| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turkey Feminine Hygiene Products Market Size 2023 |

USD 151.67 Million |

| Turkey Feminine Hygiene Products Market, CAGR |

5.13% |

| Turkey Feminine Hygiene Products Market Size 2032 |

USD 238.45 Million |

Market Overview:

Turkey Feminine Hygiene Products Market size was valued at USD 151.67 million in 2023 and is anticipated to reach USD 238.45 million by 2032, at a CAGR of 5.13% during the forecast period (2023-2032).

The growth of Turkey’s feminine hygiene products market is fueled by several key drivers. One of the primary factors is the increasing urbanization and the expanding middle class, which are contributing to higher demand for branded and premium hygiene products. As the awareness surrounding menstrual health and hygiene improves, more women are adopting products that promote better personal care, driven by educational campaigns and government initiatives. Furthermore, NGOs and public health organizations are playing a crucial role in improving access to affordable hygiene solutions, especially in rural areas, where products were previously harder to obtain. Additionally, product innovation, particularly the introduction of eco-friendly and organic feminine hygiene products, is attracting a growing segment of environmentally conscious consumers. These factors combined are helping to expand the market and boost consumer adoption across the country.

Regionally, Turkey’s feminine hygiene products market displays diverse consumption patterns influenced by geographical and socio-economic factors. Urban areas such as Istanbul, Ankara, and Izmir show higher demand for premium products, driven by greater disposable incomes, higher educational levels, and a more pronounced shift towards modern, eco-friendly options. On the other hand, rural regions are experiencing increased accessibility to basic hygiene products due to various government and non-governmental initiatives aimed at reducing menstrual health disparities. The adoption of digital sales channels is also growing rapidly, particularly in urban areas, as more consumers turn to e-commerce platforms for purchasing feminine hygiene products. This trend reflects broader shifts in retail behavior, aligning with global digital transformation efforts. Hence, the regional dynamics of the market vary, with urban consumers favoring higher-end products and rural consumers focusing on basic hygiene needs, creating a dynamic and expanding market landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Turkey’s feminine hygiene products market was valued at USD 151.67 million in 2023 and is projected to reach USD 238.45 million by 2032, growing at a CAGR of 5.13%.

- The global feminine hygiene products market, valued at USD 23,490.00 million in 2023, is projected to reach USD 43,917.35 million by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

- The increasing urbanization and the growing middle class are driving higher demand for premium hygiene products in urban areas.

- Improved awareness of menstrual health and hygiene, supported by government and NGO initiatives, is expanding the consumer base for hygiene products.

- Rural regions are benefitting from enhanced access to basic hygiene products, driven by distribution programs from government and non-governmental organizations.

- Eco-friendly and organic feminine hygiene products are seeing rising demand as consumers become more environmentally conscious.

- The adoption of e-commerce platforms is increasing rapidly, especially in urban areas, offering consumers more convenience and product choices.

- Price sensitivity remains a challenge, particularly in rural areas, where affordability limits access to premium and eco-friendly hygiene products.

Market Drivers:

Increasing Awareness of Menstrual Health

The rising awareness of menstrual health and hygiene is one of the most significant drivers for the growth of the feminine hygiene products market in Turkey. Over the past few years, both governmental and non-governmental organizations have made substantial efforts to educate women on the importance of maintaining hygiene during menstruation. For instance, in 2023, the Turkish Ministry of Health launched a national awareness campaign that reached over 15 million women, encouraging better menstrual health practices. Educational campaigns in schools, online platforms, and healthcare settings have played a crucial role in encouraging women of all age groups to prioritize their menstrual hygiene. These initiatives have helped reduce the stigma surrounding menstrual health and empowered women to adopt more effective and hygienic solutions. Educational campaigns in schools, online platforms, and healthcare settings have played a crucial role in encouraging women of all age groups to prioritize their menstrual hygiene. As a result, there has been a noticeable shift in consumer behavior, with more women opting for sanitary products such as pads, tampons, and menstrual cups, contributing to increased market demand.

Urbanization and Changing Consumer Lifestyles

Urbanization is another key factor driving the market for feminine hygiene products in Turkey. The rapid growth of urban populations, particularly in cities like Istanbul, Ankara, and Izmir, has led to an increase in disposable income and a shift towards more modern and premium hygiene products. Urban consumers tend to have greater access to a wide range of brands and products, making them more likely to purchase premium and innovative feminine hygiene solutions. Additionally, changing lifestyles, including the increasing participation of women in the workforce and educational institutions, has spurred demand for products that offer convenience and efficiency. This urban-centric shift in consumer preferences is a major contributor to the overall growth of the market, as more women embrace modern hygiene practices that offer comfort, reliability, and ease of use.

Government Initiatives and NGO Support

The Turkish government, along with various non-governmental organizations, has been actively involved in improving access to feminine hygiene products, particularly in rural and underserved regions. For instance, in 2023, the Turkish Red Crescent (Kızılay) collaborated with the Ministry of Health to distribute over 500,000 packs of sanitary pads and menstrual hygiene kits to women and girls in earthquake-affected regions of southeastern Turkey. These initiatives are aimed at reducing menstrual health disparities by providing free or subsidized products to low-income women and girls. Several programs have been introduced to distribute sanitary pads and menstrual cups at public health centers and schools, helping to eliminate the barriers that many women face in accessing these essential products. Furthermore, these efforts are not limited to just product distribution but also encompass educational components designed to raise awareness about menstrual hygiene management. Such initiatives are expanding the reach of feminine hygiene products to populations that may otherwise have limited access, thus contributing to the market’s growth.

Product Innovation and Eco-Conscious Consumers

The growing demand for eco-friendly and sustainable products has emerged as a major trend in Turkey’s feminine hygiene market. With increasing awareness about environmental issues, many consumers are opting for products made from natural, biodegradable, or organic materials. This has led to an uptick in the availability of products such as organic cotton sanitary pads, reusable menstrual cups, and eco-friendly tampons. Turkish women are increasingly interested in reducing their environmental footprint, and this shift is being reflected in their purchasing habits. Brands that innovate by offering eco-friendly alternatives are gaining traction in the market, attracting environmentally conscious consumers who are willing to pay a premium for sustainable options. The rising interest in these products not only addresses consumer demand for environmentally responsible solutions but also provides an opportunity for brands to differentiate themselves in a competitive market.

Market Trends:

E-commerce Expansion and Digital Transformation

The Turkish feminine hygiene products market is experiencing a significant shift towards digitalization, with e-commerce emerging as a dominant distribution channel. For instance, the accessibility and variety offered by online platforms have become crucial for consumers, especially as traditional retail channels face limitations in rural or underserved areas. This surge is driven by factors such as increased internet penetration, the convenience of online shopping, and the availability of a wide range of products. Consumers are increasingly turning to online platforms for purchasing sanitary pads, tampons, and menstrual cups, seeking ease of access and often better pricing. The growth of e-commerce is reshaping the retail landscape, compelling traditional retailers to adapt and integrate digital strategies to remain competitive.

Shift Towards Sustainable and Organic Products

There is a notable consumer shift towards sustainable and organic feminine hygiene products in Turkey. This trend is part of a broader global movement towards environmental consciousness and health awareness. Consumers are increasingly seeking products made from natural materials, free from synthetic chemicals and fragrances. This shift is prompting manufacturers to innovate and offer biodegradable sanitary pads, organic cotton tampons, and reusable menstrual cups. The demand for such eco-friendly products is not only driven by environmental concerns but also by a growing awareness of the potential health impacts of conventional hygiene products. Brands that align with these values are gaining traction among health-conscious and environmentally aware consumers.

Product Innovation and Diversification

Innovation in product offerings is a key trend in Turkey’s feminine hygiene market. Manufacturers are diversifying their product lines to cater to a broader range of consumer needs and preferences. This includes the introduction of ultra-thin sanitary pads, tampons with higher absorbency, and menstrual cups designed for comfort and convenience. Additionally, there is a growing emphasis on inclusive product design, with products being developed to cater to diverse consumer needs, including those with sensitive skin or specific health considerations. The focus on innovation is not only enhancing consumer choice but also driving competition among brands, leading to improved product quality and consumer satisfaction.

Government and NGO Initiatives Promoting Menstrual Equity

Governmental and non-governmental organizations in Turkey are actively working to promote menstrual equity, aiming to ensure that all women and girls have access to affordable and hygienic menstrual products. For example, UNFPA Türkiye, in partnership with local organizations, has established Women and Girls Safe Spaces (WGSS) that provide clinical, psychosocial, and empowerment services, as well as distribute hygiene and reproductive health kits to refugees and vulnerable groups. These initiatives include distributing free or subsidized products in schools and rural areas, as well as conducting educational campaigns to raise awareness about menstrual health. Such efforts are crucial in breaking down social taboos and encouraging open discussions about menstruation. By improving access to menstrual hygiene products and information, these initiatives are contributing to a more inclusive and equitable society, where menstrual health is recognized as an essential aspect of women’s health and well-being.

Market Challenges Analysis:

Price Sensitivity Among Consumers

One of the key restraints in Turkey’s feminine hygiene products market is the price sensitivity among consumers. While premium products such as organic cotton pads and menstrual cups are gaining popularity, the overall affordability of such products remains a challenge, particularly in lower-income households and rural areas. The higher price point of eco-friendly and organic products may limit their accessibility to a broader consumer base. This price barrier can lead to a reliance on less expensive, conventional hygiene products, which may not meet the same environmental or health standards. As a result, market growth may be somewhat constrained by this affordability gap.

Cultural Taboos and Lack of Open Dialogue

Cultural taboos surrounding menstruation still persist in certain parts of Turkey, particularly in more conservative regions. For instance, qualitative research has documented women feeling unable to ask for menstrual products from family members and resorting to using diapers or cloths in secrecy. These taboos discourage open discussions about menstrual health and hygiene, which can lead to a lack of awareness regarding the availability of modern feminine hygiene products. The stigma associated with menstruation can prevent women from openly purchasing or seeking information about these products, particularly in rural areas. This cultural barrier poses a challenge for brands attempting to educate and expand their consumer base, as it limits the potential for market penetration in specific segments of the population.

Limited Distribution in Rural Areas

Despite ongoing efforts by the government and NGOs to improve access to feminine hygiene products in underserved areas, distribution remains a challenge in rural regions. In many of these areas, access to modern hygiene products is limited, and consumers may rely on traditional, less effective options. This is due in part to a lack of retail infrastructure, limited availability of products in local stores, and insufficient outreach efforts. The challenge of expanding distribution networks in rural areas hinders the market’s growth potential and restricts the reach of many hygiene brands to a significant portion of the population.

Market Opportunities:

Turkey’s feminine hygiene products market presents significant opportunities driven by evolving consumer preferences and the increasing awareness of menstrual health. One of the key opportunities lies in the growing demand for eco-friendly and organic products. With increasing consumer interest in sustainable living and health-conscious choices, there is a rising preference for products made from organic cotton, biodegradable materials, and reusable alternatives like menstrual cups. As more women become aware of the potential health risks associated with synthetic materials, brands that offer environmentally responsible products can capture a larger share of the market. The expanding middle class in urban areas, coupled with rising disposable incomes, provides a fertile ground for premium and innovative product offerings, creating a substantial opportunity for brands to differentiate themselves in the market.

In addition, there is a notable opportunity to expand the reach of feminine hygiene products in rural and underserved regions. Government and non-governmental initiatives aimed at promoting menstrual health and ensuring access to hygiene products are expected to continue growing, opening doors for companies to penetrate these areas. By developing targeted strategies to increase product availability and affordability in rural markets, brands can tap into a large, untapped consumer base. Additionally, digital platforms and e-commerce offer an effective channel for reaching consumers in remote areas, making it easier for women in these regions to access modern menstrual products. This combination of product innovation and expanded distribution networks provides a promising opportunity for growth in Turkey’s feminine hygiene products market.

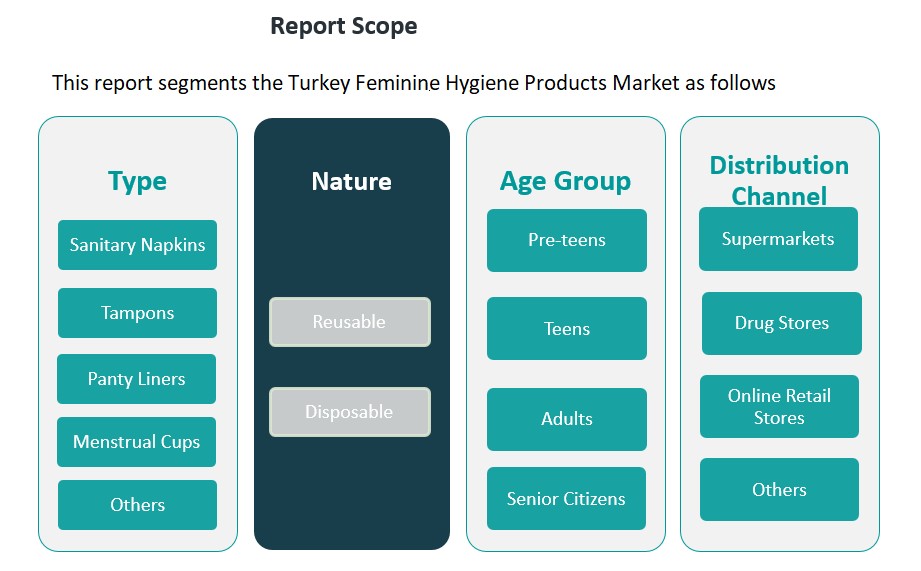

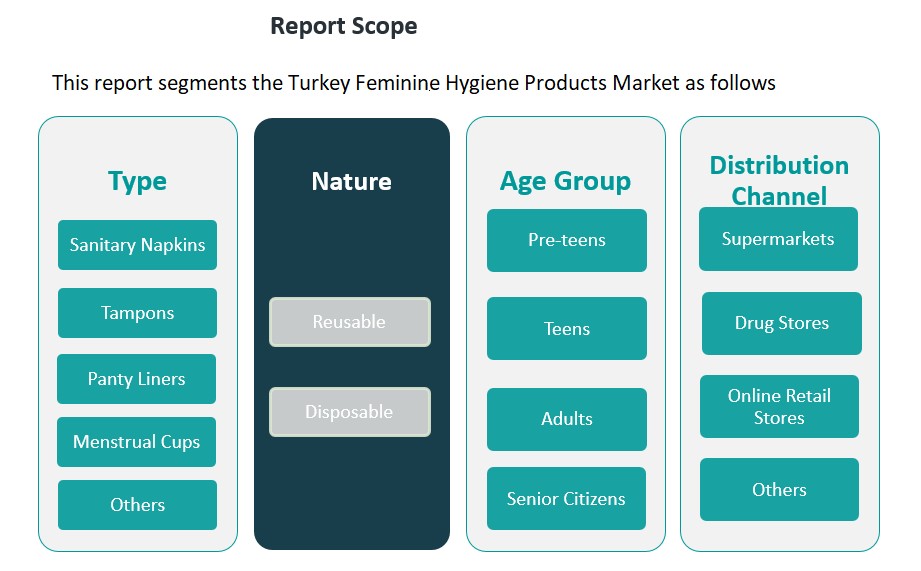

Market Segmentation Analysis:

The Turkish feminine hygiene products market is diverse, with various segments catering to different consumer needs.

By Type, sanitary napkins dominate the market due to their widespread usage and accessibility. Tampons follow as a significant product segment, gaining popularity among women seeking a more discreet option. Panty liners and menstrual cups are also growing segments, driven by increasing awareness about menstrual health and sustainability. Other products, such as feminine hygiene wipes and powders, contribute to niche demand but hold a smaller market share.

By Nature, the market is divided into disposable and reusable products. Disposable products, particularly sanitary napkins and tampons, remain dominant due to their convenience and wide availability. However, the reusable segment is gaining momentum, with menstrual cups and washable pads appealing to eco-conscious consumers and those seeking cost-effective, sustainable options.

By Age-Group, the market is segmented into pre-teens, teens, adults, and senior citizens. Teens and adults represent the largest consumer groups, with a higher demand for products that offer comfort and convenience. Pre-teens are a smaller segment, though growing awareness and education are expanding their participation. Senior citizens, though a niche, represent an emerging segment, as they require products designed for comfort and suitability during menopause or other health conditions.

By Distribution Channel, supermarkets and drug stores are the primary retail avenues, offering easy access to a wide range of products. Online retail stores are rapidly gaining traction, especially among younger, tech-savvy consumers, offering convenience and a wider variety of products. Other channels, such as pharmacies and specialty stores, serve a more specific segment of the market.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

Turkey’s feminine hygiene products market demonstrates significant regional variation, influenced by factors such as urbanization, income levels, and cultural norms. In urban centers like Istanbul, Ankara, and Izmir, the demand for feminine hygiene products is notably higher due to greater disposable incomes, higher education levels, and increased awareness of menstrual health. These cities also benefit from well-established retail infrastructures, including supermarkets, pharmacies, and online platforms, facilitating easy access to a wide range of products. As a result, urban regions account for a substantial share of the market, with Istanbul leading as the largest consumer base.

Conversely, rural areas face challenges in accessing feminine hygiene products, primarily due to limited retail outlets, lower income levels, and traditional cultural practices that may discourage open discussions about menstruation. However, ongoing government and non-governmental initiatives are working to improve access to these essential products in underserved regions. These efforts include distributing free or subsidized products in schools and rural health centers, aiming to bridge the accessibility gap. As these initiatives gain traction, rural regions are expected to experience gradual growth in the adoption of feminine hygiene products, contributing to the overall expansion of the market across Turkey.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Paksel Kimya

Competitive Analysis:

The Turkish feminine hygiene products market is characterized by a competitive landscape comprising both multinational corporations and local players. Leading global companies such as Procter & Gamble (P&G), Kimberly-Clark, and Unicharm Corporation have established a strong presence through well-known brands like Always, Kotex, and Evax. These brands leverage extensive distribution networks, robust marketing strategies, and product innovation to maintain their market positions. In addition to these international giants, Turkish companies like Hayat Kimya and Eruslu Saglik Urunleri have gained significant market share with brands such as Molped and Orkid, respectively. These local brands often emphasize affordability and cater to regional preferences, providing strong competition to global players. The market is also witnessing the emergence of niche and eco-conscious brands that focus on organic and sustainable products. These brands are capitalizing on the growing consumer demand for environmentally friendly options, offering products like organic cotton sanitary pads and reusable menstrual cups. While their market share remains smaller compared to established brands, their presence is expanding, particularly among environmentally conscious consumers. The competitive dynamics in Turkey’s feminine hygiene market are further influenced by factors such as pricing strategies, product differentiation, and the ability to adapt to changing consumer preferences. As the market continues to evolve, companies that can effectively balance innovation, sustainability, and affordability are likely to strengthen their positions in the Turkish market.

Recent Developments:

- In February 2025, Ontex Group NV, a leading international developer and producer of personal care solutions, entered into a binding agreement to sell its Turkish subsidiary to Dilek Grup. This transaction includes Ontex’s business in Türkiye, its Istanbul manufacturing plant, and related export business. Ontex’s Turkish subsidiary is known for developing, manufacturing, commercializing, and distributing predominantly branded personal hygiene products, with a strong presence in Turkey and surrounding regions. In 2024, the subsidiary generated approximately €90 million in sales and is part of Ontex’s Emerging Markets division, which has been classified as discontinued operations.

- In March 2025, Procter & Gamble launched Always Pocket Flexfoam, a new addition to its feminine care line, designed for portability and on-the-go protection. The launch was celebrated with a high-profile partnership at Coachella 2025, where Always and Tampax became the festival’s first-ever period care partners, providing products and on-site activations for attendees. This campaign highlights P&G’s commitment to both product innovation and experiential marketing in the feminine hygiene space.

- In July 2023, Unicharm’s subsidiary in Indonesia launched Charm Daun Sirih + Herbal Bio sanitary napkins, featuring eco-friendly materials. The company continues to innovate with products using bio-materials and is expanding its range of disposable period underwear to meet growing demand, particularly among younger consumers.

Market Concentration & Characteristics:

Turkey’s feminine hygiene products market is moderately concentrated, with both global and local players competing for market share. Leading multinational corporations such as Procter & Gamble (Always), Kimberly-Clark (Kotex), and Unicharm (Evax) dominate the market due to their well-established brand recognition and extensive distribution networks. At the same time, local companies like Hayat Kimya (Molped) and Eruslu Sağlık Ürünleri (Orkid) maintain significant positions by offering products tailored to regional preferences and price sensitivities, effectively catering to a diverse consumer base. The market is characterized by a wide range of products, including sanitary pads, tampons, panty liners, menstrual cups, and intimate cleansers. Sanitary pads remain the most popular product category, driven by their accessibility and widespread use. However, there is an increasing shift toward eco-friendly and reusable options, such as menstrual cups and organic cotton pads, as more consumers prioritize sustainability and health-conscious choices. Distribution channels are evolving, with supermarkets and drugstores maintaining strong shares, while e-commerce platforms see rapid growth, particularly among younger consumers who seek convenience and broader product selections.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will experience continued growth due to increasing awareness of menstrual health and hygiene.

- E-commerce will become a key channel, offering convenience and access to a wider range of products.

- The demand for eco-friendly and organic feminine hygiene products will rise as sustainability becomes a priority.

- Product innovation will drive market expansion, with a focus on convenience, comfort, and health-conscious formulations.

- Government and NGO initiatives will improve access to hygiene products in rural and underserved areas.

- Cultural shifts towards more open discussions about menstrual health will reduce stigmas and encourage product adoption.

- The premium segment will see steady growth, especially among urban consumers with higher disposable incomes.

- Local brands will continue to strengthen their position by offering tailored products at competitive prices.

- The popularity of reusable products, such as menstrual cups, will increase as consumers seek more sustainable options.

- Advances in distribution networks will improve product availability across both urban and rural regions.