Market Overview

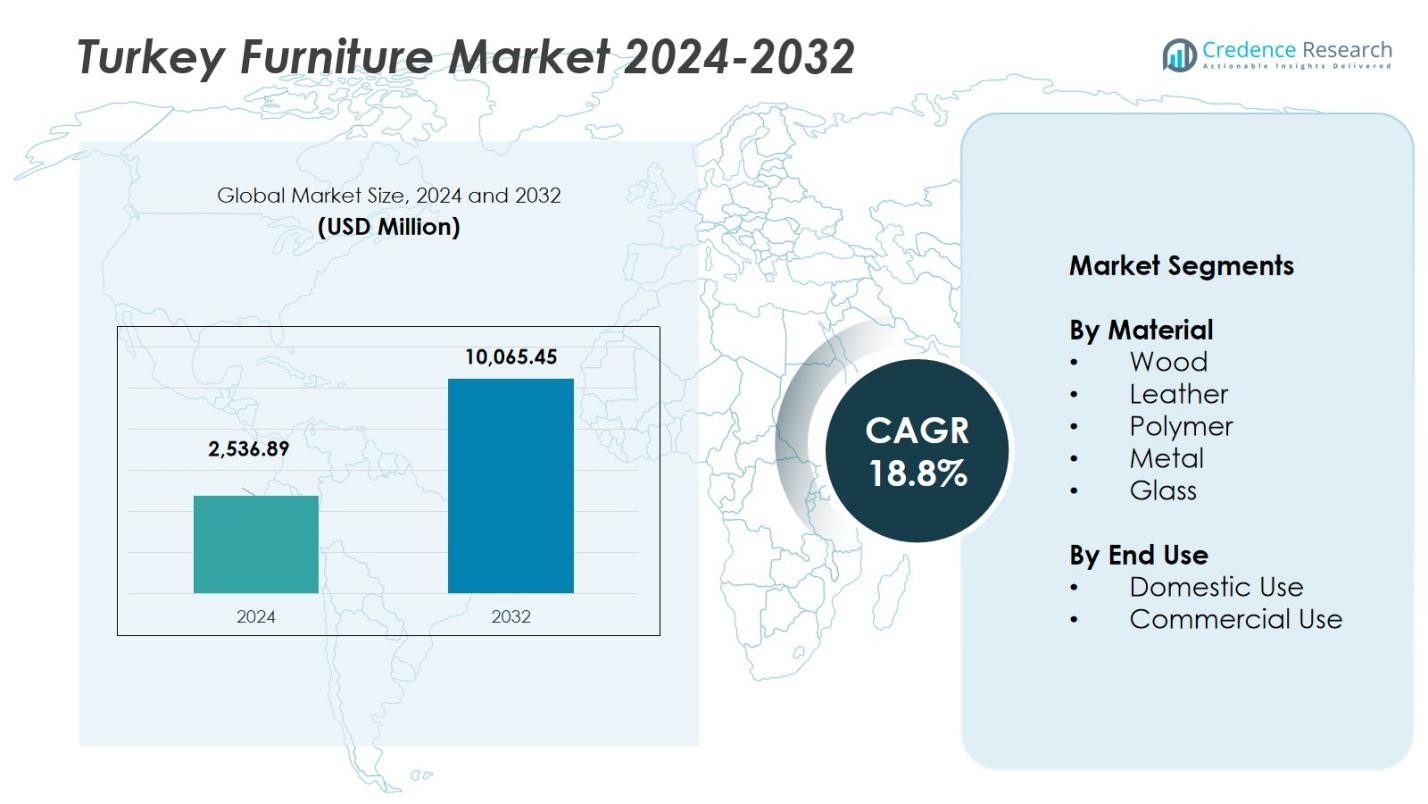

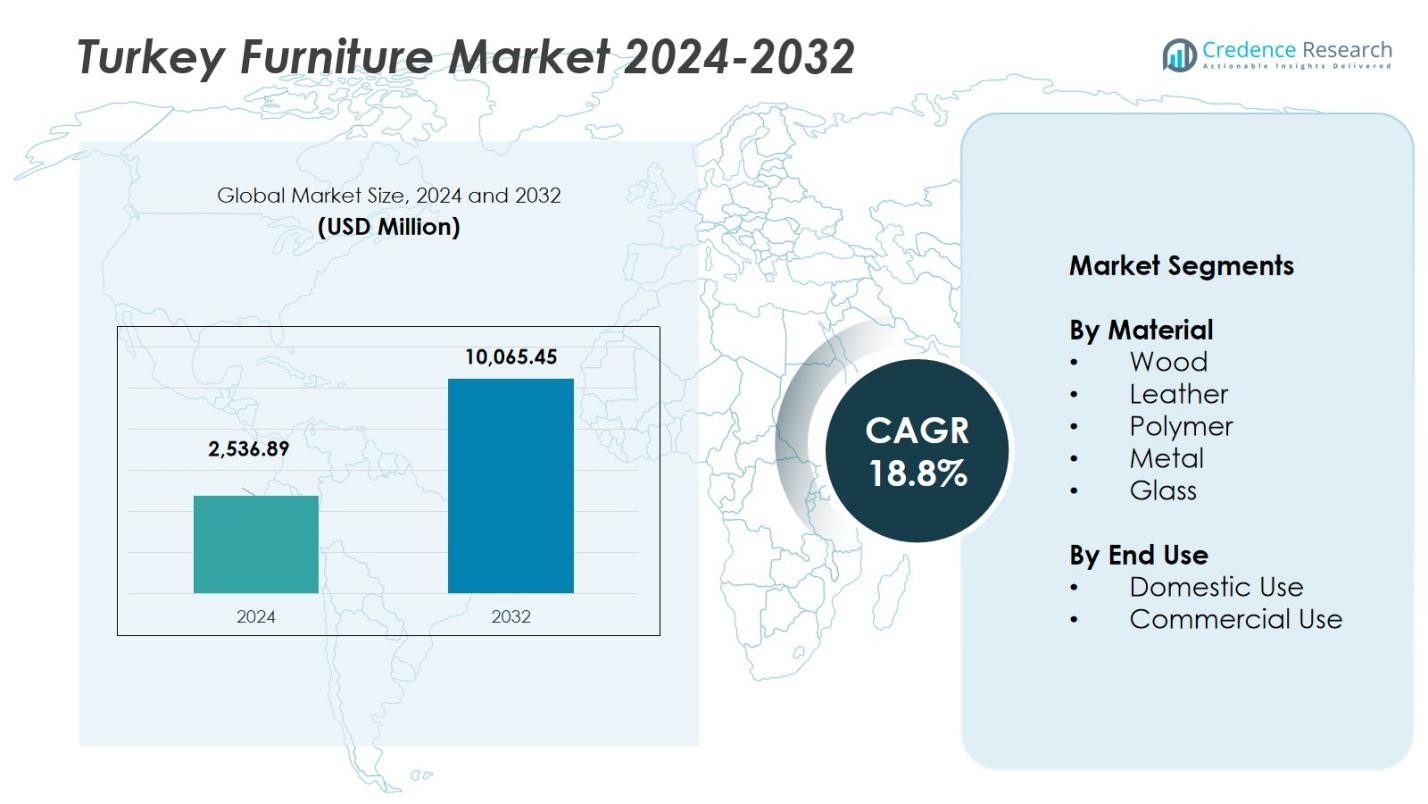

The Turkey Furniture Market size was valued at USD 2,536.89 Million in 2024 and is anticipated to reach USD 10,065.45 Million by 2032, at a CAGR of 18.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turkey Furniture Market Size 2024 |

USD 2,536.89 Million |

| Turkey Furniture Market, CAGR |

18.8% |

| Turkey Furniture Market Size 2032 |

USD 10,065.45 Million |

The Turkey Furniture Market is led by prominent companies such as İstikbal Mobilya, Kelebek Mobilya, Bellona, Doğtaş Mobilya, and IKEA Turkey. These companies dominate the market due to their strong brand recognition, extensive product offerings, and nationwide distribution networks. They focus on innovation, sustainable practices, and modern designs to cater to evolving consumer preferences. The market is experiencing significant growth, driven by factors such as rising disposable incomes, urbanization, and a shift towards stylish, eco-friendly furniture. Western Turkey holds the largest market share, accounting for approximately 45%. This region benefits from its established industrial base, particularly around major cities like Bursa and İzmir, which are key hubs for furniture manufacturing. The infrastructure in Western Turkey also facilitates efficient supply chain operations, contributing to the region’s market leadership. With rapid urbanization and increased demand for both residential and commercial furniture, Western Turkey continues to drive the overall market growth.

Market Insights

Market Insights

- The Turkey Furniture Market size reached USD 2,536.89 million in 2024 and is projected to expand at a CAGR of 18.8%.

- Rising disposable incomes and rapid urbanisation are driving demand for furniture in residential and commercial sectors, especially with wood-based products holding a 40% share and domestic use at 60%.

- Multi-functional and space‑saving furniture designs are gaining traction in urban dwellings, while customisation options are drawing younger consumers seeking unique styles.

- Major firms such as İstikbal Mobilya, Kelebek Mobilya, Bellona, Doğtaş Mobilya and IKEA Turkey dominate the marketplace, leveraging strong brand recognition, broad retail networks and integrated manufacturing.

- Raw‑material price volatility and competition from low‑cost imports continue to constrain growth, while Western Turkey leads with a 45% regional share and remains the focal point for production and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material:

In the Turkey Furniture Market, the Wood segment holds the largest market share, accounting for approximately 40% of the total market. Wood-based furniture continues to dominate due to its aesthetic appeal, durability, and widespread use in both residential and commercial settings. The growing demand for eco-friendly, sustainable materials, along with the preference for custom-made wooden furniture, further drives the growth of this segment. Additionally, wood’s versatility in design and finish makes it a preferred choice for a wide range of consumers.

- For instance, Istikbal Mobilya utilizes advanced manufacturing technologies to produce durable wooden furniture collections that blend traditional Turkish design with contemporary styles, catering to diverse consumer preferences.

By End Use:

The Domestic Use segment leads the Turkey Furniture Market, with a market share of around 60%. The demand for furniture in the residential sector is driven by factors such as rising disposable incomes, urbanization, and the growing trend of home decoration. Additionally, the increasing number of home renovation projects, coupled with the need for functional and stylish home furnishings, supports the continued dominance of this segment. Consumer preference for multi-functional and space-saving furniture is another key driver in this sub-segment.

- For instance, Bellona Mobilya offers extendable dining tables and storage-integrated ottomans that blend style and functionality, meeting the trend for versatile home furnishings.

Key Growth Drivers

Rising Disposable Incomes and Urbanization

The increasing disposable income of Turkey’s middle class is a major driver of the furniture market. As more consumers can afford premium products, demand for high-quality and stylish furniture is rising, especially in urban areas. This growth is further fueled by rapid urbanization, where people seek to enhance their living spaces with modern and functional furniture. The expanding construction and real estate sectors also contribute to higher demand for both residential and commercial furniture.

- For instance, AS MENU, specializes in high-quality rattan furniture, reflecting growing consumer preferences for durable, eco-friendly outdoor pieces in rapidly urbanizing regions.

Growing Focus on Sustainable and Eco-friendly Furniture

Sustainability is becoming a key priority among Turkish consumers, who are increasingly inclined toward eco-friendly furniture made from renewable materials. Wood, particularly sourced from sustainable forests, is in high demand. The rise of environmentally conscious consumers, along with government regulations encouraging green products, is driving growth in this segment. Furniture manufacturers are also adopting eco-friendly production processes to meet consumer expectations and improve their market position, further accelerating the trend.

- For instance, Ersa Mobilya installed a 22,000 square meter solar panel system on its Ankara factory roof to meet 65% of its energy needs with renewable solar power, preventing 1,472 tons of CO2 emissions as of 2023.

Technological Advancements and Online Retail Expansion

Technological innovations in manufacturing processes, such as the integration of automation and artificial intelligence, have helped Turkish furniture companies increase production efficiency and product quality. Furthermore, the rise of online retail platforms has made purchasing furniture easier and more accessible for consumers. E-commerce growth, along with virtual reality and augmented reality technologies for online shopping, is expanding the reach of Turkish furniture brands. This trend is expected to continue as more consumers embrace the convenience of buying furniture online.

Key Trends & Opportunities

Rise in Multi-functional and Space-saving Furniture

As space constraints become a growing concern in urban Turkey, multi-functional and space-saving furniture is gaining popularity. Items that serve multiple purposes, such as convertible sofas or extendable dining tables, are highly sought after. This trend is particularly noticeable among younger, urban dwellers who live in apartments and are looking for practical solutions to optimize their living spaces. Furniture manufacturers are increasingly focusing on creating innovative designs that combine aesthetics and functionality to meet this demand.

- For instance, one of IKEA’s extendable dining tables (from the EKEDALEN series) hides an extra leaf to expand when needed and then stows away neatly when not.

Growing Demand for Customization and Personalization

Turkish consumers are increasingly seeking customized furniture that reflects their individual style and preferences. This trend is pushing manufacturers to offer bespoke designs, including unique finishes, colors, and sizes. The demand for personalized furniture is also spurred by advancements in digital design tools, which allow consumers to visualize their ideas before making a purchase. With the rise of customization, furniture brands have an opportunity to cater to a wider range of consumer needs, further boosting market growth.

- For instance, Homelli, a custom furniture manufacturer based in Istanbul, produces high-quality bespoke pieces with a variety of fabrics, finishes, and dimensions tailored to client specifications.

Key Challenges

Fluctuating Raw Material Prices

The fluctuating prices of raw materials, especially wood and metals, pose a significant challenge to the Turkey furniture market. These price fluctuations often lead to increased production costs, which may be passed on to consumers, potentially reducing demand for high-end furniture. Additionally, supply chain disruptions, such as those caused by global events, can further exacerbate this issue. Furniture manufacturers must find ways to manage these price variances effectively while maintaining product quality and profitability.

Intense Competition from Low-Cost Imports

One of the major challenges in the Turkey furniture market is the rising competition from low-cost furniture imports, particularly from Asia. These imports often offer similar designs at a lower price point, attracting budget-conscious consumers. Turkish manufacturers, who rely on premium materials and craftsmanship, find it difficult to compete on price alone. To combat this challenge, domestic brands must differentiate themselves by offering superior quality, unique designs, and focusing on the sustainability trend that is increasingly important to Turkish consumers.

Regional Analysis

Western Turkey

The Western Turkey region commands a market share of 45% of the country’s furniture market. This dominance reflects the region’s strong industrial base in textiles and furniture manufacturing, particularly around major hubs like Bursa and İzmir. The shift towards urban living and modern flats in this region boosts demand for stylish and modular furniture. Also, Western Turkey benefits from better infrastructure and logistics, enabling smoother supply‑chain operations and exports. As a result, manufacturers based in Western Turkey can scale and innovate more readily than in other regions.

Central Turkey

Central Turkey holds 30% of Turkey’s furniture market share. This region’s growth is driven by the expanding real‑estate market in cities such as Ankara and Konya, where commercial and office furniture demand is rising. Central Turkey also benefits from improved transport links connecting production centres to consumer markets. However, the region faces some constraints in raw‑material sourcing compared to Western Turkey, which compels manufacturers to focus on cost‑effective designs and regional distribution. The result is steady but slightly slower growth than in the western region.

Eastern Turkey

Eastern Turkey represents 25% of the national furniture market. Although less industrialised than the western and central regions, this region is gradually gaining traction due to rising urbanisation and government initiatives promoting local manufacturing. Furniture demand is bolstered by increasing incomes and housing developments in regional cities. Yet, infrastructure limitations and less concentration of large‑scale production units temper growth. Manufacturers here often cater to regional markets with simpler designs and rely on distribution networks from other regions for premium products.

Market Segmentations:

By Material

- Wood

- Leather

- Polymer

- Metal

- Glass

By End Use

- Domestic Use

- Commercial Use

By Region

- Western Turkey

- Central Turkey

- Eastern Turkey

Competitive Landscape

Competitive landscape analysis: The key players in the Turkey Furniture Market include Kelebek Mobilya, Doğtaş Mobilya, IKEA Turkey, Bellona, and İstikbal Mobilya. These companies dominate the market due to their established brand presence, extensive product ranges, and nationwide distribution networks. They continue to focus on innovation, with a strong emphasis on modern designs, sustainability, and technology integration in production processes. E-commerce and online retail channels have been pivotal in expanding their customer reach, particularly among younger, tech-savvy consumers. Additionally, these leading players invest heavily in manufacturing facilities to ensure high-quality production at scale. However, the market is becoming increasingly competitive as smaller and niche players enter the market, offering unique, cost-effective, and locally designed furniture. As competition intensifies, both large and small companies focus on improving customer service, enhancing the shopping experience, and optimizing supply chains to maintain market share while responding to changing consumer preferences.

Key Player Analysis

- İstikbal Mobilya

- Kelebek Mobilya

- Bellona

- Doğtaş Mobilya

- IKEA Turkey

- Enza Home

- Kilim Mobilya

- Lazzoni

- Çilek

- Weltew Home

Recent Developments

- In November 2025, Konfor Furniture of Türkiye entered the Indian market with its first store in Pune, through a partnership with Creaticity.

- In 2023, Bellona (Turkey) launched a new modular furniture collection designed to offer space-saving, customizable solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Urbanisation and rising household formation will boost demand for furniture across Turkey.

- Increasing disposable incomes among the middle class will lead consumers to spend more on higher‑quality and designer furniture.

- The rapid growth of e‑commerce will enable furniture makers and retailers to reach more buyers and expand beyond traditional outlets.

- Sustainability‑driven sourcing and green production methods will become vital, offering firms competitive advantage in both domestic and export markets.

- Smart and multifunctional furniture suited to compact urban living will gain traction among younger buyers and apartment dwellers.

- Customisation and personalised furniture solutions will grow in importance as consumers seek unique styles and tailored home pieces.

- Export opportunities will expand as Turkey leverages its manufacturing base and cost competence to serve Middle East, Europe and African markets.

- Integration of digital design tools, augmented reality showrooms and virtual try‑outs will reshape the furniture shopping experience.

- Volatility in raw‑material costs and currency fluctuations will require manufacturers to optimise supply chains and maintain pricing discipline.

- Competitive pressure from low‑cost imports and shifting consumer preferences will force domestic brands to differentiate through design, quality and service.

Market Insights

Market Insights