Market Overview:

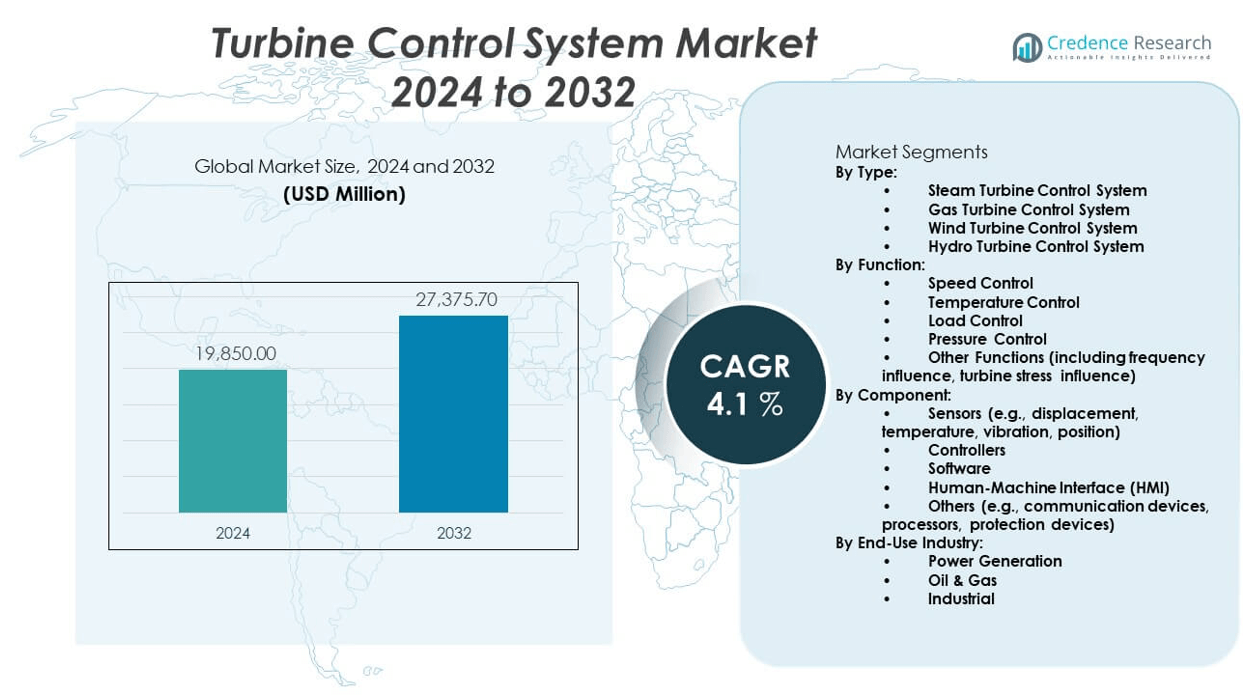

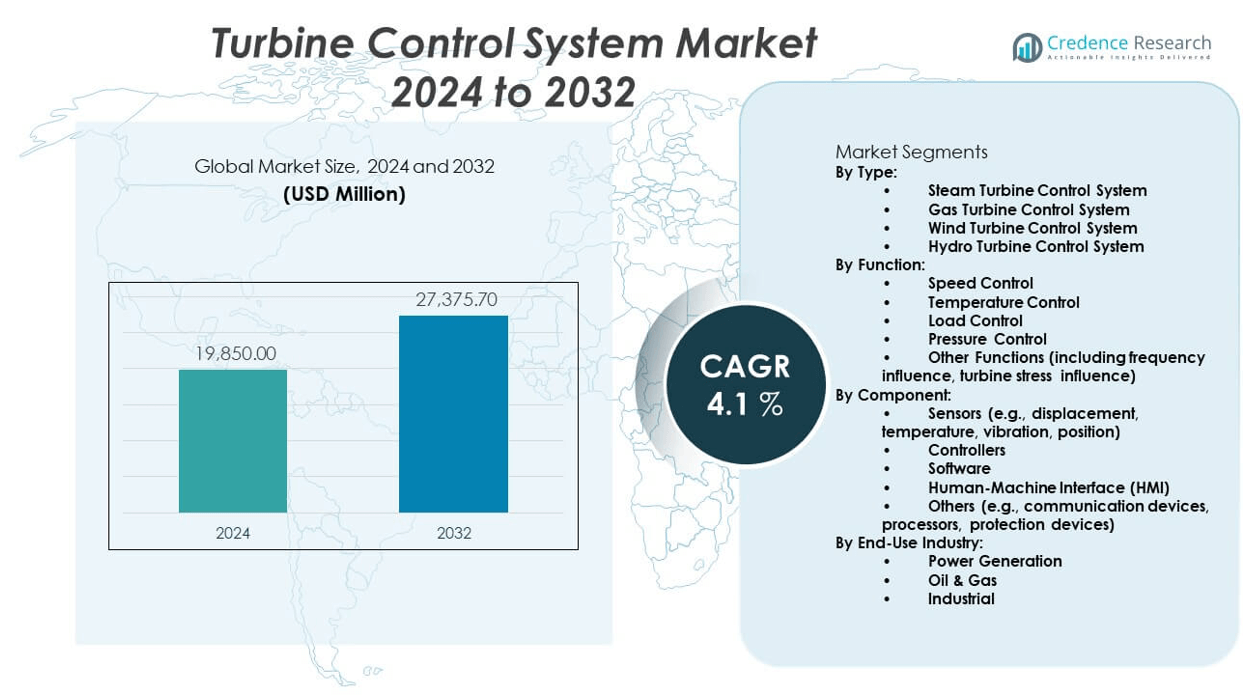

The Turbine control system market is projected to grow from USD 19,850 million in 2024 to an estimated USD 27,375.7 million by 2032, with a compound annual growth rate (CAGR) of 4.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turbine Control System Market Size 2024 |

USD 19,850 million |

| Turbine Control System Market, CAGR |

4.1% |

| Turbine Control System Market Size 2032 |

USD 27,375.7 million |

The turbine control system market is expanding due to increasing energy demands, growing focus on operational efficiency, and the rising integration of automation technologies. Industries are adopting advanced turbine control systems to enhance reliability, reduce downtime, and optimize energy output. The global shift toward renewable energy sources, especially wind and hydro, further fuels demand for intelligent control systems. Additionally, upgrades in aging turbine infrastructure and stringent environmental regulations are driving the modernization of control solutions in both thermal and renewable energy sectors.

Regionally, North America and Europe lead the turbine control system market due to established power infrastructure, technological advancements, and investment in smart grid development. The Asia-Pacific region is emerging rapidly, driven by industrialization, rising power needs, and government initiatives supporting renewable energy expansion in countries like China and India. Latin America and the Middle East & Africa are also witnessing gradual growth, supported by increasing investments in energy diversification and infrastructure modernization.

Market Insights:

- The turbine control system market is projected to grow from USD 19,850 million in 2024 to USD 27,375.7 million by 2032, at a CAGR of 4.1%.

- Rising demand for energy efficiency and automation in power plants drives the adoption of advanced turbine control systems.

- Integration of digital technologies such as AI and predictive maintenance strengthens system performance and reliability.

- High initial investment and integration challenges with legacy infrastructure limit adoption in smaller and older facilities.

- North America leads the market due to mature power infrastructure and early adoption of digital control systems.

- Asia-Pacific is emerging rapidly, supported by industrial growth, renewable energy expansion, and infrastructure investments.

- Europe maintains steady demand driven by modernization of existing plants and compliance with emissions regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Efficient Energy Generation Across Renewable and Conventional Sources:

The turbine control system market benefits from increasing demand for energy efficiency in both conventional and renewable power generation. Power producers seek to optimize output and minimize energy losses. Governments support energy-efficient infrastructure to meet environmental goals and energy security targets. High-performance control systems enhance turbine reliability and extend equipment lifespan. Utilities and IPPs deploy these systems to ensure operational continuity under varying load conditions. Fossil fuel plants upgrade turbine control platforms to reduce emissions. Wind and hydro sectors require precise turbine regulation for grid stability. The market responds to these needs with scalable and intelligent control technologies.

- For instance, Siemens Energy AG reported that its SPPA-T3000 turbine control system has been successfully deployed in over 3,000 units worldwide, enabling real-time optimization that increased turbine operational availability by up to 1.5% in combined-cycle power plants.

Aging Power Infrastructure Driving Modernization Initiatives Worldwide:

Many developed regions operate aging thermal power plants with outdated control technologies. These facilities undergo modernization to meet new operational and environmental requirements. The turbine control system market supports this transformation by enabling smarter automation and performance monitoring. Legacy turbines receive digital retrofits that improve efficiency and reduce unplanned outages. Plant operators implement advanced systems to ensure compliance with tightening regulatory standards. It also provides enhanced fault detection and response capabilities. This modernization trend creates recurring demand for software upgrades and service contracts. Vendors align their portfolios to target large-scale refurbishment projects globally.

- For instance, Emerson Electric Co. retrofitted its Ovation™ control system at the 840 MW Prairie State Generating Station in the United States, reducing forced outage rates by 32% and enhancing regulatory compliance through up-to-date automation protocols.

Integration of Smart Grid Systems and Digital Control Technologies:

Utilities worldwide are integrating smart grid technologies that require turbine control systems capable of real-time response. These systems enable grid operators to balance supply and demand fluctuations with greater accuracy. It facilitates seamless load dispatch and peak demand management through turbine output modulation. Operators use embedded analytics for predictive maintenance and asset optimization. Integration with SCADA and DCS platforms boosts control transparency and plant-wide coordination. The turbine control system market expands with this digital transformation trend across power sectors. Industrial users demand control systems with IoT connectivity and cybersecurity features. OEMs respond by embedding AI-powered functionalities in next-gen solutions.

Environmental Regulations and Emissions Reduction Mandates:

Stricter emissions regulations in major economies compel utilities to adopt advanced turbine control systems. These systems manage fuel combustion more precisely and support carbon capture integrations. The turbine control system market evolves to address this regulatory pressure by offering compliant and energy-efficient solutions. Operators retrofit gas turbines with low-emission combustion control algorithms. The systems also help reduce particulate and NOx emissions in coal-fired plants. It supports compliance through automation of reporting and diagnostics. Control vendors collaborate with environmental consultants to build regulation-ready modules. This regulatory landscape strengthens the demand pipeline across public and private energy operators.

Market Trends

Adoption of AI-Based Predictive Maintenance in Turbine Operations:

Power plant operators increasingly rely on AI-driven analytics to optimize turbine performance. Predictive maintenance capabilities reduce unplanned downtime and prevent catastrophic failures. It detects anomalies and wear patterns based on historical data and sensor inputs. Cloud-connected turbine control systems offer remote diagnostics and condition monitoring. The turbine control system market evolves to integrate advanced machine learning models. Vendors offer dashboards with performance visualization and maintenance alerts. These systems reduce O&M costs and improve decision-making. The trend enhances system resilience and operational foresight in complex power infrastructure.

- For instance, GE Vernova’s Predix Asset Performance Management (APM) platform enabled predictive analytics for over 14,000 turbines globally, achieving an average 5% reduction in unplanned downtime across monitored units according to GE’s 2024 operational data.

Rising Popularity of Modular Turbine Control Platforms for Retrofit Flexibility:

End users demand modular and scalable control systems that can adapt to existing turbine architectures. The turbine control system market moves toward modular design strategies that reduce installation complexity. Operators value retrofit solutions that limit plant downtime and operational disruption. It offers configuration flexibility across gas, steam, and hydro turbines. System integrators deploy modular units to accommodate future upgrades. These platforms simplify spare part inventory and training requirements. Vendors design plug-and-play systems compatible with legacy components. This trend enables smoother digital transitions for aging energy infrastructure.

- For instance, Woodward’s Flex500 modular control system offers deterministic, real-time control for all turbine types, with scan rates as fast as 5 milliseconds and scalable I/O via RTCnet™ or LINKnet HT™ distributed modules. This platform supports plug-and-play installation, dual-redundant configurations for high availability, and was specifically engineered for retrofit projects in hazardous environments, allowing seamless online program changes without downtime and full remote access for monitoring and control. Recent deployments have demonstrated rapid, 30% time savings on replacement projects compared to previous-generation systems

Growing Use of Cybersecurity-Integrated Control Systems in Critical Power Infrastructure:

Cybersecurity has become a strategic priority for power generation assets due to rising cyber threats. The turbine control system market incorporates embedded cybersecurity protocols in control architectures. Vendors follow global standards like IEC 62443 and NERC CIP to ensure resilience. It protects against unauthorized access, data tampering, and system sabotage. Real-time monitoring detects vulnerabilities and initiates response measures. Operators prioritize secure communication across control layers and networks. Control systems now feature encryption, multi-level access, and incident logging. This trend supports grid stability and critical asset protection in high-risk environments.

Expansion of Remote and Cloud-Based Turbine Monitoring Systems:

Remote turbine control capabilities gain traction in distributed energy environments. Operators manage multiple assets across wide geographies using centralized platforms. The turbine control system market sees rising demand for cloud-based interfaces and digital twins. These tools simulate turbine operations to optimize efficiency and prevent failures. It supports virtual testing of new control logics and predictive diagnostics. OEMs and utilities collaborate to build cloud-native solutions for real-time performance tracking. This trend improves turbine visibility, lowers maintenance costs, and extends lifecycle value. Control providers continue to enhance interoperability with remote operating centers.

Market Challenges Analysis:

Integration Complexities in Retrofitting Control Systems Across Legacy Plants:

Retrofitting turbine control systems into aging plants presents integration challenges across hardware and software layers. Many facilities lack standardized infrastructure, making system upgrades costly and time-consuming. The turbine control system market faces delays in adoption due to plant-specific customization needs. Engineers often encounter difficulties aligning legacy sensors with modern controllers. Operators worry about plant downtime, revenue loss, and operational risk during system transitions. Compatibility issues between OEM and third-party components hinder seamless integration. Vendor support and on-site technical expertise often become bottlenecks. It complicates digitalization efforts and slows modernization goals across mature energy economies.

High Capital Costs and Justification Barriers for Smaller Power Producers:

Smaller utilities and IPPs hesitate to invest in advanced turbine control systems due to high upfront costs. Many struggle to build a business case around return on investment without regulatory pressure or incentives. The turbine control system market sees uneven adoption due to this budget constraint. Cost of engineering, licensing, training, and maintenance adds to long-term financial commitments. Operators in emerging markets prioritize basic reliability over digital sophistication. Lack of skilled workforce and technical training further restricts adoption in smaller plants. It impacts market penetration beyond large-scale utility operators. Financial models for control system investment remain a critical challenge.

Market Opportunities

Expansion in Offshore Wind and Hybrid Power Installations Creating New Demand:

Offshore wind projects and hybrid energy systems represent a major growth avenue for the turbine control system market. These installations require precision turbine management under dynamic weather and load conditions. Control vendors develop adaptive algorithms to maintain output stability and maximize generation. It enables efficient coordination between wind, solar, and battery systems. Governments backing offshore wind expansion accelerate demand for intelligent control technologies. Emerging markets invest in multi-source renewable projects, increasing system complexity. Vendors gain opportunities by offering integrated turbine control solutions tailored to hybrid platforms.

Government Incentives and Digital Infrastructure Policies Supporting Adoption:

Public policy shifts toward smart grids and clean energy offer long-term growth potential. The turbine control system market benefits from government subsidies, tax credits, and digital transformation roadmaps. It aligns with initiatives targeting decarbonization and energy security. Control systems play a key role in stabilizing renewable-heavy grids. Utility modernization funds unlock procurement opportunities for intelligent control platforms. It creates demand across both centralized and distributed power assets. Vendors with policy-aligned offerings gain strategic positioning in future-ready infrastructure projects.

Market Segmentation Analysis:

By Type

The turbine control system market includes steam, gas, wind, and hydro turbine control systems. Gas turbine control systems dominate due to their widespread use in combined-cycle and industrial power plants. Steam turbines remain essential for thermal generation, especially in coal and nuclear plants. Wind and hydro turbine control systems are gaining momentum with rising renewable energy integration, supporting grid flexibility and low-emission goals.

- For instance, ABB Ltd has delivered its Symphony Plus distributed control system for over 1,400 gas turbine installations and 500 wind and hydro turbine systems globally, ensuring high-precision integration across all turbine types.

By Function

Functional segmentation comprises speed, temperature, load, and pressure control, along with other functions like frequency and turbine stress influence. Speed and load control are most critical, ensuring synchronization and operational stability. Temperature and pressure controls contribute to safe and efficient turbine operation, particularly in high-performance systems. Other advanced functions support system durability under variable operating conditions.

- For instance, Rockwell Automation’s PlantPAx Distributed Control System incorporates turbine control modules that have demonstrated, in U.S. hydro and gas plant deployments, reductions in nuisance shutdowns by nearly 90% and average start-up times by 25%. The system ensures precise, sub-second speed regulation and real-time process monitoring, with open architecture Ethernet/IP integration for third-party system compatibility and advanced diagnostics for early detection of operational anomalies

By Component

Key components include sensors, controllers, software, human-machine interfaces (HMIs), and other supporting devices. Controllers and software lead due to growing demand for intelligent, automated control solutions. Sensors enable precise monitoring of displacement, temperature, and vibration. HMIs improve operational interface, while communication and protection devices enhance system integration and security. It offers a comprehensive solution across turbine platforms.

By End-Use Industry

Power generation is the largest end-use segment, driven by rising electricity demand, infrastructure modernization, and renewable deployment. The oil & gas sector also represents a significant share, requiring precise turbine control in exploration and processing facilities. Industrial applications grow steadily, supported by cogeneration and distributed generation systems that benefit from efficient turbine management.

Segmentation:

By Type:

- Steam Turbine Control System

- Gas Turbine Control System

- Wind Turbine Control System

- Hydro Turbine Control System

By Function:

- Speed Control

- Temperature Control

- Load Control

- Pressure Control

- Other Functions (including frequency influence, turbine stress influence)

By Component:

- Sensors (e.g., displacement, temperature, vibration, position)

- Controllers

- Software

- Human-Machine Interface (HMI)

- Others (e.g., communication devices, processors, protection devices)

By End-Use Industry:

- Power Generation

- Oil & Gas

- Industrial

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading with Technological Integration and Power Sector Modernization

North America dominates the turbine control system market with a market share of 33.8%. The region benefits from extensive deployment of advanced automation technologies across thermal, hydro, and renewable power plants. The U.S. continues to lead installations due to modern grid infrastructure and consistent investments in gas-fired and wind power plants. Major OEMs and energy firms in this region adopt high-performance control systems to meet stringent operational efficiency and emission standards. Canada supports growth through grid upgrades and new hydropower capacity additions. The presence of prominent control system manufacturers accelerates the adoption of integrated turbine monitoring and control platforms across utilities and independent power producers.

Asia-Pacific: Rapid Infrastructure Development and Renewable Energy Expansion

Asia-Pacific holds the second-largest position in the turbine control system market with a market share of 30.2%. It experiences strong growth due to expanding energy demand, urbanization, and transition toward cleaner energy sources. Countries such as China, India, and Japan invest heavily in large-scale wind, hydro, and gas-based power generation projects. China’s focus on industrial automation and India’s commitment to modernize outdated power infrastructure contribute significantly to regional growth. Japan promotes the adoption of advanced turbine control solutions in nuclear and thermal facilities for safety and efficiency. The region also sees increased collaboration between local power firms and global control system providers, improving technology penetration.

Europe and Rest of the World: Stability in Modernization and Green Energy Focus

Europe accounts for a market share of 21.4% in the turbine control system market, driven by its mature power sector and strong regulatory framework promoting efficiency and sustainability. Countries like Germany, France, and the UK invest in upgrading thermal and wind power facilities with real-time control systems. It supports digital retrofitting and centralized grid control to align with EU emission norms. The Rest of the World, including Latin America, the Middle East, and Africa, collectively represents 14.6% of the market. These regions adopt turbine control systems through government-backed infrastructure projects and renewable energy programs. Brazil, the UAE, and South Africa emerge as key contributors, with new investments in hydro and thermal generation facilities improving demand visibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB Ltd

- Emerson Electric Co.

- General Electric Company

- Siemens AG / Siemens Energy AG

- Rockwell Automation

- Honeywell International Inc.

- Rolls-Royce Holding PLC

- Woodward, Inc.

- Kawasaki Heavy Industries Ltd.

- Vestas

Competitive Analysis:

The turbine control system market features a competitive landscape dominated by global players specializing in automation, energy, and industrial control technologies. Key companies include General Electric, Siemens Energy, ABB, Emerson Electric, and Woodward Inc. These firms maintain strong positions through extensive R&D, diverse product portfolios, and global service networks. It sees high differentiation based on system integration capabilities, software platforms, and compatibility with renewable energy assets. New entrants face high barriers due to technological complexity and long sales cycles. Established players leverage strategic alliances and service contracts to retain market share. Competitive intensity remains high as players compete on reliability, cybersecurity features, and digital capabilities. The market rewards innovation in predictive diagnostics, AI integration, and remote operation support. Vendor performance often depends on long-term partnerships with utilities, OEMs, and government-backed energy projects.

Recent Developments:

- In April 2025, ABB Ltd introduced a complete switchgear solution designed specifically for next-generation wind turbines. This innovation integrates a 7,200A Emax 2 air circuit breaker and a 3,200A AF Contactor, offering the industry’s highest power rating for such applications. The solution supports increased reliability and more efficient fault protection for large wind turbines, enabling the rollout of turbines with outputs reaching 20MW and heights over 200 meters, ultimately maximizing yield and minimizing maintenance costs for wind operators.

- In February 2025, Emerson Electric Co. announced a strategic partnership with Zitara Technologies, a leader in advanced battery management software. This partnership aims to strengthen Emerson’s automation solutions, with a focus on integrating Zitara’s technology into power systems, including industrial-scale turbine control where battery storage and reliability are critical.

- In May 2025, GE Vernova announced the acquisition of Woodward, Inc.’s heavy-duty gas turbine combustion parts business, with the transaction expected to close early in the year. This move secures GE Vernova’s domestic gas turbine supply chain, enhancing its Greenville, South Carolina operations and supporting increased demand for heavy-duty gas turbines globally.

- In February 2025, Siemens Energy AG and Rolls-Royce SMR entered into a partnership agreement under which Siemens Energy will be the exclusive supplier of steam turbines and auxiliary systems for Rolls-Royce’s next-generation Small Modular Reactors (SMR). The contract, covering Generation 3+ nuclear power plants, is expected to be finalized by the end of 2025 and reflects major integration of control systems and conventional technology for modular nuclear platforms.

Market Concentration & Characteristics:

The turbine control system market demonstrates moderate to high concentration, with a few multinational companies accounting for significant market share. It is characterized by high technical expertise, long-term customer relationships, and complex procurement cycles. Vendors offer customized solutions tailored to turbine type, plant size, and energy source. The market emphasizes system reliability, regulatory compliance, and integration with broader plant automation ecosystems. Customers value lifecycle support and upgrade options, which reinforces vendor loyalty. Innovation, digital integration, and global service delivery remain key success factors for competitive positioning.

Report Coverage:

The research report offers an in-depth analysis based on type, component, function and end-use industry segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for automation and smart grid compatibility will continue to drive new installations and upgrades.

- Adoption of AI and machine learning will enhance real-time diagnostics and predictive maintenance capabilities.

- Hybrid and renewable power projects will generate sustained demand for adaptive and intelligent turbine control systems.

- Government incentives and decarbonization targets will encourage utility-scale modernization across regions.

- Vendors will focus on modular, retrofit-friendly platforms to reduce integration time and operational disruptions.

- Cybersecurity will remain a top priority, influencing product development and procurement decisions.

- Emerging markets will accelerate control system adoption driven by expanding energy infrastructure.

- Cloud-enabled monitoring and digital twins will redefine O&M practices in distributed power environments.

- Partnerships between OEMs and digital solution providers will reshape the competitive landscape.

- Continued investment in control system R&D will support innovation in flexibility, compliance, and efficiency.