Market Overview:

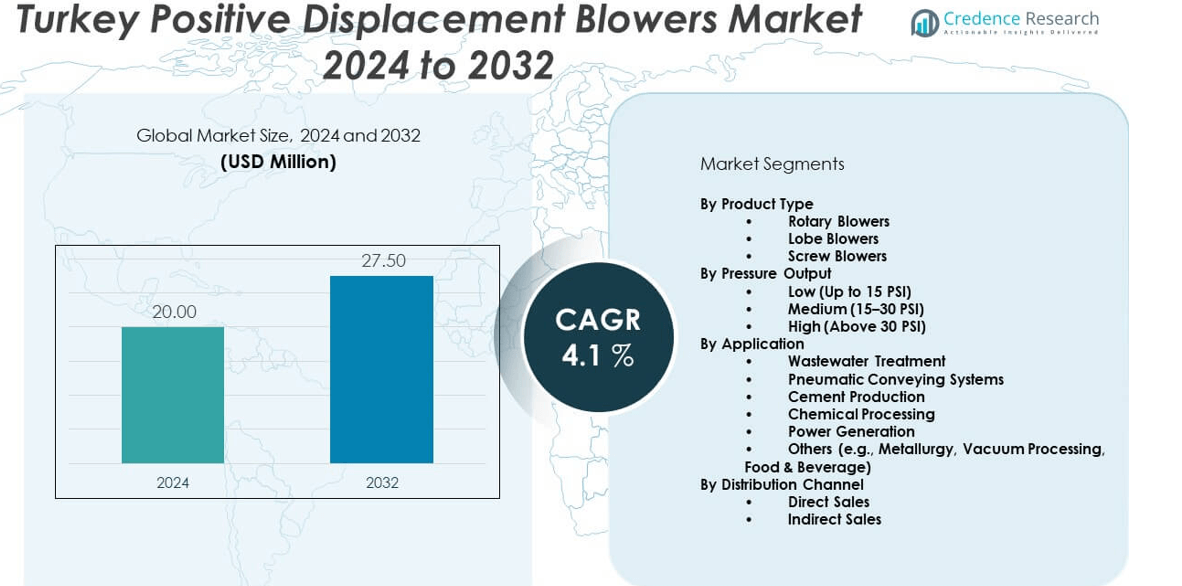

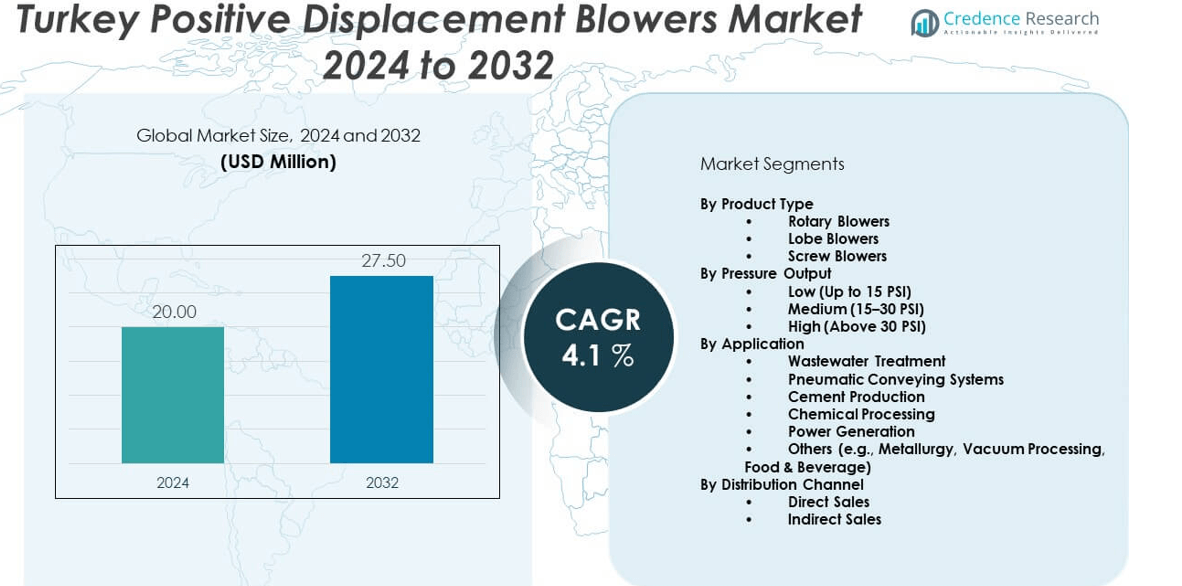

The Turkey positive displacement blowers market is projected to grow from USD 20 million in 2024 to an estimated USD 27.5 million by 2032, with a compound annual growth rate (CAGR) of 4.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turkey Positive Displacement Blowers Market Size 2024 |

USD 20 million |

| Turkey Positive Displacement Blowers Market, CAGR |

4.1% |

| Turkey Positive Displacement Blowers Market Size 2032 |

USD 27.5 million |

The market for positive displacement blowers in Turkey is expanding steadily due to growing demand from wastewater treatment, cement, food processing, and chemical industries. These sectors rely on blowers for aeration, pneumatic conveying, and maintaining consistent airflows in process operations. The push for cleaner industrial practices and regulatory requirements around emissions and environmental safety are driving investments in efficient and durable blower systems. Turkish manufacturers and industrial operators are adopting energy-efficient solutions to reduce operational costs while improving system reliability and productivity.

Within Turkey, industrialized regions such as Marmara and Central Anatolia dominate the market due to their concentration of manufacturing, chemical, and municipal infrastructure. Western provinces are experiencing steady growth as urbanization and infrastructure modernization continue. Eastern and Southeastern regions, while emerging, show increasing potential driven by government-backed industrial development zones and public utility expansion. The market’s regional dynamics align closely with industrial density and environmental investment priorities.

Market Insights:

- The Turkey positive displacement blowers market is projected to grow from USD 20 million in 2024 to USD 27.5 million by 2032, registering a CAGR of 4.1% during the forecast period.

- Growing demand from wastewater treatment, cement, and chemical industries is driving steady adoption of blowers for aeration and process airflow management.

- Energy efficiency mandates and regulatory pressure for cleaner industrial operations are encouraging investment in durable, low-maintenance blower systems.

- High initial capital cost and availability of alternative air compression technologies limit rapid adoption among cost-sensitive industrial users.

- The Marmara region holds the largest market share due to its concentration of manufacturing, municipal utilities, and logistics infrastructure.

- Central Anatolia is emerging as a strong growth region, supported by cement, energy, and government-backed industrial projects.

- Eastern and Southeastern regions show untapped potential, driven by public sector initiatives for infrastructure development and utility upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expansion of Industrial and Municipal Infrastructure Fuels Equipment Demand:

The Turkey positive displacement blowers market benefits from steady growth in industrial infrastructure and municipal utilities. Wastewater treatment facilities require reliable air supply systems for aeration, making blowers critical for biological processing. Industrial zones in cities like Istanbul, Izmir, and Ankara continue to expand, necessitating efficient pneumatic conveying systems across sectors. Cement, steel, and petrochemical industries use these blowers for material handling and combustion processes. Urbanization has increased demand for sewage treatment and solid waste management solutions, further driving blower installations. Government initiatives targeting sustainable industrial development support infrastructure upgrades. These projects mandate energy-efficient equipment that aligns with environmental norms. The market sees sustained momentum through ongoing upgrades in air treatment systems across public and private sectors.

- For instance, Atlas Copco’s ZS series screw blowers, widely deployed in Turkey’s wastewater and industrial zones, have achieved certified energy savings of up to 30–40% compared to traditional lobe blowers, based on ISO 8573-1 Class 0 standards, and support operational capacities from 248m³/h to 9,100m³/h with variable speed drive technology for adaptable flow

Rising Focus on Air Quality Management and Pollution Control:

The Turkey positive displacement blowers market gains traction from growing emphasis on environmental regulations and pollution mitigation. Industries must comply with strict air emission limits, requiring advanced air handling and filtration setups. Blowers play a vital role in dust collection, pneumatic transport, and ventilation systems in manufacturing plants. Their usage also extends to flue gas desulfurization and air pollution control units in thermal power plants. Regulatory bodies such as the Ministry of Environment enforce emission standards aligned with EU directives. Industries invest in blower-based systems to meet compliance and reduce penalties. Demand rises across food processing, pulp and paper, and chemical industries to improve air quality inside facilities. Public health concerns push for cleaner industrial processes, boosting equipment sales. The market aligns with national strategies focused on climate action and cleaner production.

- For instance, Kaeser Compressors has enabled municipal and industrial facilities in Turkey to reduce electrical energy demand by over 20% by replacing rotary lobe units with screw blower stations, rigorously tested according to ISO 1217 and ensuring high compliance with local air quality norms and EU-aligned emission standards.

Growth in Energy-Efficient Technologies and Low Maintenance Equipment:

The Turkey positive displacement blowers market sees accelerated growth from the push toward energy-efficient machinery. Blowers with lower operating costs and longer lifespans are gaining preference across sectors. Industries aim to reduce energy bills and improve ROI by choosing positive displacement models with efficient rotary lobes and helical screw designs. Manufacturers offer variable frequency drives (VFDs) and oil-free systems to appeal to sectors where contamination control is critical. Energy audits in large facilities identify blower upgrades as high-impact energy savings opportunities. Local manufacturers and international players introduce optimized models suited for continuous operations. The shift toward predictive maintenance and automation enhances system reliability. Buyers seek equipment with minimal wear and simplified servicing to reduce downtime. This preference fuels sustained investment in newer displacement blower technologies.

Development of Specialized Applications Across Key Industries:

The Turkey positive displacement blowers market gains momentum from its growing applications in niche industrial operations. In agriculture, blowers facilitate grain aeration and drying. In aquaculture, they help oxygenate water in inland fish farms. The pharmaceutical and food industries deploy them in vacuum packaging, fermentation, and ingredient handling. Their ability to handle corrosive and hazardous gases extends their use to chemical manufacturing. Market penetration increases in mining and bulk solids handling operations. Demand also rises in pneumatic transport systems within breweries, cement plants, and milling units. Equipment customization for industry-specific needs drives adoption. Versatile blower systems support critical operations where continuous air supply and pressure control are vital, allowing deeper market reach into emerging segments.

Market Trends:

Adoption of Smart Blower Systems with Remote Monitoring Capabilities:

The Turkey positive displacement blowers market experiences a shift toward intelligent, connected equipment. Industrial users demand remote monitoring and control capabilities integrated with SCADA or cloud platforms. Smart blowers help track pressure, temperature, and energy use in real time, improving operational efficiency. These systems reduce unscheduled downtimes through early detection of anomalies. Predictive maintenance reduces lifecycle costs and supports 24/7 industrial workflows. Manufacturers integrate IoT-enabled sensors, control panels, and digital interfaces for seamless connectivity. Remote access ensures continuity in production-critical environments with minimal human intervention. End users value automation and data-driven insights for better decision-making. The trend indicates strong demand for smart, digitally integrated blower solutions.

- For instance, Siemens implements industrial IoT platforms like MindSphere for real-time remote monitoring of blower assets. Their solutions allow continuous tracking of machine status, predictive maintenance, and remote diagnostics, reducing downtime and repair response times by up to 60% and enhancing lifecycle efficiency for process-critical users.

Growing Preference for Oil-Free and Contamination-Free Air Systems:

The Turkey positive displacement blowers market sees a marked rise in demand for oil-free systems. Industries like food processing, beverage, and pharmaceuticals require contamination-free compressed air. Oil-free blowers ensure product safety, reduce risk of contamination, and comply with hygiene standards. End users increasingly prioritize maintenance-free and clean air systems for sterile environments. Demand from laboratory setups, dairy facilities, and cleanrooms fuels this trend. Global brands expand local presence with specialized oil-free products, increasing competition. These systems reduce downstream filtration needs and improve process reliability. The shift to cleaner technologies aligns with industry quality certifications. This trend shapes procurement policies in sensitive application industries.

- For instance, Elmo Rietschle’s G-Series regenerative blowers deliver absolutely oil-free compression and up to 20% greater air delivery using 15% less energy versus conventional models. Their products have achieved worldwide certifications and are preferred in food and pharma industries for ensuring hygienic, contamination-free airflow, with flow rates from 35 to 1,440cfm

Customization and Modular Designs Gaining Popularity:

The Turkey positive displacement blowers market witnesses growing interest in modular and application-specific systems. Buyers seek solutions that match pressure ranges, airflows, and spatial constraints of their operations. Modular designs simplify installation, reduce footprint, and allow for capacity expansion. Custom-built systems with sound enclosures, heat recovery, and vibration control are gaining acceptance. Manufacturers cater to local demand with compact, retrofittable options for existing plants. Demand for high-performance materials and corrosion-resistant coatings rises in chemical and coastal applications. Blower housings and rotors are being designed with precision to suit unique air dynamics. The modular trend supports flexible plant layouts, rapid deployment, and simplified servicing. Industries value this design shift for enhancing process adaptability.

Rise in Domestic Manufacturing and Local Assembly Capabilities:

The Turkey positive displacement blowers market experiences a shift with the strengthening of local manufacturing. Government initiatives promote domestic production of industrial machinery under import substitution programs. Local players invest in CNC machining and casting capabilities for rotors, housings, and shafts. Faster lead times and cost competitiveness enhance market presence. International firms collaborate with Turkish partners to assemble units domestically. Regional OEMs cater to demand from mid-sized enterprises with price-sensitive offerings. Market players focus on expanding service centers and distributor networks across Anatolia and Marmara regions. Buyers favor suppliers who offer in-country support and faster delivery. The trend supports localization of the supply chain and stronger national equipment capacity.

Market Challenges Analysis:

High Initial Investment and Pressure on Pricing Margins:

The Turkey positive displacement blowers market faces constraints from high initial equipment costs. Advanced systems with energy-efficient motors, noise-reduction housing, and digital interfaces carry a premium. Small and medium enterprises delay upgrades due to limited capital budgets. Competitive bidding environments in public procurement compress pricing margins. Import duties on foreign components and currency fluctuations raise product costs. Buyers often opt for lower-cost substitutes, impacting sales of high-end models. Longer ROI cycles deter some industrial buyers from adopting advanced blowers. Vendors struggle to maintain profitability while offering after-sales support and warranty services. The market faces continuous pressure to balance performance with affordability.

Availability of Alternative Air Compression Technologies:

The Turkey positive displacement blowers market contends with rising competition from other technologies. Centrifugal blowers, side channel blowers, and screw compressors present alternative solutions for various air handling needs. These technologies offer higher flow rates or lower noise levels in some applications. Users in HVAC, aquaculture, and packaging may choose more compact or cost-effective alternatives. Energy efficiency comparisons influence procurement decisions. Hybrid solutions integrating variable technologies gain traction in large plants. Market fragmentation leads to buyer confusion and extended decision cycles. Vendors must invest in educating clients on application-specific advantages of positive displacement systems. This challenge necessitates differentiation and technical consulting to defend market share.

Market Opportunities:

Expansion of Green Energy and Waste Management Sectors:

The Turkey positive displacement blowers market holds strong opportunities in renewable energy and environmental sectors. Blowers play a key role in biogas production, landfill gas recovery, and sludge digestion processes. The government promotes waste-to-energy and circular economy models, creating equipment demand. Municipalities require reliable blowers in new sewage and waste treatment projects. International financing for green infrastructure boosts procurement of energy-efficient systems. The shift toward sustainable development creates long-term opportunities across clean-tech sectors.

Potential in Export Markets and Regional Industrial Integration:

The Turkey positive displacement blowers’ market can tap into export potential across the Middle East, Central Asia, and North Africa. Turkish manufacturers benefit from strategic geographic proximity, strong logistics networks, and customs agreements. Regional demand for affordable and durable blowers creates trade prospects. Joint ventures with neighboring markets enable production scale and shared R&D. Expanding industrial footprints across developing economies strengthen cross-border supply chains and allow Turkish OEMs to diversify revenue streams.

Market Segmentation Analysis:

By Product Type

The Turkey positive displacement blowers market includes rotary, lobe, and screw blowers. Rotary blowers dominate the segment due to their operational reliability and adaptability in continuous-use industrial environments. Lobe blowers are favored in municipal and environmental services for their simple design and ease of maintenance. Screw blowers are gaining traction in high-efficiency applications, particularly where energy savings and low noise emissions are priorities, such as in the chemical and pharmaceutical sectors.

- For instance, Kaeser’s rotary screw blowers, a leader in the Turkish market, are available in sizes up to 335hp, providing flows up to 5,650cfm while using up to 35% less energy than conventional rotary blowers. These solutions are certified for oil-free operation (ISO 1217) and are utilized extensively in 24/7 industrial environments demanding proven reliability and efficiency.

By Pressure Output

The market is segmented into low (up to 15 PSI), medium (15–30 PSI), and high (above 30 PSI) pressure categories. Low-pressure blowers are widely used in wastewater treatment and light-duty pneumatic conveying systems. Medium-pressure units support processes in food, packaging, and general manufacturing. High-pressure blowers cater to energy and heavy industry, including power generation and cement production, where higher force airflows are essential for combustion, material transport, or cooling.

- For instance, Becker Pumps’ blowers are deployed in wastewater and chemical facilities, supporting pressure outputs from up to 1.0bar for positive pressure and continuous operation vacuum up to –0.6bar. The technical design enables precise performance adjustments, maximizing blower life and minimizing maintenance in both low- and high-pressure segments

By Application

Wastewater treatment represents the largest application segment in the Turkey positive displacement blowers’ market, driven by infrastructure upgrades and environmental compliance requirements. Pneumatic conveying systems follow closely, supported by rising industrial automation and dry bulk transport demand. Cement production and chemical processing require high-reliability blowers for process air and dust control. Power generation uses blowers in combustion and emission control systems. Other growing applications include metallurgy, vacuum packaging, and aeration processes in the food and beverage industry.

Segmentation:

By Product Type

- Rotary Blowers

- Lobe Blowers

- Screw Blowers

By Pressure Output

- Low (Up to 15 PSI)

- Medium (15–30 PSI)

- High (Above 30 PSI)

By Application

- Wastewater Treatment

- Pneumatic Conveying Systems

- Cement Production

- Chemical Processing

- Power Generation

- Others (e.g., Metallurgy, Vacuum Processing, Food & Beverage)

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Marmara Region: Industrial Hub with Largest Market Share (~40%)

The Marmara region commands the highest share of the market, approximately 40 %. Industrial centers in Istanbul, Bursa, and Kocaeli host heavy manufacturing, automotive, and chemical operations that rely heavily on blowers for ventilation, material handling, and process air. Frequent capacity expansions in these zones stimulate ongoing demand. It supports a dense network of OEM service and support facilities. Proximity to ports benefits export-oriented manufacturers who require reliable blower equipment. Turkish and international suppliers maintain strong presence here. Fragmented operations across textile, food processing, and pharmaceutical clusters further drive demand for both standard and customized blowers. This region anchors overall market growth and acts as a growth barometer.

Central Anatolia Region: Emerging Industrial Growth (~30%)

Central Anatolia, centered on Ankara and Konya, holds about 30 % of the market. Investments in energy, cement, and chemical sectors fuel blower adoption in this area. It sees growing use of screw and rotary models in process air supply, pneumatic conveyance, and wastewater treatment. Government-led infrastructure and industrial park initiatives contribute to robust equipment procurement. Local production facilities offer modest cost advantages for end users. It benefits from increasing after-sales support networks. Market participants actively engage with industrial associations in the region. Demand from state-run utilities for air quality control elements raises blower installations. Central Anatolia continues making steady contributions to national demand.

Aegean and Mediterranean Regions: Moderate Demand (~20%)

The Aegean and Mediterranean regions share an estimated 20 % of the market. Industrial zones in Izmir, Antalya, and Mersin support food & beverage, textile, and agricultural processing operations. It finds application in vacuum packaging, conveying systems, and environmental control units in this area. Coastal manufacturing clusters expand, creating additional blower requirements for corrosion‑resistant designs. Export‑oriented processors in these regions choose locally assembled equipment to reduce lead time. Distributor and reseller networks provide strong regional coverage. Moderate industrial density limits absolute volume, but steady procurement continues. New processing investments in agritech and logistics support incremental growth.

Eastern & Southeastern Anatolia and Black Sea Regions: Small but Growing Segment (~10%)

Eastern, Southeastern Anatolia, and Black Sea regions together account for around 10 % of Turkey’s market share. Industrial activity remains lighter, concentrated in small chemical plants, regional wastewater facilities, and agricultural cooperatives. It receives support through regional development funds aimed at sanitation and industrial infrastructure. Utilities procure low‑pressure rotary or lobe blowers for municipal aeration projects. Remote locations raise logistical costs and limit frequent service visits. It presents opportunity for distributors with regional service capability. Growth remains gradual but consistent, supported by public infrastructure upgrades and small industrial expansions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Atlas Copco

- Becker Pumps Corporation

- Blowers, LLC

- Ebara Corporation

- Elmo Rietschle

- Fujikin

- Howden Group

- Ingersoll Rand

- Kaeser Compressors Ltd.

- Klaren

- KSB Group

- Pfeiffer Vacuum Technology AG

- Schneider Corporation

- Siemens AG

- Sulzer

Competitive Analysis:

The Turkey positive displacement blowers market features a blend of multinational and regional players competing on performance, service coverage, and pricing. Key companies such as Atlas Copco, Ingersoll Rand, Howden Group, and Kaeser Compressors dominate the market with advanced product portfolios and strong local distributor networks. It attracts buyers with a demand for application-specific configurations and energy-efficient designs. Local manufacturers and assemblers serve mid-tier clients by offering cost-effective alternatives and faster service. Market participants focus on expanding their presence in key industrial zones through partnerships and technical support centers. Customization capabilities and after-sales services have become critical differentiators. The market remains moderately fragmented, with global brands securing larger industrial projects and regional firms competing in standardized applications.

Recent Developments:

- In May 2025, Atlas Copco launched the CDR and CDR+ portable air dryers, introducing six new models designed to deliver clean, dry air across challenging environments. This expansion enhances Atlas Copco’s range of portable air treatment solutions and demonstrates its continued focus on energy efficiency and reliable compressed air technologies for industrial and municipal applications in Turkey.

- In March 2025, Becker Pumps Corporation expanded global operations by acquiring Becker & Associates Inc., a key supplier of aviation and ground fueling components. This acquisition strengthens Becker’s position in the industrial equipment supply chain and underscores its commitment to broadening product availability and service capabilities for international customers.

- In February 2024, Blowers, LLC (Blower Application LLC/BloApCo) entered a strategic partnership with Valesco Industries through an investment, bolstering its presence in solid waste and scrap handling systems. The collaboration is aimed at accelerating growth for Blowers, LLC within the industrial and material handling sector.

- In June 2024, Ebara Corporation announced the launch of a new vacuum pump series EV-X in Europe. The technology boasts enhanced gas flow and extended maintenance cycles, targeting higher reliability for diverse industrial needs, including those relevant to Turkey’s positive displacement blowers market

Market Concentration & Characteristics:

The Turkey positive displacement blowers market exhibits medium-to-high market concentration, with leading global players holding a strong presence across industrial centers. It favors companies with localized service, modular offerings, and high energy efficiency. Product differentiation is based on durability, operational cost, and digital integration. Buyers evaluate suppliers based on reliability and support infrastructure. High competition drives innovation in noise control, oil-free operation, and compact design. Industrial end users demand rapid deployment, which benefits manufacturers with regional assembly or stock facilities. The market’s evolving regulatory environment and demand for cleaner technologies create room for product refinement.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Pressure Output, Application, and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise from wastewater treatment facilities due to expanding infrastructure.

- Energy-efficient blower systems will dominate future procurement preferences.

- Smart blowers with IoT-based monitoring will see increasing adoption.

- Medium-pressure blowers will gain market share in food and logistics industries.

- Industrial growth in Central Anatolia will drive regional equipment demand.

- Oil-free blowers will penetrate pharmaceutical and cleanroom applications.

- Manufacturers will invest in service hubs for faster response and local support.

- Government-led industrial modernization projects will boost installations.

- Screw blower adoption will increase in high-efficiency operations.

- Partnerships between OEMs and automation firms will enhance product integration