heavy-duty vehicles require highly specialized reinforcement fabrics, raising the technical complexity of production. Ensuring consistent quality at scale while complying with global regulatory frameworks remains a significant operational and financial challenge for market participants.

Regional Analysis

North America

North America holds about 18–25% of the tire cord and tire fabrics market, supported by strong automobile production and a large replacement-tire sector. The region shows steady demand for durable polyester, nylon, and steel cords due to growing usage of light trucks, SUVs, and electric vehicles. Manufacturers benefit from strict safety standards that encourage high-quality reinforcing materials. The presence of major tire companies and advanced manufacturing facilities further supports consistent growth. Additionally, increasing consumer preference for premium and high-performance tires boosts the adoption of advanced tire fabrics.

Europe

Europe accounts for roughly 20–23% of the global market, driven by strong demand from premium car manufacturers and a well-established tire industry. The region increasingly adopts advanced polyester and aramid-based tire cords due to fuel-efficiency and sustainability targets. Strict EU regulations promote lightweight and durable materials, supporting growth in high-strength reinforcing fabrics. Countries including Germany, France, and Italy lead consumption. Demand also grows from the growing electric-vehicle segment, which requires high-performance tire construction. Europe’s focus on innovation and environmentally responsible materials reinforces its stable market position.

Asia-Pacific

Asia-Pacific dominates the market with about 40–50% share, making it the largest regional contributor. Rapid vehicle production in China, India, Japan, and Southeast Asia significantly drives tire cord and fabric consumption. The region benefits from large manufacturing bases, easy raw-material access, and growing passenger and commercial vehicle fleets. Rising demand for radial tires and expanding electric-vehicle adoption further boost growth. Many global and local tire manufacturers continue to invest in new facilities across Asia, strengthening supply capability. Asia-Pacific’s strong economic activity and cost-efficient production keep it the primary growth engine.

Latin America

Latin America holds around 5–8% of the market, with demand mainly supported by Brazil, Mexico, and Argentina. Vehicle ownership continues to rise, and the region shows growing need for replacement tires, which drives consumption of tire cords and fabrics. Although local production capacities are limited, imports fill much of the regional requirement. Development of logistics and commercial fleets increases demand for durable reinforcing materials. Economic improvements and expansion in automotive servicing networks further support steady growth. The region remains an emerging but promising market for global suppliers.

Middle East & Africa

The Middle East & Africa region contributes about 5–10% of the market, driven by rising infrastructure development, expanding logistics activity, and growth in commercial vehicles. Countries like Saudi Arabia, UAE, Turkey, and South Africa lead consumption. Most tire cord and fabric demand is met through imports due to low local production capacity. Increasing construction and transport needs continue to boost tire usage, especially for heavy-duty vehicles. Steady urbanization and economic diversification efforts across the region support gradual market growth, making MEA a developing but steadily expanding segment.

Market Segmentations:

By Fiber:

By Tire Type:

- Bias/Diagonal

- Semi-Radial

By Vehicle Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Tire Cord and Tire Fabrics Market players such as TJX Companies, Toray Industries, Inc., Chargeurs SA, Far Eastern New Century Corporation, Hengli Petrochemical Co., Ltd., Eclat Textile Co. Ltd, Vardhman Textiles, Shenzhou International Group Holdings Ltd, Inditex, and Sasa Polyester Sanayi A.S. The Tire Cord and Tire Fabrics Market is shaped by continuous innovation, capacity expansion, and strong integration across the tire manufacturing value chain. Companies actively invest in high-performance materials such as advanced polyester, nylon, rayon, and aramid fibers to meet the growing demand for radial tires and durable reinforcement structures. Competition intensifies as manufacturers focus on improving tensile strength, heat resistance, and fatigue performance to support evolving automotive requirements, including electric vehicles and high-load commercial fleets. Many firms enhance production efficiency through automated spinning, dipping, and weaving technologies while strengthening global supply networks to ensure consistent delivery. Sustainability is also becoming a key differentiator, with producers increasing the use of recycled polymers and adopting cleaner manufacturing processes. Overall, the market remains highly competitive, driven by performance optimization, cost efficiency, and long-term partnerships with major tire producers worldwide.

Key Player Analysis

- TJX Companies

- Toray Industries, Inc.

- Chargeurs SA

- Far Eastern New Century Corporation

- Hengli Petrochemical Co., Ltd.

- Eclat Textile Co. Ltd

- Vardhman Textiles

- Shenzhou International Group Holdings Ltd

- Inditex

- Sasa Polyester Sanayi A.S.

Recent Developments

- In January 2025, Kolon Industries announced a investment to expand its tire-cord production in Vietnam. The project aims to increase the plant’s annual output from 36,000 to 57,000 tons leveraging repurposed equipment from a recently closed plant in China to cut costs.

- In May 2024, Chargeurs SA’s acquisition of two business units from Cilander, which was initially included the shirting fabrics business and the technical textiles finishing activities.

- In January 2023, Century Enka Limited commenced commercializing a nylon tire cord fabric crafted entirely from fully recycled nylon waste. Apollo Tyres Ltd. will utilize this new environment-friendly material for specific product lines across various market sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Fiber, Tire Type, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue shifting toward high-performance polyester, nylon, and aramid cords to support advanced tire designs.

- Manufacturers will increase investment in lightweight reinforcement materials to enhance fuel efficiency and vehicle handling.

- Demand for durable tire fabrics will rise as electric vehicles require stronger and heat-resistant tire structures.

- Automation and digital monitoring will improve production efficiency and reduce defects in cord and fabric manufacturing.

- Sustainability initiatives will encourage wider adoption of recycled fibers and eco-friendly dipping chemicals.

- Growth in commercial transportation will drive higher consumption of heavy-duty tire cords.

- Regional tire producers will expand capacity to strengthen supply chain resilience and reduce import dependence.

- Advanced coating and surface-treatment technologies will enhance bonding performance with rubber compounds.

- Partnerships between tire manufacturers and material suppliers will accelerate product innovation.

- Emerging markets will see rapid demand growth as vehicle ownership and infrastructure development expand.