| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turkey Autonomous Off-road Vehicles And Machinery Market Size 2023 |

USD 150.44 Million |

| Turkey Autonomous Off-road Vehicles And Machinery Market, CAGR |

10.62% |

| Turkey Autonomous Off-road Vehicles And Machinery Market Size 2032 |

USD 374.02 Million |

Market Overview:

Turkey Autonomous Off-road Vehicles And Machinery Market size was valued at USD 150.44 million in 2023 and is anticipated to reach USD 374.02 million by 2032, at a CAGR of 10.62% during the forecast period (2023-2032).

The adoption of autonomous off-road vehicles and machinery in Turkey is driven by several key factors. Technological advancements, particularly in artificial intelligence, machine learning, and sensor technologies, are enhancing the performance and reliability of autonomous systems in off-road environments. These innovations are enabling more efficient operations and allowing for real-time decision-making in complex terrains. Additionally, Turkey’s industries, including agriculture, mining, and construction, face challenges such as labor shortages and high operational costs. Autonomous vehicles offer an effective solution by reducing the reliance on human labor while improving operational efficiency. The increased focus on safety and productivity further accelerates the adoption of autonomous systems, as they can operate in hazardous conditions and increase overall productivity without the risks associated with human operators. Moreover, the growing emphasis on sustainability drives demand for autonomous off-road vehicles, as they can be designed to optimize fuel efficiency and reduce emissions, supporting Turkey’s environmental goals.

Regionally, Turkey’s strategic location at the crossroads of Europe and Asia plays a crucial role in the growth of autonomous off-road vehicles. The country’s well-developed automotive industry infrastructure, combined with strong government support for technological innovation, creates an ideal environment for the development and deployment of these advanced technologies. Key regions such as Central Anatolia, with its automotive manufacturing hubs, and the Aegean region, with its focus on agriculture and forestry, are expected to see substantial adoption of autonomous machinery. The Marmara region, a center for industrial activities like mining and construction, also presents a significant market for autonomous vehicles. This regional diversity further positions Turkey as a key player in the autonomous off-road vehicle market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Turkey Autonomous Off-road Vehicles and Machinery market was valued at USD 150.44 million in 2023 and is projected to reach USD 374.02 million by 2032, growing at a CAGR of 10.62% during the forecast period.

- Global Autonomous Off-road Vehicles and Machinery size was valued at USD 23,300.00 million in 2023 and is anticipated to reach USD 68,887.09 million by 2032, at a CAGR of 12.80% during the forecast period (2023-2032).

- Technological advancements in AI, machine learning, and sensor technologies are enhancing the performance of autonomous systems, enabling real-time decision-making in complex terrains.

- The need for cost efficiency and labor reduction is driving the adoption of autonomous machinery in Turkey’s agriculture, mining, and construction industries.

- Autonomous systems increase safety by operating in hazardous environments, reducing human intervention and boosting productivity with continuous operation.

- Sustainability goals are a key driver, as autonomous off-road vehicles are designed to optimize fuel efficiency, minimize emissions, and support Turkey’s environmental objectives.

- High initial investment costs present a challenge for small and medium enterprises (SMEs) in Turkey, despite the long-term cost-saving benefits of autonomous systems.

- Regional differences in Turkey, such as the automotive hubs in Central Anatolia and agriculture-driven demand in the Aegean region, contribute to varied adoption rates of autonomous machinery.

Market Drivers:

Technological Advancements

The rapid advancements in artificial intelligence (AI), machine learning, and sensor technologies are key drivers of the autonomous off-road vehicle and machinery market in Turkey. These technological innovations have enabled significant improvements in the capabilities of autonomous systems, allowing them to operate more efficiently and reliably in complex and rugged terrains. AI and machine learning algorithms enable these vehicles to make real-time decisions, adapt to changing environmental conditions, and navigate obstacles with precision. Additionally, the integration of advanced sensors, including LiDAR, radar, and cameras, enhances the vehicles’ ability to sense their surroundings, ensuring safety and operational efficiency. As these technologies continue to evolve, the performance of autonomous off-road vehicles will further improve, driving their adoption across various industries.

Cost Efficiency and Labor Shortages

One of the primary drivers behind the growing demand for autonomous off-road vehicles in Turkey is the need for cost efficiency in sectors such as agriculture, mining, and construction. These industries often face challenges related to labor shortages and high operational costs. For example, the use of autonomous machinery has enabled continuous operation in hazardous or remote environments, reducing the need for human intervention and minimizing downtime. With the increasing demand for productivity and reduced operational costs, autonomous off-road vehicles can perform tasks more efficiently, even in hazardous environments, without the need for constant human oversight. This shift toward automation allows companies to optimize their operations, reduce downtime, and improve the overall cost-effectiveness of their projects.

Safety and Productivity Improvements

The focus on enhancing safety and productivity is another important factor driving the adoption of autonomous off-road vehicles and machinery in Turkey. Autonomous systems can operate in hazardous environments, such as mining sites, construction zones, and agricultural fields, where human workers may face safety risks. By removing humans from dangerous tasks, these vehicles significantly reduce the likelihood of accidents and injuries. Furthermore, autonomous vehicles can operate continuously without fatigue, enabling them to work round-the-clock, which significantly boosts overall productivity. The ability to complete tasks with greater precision and consistency also enhances the quality of work, making autonomous systems a valuable asset for industries seeking to improve both safety and operational performance.

Sustainability and Environmental Goals

Sustainability has become a major concern for industries worldwide, and Turkey is no exception. With a growing emphasis on environmental preservation and sustainability, there is an increasing demand for technologies that can help reduce environmental impact. For instance, Arçelik, a leading Turkish manufacturer of household appliances and industrial equipment, has integrated autonomous electric vehicles into its logistics operations at its Eskişehir plant. Autonomous off-road vehicles offer a viable solution by improving fuel efficiency and minimizing emissions. These vehicles can be designed with energy-efficient systems, ensuring optimal fuel usage and reduced carbon footprints. As industries in Turkey continue to face stricter environmental regulations and growing public pressure to adopt sustainable practices, the demand for autonomous vehicles that contribute to greener operations is expected to rise. The integration of environmentally friendly technologies aligns with Turkey’s broader sustainability goals, further driving the adoption of autonomous off-road machinery.

Market Trends:

Integration of Electric Powertrains

One of the most notable trends in the autonomous off-road vehicles and machinery market in Turkey is the increasing integration of electric powertrains into autonomous systems. As the global push for sustainability intensifies, many industries are turning to electric vehicles (EVs) to reduce their carbon footprints. This trend is particularly relevant for off-road vehicles, which are often used in harsh and energy-intensive environments. For instance, TEMSA, which, in partnership with ASELSAN, developed Turkey’s first fully electric domestic bus, Avenue EV, equipped with advanced technologies and currently being studied for autonomous features. Electric autonomous vehicles offer several benefits, including lower operational costs, reduced maintenance requirements, and enhanced energy efficiency. In Turkey, where there is a growing commitment to reducing emissions and promoting green technologies, the adoption of electric autonomous off-road vehicles is expected to increase significantly. As advancements in battery technology continue, these electric powertrains will become more viable for off-road applications, accelerating their adoption in Turkey’s key industries.

Advancements in AI and Machine Learning

Artificial intelligence (AI) and machine learning continue to be at the forefront of technological advancements driving the autonomous off-road vehicle market in Turkey. As these technologies mature, they are being increasingly integrated into off-road machinery to enhance their autonomous capabilities. AI algorithms enable these vehicles to analyze and process vast amounts of data in real time, improving decision-making, obstacle avoidance, and route optimization. For instance, Büyütech is another Turkish innovator, developing camera-based Advanced Driver Assistance Systems (ADAS) that address perception challenges in autonomous driving by tracking drivers and occupants for enhanced safety. Machine learning allows these systems to continually improve their performance by learning from past experiences, making autonomous vehicles more efficient over time. In Turkey, industries such as agriculture, construction, and mining are beginning to leverage these advancements to improve productivity, reduce errors, and enhance operational safety. The integration of AI and machine learning will continue to shape the future of autonomous off-road vehicles in the country, enhancing their capabilities and reliability.

Rise of Remote Monitoring and Control

Another key trend in the Turkish market is the increasing use of remote monitoring and control systems for autonomous off-road vehicles. Remote monitoring allows operators to track the performance and status of autonomous machinery in real-time, regardless of their location. This capability is especially useful in off-road environments where vehicles often operate in remote or hazardous locations. With remote control systems, operators can intervene when necessary, providing an additional layer of safety and ensuring that the vehicles perform as expected. In Turkey, where rugged terrain and challenging environments are common in industries like agriculture and mining, the ability to monitor and control autonomous systems remotely is becoming a crucial feature. This trend is driving the development of more sophisticated telematics and connectivity solutions for off-road vehicles, making them more flexible and efficient.

Regulatory Support and Government Initiatives

The Turkish government has shown increasing support for the development and adoption of autonomous off-road vehicles through regulatory frameworks and initiatives aimed at fostering technological innovation. As part of its broader push for technological advancement and economic modernization, Turkey is investing in autonomous technologies across multiple sectors. The government has introduced policies that encourage research and development in autonomous systems, with a focus on safety standards, environmental sustainability, and the integration of AI and machine learning. These regulatory efforts are expected to accelerate the adoption of autonomous off-road vehicles by providing clear guidelines and standards for their deployment. As the regulatory environment continues to evolve, Turkey will likely see increased interest from both domestic and international companies in developing autonomous technologies tailored to the needs of the country’s key industries.

Market Challenges Analysis:

High Initial Investment Costs

One of the significant challenges facing the adoption of autonomous off-road vehicles and machinery in Turkey is the high initial investment required for these advanced systems. For instance, in Turkey’s agricultural sector, the adoption of autonomous tractors is hampered by substantial upfront costs associated with integrating advanced technologies like GPS, sensors, and artificial intelligence. These costs are particularly challenging for small-scale farmers and SMEs, making the equipment less accessible and limiting widespread adoption. Autonomous vehicles, particularly those integrated with AI, machine learning, and electric powertrains, demand substantial capital for development and deployment. These high costs can be prohibitive for many businesses, particularly small and medium-sized enterprises (SMEs) operating in industries like agriculture and construction. Although the long-term benefits of autonomous systems, such as reduced labor costs and increased productivity, may offset these initial costs, the upfront financial commitment remains a barrier for many companies in Turkey. The lack of accessible financing options further exacerbates this challenge, making it more difficult for businesses to transition to autonomous machinery.

Technological Complexity and Integration

The complexity of integrating autonomous technology into existing off-road machinery is another key challenge in the Turkish market. Autonomous systems require sophisticated software, hardware, and sensors, as well as seamless integration with the vehicle’s mechanical components. Ensuring that these advanced systems function optimally in off-road environments, which often involve harsh and unpredictable conditions, presents a significant technical hurdle. Additionally, the need for continuous updates and maintenance of autonomous systems adds to the complexity. Many businesses in Turkey may face difficulties in implementing these technologies due to the lack of specialized skills and infrastructure required for integration and support, hindering the widespread adoption of autonomous vehicles.

Regulatory and Safety Concerns

Despite growing government support for autonomous technologies in Turkey, regulatory frameworks surrounding the deployment of autonomous off-road vehicles are still in the developmental stages. The lack of clear and standardized regulations for autonomous machinery creates uncertainty for businesses looking to invest in these technologies. Issues related to safety standards, vehicle certification, and liability in the event of malfunctions or accidents remain unresolved in some cases, further complicating the adoption process. As Turkey moves toward developing a comprehensive regulatory environment, these concerns must be addressed to foster greater confidence in the deployment of autonomous off-road vehicles.

Market Opportunities:

The market for autonomous off-road vehicles and machinery in Turkey presents significant growth opportunities, driven by the increasing demand for automation across key industries such as agriculture, mining, and construction. The adoption of autonomous vehicles offers the potential for substantial improvements in operational efficiency and safety, reducing the reliance on human labor and mitigating risks associated with hazardous work environments. As the Turkish government continues to invest in technological advancements and automation, businesses in these sectors can capitalize on government incentives and support for innovation. The integration of autonomous machinery can help companies optimize workflows, enhance productivity, and achieve cost savings, particularly in industries facing labor shortages and rising operational expenses.

Additionally, the growing emphasis on sustainability in Turkey presents a valuable opportunity for the autonomous off-road vehicle market. With increasing regulatory pressure to reduce emissions and environmental impact, autonomous vehicles equipped with electric powertrains can offer a cleaner, more energy-efficient solution compared to traditional machinery. As Turkey strives to meet its sustainability goals, the adoption of autonomous electric vehicles will align with both environmental regulations and corporate sustainability initiatives. This presents an opportunity for manufacturers and technology providers to offer innovative, eco-friendly autonomous solutions tailored to Turkey’s industries, positioning themselves as leaders in a market that is set to expand significantly in the coming years.

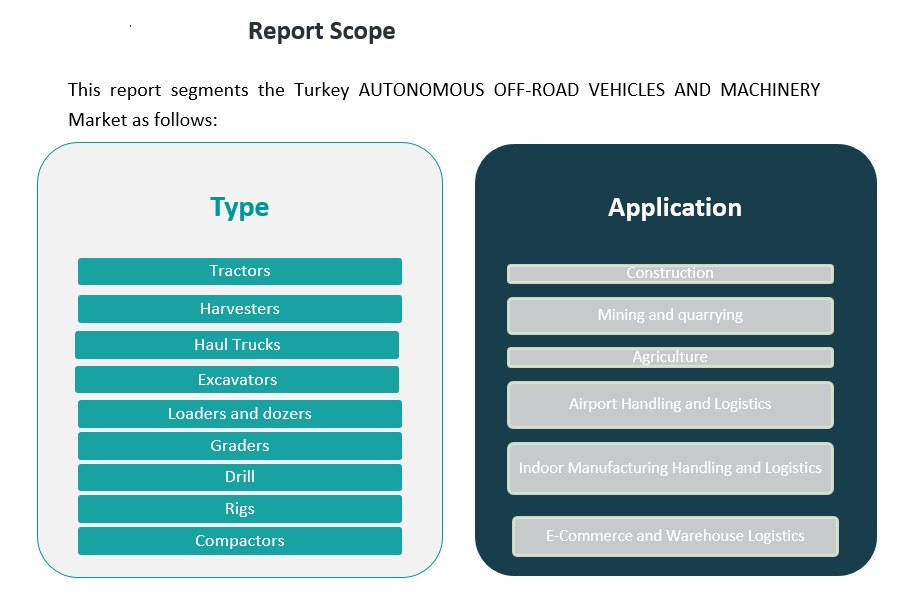

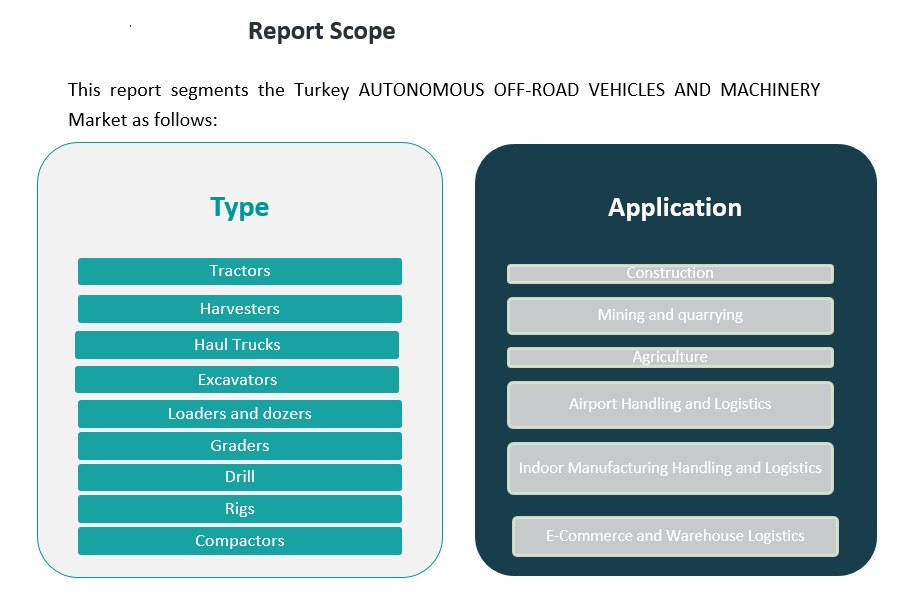

Market Segmentation Analysis:

The Turkish autonomous off-road vehicles and machinery market can be segmented by both type and application, offering a detailed view of its potential across various industries.

By Type Segment: The market includes a wide range of autonomous machinery, such as tractors, harvesters, and haul trucks used primarily in agriculture and mining. Excavators, loaders, and dozers are pivotal in construction and excavation operations, allowing for improved efficiency and safety in hazardous environments. Other significant segments include graders, drills, and rigs, which are extensively utilized in mining and construction. Compactors play a vital role in soil and road compaction, essential for infrastructure development. The growth of these segments is supported by the increasing adoption of automation in off-road operations to enhance productivity, reduce labor costs, and improve safety standards.

By Application Segment: The application of autonomous off-road vehicles spans various industries. Construction is a key sector, driven by the need for efficient and safe machinery in large-scale projects. Mining and quarrying are also prominent, where autonomous vehicles enhance operational safety and productivity by reducing human intervention in hazardous environments. In agriculture, autonomous tractors and harvesters offer precise field management, increasing yields and reducing operational costs. Additionally, airport handling and logistics, indoor manufacturing handling and logistics, and e-commerce and warehouse logistics represent growing areas of opportunity as businesses seek automation to streamline operations, improve efficiency, and manage inventory in real time. These application segments are expected to see significant growth as Turkey continues to adopt more autonomous systems across diverse sectors.

Segmentation:

By Type Segment:

- Tractors

- Harvesters

- Haul Trucks

- Excavators

- Loaders and Dozers

- Graders

- Drill

- Rigs

- Compactors

By Application Segment:

- Construction

- Mining and Quarrying

- Agriculture

- Airport Handling and Logistics

- Indoor Manufacturing Handling and Logistics

- E-Commerce and Warehouse Logistics

Regional Analysis:

Turkey’s autonomous off-road vehicles and machinery market exhibits regional disparities influenced by industrial concentration, infrastructure development, and economic activities. While specific market share data for each region is limited, general trends can be inferred based on industrial hubs and regional economic profiles.

Marmara Region

The Marmara region, encompassing Istanbul and Bursa, stands as Turkey’s industrial and economic powerhouse. With a strong presence in automotive manufacturing, logistics, and construction, it serves as a significant market for autonomous off-road vehicles and machinery. The region’s advanced infrastructure and proximity to international trade routes further bolster its position as a key player in the adoption of autonomous technologies.

Central Anatolia Region

Central Anatolia, home to Ankara and Konya, is a vital agricultural hub. The demand for autonomous tractors, harvesters, and other machinery is growing, driven by the need for increased agricultural efficiency and labor cost reduction. While specific market share figures are not readily available, the region’s agricultural significance suggests a substantial share in the autonomous off-road vehicle market.

Aegean Region

The Aegean region, with cities like Izmir, is known for its agricultural production, including cotton and olives. The adoption of autonomous machinery in agriculture is gaining momentum, aiming to enhance productivity and sustainability. Although precise market share data is scarce, the region’s agricultural activities indicate a growing demand for autonomous off-road vehicles.

Mediterranean and Southeastern Anatolia Regions

These regions, encompassing cities such as Antalya and Gaziantep, are pivotal in agriculture and construction. The integration of autonomous machinery in these sectors is on the rise, driven by the need for efficiency and safety. While detailed market share statistics are not specified, the regions’ economic activities suggest an increasing adoption of autonomous off-road vehicles.

Key Player Analysis:

- Caterpillar Inc

- Komatsu Ltd

- Sandvik AB

- John Deere

- Liebherr Group

- Jungheinrich AG

- Daifuku Co. Ltd.

- KION Group

- NAVYA

- EasyMile

Competitive Analysis:

The competitive landscape of Turkey’s autonomous off-road vehicles and machinery market is characterized by a mix of global and domestic players, focusing on the integration of cutting-edge technologies like artificial intelligence, machine learning, and electric powertrains. Key international companies, including Caterpillar, Komatsu, and Volvo Construction Equipment, dominate the market with their advanced autonomous machinery solutions for sectors such as mining, construction, and agriculture. These companies are increasingly collaborating with Turkish manufacturers to tailor their products to local needs, ensuring compatibility with the country’s regulatory standards and operational environments. Domestic players, such as Turkish engineering firms, are gaining ground by offering cost-effective solutions and capitalizing on Turkey’s strategic location to serve both domestic and regional markets. Additionally, partnerships between global technology providers and local firms are fostering innovation, with a focus on improving autonomous systems’ efficiency, safety, and sustainability. As a result, Turkey is poised to become a key market for autonomous off-road machinery in the region.

Recent Developments:

- In late March 2025, Havelsan, a leading Turkish defense and autonomous systems company, entered a strategic partnership with Egypt for the joint production of advanced unmanned ground vehicles (UGVs) in Cairo. The agreement involves technology transfer and licensing support from Havelsan to Egypt’s Kader Advanced Industrial Factory, with the aim of developing a new UGV tailored to the specific operational needs of the Egyptian military.

- In March 2025, Caterpillar Inc. announced a significant partnership with Luminar, a global automotive technology company, to integrate Luminar’s LiDAR technology into Caterpillar’s industrial autonomous solutions. This collaboration aims to enhance safety and profitability for Caterpillar’s customers worldwide by leveraging advanced hardware and AI platforms to drive the next generation of automation in industrial equipment.

- In May 2023, Komatsu Ltd. and Toyota Motor Corporation launched a joint project to develop an autonomous light vehicle (ALV) that operates on Komatsu’s Autonomous Haulage System (AHS) for mining applications. The collaboration is designed to accelerate the deployment of autonomy in mining operations, with concept ALVs being tested and a proof of concept expected at a customer site by January 2024.

- In July 2024, Liebherr Group expanded its partnership with Fortescue to jointly develop a fully integrated Autonomous Haulage Solution (AHS). This collaboration focuses on creating an OEM-agnostic fleet management system that can coordinate mixed fleets of autonomous vehicles, including ultra-class mining trucks and road trains, providing greater flexibility and control for mining operations

Market Concentration & Characteristics:

The market for autonomous off-road vehicles and machinery in Turkey is moderately concentrated, with a mix of global and local players. Major international companies such as Caterpillar, Komatsu, Volvo, and Deere & Company lead the market, providing advanced autonomous systems for industries like construction, mining, and agriculture. These global giants have a strong foothold due to their established technology, brand recognition, and expertise in off-road machinery. On the other hand, the Turkish market also features domestic companies that offer cost-effective and regionally tailored solutions. These local players are increasingly focusing on innovation, with an emphasis on developing autonomous systems that meet local regulatory standards and operational demands. The market is evolving, with partnerships between global technology providers and local firms driving further growth. The increasing adoption of autonomous machinery is leading to a competitive environment where technology, efficiency, and cost-effectiveness are key factors for success.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and Application It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Turkish autonomous off-road vehicle market is expected to grow significantly as industries increasingly adopt automation for efficiency and cost reduction.

- Government incentives and support for technological innovation will foster the development of autonomous systems tailored to local industries.

- Advancements in electric powertrains will drive the adoption of eco-friendly autonomous vehicles in construction, agriculture, and mining.

- The demand for autonomous off-road vehicles in agriculture will rise due to labor shortages and the need for precision farming.

- Autonomous solutions in construction will focus on improving safety, productivity, and reducing human error in hazardous environments.

- The integration of AI, machine learning, and IoT will enhance the functionality and intelligence of autonomous machinery, improving operational performance.

- Local manufacturers will play a growing role in developing cost-effective solutions that meet Turkish market demands.

- Increased collaboration between global and local players will facilitate technology transfer and innovation.

- The expansion of autonomous systems into logistics, mining, and airport handling will contribute to broader market penetration.

- Regulatory developments will shape the pace of adoption, with clear standards and safety protocols encouraging industry confidence in autonomous solutions.